Today we review current conditions to verify that we are not at the bottom of the housing market, and examine the property of a grade D HELOC abuser.

Irvine Home Address … 17 SUNRISE Irvine, CA 92603

Resale Home Price …… $1,528,000

{book1}

I don't wanna close my eyes

I don't wanna fall asleep

'Cause I'd miss you, babe

And I don't wanna miss a thing

'Cause even when I dream of you

The sweetest dream will never do

I'd still miss you, babe

And I don't wanna miss a thing

Aerosmith – I Don't Wanna Miss A Thing

Their gullets awash with kool aid and eyes ablaze with imagined riches, fanatical bulls prematurely celebrate the bottom of the housing market.

Relax. You haven't missed a thing; we are not at a bottom, and although I have stated I will not call a bottom, I do not believe conditions exist for a bottom to form — unless perhaps kool aid intoxication is so strong that bulls can make it happen through force of will. Anything is possible.

The obsession with a market bottom comes mostly from bulls hoping to make a fortune and to restart the housing ATM and to live the bubble lifestyle — a foolish mindset discordant with our future reality of (1) flat home prices, (2) rising interest rates, (3) less borrowing, (4) increased saving and (5) less spending. Timing Does Matter, and nobody wants to overpay for real estate, but once prices fall below rental parity, timing the bottom becomes less important, and drop duration takes on new importance because it determines how long buyers will be trapped in the homes they purchase.

Today I want to look at where prices are, where they are going, and how long it will take them to get there.

Good News

On the positive side, many of the IHB Property Valuation Reports we prepare show properties as positive cashflow, a prerequisite for a durable market bottom. As long as it is less expensive to own than to rent, buyers intent on long-term ownership of a particular property are making a rational decision, and the collective action of these buyers (coupled with the irrational ones) forms a market bottom.

Bulls want to end the discussion with acheiving rental parity and assume other problems — like rising interest rates, falling rents and foreclosures — will not impact pricing, so when prices do go down, they claim the obvious forces working against prices were a surprise — it is only surprising to those who bury their heads.

Bad News

I wrote a post early last month titled House Prices Will Decline in 2010. I mentioned the 3 primary factors working against the market; (1) prices are too high, (2) mortgage interest rates will go up, and (3) foreclosures will increase.

Prices are too High

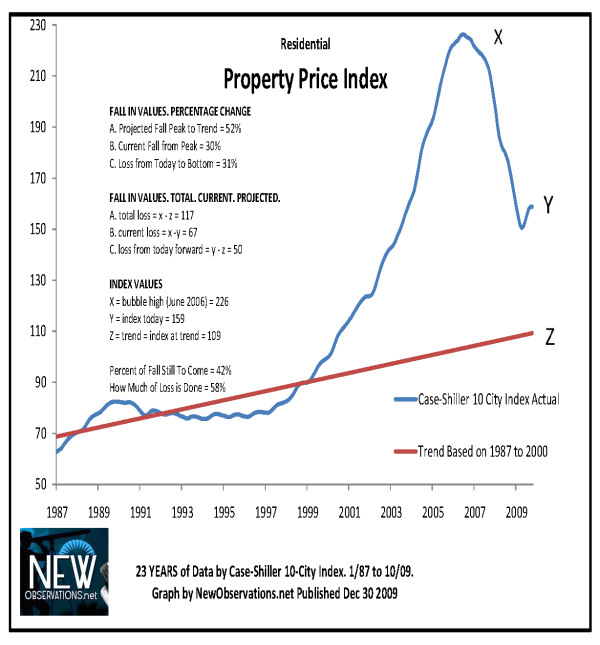

The basic argument as to why prices will fall is not complex; prices are still too high by historic measures.

Calculated Risk put it this way: "House prices are not cheap nationally. This is apparent in the price-to-income, price-to-rent, and also using real prices.

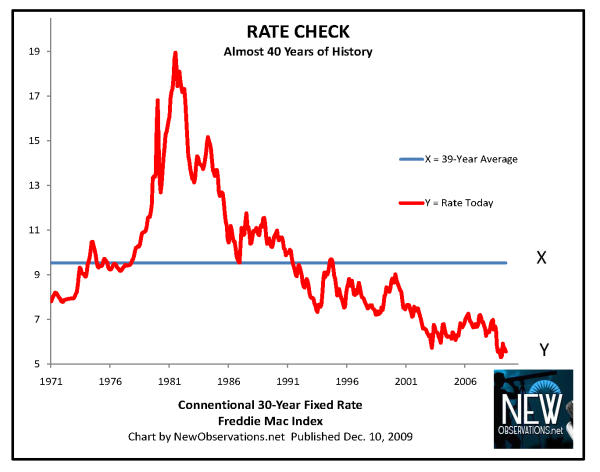

Mortgage Interest Rates will go up

This is also a simple argument; interest rates are nearly zero, and based on the long-term chart, it looks like rates must move higher.

Perhaps the best evidence for concluding interest rates have bottomed and will soon move higher comes from Ben Bernanke, Chairman of the Federal Reserve, who recently refinanced his ARM to a fixed-rate mortgage.

Foreclosures will Increase

CNN Money recently published an article titled, 3 reasons home prices are heading lower, where the authors cited (1) foreclosures, (2) rising interest rates, and (3) the end of the tax credit. Rising interest rates was mentioned above, and tax credit props made my list of caveats as to why people may not want to buy now. Foreclosures and Shadow Inventory made my list of 2009 Residential Real Estate Stories in Review, and it is the biggest unknown facing the market — it isn't unknown as to whether or not this inventory exists; it does, what is unknown is when this inventory will hit the market.

Nothing has changed, but for further support, I want to enlist economists Dean Baker and Christopher Thornberg.

Dean Baker: We’re Still In a Housing Bubble

Housing economist Dean Baker, the co-director of the Center for Economic and Policy Research, speaks frequently about the relationship between the cost of ownership and the cost of rental — rental parity as we call it — as an important measure of house prices. Obviously, I agree with him. His latest writing, Dean Baker: We’re Still In a Housing Bubble, is a cogent presentation of the current housing market situation.

"Home prices have posted six months of gains, according to the Case-Shiller home price index, released this morning. But some housing bears say that the fundamentals don’t support those price gains and that, even once the market finds a bottom, home prices aren’t likely to show significant appreciation for many years to come.

Housing economist Dean Baker, the co-director of the Center for Economic and Policy Research, laid out his case [PDF warning] at a risk conference last week for why we still have a housing bubble. Adjusted for inflation, home prices are still 15-20% higher than they were in the mid-1990s. “There’s no plausible fundamental explanation for that,” he says."

Remember Christopher Thornberg's Beacon Economics 2010 Orange County Forecast? He had the same observation:

![]()

Back to the article:

Why? Simple, he says: Economic fundamentals are all going in the other direction. Rental apartment vacancies are reaching record highs. [also see Rents Fall to 3 1/2 Year Low in Orange County] Many segments of the housing market are still oversupplied. And the core demographic in the country—the baby boomers—are reaching the age where they’re more likely to downsize, buying less house in the years to come.

Far from some rosy estimates that housing is going through a temporary, once in a lifetime downturn, and that once the market bottoms, homes will again appreciate well beyond the rate of inflation, Mr. Baker argues that home prices are far more likely to increase annually at the rate of inflation, at best.

“If anything, I expect housing to be weaker than normal rather than stronger over the next decade,” he says. “People who say this is a temporary story, there’s no real reason to believe anything like that.”

The recent burst of good housing news has been fueled by government stimulus, including the tax credit, low mortgage rates and easy financing from the Federal Housing Administration. Mr. Baker, who had been a skeptic of the tax credit, concedes that it has worked. So, too, he says, has the FHA effectively supplied credit to goose sales.”

Yes, we replaced subprime with FHA (and the GSEs), and we put thousands of people into homes with 3.5% down FHA loans, money renters likely to fall 10% or more underwater. If they walk, you and I pay the bills.

Housing Bubble Deflation Progress by Market Segment

The Great Housing Bubble deflates unevenly across market segments with the low-end falling most and the high-end falling least — so far anyway. The differential rates of decline has created a gap between top and bottom that has never been so stretched. The bottom of the market collapsed first as toxic financing is most lethal to those with least sophistication, resources and experience: subprime. Borrowers further up the property ladder are falling flat like subprime but they are allowed to dance with lenders in amend, extend, pretend — a charade seemingly with no end.

Many people believe the high end will suffer the least while the low end suffers the most because history recorded same over the last 3 years. I contend the various market strata are like Shoemaker Levy comet fragments marking different points along the same trajectory destined to meet with the same fate. Only time will tell if I am right or wrong.

I have a difficult time visualizing how prices at the high end can stay so high. The high end and the low end went up together, and the low end has since fallen; either the low end must go back up a great deal, or the high end must come down — unless you believe the gap between the rich and the poor is destined to widen forever.

Bulls would have us believe that Irvine and Orange County are so desirable that wealth will concentrate here in abundance saving our housing market and making it different than the rest; it is a compelling narrative with a small kernel of truth; however, the narrative ignores the size and interrelationship of all housing markets and the consequences of the substitution effect on housing values.

Roaring Back?

What about the idea that "housing is going through a temporary, once in a lifetime downturn, and that once the market bottoms, homes will again appreciate well beyond the rate of inflation?" It is the prevailing (and incorrect) belief in the market today. Dissenting views exist: Housing recovery could take a decade, say optimists, and House values won't regain bubble heights for AT LEAST a decade. That doesn't sound good.

The first story has a great opening:

"Even as the housing market shows signs of improvement, including in new data released Tuesday, economists warn that it could take up to a decade for many homeowners to regain equity in their homes, while some people in the hardest-hit regions of the country may not see a recovery during their lifetime."

During their lifetime? Yikes! Certainly not giving any false hopes here.

The second story is interesting because it is either extremely bearish or condescending of bears, and I can't determine which:

"A New Jersey financial publishing house assumes conservative rates of growth in its formulas but acknowledges that its conclusions take a 'real leap of faith.'"

It is a leap of faith because (bearish) house prices will not bottom as quickly and prices will not rise as fast as projected? Or, is the leap required because (bullish) prices are obviously going to rise much faster than this guy projects, so he is way too conservative? Enlighten me in the astute observations.

"According to the Standard & Poor's/Case-Shiller index, which tracks changes in the value of residential real estate in 20 metropolitan regions, prices have fallen 32.6%, peak to trough, between 2006 and the third quarter of 2009.

HSH is predicting a flat real estate market with no increase in value through June 2010. Then, from July 2010 through August 2011, a period of 14 months, prices are projected to increase at a rate of about 2.5% a year. And from then on out, the company is figuring on a yearly gain of 3%.

With these percentages in mind, let's look at what would happen to the value of a $200,000 house purchased at the top of the market in July 2006.

By the time the market hit bottom — at least the bottom according to Case-Shiller's 32.6% figure — that property was worth $134,800. Using HSH's assumptions, the value of the imaginary house won't get back to the $200,000 paid for it until July 2022 — 12 1/2 years from now."

As you may have surmised, I also projected recovery times in The Great Housing Bubble, Future House Prices – Part 1:

Irvine, CA, Projections from Historic Appreciation Rates, 1984-2026

Perhaps we will round out the bottom a bit with 5% interest rates, but we do eventually need to get back on line of rational appreciation instead of the line of irrational exuberance. What many consider normal appreciation is in fact a parabolic blowoff of a speculative mania.

Don't worry, it is different here.

What happens in Vegas, stays in Vegas, right?…

Fortunately, we are much closer to the bottom than to the top for most market segments. In fact, I am very bullish on Las Vegas, if for no other reason than I see where we are in the chart above. Here in Orange County and Irvine in particular, we have not progressed far enough along the journey to reach bottom.

It is what it is. Stay tuned.

Irvine Home Address … 17 SUNRISE Irvine, CA 92603

Resale Home Price … $1,528,000

Income Requirement ……. $321,086

Downpayment Needed … $305,600

20% Down Conventional

Home Purchase Price … $675,000

Home Purchase Date …. 4/9/1999

Net Gain (Loss) ………. $761,320

Percent Change ………. 126.4%

Annual Appreciation … 7.7%

Mortgage Interest Rate ………. 5.13%

Monthly Mortgage Payment … $6,660

Monthly Cash Outlays ………… $8,340

Monthly Cost of Ownership … $6,150

Property Details for 17 SUNRISE Irvine, CA 92603

Beds 5

Baths 3 full 1 part baths

Home Size 3,500 sq ft

($437 / sq ft)

Lot Size 5,800 sq ft

Year Built 1980

Days on Market 424

Listing Updated 11/13/2009

MLS Number U8005368

Property Type Single Family, Residential

Community Turtle Rock

Tract Rg

Rarely on the market. Location, location. Thousands spent in upgrades. Home has been remodeled and updated. Beautiful backyard, light and bright, open floor plan. Hardwood flooring throughout, Huge family room/den area. Office area. Master suite with private sitting area attached. Entertainers backyard with BBQ area, Private jacuzzi and sitting area. Awnings, outdoor fireplace. Three indoor fireplaces enhance the living areas. Kitchen nook, large den with wine room attached. Skylights bring more sun to already bright home. Low association fees. No Melo-Roos. Walking distance to Bonita Canyon and Turtle Rock schools, University High School. Next to Turtle Rock Community Park, Tennis, Pools and Association. Beautifully kept and maintained. Thank you

I have to admit, when I look into the details of some of these HELOC abuse cases, I try to imagine the borrower's life and the feeling of power of having hundreds of thousands of dollars given to you by the market to spend as you will. Borrowers get to enjoy a carefree (and careless) attitude toward money where they simply spend whatever it takes to get whatever they want; what a great reality to live in. It's unfortunate that reality isn't Reality.

Some assume I must be jealous to even ponder such things, but I assure you it isn't jealousy. There are some things in life you have to see for what they are, and the seduction of kool aid intoxication and reckless spending is just as potent as any vice known to man. As a society, we succumbed to the Siren's Song in large numbers and inflated the largest and most destructive housing bubble in US history. I hope we can see clear not to do it again.