Commercial borrowers also enjoyed the cash-out refinance booty enjoyed by residential borrowres, only the take was much, much larger.

Irvine Home Address … 14 ROSEMARY Irvine, CA 92604

Resale Home Price …… $275,000

Winter night in Harlem

Radiator won't get hot

Well the mean old landlord, he don't care

If I freeze to death or not

Bill Withers — Harlem

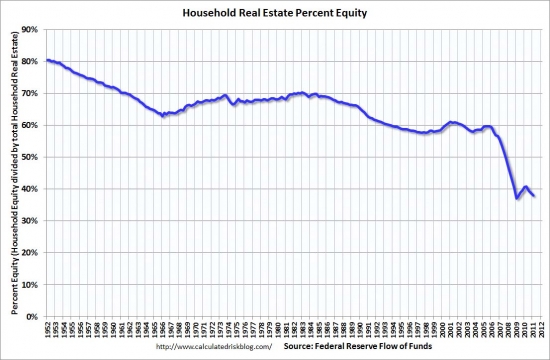

I have profiled hundreds of HELOC abuse cases here in Irvine. This behavior was very widespread, and I documented, the desire for HELOC money is what inflated the housing bubble.

Lenders are largely responsible for this problem because as the party extending the loan, they should have taken more care to make sure they were going to get paid back. If our tax dollars wouldn't have been required to cover their losses, it would have been a tragic case of lender stupidity, a curiosity, but nothing more. However, once the government got involved in bailing these bozos out, then it becomes state sanctioned theft, and a matter of great public concern.

Residential real estate was not the only area where lenders lost their minds and gave out free money to anyone with a pulse proforma. Commercial real estate lending was similarly stupid, and since the dollar values of commercial properties are orders of magnitude larger, so was the lender folly.

In Harlem Buildings, Reminders of Easy Money and the Financial Crisis

By CHARLES V. BAGLI

Published: June 9, 2011

At Riverton Houses, a middle- and working-class apartment complex in Harlem, residents noticed a few changes after new owners came in. Lobbies were renovated. New elevators were installed. A decorative fence went up around the entire property.

Nearby, the new owners of another complex, Delano Village, were doing similar work with the same goal, to replace rent-stabilized tenants with ones paying market rates.

But while they were making improvements — some of which they would eventually charge to tenants — the new owners were piling on debt that their rental income could not support. Yet in each case, they have not exactly suffered: despite plunging the buildings into financial despair, each has been able to take tens of millions of dollars in cash out of the properties.

I wasn't interested in real estate finance until I went to graduate school at Texas A&M. I was fortunate to be a student there from 1992 to 1994 in the aftermath of the savings and loan debacle in which Texas was a major participant. Most of the case studies from my classes were focused on what lenders did during that time.

I was taught the importance of positive cashflow and equity requirements. I was also taught the folly of lending based on proforma projections and anticipation of rising rents or rising prices. I never forgot those lessons, so when I began observing residential real estate being purchased as investment with strongly negative cashflow, I knew it was only a matter of time before we saw rampant overbuilding and a complete collapse of prices back down to cashflow positive levels.

Commercial real estate in Texas was crushed in the early 90s, and many empty commercial centers remained empty for years. The excess supply caused declining rents and deteriorating values through the mid 90s. Prices finally stabilized when prices reached a level where 30% down equity made 12% returns and the 70% loan at 8% could be comfortably serviced. Like residential real estate across much of the country today, the price adjustment in commercial in the 90s required a 50% haircut.

What the owners did was legal, and in the microcosm of a few square blocks of Manhattan, it tells a story of the nation’s real estate bubble and collapse. As millions of homeowners did, but on a much larger scale, the owners refinanced their properties, finding lenders willing to give them far more money than the buildings turned out to be worth.

When they refinanced, the owners of Riverton took out as much as $60 million in cash, and the owners of Delano Village, which they renamed Savoy Park, initially took out as much as $105 million, according to loan documents, credit analysts and lenders.

Wow! That is a great deal of money.

In the savings and loan bubble, lenders would often loan out 100% of the value established by proforma. These loans were still cashflow positive on paper, but if a proforma backed by an appraisal justified cashing out the developer with millions of dollars, lenders completely abandoned equity requirements and gave them the money. Developers didn't need to sell the property in order to get their cash out of the deal. Plus, they shifted all the risk onto the savings and loan which in turn shifted the risk onto the US taxpayer through the FSLIC.

It is difficult to say exactly how much of that turned into profit because their books are not in the public record. James H. Simmons, a partner at AREA Property Partners, which bought Delano Village in a partnership with Vantage Properties, said they had put millions of dollars back into the property to cover shortfalls since running into financial problems at the end of 2009, although he declined to divulge any numbers.

Using debt to pay debt service is the essence of a Ponzi scheme. Many residential borrowers did the same thing. Some are still draining their pile of borrowed cash from the bubble to make debt service payments. If financial history repeats itself, prices will remain low longer than these borrowers can remain solvent.

Mr. Simmons said they were negotiating with the lenders to restructure the loans. If the talks were successful, he said, they would put a “substantial” sum of money toward retiring some of the debt.

How does this guy plan to borrow his way out of debt? In reality, he doesn't. The substantial sum toward retiring debt will be a write off at the bank.

“We are very close to a solution that works for the lenders and for us,” Mr. Simmons said. “We continue to maintain the property for the benefit of the tenants.”

A huge problem in the wake of the savings and loan collapse was ongoing operations for REO and those properties in receivership. When properties are cashflow negative, nobody wants to operate them because there is no money in it. The developer or owner has no interest because they have no equity, so lenders end up hiring management for a fee. Sometimes, the only reasonable choice for management was the borrower who was in default on the loan. Many properties remained in this zombie status for years.

Riverton’s owners, Stellar Management and Rockpoint, declined to comment. They tried to restructure their loans by reinvesting as much as $40 million, said real estate executives who work with Laurence Gluck, Stellar’s chief executive. But after one of the lenders refused to go along with the deal, the senior lenders foreclosed last year, with the property’s value estimated to be less than half the $250 million debt.

We see the same dynamic in place with residential lenders. The subordinate mortgages, seconds, HELOCs, thirds, and so on, have no value because the first loan is underwater. The only power subordinate lien holders have in the negotiation is the ability to say no. If they exercise that power and kill restructuring deals, the first lender will foreclose and blow out the subordinate lien holders who end up with nothing other than an unsecured claim against an insolvent borrower.

Harold Shultz, a senior fellow at the Citizens Housing and Planning Council and a former city housing official, said that both deals emerged in an era when investors stopped looking at complexes like Savoy Park and Riverton “as housing and started looking at them as commodities.” Mr. Shultz and others estimate that there are as many as 100,000 overleveraged apartments in the city’s working-class neighborhoods.

“They mistook Harlem for Fifth Avenue and 79th Street,” Mr. Shultz said of the banks. “The only surprise is that it took this long.”

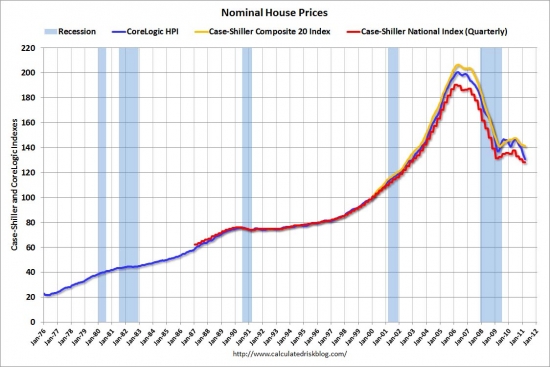

Once a Ponzi scheme gets started, it will grow larger until lenders stop lending. It is only a matter of time before the system collapses, and the damage is directly related to how far values become detached from the cashflow basis. In the case of The Great Housing Bubble, lenders inflated house prices by trillions of dollars, and the economic fallout has been devastating. None of it would have occurred if we had not let residential lending become detached from rental cashflow.

Riverton, seven buildings with 1,232 units and a grassy courtyard, between 135th and 138th Streets, from Fifth Avenue to the Harlem River, was built in the late 1940s by Metropolitan Life Insurance as part of a “slum clearance” program led by Robert Moses. At the same time, MetLife built the larger Stuyvesant Town and Peter Cooper Village complexes north of 14th Street, but refused to rent those apartments to blacks and Hispanics. (The new owners of those complexes, Tishman Speyer Properties and BlackRock, defaulted on their loans in 2010 and relinquished control to lenders; they had not refinanced.)

Despite its bitter roots, Riverton developed a cachet within Harlem and was home to tenants like Samuel R. Pierce Jr., a former secretary of housing and urban development; the jazz pianist Billy Taylor; and former Mayor David N. Dinkins. “It was the crème de la crème,” said Nellie Hester Bailey, director of the Harlem Tenants Council.

Stellar and Rockpoint bought Riverton in 2005 for $132 million, with a $105 million mortgage. A year later, the partners refinanced Riverton, more than doubling the debt with $250 million in new loans.

Reads like an IHB post, doesn't it? They put money down when they purchased — something optional during the bubble — and then they proceeded to HELOC out a fortune.

The new financing enabled the partners to repay the original loan, recoup their investment and establish $53 million in reserve money to cover renovations and any shortfalls in revenue, leaving them with an additional $60 million. But the rental income covered less than half of the debt service, and turnover was slow. They converted 10 percent of the apartments to market rates — not the 50 percent the owners had projected in loan documents. The complex’s default served as a warning bell on Wall Street for dozens of overleveraged apartment building deals.

Ordinarily, I would wonder what the lender was thinking. Who underwrites loans where the cashflow doesn't cover the payments? Originating lenders, that's who. The lender didn't keep the loan on its books, so the fact that the borrower was certain to default didn't matter to them.

The main lender on the refinancing, Deutsche Bank, eventually packaged the loan with other mortgages as a commercial mortgage-backed security and sold it to investors. The use of mortgage-backed securities, many of them filled with bad loans, was a major contributor to the most recent financial collapse.

CW Capital, which represents investors in the Riverton debt, took control of the complex last year. The company declined to discuss Riverton’s financial history.

Delano Village, seven buildings with 1,800 apartments built in the late 1950s just to the north of Riverton, was bought by Vantage and AREA in 2006 for $175 million, including a $128.7 million mortgage. A year later, the new owners refinanced, nearly tripling the debt on the property to $367.5 million.

The new financing allowed the partners to recoup their investment, repay the original mortgage and establish $87 million in reserve funds. That left the partners with about $100 million.

They made $100,000,000 for putting the deal together and pushing paper around. Back in the day, Wall Street convinced itself this was adding value. As if pushing paper was akin to building things. Paper doesn't add value to real estate.

Vantage, with AREA and other partners, was in the midst of buying more than $2 billion worth of apartments in Harlem, Washington Heights and Queens. It set about making improvements like a new security system, a new boiler and fixed-up brick work, and won state approval to recoup some of those costs over a seven-year period by raising tenants’ rents, as Riverton’s owners also did.

Vantage, which was the operating partner at Savoy Park, also sent lease termination notices to roughly a fifth of its tenants, claiming that they were not entitled to rent-regulated apartments because it was not their primary residence, their name was not on the lease or they were in arrears on the rent.

Tenants at Savoy Park and other Vantage properties complained to the attorney general’s office that Vantage was harassing them with false eviction claims. About 115 tenants who were sent eviction notices left Savoy before the cases got to housing court. Of the 158 cases that did go to court, Vantage was successful in evicting 44 tenants. The attorney general’s office, then headed by Andrew M. Cuomo, reached a settlement in 2010 with Vantage over the 9,500 apartments controlled by the company in which Vantage promised to change its policies and pay $1 million to tenants who had suffered harassment and to finance nonprofit organizations that provide free legal advice to tenants.

I suspect there is more to this story. Vantage was well within it's rights to evict tenants who were not in fact living on the property. In rent-controlled housing, there is a large incentive for leaseholders to keep the under-market lease in place and sublease to a different tenant and pocket the difference. Rent controls were not designed to benefit people who don't live in the property.

As at Riverton and Stuyvesant Town, lenders extended large loans for Savoy Park based not on actual rental income but on income projections that turned out to be significantly overstated.

This was the primary mechanism for obtaining inflated appraisals and loans during the savings and loan crisis. Developers and owners simply made-up numbers and tried to get a loan based on them. Many lenders were in cahoots with the developers to make these loans. The lenders didn't care because they were FSLIC insured, so the US government was on the hook for all losses.

I thought we had learned the danger of explicit government guarantees of lending during that crisis, but when the government took over the residential mortgage lending market, they assumed the same risk that brought down the FSLIC fund.

According to Realpoint, a credit rating agency, the net cash flow at Savoy Park never rose much higher than $7 million, about a third of the annual loan payments. Realpoint estimates that the value of the complex has fallen to $98 million, and one executive familiar with the property suggested that it was now worth about $120 million — either way, far less than the $367.5 million in loans.

Whoever reviewed and approved these financial projections should be investigated for fraud. If it isn't fraud, it is an extraordinarily incompetent job of underwriting.

Several tenants of rent-regulated apartments interviewed at the complex last month said that the owners were slow to make repairs and that carpets laid in the hallways by the landlord were infested with bedbugs. “Things are not good here,” said Valerie M. Orridge, a retired nurse who has lived there since 1959. She pays $870 a month for her two-bedroom apartment, and will pay $910 come August. “It’s just impossible to get repairs done.”

There's a reason its impossible to get repairs done: with tenants paying $870 a month rent, there isn't any money to make repairs.

But a newcomer, Mike Brown, had a different impression of Savoy Park. He moved into a one-bedroom, 600-square-foot apartment with two roommates two months ago and is thrilled with the place, especially when compared with the dingy apartment he had in Newark. The market-rate rent is $1,500 a month, and the newly renovated apartment has a laminated parquet floor, new GE kitchen appliances and a new bathroom.

“I like the location,” Mr. Brown, 28, said. “Everything is clean. It has a nice vibe to it.”

Mr. Simmons, one of the owners, said Savoy Park would not follow Riverton into foreclosure, and Neil Rubler, his partner, said that “deregulating apartments has never been a key component of our business plan.”

But David Hershey-Webb, a lawyer who represents tenants at Savoy Park, scoffed.

“Tripling the debt and deregulating go hand in hand,” he said. “That’s what sparked the speculation.”

I used to work for a developer who purchased tax-credit apartments with rent subsidies. He stopped doing it because he was losing too much money. Any time market rents are capped, there is no opportunity to improve the property or make up for needed repairs. For example, if the property requires an unbudgeted $100,000 repair, and the owner makes that repair, he can do nothing to recapture his investment. With an infinite potential for downside and a cap on upside, these properties fall into disrepair, and nobody wants to own them. And what's worse, lenders don't want to lend on them because they don't want to step in to the owner's shoes in the event of foreclosure.

I used to work for a developer who purchased tax-credit apartments with rent subsidies. He stopped doing it because he was losing too much money. Any time market rents are capped, there is no opportunity to improve the property or make up for needed repairs. For example, if the property requires an unbudgeted $100,000 repair, and the owner makes that repair, he can do nothing to recapture his investment. With an infinite potential for downside and a cap on upside, these properties fall into disrepair, and nobody wants to own them. And what's worse, lenders don't want to lend on them because they don't want to step in to the owner's shoes in the event of foreclosure.

The parallels between the residential market and the commercial market are striking. The amend-extend-pretend policy has been the order of the day in commercial real estate. Several large hedge funds formed in 2008 to pick up the pieces, and many were promptly disbanded when the inventory never materialized. Lenders are holding on to their worthless mortgage notes in hopes that valuations will soon come back. Just like in residential, it isn't going to happen.

HELOC Abuse closer to home

The desire for free money for doing nothing is universal. If I didn't have to do anything, and someone were willing to give me hundreds of thousands of dollars, I would certainly be tempted. Of course, there is no free lunch, and even the free money given out during the housing bubble had strings attached. Borrowers didn't worry about it because, well… it was free money.

-

The owners of today's featured property paid $207,500 back on 10/2/2001. They used a $166,000 first mortgage, a $41,500 second mortgage, and a $0 down payment. In other words, they were given the house plus all the money that followed.

- On 7/14/2003 they extracted $51,000 in a new $92,500 stand-alone second.

- On 3/3/2004 they obtained a $262,500 first mortgage, and a $42,500 HELOC.

- On 3/15/2005 they got a new $351,000 first mortgage.

- On 9/15/2005 they refinanced with a $391,500 first mortgage.

- On 6/1/2006 they got an Option ARM for $390,400 with a 1.75% teaser rate, and they got a $48,800 HELOC.

- Total property debt is $439,200 plus negative amoritization on the Option ARM.

- Total mortgage equity withdrawal was $231,700.

Do you think they will want another property like this one again? They were given the house, then they were given $231,700 to spend over the next five years for signing some papers. They extracted every penny of appreciation as it appeared through the peak, and now that prices have fallen and the home ATM is shut down, they are short selling to get out from under the debt.

Irvine House Address … 14 ROSEMARY Irvine, CA 92604 ![]()

Resale House Price …… $275,000

House Purchase Price … $207,500

House Purchase Date …. 10/2/2001

Net Gain (Loss) ………. $51,000

Percent Change ………. 24.6%

Annual Appreciation … 2.9%

Cost of House Ownership

————————————————-

$275,000 ………. Asking Price

$9,625 ………. 3.5% Down FHA Financing

4.49% …………… Mortgage Interest Rate

$265,375 ………. 30-Year Mortgage

$57,559 ………. Income Requirement

$1,343 ………. Monthly Mortgage Payment

$238 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$57 ………. Homeowners Insurance (@ 0.25%)

$305 ………. Private Mortgage Insurance

$277 ………. Homeowners Association Fees

============================================.jpg)

$2,221 ………. Monthly Cash Outlays

-$123 ………. Tax Savings (% of Interest and Property Tax)

-$350 ………. Equity Hidden in Payment (Amortization)

$16 ………. Lost Income to Down Payment (net of taxes)

$54 ………. Maintenance and Replacement Reserves

============================================

$1,818 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,750 ………. Furnishing and Move In @1%

$2,750 ………. Closing Costs @1%

$2,654 ………… Interest Points @1% of Loan

$9,625 ………. Down Payment

============================================

$17,779 ………. Total Cash Costs

$27,800 ………… Emergency Cash Reserves

============================================

$45,579 ………. Total Savings Needed

Property Details for 14 ROSEMARY Irvine, CA 92604

——————————————————————————

Beds: 2

Baths: 2

Sq. Ft.: 1022

$269/SF

Property Type: Residential, Condominium

Style: Two Level, Other

Year Built: 1976

Community: 0

County: Orange

MLS#: P784020

Source: SoCalMLS

Status: Active

——————————————————————————

Private & Quiet location. Large Kitchen with built in shelves. Large Laundry Room with built-ins. Both Bedrooms Upstairs Have Celing Fans and Wood Blinds.

.png)

.png)

.jpg)