Society is predictably changing its views and attitudes toward strategic default.

Irvine Home Address … 20 WOODS Trl Irvine, CA 92603

Resale Home Price …… $2,059,000

Yes

this is the year

To make your decision.

Yes

this is the year

To open up your mind.

If you've been holding back kind of slack

Now's the time to get the things you need.

There ain't no reason why you should be shy

The Three Degrees — Year of Decision

Anyone who is underwater on their mortgage and struggling with payments is considering strategic default. Many of these people will succumb to mortgage distress whether or not they chose the timing of their default. They are debt zombies. Many others who are underwater and struggling could survive the real estate recession and divert significant family money toward excessive loan payments, but they see the advantages of a lower housing cost, so many of them are choosing to strategically default because it is in their best interest financially to do so.

Many of those who chose not to strategically default make this choice because they believe making the payment is a moral obligation — an obligation above and beyond what is written in the contract. Banks are relying on those borrowers motivated by their perceived morality to keep making payments. Unfortunately, there is no longer a moral stigma associated with strategic default (accelerated default is a more accurate term).

Banks need a moral stigma to be associated with loan repayment. If the transaction were viewed by borrowers as a simple business transaction — which it is — then issues of morality are not effective at cajoling debtors into repayment, particularly when default is in the best interest of the debtor. Banks have long relied on borrower morality to get repaid.

Banks need a moral stigma to be associated with loan repayment. If the transaction were viewed by borrowers as a simple business transaction — which it is — then issues of morality are not effective at cajoling debtors into repayment, particularly when default is in the best interest of the debtor. Banks have long relied on borrower morality to get repaid.

Due to the events of the Great Housing Bubble, borrowers no longer feel a moral obligation to repay their mortgage debts. Borrowers view the system as corrupt. Many borrowers believe greedy lenders inflated prices with oversized loans to pad their own profit margins. Those borrowers are correct in their views and beliefs, and based on that view, many borrowers no longer feel compelled by morality to repay their mortgage debt.

More see walking on mortgage as a viable plan

'Strategic default' losing stigma as homes go deeper underwater

By Jane Hodges

msnbc.com contributor msnbc.com contributor

updated 12/20/2010 12:11:34 PM ET

More Americans than ever are showing a willingness to walk away from their underwater homes, according to a recent survey. Chris Kelly is a perfect example of someone who never thought she would send the bank “jingle mail” — mailing the keys back. But she did.

Until last year Kelly, a 46-year-old administrative assistant, was living in a 3,000-square-foot home she owned with her ex-husband in the Seattle suburbs.

The duo had put the three-bedroom, three-and-a-half bath home on the market before finalizing their divorce in the spring of 2009 but had no luck luring move-up buyers to the $600,000 home even after price markdowns.

Kelly wound up living there solo, struggling to make the mortgage payments. But as she kept writing checks, and worrying, she became aware that she’d have to make a hard choice: Leave the house while she still had decent savings, or pay until she’d emptied out all her accounts and then enter foreclosure.

In the latter scenario, she’d have to look for a lease with no money left for a deposit. Either way, she’d lose the home, whose value had dropped underwater — below what the couple owed on it.

I know people who have wiped out their personal and retirement savings because they were unable to get themselves to default while they still had the ability to pay. It's like the slot machine gambler that refuses to get up until every last dollar has been lost. The decision to default gets forced upon them when they can no longer raid savings or Ponzi borrow to make payments. Decision by indecision is very painful in cases where accelerated default would have proven beneficial.

“It was a pretty clear decision,” says Kelly, who now lives in Austin, Texas. “I knew I had to walk away. The longer I stayed there, the worse my credit would be and the harder time I’d have finding a rental.”

So a year ago she walked way, joining the growing number of Americans willing to turn their backs on homes they can neither sell nor afford to keep. The real estate industry calls this “strategic default,” referring to people who choose to walk away even when they can technically afford to continue paying their mortgage.

Lenders would certainly prefer all borrowers to be dutiful on their way to the debtors gallows by draining every last drop of savings rather than considering options and making a “strategic” or considered decision.

Nearly half, 48 percent, of homeowners with a mortgage said they would consider walking away from their home if they owed more on it than it was worth, according to a Harris Interactive survey released this month. The survey was conducted in November for real estate listings site Trulia and foreclosure research firm RealtyTrac.

Just six months ago, a similar survey indicated that only 41 percent of consumers would consider walking if they were underwater on their mortgages.

Is a 7% movement in this statistic meaningful? I think it is. Who do you think this 7% who changed their minds are? Who else would be thinking about it? Those faced with the decision, of course. A certain amount of the stigma will fall away as people know “good people” including family, friends, and acquaintances that have elected to accelerate their defaults. The trend will be for this statistic to trend toward complete acceptance over the next several years.

“It’s a phenomenon we haven’t seen before in the housing market,” said Rick Sharga, senior vice president of RealtyTrac. “The mindset of why people purchase a home has changed over the past decade.”

In the early 2000s, as home prices rose sharply and steadily, many buyers saw their home as an investment. But in the wake of the housing bust, it's clear that a home has become far more of a “utility” — a form of shelter — than an investment.

Actually, only the public perception has changed. Houses have never been a good long-term speculative investment. The rate of appreciation only matches inflation, the carrying costs are high, the transaction costs are high, and the market is prone to bouts of illiquidity.  Given these circumstances, only during brief periods of upward volatility (sucker rallies) is it possible to reap major appreciation benefits from owning residential real estate. It has always been about utility of ownership, but people are only now detoxifying from the kool aid enough to see it.

Given these circumstances, only during brief periods of upward volatility (sucker rallies) is it possible to reap major appreciation benefits from owning residential real estate. It has always been about utility of ownership, but people are only now detoxifying from the kool aid enough to see it.

Over the next year, hundreds of thousands of homeowners will face the question of whether to walk away as their mortgage payments spike.

Sharga said that $300 billion worth of adjustable rate mortgages are expected to reset upward over the next 12 to 15 months, adding on average $1,000 to monthly mortgage payments on homes that already are worth 30 percent to 50 percent less than their original sale price.

Remember, it isn't the reset of the interest rate that is a problem because rates are still low, the real problem is the recasting of these loans from interest-only to fully amortizing. The recasts add significantly to the payment as Sharga suggested above.

Roughly 23.2 percent of all single-family homeowners who have a mortgage are underwater on their property, according to third-quarter data from Zillow. (Zillow estimates that 40 percent of single-family homes are owned, with the rest mortgaged.)

Major banks, including Bank of America and Wells Fargo, are preparing to work with these owners through modification programs that may include principal reduction or temporary interest-only loan payments until markets improve and refinancing is possible, Sharga says.

But clearly, many homeowners may have motivation to walk. They’ll see their mortgage payments spike at a time when their home value is underwater the deepest.

American homeowners lost $1.7 trillion in home value during 2010, a far higher loss of equity than the $1 trillion lost during 2009, according to Zillow data released earlier this month. Zillow also reported on a blog that less than one-fourth of the 129 metro areas it tracks showed home value gains in 2010.

In addition, the impacts to credit from a foreclosure are typically less damaging than those from a bankruptcy, which hits more lines of credit and loans than just the home loan. According to Barry Paperno, consumer operations manager at myFico.com, the consumer site for Minneapolis-based credit scoring company Fair Isaac Corp., a personal bankruptcy can shave 130 to 240 points off a person’s credit score, while a foreclosure typically reduces a score by 85 to 160 points. (FICO scores range from 350 to 850, with higher scores better.)

“It’s serious, and it certainly complicate future purchases,” Paperno says. “Compared to a bankruptcy, though, the score impact can be surprisingly different.”

The latest Harris survey also revealed some interesting gender differences in attitudes about strategic default: Men were nearly 50 percent more likely than women to consider walking away from an underwater loan, with 57 percent indicating willingness, vs. 40 percent of women.

That one surprises me. It may be interesting to see that broken down by who manages the money in the family. It's probably a higher percentage among those who face the realities of the bills than those that do not.

Pete Flint, CEO of Trulia, said that this may indicate men take a more investment-minded approach to homeownership and evaluate when to walk as a financial decision, while women may view their property as a home and have a harder time with the concept of leaving it even under fiscal duress.

Kelly embodies both approaches. She says she was torn about the decision, but couldn’t let sentiment overtake what, ultimately, was a move toward self-preservation.

“I never thought that this was something that would happen,” she says. “I loved that house.”

Is this about survival, or is this about entitlement? Ultimately, each borrower evaluates financial alternatives, determines the emotional toll to be paid, and finally makes a decision and acts on it. Some may consider that survival, but it is really the survival of entitlement. It is wise to squat in a nice home and avoid sending those resources to a lender, and it is wise to find a comparable rental for less than the former house payment. That's why borrowers quit paying and squat until finally moving into a rental. It's a trend we will see more of in 2011.

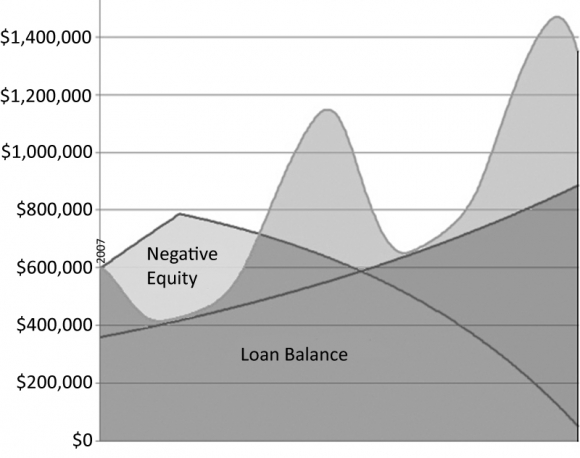

They didn't risk much of their money

Prior to the housing bubble, if you owned a $2,000,000 home, it meant you probably had more than a $1,000,000 in equity because very few borrowers tried to manage a note over $1,000,000. During the housing bubble, loans over $1,000,000 became common. Too common.

- Todays featured property was purchased for $1,987,500 on 9/30/2006, right at the peak. The owners used a $1,490,300 first mortgage, a $298,050 second mortgage, and a $199,150 down payment.

- Two months later on 12/6/2006 they opened a $250,000 HELOC and had immdieate access to their downpayment money plus another $50,850 in free money.

- On 3/6/2007 they refinanced with a $1,770,000 Option ARM with a 2% teaer rate and obtained a $150,000 HELOC.

- They quit paying a few months ago.

Foreclosure Record

Recording Date: 11/01/2010

Document Type: Notice of Default

Irvine Home Address … 20 WOODS Trl Irvine, CA 92603 ![]()

Resale Home Price … $2,059,000

Home Purchase Price … $1,987,500

Home Purchase Date …. 9/30/2006

Net Gain (Loss) ………. $(52,040)

Percent Change ………. -2.6%

Annual Appreciation … 0.8%

Cost of Ownership

————————————————-

$2,059,000 ………. Asking Price

$411,800 ………. 20% Down Conventional

5.07% …………… Mortgage Interest Rate

$1,647,200 ………. 30-Year Mortgage

$429,740 ………. Income Requirement

$8,913 ………. Monthly Mortgage Payment

$1784 ………. Property Tax

$433 ………. Special Taxes and Levies (Mello Roos)

$343 ………. Homeowners Insurance

$420 ………. Homeowners Association Fees

============================================

$11,894 ………. Monthly Cash Outlays

-$1683 ………. Tax Savings (% of Interest and Property Tax)

-$1954 ………. Equity Hidden in Payment

$817 ………. Lost Income to Down Payment (net of taxes)

$257 ………. Maintenance and Replacement Reserves

============================================

$9,332 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$20,590 ………. Furnishing and Move In @1%

$20,590 ………. Closing Costs @1%

$16,472 ………… Interest Points @1% of Loan

$411,800 ………. Down Payment

============================================

$469,452 ………. Total Cash Costs

$143,000 ………… Emergency Cash Reserves

============================================

$612,452 ………. Total Savings Needed

Property Details for 20 WOODS Trl Irvine, CA 92603

——————————————————————————

Beds: 5

Baths: 4 full 1 part baths

Home size: 3,800 sq ft

($542 / sq ft)

Lot Size: 10,236 sq ft

Year Built: 2006

Days on Market: 348

Listing Updated: 40519

MLS Number: S600723

Property Type: Single Family, Residential

Community: Turtle Ridge

Tract: Arez

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

This Luxury Built Pardee Home is situated at the end of the cul-de-sac Nestled alongside Nature. Step thru the Gated entryway to two sitting areas, Built-in BBQ features Granite top seating gather around the firepit or just enjoy the nearly 10,000 sq. ft. lot and upgraded hardscaping. 5 bedrooms & Bonus Room allow room for any family needs. Designer Mahogany cabinetry, Viking Professional Stainless Steel appliances, Blt-in desk, Baltic Brown Granite Counters Center island w/bar seating. Living/Family Room Fireplaces. Spacious Family Room with cozy breakfast nook. Laura Ashley Plantation Shutters throughout. Recessed Lighting, Wired for surrond sound or security. 3 car garage features Remoteless entry & Epoxy flooring. Master suite features elegant Master Bath with jacuzzi tub and dual shower fixtures. Upstairs laundry room. Upgraded carpeting and neutral decor makes it easy for this to be your new home, VERY CLEAN and hardly lived it.

This Luxury Built Pardee Home is situated at the end of the cul-de-sac Nestled alongside Nature. Step thru the Gated entryway to two sitting areas, Built-in BBQ features Granite top seating gather around the firepit or just enjoy the nearly 10,000 sq. ft. lot and upgraded hardscaping. 5 bedrooms & Bonus Room allow room for any family needs. Designer Mahogany cabinetry, Viking Professional Stainless Steel appliances, Blt-in desk, Baltic Brown Granite Counters Center island w/bar seating. Living/Family Room Fireplaces. Spacious Family Room with cozy breakfast nook. Laura Ashley Plantation Shutters throughout. Recessed Lighting, Wired for surrond sound or security. 3 car garage features Remoteless entry & Epoxy flooring. Master suite features elegant Master Bath with jacuzzi tub and dual shower fixtures. Upstairs laundry room. Upgraded carpeting and neutral decor makes it easy for this to be your new home, VERY CLEAN and hardly lived it.

Women tend to be less willing than men to cut losses in every area of life, including personal relationships as well as business situations. It really doesn’t have anything to do with who is financially responsible. Maybe it just comes with being the one with the most responsibility for the kids- you don’t shirk your responsibility for your children just because you no longer have the means you had when you decided to give birth to them, and women are less likely to default on their parental obligations (even though some do), no matter how poor and unable to meet those obligations they are.

I have a couple female friends, single women with the sole responsibility for their own support and financial well-being, who are fairly well buried in their condo mortgages, but they would not consider defaulting because they have put money and love into their places, and they don’t want to take the loss of the money they spent on the down payment and renovations. Sure, they MIGHT be able to buy comparable places back at prices far enough below their original purchase prices that they would more than offset what they lost in their down payments, but that is not the main thing, in their eyes. They bought to have permanent homes they could make their own and they bought well within their means.It might make a certain amount of business sense to default, but it would be very damaging to their credit at a stage in life where it is difficult to make up large losses, and they are also afraid that credit will be much tighter when things bottom out at last, and they will be unable to obtain one of the many bargains that will be available because of blighted credit.

And I wouldn’t walk, either, as long as I had the ability to pay. I only contemplated buying because I wanted to have a permanent claim on a place I really liked and to be able to make improvements without having the place sold from underneath me, and to beat inflation.

“who are fairly well buried in their condo mortgages, but they would not consider defaulting because they have put money and love into their places”

such is the problem of using emotions to make financial decisions. i’ve gotta hand it to them for having the guts to hang on.

Guts is one word for it…

Obama administration is proposing to relax the damage done to credit after a foreclosure. If that was the case those who were afraid before would be willing to default. This is basically a once in a lifetime opportunity to get free money and free living.

Remember, there isn’t any check box that says that you’re ‘morally obligated’ to pay back this loan. BTW, banks default all the time. Just search for ‘Mortgage Bankers Association “Walks Away” from HQ’

Geeze, if they are doing it why shouldn’t I?

I hate to derail this conversation into misogyny but I have to agree. If a women becomes ’emotionally’ invested in a house – she’s never leaving. Yes, men like their houses too – but it doesn’t seem to be at the same level of attachment.

Have you ever heard a man say “But this is where I raised my babies!” or “It’s perfect. I just fell in love with it.”

I asked my wife if she ever ‘fell in love’ with a stock in her 401k and she looked at me like I was an idiot.

As one who has been in the securities industry and worked for FINRA-member firms for over 20 years, first as a broker and then as a compliance examiner, I can attest to the emotionality and irrationality of mostly male stock investors… which is why most people lose their asses in the stock markets.

YES, people get emotionally attached to stocks for reasons that have nothing to do with the intrinsic value or growth and income potential of the issue involved. I got used to hearing old guys say stuff like, “I like IBM” back when it was rapidly dropping off the cliff and went clear down to $50 a share, or “I like ‘motors”, meaning GM. I’d say, you LIKE a company that has dropped nearly 50% and is bleeding money out of every pore while its market share evaporates? People tend to have a preference for companies located in their home towns- in Chicago, for example, you find a huge number of people owning a woofer like Tribune Company, just because it is known and familiar. Oftentimes they buy a stock because they like the company’s products, which is a really good way to lose money. I have watched dozens of investors cling to options that are on their way to expiring worthless and to companies that can barely afford their office space, usually because the investor just can’t stand to take a loss, or has some emotional attachment to the company because his dad worked there, or he has always driven a Caddy, or some such other absurd reason that has nothing to do with how much financial gain he was realizing from the piece of garbage.

At least you can live in the house, and if you have shoveled $50K into a down payment and another $50K into improvements, and the payments are no problem, then you just might want to hang around, given the damage a foreclosure will do to your credit rating and the difficulty in getting financed for a “bargain” priced property after you’ve defaulted.

Another good, rational reason to hang around and just tough it out is that here in Illinois, like a number of other states, you are on the hook for a deficiency. If your place sells for, say, $90K less than the face amount of the mortgage, you are liable for that amount of money. Add that to your 20% downpayment, and you are looking at a very serious hit.

And even in states where there is no recourse, there just might be tax consequences for defaults or short sales.

All in all, you might be better off just paying and staying, especially if you bought to have a home for life, which is the only reason to buy a house to begin with. If all you bought for was to “make money”, than maybe you are better off sticking with stuff that can be liquidated with a mouse click.

True that!

It’s human nature to associate the ‘familiar’ with the ‘safe’.

Time and again I hear from friends, co-workers etc. that they are now investing only in Bonds because they’re ‘safe’. When I ask how much money they stand to lose if interest rates go up the typically (8 out of 10) is stunned silence. My favorite response was once “You don’t understand, bonds don’t lose unless the company goes bankrupt…” This coming from someone who never even heard of (muck less calculate) NPV, FV, IRR or a bond yield.

However, they just knew that their freshly purchased Bond ETF was guaranteed to go up.

Human psychology! How do you ever work around that most human of weaknesses.

Those concerns don’t exist here in CA for the most part as our foreclosures are primarily non-judicial with no recourse and recourse is unavailable on any purchase money mortgages.

Also, nationally, the federal income tax consequences of debt forgiveness have been eliminated for debt discharged before 1/1/2013. CA’s FTB has copied this treatment for state income tax here.

Too bad most of the mortgages out there are no longer “purchase money”.

Not to mention that as soon as they take the horse & carrot loan mod the “no recourse” provision is “out the window”

It is not clear that this is the case in CA.

A loan mod is not a refi, it is merely a change in the terms of the existing non-recourse loan.

A refi theoretically turns the loan into a recourse loan. However, I believe either through legislative action or case law, refis of purchase money loans may end up also being non-recourse up to the outstanding purchase money loan balance.

Fear-mongerer with ties to the real estate industry will get you act against your own self-interest.

Someone is afraid to walk, and wants us to be afraid too.

I am no longer afraid because I have been through ALL of this and I am speaking from experience.

Buying a home “for life” is not the only reason to buy a home.

True, we buy homes to live in, but also as an investment, since one of the main aruguments for buying over renting which is generally cheaper, is that the forced savings that comes with purchasing offsets moneys saved by renting.

We expect to see that savings in price appreciation, and when we experience tremendous price drops in property value we get upset because we not only feel poorer, but we also experience buyer’s remorse because a neighbor may have bought his house for much less.

Take me. I paid 300k. My neighbor one block over bought his foreclosure for 40K. He fixed it up and has no mortgage. He is outside barbequeing and lauging with his family. Now me and my wife are barbequing, but are arguing over our mortgage, and stressing over our bills. My high-ass property taxes are financing his city services, so why should I stay and pay? NO Chance! I defaulted.

Now me and my wife are barbequeing and laughing too, from a 2600 note to 1200 rent. Not to mention no propery taxes, maintenance, water bill, insurance and snow removal, lawn care, etc. All in all I am saving over 2k.

It is way stupid to pay and stay if you’re underwater by over 50%. It is not hard to walk and find an apartment for 50% less in many markets. Only a moron pays money on an underperforming, depreciating asset. That’s what makes buying a new car so stupid.

Sure the banks may come after you for a deficiency, but this is not happening as much as you would think. As a matter of fact, in Illinois, a defieciency judgment cannot be obtained if you were never served with a foreclosre or the court never exercised jurisdiction over your person in that you never personally responded in court to the foreclosure action.

I admit deficiency judgements can be obtained by the judge at the conclusion of the orginal foreclosure action, but the attachemnt of the judgement to wages in the form of garnishment, is a separate court action. This costs money, time and expensive attorneys.

Why do you think in 99% of cases in IL the lender issues a 1099 or sells the debt to a collection agency for pennies on the dollar. Most collection agencies operate out of fear, but it is easy to deal with them.

Ask that they produce proof of ownership of the original debt, get the free application of Google Phone and block or re-route the calls to a busy signal, or if the collectors get through tell them you already settled the debt and to not call you.

My favorite is tell them you are recording THEIR call to ensure quality control and see how fast they hang up. I assure you, you will stop receiving calls. I did not even mention writing a letter to the debt collector under the Fair Debt Collections Practices Act.

I will concede, if given a 1099 on a rental or second home you must pay, but if it is on a primary residence that was not re-fi’d or HELOC’d then until the end of 2012, this debt is forgiven. Thank you George W. Bush!

Even so, should a lender pursue you for a defeciency, just filing bankruptcy even if it not completed is an option. Once the lender gets word of the automatic stay, they usually deem the account uncollectable and sell the debt to an a debt collector.

I have fought foreclosure lawyers in court Pro Se. I was nervous until I happended to see a case log for one of the 3 lawyers that was assigned to my case at any given time. He was in multiple courts handling at least 50 cases———-THAT DAY!

Hey my credit is shot, buy after walking away and renting, I was able to save 32K. So now, I don’t use credit and when I something I spend real money.

I must admit, my landlord originally told me my credit was too poor to rent to, so I put down 6 months of rent and she recosidered. Money overrides judgement a lot of the time.

I have no ties to the real estate industry.

Full disclosure: I’m a prospective buyer who has been through 30 kinds of financial hell as a financial “professional”. I’ve experienced partial income and wild swings in my personal income, and there’s nothing that spooks me like the prospect of buying a house just to have it taken from me because I can no longer pay for it. When I was a child, my family lost its house to foreclosure because of my male parent’s profligate ways, and I’ll never forget how it felt to leave a 6 room house for a cruddy one-room apt.

In the case of my friend, walking would be very, very costly for her, for she has made about $30K in improvements on her rather unique vintage apt. and ponied up about $10K in special assessments for the old building, so she would be out about $80K, more than she is “down” on the mortgage, were she to walk. Additionally, she and I come from backgrounds where welching on a debt you are able to pay is considered shameful, and losing a house is great personal defeat.

Yeah, it’s an emotional thing. Buying a house is an emotional thing as well as a financial thing. As I said, the only reason to buy a house is to be able to predict my housing expense and to make the place mine in a way I never could a rental. Would it make sense for me to renovate my rental to taste? I know people who do this and wonder how they figure it’s a good idea to dump $20K or more into a dwelling they could lose just because the landlord decides to sell .

I actually admire you Laura. You have clearly overcome great obstacles in you life and you should be proud.

I am sorry about what happened to you as a child, yet if what you said is true, then fear is the guiding force in the lives of you and your friend, but that’s O.K. a little fear is healthy.

I grew up in Chicago and watched my parents slave for 30 years to pay for a mortgage that they rented from the bank, that was never truly their own as escalating property taxes almost forced us from our home.

Didn’t matter much after my father dropped dead of a heart attack working 2 jobs to pay never ending bills. My mother just wanted out and sold the house for pennnies on the dollar. So fear is motivating me too. I have been there.

As a financial professional, you understand that the $30K in improvements, and $10K in special assessments are sunk costs that she will never recover.

Our government’s futile attempt to re-inflate the housing market has failed, is failing, and will fail. More payments made by your friend, only waste money on the non-performing asset.

She is already more that the $80K, on the mortgage. She should cut her losses and walk, then save enough money to buy a home outright.

You and she may come from backgrounds where welching on a debt you are able to pay is considered shameful, and losing a house is great personal defeat, but as a financial advisor you can understand the greater moral obligation is to ensure profitablity of the firm of YOU, not to let others shame you into performance.

If my financial advisor told me I should pay my mortgage due to shame or obligation, I would die laughing, and then quickly find another advisor.

I don’t mean to be insensitive, and you are obviously an very intelligent and intriguinging woman, but you are not making this decision based on facts, but emotions. This is the very thing that you said causes men in your field to finanically mismanagment stocks.

FACT..You are you number one shareholder. Given this, it is OK for women to financially mismanage their personal life portfolio, but not OK for men to mismanage the financial portfolio of others. Yeah right.

Mismanagement is the very thing that threatens to send many people like you friend back to poverty as they liquidate their personal financial portfilio to make home payments on a declining assest, thereby ensuring investors have boats and retirement homes.

You stated that the only reason to buy a house is to be able to predict your housing expenses and to make the place yours in a way I never could a rental.

As a financial advisor you understand that home expenses are predicable in that you pay a fixed mortgage every month, for those lucky enough to have fixed mortgages. However, many had Alt-A and Option Arm loans that are scheduled to reset in 2011-2012. How predictable are their payments?

Furthermore as a homeowner in IL, you understand that our 12 billion dollar deficit has already incited our governor to float a multi-billion dollar borrowing plan and a proposed property tax hike. Who do you think will pay for this? You guessed, homeowners. It makes sense to walk and assume a lower housing cost to prepare for higher sales, and property taxes.

As a financial advisor, you understand that every dollar sunk into a home in the form of “upgrades” or “customization” is a dollar lost. In Chicago I always see impoversihed people spending thousands of dollars on shoes, clothes, rims, and wheels for their cars…..Money down the drain. Financial mismanagement….

Would it make sense for me to renovate my rental to taste? No, and neither would it make sense to over-renovate you home. Mega-dollars spend on customization gives the next guy a better quality of life.

I don’t think that women are overly emotional. I just think that women have over attachments to things that matter to them.

To most women, having a home matters more than the sensibility of overspending on one. This is why women are exploited for their willingness to overspend of kitchens and bathrooms, which are usually the most expensive rooms.

You have more and greater things to accomplish. I am sure the same applies to your friend. Yet faced with clear, facts, you and your friend will continue to pay for an underperforming asset. That is your perogative, but given your reasons (shame and obligation)for paying is it truly you choice?

I know it was MUCH harder emotionally on my wife when we moved than it was for me. And we were upgrading from a 1800 foot 1950’s ranch to a 2800 foot house built in the 1990’s.

And I can’t resist a flyover country price comparison. There are plenty of houses very similar to today’s example in my neighborhood… They sell for around $450k and have a 40% larger lot.

Sure, it is midwest, and our weather is not nearly as good as OC. But we do have a decent diversified economy good schools, less traffic, and lower taxes.

I’m glad that we don’t have people willing to bid up houses to $542 a sq ft. If Irvinites want to make that trade off… fine with me. It is only my business because too many of them turned into deadbeats and nearly brought down the economy.

I’m hoping Planet is right and IR is wrong, but I’m thinking the odds are Irvine are more in IRs favor.

@flyovercountry:

Do you honestly think that Irvinites “brought down the economy”?

I hope you did not come to that conclusion based on the daily Ponzi posts you see here. IHB is but a slice of what’s going on in Irvine and that’s the point I’m trying to make… the exceptions are not the rule.

(Sorry original reply didn’t nest the way I wanted)

You guys have to claim Mozilo and Countrywide, so you get extra portions of the blame. 🙂

No, it wasn’t just Irvine, it was all the bubbly areas and the banks that enabled it. But Irvine seems to have some of the most stubborn resistance to normal valuations, so I’m using you as a scapegoat.

Great stuff on CNBC right now – Peter Schiff. Shows long term trend of housing growing at 3%/year but, from 1998 – 2006 grew 18-19%! Prices need to fall another 20% just to hit trend…

Irvine will not be different.

BD

Dragon slayer.

http://online.wsj.com/article/SB10001424052702304173704575578190261574342.html?mod=googlenews_wsj

We will overshoot the trendline.

Even schiff noted, “except irvine”

Funny…. so vote with your dollars. Just buy now… It is simple.

Got Koolaide??

Wait until you have to or want to sell 5 -20 years from now and the pool of buyers has to pay 12% interest on the 30 year.

Lets hope for incredible inflation. Which, BTW, is exactly what the fed is hoping to do..

Best of luck… 🙂

BD

In case anyone rational wants to look at how history has treated our exact situation – just check out Japan.

Nearly 3 decades (30 years for those of you challenged with koolaide intoxication), after their housing bubble – prices have still not recovered to their former glory.

If you are smart just rent fabulously…!! Keep your money in the market and emerging markets. Grow your cash and live! RE in OC is dead money for 10 plus years barring a 30% dive in the next year or two.. which is possible.

Let’s hope.. 🙂

B

Today’s profile is the poster child for loose lending standards in 2006

Given that this buyer was able to leverage $200K into a $2M home and be on the verge of losing it 5 years later is not surprising.

Interesting. I know the people who owned that home. It was purely an investment property, if you can call a $2,000,000 home an investment.

I think there’s many people who have thought about strategic default, but have chosen not to because they keep hearing in the media that housing is recovering. These people are uninformed zombies, banking (literally), on a housing recovery, yet prices in Orange County still have significant downside. This economic quandary that the country is facing is something we haven’t seen before … at least not in our lifetimes.

Even after the govt has thrown billions into this massive pile of sh*t, we still see no real benefit, but we’ve added massive amounts of debt.

“We’re doing it again today, 20-billion a month to The FHA, on top of what happened to Fannie Mae & Freddie Mac. We’re doing it again today, for 20-billion dollars a month, we’re destroying the housing market. Under the name of a stimulus … phony, misrepresented names”. ~ Steve Wynn

I couldn’t have said it better.

If you’re not in hardship, then you just have to ask whether the tax-adjusted monthly price of remaining is worth the cost relative to what you will rent after the foreclosure. If that spread (fair assumption there is a spread) is just a fraction of your income, then why default now when you can keep that option in your back pocket? The only urgency might be the 12.31.2012 expiration of the IRS/FTB non-taxation of debt forgiveness (What are the chances that’s extended though?).

Tax adjusted???

Most 200K families and all indivduals are caught by AMT. There are no tax savings…

Let’s hope that the states CA, IL other that are 2mm close to BK don’t opt for higher property taxes to fill the revenue void… just another example of the problams coming that won’t be played out in a year or two of falling prices. Couple that with rising rates and you have trouble! OC and Irvine will drop another 20+% in price….

My thesis… if you believe differently than just vote with your dollars (and the banks if you can) and buy…

BD

As said before, you only OWN the equity. Once you no longer have any equity, you’re no longer the owner. So defaulting is really just returning the property to it’s rightful owner.

When looked at in the light of reality, a strategic default is actually the MORAL thing to do. Just don’t drag it out, don’t trash the place, don’t be an immoral jerk. The day you quit paying, mail the keys back to the rightful owner.

I think more people have problems with the squatting after the default… not just the default itself.

“The latest Harris survey also revealed some interesting gender differences in attitudes about strategic default: Men were nearly 50 percent more likely than women to consider walking away from an underwater loan, with 57 percent indicating willingness, vs. 40 percent of women.”

“That one surprises me. It may be interesting to see that broken down by who manages the money in the family. It’s probably a higher percentage among those who face the realities of the bills than those that do not.”

You’re right to be surprised, IMO — because in the course of many face-to-face conversations with debtors, often right at their kitchen table with the numbers laid out on paper, I see the opposite: when “the kids are on the table,” so to speak, the women are more willing to walk. The men almost always bring up the issue of their credit score and (yadda, yadda, yadda) — but when the numbers say that staying in the home means no shoes for the kids, the women are remarkably unsentimental — in fact their facial expressions look like they’re thinking about packing, garage sales, and how to stay in the same school district.

With no children in the picture, in my experience, men and women act about the same: their behavior depends on how much they link their self-esteem to their FICO score. (This is not cynicism, simply observation, and as Yogi Berra said, you can observe a lot by just watching.) “Morality” doesn’t really seem to come into the picture much, except for a few religious denominations that place a heavy emphasis on paying off debts.

There is a huge amount of corporate lending, and banks know that corporations will walk when the tide says to. Banks today aren’t retaining much risk in their mortgage lending. Everything is going to Fannie/Freddie, so it doesn’t really matter what banks think of borrowers.

If this is an investment property as IndieDev says, I’m surprised it took them this long to walk. There were lots of $1-2M ‘investment’ properties in my in-laws town. They have all been crushed and nearly all churned through the foreclosure machine (some investors have eaten the loss, but it’s still massive losses).

Are there really that many 2006-7 buyers that are out there to strategic default? This is again a geography dependent situation. NV has the worst neg-eq situation, with FL, AZ, Mich at 50% each.

One of the key determiners of whether someone will strategic default is whether a neighbor has done it. This plays to the domino theory. You’ve got a neighborhood that was either new construction in 06/07 or had a lot of people move in then. You get a few strategic defaulters moving to much cheaper rentals and then you’ll get a snowball effect.

http://www.nber.org/papers/w15145

There’s lots of research into stuff like this, by economists that aren’t of the truthiness variety.

Larry – be careful in NV. They are the only state with no net mortgage equity.

http://s.wsj.net/public/resources/documents/info-NEGATIVE_EQUITY_0911.html

CA is in much better shape than its sand state bretheren, 28% net equity vs 9% for AZ and 13% for FL.

You guys have to claim Mozilo and Countrywide, so you get extra portions of the blame. 🙂

No, it wasn’t just Irvine, it was all the bubbly areas and the banks that enabled it. But Irvine seems to have some of the most stubborn resistance to normal valuations, so I’m using you as a scapegoat.

Obama administration is proposing to relax the damage done to credit after a foreclosure. If that was the case those who were afraid before would be willing to default. This is basically a once in a lifetime opportunity to get free money and free living.

Remember, there isn’t any check box that says that you’re ‘morally obligated’ to pay back this loan. BTW, banks default all the time. Just google ‘Mortgage Bankers Association “Walks Away” from HQ’

Geeze, if they are doing it why shouldn’t I?

This blog is great! But, we need to do some comparative analysis here…

For example, why would anyone pay twice the cost to own compared to what it costs to rent??

Simple analysis are done at the ‘low end’ of pricing. Maybe there you can make a rational decision to buy… but, with rising rates and a return to the basics i.e., 20% down in financing I would suggest that is still stupid. but, let’s not squabble.

IR, can we consider including the rent equivalent calculation to your posts??

My personal problem is that the things I would like to own are in the $2M ask arena…but, I can rent those same homes plus lease a Ferrari, for half the amount of the price and costs to own…

Just a thought.. prices on everything other than ‘entry level’ are 20-50% higher than what it costs to rent. That means some fool is going to subsidize my lifestyle big time. I’m ok with this..

I just won’t buy until things have reversed dramatically.

Anything purchased with borrowed money will get cheaper for the next 20+ years IMHO. If it doesn’t I’ll have my money on the sidelines waiting to come in…

BD

…just an example – I can lease a home in Newport Harbor for $4500/month. But to own based on asking price it will cost me $14000/moth.

These people are either stupid or have too much money to care (also stupid).

I’ll take the difference and live soooooo well. I actually, make a good living but, still don’t have enough vacation time to exploit all those saved dollars. So, it will go into the market buying anything other than bonds, mostly the emerging markets, technology, and energy companies.

The point here for the group, is that the bubble and crisis took out the legs of the stool and now the high end is collapsing. This will only put far more pressure on everything below…

Timber…

BD

Newport finally (finally!) looks like it is starting to meaningfully fall in price.

Whether you look at the ultra high-end Portabello or Villa Del Lago (just dropped in price by $20 million), or the waterfront homes in the $5-10 million price range, the waterfront-close homes in the $2-$4 million range, or the more modestly priced homes in Newport Heights, north of PCH CDM, or the Port Streets — they all seem to be moving lower.

I have noticed this year that the high-end contagion, which started in the high-end areas of inland OC has moved towards the beaches in recent months.

It is fairly textbook that the high-end areas are last to fall, and it looks like it may play out in 2011.

Maybe we need a comparative analysis that shows what you can rent/lease for the amount to own?

When you include AMT and property taxes at only 1% you add tens of thousands of dollars to anything other than the ‘low end’.

God hope you or your business insn’t successful in CA or OC because the gov steal it all away…

Why do Californians keep electing tards into gov?

Sooner or later Atlas will Shrug.. and dump all of those that live on us…

I’m planning to move to NV and take my business …

But, wait! I’ll come back to the OC and live like a rock star simply on half of my tax savings. Oh, and my house will be 5 times the size of anything here for the money. Maybe just by a 50ft Hatteras to sit in the harbor to live on and go to Catalina….

It all works out with the basic math. No arguements about policy. Just math…

Just a thought.

BD

You gotta understand that the used house salesmen are math challenged.

Well….except when it comes to calculating 6% of $xxxxxx.