Despite the political pressure, Wells Fargo is pressing ahead with its planned foreclosures.

Irvine Home Address … 14492 GUAMA Ave Irvine, CA 92606

Resale Home Price …… $499,000

If you believe in the power of magic,

I can change your mind

And if you need to believe in someone,

Turn and look behind

When we were living in a dream world,

Clouds got in the way

We gave it up in a moment of madness

And threw it all away

Don't answer me, don't break the silence

Don't let me win

Alan Parsons Project — Don't Answer Me

Borrowers believe in the power of magic. Either the market will save them or the government will. Fortunately, not every bank answered the politicians' call to stop foreclosures. B of A answered this call and in a moment of madness, they threw it all away.

Wells Fargo Foreclosures Proceed After Data Queried

By – Oct 6, 2010 9:22 AM PT

Wells Fargo & Co. is standing by the accuracy of its foreclosure filings and won’t follow competitors in delaying seizures, after an employee testified he signed documents for proceedings without personally reviewing records.

The bank said yesterday it doesn’t plan to halt repossessions because its “procedures and daily auditing demonstrate that our foreclosure affidavits are accurate.”

In a May 20 deposition, a Wells Fargo Home Mortgage employee said he signed 50 to 150 documents a day, including statements describing debts and borrowers used to justify foreclosures, without personally confirming the information was correct. His testimony related to a civil claim against the bank in a Washington state court. A judge dismissed the case in June.

Can you guess why the judge dimissed the claim? Because it was baseless. Who cares if some employee batch signed a few documents. Supervisors do this all the time. These documents were probably already reviewed by an army of staff before the signer ever saw them. The statement above implies that the banks were not reviewing these documents which is crazy.

Mortgage firms have drawn fire from borrowers, lawyers and state officials for letting employees sign affidavits for court- monitored foreclosures without personally checking loan records. JPMorgan Chase & Co. and Bank of America Corp. last week delayed foreclosures to review the accuracy of their filings. Last month, Ally Financial Inc. said its GMAC Mortgage unit would halt evictions for a similar review.

Let's be clear here: mortgage holders do not have the power of eviction. If they did, we wouldn't have so many squatters. They only have the power to foreclose, an act that leads to auction and later an eviction if the former owner doesn't leave on their own.

The Wells Fargo employee said he relied on foreclosure lawyers and personnel in other departments to check files, according to a deposition transcript provided by Melissa Huelsman, the Seattle attorney representing the homeowner. The employee said he confirmed the date on the file before signing without verifying other information.

‘Out of Context’

Those comments “should not be taken out of context,” Wells Fargo said in yesterday’s statement, e-mailed by a spokeswoman, Vickee Adams. The judge “reviewed Wells Fargo’s procedures, documents and declarations and summarily dismissed the borrower’s case, confirming that the foreclosure was valid,” the bank said in the statement.

For once, I agree with a bank. These lawsuits are silly.

Such a dismissal doesn’t necessarily invalidate testimony, said Peter Henning, a professor at Wayne State University Law School in Detroit and a former federal prosecutor.

“It’s not that the judge rejected the deposition, or found that the deposition was incorrect,” he said. “The firm probably went back into court and said ‘Here you go, you can inspect all the documents.’ Maybe that was enough.”

Wells Fargo is the second-largest servicer of U.S. home loans, according to industry newsletter Inside Mortgage Finance. The San Francisco-based bank handles about $1.8 trillion of residential mortgages, according to company filings. Bank of America, JPMorgan, Citigroup Inc. and Ally round out the top five. Through June, 92 percent of Wells Fargo’s mortgages were current, according to the statement.

If 92% of its loans are current, then 8% are delinquent. That is still an astonishingly high number.

‘How Do You Know?’

Andrew Yates, a Seattle-based lawyer representing the employee, didn’t return calls for comment. Adams declined to comment beyond the statement.

During questioning from Huelsman, the bank employee described his efforts before signing filings.

“So you’re simply signing the document that’s presented to you and you’re just making sure the date is correct?” Huelsman asked during the deposition.

“Correct,” the employee said.

“So how do you know when you’re signing this document that it’s true and correct?” Huelsman said.

“There are people that are responsible for” maintaining the paperwork, the employee said.

This is akin to asking the guy on the assembly line who installs doors if he knows anything about the motor mounts. If it isn't his responsibility, how is he supposed to have knowledge of it?

States Take a Stance

The employee said he oversaw 53 full-time staff and 15 contract workers, and that other supervisors within the department signed the same amount of paperwork. That would amount to each supervisor signing 1,000 to 3,000 documents during 20 business days each month.

In a separate case in Florida, an employee at New York- based JPMorgan said in May that her team of managers signed about 18,000 documents a month. In a December deposition, an employee at Detroit-based Ally said he signed about 10,000 documents a month. Attorneys general in at least seven states including Texas, Illinois and Ohio are investigating practices at Ally’s GMAC Mortgage unit.

In Wells Fargo’s home state, California Attorney General Jerry Brown asked JPMorgan to prove its foreclosures are legal or else freeze them, and made a similar request to Ally in September.

“This goes to the internal processes and oversight at these institutions with respect to the conduct of their employees,” said Jacob Frenkel, a partner at Potomac, Maryland- based law firm Shulman Rogers Gandal Pordy & Ecker, which isn’t representing any lenders in foreclosure proceedings. “It’s not in the banks’ interest for the records not to be right. As a lawyer I want to go into court with papers that are solid.”

If the fact that banks are processing large amounts of documents is the best these plaintiffs can do, no wonder the judges are dismissing these cases.

Published: Thursday, 7 Oct 2010 — Diana Olick

I'm not going to tally the number of Attorneys General filing lender lawsuits or lawmakers demanding foreclosure moratoria, because the minute I do the number will change.

Suffice it to say that you're not in political fashion these days if you're not "demanding" a federal investigation into shoddy foreclosure procedures or "ordering" a freeze on foreclosures for the foreseeable future, even though you might not exactly have the jurisdiction to do so.

“Our families deserve to know that an action with such a huge and lasting impact is the absolute last resort, and that every effort has been made to keep them in their homes prior to foreclosure,” wrote Oregon Senator Jeff Merkley. He's a Democrat, by the way, and they appear to be in the majority of those screaming at the wind; gee I wonder why.

No less than the Speaker of the House, Nancy Pelosi, and her cadre of California lawmakers noted that, "Avoidable foreclosures end up being unnecessarily costly for homeowners, lenders and servicers, and our housing market, whose health is essential to our economic recovery," in a letter addressed to the U.S. Attorney General, Fed Chairman and the acting Comptroller of the Currency. "Recent reports that Ally Financial (formerly GMAC), JP Morgan, and Bank of America may have approved thousands of unwarranted foreclosures only amplify our concerns that systemic problems exist," she adds.

And it's not just the Dems posturing on this one. Far be it for Republicans to pass up a chance to use the scandal as a weapon. Alabama Senator Richard Shelby, ranking Republican on the Banking Committee is calling for a hearing: "I am highly troubled that once again our federal regulators appear to be asleep at the switch.”

I'm not going to feign surprise at any of this. It's to be expected, especially given this particular upcoming election. I just wish these folks would stick to the facts. This scandal is largely about bad paperwork, not "unwarranted foreclosures." Right now close to 10 percent of borrowers in this country are delinquent on their loans.

Translation: They're not paying their mortgages.

Another 4 percent have been delinquent for so long that they're now in the foreclosure process.

Yes, the process is flawed because the banks clearly aren't equipped to handle the numbers.

Yes, there may be some loans that could have been saved, but the vast majority can't.

Still lawmakers want to freeze all foreclosures to make sure all of them are fair because, as Speaker Pelosi writes, "People in our districts are hurting."

Boo Hoo.

The question is, how much would a foreclosure freeze hurt the greater housing market?

I asked some mortgage mavens and got the following responses:

Josh Rosner, Graham-Fisher: With REO sales being a large part of supply we would see home prices artificially and unsustainably rise, foreclosure volumes paint a false picture of stability and investors in MBS would be further harmed as their losses grow. Once the moratorium ended prices would fall and foreclosures would skyrocket. But, it would paint a prettier picture than reality heading into mid-term elections.

That is a brilliant synopsis of what would happen if this moratorium continues and becomes more widespread.

Guy Cecala, Inside Mortgage Finance: Instead of having a ton of mortgage borrowers who haven’t made any payments in at least a year, we would have a ton who haven’t made a payment in a year-and-half. Keep in mind we will have new problem loans entering the system throughout any moratorium whether we acknowledge them or not. Do we seriously believe that a foreclosure moratorium can change the outcome of potentially 5 million or more homeowners losing their homes over the next two years? Ultimately, if we don’t do something to handle distressed properties more efficiently (and faster), the housing market is going to remain stuck in limbo with no recovery in sight.

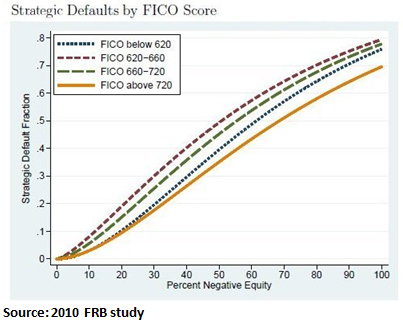

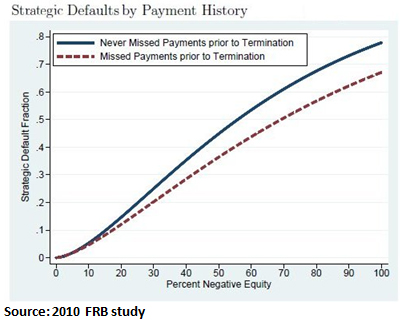

Right again. any widespread moratorium will encourage strategic default.

Janet Tavakoli, Tavakoli Structured Finance: Banks are vulnerable to lawsuits from investors in the [securitization] trusts. This problem could cost the banks significantly more money, which could mean TARP II (Washington Post)

Another very likely outcome. Banks are going to either lose money through foreclosure or lose money through lawsuits due to their failure to foreclose.

Rick Sharga, RealtyTrac: If foreclosure sales are prohibited, home sales would tail off dramatically…foreclosures and REOs accounted for over 30% of all sales during the quarter [Q3] Fewer home sales will put more pressure on home prices, reduce tax receipts for already-strapped municipal and state governments, and put even more pressure on an already-moribund economy. This could cause at least a temporary loss of jobs in a number of sectors. A 90-day moratorium would also extend the housing market downturn, pushing the anticipated recovery from early 2014 into late 2014 – and possibly even longer.

Any foreclosure moratorium would be a disaster. Since B of A is at least temporarily going that route, perhaps Wells Fargo and other banks will take advantage and push a few more foreclosures through the system. If I were in their shoes, I would..jpg)

They got their share of the HELOC riches

- The owners of today's featured property paid $486,000 on 5/29/2003. The used a $388,800 first mortgage, a $48,600 second mortgage, and a $48,600 down payment.

- On 6/4/2004 they refinanced with a $437,000 first mortgage.

- On 9/27/2004 they obtained a $75,000 HELOC.

- On 3/16/2005 they refinanced with a first mortgage for $439,000.

- On 1/26/2006 they refinanced the first mortgage for $555,000.

- On 8/28/2006 they refinanced with a $564,000 Option ARM with a 1.25% teaser rate, and they obtained a $100,000 HELOC.

- Total property debt is $664,000.

- Total mortgage equity withdrawal is $226,600.

- Total squatting time is about 18 months.

Foreclosure Record

Recording Date: 10/29/2009

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 07/24/2009

Document Type: Notice of Default

Irvine Home Address … 14492 GUAMA Ave Irvine, CA 92606 ![]()

Resale Home Price … $499,000

Home Purchase Price … $486,000

Home Purchase Date …. 5/29/2003

Net Gain (Loss) ………. $(16,940)

Percent Change ………. -3.5%

Annual Appreciation … 0.3%

Cost of Ownership

————————————————-

$499,000 ………. Asking Price

$17,465 ………. 3.5% Down FHA Financing

4.21% …………… Mortgage Interest Rate

$481,535 ………. 30-Year Mortgage

$94,234 ………. Income Requirement

$2,358 ………. Monthly Mortgage Payment

$432 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$42 ………. Homeowners Insurance

$43 ………. Homeowners Association Fees

============================================

$2,875 ………. Monthly Cash Outlays

-$371 ………. Tax Savings (% of Interest and Property Tax)

-$668 ………. Equity Hidden in Payment

$26 ………. Lost Income to Down Payment (net of taxes)

$62 ………. Maintenance and Replacement Reserves

============================================

$1,924 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,990 ………. Furnishing and Move In @1%

$4,990 ………. Closing Costs @1%

$4,815 ………… Interest Points @1% of Loan

$17,465 ………. Down Payment

============================================

$32,260 ………. Total Cash Costs

$29,400 ………… Emergency Cash Reserves

============================================

$61,660 ………. Total Savings Needed

Property Details for 14492 GUAMA Ave Irvine, CA 92606

——————————————————————————

Beds: 4

Baths: 1 full 2 part baths

Home size: 1,897 sq ft

($263 / sq ft)

Lot Size: 5,130 sq ft

Year Built: 1971

Days on Market: 9

Listing Updated: 40457

MLS Number: S634529

Property Type: Single Family, Residential

Community: Walnut

Tract: Cp

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Ready to work, Here is great opportunity for you. Located in cul-de-sac. Walking distance to elementary school. Large house for little money.

![[BOFA]](https://sg.wsj.net/public/resources/images/P1-AX620A_BOFA_NS_20101008192429.gif)

.jpg)

.jpg)