Delinquent mortgage squatters are spending $50 billion this year stimulating the economy rather than paying their mortgages.

Irvine Home Address … 37 NAVARRE Irvine, CA 92612

Resale Home Price …… $395,000

I was a young boy that had big plans.

Now I'm just another shitty old man.

I don't have fun and I hate everything.

The world owes me, so F you.

Glory days don't mean shit to me.

I drank a six pack of apathy.

Life's a bitch and so am I.

The world owes me, so F you.

Green Day — The Grouch

Recently I wrote about The real Ponzis and posers of Irvine. Peggy Tanous of the Real Housewives of OC made a conscious decision to get a boob job rather than pay her rent. She is not alone.

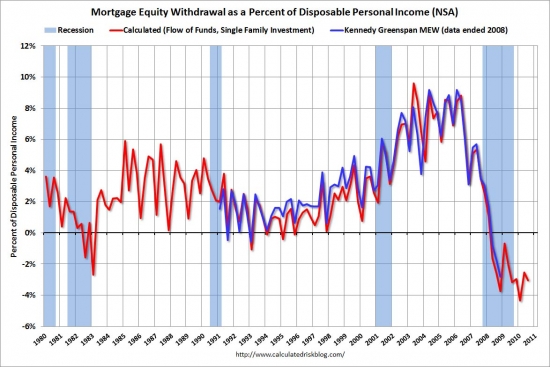

The plastic surgeon undoubtedly appreciated the money, and any other provider of goods and services that received the Tanous's money did the same. The combined economic stimulus of all the delinquent mortgage squatters is estimated at $50 billion this year alone. Back in June of last year, I reported Strategic Default: The $10,000,000,000 Monthly Economic Stimulus.

The case could be made that our HELOC economy based on mortgage equity withdrawal and consumption has been replaced with a squatter rent economy based on people failing to pay their mortgages and spending that money instead.

In the astute observations recently some challenged me on why this upsets me so much. The real question is why doesn't it upset all of you? Does anyone want to see this behavior rewarded? With our tax money going to bail out the enabling banks, you and I as taxpayers are indirectly supporting these people.

You paid for part of Peggy Tanous's boob job.

I want a refund.

‘Squatter Rent’ May Boost Spending as Mortgage Holders Bail on Payments

By Bob Willis and John Gittelsohn – May 6, 2011 7:26 AM PT

Melissa White and her husband stopped paying their mortgage in May 2008 after it reset to $3,200 a month, more than double the original rate. That gave them extra cash to pay off debts and spend on staples until their Las Vegas home sold two years later for less than they owed.

“We didn’t pay it for about 24 months,” said White, who quit her job as a beautician during that period after becoming pregnant with her first child and experiencing medical complications. “What we had, we could put towards food and the truck payments and insurance and health things I was dealing with.”

The couple above aren't the only ones enjoying a payment-free lifestyle.

Millions of Americans have more money to spend since they fell delinquent on their mortgages amid the worst housing collapse since the Great Depression. They are staying in their homes for free about a year and a half on average, buying time to restructure their finances and providing an unexpected support for consumer spending, which makes up about 70 percent of the economy.

So-called “squatter’s rent,” or the increase to income from withheld mortgage payments, will be an estimated $50 billion this year, according to Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. in New York. The extra cash could represent a boost to spending that’s equal to about half the estimated savings generated by cuts to payroll withholding in December’s bipartisan tax plan.

“We’ve had a lot of government transfers to the household sector; this is a transfer from the business sector to households,” Feroli said. “It’s a shock absorber that has helped the consumer ride out the storm.”

We have created a subsidy for the least deserving in our culture, and it is being spun as if it's an economic boost we should all be happy about. Mortgage squatting doesn't help out the American consumer, it only helps those consumers who are not paying their mortgages.

BTW, why don't we have rent modification programs? If renters become unemployed, why aren't we forcing landlords to lower their rent? Why doesn't the government allocate some TARP money to paying the rent of those who cannot afford it?

When a renter fails to pay their rent, for any reason, it's just assumed they should move out and find a more affordable place even if that is in the gutter. Loan owners get to apply for relief programs and government assistance not being offered to renters — programs renters are being forced to pay for. And if none of those programs offer satisfactory relief, loan owners get to squat in these houses indefinitely.

Now Renting

White, 28, now has two children, daughter Makenzie, 2, and son Christian, 1. She and her husband, Shannon, a sheet-metal worker, rent a house for $1,425 a month.

$1,425 per month in Las Vegas will rent a very nice property. Most rents in Las Vegas run between $1,000 and $1,200 per month. I'm not sure how an unemployed beautician and a sheet-metal worker afford that.

“My credit’s back,” she said. “I’d buy a house again, but I’d get a fixed-rate loan.”

At least they learned something of value for this experience. BTW, there are now loan offerings for people a day out of short sale. This family probably could get a loan. That won't contribute to strategic default, will it?

Consumer spending is projected to rise 2.8 percent this year, according to economists in an April Bloomberg News survey, after a 1.7 percent increase in 2010.

Delinquencies and defaults have helped homeowners save more, pay down other debts and move on to more affordable homes, according to Stan Humphries, chief economist at Zillow Inc., a Seattle-based provider of housing data. Owners in default need the savings because degraded credit scores from the default make it more difficult to borrow, he said.

“It’s bad that they’ve lost the home, but household finances have been rearranged in such a way that it’s arguably more sustainable,” Humphries said.

That reality is why we will continue to see strategic default, particularly once the general public realizes the 2009 bottom was an illusion.

Delinquent Debt

Van Perrault, a home appraiser who defaulted on his Saint Mary’s, Maryland, investment property in 2007 after his tenants stopped paying the rent, used the extra money to take care of late payments on his delinquent credit-card debt.

Do you think his tenants stopped paying the rent, or do you think he stopped paying the mortgage and skimmed their rent?

The additional $1,500 a month “made a difference in my life,” said Perrault, 60, adding that paying down his card balances helped him and his wife limit the damage to their credit scores.

Anyone who avoids paying a $1,500 monthly bill will find it makes a difference in their life. What's astonishing about this situation is that failing to pay their bills is being so handsomely rewarded.

Consumer debt fell to $11.4 trillion in the fourth quarter of 2010, down about $1.1 trillion from the peak in the third quarter of 2008, the Federal Reserve Bank of New York said in February. Mortgage debt dropped 9.1 percent in the period.

A total of 6.3 million homeowners weren’t current on their loans at the end of March, with 2.2 million in the process of foreclosure, according to data from Lender Processing Services Inc., a Jacksonville, Florida-based provider of mortgage- processing services and data. Loans in foreclosure were an average 549 days late.

If 6.3 million people haven't been making mortgage payments for nearly two years, you can see how the $50 billion adds up.

Conscious Decision

While many Americans couldn’t make payments because they lost their jobs or earned less during the recession, others made the conscious decision to stop paying — or carry out a so- called strategic default — on homes worth less than the outstanding obligation.

About 27 percent of single-family homeowners with mortgages, or about 15.7 million, were “underwater” at the end of last year, according to Zillow, the highest share since the first quarter of 2009, during the recession. Las Vegas led the nation, at 82 percent, followed by 70 percent for Phoenix.

Those numbers are shocking. Everyone in Las Vegas is underwater. The 18% that aren't include some recent buyers with large down payments and buyers from before the 00s who paid down their mortgages. It isn't very many people.

Failing to pay a mortgage bill is “a big moral issue,” said Karl Case, co-founder of a housing-price index that bears his name. “On the other hand, it’s exactly what you would expect given the way we treat and reward behavior in an economic system built for private gain.”

Strategic Default

More than a third of mortgage defaults were strategic, according to a June 2010 survey by finance professors Paola Sapienza of the Kellogg School of Management at Northwestern University and Luigi Zingales of the University of Chicago’s Booth School of Business. That was up from 29 percent in a March 2009 survey.

In Las Vegas that number is much, much higher. The people who believe they are paying because it's the right thing to do are being tested by market conditions. At some point, they have to wonder if they are doing the right thing for their families.

Almost half of Americans surveyed in January “said they would be more likely to default if their bank was accused of predatory lending, even if they’re morally opposed to strategic default,” Zingales said in a telephone interview from Chicago. “One likely reason for this may be related to a psychological notion of retribution.”

Adam Turner, 43, went eight months without making payments on his Las Vegas townhouse after he quit his job as a casino- restaurant wine steward in November 2009. He stopped paying as “a way of sticking it back to the banks” for pushing mortgages on people who shouldn’t have been qualified, he said. He sold the property in a July 2010 short-sale — when a bank agrees to accept less than the outstanding value of the loan.

When people want to take an action or make a decision they are morally uncomfortable with, it is quite common to seek out rationalizations and justifications. If they believe they have been victimized, even if it was by their own decisions, they can cloak their own misdeeds as bringing justice to an unjust situation.

Distressed Deals

Distressed deals — short sales and foreclosures — accounted for 40 percent of existing-home transactions in March, up from about one third last year, according to the Chicago- based National Association of Realtors.

With unemployment at 9 percent in April and forecast to average 8.7 percent for the full year — well above the 4.6 percent average in 2007 before the recession began — more Americans probably will enter the default pipeline this year. The number of homes receiving a foreclosure notice will climb about 20 percent, reaching a peak for the housing crisis, predicts RealtyTrac Inc., an Irvine, California-based data seller.

Turner, now a waiter and renting an apartment, used the money he saved by not making mortgage payments to take care of electric and phone bills and buy necessities while he was unemployed.

I wonder how he defined necessities….

“It definitely boosted my cash flow, which was helpful to move on with my life,” said Turner, who made almost $100,000 a year before the recession. “It was not like I was celebrating and partying. It was a rough time. It represented the American dream that collapsed around me.”

To contact the reporters on this story: Robert Willis in Washington at bwillis@bloomberg.net; John Gittelsohn in New York at johngitt@bloomberg.net

To contact the editors responsible for this story: Chris Wellisz at cwellisz@bloomberg.net; Kara Wetzel at kwetzel@bloomberg.net

(Almost) 20% down the drain

The owners of today's featured property are offering it as a short sale. Although they have not been served a NOD, in all likelihood, they are not paying the mortgage. Why would they? They credit is going to take a big hit either way.

I heard yesterday that FHA has guidelines which punish short sellers more severely if they also have missed payments, so perhaps there is some small incentive in the system to keep paying. The incentive to save two years of mortgage payments is arguably more enticing.

- These owners paid $608,000 on 4/7/2006. They used a $456,000 first mortgage and a $152,000 down payment.

- They refinanced on 8/30/2007 with a $482,400 first mortgage.

- On 11/14/2007 they refinanced again with a $492,000 first mortgage.

They bought at the peak, and they still managed to squeeze out $36,000 of their down payment in mortgage equity withdrawal. Like most bubble era buyers, they undoubtedly expected the HELOC money ATM to go on forever.

They were wrong.

They bought a house they can't afford, and now they are selling it short.

Irvine House Address … 37 NAVARRE Irvine, CA 92612 ![]()

Resale House Price …… $395,000

House Purchase Price … $608,000

House Purchase Date …. 4/7/2006

Net Gain (Loss) ………. ($236,700)

Percent Change ………. -38.9%

Annual Appreciation … -8.1%

Cost of House Ownership

————————————————-

$395,000 ………. Asking Price

$13,825 ………. 3.5% Down FHA Financing

4.62% …………… Mortgage Interest Rate

$381,175 ………. 30-Year Mortgage

$83,941 ………. Income Requirement

$1,959 ………. Monthly Mortgage Payment

$342 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$82 ………. Homeowners Insurance (@ 0.25%)

$438 ………. Private Mortgage Insurance

$395 ………. Homeowners Association Fees

============================================

$3,217 ………. Monthly Cash Outlays

-$317 ………. Tax Savings (% of Interest and Property Tax)

-$491 ………. Equity Hidden in Payment (Amortization)

$24 ………. Lost Income to Down Payment (net of taxes)

$69 ………. Maintenance and Replacement Reserves

============================================

$2,502 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,950 ………. Furnishing and Move In @1%

$3,950 ………. Closing Costs @1%

$3,812 ………… Interest Points @1% of Loan

$13,825 ………. Down Payment

============================================

$25,537 ………. Total Cash Costs

$38,300 ………… Emergency Cash Reserves

============================================

$63,837 ………. Total Savings Needed

Property Details for 37 NAVARRE Irvine, CA 92612

——————————————————————————

Beds: 2

Baths: 3

Sq. Ft.: 1524

$259/SF

Property Type: Residential, Condominium

Style: Two Level, Villa

Year Built: 1978

Community: 0

County: Orange

MLS#: S656795

Source: SoCalMLS

Status: Active

On Redfin: 10 days

——————————————————————————

Two-story townhome–award-winning floor plan is bright and open with extra-high ceilings and has direct access to 2-car garage Two full bedrooms and baths upstairs. Master suite is huge. A den/office and full bath downstairs. Very private enclosed courtyard entry with lush plants. Remodeled kitchen is full of light and overlooks spacious open atrium/porch. Dual-pane windows and sliders. Baths remodeled. Easy-care wood-like tile flooring. Build-in wine rack, inside laundry, and more. Enjoy the Villas at RSJ, a unique, upscale comminity ideally located next to the golf course and the Racqet Club. Walk across the street to shops, restaurants, etc. Resort-like Pool and Spa. Near UCI, Senior Center, best schools and public transportation. Plus, HOA dues covers trash, water, and earthquake insurance.

Is Rancho San Joaquin upscale? comminity?

.jpg)

.png)

Lenders learned from their mistakes of the housing bubble, and they don't want to repeat them. Steve Thomas does want them to repeat these mistakes because it would increase sales volumes and make him a few more pennies on commissions.

Lenders learned from their mistakes of the housing bubble, and they don't want to repeat them. Steve Thomas does want them to repeat these mistakes because it would increase sales volumes and make him a few more pennies on commissions.

.png)

What does it mean to “fully evaluate?” And when did it become an entitlement for borrowers to get a loan modification? Aren't these private contracts? The attorneys will generate a lot of fees fighting over the definition of “fully.” No matter what banks do, lawsuits will be filed stating they haven't done enough.

What does it mean to “fully evaluate?” And when did it become an entitlement for borrowers to get a loan modification? Aren't these private contracts? The attorneys will generate a lot of fees fighting over the definition of “fully.” No matter what banks do, lawsuits will be filed stating they haven't done enough.

ONE BEDROOM DOWN AND THREE UP INCLUDING A GRAND MASTER SUITE WITH A SPA LIKE BATH + BONUS ROOM + COMPUTER CENTER. .. 3 CAR GARAGE. .. LIMITED SHOWINGS WITH 24 HOUR(OR MORE) NOTICE BUT WELL WORTH IT. .. DO NOT DISTURB OCCUPANTS

ONE BEDROOM DOWN AND THREE UP INCLUDING A GRAND MASTER SUITE WITH A SPA LIKE BATH + BONUS ROOM + COMPUTER CENTER. .. 3 CAR GARAGE. .. LIMITED SHOWINGS WITH 24 HOUR(OR MORE) NOTICE BUT WELL WORTH IT. .. DO NOT DISTURB OCCUPANTS