If people took responsibility for themselves, we would not need paternalistic rules and regulations. Unfortunately, they do not. Now that we are all paying for the foolish risk taking of the past decade, it is time to access what risks people should be allowed to take.

Our property today is an REO rolled back to 2002 pricing.

Asking Price: $299,900

Address: 7 Goldenbush #28, Irvine, CA 92604

{book1}

Rules and Regulations — Rufus Wainwright

I will never be as cute as you, according to the board of human relations

I will never fly as high as you, according to the board of public citations

Flying high is dangerous; just ask Icarus. Everybody was flying high on free money but they got too close to the sun and got burnt. When they fell back to earth, their impact created a debt crater that the rest of us are being asked to fill in.

Borrowers took on enormous risks during The Great Housing Bubble. If this were not the case, we would not now be facing a foreclosure crisis that eclipses the magnitude of the Great Depression. As a society we need to accurately identify the risks assumed by borrowers that caused them to lose their homes. We must enact legislation that limits or reduces these risks in the future. We need to do this for one simple reason: those of us who did not take on these risks are being asked to pay the price. The benefits of these risks are privatized while the losses incurred from these risks are being socialized. This is not just.

I first wrote about this issue in the post Bring Back Paternalism in The Mortgage Market. In that post I suggested limitations to mortgage equity withdrawal through home equity lines of credit. This post I’m going to go even farther and suggest that mortgage options should be limited to fixed-rate financing with reasonable debt to income ratios and high down payment requirements. In my book, The Great Housing Bubble, I provide detail and nuance to these legislative mandates, but I will discuss the basics here.

{book2}

The foreclosure crisis of the Great Depression was caused by a number of related factors. First, there was systemic mortgage related risk. At the time almost all mortgages were interest-only loans with very high equity requirements (50% down was the norm). Loans were interest-only because banks wanted to pass interest rate risk on to the borrower, and equity requirements were very high to insulate the banks from risk of loss if people defaulted. Despite the lenders low risk tolerance, many banks failed during the Great Depression.

The foreclosure crisis of the Great Depression was triggered by mass unemployment causing borrowers to default. As these defaults caused banks to lose money, it imperiled our entire financial system. It caused a contraction in lending and created an economic contraction that resulted in even more unemployment; a downward spiral ensued. It is the same phenomena that we are witnessing today.

The Great Depression exposed the risks of the debt-service mentality. Since the primary loan program of the Great Depression was the interest only loan, most people did nothing to retire their debt. If people are not retiring their debt, lenders have an ongoing problem with risk. This lending risk is so great that even the high equity requirements of the pre-depression era were not sufficient to save the banking industry. Everyone who analyzed this problem realized that a new loan program that retired debt was needed.

After World War II lenders embraced a new loan program, the fixed-rate conventionally-amortized 30-year mortgage. This loan program had a mechanism to pay back the principal and retire the debt. This retirement of debt compensated the banks for the interest rate risk they were taking on. Also this allowed banks to lower their loan-to-value ratios because over time their risk was being reduced. The lower loan-to-value ratios opened the housing market to many new people and contributed to the housing boom immediately following World War II.

Our foreclosure crisis, the one resulting from The Great Housing Bubble, is caused by a failure of finance. Numerous unstable loan programs were introduced that inflated house prices to unprecedented levels. These loan programs encouraged people to take on numerous risks that most people were either ignorant of or did not believe would become a problem. Of course they were wrong. Removing these loan programs is what is causing the house price collapse. Part of these unstable loan programs is the mindset that debt can be endlessly serviced. It is the same problem that plagued the Great Depression. The unstable loan programs and the debt-service mindset prompted copious borrowing. People were allowed to take on risks that cost them their homes.

The risks borrowers took on are easily identified. These risks include:

- interest-rate risk,

- mortgage-availability risk, and

- increasing-payment risk.

Interest-rate risk is caused by the use of adjustable-rate mortgages. I have written many times about the ARM Problem. The Federal Reserve is working hard to artificially manipulate mortgage interest rates to deal with this problem. Lowering interest rates may help if the payment is simply resetting but it does nothing for those facing a recast of their loan from an interest-only to a fully-amortized payment. This loan recast is the root of the problem.

It is amazing to me that former Fed Chairman Alan Greenspan actually suggested people take on interest rate risk and use adjustable-rate mortgages. It is debatable whether or not he was a great central banker, but it is clear that he was a very poor financial advisor. People are not capable of managing their own interest rate risks as Mr. Greenspan had suggested. In reality everyone is merely betting on lower interest rates. If this bet moves against them, the government or the Federal Reserve is asked to step in and bail everyone out. Again, the rewards are privatized and the risks are socialized.

{book3}

Mortgage-availability risk is the problem being faced by those who assume they can serial refinance from one teaser-rate mortgage to another. Everyone who has a mortgage that is going to require refinancing before it is paid-in-full has assumed mortgage-availability risk. Of course most people simply presuppose that favorable loan terms will be available forever and they will always have access to capital. Our recent credit crunch has shown how serious this risk really is.

Increasing-payment risk is caused by loan terms where the borrowers payment may go up over time. Loan terms that have increasing payments have high default rates; people cannot afford the increased debt-service burden. This commonsense fact seems to have eluded lenders as they developed these unstable loan programs. This increasing payment forces people to refinance which in turn exacerbates the mortgage availability risk when people find their ability to refinance curtailed.

Borrowers should simply not be allowed to take on these risks. Once the downside of these risks comes to be, it leads to a foreclosure crisis. This leads to government bailouts which in turn leads to the prudent paying for the sins of the irresponsible. The borrower risks described above can be eliminated.

We can require high down payments. Initial equity in the form of a down payment provides a buffer in case house prices fall so homeowners do not go underwater. We can limit the debt-to-income ratios of borrowers. If people are not over extended under mortgage debt they are far less likely to default. Statistics bear this out. And we can limit lending options to the fixed-rate conventionally-amortized mortgage. It is the only product that pays down debt and does not face an escalating payment.

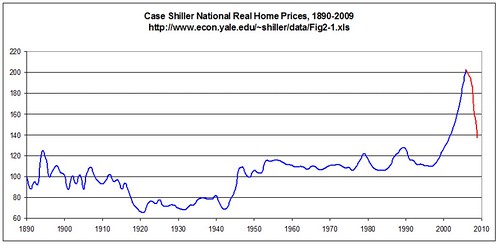

There was a 30-year era were borrowers were not permitted to take on these risks. From 1948 to 1978, we experienced price stability (after the brief price recovery following the Great Depression and WWII). House prices were relatively stable even when the economy was not. The era ended with the hyperinflation of the late 70s and the first California housing bubble which coincided. This ushered in an era of price instability and experimentation with affordability products (See Robert Shiller’s chart above).

Our modern era of experimenting with affordability products has been a dismal failure. The Great Housing Bubble is a direct result of this failure. We must return to the lending practices of the 1948 to 1978 era. Many will view this as a big step backward. However, when lending steps off a cliff, perhaps a step backward is a good thing.

Maybe that cartoon should read, “What Lender’s Believe?”

Today’s featured property is one of those undesirable condos that is likely to crash in price down to cashflow investor levels. It is probably already at rental parity, but would you want to live there for the next 10 years?

Income Requirement: $75,000

Downpayment Needed: $60,000

Monthly Equity Burn: $2,500

Purchase Price: $280,000

Purchase Date: 7/3/2002

Address: 7 Goldenbush #28, Irvine, CA 92604

| Beds: | 2 |

| Baths: | 3 |

| Sq. Ft.: | 1,150 |

| $/Sq. Ft.: | $261 |

| Lot Size: | – |

| Property Type: | Condominium |

| Style: | Other |

| Year Built: | 1974 |

| Stories: | 2 |

| Floor: | 1 |

| Area: | El Camino Real |

| County: | Orange |

| MLS#: | S565052 |

| Source: | SoCalMLS |

| Status: | Active |

| On Redfin: | 4 days

|

Light and bright with nice wood laminate floors throughout first level.

Light and bright with nice wood laminate floors throughout first level.Beautiful slate and cherry-wood fireplace in living room. Needs carpet

and paint. Great potential!

As you can see, this is quickly approaching its 2002 purchase price.

Listing and Sales History

| Feb 25, 2009 | Listed | $299,900 |

| Jan 22, 2009 | Sold | $373,000 |

| Jul 03, 2002 | Sold | $280,000 |

| Jul 17, 1998 | Sold | $151,000 |

So what would this place be worth with 4% appreciation since 1998?

| 1998 | $ 151,000 |

| 1999 | $ 157,040 |

| 2000 | $ 163,322 |

| 2001 | $ 169,854 |

| 2002 | $ 176,649 |

| 2003 | $ 183,715 |

| 2004 | $ 191,063 |

| 2005 | $ 198,706 |

| 2006 | $ 206,654 |

| 2007 | $ 214,920 |

| 2008 | $ 223,517 |

| 2009 | $ 232,458 |

Somewhere around $232,000 is a reasonable bottoming figure, perhaps a bit higher if interest rates remain artificially low. Just think, the peak appraised value for this property was around $450,000…

- This property was purchased on 7/3/2002 for $280,000. The owner used a $280,000 first mortgage, and a $42,000 second… Wait a minute. How is that possible? I suspect the purchase price as reported is incorrect. This most likely sold for $322,000. If so, then this asking price is a 2002 rollback.

- On 10/13/2005 they refinanced with a $330,000 Option ARM.

- On 5/31/2006 they opened a HELOC for $100,000. It does not look as if this money was taken out.

- On 4/28/2008 they took out a stand-alone second for $28,579.

- Total property debt is $358,579 plus negative amortization.

- Total mortgage equity withdrawal is approximately $50,000. It is impossible to be accurate with the data I have.

These were actually somewhat conservative borrowers. They were not going back to the housing ATM every year, and when they refinanced in 2005, they did not take out all their equity. The bank foreclosed and bought the property for $379,000 which was probably the balance of the first mortgage (with negative amortization) and the small second they took out. It looks as if these are people who were simply in over their heads. They tried to be responsible, but they could not afford their home.

Perhaps they should not have been loaned more money than they could pay back…

{book4}

I will never be as cute as you, according to the board of human relations

I will never fly as high as you, according to the board of public citations

These are just the rules and regulations

Of the birds, and the bees

The earth, and the trees,

Not to mention the gods, not to mention the gods

All my little life I’ve wanted to roam

Even if it was just inside my own home

Then one little day I chanced to look back

Saw you sittin’ there, being a sad culprit

These are just the rules and regulations

Of the birds, and the bees

The earth, and the trees,

Not to mention the gods, not to mention the gods

These are just the rules and regulations

Yeah, these are just the rules and regulations

And I like every one, yes I like every one

Must follow them

Rules and Regulations — Rufus Wainwright

Great post today, IR.

My old man always said fixed thirty year and it even worked during the Carter years,but had to live in Corona and drive to Brea to work.Interest rates were 18 to 23 percent but with a new family and plenty of energy for the drive I didnt care.Would I do it now? NO..but I dont have to.

For the Woodbridge HOA dues of *only* $355/mo this place sure isn’t very close to any of the amenities (lakes, pools, tennis courts, etc). IHMO Deerfield is the second worst part of Woodbridge right after to the ghetto apartments at the corner of Irvine Center and Jeffrey.

Using the calculator on this site, the $2,491.96 in cash outflow per month at a $300,000 purchase price with $60,000 down doesn’t exactly inspire me to go out and take on a 30 year commitment.

IR, you really think this is already at rental parity? Somebody put sunshine in your coffee this morning!

I’d rather keep my $60,000 down payment and rent an equivalent apartment (lets not fool ourselves) with no strings attached for much less than $2500/mo for the next 10 years. Oh, and I won’t have to bring my own paint and carpet…

I think rental parity is a bit of a moving target right now. If I look online I can see that the IAC apartment I rented 1-1/2 years ago is now 15% less than my lease rate then. We are undergoing deflationary pressures in just about everything and with the vicious cycle caused by unemployment and falling demand, who knows where rental parity will be in the future.

This is the one thing about IR’s writings that drives me a little crazy. When he says a property is at rental parity I wonder how many people might be going out to buy the place thinking they will always be at breakeven.

I agree that rental parity is a moving target. I would add my “2 cents” which is to say that to see if a place is at rental parity TODAY, I would do the math assuming 0% down (just for mathematical purposes) interest only to calculate monthly payment (i.e. strip out monthly amount going to pay down principal) and see where the math takes me.

I second this. This is the same exact problem that I’m seeing with condos literally across the street from my house in Dallas. The owners of properties for rent in my neighborhood are following the market down, still in denial over what’s happened to the market. The condos are the usual converted apartments, about 35 years old, with living room and kitchen windows that give a fabulous view of the filthy, muddy alleyway separating the building from the back of the nearby Chili’s. However, the owners of the condos are still trying to get rent at the same rate as they were getting back in 2006.

The problem here is that we’re starting to see a consolidation of rentals, and most property owners don’t want to understand why. The presumption among many real estate agents and apartment managers was as people had to abandon their homes, they’d still need places to live. Ergo, not only did apartment prices stay stable, but in some markets, they went up. The bad news for these greedheads is that the folks mailing in their keys and walking away aren’t moving into brand new apartments. Either they’re moving in with friends (the house I rented ten years ago now has three families living in it, apparently with the blessings of the owner) or family, but they’re not moving into apartments. The high-end apts are expecting higher credit ratings, and the rest are still asking waaaaay too much for people who had to abandon everything and move out.

I drive from north orange county to Santa Ana every day and my question is if the rental market is so hot where the hell did everybody go?Nothing but vacant properties-rentals,empty houses etc..My brother lives in Dana Point and its no better.So no more articals in the Orange County Register about the hot rental market and speculords jacking up rents anymore.Its a ghost town out there.

No smart investor will touch this until it is below $200k.

I agree. Built in 1974, and only 1,150 sqr ft? Is the 3rd bathroom a toilet in a closet??

This old piece of crap should bottom out at $195k.

You are too nice. I say $100k.

I know you’re exaggerating to make a point, but there is nothing in Irvine that even approaches ‘ghetto.’ It just smacks of that the ‘everybody deserves to be rich’ mentality that landed our entire society in this mess in the first place.

Walnut and Jeffrey…. that’s an “Irvine Ghetto”.

I do agree, if you want to talk about the worst section of Irvine, that area is a top candidate 🙂

“Ghetto” ? I would not use that word for that area at all. That area still has good schools, safety..etc. And Jeffrey Road is being improved, will look a lot nicer. IMHO, the Orangetree area is the least “prestigeous”.

Proper you should mistype “prestigious”…. That place is everything but prestigious.

Dang it, you can smell the chinese restaurants from the Santa Ana Fwy as you go by… and the parking lot SW of Jeffrey and Walnut is always packed with people waiting to eat at Taiko because it’s cheap.

Yeah, they may have Lexus and what not but I avoid the place like crazy. We’ve been almost run into several times.

And now I ignore the place, particularly when they ran out my favorite cheap mexican restaurant in Irvine: El Conejo. The place had been there forever, with good hot salsa and cheap beer. Now, it just another pseudo asian hole in the wall… (Thai Cafe, owned by Persians) 😛

[url]http://irvineretail.freedomblogging.com/2008/01/17/el-conejo-closes-down-spot-will-become-thai-cafe/[/url]

I don’t know that the parking lot is always packed due to Taiko. Certainly it’s a contributor, but there are a lot of great and unique Asian businesses in that center that are popular (e.g. Yogurtland, which is certainly not cheap), and not enough parking to go around.

I will admit that the frequency of bad driving skills seen in that parking lot reinforces a stereotype about Asians (I’ve never had a problem at the Asian center across the street with 99 Ranch, etc., though).

I feel your pain with regards to losing a favorite restaurant, but personally I thought El Conejo was only so-so, and I stopped going there several years ago after they (I’m pretty sure) gave me some bad food poisoning. At least there are branches in other cities, if you care to drive there (I know, not too useful if you were going there primarily because it was cheap).

Per your article, the new Thai place is owned by Indonesians, not Persians. At least closer to the right part of the world. 😉

My 2 cents on parking in an Asian plaza, don’t go between the hours of 11:00AM and 3:00PM. Any Asian plaza you go to during this time will be a zoo, Asians love their food and will run your ass over for it.

For what its worth, this condo is not part of Woodbridge. I believe Deerfield is a separate village of Irvine (Refind calls it El Camino Real, actually) that doesn’t have access to the Woodbridge pools, lagoons, etc. So if the dues are really $355 per month this is crazy…

While the irresponsible lending and borrowing were the basis of the current mess, the ability for Wall Street to package up these loans and play all kinds of financial shenanigans has amplified the problem thirty-fold.

What is truly frightening is that the loss of 100-500K we see on these properties is only a fraction of the overall loss, as these nearly worthless loans were packaged, sold, re-sold, and used as collateral for more borrowing, much of this insured against losses by AIG with no reserve to back them up, and on and on, enriching a few people who are now hiding out on their own private islands.

“AIG posts $61.7B 4Q loss, bailout is restructured”

Yeah, talk about the smartest guys in the room – how about Martin J. Sullivan, the CEO that left AIG in July with a 47 million dollar severance.

This guy must think to himself, “what a bunch of idiots!”, as he sees news of the world’s economies collapsing.

I wish I could be the smartest guy in the room for once.

Updated chart through year end 2008.

“Somewhere around $232,000 is a reasonable bottoming figure, perhaps a bit higher if interest rates remain artificially low. Just think, the peak appraised value for this property was around $450,000…”

This is pretty good mathematics; But would one say that economic conditions were better in 1998 than 2009? Should there be a price hit for that? IMHO, the job insecurity and sentiment that exist today is significantly worse than in 1998.

I think that you make a good point about credit expansion, that can be easily demonstrated at home with a credit card. Put $500 on that credit card in a month, and it is an apparant income gain in one month. But the debt sticks around for a while. Put on a macro level, you can see how this thing is not sustainable. Credit expansion has built our economy over and over again in good times, but it a one time boost that does not last very long, and we pay for it for a long, long time.

In the paper this weekend I noticed more rental ads–one a 5 bedroom in Tustin renting for $2700 another in Santa Ana renting for $2400 but it would be happy to take in two families. Rents are coming down a few others in Northpark for $2400 (three bedrooms).

Excellent post

I was just thinking about this over the weekend, if we could come out with firm rules based on income and down payments, the market would come out of severe denial into cold hard reality 😆

we then could reassess the damage and move on. In most parts of the OC, whild lending standards are tighter than 2 years ago, still some sellers live in WTF territory. if every one knew the new lending rules that would help the housing market readjust much quicker.

The Gov should hire IR (and other bloggers who have been the closest in analysis to reality so far such as Mish, CR and others ) as a consultant ASAP instead of all the so called economists they have.

Just my 2 cents.

This is a worthwhile read. It validates a lot of what I have read here.

http://economistsview.typepad.com/timduy/2009/03/when-does-faith-in-financial-engineering-wane.html

Jeff

super blog thanks Jeff–

Piggington rate of change in price yoy recent post suggests that we may have just passed the halfway down mark with a “bottom” in Jan 2010. But I am with the wise poster above who suggested that 2010 may not be as rosy as all that, and the declines go on well beyond. $180? especially if you enforce the 20% down rule. This apartment is for people with no down payment 60 month auto payments.

I have been looking at buying a home and still find most Irvine homes are holding around the 700-800k price mark. I feel they will fall, like everyone on this blog. Since most of us here are probably renting, I was wondering if renters have taken the plunge or waiting another year.

We will probably rent for another year and are wondering have rents come down? I feel they have and our lease is up in April.

Anyone have their rents drop? some examples would be great as we negotiate with our landlord.

We have a standalone house, brand new when we rented. 4 br. 3 bath, 2100 sf. $2,900 / month.

We decided to rent a house 3 months ago and used our good credit rating to get 10% less than the going rate of $2500 on a 1600 sq ft. house. Even though we thought we got a good deal we are considering offering less next year. We’ll see.

Our rental is around a bit over 2k sqft. 3 bedroom 2.5 bath with loft (made into room) 3k a month but it has a very large pool. But the house is old has tile first floor and in master. Has some decent upgrades. Large yard. fyi

IR,

Some observations on your implied assumptions:

1. “This is not just.” Were you expecting otherwise? And

2. House appreciation at 4%. Houses depreciate due to wear and tear. Land can appreciate.

Your doing a great service in educating people in making an informed decision on housing.

IMHO, the cost of the condo at ~$2000 per month with taxes, HOA, repairs, etc. And about $1500 or less as possible rent for an old place. An aligator with greater than $500 per month feeding expense. Price needs to significantly come down as an investment. Plus on the place is straight stucco that’s easy to maintain.

You are sounding rather Big Brother-esque in your prose above, IR.

“We can require high down payments…. We can limit the debt-to-income ratios of borrowers” etc.

The problem with going down that slope is that it is slippery, and steep.

Busts are the unfortunate ugly parts of capitalism, but they are not as ugly as statism.

Governments that grow, and almost all do… inevitably hobble the invisible hands of capitalism over time. Some regulations are necessary, but do you want gov pencil pushers deciding whether you will get your business loan in the future? Do you want members of congress telling you how to run your business, what car to drive, nay what products to build (cars for example)?

The banks have learned their lesson. Regulating them now on financing guidelines makes about as much sense as screening for shoe-bombs at airports. The gov obviously hasn’t, as they are putting forth a plan to do the same kind of neg-am home finance that contributed to this mess.

Part of the problem was certainly Fannie an Freddie, TBTF, leveraged to the hilt, encouraging and backing reckless lending.

As for Alan G – why is it debatable that he was a great central banker?

Is it debatable that GW Bush was a great President?

I should add that I fully share the frustration of the moral hazard we are being inflicted with by the last and new administration. This hazard won’t directly encourage the ‘exact’ same behaviour on the part of banks, borrowers and hedge funds, but it does send a message of non-responsibility/accountability, and it thrusts a horrific debt and tax burden on us, and future generations. The honest, responsible, and careful pay a steep price.

Perhaps they should not have been loaned more money than they could pay back…

Perhaps they should have housing ATMed out all the equity for bling-bling, then held out (using all the legal tricks to delay foreclosure) for the Gummint Gravy Train.

Because the REAL top of the food chain is The Parasite.

“Here comes Santa Claus,

Here comes Santa Claus,

Right down Bailout Lane;

Fannie Mae & Freddy Mac

A-pullin’ on the reins;

Gummint Gravy pouring in,

All is Happy and Bright!

Dream of condos to flip flip flip

‘Cause Santa Claus Comes Tonight!”