The California housing market continues to sputter with declining sales and declining prices.

Irvine Home Address … 4 AMBERWOOD Irvine, CA 92604

Resale Home Price …… $464,900

They waitin' for that decline

Pray that I lose my mind

They never want me to shine

Uh-huh I know what's on your mind

You don't think were gonna shine

I face you to prove you wrong

Chiddy Bang — Decline

The largely unexpected decline in house prices has been deep and long lasting, particularly in markets outside of Coastal California. Since lenders have embarked on the amend-extend-pretend policy, sales volumes have dried up, and prices edge lower as supply begins to weigh on the market.

Southland Home Sales Still Slow, Prices Edge Down

April 13, 2011

La Jolla, CA—Southern California home sales turned in another lackluster month in March, the result of a fussy mortgage market, slow job growth and a continued wait-and-see attitude among potential buyers and sellers. There were signs, however, that the market was a little less dysfunctional than in recent months, a real estate information service reported.

I think it's sad that DataQuick feels they need to punch up their reporting with feel-good realtor nonsense. The market shows no signs of strength whatsoever. Sales are weak and prices are falling.

A total of 19,412 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in March. That was up 35.1 percent from 14,369 in February, and down 5.2 percent from 20,476 in March 2010, according to DataQuick of San Diego.

Sales were dismal last year, for sales to be down despite the lower prices is surprising, and it isn't a good sign.

Sales always increase from February to March. Last month’s sales count was 21.4 percent below the 24,706 average for all the months of March since 1988. Sales so far this year are 20 percent below the norm. During the last half of 2010 sales were 25-30 percent below average.

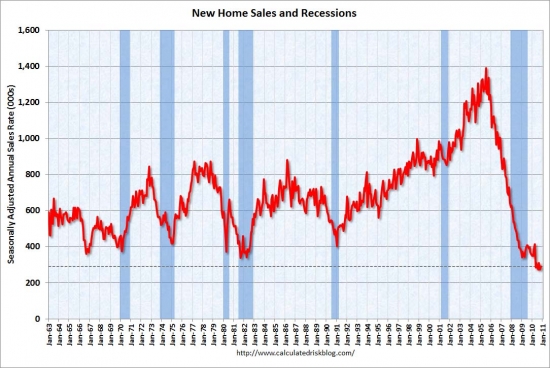

Sales of newly built Southland homes totaled 1,144, the lowest March in DataQuick’s statistics, which go back to 1988. The peak March was in 2006 with 7,205 sales. The March new-home average is 3,661.

New home sales are at the lowest levels ever. Wow! Sales are 50% off their historic averages and 85% below the peak.

Not to worry, all is well in Irvine. Or so they say.

Irvine home sales drop 11%.

- Citywide sales totaled 210 – that's down 26 purchases or 11.0% vs. a year ago. Countywide, sales were down 4.3% vs. a year earlier.

- Irvine home sales were 8.6% of the countywide market in the latest period vs. 9.2% in the year-ago period.

- Of Irvine's 8 ZIP codes, 4 had sales gains vs. a year ago while 3 had a gain in their median selling price vs. a year ago.

- Medians within the city's ZIPs ran from $386,500 to $830,000 – while the price gap was $442,500 to $874,000 a year ago.

- 3 of these 8 ZIP codes beat the -0.1% overall performance of the countywide median for the past year.

Back to the DQ News press release:

The median price paid for a Southland home last month was $280,500, up 2.0 percent from $275,000 in February, and down 1.6 percent from $285,000 for March a year ago.

Sales volumes are down and prices are down. If sales volumes pick up, lenders will release more inventory. It doesn't look like prices will go up any time soon.

The median’s low point for the current real estate cycle was $247,000 in April 2009, while the high point was $505,000 in mid 2007. The peak-to-trough drop was due to a decline in home values as well as a shift in sales toward low-cost homes, especially inland foreclosures.

“As an indicator of upcoming trends, the month of March is actually pretty reliable. We got off to a slow start with sales this year and it doesn’t look like that will change anytime soon. Two of the likely game changers in the short run would be a surge in job creation or another round of price corrections,” said John Walsh, DataQuick president.

It's more likely we will see another round of price corrections before we see a surge in hiring.

“The foreclosure issue is going to be with us for a good while. But mortgage availability, or rather the lack thereof, is key. If a well-crafted home loan program comes down the pike, it’s going to make some lending institution the dominant player, at least for a while,” he said.

This is the holy grail of lending, isn't it? Financial innovation is folly. There is no mortgage innovation beyond the 30-year fixed-rate mortgage. Only the event horizon of the Ponzi abyss awaits those who eschew amortization through complicated financial innovation schemes.

Adjustable-rate mortgages (ARMs) accounted for 7.8 percent of last month’s Southland purchase loans, up from 7.7 percent in February and 4.9 percent a year ago. While still at a low level, last month’s ARM usage was the highest since 10.3 percent in August 2008. Over the past decade, a monthly average of about 42 percent of purchase loans were ARMs.

Jumbo loans, mortgages above the old conforming limit of $417,000, accounted for 15.9 percent of last month’s purchase lending, up from 15.6 percent in February and the same as a year earlier. In the months leading up to the credit crisis that struck in August 2007, jumbos accounted for 40 percent of the market.

Think about the Orange County housing market. How many properties require a jumbo loan for financing. More than 15.6% i imagine. If high end prices were inflated by debt, and if both loan balances and the number of transactions is declining, the only support for this market is the large down payments of the few active buyers that remain.

Foreclosure resales – properties foreclosed on in the prior 12 months – made up 36.4 percent of resales last month, down from a revised 37.0 percent in February and down from 38.3 percent a year ago. Foreclosure resales hit a high of 56.7 percent in February 2009 and a low of 32.8 percent last June.

In the post 2008 era of amend-extend-pretend and shadow inventory, foreclosure numbers don't really mean much.

Short sales – transactions where the sale price fell short of what had been owed on the property – made up an estimated 18.5 percent of Southland resales last month. That was down from an estimated 19.6 percent in February but up from 18.0 percent a year earlier and 12.2 percent two years ago.

Absentee buyers – mostly investors and some second-home purchasers – bought 26.0 percent of the Southland homes sold in March, paying a median $205,000. The absentee share of the market reached a peak in February at 26.4 percent. Over the last decade, absentee buyers purchased a monthly average of 16.3 percent of homes.

Are these the elusive foreign cash buyers being active in the high-end market? Perhaps, but increased investor activity both foreign and domestic at the low end is more likely.

Cash purchases accounted for 30.5 percent of March home sales, paying a median $205,250. The cash purchase share was down from 32.3 percent in February, the all-time high, but up from 27.9 percent a year earlier. The 10-year monthly average for Southland homes purchased with cash is 13.3 percent. Cash purchases are where there was no indication in the public record that a corresponding purchase loan was recorded.

Government-insured FHA loans, a popular low-down-payment choice among first-time buyers, accounted for 32.0 percent of all mortgages used to purchase homes in March – the lowest level since August 2008, when 26.8 percent of purchase loans were FHA. Last month’s FHA level was down from 32.2 percent in February and 36.5 percent in March 2010. Two years ago FHA loans made up 36.5 percent of the purchase loan market, while three years ago it was just 10.5 percent.

interesting that FHA sales are dropping off. It may be partly due to the increased cost of private mortgage insurance on FHA loans. In fact, I have updated my cost of ownership spreadsheet to reflect the 1.15% PMI currently being charged FHA borrowers. The cost is so high that it no longer makes sense to use FHA financing in many circumstances. This increased cost is also contributing to the continued weakness in pricing across all price levels.

Last month 19.2 percent of all sales were for $500,000 or more, up from a revised 18.7 percent in February and down from 20.3 percent a year earlier. The low point for $500,000-plus sales was in January 2009, when only 13.8 percent of sales were above that threshold. Over the past decade, a monthly average of 26.9 percent of homes sold for $500,000 or more.

Viewed differently, Southland zip codes in the top one-third of the housing market, based on historical prices, accounted for 35.8 percent of total sales last month. That was up from 34.8 percent in February and up from 35.2 percent a year ago. Over the last decade, those higher-end areas contributed a monthly average of 37.0 percent of regional sales. Their contribution to overall sales hit a low of 26.2 percent in January 2009.

Last month the percentage of Southland homes bought and re-sold on the open market within a six-month period was 3.2 percent, the same “flipping” rate as the month before but down slightly from 3.3 percent a year ago. Flipping varied last month from as little as 2.5 percent in Ventura County to as much as 3.5 percent in Orange County.

Not surprisingly, the flipping rate is close to the foreclosure rate.

DataQuick monitors real estate activity nationwide and provides information to consumers, educational institutions, public agencies, lending institutions, title companies and industry analysts.

The typical monthly mortgage payment that Southland buyers committed themselves to paying was $1,185 last month, up from $1,174 in February and down from $1,220 in March 2010. Adjusted for inflation, current payments are 48.0 percent below typical payments in the spring of 1989, the peak of the prior real estate cycle. They are 57.4 percent below the current cycle’s peak in July 2007.

Affordability is becoming widespread in Southern California — just not here in Irvine.

Indicators of market distress continue to move in different directions. Foreclosure activity remains high by historical standards but is lower than peak levels reached over the last two years. Financing with multiple mortgages is very low, and down payment sizes are stable, DataQuick reported.

| Sales Volume | Median Price | |||||

| All homes | Mar-10 | Mar-11 | %Chng | Mar-10 | Mar-11 | %Chng |

| Los Angeles | 6,747 | 6,590 | -2.3% | $329,000 | $320,000 | -2.7% |

| Orange | 2,652 | 2,615 | -1.4% | $432,000 | $430,000 | -0.5% |

| Riverside | 4,156 | 3,843 | -7.5% | $198,000 | $198,000 | -0.0% |

| San Bernardino | 2,955 | 2,544 | -13.9% | $152,000 | $150,000 | -1.3% |

| San Diego | 3,227 | 3,063 | -5.1% | $330,000 | $325,000 | -1.5% |

| Ventura | 739 | 757 | 2.4% | $375,000 | $349,000 | -6.9% |

| SoCal | 20,476 | 19,412 | -5.2% | $285,000 | $280,500 | -1.6% |

Source: DQNews.com Media calls: Andrew LePage (916) 456-7157

The spent most of it

- The owners of today's featured property paid $269,000 on 1/12/2001. The used a $215,200 first mortgage, a $40,350 second mortgage, and a $13,450 down payment. A whopping 5% down.

- On 9/3/2002 they refinanced with a $257,000 first mortgage and obtained about $12,000 for whatever.

- On 1/10/2005 they obtained a $25,000 HELOC.

- On 10/18/2005 they refinanced with a $254,600 first mortgage.

- On 5/10/2006 they obtained a $125,000 HELOC.

- On 10/18/2006 they refinanced again with a $305,600 HELOC.

- On 12/26/2007 they got another $75,000 HELOC.

- On 7/20/2009 they refinanced with a $370,000 first mortgage.

- Total mortgage equity withdrawal is $114,500.

Irvine House Address … 4 AMBERWOOD Irvine, CA 92604 ![]()

Resale House Price …… $464,900

House Purchase Price … $269,000

House Purchase Date …. 1/12/2001

Net Gain (Loss) ………. $168,006

Percent Change ………. 62.5%

Annual Appreciation … 5.2%

Cost of House Ownership

————————————————-

$464,900 ………. Asking Price

$16,272 ………. 3.5% Down FHA Financing

4.87% …………… Mortgage Interest Rate

$448,628 ………. 30-Year Mortgage

$101,692 ………. Income Requirement

$2,373 ………. Monthly Mortgage Payment

$403 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$97 ………. Homeowners Insurance (@ 0.25%)

$516 ………. Private Mortgage Insurance

$320 ………. Homeowners Association Fees

============================================

$3,709 ………. Monthly Cash Outlays

-$389 ………. Tax Savings (% of Interest and Property Tax)

-$552 ………. Equity Hidden in Payment (Amortization)

$30 ………. Lost Income to Down Payment (net of taxes)

$78 ………. Maintenance and Replacement Reserves

============================================

$2,876 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,649 ………. Furnishing and Move In @1%

$4,649 ………. Closing Costs @1%

$4,486 ………… Interest Points @1% of Loan

$16,272 ………. Down Payment

============================================

$30,056 ………. Total Cash Costs

$44,000 ………… Emergency Cash Reserves

============================================

$74,056 ………. Total Savings Needed

Property Details for 4 AMBERWOOD Irvine, CA 92604

—————————————————————————— .png)

Beds: 3

Baths: 2

Sq. Ft.: 1520

$306/SF

Property Type: Residential, Condominium

Style: Two Level, Contemporary

Year Built: 1976

Community: 0

County: Orange

MLS#: S654402

Source: SoCalMLS

Status: Active

On Redfin: 7 days

——————————————————————————

Get the most for your money in Irvine! Convenience and comfort set this townhome apart. Near freeways and shopping while being adjacent to a city park, tennis courts, and bike trails (and across from a golf course) allow you to live in the city with room to breathe! Bright and open, it includes a master retreat with fireplace, garden window in the kitchen, and tons of storage space. Custom upgrades: hardwood floors, high quality carpet, duel paned windows, new doors, remodeled staircase, large entertaining patio/yard, and $25k spa-inspired bathrooms! Come for a visit. Make it your home.

“primate mortgage insurance”?? 😀

Freudian slip? PMI is insurance to protect those lender monkeys I always cartoon about.

Did you hear? Primate Mortgage Insurance just merged with:

http://www.crackthecode.us/images/caveman_appraisals.jpg

“Duel” paned windows LOL

…hey, it’s a violent neighborhood…

Just what kind of neighborhood is this? How does one protect the children from the carnage?

Debt to income ratios during the inflation ridden 1970s were over 30% for nearly a decade and higher than the recent bubble.

Thank god we’ll never get back to those levels. I’ve been told that type of stuff never happens in an inflationary environment. I’ve been told on this blog that irvine prices drop in both deflationary and inflationary environments. Close your eyes and listen to the sweet music.

And it’s the Christmas season every day at SCP

Especially when interest rates continue to break record lows in their steady march toward 2%. Thank God we are almost there so 500K$ houses can be bought by 98K$ income households with DTI much higher than 30%.

Have you ever seen an interest rate chart from 1960 to the 1970s?

The poor were devastated in the 1970s, interest rates sky rocketed from historic lows of the 1960s and home prices and commodities were elevated at the same time.

Hey PR,

How about all that demand for premium Irvine real estate that has intensely surged over the past year to tune of negative 11%? Thank God all of the posers have been kicked out so all that real money could find a way in.

You hear that everybody? Irvine homes are now 11% cheaper versus last year. David I saw you flying over Irvine on your unicorn this morning. Make sure you feed him enough magical beans to get back to AZ.

He said demand is off 11%, not prices.

Pretty shrill even for a shill like you.

PR did not read the blog post today before he started in with the astute observations I guess. Was your favorite unicorn show on the cartoon channel this morning, PR?

Hey PR,

Do you have a chart of housing prices in the 70’s?

You say housing prices rose in the 70’s as if it counter intuitive. But wouldn’t that be normal in a high inflation environment. I guess I am not clear on if we are talking real or nominal.

It would also be nice if PR would put it into context. Is he talking about just Irvine or is he talking county wide? Statewide? Nationwide?

Right now you have falling prices nationwide with pockets here and there still selling at bubble prices. Is this the EXACT same scenario as PR’s inflationary 70’s?

SW, that’s right interest rates went up and house prices went up with inflation. Look up the charts for yourself, I’m not here to cater to your every need.

Look at the DTI chart which is of course backwards looking with DTI in the 1970s higher than the most recent bubble. But of course inflation will never happen again and even if it did I’ve been told Irvine nominal prices will only go down… Never up, no never ever, not like they have since 2009. Run the bubble bath, turn up the Kenny G and close your eyes. Boy the way Glen Miller played.

SW, that’s right interest rates went up and house prices went up with inflation

Except now we have falling house prices (in most of the country) plus inflation. Just like in your 70’s example!

BTW – PR, how are those predictions going about prices never going lower than spring 2009 and interest rates going down?

You’re a regular oracle…

Pretty damn good, considering we have seen properties profiles here sold recently for more than spring 2009.

Interest rates are still low, I’m still waiting for them to sky rocket any now….

No way that interest rates will sky rocket when they are continuing to break record lows in the continuation of 200 years of Capitalism tradition in America. They may even hit 2% at some point in the near future!

Boy the way Glen Miller played

Songs that made the hit parade.

Guys like us we had it made,

Those were the days.

And you knew who you were then,

Girls were girls and men were men,

Mister we could use a man

Like Herbert Hoover again.

Didn’t need no welfare state,

Everybody pulled his weight.

Gee our old LaSalle ran great.

Those were the days.

“They may even hit 2% at some point in the near future!”

And Irvine may see 1999 prices in the future too.

Just believe.

Thooooose weeere the daaaaaaayyyys !!!

Dating yourself? That might strain credibility.

Nothing to see here, right, Irvine HO?

http://www.crackthecode.us/images/28_Yorktown_Nothing_To_See_Here.jpg

PR is in rare form singing to himself on the blog today. PR, are you taking requests? How about “I’m Just A Girl” by No Doubt?

@DaveAzPhx:

Is there some drop to 1999 prices missing on your oh-so-clever jpg?

There can be miracles… when you believe…

Is there some drop to 1999 prices missing on your oh-so-clever jpg?

I like how you disingenuously insinuate that I have claimed Irvine prices will fall back to 1998. I have corrected you on multiple occasions; stating that I personally would not pay above the ’98 comp. There is some wiggle-room with interest rates, but without the inflation, I would not want to get myself involved with an overpriced Irvine tract house if interest rates ever return to their 1998 levels which is where I ultimately believe they will go. If inflation bails out the Irvine house debtors by that time – oh well it sucks for savers but will not be my problem.

You clearly don’t get it AZDavidPhx. They are not interested in debating you. They are only interested in debating the fictional version of you that makes absurd claims. It’s a fight they can actually win.

Nice revisionist history.

Are we doing to this again?

That last time you danced around this I actually quoted some of your posts where you said as much (even answering my question to you about it). And there were numerous times where I’ve mentioned 1999 prices and you did not deny it.

My claim is much stronger than your 2% interest rate claim on PR where he agreed with someone else’s post, but not specifically on 2% interest rates. Are you course-correcting now?

This reminds me of the time when you said the majority of Irvine residents game the system with their zero down loans and when I showed you evidence to the contrary that Irvine sales were upwards of 35%+ down, you changed your song to “Uh… those are equity flips”.

In between your Paint projects, use some Google here and you’ll find two things:

1. Several posts where you talk about 1999 prices.

2. Little, if any, posts directly from PR where he cites 2% interest rates.

So as long as you want to disingenuously insinuate your claims, I’ll accurately post mine.

It’s okay, you have an out… like you’ve said in the past, you don’t have to prove your stance, you just have to believe.

@BMS:

Oh really?

Here’s another:

There are more but I guess those were from the fictional AZDave.

Yes, really.

I read your quotes from last month before I posted. There is no claim that prices will fall to 1999 levels. My read on the above is that you are taking his ambiguous language and casting it as an unambiguous prediction.

IHO, you have to love the bullshit that is made up.

It must be painful for people who years ago predicted rates to be 7-9+% by now.. To be proven so very wrong. Watch for record low treasury rates as Greece, Ireland, etc finally default.

You are proving my point, Irvine HO.

The statement

“I see no reason why Irvine could not revert back to 1999 prices”

Is not equivalent to:

“Irvine prices shall revert to 1999 prices”

Likewise, the statement:

“I see no reason why 1997 prices could not be reached”

is not equivalent to

“1997 prices shall be reached”

I stand by every word in those quotes. What do you think today’s house would sell for if interest rates went to 9% or 10%?

Please, keep going. Show some more “quotes” where I have boldly stated that prices are on their way back to 1998.

@bms:

“My read on the above is that you are taking his ambiguous language and casting it as an unambiguous prediction.”

Actually, that first quote was in a response to my question directly asking him about 1999 prices. If you think that’s ambiguous but AZDave’s claim of PR’s 2% interest rate prediction is not, oh well.

@AZDave:

King of Strawman now breaks out the semantics card? Bust out the unicycle, Dave is backpedaling!

Show some more “quotes” where I have boldly stated that prices are on their way back to 1998.

I just did… you still haven’t shown me where PR directly said 2% interest rates. And quite honestly, I thought the same thing since so many people claims he did so, but when I went to look for it, I couldn’t find it. So I asked you, the proponent of “All Things PR Predicts” and you couldn’t come up with it either.

So let’s settle this now (since you didn’t last time we did this)… do you still think Irvine will go back to 1999 prices (and I may add you did say unadjusted).

I never said anything about PR’s 2% prediction. Ever. Google away. You are thinking of the fictional bigmoneysalsa.

Yeah let’s all pretend mortgage rates are 10% and play the bullshit game of what we would pay for an Irvine Home, and ignore the F out of reality.

Watch for record low treasury rates as Greece, Ireland, etc finally default.

Hey PR, let’s assume that you are right and that does happen. How long will it last? Days? Weeks? Months? Years? Forever? Should an Irvine House buyer get ready to take the plunge when Greece defaults?

@bgm:

“I never said anything about PR’s 2% prediction. Ever. Google away. You are thinking of the fictional bigmoneysalsa.”

No offense, but you need to read before you post a response.

Not once did I say you made that claim, just pointing out the inequity of you saying my claim is ambiguous yet AZDave’s is not.

Are you and him the same person?

David I don’t know, but the interest rate cycle is extremely long. It could be 60 years in total, 80, 100 years who knows. I expect this cycle to be at least another 5-10 years at a minimum.

Though I never predicted it, 2% mortgage rates are a possibility, but I doubt that will happen. It would take a century long interest rate cycle, or brutal deflation. I have too much faith in the Fed’s ability to continually inflate all asset values.

It’s not backpedaling at all, Irvine HO – what you have done is taken the quote out of context.

Example:

Suppose I said to you that there is no reason that it could not rain tomorrow. Would you go off and tell people that AZDave was predicting rain for tomorrow? Of course not – that would be idiotic wouldn’t it?

AZDave: “There is no reason that it could not rain tomorrow”

Irvine HO: “AZDave is predicting rain for tomorrow everybody – look, I have the quote!”

Is that the best you got?

I’ve been reading this blog for a few years and you’ve been talking about going back to 90s pricing so much, it’s why I originally asked you that question. In fact, I even found IR’s comments where he felt the same thing… but since then, he’s amended his claims and you have not. There is no “out of context”, here’s another one:

Now, I understand that things are different now so I am wondering, for the record, do you still believe that Irvine will fall to 90s pricing?

King of Strawman now breaks out the semantics card?

It’s not semantics at all – it’s just logic. If you told me that there was no reason why it could not rain tomorrow and I went off telling everybody that you predicted rain for tomorrow – I would not call you some semantic back-pedaler for taking exception with my taking your statement out of context. DUH.

@iho

“Are you and him the same person?”

Way to raise the level of discourse.

The fact that I haven’t criticized every falacious argument ever made on this blog doesn’t mean I can’t criticize a particular falacious argument when I see it. If that makes me guilty of “inequity”, so be it.

Yeah, because “there is no reason” is totally different. You might as well add “pretty much guaranteed at this point” to that.

You would have a point if I didn’t ask you about the rain to give it context:

IHO: Do you really think it’s going to rain tomorrow?

Dave: There is no reason that it shouldn’t.

That’s called semantics… not logic. Uh… want to try that again?

Again, answer the question:

Do you still believe Irvine will drop to 90s prices?

Or you can continue to obfuscate the obvious to throw people off the scent.

A 90’s rollback as a pretty much guaranteed at this point judging by the state of the economy.

but since then, he’s amended his claims and you have not.

Look at what the Government did to stop the free-fall, Irvine HO. Do you think that prices stopped falling in 2009 because your local market was healthy? On May 5 2009, it certainly looked like a guarantee that prices were on their way back to the 90’s at the height of the financial crisis and also at a time when prices were free-falling in Irvine. What have we seen since? The Government re-wrote the rules for banks, the Fed initiated QE, etc.

I certainly have amended my claims since May 5 2009 as is evidenced by my 2011 quotes. The game changed from free market to socialism.

Here is my question for you – Do you believe that your current prices would have not gone back to 90’s levels if the Government had not intervened? I think that if you answer honestly then my quote is not that far-fetched.

IHO: Do you really think it’s going to rain tomorrow?

Dave: There is no reason that it shouldn’t.

That’s called semantics… not logic. Uh… want to try that again?

Actually, it is logic. A semantic difference implies 2 ways of saying the same thing. Example:

AZDave: “I see no reason why it could not rain tomorrow”

Irvine HO: “AZDave says it might rain tomorrow!”

AZDave: “I never said it might rain – I said there was no reason that it could not”

That’s a semantic difference there. You would agree that saying “it might rain” is not logically equivalent with “it will rain” (I hope).

Do you still believe Irvine will drop to 90s prices?

Or you can continue to obfuscate the obvious to throw people off the scent.

This is actually a good question. In the context of today’s environment, my bet is that inflation is going to hit before house prices in Irvine decline nominally to 90’s prices. However, I do believe that pricing in Irvine will ultimately reflect 90’s prices in “real” Dollars even though a 90’s rollback in nominal Dollars is not likely given the actions taken by the Government.

Keep digging for more quotes. You found a pretty good one from 2 years ago but given the context of the environment at the time combined with the rather unorthodoxed Government intervention, I don’t think it is as crackpot as you insinuate.

I certainly have amended my claims since May 5 2009 as is evidenced by my 2011 quotes.

So are you finally admitting you made those claims… or is there some semantics/logic I’m not seeing here? Can you please show me a 2011 quote where you made such an amendment so that I’m not taking something out of context?

Do you believe that your current prices would have not gone back to 90’s levels if the Government had not intervened?

Yes… they would have not. I would hope closer to 03 but definitely not the 90s. Unlike you, I’ve lived in Irvine for quite a bit of time and have seen where prices have gone in the last TWO bubbles. The one prior to this, Irvine housing did not get back to pricing pre-bubble so there aren’t many reasons why it should have done it this last time. This is why I always ask you about it because I cannot see 4br SFRs that currently trade at over $600k+ now go back down to the $300k they were selling for in the 90s. If your dream home in AZ is going to go for $250k (which I assume to be a 3br SFR), that’s very unlikely to happen in Irvine.

And I still stand by my quote that there is no reason that Irvine prices could not return to 90’s prices. We have seen it in other parts of the country. If interest rates jump high enough, prices could easily go back to 90’s. However, if the Government can keep the low interest rate trick going long enough and create a lot of inflation then prices may not fall back to 90’s in your market.

this fight is like edhne vs indiedev. so funny.

So are you finally admitting you made those claims

Finally admitting? You are saying as though I remember every post that I made going back to 2009. If you had to dig that far back to find a single quote that was made before the Government rode in on their white knight, that’s a pretty big stretch.

It did look like a guarantee in 2009 and I stand by the quote given the context of what was going on at the time. Had the Government allowed the banks and Fannie Mae to fail and had they not engineered the massive life support for the housing market – Yes, I believe your house prices would be in the 90’s today.

But that is just one quote from 2009. Surely you have many more from 2010 and 2011.

Look at what the Government did to stop the free-fall, Irvine HO

—

So why late 1999’s pricing for las vegas, miami etc, but not irvine?

Does Bernanke own around here? It must be the fact he he fears all those PIMCO employees who live around here so they saved Irvine and newport specifically with only 20% falls while letting others fall 60%.

So why late 1999’s pricing for las vegas, miami etc, but not irvine?

Higher frequency of speculation purchases, shoddier lending standards, higher rates of foreclosure, less squatting, economies that rely more on tourism etc are going to fall first. I don’t think that is a big secret although your Bernanke theory is much more entertaining even though you were just being stupid.

Dave,

Why do you debase yourself with the he-said-she-said game with these jokers? Please don’t feed the trolls.

Sure, it’s fun to toss a sarcastic comment their way from time to time, but why lower yourself by engaging them in a prolonged argument? That sort of attention is exactly what they want. It makes them feel like someone is taking their nonsense seriously.

-Darth

Somebody’s old.

“It did look like a guarantee in 2009 and I stand by the quote given the context of what was going on at the time. Had the Government allowed the banks and Fannie Mae to fail and had they not engineered the massive life support for the housing market”

but the government (aka bush, paulson and co.) bailed out fannie and freddie in 2008… so you knew that the government had already bailed out the housing market… so your prediction was predicated on that fact.

Nice try – the Government did not flip a magic switch and everything changed over night. Notice how the Irvine house prices did a freefall into 2009 before credit started loosening up again.

Yeah it was the right time to predict higher rates LOL.

I’m so confused on whatever I’m seeing in this patio area. It that a mural of a brick wall? What’s with the bright blue everywhere? The association police won’t like that, even if it’s your patio area.

You don’t see the face? I think it resembles Jesus, personally. Wonder what it would fetch on E-bay.

Let the bidding begin.

http://www.crackthecode.us/images/Irvine_Jesus.jpg

@Sue

It’s actually a very nice wall fountain and not a mural of a brick wall.

Unfortunately, their design and the elements they have selected to surround it are very poorly executed making it look both cheap and ugly.

The space is too small for the fountain.

They put an ugly urn/pot underneath it making it even more unappealing.

It belongs in a larger space such as a courtyard and with the right mix of colors and planting will look very elegant and much more appealing.

Where’s the “Village of Stonegate awash in FCB money” headline?

Those were the days. Who could ever imagine that John McMonigle would be filing Chapter 7. Its on Lansner in todays Register. The biggest OC Real Estate guy bites the dust. Guess he should have learned how to speak Chinese.

I think he should have just hired Planet Realty. I mean, Reality.

Indeed, the “crash” is nowhere to be seen.

When to the 40th birthday of the city of Irivne. One piture was of Culvert c.a. 1971. It looked like a dirt road. I would definately expect that house prices would increase with a paved road in any neighorhood. Looking back too far back it time, negates intrastructure improvements especially to “undeveloped areas.” The nice areas might have been closer to Santa Ann and Tustin pre-1960’s. Irvine was likely in the sticks in those days. Anybody remember thoses days in Irvine or have data on the prices?

Inflationary times of the 1970 were measured in the misery index for the poor. Inflation + unemployment.

Remember, keep chanting there is no inflation, there is no inflation.

We moved to Irvine in 1970 and paid $36k for a new 2200 sg ft Pacesetter House in the Ranch. Interest rates were 8.5% and nobody was buying. Our house was the only one occupied on the street for several months.

Welcome. I always enjoy having astute observers with history on Irvine.

Back in 1970, Irvine must have felt like a fringe community carved out of the orange groves. How times have changed.

While I view anything from Lansner with a great deal of suspicion, his by-ZIP chart shows University Park getting a decent boost in both prices AND sales: http://lansner.ocregister.com/2011/04/18/home-prices-up-27-zips-yours/106877/. Northwood was the only Irvine ZIP to get a rise in both stats, but Northwood’s sales rise was much smaller and their price increase was virtually flat. So, what’s up with UP? I don’t see anything particularly negative about UP that makes this especially unlikely for that neighborhood, but this increase surprises me for any Irvine ZIP. Anyone got an explanation for why this might be happening? This ZIP does NOT include Turtle Rock, so it can’t be big Turtle Rock SFR’s skewing the median price. Even if it had been, how would one account for the increase in sales? So, any ideas?

Meanwhile, Lansner’s chart shows 6 Irvine ZIP’s with median price declines, 3 of those in double digits. Not surprisingly, all 3 of those ZIP’s with double-digit price drops had sales increases. What a shocker, right?! Lower your price and you get more sales. Duh!

Poor ‘West Irvine’ (92602) had a 7.5% drop in prices and a 43% drop in sales! Ouch! Sucks to be them! Actually, scratch that, they probably don’t care. If you’re squatting while waiting for a short sale, you’d probably rather not see inventory moving in your neighborhood. Gridlock is good!

-Darth

CORRECTION: “…Northwood was the only OTHER Irvine ZIP to get a rise in both stats…”

-Darth