The Astoria at Central Park West in Irvine has given up on sales and is converting to rentals until the next housing bubble.

Irvine Home Address … 401 ROCKEFELLER #805 Irvine, CA 92612

Resale Home Price …… $625,000

And when I lost my grip

And I hit the floor

Yeah, I thought I could leave

But couldn't get out the door

Aerosmith — Amazing

The investors who financed the Astoria at Central Park West lost their grip on financial reality. When prices hit the floor, they wanted to leave with their money, but they couldn't find the door. Now, they are stuck with a loser investment, and they have few good options to get out.

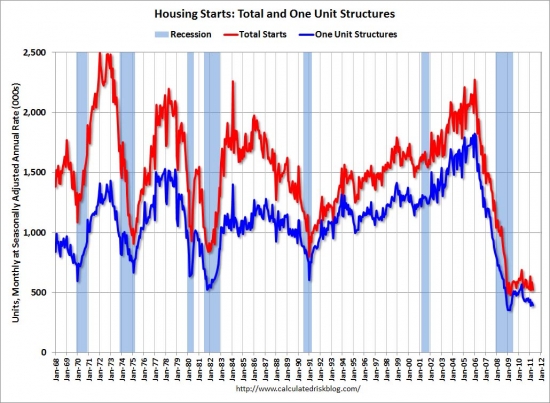

High density real estate costs

High density residential construction costs are the biggest variable in determining the type of construction a specific project can support. The income must be sufficient to provide a return relative to those costs for a project to go forward.

The first major cost barrier comes when a project goes from three stories built on grade to four stories over parking (aka podium construction). A typical apartment complex like those built by the Irvine Company are usually three stories of wood-frame construction built on grade. This is the most cost-effective method of producing housing units. Unfortunately, it is difficult to get more than 28 units per acre using this method of construction, so land values are limited.

Podium construction, typically four stories over a two-story underground parking garage, is the next step up the cost and density scale. Villa Siena and the Village at Irvine Spectrum Center are examples of this kind of construction. Densities exceeding 30 units per acre are achievable, but costs jump significantly. Projects must have significantly higher revenue potential to justify this kind of construction.

True high rise construction, defined here as five stories or higher, take another major step up in cost and require a commensurate increase in revenue to justify their existence. These units are generally confined to city centers in major urban hubs — not in low-density Orange County.

When prices rose so high so fast, rather than consider this price action to be a housing bubble — which it was — developers saw an opportunity to build high-rise condos. If prices had held at their 2006 levels, they would have made money. The developers of the North Korea towers did. The developers of the Astoria; well, they weren't quite so lucky.

The Astoria at Central Park West

I last wrote about the Astoria on February 11, 2010 in Free Wine, Food and Gifts Plus a Tour of an Epic Real Estate Disaster. Lennar was gearing up to sell units in this project with a big party. I thought I would give them some additional press coverage. I heard the turnout was good.

Lennar attempted some creative financing, but buyers didn't go for it:

Builders often buy-down the interest rate to artificially lower the payments for early years. Personally, I think the practice is egregious differing in no way from the subprime 2/28 programs that proved so disastrous. Lennar and their partner obviously do not care about the long-term viability of ownership of buyers; any who use their advertised financing will not be living there 7 years from now. The the builder bought down the interest rate on an ARM which is taken out at the bottom of the interest rate cycle; this interest rate is going to rise, and it is going to make future payments unaffordable. I suppose these will appreciate so much over the next 7 years that it won't matter, right? Bubble thinking is not dead.

I first wrote about the Astoria at Central Park West in August of 2009:

When you look back on the towers built along the Jamboree corridor, you see differing groups of winners and losers. The developers of the North Korea Towers (Marquee at Park Place) were winners. They sold the property out at peak prices and made a fortune. The buyers and the lenders who bankrolled the purchases there are the big losers. The other condos that came a little later have a mixed bag of winners and losers with both the developers and the buyers suffering.

Today's featured property, Astoria at Central Park West has a clear loser — the ownership entity that developed this property (Lennar has only a small investment). None of these units sold at the peak, and now that we are nearing a long, flat bottom, these units are hitting the market. The early buyers will be knife catchers, but in a couple of years, some of these units will be good buys — at about $300,000 to $350,000.

As today's featured property attests to, about half a dozen knife catchers did purchase units in Astoria in the 500s. With competition across the street at the North Korea towers selling in the 300s, rather than lower their price to sell more units, Lennar has chosen to convert this community to rentals.

Luxury Irvine condo towers go rental

By MARILYN KALFUS — June 21, 2011

The luxe new high-rise condos at Astoria in Irvine's Central Park West are no longer for sale — they're for rent.

In leasing the units, the upscale project follows the path of the 25-story Skyline at MacArthur Place in Santa Ana’s South Coast Metro district, which turned to apartments last year as the market for buying high-end condos eroded.

Several other less pricey O.C. condo projects also launched before the housing crash have gone the same route.

The apartments at Astoria, once priced to sell from $415,000 to $779,000 — along with homeowner association (HOA) dues ranging from $915 to $965 a month — now rent beginning at $2,590. The most expensive unit is a 14th-floor, 2-story, 3,185-square foot corner penthouse that can be leased for $20,000 a month.

At present, there is no rent-to-buy program, said Alicia Scott, national business development director for Alliance, the company brought in to manage and rent the units by Lennar Corp., the builder.

The 240-unit towers aren't entirely without owners. Six condos were sold as of February, according to a report we did then.

Astoria is alongside the I-405 freeway, but with the windows shut and the air on in one unit, there was no noise. In another unit, with no air on and one window open, some traffic was audible.

Last November, LuxeListHome.com CEO David Doyle told ocregister.com in a podcast interview that luxury apartments are a growing business even as the economy — and other housing markets — slowed. He credited people of means who don’t want to commit to home ownership in unsettling times, an affinity for resort-like living and renters who just aren't interested in owning.

Astoria’s highlights include:

- A concierge

- Free valet parking for guests

- Limestone and marble flooring

- Fisher & Paykel stainless steel appliances

- Electrolux appliances in penthouse

- Units with built-in surround sound and fireplaces

- A swimming pool, spa and fitness center, with access to Central Park West's junior olympic-size pool, and an 8,000-square foot recreation center with an additional gym

- A wine tasting room and 55-degree wine vault with more than 120 cages

- Pets are ok (but not all)

Prospective renters include international and bicoastal business people as well as Los Angeles residents who spend time in Orange County and want to cut down on commuting, Scott says.

Rent pending another housing bubble

I heard through industry sources that Lennar projected sales of these units for about $750,000 back in 2006. With values in the North Korea towers at about half that price, how long do you think it will take for Lennar to hit their numbers? Forever is my guess.

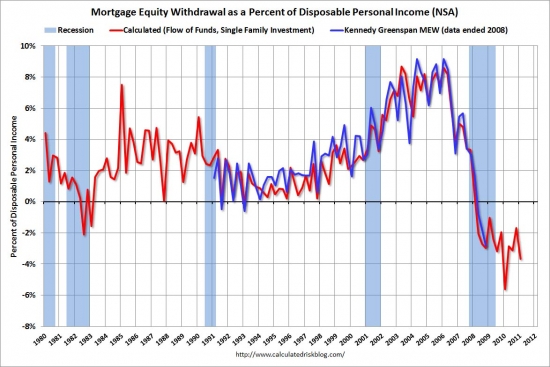

These high rises should never have been built. The economics simply do not support it. The housing bubble sent a false price signal and builders responded. At $750,000 per unit, high-rises justify their construction costs. At $350,000 per unit, they don't. Twenty years from now — or sooner if we inflate another housing bubble — these units might make sense, but today, forget about it.

Renting these units out is admitting failure, but it is probably the wisest course of action in today's markets for real estate and money. The investors whose capital is tied up in this loser project can take a 50% haircut, or they can rent the properties out and get a 3.5% return. Given the options for competing returns, keeping their money tied up in this property is the best use of the money.

Perhaps if competing returns making 10% were widely available, dumping the property and putting the money to work in a better investment might be wiser, but since good investment returns are hard to find, making a small premium over Treasury bills with the potential for future appreciation is a gamble worth taking. Quite honestly, both of their options suck.

Greater fool wanted

Today's featured property makes a nice study in value based on rental parity. We know from the article above that Lennar is going to rent identical units for $2,590 and up. Even with the super-low interest rates and owner-occupant tax deductions, this property costs $3,291 to own. Why would anyone do that?

What would an owner get for the additional $600 per month in their cost of ownership? The potential to lose more value as prices continue to decline?

Sign me up for two….

Irvine House Address … 401 ROCKEFELLER #805 Irvine, CA 92612 ![]()

Resale House Price …… $625,000

House Purchase Price … $555,000

House Purchase Date …. 5/21/2010

Net Gain (Loss) ………. $32,500

Percent Change ………. 5.9%

Annual Appreciation … 10.2%

Cost of House Ownership

————————————————-

$625,000 ………. Asking Price

$125,000 ………. 20% Down Conventional

4.49% …………… Mortgage Interest Rate

$500,000 ………. 30-Year Mortgage

$108,448 ………. Income Requirement

$2,530 ………. Monthly Mortgage Payment

$542 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$130 ………. Homeowners Insurance (@ 0.25%)

$0 ………. Private Mortgage Insurance

$865 ………. Homeowners Association Fees

============================================

$4,067 ………. Monthly Cash Outlays

-$422 ………. Tax Savings (% of Interest and Property Tax)

-$660 ………. Equity Hidden in Payment (Amortization)

$208 ………. Lost Income to Down Payment (net of taxes)

$98 ………. Maintenance and Replacement Reserves

============================================

$3,291 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,250 ………. Furnishing and Move In @1%

$6,250 ………. Closing Costs @1%

$5,000 ………… Interest Points @1% of Loan

$125,000 ………. Down Payment

============================================

$142,500 ………. Total Cash Costs

$50,400 ………… Emergency Cash Reserves

============================================

$192,900 ………. Total Savings Needed

Property Details for 401 ROCKEFELLER #805 Irvine, CA 92612

——————————————————————————

Beds: 2

Baths: 2

Sq. Ft.: 1583

$395/SF

Property Type: Residential, Condominium

Style: One Level, Modern

View: City Lights, City, Hills, Mountain, Panoramic, Yes, Faces North

Year Built: 2009

Community: Airport Area

County: Orange

MLS#: S657365

Source: SoCalMLS

Status: Active

——————————————————————————

Astoria is Irvine's preferred newest High-Rise Luxury Urban Living. This dual master suite is located on the 8th floor with unobstructed 180 degree City and Mountain views, and a terrace for entertaining. The Gourmet kitchen features stainless steel appliances and granite counter tops. Dual full baths include pristine marble throughout, dual-vanity sinks, glass showers and separate soaking tubs. Over $85,000 in private upgrades: fully integrated 12-speaker home entertainment system with component/amplifier tower, 3 wall mounted touch screens, Lutron lighting & remote window shades! Resort-style landscaping featuring an elevated terrace with pool & spa, a private wine tasting room and wine vault, business center, grand fitness center, outdoor entertaining areas, Concierge service & 24hr valet parking. Live in Orange County's newest and most luxurious resort-style master planned community. .. Central Park West

In a select few neighborhoods this may be true. The rich have gotten much richer over the last decade or more. Unfortunately, this wealth is very concentrated in the hands of a few people. Certain neighborhoods may be spared the high-end crash, but properties that benefited from their proximity to wealth — properties typically purchased with extreme leverage by posers — these less desirable properties will be crushed just like the condos we see here in Irvine.

In a select few neighborhoods this may be true. The rich have gotten much richer over the last decade or more. Unfortunately, this wealth is very concentrated in the hands of a few people. Certain neighborhoods may be spared the high-end crash, but properties that benefited from their proximity to wealth — properties typically purchased with extreme leverage by posers — these less desirable properties will be crushed just like the condos we see here in Irvine.

.jpg)