Republicans in the House of Representatives are introducing legislation to tighten lending standards on government-backed loans to limit the exposure of taxpayers to ongoing price declines.

Irvine Home Address … 2418 SCHOLARSHIP Irvine, CA 92612

Resale Home Price …… $325,000

Hey yo I once was a kid all I had was a dream

mo money mo problems when I get it I'm a pile it up

Now I'm dope, wonderbread we can toast

Chiddy Bang — Opposite of Adults

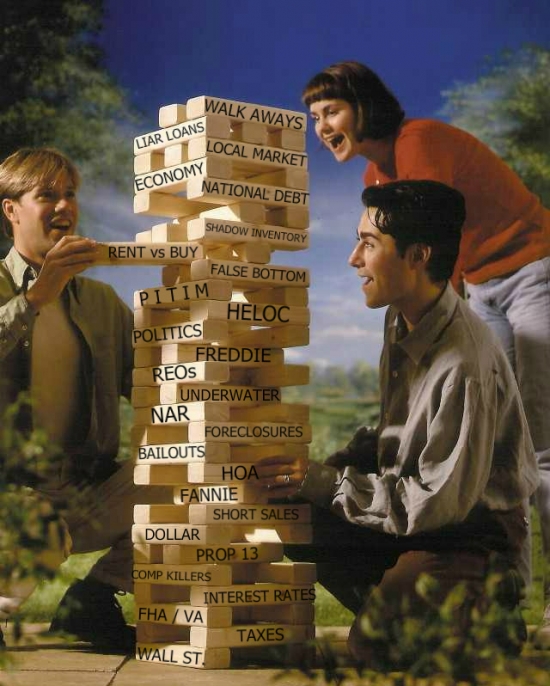

In our two-party political system, the function of the minority party is to oppose policies of the party in power, particularly when the party in power is overreaching or enacting legislation that is not in the best interest of the country. Sometimes, members of Congress act the opposite of adults, and the rhetoric gets heated and sometimes pretty ridiculous. But for the most part, the two-party system is successful in debating ideas and allowing only the most supported to become law.

One of the advantages of the minority party is that they can force uncomfortable public votes on major issues. When the majority party begins pandering to its constituencies with handouts and political seniorage, the minority party can garner attention by introducing good competing legislation and force the majority party to cast an unpopular vote.

The Republicans in the House of Representatives in Washington now hold a majority, and thereby they control the introduction of most new legislation into our grand political theater. They are taking advantage of their majority in the House to force the Democrats which control the Senate and the Presidency to vote down common-sense legislation designed to protect the interests of US taxpayers.

Republicans Aim to Raise FHA Down Payment Requirement

by Adam Quinones — May 25, 2011

The Republican led House Financial Services Committee has drafted legislation that would, among other things, (1) raise the FHA down-payment requirement to 5 percent and (2) prohibit borrowers from financing their closing costs.

The draft legislation, ‘‘FHA-Rural Regulatory Improvement Act of 2011’’, was discussed today in a House Subcommittee hearing entitled “Legislative Proposals to Determine the Future Role of FHA, RHS and GNMA in the Single-and Multi-Family Mortgage Markets”.

If both provisions above were enacted, the already depleted buyer pool would be made much smaller because it would require much more savings for buyers to close the deal. Raising the down payment requirement from 3.5% to 5% will get the most attention, but the other provision prohibiting buyers from financing their closing costs that will really add to the savings requirement and decimate the buyer pool.

I have sold several houses in Las Vegas to FHA borrowers. On properties selling for less than the $118,000 median, FHA dominates the market. In a typical FHA deal, the buyer submits a full asking price offer but asks for the seller to pay all buyer closing costs which generally run between 3% and 5% of the purchase price. If borrowers are prohibited from financing these costs into the loan, the effective down payment doubles to 7% or more.

By far the most damaging provision to the quantity of buyers in the buyer pool is the prohibition against financing their closing costs.

However, the long-term effect of this will be to have buyers with more of their own money into the deal which makes most borrowers much less likely to strategically default, partly because they are less likely to fall underwater, and partly because they don't want to lose their money in a sale. Despite the horrendous impact this policy would have the in the short term — and it would inflict a great deal of pain in the most beaten down markets — the long term impact is nothing but positive.

In a formal release, the House Financial Services Committee's Republican Chairman Spencer Bachus touted the bill as a coming at an important time in history, “This hearing and legislative proposal come at a pivotal moment, as the Committee debates the future of the mortgage finance system, and in particular, government guarantee programs that could expose taxpayers to significant losses.”

Senator Bachus is right. The various government guarantees have been used to shift much of the private sector garbage onto the balance sheets of Uncle Sam and the federal reserve. It was a short-term policy designed to keep our banks solvent, but since the various players in the real estate industry gain advantage from the government assignment of risk, they are lobbying to keep their advantage in place.

Industry advocates were quick to respond to the proposal as a move in the wrong direction. Michael Berman, Chairman of the Mortgage Bankers Association, explained that down-payments are not the best indicator of payment default. Berman said, “Recently, policymakers have focused on required minimum down-payments as a measure of what factors are necessary to create sound lending practices. While down-payment certainly impacts default risk, other compensating factors, particularly full documentation of conservative loan products, are more influential mitigating factors.”

This is a straw-man argument. This legislation does not argue that down payments are the best indicator of default. It isn't. However, based on the government database of loans in both the GSEs and FHA, the data shows that default rates are inversely related to down payment. As down payments go down, default rates go up. Some of this may be due to the borrower being underwater and hopeless, but much of this documented behavior is because borrowers aren't losing their money.

Berman went on to share the MBA's opinion on the matter, saying, “The current minimum down-payment of 3.5 percent for borrowers with credit scores of 580 or above and 10 percent for borrowers with credit scores of 579 and below permits borrowers to have appropriate “skin in the game” while providing credit-worthy homebuyers with an option for entering the purchase market. Maintaining the existing minimum down-payment requirements, while requiring strong underwriting standards, such as full documentation and income verification, allows borrowers to responsibly become, and stay, homeowners.”

The MBA isn't the only industry group to oppose the down-payment hike. Ron Phillips, President of the National Association of Realtors, shared similar sentiments in his prepared remarks. “NAR strongly opposes increasing the down-payment for FHA. The correlation between down-payment and loan performance is significantly less important than the linkage to strong underwriting, which FHA continues to have. FHA’s foreclosure rate remains less than conventional mortgages, so we don’t believe changes to the down-payment would do anything but disenfranchise many creditworthy homebuyers”.

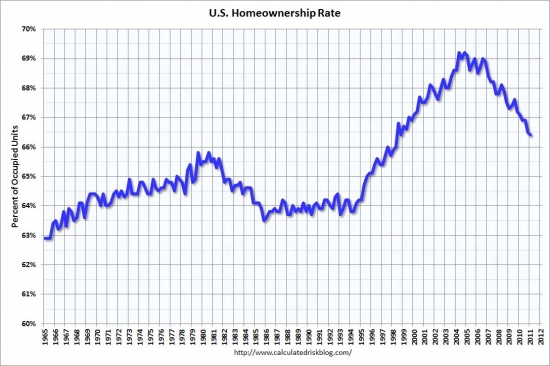

Does the government really want to disenfranchise creditworthy borrowers? Increased home ownership has been the goal of Congressional public policy and every presidential administration since the 1920s. A declining home ownership rate is not politically popular. The only way a policy that negatively impacts the home ownership rate would be proposed is because the alternative is even less appealing — endless government bailouts.

Not all feelings were mutual though. The Cato Institute, a D.C. think tank devoted to limiting government participation in free markets, believes a combination of poor credit history and low down-payment requirements have resulted in “tremendous losses” for private mortgage investors and the FHA. In its prepared testimony Cato said, “Given the relatively “safe” features of an FHA loan, we do not have to guess about loan characteristics driving the borrower into default. We know it is equity and credit history that drives losses.”

To complete their list of causes, they should add unemployment due to the economic collapse that was a direct result of the anti-regulation policies endorsed by groups like the Cato Institute, but I don't want to quibble with their well-reasoned argument….

Cato outlined a variety of FHA program reforms it believes must be implemented immediately to ensure taxpayers are exposed to minimal risk. These reforms include:

- Immediately require a 5 percent cash down-payment on the part of the borrower.

- Require FHA to allow only reasonable debt-to-income ratios.

- Restrict borrower eligibility to a credit history that is equivalent to no worse than a 600 FICO score.

- Require pre-purchase counseling for borrowers with a credit history that is equivalent to a FICO score between 600 and 680.

- Require a 10 percent down-payment, immediately, for borrowers with a credit history equivalent to below a 680 FICO score.

- Borrower eligibility should also be limited to borrowers whose incomes do not exceed 115 percent of median area income, so as to mirror the requirements of section 502(h)(2), as amended, of the Housing Act of 1949.

That's the best policy proposal I have seen come out of Washington. Each one of those provisions would serve to limit the borrower pool to those most likely to repay the debt which in turn limits the exposure of taxpayers to further Ponzi scheme losses.

Besides raising the down-payment requirement, the proposed legislation would also cement the reduction of current “high-cost” loan limits. The maximum loan limits for Fannie Mae, Freddie Mac, and FHA are currently $417,000 with a temporary limit of up to $729,750 for one-unit properties in high-cost areas. The temporary high-cost area limit was first set in the Economic Stimulus Act of 2008, and was extended in subsequent legislation. It expires on September 30, 2011. Without the extension, the high-cost loan limit ceiling would revert back to the limits established under the Housing and Economic Reform Act (HERA), a maximum of $625,500 in high-cost areas.

The change from $729,750 to $625,000 will be effective October 1, 2011. There is no political will to save markets like Irvine where GSE financing between $625,000 and $729,750 is common.

The Obama administration already stated in its white paper that it will not support another extension of the higher loan limits, but the MBA believes the higher limits should be maintained until the housing market stabilizes and the private market shows more signs that demand has returned.

Why should government policy be used to prop up house prices for the upper-middle class? What societal benefit is obtained? Money is fungible, and any assistance the government is providing to upper income households is merely supporting their entitlements.

MBA urged such legislation to be enacted well before October 1, 2011, in order to avoid certain market disruptions that will, because of rate locks, occur within 90 days of the current limits expiring. The National Association of Home Builders echoed that perspective.

NAHB First Vice Chairman Barry Rutenberg, a home builder from Gainesville, Fla., told the House Financial Services Subcommittee, “Counties across the country would see their loan limit reduced by tens of thousands of dollars, placing further downward pressure on home prices and impairing the ability of borrowers to use FHA-insured mortgages to purchase new homes,”

To keep FHA, Fannie Mae and Freddie Mac loan limits at their current levels, NAHB called on Congress to support H.R. 1754, the Preserving Equal Access to Mortgage Finance Programs Act, a bipartisan measure sponsored by Reps. Gary Miller (R-Calif.) and Brad Sherman (D-Calif.).

The draft legislative proposal will require a full Committee vote before it is formally introduced to be voted on by the entire house. Such measures would not be expected to pass the Senate.

Is anyone surprised that two California legislators signed on to a bill designed to support the California real estate Ponzi scheme? I'm not.

A stable home ownership rate requires the limiting of access to home loans to those who cannot make the payments. It doesn't serve anyone for lenders to let borrowers move into properties they cannot afford, develop a sense of entitlement to property they cannot afford, and then foreclose on them because the borrower cannot afford it. The cycle merely upsets everyone involved and makes the taxpayer lose money through losses on the insured loan.

It has been a long and painful process as the bubble deflates back to levels of affordability. Housing deflation is not over yet, particularly in markets like ours where price deflation has been slowed by the government meddling. Kool aid intoxication must die, and buyers must give up on the idea of their California house being a substitute wage earner. Until that happens, a few people will overpay, the the slow grind of lower prices will go on.

Welcome to our new normal.

A 50% loss in an Irvine high rise

One of the most obvious signs of the housing bubble was the rise of buildings on the Jamboree corridor about 25 years ahead of when the economics may support it. These properties should never have been built. The units within them are worth less than half of what they were at the peak, and if today's pricing would have been the order of the day back when these were proposed, they wouldn't have been financed.

The owner of today's featured property paid $635,000 back on 1/27/2006. He used a $507,650 first mortgage and a $127,350 down payment. However, on 10/6/2006 he obtained a $150,000 HELOC from Wells Fargo which gave him access to his down payment plus $22,650 in HELOC booty.

Do you think he took the HELOC money, or did he lose his down payment?

And, if he didn't take the HELOC money, do you imagine he wishes he did?

Irvine House Address … 2418 SCHOLARSHIP Irvine, CA 92612 ![]()

Resale House Price …… $325,000

House Purchase Price … $635,000

House Purchase Date …. 1/27/2006

Net Gain (Loss) ………. ($329,500)

Percent Change ………. -51.9%

Annual Appreciation … -12.0%

Cost of House Ownership

————————————————-

$325,000 ………. Asking Price

$11,375 ………. 3.5% Down FHA Financing

4.54% …………… Mortgage Interest Rate

$313,625 ………. 30-Year Mortgage

$68,424 ………. Income Requirement

$1,597 ………. Monthly Mortgage Payment

$282 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$68 ………. Homeowners Insurance (@ 0.25%)

$361 ………. Private Mortgage Insurance

$460 ………. Homeowners Association Fees

============================================

$2,767 ………. Monthly Cash Outlays

-$257 ………. Tax Savings (% of Interest and Property Tax)

-$410 ………. Equity Hidden in Payment (Amortization)

$19 ………. Lost Income to Down Payment (net of taxes)

$61 ………. Maintenance and Replacement Reserves

============================================

$2,179 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,250 ………. Furnishing and Move In @1%

$3,250 ………. Closing Costs @1%

$3,136 ………… Interest Points @1% of Loan

$11,375 ………. Down Payment

============================================

$21,011 ………. Total Cash Costs

$33,400 ………… Emergency Cash Reserves

============================================

$54,411 ………. Total Savings Needed

Property Details for 2418 SCHOLARSHIP Irvine, CA 92612

——————————————————————————

Beds: 2

Baths: 2

Sq. Ft.: 1260

$258/SF

Property Type: Residential, Condominium

Style: Two Level, French

Year Built: 2007

Community: 0

County: Orange

MLS#: P782365

Source: SoCalMLS

Status: Active

——————————————————————————

THIS CONDO HAS OVER 100K IN UPGRADES. .. INTERIOR IS IMMACULATE. .. TURN KEY READY. ..

Off Topic: Las Vegas auction property in today's offerings

Anyone want that house? They ripped out the copper plumbing in the walls.

$635,000 to $325,000 (asking)

ouch !

is that even possible ?

Compare this former/current price…

http://www.redfin.com/NV/Henderson/74-Strada-Principale-89011/home/29600262

Appears to have sold for $1,016,728 in 2007. Listed for $289,000 in 2011. It’s under contract, unknown what final sale price will be.

Not to mention the $100k of upgrades (allegedly). Did $635k really buy such low quality that upgrades were needed? Since the outer building envelope and HVAC etc. would be off-limits, all of that upgrade had to go into kitchen, bathroom, floors and the like. A lot for 1200 sq. ft. Crazy!

IR:

1) #2418 is actually a 4 storey building, and this unit is on the top. You have used the pic for #3101, a real high-rise.

2) This is a short sale, so the listed price is meaningless.

3) Also, although the fotos make the unit look like a dollhouse in size, #2418 does have 2 parking spots. The best fotos are on redfin at 320×240.

Thanks. I updated the post. The listing didn’t provide a picture of the front of the building, so I dug one up out of our archives. I didn’t realize it was a different building.

It’s difficult to imagine how anyone thought that a high rise like this would be successful in your area, a place where everyone wants a single family home. High rises tend to have much higher maintenance and service costs for the same square footage and are unsuitable for families with children, who are very restricted in where they can congregate and play and have to be protected from “attractive nuisances” such as elevator shafts and areas where they could fall a long way. Most parents hate having to live in a high rise with young children and feel very confined and limited in them.

On the other matter, the proposed FHA legislation: a higher down payment and credit score requirement is essential to make this loan program work as intended. If you cannot maintain your score over 600 and come up with 10% at least, then you are much better off not buying. Enabling financially unstable people to buy is only setting them up for failure.

However, the best protection for taxpayers is to sunset these programs altogether. I hope that this policy change is preliminary to fading these programs and only wish it would proceed faster.

Your observation on the unsuitability of these high rises is right on. To make matters worse, these buildings are not in the Irvine school district and instead feed into the low-rated Santa Ana schools.

IR, don’t you find 600 FICO’s awfully low? They don’t even call these subprime! Youcan default on a student loan and still have a FICO in the 700’s!

700 should be the MINIMUM for taxpayer-backed mortgages.

Yes, 600 is low. The only way lenders got away with loaning to people with credit scores that low during the bubble was because the appreciation limited their default losses. Without a rising market to sell into, defaults by those with low credit scores made for much larger default losses by the lenders.

Accepting lower FICO scores is a one-way ticket to Ponzi. At first, opening a new source of buyers makes prices go up, so even when the new buyers default in large numbers, the damage is minimal. That works as long as FICO score requirements continually decline. Once standards are eliminated, as they were in the bubble, there are no more buyers to push prices up, and the default losses grow out of control.

I rent in this building in the same model as this unit and am shocked at a price north of $300k, let alone a price north of $600k (which is what my unit was purchased for…and is currently in foreclosure, of course). The perceived value of these units will slowly degrade as they age, not increase. These were originally built as apartments (from what I understand) and the cheap stucco and long hallways will turn off future buyers, not to mention the crazy HOA fees which go towards enforcing overzealous parking policies and paying for crowded yoga lessons…which I doubt do much for home values…

What does the $460 HOA buy you? Seems like a lot.

Must be cold in hell today. I’m cheering for the Republic party on an issue.

Of course, if they do raise the down-payment limits, they will either reduce them again on the day the next Republic president is inaugurated, or offset them with tax credits to those whose home values have dropped, or build a few military bases near the most heavily-affected areas – Fort Irvine AFB, anyone? – to create govermnent jobs for the sake of the homedebtors (oops, typo: should read “for the sake of the bankers”).

Sigh. Maybe it will happen. Visualize 20% down and no more mortgage-interest tax deduction. Dare to dream!

“Must be cold in hell today. I’m cheering for the Republic party on an issue.”

I feel the same surprise. The housing bubble has made for an interesting shakeup in politics.

“Visualize 20% down and no more mortgage-interest tax deduction. Dare to dream!”

I’m with you, Brother.

Hey, Regan was a democrat too once, maybe we can recruit fiscal moderates like IR back into the party, chuck the religous right and get the Republicans back to what their supposed to be about, personal responsiblity, fiscal responsibility and building businesses.

I’m sorry, Democrats are all about entitlements and unions. Personal responsiblity is not what they are about.

The Republicans MUST chuck the religious Right and its war on personal liberties if they want to succeed. This is the major reason I cannot support a Republican.

The Republicans must also end the Corporate Welfare State and take a stand for individual rights and dare to challenge corporate control of our legislature, but they will never do this. Neither will the Dems.

Both of our major parties are slaves to corporate interests and neither is interested in protecting individual rights, reforming our corrupt justice system, or our broken financial system. Both parties are slated for irrelevance and the only question is who will replace them? This is a scary question, because our politics have become so grotesque that it’s frightening to consider what maniac will fill the vacuum left by these two failed parties.

Irvine Renter wrote:

Can you show us the data that supports this statement?

With an average of 30% down and a higher than average all-cash transaction count… is this an actual statistic or maybe a bit of color?

If you asking me if I have a count of the number of loans in this price range, I do not.

At each loan amount threshold where there is a change in cost, there is always a cluster of loans. For instance, the main reason the median loan amount in Irvine hovers between $400,000 and $417,000 is because many loans are underwritten for $417,000 because conforming loans are cheaper than jumbo-conforming.

The same holds true at $729,750, but not to the same degree as $417,000 because there are fewer loans underwritten at this amount.

There are many borrowers who can currently qualify for loans between $625,000 and $729,750 under GSE guidelines that will not be able to qualify after October 1 under jumbo guidelines. Further, those that still do qualify will be paying a higher interest rate when they go jumbo, so if they are stretching to get to $729,750, they will not qualify for such a large loan when they are forced to pay jumbo interest rates.

The slow sales of the recent Irvine Company offerings are testament to the difficulty in getting financing at these higher price ranges. The buyer pool who can afford jumbo financing and have large down payments is not very deep. If it were, sales at those price points would be better.

But your assertion is that “markets like Irvine where GSE financing between $625k and $729+k is common“.

You have the data for the average down payments, so you should also have the data for number of transactions that have loan amounts in that range for Irvine in the last X months/years to prove if it’s “common” or not.

Here’s something I posted a while back when this new limit was discussed earlier courtesy of IrvineRealtor/Scott Gunther (and this is regarding FHA only):

I’m just asking you to qualify that statement because I don’t think it is as common as you state. You’re making quite a leap from the lowering of the jumbo conforming limit to “saving a market like Irvine” that may not need such a save if the limit is not that much of a factor in Irvine purchases.

While you contend that it will disqualify some or maybe extend others, I can also contend that some will just put more down or that others can afford the higher rates above the new conforming limit. Don’t you think someone will step in with loans/programs/interest rates that will fill that gap with some fancy term like Jumbo Conforming Plus?

As to the slow sales clip for the new homes… I think there is more to that than just affordability and the ability to get financing. Quite simply… they are just not worth the prices TIC is charging (in my opinion). People can buy them… they’re just pickier in 2011 than 2010.

I would have assumed FHA loans were near non-existent in Irvine…but FHA is the smallest GSE. How many are Fannie/Freddie loans? Or loans that would eventually be sold to Fannie/Freddie? I would imagine that number would be significant.

The jumbo market is moving a lot more than it was, and banks are again doing piggy-back 2nds to get the firsts to conforming, so I would not see a huge impact on sales or prices.

Wouldn’t the relevant data be the percentage of Irvine homes in the $625,000 to $729,750 price range that are FHA financed? If the percentage is, say, 1% then we would expect basically no effect. If it’s 20%… huge effect. The average down payment by itself doesn’t tell us how big the affected segment is. I don’t know what the data are but agree that it’d be interesting to see.

Yes. See my response to IR above, based on data from last year, that percentage is 1.62%.

Thanks IHO. Just to be clear though, 1.62 is the percentage of FHA financed homes in that price range as a percentage of all sales in Irvine at all price ranges. Whereas I was asking what percentage were FHA financed in that price range.

Nope, the 1.6% is the percent of all FHA loans. (1.6% of all loans are FHA in Irvine and 95% of those are below $417k). The number you are looking for is much lower than 1.6% there is basically no impact on Irvine. Much a do about nothing. Basically FHA loans are non existent in Irvine, and a good portion of those who use the FHA loan don’t even need it. Why does IR continually use FHA financing in examples? Good question, it’s ignoring all factual data, he shouldn’t be using it in examples. He shouldn’t be using it to rationalize anything.

That’s not what IHO said. He states that 7.5% of loans in Irvine are FHA, and 1.6% are FHA over $648,186. Based on his numbers, and the median selling price in Irvine, the number I’m looking for is probably somewhere around 4%.

Correction: “sales” not “loans”.

Yet another article today. Double dip confirmed,

http://finance.yahoo.com/news/Home-prices-Doubledip-cnnm-516185177.html

FCB Miami style

The night is the darkest right before dawn. Now that everyone and their grandmother are denouncing real estate it is time to buy, just as it was time to sell when everyone was flipping houses. Most bears missed the 100% stock market rally because the world was going to come to an end. Also, a lot of houses are now cheaper to rent than to own and we will see significant inflation in the coming years against which real estate traditionally has been a hedge.

I am bullish for those very reasons in markets where the valuations are supported by income affordability. Unfortunately, that isn’t here.

That might be the case for Irvine (and I am aware that this is the Irvine Housingblog) but in communities such as Aliso or Laguna you can now buy SFHs for $450k. With a $50k down payment that is pretty affordable for a family with one higher income or two median incomes. There are many families living in the IE who would love to minimize their commute or live closer to the water (and save a few hundred $ on A/C). These prices could also attract people from other parts of the country.

Somehow I don’t see much of a downside given that coastal SoCal will always be a very desirable location to live in and we have reached a level where housing becomes affordable for families with decent credit scores and median incomes. If I also assign a positive value to not having to deal with a landlord and take the inflation risk into consideration I see these (non-Irvine) areas as a buy.

Could you provide some examples of SFH in aliso or laguna (I’m guessing you mean ‘niguel’, not ‘beach’) that have sold for $450k?

Thanks

I just bought a 3 BR SFH in Aliso in good condition and built in the 90ies for between $450k and $480k; there are a few sales like that every month. Very low HOA but there is an additional $1.5k Mello Roos per year but overall it was well worth it since we save significantly over renting a 3 BR SFH. I might have to live with another 5-10% loss but that’s fine since I can hold on to it. Also, as I described above I think we are getting to a level where these houses 15 min from the beach become affordable again…

If you think it such a hot market to buy, are you buying?

I agree. I threw in a extra $100,000 to get a house on a bigger lot and 3 car garage near the top of the hill in Foothill Ranch. Homes in the mid $400,000s can be had lower down the hill.

Payment with PITI 30 yr fixed is $2,700. Can’t rent for that. Yes, I have my down payment tied up, but I am ready to move out of fiat currency at this point.

Gave up buying in Irvine.

> Payment with PITI 30 yr fixed is $2,700. Can’t rent for that.

You can *always* rent a smaller condo for less than $2,700/month.

So that is not a valid argument for buying, and I wish homeloaners would stop trotting that out as some kind of rental parity trump card.

More accurate would be, “I found that I could overbuy and stoke my vanity at the same time for $2,700/month.”

“Payment with PITI 30 yr fixed is $2,700. Can’t rent for that.”

Dude, how nice a house we talking about here? I did a quick search for Lake Forest / Foothill Ranch and found some pretty decent sub $3000 SFR listings.

When it comes to Saddleback Valley, prices are low enough for buying to make sense for some people, but they’re definitely not low enough to make buying a no brainer.

Congrats, right decision. You can’t time the market perfectly but the pendulum has swung too far to the other side for some desirable but less expensive areas outside of Irvine. And no, I cannot (and won’t be able to in the forseeable future) rent a 3 BR SFH with garden for ~$2k a month (which is what my monthly payment is).

“I could overbuy and stoke my vanity”

Correction: I could afford to buy a much bigger, more expensive house. I way under bought and will be adding to the small condos I already own with the rest of the cash.

The family and I have been living in a 1,000 SF small house for 6 years now waiting for the housing storm to clam down. I also lived for 10 years in a 500 SF studio I own. I can live big and small.

You sound unhappy I spent years saving and bought a house I will be happy to live in for years to come at a price it would be hard to rent the same house for.

It was a short sale I picked up at about $80,000 under market. I would not pay full price, market is still to rich for that.

I don’t care where you live.

But using the argument that your mortgage payment is lower than some arbitrarily high rental makes it a deal is absurd.

Just because there’s a rental somewhere for $10,000/month doesn’t mean you’re obligated to rent it, and paying $9,999/month for a mortgage doesn’t mean you’re “saving money on rent” in comparison.

Either way you’re overpaying.

“Also, a lot of houses are now cheaper to rent than to own ”

OK.

How did you get that photo of the LV interior?

I continue to think that Las Vegas could make a great retirement spot. I don’t know what health care is like there, and old folks like to avoid higher crime areas, but it has a lot going for it.

Warm weather, cheap houses, adult entertainment, golf, and maybe continuing ed classes at UNLV. Do casinos hire oldster part-timers? Lots of retiring baby boomers looking for easy pt jobs….

With 5% down the new “owner” is already 8% underwater. The plus side for the borrower with 5% down is a possible 2 years of squatting that will put the borrower 10% ahead of the renter, who will be evict after 90 days and face a judgement. I really don’t see the govt GSE raising the downpayment because it will not be in the banks’ best interest. The banks need to transfer liabilities to the taxpayers.

There are lots of larger condo’s in Irvine that rent for under $3000 per month.

What are the SFH rents in Aliso Viejo, Laguna Nigel, Foothill Ranch or San Juan Capistrano? The closer to the beach the better. Does that normally include extra’s such a garden service, water, etc.?

Clarification: Govt might raise the downpayment requirement after enough of the liabilities are taken off the banks responsibility. The will trigger back to proper pricing, i.e., another crash. After the crash, the downpayment requirement will be relaxed again for another cycle.