Most major lenders stopped processing on loans over the conforming limit intended for sale to the GSEs. In July, both sales and prices declined statewide. Is there a connection?

Irvine Home Address … 3742 CLAREMONT Irvine, CA 92614

Resale Home Price …… $659,500

There was no help, no help from you (Thunder)

Sound of the drums

Beatin' in my heart

The thunder of guns!

Tore me apart

You've been – thunderstruck!

Rode down the highway

Broke the limit, we hit the ton

AC/DC — Thunderstruck

The heartbeats of sellers are racing a little faster. Prices are falling and sellers are becoming more motivated to sell before prices fall further. The high end of the market has been thunderstruck. The conforming limit broke, and the market is hit by a ton of inventory. The high end collapse has finally begun.

New lower conforming loan limit impact on Irvine, CA

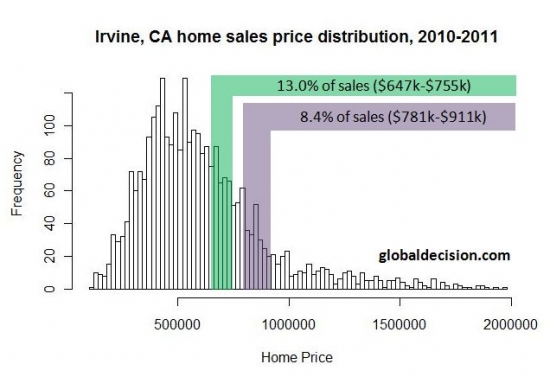

The above chart shows the distribution of home prices for all sales under $2M in Irvine, CA from 1/1/2010 through 7/31/2011. Irvine, CA is an expensive sub-market of an expensive region (Southern California). As a result, it is likely to feel any impact from lower conforming home limits more than most other places.

Based on the chart above, it's hard to argue that tighter loan standards and more expensive debt will not impact the upper third of the Irvine home market. Just wait until the increase in the conforming limit enacted in 2008 is completely removed and every loan over $417,000 is subject to jumbo financing. That will impact over half of the Irvine market.

With that in mind, we’ve identified two potential price ranges that could be most impacted by the new limits. The green band represents homes that have selling prices where a 3.5% down payment represents a loan between the old limit ($729,000) and the new limit ($625,000). These properties represent 13.0% of all home sales in Irvine, CA.

For the sake of clarity, this is not to say that 13% of sales used FHA financing. But this is the price range were FHA financing will no longer be bidding on properties. Fewer bidders make for less buyer competition and lower prices.

For the taxpayer’s sake, let’s hope that not many of the buyers in this price range are using only a 3.5% down payment. Those buyers are likely to be underwater soon as we predict continued downward drift in higher end home values in Southern California. These buyers represent one end of the spectrum.

FHA buyers in this price range are candidates for strategic default. They will almost certainly submerge beneath their debts, and they may not breathe the air of equity for many years.

realtors have been creating a false sense of urgency with these buyers cajoling them into buying by stoking fears of being priced out. I pity those who fall for that bullshit. Any of those buyers will be priced-in for years trapped in their homes as prices fall to the new equilibrium of affordability.

On another point (but not the end, which would be “all cash” buyers) of the spectrum, we have buyers who put down 20%. At current Irvine, CA valuations, this is a substantial down-payment of around $170,000. For this level of royalty, we’ve used a purple band in the chart above. Using a 20% downpayment, 8.4% of sales in Irvine, CA would be impacted by the gap between the old and new conforming loan limits.

The purple band is the market segment most at risk. The buyer pool in this segment is very thin, and the supply is very large.

.jpg)

These are estimates — buyers in the green and purple bands have a few options. In order of long-term common sense for the buyer they are:

1. Pay less. Leverage seller fear that the loan limits really will reduce demand and correspondingly demand a lower price.

For sellers who are not delusional, the reality of the situation should increase their motivation. Sellers have stoked fears in buyers for years with nonsense like “buy now or be priced out forever.” The reality today is sellers are facing lower future prices. If they don't sell today, it will be several years before they can obtain today's prices again.

2. (tie) Put more down. Buy down the loan amount so that it becomes conforming.

3. (tie) Delay the purchase. The price-lowering impact from this change will be slight, but will occur over time. With an ongoing slow economy and prices above rental parity, there are no upward drivers for Irvine, CA home values.

4. Use “creative” financing. Pay the asking price but increase your monthly carrying cost for the term of the debt obligation.

I never advise anyone to use any form of creative financing. It is an option one should never consider.

Even though the higher limits don’t go into full effect until 1 Oct 2011, the delays involved in funding a loan will require that banks and brokers use the new limits as soon as possible.

I have heard reports from buyers that B of A and Wells Fargo have already stopped underwriting loans above $625,000 except as jumbo loans. It is likely the dramatic drop in sales in July was exacerbated by this fact.

Mitigating factor: long-term rates, paradoxically, plunged after the US downgrade. One can argue that it makes little sense that a downgraded asset class would be seen as safer after the downgrade, but that’s what Mr Market has said. Because rates are so low, investors will likely be interested in more non-comforming loans as the government makes its slow but necessary disengagement from being the mortgage underwriter of last resort.

Southern California home sales and prices fall again in July

August 15, 2011

Home sales in Southern California fell to their lowest level for a July in four years — though the decline from a year earlier was the smallest in 13 months. The median price was down 4% to $283,000.

This is July. House prices and sales typically do not decline in July. What is going to happen this fall in winter if we are seeing declining sales and prices in July?

The drop in sales from June was more pronounced, especially for houses that cost more than $500,000,

I believe this is directly related to the change in the conforming limit. High end sales were weak before because (1) prices are too high relative to incomes, (2) asking prices have been declining as a sign of seller capitulation, and (3) an abundance of high-end inventory greatly exceeds the depth of the buyer pool.

In reality, what is prices as high-end homes here in Orange County are not really high end. Many houses in many neighborhoods were elevated to high-end price levels from the foolishness of the bubble, and prices are yet to fully deflate. The market for high-end houses only appears weak because so many houses are delusionally priced as if they are high end when they really aren't. The correction in pricing is one of seller's perceptions. The market will force reality on the delusional masses in time.

as the job market sputtered, economic uncertainty intensified and some potential homebuyers got cold feet, real estate information service Dataquick said.

A total of 18,090 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in July. That was down 11.9% from 20,532 in June and down 4.5% from 18,946 in July 2010, according to San Diego-based DataQuick.

Those are very bad numbers. The declines this fall and winter should be substantial, particularly at the high end.

“The latest sales figures look a bit worse than they really are, given this July was a fairly short month, but they still suggest some potential homebuyers got spooked,” said John Walsh, DataQuick president. “Reports on the economy became increasingly downbeat and, no doubt, some people fretted over the possibility the country would default on its obligations.”

July was a fairly short month? Last I checked the calendar, July still had 31 days. WTF is he talking about? John Walsh's consistent market cheerleading has all but eliminated his credibility as a market commenter. He has embraced his role as a realtor shill.

Some wise renters likely did chose to sit on the sidelines, but the drop in sales is more likely a reflection of the fact that the buyer pool is diminished, and prices are too high relative to incomes in most of Coastal Southern California.

Prices also continued to slide. The median, the point at which half the homes sold for more and half for less, has declined year-over-year for the past five months. It has been unchanged or lower than a year earlier each month since last December, when it posted a 0.3% annual increase.

Take a look at the bar graph above again. The first and second quarters of the year are the two which historically post the largest gains in prices, yet prices have declined steadily during that time. There are no signs sales or prices will pick up during the fall and winter when they usually decline.

“If there’s a shred of good news in the data it’s that last month’s sales weren’t much worse than a year earlier,” Walsh said. “For the first time in many months, we get an apples-to-apples comparison to year-ago sales, given that in July 2010 the market lost its crutch — federal homebuyer tax credits.”

Yes, we have our first apples-to-apples comparison, and according to Dataquick's data, sales were down 4.5% from last July's weak numbers and prices are also lower. Most market analysts noted the figures for June and July 2010 were very low because the summer demand was pulled forward to April and June 2010 due to the tax credits. Therefore, we are below what was already and artificially low number. That can't be good.

Ponzi borrower gets over two years of squatting

Today's featured property falls in the no-man's land above the new conforming limit. FHA buyers can no longer afford this property with 3.5% down.

The former owner managed to quadruple their mortgage, then they got to squat for over two years when they couldn't make the payments. Rather than selling the house for a half-million dollar gain and walking way with a sizable check, they endured a foreclosure, they are flat broke, and their credit is trashed.

- This property was purchased on 2/20/1987 for $170,000. The owners original mortgage information is not available, but it's safe to say it was less than $170,000. In all likelihood, they put 20% down back in 1987.

- On 10/1/1999, they refinanced with a $292,000 first mortgage. They had already gone Ponzi with over $122,000 in mortgage equity withdrawal.

- On 3/30/2001 they refinanced again with a $340,000 first mortgage.

- On 3/15/2002 they obtained a $75,000 stand-alone second mortgage.

- On 3/17/2003 — do you see a yearly pattern here? — they refinanced with a $448,000 first mortgage.

- On 1/26/2004 they got a $520,000 first mortgage.

- On 2/25/2005 they were approved for a $130,000 HELOC.

-

On 5/14/2007 they obtained a $554,000 first mortgage and a $240,700 HELOC.

- Assuming they maxed out the HELOC, total mortgage debt was $794,700.

- Total mortgage equity withdrawal was $624,700.

- Assuming the NOD followed after 90 days of delinquency, total squatting time was at least 27 months.

Foreclosure Record

Recording Date: 04/22/2011

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 08/11/2009

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 05/06/2009

Document Type: Notice of Default

The bank finally took this one back on 5/25/2011 for $492,109. They dropped their opening bid to find a third-party, but nobody stepped up to buy the place. The lender must really believe they have a gem as they are pricing it about 30% higher than they paid at auction. If they get anywhere near their asking price, the flippers missed a good deal. Given the plethora of negatives with this property, I doubt they get over $600,000.

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 3742 CLAREMONT Irvine, CA 92614

Resale House Price …… $659,500

Beds: 5

Baths: 4

Sq. Ft.: 2754

$239/SF

Property Type: Residential, Single Family

Style: Two Level, Other

Year Built: 1970

Community: Westpark

County: Orange

MLS#: S660785

Source: SoCalMLS

Status: Active

On Redfin: 82 days

——————————————————————————

This Two Story Home Features Five Bedrooms and Four Baths, No Mello Roos, Low HOA Dues And An Association Pool And Spa, Tennis Courts And Clubhouse.

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis![]()

Resale Home Price …… $659,500

House Purchase Price … $492,109

House Purchase Date …. 5/25/2011

Net Gain (Loss) ………. $127,821

Percent Change ………. 26.0%

Annual Appreciation … 123.0%

Cost of Home Ownership

————————————————-

$659,500 ………. Asking Price

$131,900 ………. 20% Down Conventional

4.19% …………… Mortgage Interest Rate

$527,600 ………. 30-Year Mortgage

$129,520 ………. Income Requirement

$2,577 ………. Monthly Mortgage Payment

$572 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$137 ………. Homeowners Insurance (@ 0.25%)

$0 ………. Private Mortgage Insurance

$60 ………. Homeowners Association Fees

============================================.jpg)

$3,346 ………. Monthly Cash Outlays

-$422 ………. Tax Savings (% of Interest and Property Tax)

-$735 ………. Equity Hidden in Payment (Amortization)

$197 ………. Lost Income to Down Payment (net of taxes)

$102 ………. Maintenance and Replacement Reserves

============================================

$2,488 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,595 ………. Furnishing and Move In @1%

$6,595 ………. Closing Costs @1%

$5,276 ………… Interest Points @1% of Loan

$131,900 ………. Down Payment

============================================

$150,366 ………. Total Cash Costs

$38,100 ………… Emergency Cash Reserves

============================================

$188,466 ………. Total Savings Needed

——————————————————————————————————————————————————-

First-time homebuyer’s presentation 6:30 Wednesday, August 24, 2011

Everyone is invited to our first-time homebuyer presentation. Put it on your calender for Wednesday evening. I look forward to seeing you there.

All of the established lenders stopped originating these loans August 15th. There are still a few shops pulling in loans that are above the $625,500 limit. You have to be a plain vanilla as possible (W-2, not Self Employed, no FHA, no gifts, significant equity if refinancing) and there is no certainty of closing. With the amount of new refinance business out there, the likely chance of closing if your new loan started today is pretty slim.

The loan limit change impacts not only purchases, but the refinance market. I’m getting a call per day from people who funded at 4.875% or higher wanting to refinance to 4.x or lower with some taking ARM programs in the mid 3’s. These homeowners are now stranded, unable to reduce their house expense without a significant principal reduction.

On the one hand come October the confluence of slowing sales, crushed buyer confidence, and restricted loan limits should finally register with sellers. A mad rush to the exits may finally start. On the other hand if the Temporary Limits are restated, another Gubmit induced sales price sugar high will keep prices artificially supported. We’ll soon see who has the stronger lobby: bankers and the NAR, or the debt resistant citizenry. Interesting times we live in, don’t you agree?

My .02c

Soylent Green Is People.

Yes – it will be very interesting indeed if the temporary loan limits get extended “temporarily” again. If I was betting on this, I’d put my money on the banksters/NAr, and if they win come October all of us fence-sitters will need to tack on several more years (maybe another decade?) of waiting/investing outside of SoCal RE. There will be zero doubt who runs this country if it comes to that.

I’d bet against the banksters/NAr on this one. They may have prevailed in Washington a couple years ago but this is just the kind of deal that the Tea Party can’t stand and I doubt the Dems want to waste any polical capital fighting the Tea Party to save banksters. The Dems would only fight it if they could add some sort of “foreclosure” prevention to it which would require banksters to write down principal (see todays NY Times opinion page) and banksters are not going to go along with that.

I don’t get it. Why is it so important to reduce limits?

Is it because this limits exposure to FNM/FRE? Or, is it because we want prices to fall?

If it’s because of the former, I believe there are many arguments that in places like OC, stable jobs are more plentiful than elsewhere, so that argument doesn’t really hold water. People also get paid more here than many other places. Owning in the present rate environment can also be cheaper than renting. Why not just require 20% down for lower rates? Oh, I forgot, we already do that for FHA PMI. Why again?

If it’s because we want prices to fall, that’s somewhat of a self fulfilling prophecy. Without a healthy banking sector, there are few lenders that can make reasonable money without leverage, something that is not necessarily a bad thing (especially when the goal is to promote the economy through lower rates). And, more importantly, that’s sour grapes.

I was a bubble sitter too, but don’t just sit around and complain, find a way to profit from the inevitable.

The writers of this blog did.

Chuck

I think reducing limits was a political expression about the liabilities of the government through Fannie and Freddie.

No one is saying you cannot get a loan. The Feds are saying you cannot get a government subsidized rate through it’s implicit guarantees for any amount over $625,500 or get a mortgage with less than 20% down over that amount.

Don’t like the rate you’re getting on private financing? Don’t have the funds to put 20% down? Too bad. There is no legitimate reason to keep loan limits up at $729,750, and barely one at $625,500. If people earn more in OC, they should be saving more for a house – a prudent direction to head in these uncertain times. You can still leverage the heck out of your home purchase by borrowing against your retirement plan instead of TBTF banks. No one is stopping anyone from purchasing, but there are realistic restrictions being put in place.

Had FNMA and FHLMC reduced the $417,000 loan limit in 2005 and they had wanted to, many of the problems before us wouldn’t have come to pass. It was the Banker / NAR cartel who wanted the limit retained. They sowed the wind and reaped the whirlwind because of it.

How about to reduce the entitlement spending on the rich?

And yes, anyone who can spend $730k (or even $630k) on a house is rich.

Why should the government use the tax money of the rest of us to support the rich’s housing addiction?

That house is so lovely!

I only wish that they had commented that it backs to the “culverdale wilderness park”, surely that would have supported the $234/sf offering price!

We cannot forget the mortgage provision in the Graham Dodd bill that will become active April 1st of 2012.

ALL MORTGAGES GOING FORWARD WILL REQUIRE A MINIMUM 20% DOWN.

When added all up, Declining housing market, lowering of the conforming limit, rising down payment requirements, and bad economy………

I think we may be looking at Armageddon for the residential real estate market.

did this proposal pass or is it still being debated? maybe in Irvine, the 20% down requirement may not have much inpact; however, it will certainly impact other surrounding areas which will impact irvine indirectly. everywhere, the high end will get hit quite hard. 20% down and lowered jumbo loan requirement? no more FHA, not that it should impact Irvine anway? Looking for more clarification. thanks

Interesting times indeed. On a completely different note, I noticed signs in Harvard Circle Park, that using your cell phone for talking OR texting was not allowed. I didn’t think it was possible to ban cell phones from parks, but dayem, leave it to freedom loving Irvine to do so.

Yet another reason to not buy and live in Irvine. I’ve said it before, and I’ll say it again, America is not the most free country in the world. How could it be, yet support such a strong prison industrial complex?

Interesting times indeed. On a completely different note, I noticed signs in Harvard Circle Park, that using your cell phone for talking OR texting was not allowed. I didn’t think it was possible to ban cell phones from parks, but dayem, leave it to freedom loving Irvine to do so.

Yet another reason to not buy and live in Irvine. I’ve said it before, and I’ll say it again, America is not the most free country in the world. How could it be, yet support such a strong prison industrial complex?

This is Off Topic IHB, but last week I was sued in court by a collection agency that bought 5500 worth of bad credit card debt from a well-known bank, then added over 2K in fees.

Having throughly researched and participated in a foreclosure lawsuit that resulted in my mortgage company halting my foreclosure, I used an IL Pro Bono legal aid website tutorial to fight the debt collection agency.

I felt justified, since I never had an agreement to pay any collection agency, or no specific memory of anything that the collection agency alleged in their complaint.

I was able to have my lawsuit terminated by demanding that they produce evidence of the original contract that led to the purchase of my alleged debt, assignor and assignee documents, amount of purchase consideration, and dates of all of my alleged purchases.

The IL Collections Agency Act, Uniform Commercial Code and IL Civil Code of Procedure are powerful tools that helped my situation.

I told myself that I would use 10% ($770) of the savings to buy my family something nice!

You borrow money to buy something and you never pay it back, and you feel justified? You should feel like a thief.

Would you want to be living that guy’s life? I wouldn’t. Way better things to do with your time than hanging out in courts and studying ways to avoid paying your debts.

Congratulations to the proud family of ChicagoWalkAway. Enjoy your new toys!

So Pez ……if a business goes bankrupt and doesn’t pay their creditors, they should be charged as thieves?

How about the untold amounts of millionaires that have been BK at one point or more of their lives? Are they thieves?

Why is it the working class that is only held to ethics and morals?

Yeah he’s a thief, but moral hazard in this country has already taken root. You are either a thief, or sit idly by as other people profit from gaming the broken system.

I’d game it.

Government workers can wait until their last year to get as much overtime and vacation pay so they have the highest pension when they retire. That’s gaming the system…and everyone should do it…and this will cause systemic failure which will finally lead to real change we can believe in, not obamas’ change.

game the system!

game the system!

game the system!

Not only is this deadbeat profiting from the system, but he is causing others to pay higher interest rates to make up for his behavior. Then, he comes on here and boasts about his “accomplishments.”

This guy is a prime example of why we should bring back debtor prisons.

Your frothing at the mouth about debtors prison for a guy who owed $5500, but you still vote for people who have allowed banksters to walk away with billions of taxpayer money.

Good ol’ Orange County. Next thing you know, ol’ Pez will want to bring back slavery….for debtors only of course. Perhaps “indentured servant” would sound better in republicanville no?

Whoa pal, don’t get your panties in a bunch!

I am not boasting, but this blog has many readers some of which may be in financial trouble. I was only trying to illustrate how I, a blue collar worker was albe to defend myself in court.

The law is the law, and it should apply to all of us equally, citizens, politicians, insitutions, and corporations. You do remember the consitution, right?

Corporations have a duty to follow the law, not ride roughshod over civil procedure because individuals are not aware of laws that are designed to protect them against false debtor claims. (False notes, forged documents, etc.)

I didn’t go into court to “game the system”. But after experiencing a situation in which two separate banks demanded that I pay them my mortgage, I am now from Missouri. You have to SHOW me the proof.

By the way sir, we already have debtor prisons: Citizens who are arrested for contempt of court because they violate a court order to pay their bills. No matter how bankrupt or insolvent they may be…..

“I felt justified, since I never had an agreement to pay any collection agency, or no specific memory of anything that the collection agency alleged in their complaint.”

I understand your point of view on this one. When the original lender sold the right to collect, they were basically writing it off.

I think most people have a guttural revulsion to debt collectors, and those who have no connection to the original lender are even more repugnant.

That being said, reactions like Pez Dispenser’s will also be common. For some the issue is more black and white. I think it would be easier to digest if you went through a bankruptcy so your debts could be legally purged.

“I think it would be easier to digest if you went through a bankruptcy so your debts could be legally purged.”

I understand your position, but that is just it.

With all due respect, my debt was legally purged when the debt collector was unable to prove standing as required in the IL Civil Code of Procedure and the IL Collections Agency Act.

I didn’t mean to imply what you did was not legal. The problem you will face is having to defend yourself over and over again. If you declare bankruptcy, you can wipe out all the old debts for good, and none of the zombie debt collectors can bother you again. Unless you do that, you will likely have to face repeated attempts by debt collectors to get something from you. It becomes a drain on your time.

It sounds like Illinois has some very debtor-friendly laws. Perhaps that will stop lenders from trying to enslave the population there. We can only hope.

Well, ya’ll better move to Austin like we did! NO STATE TAX and NO FALLING HOUSE PRICES! BBQ!

The Official assessment has prices in my neighborhood going up ten percent a year. I can’t tell you of too many other housing markets where this kind of appreciation still exists.

move to texas

that’s funny

when was the last time it rained there ? 2nd clinton term ?

and tell us a little about the school tax on your house ; u seem to have left that part out

I’ve had this argument with folks in my market area, Manhattan Beach. There’s a misconception that conforming loan limit changes don’t apply to markets where most homes are valued higher than the limit. If each market were its own isolated world then that might be the case. The truth is that everything is connected, and declines in prices for markets priced on the margin will effect everyone.