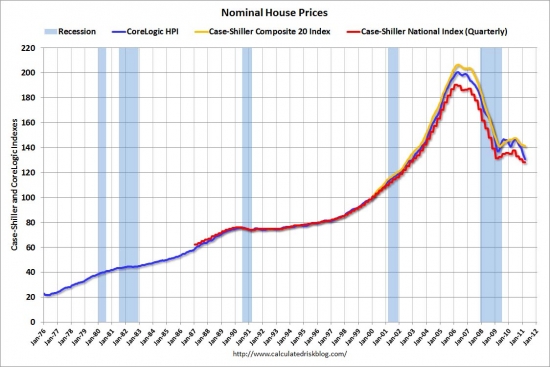

Money seeking returns in real estate is flowing into apartment development. The financial assumptions may not be realistic, and the money flows portend of another real estate bubble.

Irvine Home Address … 38 REMINGTON #31 Irvine, CA 92620

Resale Home Price …… $309,900

It's not as if you didn't get the warning

You got the transcripts and recordings

History has a way of signing us up in the morning

But you're a late starter make it easy to ignore it

Later not recall it – yo

You had unfettered access to the facts

But the fact is your back was turned to the atlas

Nothing like not being in the crash test

To help you make your mind up

2020 — The Herd

There is an old saying in investments: the herd is always wrong. This is only partially true. The herd is wrong about 80% of the time, and for a short time, the movement of the heard makes it right. However, once the herd has taken a position and nobody is left to buy, the herd realizes their mistake and panics to get out causing epic financial disasters.

The latest movement of the herd is into apartment development. As the only asset class related to real estate that makes sense for institutional investors, it stands to reason that some capital flows are warranted. However, in our era of cheap money, more than a little capital is flowing into apartment development.

Cheap money and the flow of capital

The federal reserve is attempting to flood the economy with cheap money. The problem with this approach is that the few good investment alternatives available receive an inordinate amount of capital inflows which causes prices to bubble. This was the consistent criticism of Alan Greenspan, and the same is true of Ben Bernanke. Both of them are bubble boys.

The asset class to receive an over-abundance of capital is apartments. Capital managers have put a small box around class A apartments and said they are acceptable investments. As a result, the capital inflows are keeping apartment cap rates south of 5.5%. Many deals being underwritten today have low cap rates, aggressive assumptions on rent growth, and ridiculous assumptions on the cap rates future buyers will be willing to pay — and capital managers are funding these deals.

This flow of capital is causing apartment development in class A markets — whether they need apartments or not. This supply being added will prevent the rental increases the proformas all rely on. Further, in today's risk adverse environment, 5.5% cap rates sound great, but ten years from now when apartment REITs want to unload these investments at 4% cap rates, buyers will be less risk adverse, and they likely will have better use for the funds than paying a huge premium for a 4% cap rate apartment complex.

The bottom line is apartment deals being underwritten today will not perform as expected. They will not achieve the rent growth, and they will not obtain the resale price at liquidation. It's a bubble. It will likely inflate for another two or three years, then the REITs will watch for the next several years while these investments underperform. Ultimately, they will liquidate for a loss.

So much for being risk adverse.

Analyst: Rents to rise 4.5% for years

June 20th, 2011, 12:00 am — posted by Jon Lansner

The folks at John Burns Real Estate Consulting in Irvine have some bad news for renters: The landlord has pricing power!

“We believe the apartment business is set to explode, with steadily rising rents and occupancy that will justify new construction.”

I also believe the apartment business is set to explode. There will be a boom in construction because dumb money is forcing it to happen. The steadily risiing rents will not materialize at the stellar rates they are hoping for, primarily due to the new supply which will come to the market.

JBREC’s forecast shows rents growing 4.5% annually on average through 2015. The report notes that “Wall Street and pension fund consensus, at least for apartments in good locations in coastal cities, seems to be that 25%-plus rent growth over the next three years can easily occur.”

The pension fund herd is all moving in the same direction. That spells disaster for whatever asset class they are piling into.

Why are landlords in a good spot? Growing household formation and homeownership skittishness. Your landlord’s best new customer will be “young adults, who have either moved back in with their parents or taken on roommates.” Also, weak jobs. “The uncertain environment is enough to convince consumers that renting is safer than taking on a mortgage.”

Weak jobs is a plus for apartments? That is pretty stupid. Rents are directly tied to incomes. Without both job growth and wage growth, rents aren't going anywhere.

Caveats … or why JBREC sees some hope for renters – and homeownership:

Affordability Favors Homeownership: From a mortgage payment to income standpoint, for-sale housing has not been this inexpensive in at least 30 years. We calculate an own vs. rent premium across all metropolitan areas, and in many areas, it is considerably cheaper to own a home than to rent an apartment. …

That is true. However, in our market, it is still cheaper to rent than to own.

Not Smart to Rent Forever: Increasing rents will provide the motivation renters will need to explore owning. As rents start to grow, more renters will consider buying. Most people realize that paying rent all your life is probably not a great retirement decision unless you are a fantastic saver. … Construction Will Increase: Development money is flowing steadily into apartments. One of our favorite land brokers in Tampa, Bruce Erhardt, told us that there are at least eight apartment development sites in escrow right now! … Renters Have a Limit: Several of our apartment clients feel that they are already near the limit of what their tenants can afford. Renters are a clever, creative bunch who won’t take huge rent increases easily.

Rents will start rising from where they are today, but unless incomes go up, rental rate increases will be muted.

Apartments Shine as Beacon of Hope

By Hessam Nadji — August 3, 2011![]()

The nation’s apartment market continues to beat expectations as it speeds along to a full-scale recovery. Vacancy rates peaked in early 2010 at 8 percent and have since dropped to a healthy 5.9%. Effective rental rates have been moving upward for a year-and-a-half now, by 2.5% per year on average, and picking up pace to the 4% to5% range this year. Select markets are registering high single-digit rent growth.

The outlook is quite positive. Tenant demand appears likely to continue to swell, driven by a still-recovering economy, unbundling of households that doubled up during the Great Recession, continued weakness in the for-sale housing market and movement of the relatively large Generation Y (those born between 1983 and 1992) into their peak renter-household-formation years of their 20s and early 30s.

He is overlooking the fact that a weak housing market is direct competition to rentals. As rental rates go up, the rent versus own calculation begins to favor owning, and rental demand will diminish as people chose to buy.

While the number of planned projects is picking up, and the risk of overbuilding by 2013 is increasing in certain pockets, overall construction activity remains very restrained. These factors strongly suggest that vacancy rates will soon fall into the 5% range nationwide, and into the low single-digits in a number of high-beta areas (MSAs, primarily in the Sun Belt and in the West, with above average job growth and net absorption during recovery years) and in a number of supply-constrained areas, primarily coastal MSAs. As it does, rent growth will likely escalate sharply.

This is the kind of delusional nonsense asset managers are listening to. This guy writes a good narrative on why rents should to up, but it is fiction. We will not see above-average job growth for several years, and rents in coastal MSAs will not rise dramatically because they are already astronomically high.

How long will the up market last? Probably through at least 2014 or 2015. It will take at least that long for construction completions to pick up enough to cause vacancy to climb significantly once again. Also, while at some point there likely will be some shift back toward home ownership as consumer confidence in the for-sale market improves, that probably won’t happen to the degree that significantly impacts the apartment market for at least another three to four years. In the meantime, these should be great years for apartment investors.

As i stated earlier, apartment REITs will watch the values of their holdings underperform in the last several years of their ownership. Overbuilding and a renewed enthusiasm for owning will limit demand and prevent large increases in rents.

The investment community already has already anticipated this. The total dollar volume of apartment sales priced at $1 million or greater climbed by an exceptional 77% in 2010 over 2009, albeit from a depressed level in 2009. During the first half of 2011 apartment sales volume reached $25 billion, a 67% jump over the first half of 2010. The average price per unit climbed by 16% in 2010 and by an additional 7% so far in 2011. Median cap rates across the United States have dropped from 7.5% in 2009 to 6.8% as of mid-year 2011, which masks the dramatic drop in cap rates among top-tier assets in primary markets. Prices for large, Class A apartment complexes have come back first, with appreciation starting in late 2009. Class A cap rates in primary markets have re-compressed by 150 bps to 200 bps since the market bottom with many reporting 4% to 4.5% averages, and some below 4%. Given the extraordinary levels of capital looking to enter the sector, the razor-thin cap rate to interest rate spread in upper tiers of the market place, is causing a capital migration to Class B and secondary markets. Value-add, a shunned strategy viewed as too risky just 12 months ago, has reemerged as a viable alternative, even for some institutional investors.

Asset mangers are clueless herd-following sheeple just like residential loan owners. They are overpaying for apartments in anticipation of the greater fool to come along. This is a bubble in the making.

Price support in the future will come from significantly above-inflation rent growth and low vacancies.

LOL! Yeah, right.

In addition, the spread between average, overall cap rates and underlying mortgage rates is near record highs, providing exceptional opportunities for apartment investors.

While many investors are concerned about future funding from the GSEs and their eventual restructuring, the biggest risk to this forecast is the economy.

No, the biggest risk is that asset managers wake up from their delusions and realizes they are a foolish herd being led to slaughter.

This is because other sources of financing are rapidly entering the multifamily market led by life insurance companies and healthy commercial banks. Although the recent boom in rental demand appears to defy weak employment, the tie between apartment absorption and job creation is still significant. Approximately 78% of the jobs added in the last 12 months went to young adults between the ages of 20 years old and 34 years old. While the release of pent up-demand and reversal in home ownership are important drivers, jobs still matter the most.

We have a persistent problem with unemployment. Without great job growth, the dreams of apartment investors will not come to pass.

Even modest job growth should continue to support base line demand for apartments but should the unlikely scenario of an economic contraction materialize, apartment occupancy gains will lose steam, at lease temporarily. The other risk is the lack of economic recovery in the tertiary markets. While the capital migration will bring more capital to secondary markets, and secondary submarket within major metros, true tertiary locations will continue to lag for some time.

Hessam Nadji is managing director, research and advisory services, for Marcus & Millichap Real Estate Investment Services. Contact him at hessam.nadji@marcusmillichap.com.

Stay away from apartment REITs as long-term investments. Perhaps in three to five years, this will be an asset class to short as the bubble becomes obvious.

Flip that REO

Flipping is easy when prices are going up 10% or more a year. No matter how incompetent the flipper, time and appreciation will bail them out. In a flat or declining market, flipping is much more difficult.

This property was taken back by the bank at auction on 4/13/2011 for $256,950. It was sold to the flippers for $236,500. The flippers went and borrowed $285,000 from a private investment group who funded the improvements and basically took all the profit from the deal. The flippers have to net more than $285,000 to make any money. If they get their full asking price and pay a 6% commission, they stand to make about $15,000. If they have to come down on the price, they won't make anything.

The previous HELOC abusing Ponzi

The interesting sub-plot to this property is with the woman who owned it previously.

- This property was purchased as the last bubble was deflating on 1/23/1992. The the original mortgage data is not available, but based on later loans, it is likely this was a 20% down loan. The purchase price was $151,000. The first mortgage was likely $120,800 and the down payment was likely $30,200.

- On 5/31/2000 (the date I was married), the owner refinanced with a $140,000 first mortgage.

- On 6/6/2002 she refinanced with a $147,000 first mortgage.

- On 12/4/2002 she refinanced with a $185,250 first mortgage.

- On 6/11/2004 she obtained a $125,000 HELOC.

- On 4/12/2005 she refinanced the first mortgage with a $316,500 Option ARM.

-

After five years on the Option ARM, she likely hit their recast and couldn't afford the payments.

Foreclosure Record

Recording Date: 12/13/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 07/22/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 04/13/2010

Document Type: Notice of Default

Foreclosure Record

Recording Date: 04/13/2010

Document Type: Notice of Rescission

Foreclosure Record

Recording Date: 03/12/2010

Document Type: Notice of Default

This woman was one of thousands of Irvine residents who spent themselves out of house and home.

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 38 REMINGTON #31 Irvine, CA 92620

Resale House Price …… $309,900

Beds: 2

Baths: 2

Sq. Ft.: 1016

$305/SF

Property Type: Residential, Condominium

Style: One Level, Traditional

View: Faces South

Year Built: 1986

Community: Northwood

County: Orange

MLS#: S669573

Source: SoCalMLS

On Redfin: 2 days

——————————————————————————

This Remodeled Single Story Lower end unit has 2 Master bedrooms each with their own full bathroom and all on one level. This is off the main road with a large patio for BBQ's or for the kids to play. Also inludes an Inside Laundry area. Granite Kitchen and bathroom counter tops. Seperate Dining area. Walk in Closet with direct patio access from one of the bedrooms. Unit has a Shared 1 car Garage. Garage is number 31. Plenty of additional parking in the complex. Very Clean and a great location in this complex. Standard Sale.

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis ![]()

Resale Home Price …… $309,900

House Purchase Price … $236,500

House Purchase Date …. 6/28/2011

Net Gain (Loss) ………. $54,806

Percent Change ………. 23.2%

Annual Appreciation … 173.7%

Cost of Home Ownership

————————————————-

$309,900 ………. Asking Price

$10,847 ………. 3.5% Down FHA Financing

4.19% …………… Mortgage Interest Rate

$299,054 ………. 30-Year Mortgage

$92,428 ………. Income Requirement

$1,461 ………. Monthly Mortgage Payment

$269 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$65 ………. Homeowners Insurance (@ 0.25%)

$344 ………. Private Mortgage Insurance

$250 ………. Homeowners Association Fees

============================================

$2,388 ………. Monthly Cash Outlays

-$230 ………. Tax Savings (% of Interest and Property Tax)

-$416 ………. Equity Hidden in Payment (Amortization)

$16 ………. Lost Income to Down Payment (net of taxes)

$59 ………. Maintenance and Replacement Reserves

============================================

$1,816 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,099 ………. Furnishing and Move In @1%

$3,099 ………. Closing Costs @1%

$2,991 ………… Interest Points @1% of Loan

$10,847 ………. Down Payment

============================================

$20,035 ………. Total Cash Costs

$27,800 ………… Emergency Cash Reserves

============================================

$47,835 ………. Total Savings Needed

——————————————————————————————————————————————————-

Notice how the sentence above starts with spin to put a good face on the really bad news that follows.

Notice how the sentence above starts with spin to put a good face on the really bad news that follows.

.jpg)