Irvine is a premium Orange County Community, but how large is the premium for the land? Today we will take a look.

Irvine Home Address … 14132 MOORE Ct Irvine, CA 92606

Resale Home Price …… $559,900

We never lost control

You're face to face

With The Man Who Sold The World

Nirvana — The Man Who Sold The World

Has any man sold more homes than Donald Bren? I don't know, but I doubt it. He and his Irvine Company are planning to sell a few more. Any takers?

Irvine Co.: 1,350 homes sold, more coming

April 8th, 2011, 3:00 pm — Jon Lansner

The Irvine Co. — fresh from a remarkable 2010 where their Irvine villages were a top-selling new-home project in America — will officially launch four more North Irvine projects Saturday.

The company has sold 1,350 homes in North Irvine communities since January 2010 —

Perhaps the Irvine Company is not used to having fact checkers follow them around, but the sales numbers they throw out are not accurate. And I strongly suspect the sales numbers are intentionally exaggerated to create false urgency to sell more homes.

From January 2010 to February 2011, they closed on 642 home sales. The numbers they are reporting are double what really sold. Perhaps if I were dependent upon the Irvine Company for advertising revenue, perhaps I would let transparent lies pass by, but since I don't fear them pulling ad revenue from me, I will provide accurate numbers.

and officially launches 12 model homes in four neighborhoods (DETAILS HERE!) in the Stonegate neighborhood. All told, the four new projects — click on sketches above for larger images and details — consist of 486 homes from one-bedroom, 1,129-square-foot flats to 2,974-square-foot, 5-bedroom detached homes. Prices? From the mid-$300,000s to high-$700,000-plus.

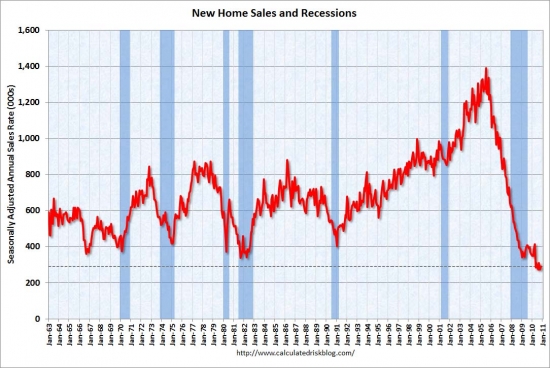

Dan Young, Irvine Co.’s homebuilding chief, continues to credit detailed market research for the company’s success — a distinct rarity in a homebuilding world that elsewhere runs near historic lows.

He's right in pointing out that the Irvine Company is leading the way out of the home building recession. They restricted sales so much in 2008 and 2009, they didn't overbuild and saturate the market with product they couldn't move. The activity in 2010 stands in stark contrast to the rest of the industry.

“It’s got to be about the house,” he says of the projects continued focus, which he admits sounds simplistic — but it is not.

The Irvine Co.’s ongoing research found that the key buying group are young professionals who are picky — “they grew up in great homes” — and want something different than their parents’ house — “their expectations are higher.”

The long-vanished real estate boom, in Young’s eyes, made house selling so easy that bad homebuilding habits were born so that homes were “engineered not designed,” and that “took a lot of the romance out of the product.”

Having worked in architectural firms as a land planner for a number of years, I can attest to what Mr. Young is saying. When architects are busy, they are more concerned with putting out drawings and getting paid than they are about the nuances of the product. Plus, overly cost conscious builders end up stripping down the design to it's simplest and easiest to build form.

The new research helped the Irvine Co. plan homes that trade housing traditions — like a formal dining area– for large, kitchen-linked “great room” with a built-in “home management” area plus a covered, outdoor “California room” dining area. Buyer feedback has also led to further innovations, such as building bigger and more functional kitchen islands that are sculpted “more like a piece of furniture.”

It didn’t hurt the homebuilding endeavor that the Irvine Co. was blessed with a well-financed owner, billionaire Don Bren, who was able to put his own cash at risk on new homes when other builders still scramble for construction financing. ”We were in a position, financially, to take the large risk,” adds Young, who notes that the homebuilding effort has met or exceeded every financial plan including, “a good profit.”

The should be able to make a good profit considering they likely have less than $100/SF into the house itself, and the land basis is near zero.

The Irvine land premium

When the Irvine Company developed the Ranch, through good land planning and a commitment to quality, they have managed to create an enormous premium for Irvine compared to other inland Orange County communities. Only the beach communities carry a higher premium on the land.

I created the chart above by taking the median home prices and dividing it by the median lot size. Similar to a $/SF for houses, this reflects the value of the underlying land.

Irvine has always had a price premium, but when you factor in the fact that lots are also 20% to 30% smaller than surrounding communities, the $/SF of lot value is extraordinarily high. Creating this premium from nothing is the real genius and accomplishment of Donald Bren and the Irvine Company.

If you compared Irvine to the remainder of Orange County, how large is the Irvine land premium? How much more do buyers in Irvine pay on a per-square-foot basis than the Orange County median? Quite a bit.

From 1988 to 1994, the premium hovered around 50%, but in 1995 it began to climb. From 1995 to 2009, the Irvine premium hovered between 50% and 80%. When land values in the subprime areas crashed and took down the Orange County median, the Irvine land premium rose to unprecedented levels.

IMO, the elevated Irvine land premium reflects the fact that prices have not fallen in Irvine compared to surrounding communities. Perhaps Irvine has taken another step up from the crowd and the Irvine premium will remain above 80% permanently.

I doubt it.

It seems far more likely to me that resale asking prices in Irvine will continue to fall. Perhaps the Irvine Company will be able to hold pricing on its new product, but they may find sales goals elusive as the substitution effect drags down the high end and brings the Irvine land premium back into its historic stable range.

That check won't be very big

Sometimes when I comb through the property records, I feel like I am spinning the wheel of fortune. Some of these owners didn't spend their equity, so they leave the closing table with big equity checks. Most have some degree of Ponzi borrowing. My observation is that well over half have increased their mortgage. Some borrow a lot and some borrow a little, but most borrow something.

The owner of today's featured property borrowed enough to put a major dent in their closing check. At least they won't be a short sale.

Todays featured property was purchased on 7/22/1994 for $235,000. The owners used a $188,000 first mortgage and a $47,000 down payment. At first they behaved well, and when they first refinanced in 1997, they paid down the first mortgage to $186,000. However, on 12/10/2001, they opened a $50,000 HELOC and went Ponzi.

On 10/3/2002 they refinanced with a $232,500 first mortgage and got another $25,000 HELOC. They had gone Ponzi, and there was no looking back.

On 8/24/2004 they obtained another $75,000 HELOC, and they increased it to $100,000 on 4/18/2005.

On 7/26/2005 they refinanced with a $350,000 first mortgage, and finally on 4/24/2008 they obtained their final $100,000 HELOC. There is no way to be sure if they spent it. Either way, they already nearly doubled their initial mortgage and Ponzi borrowed at least $165,000 — money that won't be in their closing check.

Irvine House Address … 14132 MOORE Ct Irvine, CA 92606 ![]()

Resale House Price …… $559,900

House Purchase Price … $235,000

House Purchase Date …. 7/22/1994

Net Gain (Loss) ………. $291,306

Percent Change ………. 124.0%

Annual Appreciation … 5.2%

Cost of House Ownership

————————————————-

$559,900 ………. Asking Price

$111,980 ………. 20% Down Conventional

4.84% …………… Mortgage Interest Rate

$447,920 ………. 30-Year Mortgage

$113,830 ………. Income Requirement

$2,361 ………. Monthly Mortgage Payment

$485 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$117 ………. Homeowners Insurance (@ 0.25%)

$52 ………. Homeowners Association Fees

============================================

$3,015 ………. Monthly Cash Outlays

-$401 ………. Tax Savings (% of Interest and Property Tax)

-$554 ………. Equity Hidden in Payment (Amortization)

$208 ………. Lost Income to Down Payment (net of taxes)

$70 ………. Maintenance and Replacement Reserves

============================================

$2,337 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$5,599 ………. Furnishing and Move In @1%

$5,599 ………. Closing Costs @1%

$4,479 ………… Interest Points @1% of Loan

$111,980 ………. Down Payment

============================================

$127,657 ………. Total Cash Costs

$35,800 ………… Emergency Cash Reserves

============================================

$163,457 ………. Total Savings Needed

Property Details for 14132 MOORE Ct Irvine, CA 92606

——————————————————————————

Beds: 4

Baths: 2

Sq. Ft.: 1910

$293/SF

Property Type: Residential, Single Family

Style: One Level, Contemporary

Year Built: 1975

Community: 0

County: Orange

MLS#: S653562

Source: SoCalMLS

Status: Active

On Redfin: 4 days

——————————————————————————

Immaculately maintained open plan single story detached home in the Colony. STANDARD SALE! Master and 2 bedrooms on ground floor level, permitted addition includes loft currently used as 4th bedroom. Large family room and bay window views of a private, tree-lined, greenbelt. Peaceful cul de sac street. Adjacent to all shopping and the 5 freeway on/off-ramps. Many upgrades including: quiet, dual pane custom Anderson windows, 6 panel doors, Travertine 16' tiles and carpeting, landscaped bricked yard with built in grill. Roof is 2 yrs new Eaglelite Concrete tile, All appliances-insured and inspected plus replaced AC, Heat, Vents about 6 years ago. Annual Termite inspections. The Colony has the lowest HOA fees in Irvine-$52.00/month-NO Mello Roos, includes free clubhouse use w/ bbqs, pool/lifeguard/swim team, basketball, tennis, volleyball, serene tree-lined park with large tot-lot playground. Many community events. 4 Blocks-Irvine HS; 6 Blocks-College Pk. Elementary; 10 Blocks-Venado Middle.

.jpg)

.jpg)

Completely REMODELED KITCHEN overlooks PRIVATE COURTYARD & BBQ Area. HUGE MASTER BEDROOM SUITE, with His & Hers Closet & Mirrored doors. Plus Large LOFT that could be used as an OFFICE/DEN OR 2ND BEDROOM. PREMIUM CORNER LOCATION with Upgraded Brick Floors on Front Porch, Custom MARBLE FIREPLACE & Foyer, Plantation Shutters, Crown Molding & More! . .. RESORT-LIKE Living at community POOL and SPA. Conveniently located by The Racket Club of Irvine, Rancho San Joaquin Golf Course, William R. Mason Regional Park, John Wayne Airport, Freeway Transportation, Shops, Restaurants, UCI and Highly Acclaimed Irvine AWARD-WINNING Schools. MUST SEE TODAY!!!

Completely REMODELED KITCHEN overlooks PRIVATE COURTYARD & BBQ Area. HUGE MASTER BEDROOM SUITE, with His & Hers Closet & Mirrored doors. Plus Large LOFT that could be used as an OFFICE/DEN OR 2ND BEDROOM. PREMIUM CORNER LOCATION with Upgraded Brick Floors on Front Porch, Custom MARBLE FIREPLACE & Foyer, Plantation Shutters, Crown Molding & More! . .. RESORT-LIKE Living at community POOL and SPA. Conveniently located by The Racket Club of Irvine, Rancho San Joaquin Golf Course, William R. Mason Regional Park, John Wayne Airport, Freeway Transportation, Shops, Restaurants, UCI and Highly Acclaimed Irvine AWARD-WINNING Schools. MUST SEE TODAY!!!

.png)

As Home Ownership grew older, King Conforming took him up to the highest point of the land – Peak Equity – and showed him a bountiful future. “Someday you’ll be a part of the Circle of Life. You’ll buy a home, pay off the loan, have plenty of equity to share with your children, and eventually see them become a home owner just like you.” That’s how it’s supposed to work out.

As Home Ownership grew older, King Conforming took him up to the highest point of the land – Peak Equity – and showed him a bountiful future. “Someday you’ll be a part of the Circle of Life. You’ll buy a home, pay off the loan, have plenty of equity to share with your children, and eventually see them become a home owner just like you.” That’s how it’s supposed to work out.

.png)

All rooms are open to each other, making this a perfect floorplan for living & entertaining. Gorgeous slate tile flooring accents the main floor. Tranquil master bedroom features bath area with dual sinks, travertine tile floors, & walk in closet. Second bedroom has it's own private full bath w/ travertine tile floor. The versatile den could also be used as an office, playroom, nursery, workout room, or craft area. Your yard & outdoor living area is highlighted by a custom built in BBQ area w/ sink & slate topped dining bar, a patio trellis with outdoor lighting, & mature trees for privacy. Enjoy relaxing in this tranquil oasis at the end of the day. 2 car garage has built in storage. Walking distance to award winning Canyon View Elementary & Northwood High. A real gem!

All rooms are open to each other, making this a perfect floorplan for living & entertaining. Gorgeous slate tile flooring accents the main floor. Tranquil master bedroom features bath area with dual sinks, travertine tile floors, & walk in closet. Second bedroom has it's own private full bath w/ travertine tile floor. The versatile den could also be used as an office, playroom, nursery, workout room, or craft area. Your yard & outdoor living area is highlighted by a custom built in BBQ area w/ sink & slate topped dining bar, a patio trellis with outdoor lighting, & mature trees for privacy. Enjoy relaxing in this tranquil oasis at the end of the day. 2 car garage has built in storage. Walking distance to award winning Canyon View Elementary & Northwood High. A real gem!