Some people who should know better got caught up in the financial mania. Today's story is very instructive. I admire the author for his bravery in admitting his idiocy.

Irvine Home Address … 76 TIDEWIND Irvine, CA 92603

Resale Home Price …… $789,000

how stupid could I be

a simpleton could see

everything changes

everything falls apart

can't stop to feel myself losing control

but deep in my senses I know

Sarah McLachlan — Stupid

We all do stupid things. I know I have. It's what people learn from their mistakes that counts.

Today's featured article is written by a financial planner in Las Vegas who believed and acted upon every false belief of the housing bubble. He didn't just make a few stupid decisions, he made them all. Rather than being an object of ridicule, I admire his courage to stand up and tell his story.

Since I began writing for the IHB, my focus has always been on educating people on the mistakes of the housing bubble. If the foolish decisions people made are not seen for the folly they were, the mistakes will be repeated. In that regard, I find Carl Richards' story compelling. He appears to have learned from his mistakes, and now he is working to educate others on what not to do. Perhaps he may become a good finanical planner after all. His advice is undoubtedly better today than it was five years ago.

How a Financial Pro Lost His House

By CARL RICHARDS — Published: November 8, 2011

… I’m a financial adviser. I get paid to help people make smart financial choices, and I speak and write about personal finance issues for this publication and others. My first book comes out in January, “The Behavior Gap: Simple Ways to Stop Doing Dumb Things With Money” (Portfolio, a Penguin imprint).The thing that few people know, though, is that I learned a lot of this from experience. I made a bunch of mistakes, the very same ones that I now go around warning people to avoid.

So this is the story of how I lost my home, the profound ethical questions that arose along the way, and what my wife and I learned from the mistakes that led us to that point. It made me better at what I do, but it wasn’t much fun getting there.

… That was May 2003. Housing prices were already crazy, so we rented. But our neighborhood had zero character and lots of cookie-cutter houses. Within a few weeks, we were looking for a place to buy.I felt we could afford around $350,000. We called a real estate agent named Mitch, who had signs on all the bus stops: Talk to Mitch! He picked us up in a gold Jaguar, and suddenly we were looking at houses that listed at $500,000 or more.

It felt a little crazy to be shopping for houses that cost half a million dollars, but my income was growing rapidly. Everywhere I looked, people were being rewarded for buying as much house as they could possibly afford, and then some. There was this excitement in the air, almost like static. I started to think that if I didn’t buy a house right then, I would never be able to afford one.

Fallacy #1: Buy now or be priced out forever. How many people succumb to that fallacy?

At moments during our house hunt, I felt in my gut that something wasn’t right. We’d go to open houses for $400,000 homes and see lines of couples in their late 20s — younger than we were — waiting to get inside. I kept wondering where all the money was coming from. How did all these people make so much?

But prices just kept rising, and when people kept buying, that made it seem safer. I knew from my work as a financial adviser that following the crowd could be costly. But like everyone else, I felt safer in a crowd.

Fallacy #2: There is safety in the Herd. Following the herd is almost always a financial disaster.

We didn’t find anything we liked with Mitch, but one day in September 2003 Cori spotted a for-sale-by-owner sign in a really nice neighborhood. We ended up buying the house and paid the asking price of $575,000. (When we tried to negotiate on price, the owners were amused; it just wasn’t that kind of market.)

We borrowed 100 percent of the purchase price. In fact, I was told I could borrow even more if I wanted. I had perfect credit and a solid income that was growing. But even so, when the lender approved us at 100 percent, it was more than I had expected. I remember thinking something like “Wow. I guess if they’re willing to lend it to us it must be O.K.”

Fallacy #3: Using 100% financing is safe.

I should have known better. No matter how well things are going, borrowing 100 percent of the purchase price of a home is not a good idea. I shouldn’t have relied on someone else to make that calculation, let alone the guy who was making money putting me in the loan. I was a financial adviser, and I never sat down to figure out what it would take to make this work. I just wanted to believe him. And it was so easy to believe he had been right, at least at first. We loved living there. The children went to an awesome public school, and we made some great friends. I could ride my bike to Red Rocks, the wilderness area outside of town. And for a time, the real estate market erased any doubt I may have had. It just kept going up.

One evening in 2006 comes to mind. My sister-in-law was thinking of moving to Las Vegas, and a real estate agent told me about an open house for a new Toll Brothers community. This wasn’t a come-by-for-cookies type of open house; it was held at a Las Vegas hotel ballroom. I arrived to find a line that led down a flight of stairs and out of the front door. Before I got to the front of the line, they stopped admitting people. Then people rushed the door, like it was a rock concert.

The market’s continued strength meant we could borrow even more. It was easy. In late 2004, a year after buying the house, we refinanced our mortgage with World Savings Bank, which later ended up in the hands of Wells Fargo, using one of the pick-a-payment loans that let you choose your own payment each month.

We picked the lowest possible payment, the one that added to our balance each month instead of subtracting from it. And we added a line of credit with Wells Fargo.

Fallacy #4: Option ARMs are a safe form of financing.

Around that time, I left Merrill Lynch to become an independent financial adviser, so it was easy enough to convince ourselves that we were borrowing to pay for the start-up costs.

Fallacy #5: Rising house prices can finance a new business or a spendthrift lifestyle.

There was some truth to that, but we were also borrowing against the house to finance our lifestyle. The line between business expenses and personal ones is sometimes hard to draw when you run your own business, and during those heady times it seemed even harder. But in hindsight it is clear that we were spending more than we should have on things like recreational gear and family trips for ourselves and our four children.

It was extravagant, but it seemed modest compared to what some of our neighbors were doing. Our house was the smallest model in the neighborhood (though at 3,500 square feet it was hardly tiny), and we drove a Chevy and a VW. Cori and I and some of our friends had a lot of conversations comparing our spending habits to those around us. How can so-and-so afford a boat? How are people buying new trucks and four-wheelers and 5,000-square-foot homes? Do they know something we don’t know?

At times, it seemed as if maybe they did. I knew a builder of custom homes who urged me to buy one of his houses for close to $2 million. I told him there were at least a million reasons why I couldn’t do that. He looked at me like I just didn’t get it. He assured me the house was appraised for $200,000 more than the asking price, and that after I lived there I could take out a line of credit to live on while the house went up even further.

The crazy thing is, he was right. The place eventually sold for more than $3 million. When I heard that, I felt a little silly that we hadn’t taken that risk.

Fallacy #6: The high end is immune to price declines from credit problems.

As for our spending, we told each other that we’d catch up later, as my income and the value of our home continued to rise. As late as February 2006, a comparable home in our neighborhood sold for $998,000. We made the classic mistake of projecting recent trends — even extreme ones — into the future.

But slowly — and then increasingly — we began to have a different kind of conversation, “When are we going to stop and just get on top of this?” The solution was always making more money, not cutting back. The fact is, it’s much easier to set a goal of making more money in the future than it is to buckle down and cut back today.

Fallacy #7: You can earn your way out of insolvency. Unless your Nicolas Cage making $20M a picture, once you go insolvent, bankruptcy is likely the only way out.

We never really worried that things would go to pieces the way they ultimately did. But then came the collapse in the stock market. I had clients calling in tears and breaking down in my office. People who had never worried about their portfolios were calling me from their vacations. It was like talking people in off a ledge virtually every day, maybe three times a day, for maybe 90 days in a row.

The range of potential outcomes had gotten so broad in people’s minds that it now included the end of the world. What they wanted and needed more than anything was reassurance that things would be O.K. and that they should stick with the investment plans we had created together. Providing that reassurance had been my job for 10 years or more, but this was the first time that I really wondered if my advice was right.

It was my job to assist them, but I found it incredibly stressful. It didn’t help that we were in increasingly dire straits ourselves. My income fell about 20 percent because my take-home pay depended on the amount of money I managed. At the same time, our cost for health insurance and property taxes kept increasing, and the payment on our mortgage reset higher as well.

By then, housing prices in Las Vegas were falling quickly, and the bank had cut off our home equity line of credit. We quickly got rid of a car and stopped taking trips. I moved into a smaller workspace and cut back on my administrative and marketing costs. Even so, we found ourselves using credit cards as emergency stopgaps.

Fallacy #8: You can borrow your way to prosperity.

Then, the sickness set in. The pain would start in my stomach, and then I’d spend six hours vomiting. It happened once, then three months later it happened again, then one month later it happened yet again. Eventually, it was happening every couple of weeks. The doctors couldn’t find a physical cause.

I know that problem. I've never found myself throwing up from stress, but I have had all-day headaches and days I could not eat. Stress will tear you apart.

Right around that time, it became clear that we might need to get back to Utah, where 90 percent of my (still nervous) clients lived. We spent the summer of 2009 living in my in-laws’ basement in Salt Lake City, while I tried to stabilize my financial planning business. By that fall, I was convinced we had to move back permanently to save the business. But that meant we faced the question of what to do about the house.

By then, we owed over $200,000 more than our original loan balance. …

At first, I dismissed the idea of a short sale. Late that summer, I sat down with a really close friend in Las Vegas, someone I looked up to. He cut to the heart of the matter right away: Why, he wanted to know, were we still making the payments?

Because I have a moral obligation, I said. You pay your debts.

He proceeded to explain that I didn’t have a moral obligation to the bank. I had a moral obligation to my family. I had a contractual obligation to the bank, along with a clear moral obligation to be honest in my dealings. What he was asking was this: Which is more important? Your contractual obligation to the bank or your obligation to your family to preserve your ability to make a living?

I had never thought of it that way. But it made sense. I summed it up to myself like this: I have a contractual obligation to the bank (as well as a moral obligation not to skirt the consequences of breaking it: losing my house and wrecking my credit score). But my moral obligation to my family trumps the contractual obligation to the bank.

I have made the same argument many times. I still believe it to be true.

Cori and I thought about this for months, but we finally decided to let the house go and stop making payments so we could pursue a mortgage modification or a short sale. The fact was, we didn’t have a choice. We simply couldn’t afford it.

I remained troubled by the ethical implications of what I was doing, but I soon started seeing some of my friend’s arguments echoed in the work of Brent T. White, a law professor at the University of Arizona. He and others were arguing that homeowners should act more like companies — taking into account legal and economic reasons for stopping a regular payment rather than “perceived moral obligations.”

That was reassuring in the dead of night while I sat in front of the computer trying to make sense of the world financial markets and my own personal situation. I remember being relieved at discovering a way to frame my decision.

But we didn’t know what would happen in the harsh light of day, and we were scared to death. Would we be kicked out of our house? What would the neighbors think? What would the children think? We worried about the stress on our relationship and even the survival of our marriage. I felt like a complete failure.

I am always amazed when I hear people who are motivated about what they believe the neighbors will think. It reminds me of an old adage: At 20, you worry about what everyone thinks. At 40, you don't care what anyone thinks. At 60, you realize nobody was ever thinking about you. They were all too busy worrying about what you were thinking.

… We were pretty low when we packed up to leave. We hadn’t told anyone about the short sale — not family and only one or two friends. But we sensed that people knew anyway.

We borrowed a truck from a friend who owns a wood mill to move our belongings. Back in Utah, we found a house to rent— much to my relief and after months of being terrified that we’d never be able to find a landlord willing to take a chance on us. I had to tell the owner what had happened. He looked at our personal references and let us lease the house anyway.

People worry they won't be able to rent a house or borrow money after a financial collapse. Most people grossly overestimate the negative consequences of strategic default.

We love where we live now. Still, there are consequences. We lost our home. It’s not clear when we’ll be in a position to become homeowners again.

But the worst thing was my sense of complete failure and powerlessness when I realized that things were out of control and that it was my fault. These days, there is still a sense of genuine regret that I screwed up and hurt myself and other people. I still worry about what others think of my behavior, which is one reason I haven’t shared this story with many people until recently.

… Still, the questions linger. As I ponder all this — and I think about it a lot — it occurs to me that we are a nation of risk-takers. Some of us were overoptimistic; some were ignorant; some were deluded; some were greedy; some just had bad timing. We erred to different degrees. Our experiences varied; each story is different. Now you know mine. The experience has changed just about everything about how I do financial planning and the advice I give in public. For one thing, I am less quick to judge other people’s financial behavior. I’m also more inclined to take into account personal factors that determine how people behave around money.

Just because you make some mistakes about money doesn't mean you shouldn't use that wisdom to notice the mistakes other people make. Mistakes are still mistakes. If you can make judgments and discrenments about what behaviors are wise and which ones are foolish, you don't grow.

I have a friend who is going through a tough time financially. He has a high income, but is burdened by debt from a few real estate deals that went south. He continues to take fairly expensive ski trips. That would seem irresponsible in his situation, and maybe they are.

But I now realize that it is not that simple. Maybe those trips are keeping the guy alive, or saving his marriage or keeping him sane enough to work.

Bullshit. Spendthrift behavior is not going to allow anyone to reach their financial goals. It isn't a matter of judging someone good or evil to notice whether or not their behavior is serving them well or not. I watched a guy at a craps table lose most of his paycheck while his wife was standing there berating him and complaining about having no money to buy diapers for their baby. I don't think that man was well served by his behavior, and I didn't think him evil, but he was clearly pretty stupid. Is that judging, or observing?

As for Cori and me, things are much better now. Moving back to Utah clearly was the right choice. The business is doing well, and we’ve managed to pay down most of our debt. It would be easy to say that we’ve learned our lesson, that we’ll never screw up again.

But it’s not that simple. At times I’m absolutely clear about what makes sense. Then ordinary life choices arise, and things can get cloudy. Should our children play sports that cost money? What kind of family vacation is O.K.? How much is enough?

We’re still working on that last one. But we are asking the question, repeatedly. And the temptation to overspend, to go for it, to tell ourselves that things will work out in the long run, is tempered by a feeling that something big is at stake. …

I question whether or not this guy has figured it out yet. Perhaps this will help:

Turtle Rock 3/2 under $400/SF, under $3,000 monthly cost of ownership

Given how inflated prices still are in Turtle Rock, it's unusual to find a property trading at or below rental parity. Today's featured property is one of them.

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 76 TIDEWIND Irvine, CA 92603

Resale House Price …… $789,000

Beds: 3

Baths: 2

Sq. Ft.: 2000

$394/SF

Property Type: Residential, Condominium

Style: Two Level, Traditional

Year Built: 1984

Community: Turtle Rock

County: Orange

MLS#: S656808

Source: CRMLS

Status: Active

On Redfin: 197 days

——————————————————————————

WOW!! Priced Reduced to sell NOW!! Great price for this lovely neighborhood!!!Beautiful 'Standard Pacific' Home located on a private cul de sac * * Gated entry w/ Pavers * * Tastefully upgraded Home * * Foyer has Porcelian Tile Flooring * Separate Formal Dining Room * * Formal Living Room w/ Gorgeous Custom Tile Fireplace and Mantel * * Kitchen offers Granite Countertops W/ Tumbled Marble Backsplash & extended spacious counters, Nickel hardware & Stainless Steel Appliances * Recessed Lighting * All Baths have Granite countertops and Customs Mirrors * Master has dual Vanity sinks, large tile shower, walk in closest * Backyard Brick Patio and raised Brick planters * Lemon and Lime trees *

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis ![]()

Resale Home Price …… $789,000

House Purchase Price … $452,000

House Purchase Date …. 5/16/2001

Net Gain (Loss) ………. $289,660

Percent Change ………. 64.1%

Annual Appreciation … 5.3%

Cost of Home Ownership

————————————————-

$789,000 ………. Asking Price

$157,800 ………. 20% Down Conventional

4.06% …………… Mortgage Interest Rate

$631,200 ………. 30-Year Mortgage

$162,909 ………. Income Requirement

$3,035 ………. Monthly Mortgage Payment

$684 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$164 ………. Homeowners Insurance (@ 0.25%)

$0 ………. Private Mortgage Insurance

$325 ………. Homeowners Association Fees

============================================

$4,208 ………. Monthly Cash Outlays

-$705 ………. Tax Savings (% of Interest and Property Tax)

-$900 ………. Equity Hidden in Payment (Amortization)

$224 ………. Lost Income to Down Payment (net of taxes)

$119 ………. Maintenance and Replacement Reserves

============================================

$2,947 ………. Monthly Cost of Ownership

Cash Acquisition Demands

—————————————————————————–

$7,890 ………. Furnishing and Move In @1%

$7,890 ………. Closing Costs @1%

$6,312 ………. Interest Points

$157,800 ………. Down Payment

============================================

$179,892 ………. Total Cash Costs

$45,100 ………… Emergency Cash Reserves

============================================

$224,992 ………. Total Savings Needed

—————————————————————————–

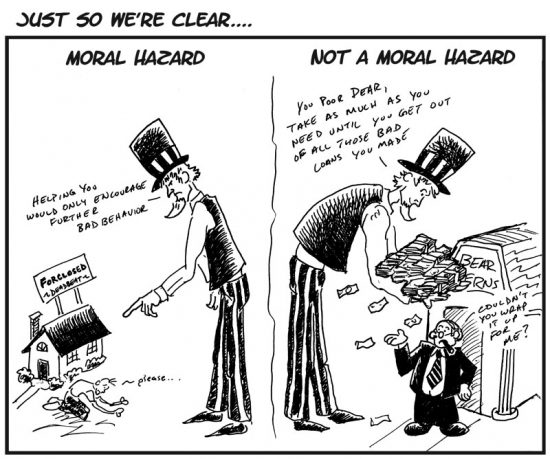

Iceland bailing out the banks was never an option because the problem was too big. It turned out to be a blessing for them. Rather than be saddled with a generation of debt, the Icelandic taxpayers have a clean slate. What do we have? How many trillions of dollars will this cost us?

Iceland bailing out the banks was never an option because the problem was too big. It turned out to be a blessing for them. Rather than be saddled with a generation of debt, the Icelandic taxpayers have a clean slate. What do we have? How many trillions of dollars will this cost us?

The former owner of today's featured REO paid $835,000 on 3/13/2006. They used a $636,000 first mortgage, a $64,000 HELOC, and a $135,000 down payment. The down payment money is now gone. They did manage to obtain two years of squatting before the auction.

The former owner of today's featured REO paid $835,000 on 3/13/2006. They used a $636,000 first mortgage, a $64,000 HELOC, and a $135,000 down payment. The down payment money is now gone. They did manage to obtain two years of squatting before the auction.

The previous owners of today's featured property bought so long ago their purchase is not on my database. Their taxable basis was $93,605 which suggests they likely bought in the 1970s. By 4/6/1999 they had increased their first mortgage to $169,600. They followed by refinancing a few times including a $343,000 HELOC on 6/21/2005 and a $270,000 mortgage on 8/28/2006. The bank took the property back on 2/14/2011 for $238,000. They did get to squat for a while…

The previous owners of today's featured property bought so long ago their purchase is not on my database. Their taxable basis was $93,605 which suggests they likely bought in the 1970s. By 4/6/1999 they had increased their first mortgage to $169,600. They followed by refinancing a few times including a $343,000 HELOC on 6/21/2005 and a $270,000 mortgage on 8/28/2006. The bank took the property back on 2/14/2011 for $238,000. They did get to squat for a while…

This is a key point. Attempts to reflate a housing bubble will invariably go to another asset class. The problem with bubbles is that prices get detached from their underlying values. The inevitable crash refocuses investors on value, so even when cheap money is made available, that money will not flow into the previously inflated asset class. Instead, the cheap money will flow into some other asset class and form a bubble there. Anyone noticed how well commodities have done since housing and stocks crashed?

This is a key point. Attempts to reflate a housing bubble will invariably go to another asset class. The problem with bubbles is that prices get detached from their underlying values. The inevitable crash refocuses investors on value, so even when cheap money is made available, that money will not flow into the previously inflated asset class. Instead, the cheap money will flow into some other asset class and form a bubble there. Anyone noticed how well commodities have done since housing and stocks crashed? Everyone who wants higher prices and lower lending standards harkens back to the prices and standards of the bubble which by definition were not stable. Lending standards are not too tight today. In fact, they are still loose by pre-bubble standards. Many in the real estate industry viewed looser lending standards as a sign of innovation in finance. In reality, it was merely folly, and we are all paying the price for this epic failure.

Everyone who wants higher prices and lower lending standards harkens back to the prices and standards of the bubble which by definition were not stable. Lending standards are not too tight today. In fact, they are still loose by pre-bubble standards. Many in the real estate industry viewed looser lending standards as a sign of innovation in finance. In reality, it was merely folly, and we are all paying the price for this epic failure. She is right. realtors will always argue against removing any housing subsidy no matter the circumstances. The arguments they will make will differ, but their clamoring for subsidies will always be the same.

She is right. realtors will always argue against removing any housing subsidy no matter the circumstances. The arguments they will make will differ, but their clamoring for subsidies will always be the same.