Housing market instability is rooted in people's ability to raid their home equity and spend it. Curtail mortgage equity withdrawal, and home prices stabilize.

Irvine Home Address … 28 VALLEY Vw 22 Irvine, CA 92612

Resale Home Price …… $689,000

You know I'm in demand

You see I'm in demand

You need me in demand

Texas — In Demand

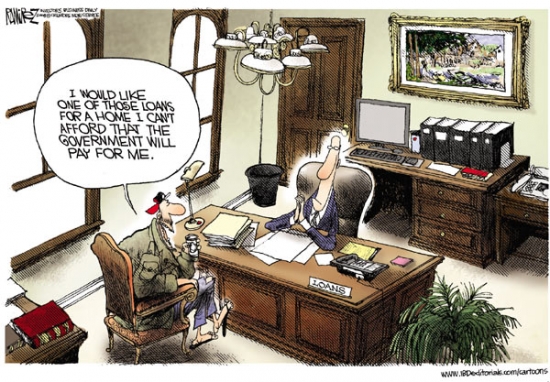

Lenders enabled the housing bubble, but people needed a reason to provide the demand to pay stupid prices to inflate a housing bubble. As I documented, the Desire for Mortgage Equity Withdrawal Inflated the Housing Bubble.

In order for home price appreciation to motivate people to pay stupid prices and inflate housing bubbles, they need a way to access this appreciation. The more immediate and plentiful this access to money, the more motivated buyers are to borrow and cash out. Mortgage equity withdrawal is the doorway to appreciation; it makes houses very desirable and very valuable.

Texas shows the way

To test this premise, we need to find a market with limited access to mortgage equity withdrawal and compare the home prices there to a market like California's where there are no restrictions at all. There is such a place: Texas.

I know Texas. I spent two and one-half years living in College Station studying real estate. Texas, along with California, was a big player in the Savings and Loan disaster. They inflated a commercial real estate bubble of epic standards, and even its residential real estate was volatile during that period. Texans are certainly not immune to the temptation to take free money from lenders. However, the delivery mechanism of the Savings and Loan disaster was through commercial lending whereas the delivery mechanism during the Great Housing Bubble was residential lending. Texas has different laws governing residential lending, and these laws prevented a housing bubble there.

I go on to discuss an article by Alyssa Katz, The Lone Star Secret. In the article, she discusses the situation in Texas:

A cash-out refinance is a mortgage taken out for a higher balance than the one on an existing loan, net of fees. Across the nation, cash-outs became ubiquitous during the mortgage boom, as skyrocketing house prices made it possible for homeowners, even those with bad credit, to use their home equity like an ATM. But not in Texas. There, cash-outs and home-equity loans can’t total more than 80 percent of a home’s appraised value. There’s a 12-day cooling-off period after an application, during which the borrower can pull out. And when a borrower refinances a mortgage, it’s illegal to get even $1 back. Texas really means it: All these protections, and more, are in the state constitution. The Texas restrictions on mortgage borrowing date back to the first days of statehood in 1845, when the constitution banned home loans entirely.

“Delinquency and foreclosure rates are significantly lower in Texas,” boasts Scott Norman, the president of the Texas Mortgage Bankers Association. “The 80 percent loan-to-value limit—that’s the catalyst for a lot of this.”

That's were the lockbox comes in. If a house is supposed to represent financial security, it should be a place of money storage, not an endless ATM machine spitting out spending money. The Texas experience shows that if you deny people access to this money, the housing market is more stable, and everyone has tangible ownership in their property with real equity. That is the real American dream.

Regulators Push 20% Down Payments on Homes

By VICTORIA MCGRANE And NICK TIMIRAOS — MARCH 2, 2011

Banking regulators are pushing for mortgage-lending rules that require homeowners to make minimum 20% down payments on loans classified as lower-risk, according to people familiar with the matter.

The proposal is being floated as a way to rewrite the rules for mortgage lending to prevent a rerun of the housing bubble and financial crisis that resulted from years of easy credit. The Dodd-Frank financial overhaul law enacted last year enabled regulators to define a so-called gold-standard residential mortgage that would be exempt from costly new rules.

At least three agencies—the Federal Reserve, the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency—back a proposal to require home buyers to put down at least 20% of the sales price in order to obtain one of these “qualified residential mortgages.” One proposal would also require borrowers to maintain a 75% loan-to-value ratio for refinances, and a 70% loan-to-value for cash-out refinances in which the borrower refinances into a larger loan, according to people familiar with the matter.

Those are great proposals. If lending is encouraged under those terms, I am all for it.

Mortgage-finance giants Fannie Mae and Freddie Mac would also be exempt from the rules while they remain in conservatorship, according to these people. The U.S. took over the firms in 2008, and the Obama administration has proposed eventually winding them down.

The behind-the-scenes debate over the proposal could have far-reaching implications for how Americans finance loans, because it addresses how much equity new borrowers should have in their homes.

The advantage of owning a home was the amortizing mortgage was a forced savings account, and inflation provided some additional return. Once we gave unfettered access to home equity, these features of home ownership no longer applied. As many Ponzis have proven, even after more than 20 years of ownership, a loan owner can lose their home to foreclosure.

It is unclear whether the proposal will garner support among other regulators and be acceptable to the White House and Congress. Altogether, six federal agencies—the three supporting the proposal plus the Department of Housing and Urban Development, the Federal Housing Finance Agency and the Securities and Exchange Commission—must sign off on the proposal before it is released for public comment. It could not be determined Tuesday whether all the agencies would support the 20% down-payment standard.

At a congressional hearing Tuesday, HUD Secretary Shaun Donovan said no deal has been reached yet, and that any plan could instead spell out options.

At a separate hearing Tuesday, Treasury Secretary Timothy Geithner said, “We've got to be careful that we get it right.” He added, “I'm not sure how much longer it's going to take, but it's going to take a bit longer than we initially expected.”

Meanwhile, some lawmakers expressed concerns that the new rules might make it too hard for homeowners to qualify for less risky, and less costly, loans.

In other words, we are worried that if risk is properly priced, people who are not qualified for home ownership may not be given a loan on which they will likely default.

Sen. Kay Hagan (D., N.C.) told Federal Reserve Chairman Ben Bernanke that several lawmakers “are really concerned about not making it so restrictive that we can't have as many well-qualified loans as possible.”

The proposal was crafted in response to a provision in Dodd-Frank that aimed to improve mortgage-lending standards. Loans that don't meet the standards for “qualified residential mortgages” and are sold to investors as securities will be subject to a “risk retention” rule, which could raise borrowing costs for homeowners.

The risk-retention rule requires banks to keep 5% of the value of all mortgages they securitize on their books. During the housing boom, many lenders passed on all of their mortgages, and all of the risk, to investors. It was designed to force lenders to have “skin in the game” when selling groups of mortgages packaged as securities.

Critics of the risk-retention rule said it could raise costs for traditionally safer lending products such as long-term, fixed-rate loans with full income documentation. A coalition of consumer advocacy groups and the real-estate industry have warned that defining the rule too narrowly could raise borrowing costs for millions of creditworthy borrowers.

Regulators must issue a rule defining “qualified residential mortgages” by April, and had initially planned to publish a draft proposal late last year. But the process has been delayed by a disagreement about whether to include in the rule national standards for loan servicers, such as how to modify loans for troubled borrowers. The new proposal reflects a compromise among the regulators to include some standards for how and when banks modify loans.

Write to Nick Timiraos at nick.timiraos@wsj.com

If the housing market returns to 20% down except for FHA or VA buyers subject to strict underwriting guidelines, the housing market would enjoy relative stability. Perhaps you can't roll back the clock to the 1960s, but removing mortgage equity withdrawal from the equation would return houses to their basic function of providing shelter, and we could go back to less expensive housing for everyone.

If they're giving away free money….

So many people took their equity and spent it just because they could. If you believe house prices are going up forever, why not? It really is free money. Unfortunately, like most things in life that sound too good to be true, the money isn't really free. It's debt.

The owner of today's featured property paid $600,000 for this condo glorified apartment back on 2/20/2003. At the time they used a $480,000 first mortgage and a $120,000 down payment.

On 4/14/2006 he refinanced with a $617,500 first mortgage and withdrew his down payment and an additional $17,500.

That last refinance is exactly the kind of transaction I believe should simply be prohibited.

If this guy had not borrowed and spent his home, (1) he would likely still be making payments on the $480,000 mortgage, (2) this house wouldn't be for sale, and (3) neither would the millions like it where the borrowers are underwater due to their reckless mortgage equity withdrawal.

Foreclosure Record

Recording Date: 04/07/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 09/04/2009

Document Type: Notice of Default

Texas's real estate market did not bubble, and although there has been some weakness due to the economy, their housing market held up well because they didn't have the cash out refinancing like we did here in California.

Irvine Home Address … 28 VALLEY Vw 22 Irvine, CA 92612 ![]()

Resale Home Price … $689,000

Home Purchase Price … $600,000

Home Purchase Date …. 2/20/03

Net Gain (Loss) ………. $47,660

Percent Change ………. 7.9%

Annual Appreciation … 1.7%

Cost of Ownership

————————————————-

$689,000 ………. Asking Price

$137,800 ………. 20% Down Conventional

4.25% …………… Mortgage Interest Rate

$551,200 ………. 30-Year Mortgage

$130,737 ………. Income Requirement

$2,712 ………. Monthly Mortgage Payment

$597 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$115 ………. Homeowners Insurance

$450 ………. Homeowners Association Fees

============================================

$3,874 ………. Monthly Cash Outlays

-$446 ………. Tax Savings (% of Interest and Property Tax)

-$759 ………. Equity Hidden in Payment

$211 ………. Lost Income to Down Payment (net of taxes)

$86 ………. Maintenance and Replacement Reserves

============================================

$2,965 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,890 ………. Furnishing and Move In @1%

$6,890 ………. Closing Costs @1%

$5,512 ………… Interest Points @1% of Loan

$137,800 ………. Down Payment

============================================

$157,092 ………. Total Cash Costs

$45,400 ………… Emergency Cash Reserves

============================================

$202,492 ………. Total Savings Needed

Property Details for 28 VALLEY Vw 22 Irvine, CA 92612

——————————————————————————

Beds: 4

Baths: 3

Sq. Ft.: 3022

$228/SF

Lot Size: –

Property Type: Residential, Condominium

Style: 3+ Levels, Other

View: City Lights, City, Hills, Mountain, Park/Green Belt, Tree Top, Trees/Woods, Yes

Year Built: 1978

Community: Turtle Rock

County: Orange

MLS#: S625023

Source: SoCalMLS

Status: Active

——————————————————————————

MAJOR PRICE REDUCTION. THOUSANDS BELOW APPRAISED VALUE. This turtle Rock home is highly upgraded and remodeled throughout. Including high-end Hardwood floors, wooden staircase railings, Wood floors in the kitchen, tile counter tops, and see-through glass kitchen cabinets. Master Bedroom has a walk-in closet and a large balcony with a view of the city. get a beautiful city lights view along with the Disneyland fireworks, on clear nights. French Doors lead to the living room balcony and Patio. The Patio is a Green Paradise with Custom Tile flooring and enclosed by Glass and an outdoor Firepit so you can enjoy the peace and quiet except for the sound of the birds and rustling trees. Two of the smaller bedrooms have been turned into one large bedroom. The storage in the garage has been turned into a Relaxation/Meditation room. This Quality in the upgrades of this home truly excels over your typical Turtle Rock Vista home. quick escrow needed approved short sale. this is a DEAL. don't miss it

TX real estate has had busts before, in residential as well as commercial, but yes, this bust is not nearly as bad in TX as other places. Mostly their past busts were tied to oil & thus to incomes, which is somewhat inevitable. Banning cash-out refinances would probably do as much as the dp requirements. In FL, it was common for people to cash-out their primary home, buy one or two more, refi them in a year and lever up even more. You had realtors with sub-100k incomes ‘owning’ four or 5 500k-1M properties, 90-100% mortgaged. 100k in total income will never cover 2.5M in mortgage payments.

“You had realtors with sub-100k incomes ‘owning’ four or 5 500k-1M properties, 90-100% mortgaged. 100k in total income will never cover 2.5M in mortgage payments.”

You just described Ladera Ranch. Many realtors in South County bought speculative flips there, and now most of them are going into foreclosure.

Winstongator also describes “The OC Housewives.”

I know not of this ‘OC Housewife’ you speak of 🙂

I was referring to records I’ve seen in South Florida. While its climate is wetter than the OC, its bipedal fauna share many of the same characteristics.

You had high income people doing this too as an investment, but they have not been put through the foreclosure grinder as they could make up the difference needed at closing in many cases.

If a bank is stupid enough to give someone a cash-out refi, then who ‘s to say it’s wrong? Just don’t let the Gub’ment bailout the lender when things go wrong! Just say “NO” to corporate welfare!

If a bank is stupid

They are not stupid. They know exactly what they are doing.

Off topic – I know. Did you hear about the lay-off notices of City of Costa Mesa? People keep talking about recovery…but it don’t look so good.

About the Costa Mesa layoffs, yeah way to go government employee associations, that’s what happens when $15 million in pension debt explodes like the Death Star in Star Wars to $25 million (166%!!!) in just 5 years time.

Costa Mesa police officers and firemen make up the biggest portion of this pension burden, but they’re not getting fired.

Oh well, these sweet pension deals sure seemed like such a *wink* “swell” idea at the time!

The argument seems to be that everyone, including private sector workers, should be able to negotiate with the same power for the same benefit deals.

I don’t understand what they’re smoking or how this can be possible. It’s typical though of state, municipal and federal employees. They’re in a special club with exclusive treaties and where greater economic laws do not apply to them.

C’mon man. $82,000 a year salary plus $16K in pension benefits for an animal control officer?

Whatever.

Are you really celebrating 200 people losing their jobs?

I think he is celebrating Alan Mansoor, the republican mayor who approved the labor agreements for the city for in past years, and who is now in sacramento proposing ‘pension reform’

And thereby celebrating 200 newly unemployed.

He must be one of those people that enjoys hearing the sound of a bug zapper……

Actually, I am celebrating.

But it’s not the loss of 200 people’s jobs, since I don’t consider welfare for 200 parasites to be the same thing as 200 revenue-generating, productive members of society.

Public employees can look for work in the private sector like anybody else can. The USA was built on mobility of labor … why should it be any different for them?

Ask any of our trade competitors if they want to support our public pensions or entitlements.

There were only 2 choices:

1) spend a quarter of the city budget to pay all pensions but cut personnel and public services

2) don’t pay pensions but continue to provide services

The city selected the first one.

The pricing history on this listing is completely ridiculous.

Shaved off 9K any takers?

No

Shave off another 5K

Still no takers?

If you knock off $10,000 every week, it can work.

The Texas law is further proof that YOUR home is ONLY worth what a bank is willing (or governed by law) to loan a 1st party (refi) or 2nd party (sell) to borrow. Can you even imagine how the Ca REIC would react if a similar law were proposed in this state.

In Texas they spend a lot less of their income for housing (mortgage & rents), therefore freeing up more disposable income for activities. These people have boats and go to the lake on weekends.

I’m surprised. Yesterday, IR (almost) called the bottom for 2011 – Is this condo at >600k$ any close 😉

It does meet the 300$ or less /sqft and it is in TR !

And by the way, I’m still surprise that any house in Irvine with >350$/sqft is at rental parity.

Yes! Totally at bottom! Don’t you want to spend half your income to live in this apartment?! At least the children get to go to a good school that is no more the better than it was in 1998.

It’s all about how you define “rental parity”. There are ways of calculating it such that most Irvine homes currently fit the definition. Of course if you had applied these calculations any time before the housing bubble you would have found that nearly every home in Irvine was selling way below rental parity. There’s no end to how much certain people will move the goalposts to justify higher prices.

There was a hell of a bubble in Austin also.

Look at some listings and then check out the purchase prices from the mid 90’s on Zillow.

I was going to say the same thing.

Compare irvine to the prime neighborhoods of Austin.

Your lumping TX as one? CA has more Riverside’s,

Fresnos, bakersfields etc than it has Irvines.

Irvine motto contest

http://www.ocregister.com/news/motto-290585-city-irvine.html

I rated like Gemfinder’s comment:

“Irvine. Where my violin-playing nerd grows up to be your kid’s boss.”

Hilarious that’s better than what I could come up with.

The kid boss viloin player is dead on

Email from a reader:

Today’s post needed two additional sections.

First, would be something that is the underlying problem of this housing downturn that no one wants to address. And that is the PRICE of housing.

Frank-Dodd is necessary. Some parts of it (in my opinion) do not go far enough. Specifically, all securities brokers should be subject to “fidicuary status”. All real estate agents are. Stock brokers often deal with more valuable assets than real estate agents do. Have you seen the TV commercial about the guy complaining that his broker “just wanted to sell him stuff”….very true, and very sad. GREED personified.

Back to Frank-Dodd…..20% down is purdent, reasonable. Texas proves that (mostly). And historically, that was good banking policy. It worked. We’ve always had some banks (World Savings, Home Savings, Lincoln Savings, a few others) who would make up their own rules for lending criteria, but they had to keep those loans in their portfolio, and even that portfolio had to be balanced against bank assets.

The changes that began to happen in the 1980’s changed everything. Particularly land prices. Land prices made billionaires out of many who had land holdings. As lending loosened up, more potential buyers could buy homes formerly out of their reach because of their INCOME. The old relationship of payment to income vanished.

Now, the lending institutions are reluctant to incur the losses resulting from those changes and are doing everything they can to sustain prices, especially in areas where there are a lot of delinquent loans. Hoping to fend off dramatic price drops, they are willing to absorb (accounting magic) loss by non-performing loans, rather than bring the property to foreclosure.

This, in turn, encourages land owners…such as TIC….to still think their land is worth 2004 land values, which were part of the inflated bubble. It all starts with the land. The sticks & bricks cost doesn’t vary that much, nor does labor.

The Second aspect is….a paradigm shift in the reason people buy houses. It used to be they bought because of a desire to own a home, establish a home base for all members of a family. In the 1970’s a new notion took root. That was that a home represented a form of wealth, not unlike stock market speculation, that while providing for basic family needs of shelter, would also contribute to overall net wealth. The whole “Planned Community” concept offered just that….from Reston, VA to Irvine, CA and Mission Viejo, CA….housing was planned and marketed expressly to those looking to begin in a starter home, move-up to a larger home, all the while remaining in the same community. We now have 2 generations of children who, having grown up in this environment, have a feeling of ‘entitlement’ to the “California Promise”.