I hope you are enjoying your weekend.

Irvine Home Address … 195 BRIARWOOD Irvine, CA 92604

Resale Home Price …… $339,990

Housing Market News

Share This | Subscribe (Free) | Mobile | RSS | Mail news links to p@patrick.net

Patrick.net is the top search result for "housing crash" with more than 20,000 daily readers

Fri Dec 10 2010

US House Values to Drop by $1.7 Trillion This Year (bloomberg.com)

LAOC house values lost $677 billion vs. peak (lansner.ocregister.com)

Excellent charts of happy deflation (PDF – msurkan.podbean.com)

Simple Math of Renting vs. Buying Your House (financialsurvivalradio.com)

Mortgage Rates Hit Six Month High, Threatening To Benefit Buyers With Savings (cnbc.com)

Jumbo loan market has completely evaporated (doctorhousingbubble.com)

Treasury Bonds: From Ultra-Safe to Battered and Bruised (dailyfinance.com)

Are The Federal Reserve's Crimes Too Big To Comprehend? (ampedstatus.com)

A Real Jaw Dropper at the Federal Reserve (huffingtonpost.com)

Bloomberg Poll Shows More Than Half of Americans Want Fed Reined In or Abolished (Mish)

Ron Paul Claims Chairmanship of Monetary Policy Subcommittee, Prepared to Subpoena Fed (Mish)

Mendacious Bernanke (atimes.com)

50% housing bubble looms over 7 major Chinese cities (english.peopledaily.com.cn)

The Grim Truth About America (exaggerated, but real) (escapefromamerica.com)

House Democrats defy Obama on tax cut bill (politicalticker.blogs.cnn.com)

Sanders: Middle class held hostage by Tea Party servants of billionaires (dailybail.com)

Working Poor Will Pay More After Obama's GOP Tax Sellout (dailyfinance.com)

Wanking Bankers (youtube.com)

Find the real worth of property, based on rents

Thu Dec 9 2010

Plunging House Prices Fuel Property Tax Appeals Swamping US Cities, Towns (bloomberg.com)

Property tax error increases assessment (wgnradio.com)

North CA House Prices Drop to Lowest Level Since 2004 (northcoastjournal.com)

Caught by mistake in foreclosure web (news.yahoo.com)

US housing doldrums to last until 2013 (bbc.co.uk)

Americans see housing inflation still far off (miamiherald.com)

Inflation Has The Upper Hand, Except In Housing (chrismartenson.com)

Repairing the Damage of Fraud as a Business Model (4closurefraud.org)

David Stockman With Stephen Colbert (dailybail.com)

Why Tax Deal Confirms the Republican Worldview (robertreich.org)

Bond vigilantes may thwart tax deal (finance.yahoo.com)

Bernanke's Lies Regarding "Printing Money" (video – Mish)

Bank of America in Municipal Bid-Rigging Case Tip of Iceberg (bloomberg.com)

"Irish People Owe Nothing To Banks, Billionaires" (dailybail.com)

10 reasons to shun stocks till banks crash (marketwatch.com)

US fiscal health worse than Europe's: China adviser (news.yahoo.com)

China #1, US #2: Corporate corruption of gov't dooms America (endoftheamericandream.com)

Is the Political Class Economically Incompetent or Simply Bought and Paid For? (Mish)

WikiLeaks cables: US lobbied Russia on behalf of Visa and MasterCard (guardian.co.uk)

WikiLeaks sparks 'mirror' sites, leaked cables easier to access than ever (nydailynews.com)

Thank You Ali D. ($25) and Linda S. ($20) for your kind donations.

Find the real worth of property, based on rents

Wed Dec 8 2010

Welcome to Zombieland: Ladera Ranch, California (money.cnn.com)

Chapman U. says prospects dim for Orange County housing (lansner.ocregister.com)

Dramatic price drops in Mt. Vernon, NY (dailyfinance.com)

At least 3 more years of good news for potential buyers (reuters.com)

Foreclosure mess: Much bigger than you thought (boston.com)

Rural Foreclosures: The Hidden Heartland Inventory (upi.com)

Walking Away from Your House for Dummies (blogs.wsj.com)

College students getting expensive lesson in debt (doctorhousingbubble.com)

Ron Paul might get to oversee Federal Reserve! (businessweek.com)

Mish emails to congress (Mish)

Sen. Sanders Keeps Pressure on Fed (online.wsj.com)

JP Morgan Getting Squeezed In Silver Market? (sfgate.com)

Irish taxpayers sacrificed to pay private bank debts to foreign investors (guardian.co.uk)

Euro collapse 'possible' amid divisions over bail-out (telegraph.co.uk)

A Reasonable Budget Would Never Pass (slate.com)

Corporate officers never go to jail (dealbook.nytimes.com)

Corporate corruption of government: Taking Down America (tomdispatch.com)

Wanted poster: ASSANGE, JULIAN PAUL (interpol.int)

Arrested WikiLeaks chief denied bail in U.K. (msnbc.msn.com)

Thank You Deiter H. ($20) for your kind donation.

Find the real worth of property, based on rents

Tue Dec 7 2010

Renting a House: It's a Great Time Not to Own (housingwatch.com)

Dr. Doom Predicts $1 Trillion in Housing Losses (dealbook.nytimes.com)

US headed for recession (reuters.com)

As housing problems linger in US and Ireland, so do fears (dallasnews.com)

The Rise and Fall of Default (observer.com)

For House Buyers, a Season for Deep Discounts (nytimes.com)

New Orleans real estate computer crash brings industry to its knees (nola.com)

Lender Processing Services, Foreclosure Giant, Faces Growing Legal Trouble (huffingtonpost.com)

Bank of Israel deputy governor hints at real estate bubble (globes.co.il)

New Zealand housing market remains in doldrums (nbr.co.nz)

Bernanke thinks housing "can't get much weaker." (cbsnews.com)

CBS Allows Fed to Spread Disinformation Unchallenged (usawatchdog.com)

Robert Reich The American Jobs Emergency Requires Action (robertreich.org)

Who Rules America: Wealth, Income, and Power (sociology.ucsc.edu)

Let's not make a deal (nytimes.com)

Movie: Inside Job (imdb.com)

Does Wikileaks Represent The End Of Internet History? (crunchgear.com)

Thank You Anonymous ($10) for your kind donation.

Find the real worth of property, based on rents

Mon Dec 6 2010

Value Sinking Fastest on Low-Price Houses (nytimes.com)

Bank-owned houses go for one-third less (tulsaworld.com)

The 25-Year Foreclosure From Hell (4closurefraud.org)

When Borrowers Default on Second Houses (nytimes.com)

Walking away from your mortgage – Military Financial Advice (armytimes.com)

Scrap the Mortgage Interest Deduction (bayarearealestatetrends.com)

The Mortgage Deduction Should Be Done Away With–But It Won't (theatlantic.com)

How The Mortgage System Works, And How It's Been Rattled (realtytrac.com)

The Bubble Was in Credit, Not Housing (ritholtz.com)

What Chase CEO Jamie Dimon Wont Tell You About Leverage (baselinescenario.com)

Federal Reserve reveals $trillions dished out to foreign banks (dailymail.co.uk)

Fed shows how hedge funds and baseball players got their cut of its cash (guardian.co.uk)

So That's Where the Fed Money Went (nytimes.com)

Ron Paul stands up for Wikileaks' Julian Assange (politico.com)

How to burst Aus. property bubble: rational lending based on rents (heraldsun.com.au)

China's credit bubble on borrowed time as inflation bites (telegraph.co.uk)

Chinese train sets speed record, US rotting from lobbyist corruption (edition.cnn.com)

72 super PACs spent $83.7 million on election manipulation (washingtonpost.com)

If Democrats are big spenders, why do Republican states get the money? (slate.com)

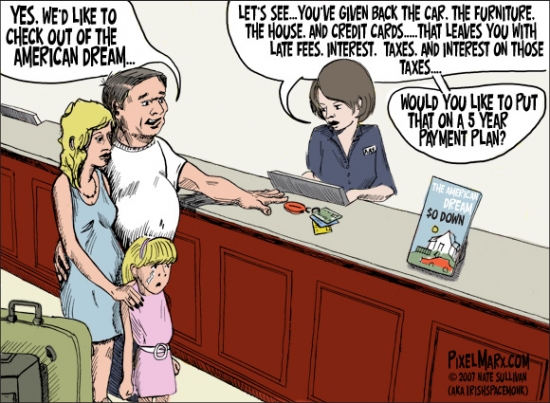

A little HELOC dependency is okay, right?

HELOCs were often used to pay off credit cards. It seems logical to pay off high interest debt with low interest debt, particularly when you get a tax deduction on the low interest debt as well. Unfortunately, any way you look at it, Ponzi borrowing is stupid. Does it make sense to pay for consumer goods with 30-year debt? That is the net effect. When you think about it, does it make sense to finance any kind of consumer debt? I don't think so.

The owner of today's featured property has owned it for almost 20 years. She only sipped kool aid during the bubble, but she still managed to pull out nearly $100,000 for purposes unknown.

- This property was purchased for $142,000 on 1/25/1991. The original mortgage information is not available, but it was likely a $113,600 first mortgage and a $28,400 down payment.

- On 3/28/2002 she refinanced with a $125,000 first mortgage.

- On 8/5/2002 she refinanced again with a $133,750 first mortgage.

- On 10/20/2004 she refinanced with a $151,577 first mortgage.

- On 1/25/2007 she obtained a stand-alone second for $50,000.

- Total property debt is $201,577.

- Total mortgage equity withdrawal is $87,977.

By Irvine standards, taking out less than $100,000 makes her a responsible homeowner — which says something about how low the bar is here.

Irvine Home Address … 195 BRIARWOOD Irvine, CA 92604 ![]()

Resale Home Price … $339,990

Home Purchase Price … $142,000

Home Purchase Date …. 1/25/1991

Net Gain (Loss) ………. $177,591

Percent Change ………. 125.1%

Annual Appreciation … 4.5%

Cost of Ownership

————————————————-

$339,990 ………. Asking Price

$11,900 ………. 3.5% Down FHA Financing

4.71% …………… Mortgage Interest Rate

$328,090 ………. 30-Year Mortgage

$68,092 ………. Income Requirement

$1,704 ………. Monthly Mortgage Payment

$295 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$57 ………. Homeowners Insurance

$308 ………. Homeowners Association Fees

============================================

$2,363 ………. Monthly Cash Outlays

-$277 ………. Tax Savings (% of Interest and Property Tax)

-$416 ………. Equity Hidden in Payment

$21 ………. Lost Income to Down Payment (net of taxes)

$42 ………. Maintenance and Replacement Reserves

============================================

$1,734 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,400 ………. Furnishing and Move In @1%

$3,400 ………. Closing Costs @1%

$3,281 ………… Interest Points @1% of Loan

$11,900 ………. Down Payment

============================================

$21,980 ………. Total Cash Costs

$26,500 ………… Emergency Cash Reserves

============================================

$48,480 ………. Total Savings Needed

Property Details for 195 BRIARWOOD Irvine, CA 92604

——————————————————————————

Beds: 3

Baths: 1 full 1 part baths

Home size: 1,135 sq ft

($300 / sq ft)

Lot Size: n/a

Year Built: 1978

Days on Market: 40

Listing Updated: 40492

MLS Number: S636940

Property Type: Condominium, Residential

Community: Woodbridge

Tract: Vg

——————————————————————————

Probably the nicest 3 bedroom upper unit ever offered in Woodbridge's Village Green. Beautifully remodeled kitchen with nice appliances and fixtures, plus lots of tile and designer carpets, fresh paint, new mirrored wardrobe doors, etc.

Probably the nicest 3 bedroom upper unit ever offered in Woodbridge's Village Green? Probably the dumbest realtor comment ever written in the MLS….

.jpg)

.jpg)

.jpg)