Despite the optimism for a better 2010, house prices are not going to rise, HELOC money is not coming back, and the giant house party of the 00s has come to an end. Properties like today’s are a symptom of our collective hangover.

Irvine Home Address … 34 CAPISTRANO Irvine, CA 92602

Resale Home Price …… $840,000

{book1}

The party’s over

It’s time to call it day

They’ve burst your pretty balloon

And taken the moon away

It’s time to wind up

The masquerade

Just make your mind up

The piper must be paid

The Party’s Over — Nat King Cole

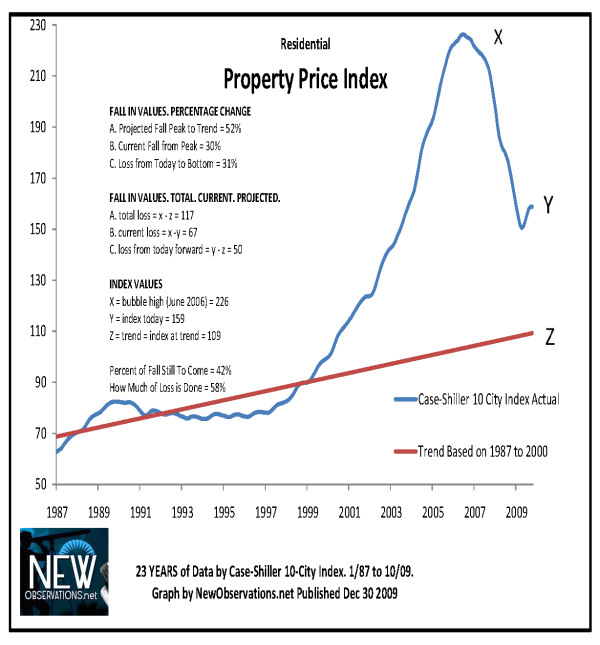

People have not accepted the fact that the The Party’s Over. Even our government and banking oligarchs are trying to re-inflate the housing bubble to avoid the consequences of their greed and incompetence. The mainstream media is full of stories about the bottom for house prices, many are planted by the NAR or their shills, but these stories reflect a concerted effort to either sell overpriced homes or keep people paying oversized loans. Some reporters and bloggers are telling the truth, and today I want to examine why house prices will decline in 2010, and why I am only predicting a small decline in the aggregate median numbers.

Prices are too High

The basic argument as to why prices will fall is not complex; prices are still too high by historic measures. As a recent article quipped, “…we

still have a 30% fall ahead of us and, as you know, we have a 30% fall

behind us. Better send in your mortgage payment.”

Calculated Risk put it this way: “House prices are not cheap nationally. This is apparent in the

price-to-income, price-to-rent, and also using real prices. Sure, most

of the price correction is behind us and it is getting safer to be a

bottom caller! But “cheap” means below normal, and I believe that is

incorrect.”The efforts of the Federal Reserve and the GSEs to reinflate the housing bubble have made payments affordable, but only falling prices is going to make houses truely affordable by conservative metrics.

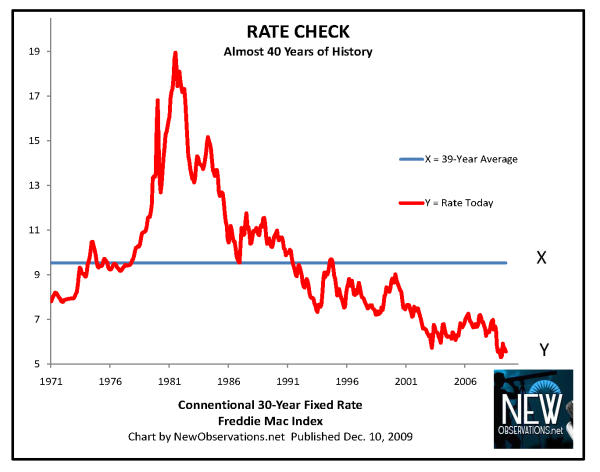

Mortgage Interest Rates will go up

This is also a simple argument; interest rates are nearly zero, and based on the long-term chart, it looks like rates must move higher.

Perhaps the best evidence for concluding interest rates have bottomed and will soon move higher comes from Ben Bernanke, Chairman of the Federal Reserve, who recently refinanced his ARM to a fixed-rate mortgage. Our central banker converted to fixed because he knows the FED is not going to push interest rates lower. Actions speak louder than words, and Ben Bernanke called the bottom in fixed-rate

interest financing without saying anything.

How high will interest rates go in 2010? Morgan Stanley thinks they could hit 7.5% in 2010. That would be an unmitigated disaster for the housing market.

Lenders would rather see Real Estate’s Lost Decade. They don’t care if real estate prices go up as long as debtors are making their payments, but further price declines will create more losses, and they would rather see a slow and orderly increase in mortgage interest rates to support prices. It probably will not happen that way.

Foreclosures will Increase

CNN Money recently published an article titled, 3 reasons home prices are heading lower, where the authors cited (1) foreclosures, (2) rising interest rates, and (3) the end of the tax credit. Rising interest rates was mentioned above, and tax credit props made my list of caveats as to why people may not want to buy now. Foreclosures and Shadow Inventory made my list of 2009 Residential Real Estate Stories in Review, and it is the biggest unknown facing the market — it isn’t unknown as to whether or not this inventory exists; it does, what is unknown is when this inventory will hit the market. This inventory may be released and push prices lower more quickly, or it may be withheld to stop prices from falling. The lending cartel may wish for a slow release, but the instability of the cartel will probably make for a quicker one.

The median declines less than the values of individual properties

The changing mix — more sales will occur at the high end — will serve to make the reported median higher, it will not reflect increasing quality in what people are getting for their money, particularly individual properties at the high end which is likely to fall much more than the 2%-5% I am predicting.

The high end is rather unique because current comps are so few and far between that is is difficult to accurately measure what those houses are worth. Our market is characterized by high end delusion with many more properties currently asking prices that only a few buyers can afford. The plethora of high-end inventory — when the actual distress is reflected in the market — will cause large declines in the values of these properties. This will reverberate through the housing market as people substitute up to better properties for less money.

The net effect of more high-end transactions at lower price points is that the median changes very little; people are still spending the same amount of money, but the quality of what buyers get for this money is much higher. We can see 10%-20% drops in the prices of high end properties without much impact on the median, and this is exactly what I believe will happen.

For evidence of these forces in the market, examine today’s featured (previously) million dollar plus property.

Irvine Home Address … 34 CAPISTRANO Irvine, CA 92602

Resale Home Price … $840,000

Income Requirement ……. $180,523

Downpayment Needed … $168,000

20% Down Conventional

Home Purchase Price … $1,127,000

Home Purchase Date …. 6/9/2006

Net Gain (Loss) ………. $(337,400)

Percent Change ………. -25.5%

Annual Appreciation … -7.8%

Mortgage Interest Rate ………. 5.33%

Monthly Mortgage Payment … $3,744

Monthly Cash Outlays ………… $4,910

Monthly Cost of Ownership … $3,690

Property Details for 34 CAPISTRANO Irvine, CA 92602

Beds 4

Baths 3 baths

Size 3,000 sq ft

($280 / sq ft)

Lot Size 4,090 sq ft

Year Built 2002

Days on Market 68

Listing Updated 12/31/2009

MLS Number S600110

Property Type Single Family, Residential

Community Northpark

Tract Bela

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Beautiful home in Northpark gated community with main floor bedroom with full bath, berber carpet, customized ceramic tile, granite counter tops and much more. In addition, there are also fountains in the front and back entrance.

The owner of this home paid $1,127,000 and timed the peak of 6/9/2006. He used a $845,250 first mortgage, a $169,050 second mortgage, and a $112,700 downpayment. The second mortgage on this property is listed as a HELOC, so the lender loss is completely dependent upon how much the borrower took out. I assume the max as this was opened at the closing as a purchase money mortgage. Perhaps someone more knowledgeable can comment on the recourse implications of a purchase money mortgage HELOC. How much use disqualifies a HELOC for non-recourse protections? This owner is probably asking an attorney these same questions, and I suspect the answers will not be favorable.

Homeowners are extremely leveraged. Without a return on their investment, many will succumb to the weight of their debt service payments and wash through the foreclosure system.

Watch the foreclosure phenomenon here under the telephoto lens of the Irvine Housing Blog.

In tGHB you list mortgage rates as: base-rate + inflation-expectateion + risk premium. Is Bernanke really going to raise rates with double-digit unemployment? I’m sure he will be reminded of the dual mandate of the fed. Let’s say it’s inflation expectations that actually happen (if expectations aren’t met then rates would go back down). General inflation would impact home prices too, wouldn’t it? I would not assume 1-1 impact, and wouldn’t apply it to bubble areas where there is still a large price-rent instability. You could have nationwide home prices increasing while local prices in still bubbly areas decreasing.

A lot of the mortgage rate increase will be linked to general inflation that will push home prices up, in a national sense. I think that impact will be much less than the impact of foreclosures. I also think there are two scenarios for the tax credit: [1] housing market and general economy strengthen, lessening need for credit (not what I predict) [2] housing market further deteriorates, combined with still double-digit unemp, and the credit is extended again.

How much of an incentive is the tax credit compared against the massive investment opportunity of real estate (double-digit yearly appreciation) combined with exotic low-payment financing (general conditions in the bubble)? Wouldn’t anyone who would have been a first time homebuyer would have been pulled more strongly by the bubble than an 8k tax credit?

The Fed only controls short-term rates. Long-term rates are controlled by the market

The fed directly impacted mortgage rates through its 1.25Tln of MBS purchases.

I understand that it is better to use something like the 10 year treasury rate, but even then much of the expectation of increased mortgage rates is from inflation expectations. Normal 10 year treasuries have inflation baked in that you can calculate out by looking at the difference between them and 10 year TIPS.

That 1.25Tln only bought a 50 basis points for about a year. Imagine the cost of doing it for 5+years at 5%plus rates.

The FED would be the only ones holding mortgages… which they’re not in the business of doing, never mind the moral hazard of doing so.

The bigger question is inflation expectations. Personally, I think that these will remain subdued for a long time because I think the economy is in worse shape that the consensus… Only time will tell.

Chuck Ponzi

FHA makes the loans. Fan and Fred buy the loans and securitize them. The “Market” currently dominated by the Fed buys the bonds to yield a market rate. The problem is that the Fed is only looking for a 4.5% yield on their purchase of Fan and Fred MBS. When the Fed buys MBS to yield 4.5%, the cost of funding mortgages is 4.5%. If the Fed stops buying Fan and Fred MBS, mortgage rates will go up. So, right now the Fed is the Market, but that is suppose to stop soon, but I doubt it. The yield private buyer of MBS demand is above 4.5%.

This article has some timely information:

Mortgage Bond Rally May End, Rates Rise as Fed Stops Purchases

Dec. 31 (Bloomberg) — Mortgage bonds are poised to slump after a record rally as the Federal Reserve’s unprecedented buying of $1.25 trillion of the securities ends as soon as March, driving up interest rates on new home loans.

Analysts at BNP Paribas SA, Credit Suisse Group AG and JPMorgan Chase & Co. say the extra yield over benchmark rates that investors demand to hold the securities will widen as much as half a percentage point as the Fed stops purchasing. The 11- month-old program has reduced yields, which guide lending rates, by about 1 percentage point, BNP estimates.

The Fed has been buying at “way” narrower spreads than “where the private sector would be willing to” invest, said Doug Dachille, chief executive officer of New York-based First Principles Capital Management LLC, which oversees about $8 billion of fixed-income investments.

Rising yields mean loan rates are likely to end 2010 almost 0.75 percentage point higher than they are currently, based on forecasts for government bonds and spreads, adding to challenges for a housing market struggling to recover from its worst slump since the 1930s. Fed Chairman Ben S. Bernanke’s goal this year has been to lower the costs for consumers to borrow and help bolster the economy as banks curbed lending.

I agree with this author. The fed’s purchase of MBS’s has lowered rates by about 1 percentage point. Say Jan 1 2011 we’re at 6% 30y FRM’s, that is still historically low. To get to the 8% IR sees in 2019 and beyond (don’t bet on anyone’s 10 year interest rate predictions), you need either inflation and/or a rise in the risk-free rate.

Mortgage rates are not going to increase in a vacuum, and will probably be accompanied by some general inflation that will push home prices upward. Net impact may be stagnant home prices in a general inflationary environment.

What subsidy limit (dollar amount or time limit), has the gov/t stuck to lately?

For now, the Fed does not need to raise any rates, they just need to stop buying MBSs to impact the mortgage market.

Once the MBS program is over, then we can talk about rates.

I think you’re right. When the Fed buys all these mortgages, they are in fact offering a mortgage rate negative of market forces … e.g. negative interest rates.

“IF” the Fed exits the MBS market (I’ll believe it when I see it), then mortgage rates will hopefully revert back to economic conditions.

Somebody has to pay for the gap between negative mortgage rates, and true market mortgage rates. Who pays these cost? The US Taxpayer!

If the Fed decides to continue to buy MBS’s, then it has to increase its balance sheet (expand money supply even more). I doubt it can continue to do that forever.

If the local economy does well, housing prices will go up.

so you have to ask your self.

Are you tired of this recession yet ???

Actually, history has shown there is a lag between when the economy picks up and when house prices go up because at the bottom of the recession, like now or 1992, prices are still inflated and an improving economy helps improve cashflow values, but until pricing drops to reach stable cashflow values, prices have no upward pressure. House prices fell from 1993-1997 in California despite a growing economy.

Indeed, we had the dot com “new economy”, which more or less started with the Netscape IPO, 08/1995, and the economy kept going up after or at least people making tons of money in the dot com bubble, ask yourself, how come that didn’t translate to SoCal house prices?!, only until 1998 is when house prices starting to go up.

Tired of the recession, ready for the depression.

If Obama initiates payment to the banks for principal reductions, the foreclosures will diminish. In the past that sounded like a big “IF” to me, now, not so much.

Care to explain what “payments to banks for principal reductions” means?

If it’s what I think -the Gov. actively using MY tax dollars (and those of our kids) to pay off personal debt- then I suggest it’s time for a revolution.

One explanation is fannie and freddie buying or insuring the loans for the full (and fictitious) marked-to-market price that the banks have been, under revised accounting rules, allowed to carry their bad loans. That would not only saddle the taxpayer with additional obligations, it would simultaneously provide the banks with large increases in cash which could be loaned immediately rekindling the balloon.

It’s worse than that. If I’m reading Calculated Risk/Tanta correctly, for those MBS issued by Fannie and Freddie that go delinquent, they HAVE to buy back the loan at the full principal balance. At which point the GSE’s, i.e. our government are in control over how to deal with the delinquent borrower.

I could have misunderstood though. Look at CR’s comments on the raising of the GSE’s cap on X-mas Eve.

You should’ve been revolting for decades. The government forcibly takes your money every payday, and uses it for any number of programs you probably don’t like. What’s the difference between using your tax dollars to reduce homedebtors’ mortgage balances, and using your tax dollars to reduce the purchase price of the home initially? e.g. In my neighborhood (Columbus Square) there is “affordable housing” – meaning that 10% or so of the homes in the condo developments were sold at reduced prices subsidized by taxpayers. Is that fair? Your personal financial situation is principally a result of the choices you made in life (no college degree, married someone with no college degree, had children too soon, had too many children, etc.). However, the government would like to reward your choices and punish mine.

May the revolution begin!

Tonye, read this

http://online.wsj.com/article_email/SB10001424052748704152804574628350980043082-lMyQjAxMTAwMDAwNDEwNDQyWj.html

Article in OC Register Dec 26 predicts 0% price gain this year. Interesting that there is no mention of the landslide of prime jumbo loan resets that will occur in 2010 and 2011. These are surely very much a part of the OC bubble.

Article link is:

http://lansner.freedomblogging.com/2009/12/26/flat-pricing-eyed-for-oc-homes-in-2010/48265/

Happy New Year everyone! Happy new decade too!

I have a observations to make-

America just experienced it’s first lost decade. It’s sad but it’s true.

When the year 2000 started, the dow industrial average was about 11,500, today it’s 1,000 points less.

When we started the year 2000, unemployment was at a minimum, today we have 10% unemployment with another 7% underemployment.

When the year 2000 began America ran an economic surplus. Today we borrow about 10% of the gross domestic product in order “to meet our needs”.

When the credit crunch calamity began, the key issue was financial institutions being “Too Big To Fail”. Today many of these same institutions are significantly bigger!

When this calamity begun, many top economists said it was a result of ultra-cheap interest rates, today the Fed loans money at 0%. Free money … yipee!

When the prior decade begun, we had Greenspan the “Maestro”, today we have Bernanke, Time “Man of the Year”.

On a final note, let’s all hope this decade is better than the prior one.

A few data points from the Ritholtz blog:

Here is the change in Gross Domestic Product and household wealth (inflation adjusted) from different decades:

1940’s

GDP Growth – 72%

HHW Growth – Not available

1950’s

GDP Grorth – 51.3%

HHW Growth – Not available

1960’s

GDP Growth – 53.1%

HHW Growth – 44%

1970’s

GDP Growth – 38.1%

HHW Growth – 28%

1980’s

GDP Growth – 34.9%

HHW Growth – 42%

1990’s

GDP Growth – 38.6%

HHW Growth – 58%

2000’s

GDP Growth – 17.8%

HHW Growth – (-4%)

I would make the argument that if you remove govt borrowing, today’s GDP is about where it was in the year 2000 … the lost decade.

BTW, I point this shit out, not because I’m a permabear, but rather because I’m disgusted with the statuesque.

What happen in 1992-97 was much much different than what is happing now, in 1992 much of the SoCal’s best industries packed up left and took their best people with them.

That did not happen this time…

This recession started with a finance bubble burst, and it will end when with a finance cure.

“it will end when with a finance cure”

I agree with this statement. It will end when the housing market has re-adjusted to stable financing which means 30-year fixed-rate mortgages, 20% downpayments and DTIs under 28%.

I disagree with what I think you really meant. This problem will NOT be solved by financial innovation or a magical improvement in the debt markets. We tried that once, and it is what created the housing bubble.

We have made it to 2010! It sort of feels like we just came out of the first loop on The Viper over at your Magic Mountain.

I agree with you that Bernanke’s switch to fixed rate is a very good indicator that rates are about as low as they can possibly get. The question is now how long are we going to be leaving them there. Do you really think they are going to stop buying MBS this year? I don’t.

Anyone else completely appalled at Bernanke’s disgraceful passing blame and pointing fingers at ‘regulators’ while saying low interest rates had no role in the bubble?

This guy is a first class lowlife DI_K. Their job is to oversee the financial system and keep things stable. They could have easily snuffed out the bubble by raising interest rates when demand for credit started sky rocketing in 2002. One would think that increased demand for credit would cause higher interest rates – not in our world where it just makes borrowing even cheaper.

Oh if only those greedy lenders had policed themselves better! Those bad boys! Tsk Tsk Tsk!

The central bank pours a bunch of alcohol into the punchbowl at an AA meeting and then blames the drunks for going out and crashing while saying ‘if only they had exercised better judgement’.

This pinhead is so clueless and detached from the real world up in his ivory tower where money is just created from nothing. I propose that we drop him onto a deserted island with a bunch of hungry jackals and helicopter drop a steak from up in the air down to him; I think he might ‘get it’ then.

“The question is now how long are we going to be leaving them there. Do you really think they are going to stop buying MBS this year? I don’t.”

I don’t either. ZIRP, mark-to-fantasy, full blown Fannie and Freddie support by Treasury, and the list will go on.

If we don’t get a turnover after Nov. 2010 (hey, a divided Congress is better than a **working** Congress), we’ll continue to see this charade on scamming the taxpayers.

Sorry for the typo’s in the last post,

But adding another note, although there has been some outbound domestic migration from SoCal in the last 5 years, there has been a dramatic immigration boom from Asia during that same period and it just seems to be increasing.

Socal’s population is still increasing very fast both from birth/death rates and from immigration.

The U.S.A in 2007 had the largest baby boom ever (EVER!!!)

Much bigger than even the baby boom years on the 50’s and early 60’s.

.

So I would expect to see house hold formation to spike dramatically soon,

Just my opinions

I appreciate your opinions. I make sure you and others like you have facts to base your opinions on.

Southern California’s population is not growing very fast, and there is no Asian invasion compensating for the steady outmigration of people to other states, and in fact, California is losing almost 100,000 residents each near.

Biggest losers: Where Americans aren’t moving

For years more people have fled the Golden State than have arrived. In the year ended July 1, California was the country’s biggest loser, with nearly 100,000 more residents leaving than moving in.

Still, that was an improvement over earlier losses: In 2006 the net decline was 313,081.

Much of that improvement came from the housing bubble bursting. Homes became harder to sell as thousands of foreclosures sat on the market. As a result, many Californians stayed on rather than sell their homes at a loss.

Mobility in the weak economy has declined in general, according to demographer Greg Harper of the Census Bureau. There’s no point in moving to find work if few jobs are available in most parts of the country.

Net migration is less important, IMHO, than actual population changes. That is, the number to look at is births – deaths + coming – leaving, not just coming – leaving. Plus, the coming and leaving numbers need to include international migration, not just people moving to or from other states.

California, and most specific parts of it, are not having population declines. There are parts of the country that are losing population-mainly some very rural areas and the rust belt (especially larger cities in it, such as Detroit).

And where do you think those gains from births – deaths are coming from? And what do you think constitutes the majority of “international migration”?

What’s funny is the Irvine bullish belief always persists that the mysterious rich foreigners are sweeping in to save the day and prop up home prices. The reality is closer to this: California’s “international migration” is essentially immigration from our poorer brethren down south. And the “birth – death” gains are greatest among these same groups: primarily, immigrants from Latin America. FYI, they ain’t gonna’ be shopping in Turtle Rock.

Lee In Irvine summed it up perfectly.

In this land of the free and worship at the altar of ‘personal responsibility’ and ‘accountability’ – if I give a gun to someone who then goes and commits a crime, the law shall hold me partially liable for the crime due to my act of facilitating it whether or not I had any knowledge of what the firearm was going to be used for.

Not in the world of central banking where you stupidly and ignorantly facilitate the destruction of a country’s economy and then get made man of the year by some magazine run by airheads and bimbos who probably don’t know anything about banking to begin with.

Accountability is only for the little people.

Not quite.

You forgot to include the politicians.

They can do anything they want and are never held responsible so long as they feed the uber rich that keep them in power.

Also, the real “little people”… the ones that don’t pay taxes but still get to vote are not held responsible either. They are deigned to be “victims” by the patronizing rich and then they get the tax paying middle class (what’s left of us) to foot the bill.

It’s the dwindling “middle class” that is always held accountable -with our pocketbooks.

+1

Nicely said!

At first I thought Time’s Man of the Year was for greatness, but really it just means the person who was most influential in the past year. BB was the most important man last year.

Maybe he did a good job averting a depression. Choices were not good and he picked the lesser evil. He is still a Harvard grad with expertise in the great depression. Should we have put our faith in someone else?

Time’s Man of the Year award is now completely meaningless. This has been clear to me since they wimped out and named Rudy over Bin Laden in 2001. Hitler won it, so should have Bin Laden-it’s supposedly for the person who was most influential, for good or bad, not “the guy we like the most”.

Emperor Hirohito should have won it in 1941

“Should we have put our faith in someone else?”

How about Mr. Market?

Oh wait, I forgot that its only private citizens and not banking cartels that must contend with market forces.

In response to jonrent who stated that ‘if a local economy does well then house prices will go up’ – my question is:

WHY?

WHY will they go up, jonrent?

They can only go up with increases in personal income. Suppose that McDonalds adds 1 million new Hamburger Rotation Engineers to it’s workforce which results in a decrease in the national unemployment statistics. Well our economy is now doing much much better! Look at the numbers!

Are all these newly employed folk now suddenly in the market to buy 500K houses?

NO.

Looks like house prices are just going to have to fall to what all these newly employed peasants can finance on their new lower incomes.

Doesn’t this contradict your economic manifesto?

In Socal, there is many more people working than can afford a home, it’s a numbers game.

Then more people working, the more there will be of the people who can afford it.

Supply/Demand simple as that,

Get on the freeway Monday morning in L.A.

Do you really think people are leaving SoCal ???

The home loan default rate in Orange County is 7%+ and rising every month about 35bps. Can you please provide us some proof of an improving local economy.

BTW, you talk about traffic on the freeway, I read about people living in Anaheim Motels and under bridges.

Just saying …

I have a long commute. And while it still sucks, it is better then a few years ago because of less cars on the road.

There were some articles some time ago with the stats. Maybe someone has a link.

Traffic is always lower during recessions. Fewer people with jobs and fewer people with money to go shopping or eat out means fewer cars on the road.

Excatly, I was looking for some stats to back up what we already know.

Mr. jonrent is throwing out statements with no hard data.

Awgee –

I do not see the Government writing a blank check to cover principal reductions. They clearly understand the moral hazard there that would ignite a house debtor ‘Where is my reduction?’ nuke with every debtor in the country demanding their ‘fair share’ of the giveaway.

Their overall goal is to keep the peasants paying their debts and keeping busy with their makework jobs. The last thing they want is to tell everybody that quitting your makework job defaulting is a faster equity builder than standing around 8 hours a day making milkshakes.

No, they are not that foolish. They are going to continue this policy of pretending to care about debtors while the banks slowly and quietly foreclose and the mainstream media reports the official government statistics and reports as FACT without any independent or substantial analysis. The losses will slowly be paid off by taxpayers.

I sort of think of it like when the bank charges you a 39.00 late fee and you respond by paying 1.00 per month for the next 39 months to make sure they get it VERY SLOWLY.

This is exactly what they are doing to taxpayers – distributing their money to banks VERY SLOWLY while the folks are busy checking football scores and the banks are pretending that their junk ‘assets’ are worth more than they really are.

Public manipulation at it’s finest.

If the banks can continue the pretend and extend, then they will. But the number of NTSes is expanding. And what makes you think Obama cares on whit about moral hazard? He is trying to nationalize, governmentalize, socialize one sixth of the GDP, and it looks like he is having some success. Are you aware that on Christmas Eve, the amounts to be paid to FNM/FRE for losses were made unlimited? My speculation is that was done to set up principal reductions for FNM/FRE mortgages.

Principal reduction is the kitchen sink solution. The govt won’t do it until the next leg drop.

Which gets back to my first question,

Are you tired of this recession yet !!

Nope…tired of idiots like yourself. As long as there are people like you, this recession needs to go on for a long long time.

Hahahahaha…………….:-)

jonrent –

The freeways are busy here too in one of the worst real estate markets in the country! I daily sit in long lines of cars backed up at freeway transitions.

How can prices in PHX still be falling when I can clearly see traffic on freeways? We all know that increased freeway traffic means increasing personal incomes!

I am also seeing lots of people ordering 13.00 Chimichanga’s in the restaurants. And the 3.00 happy hour drinks have never been more THE Rage.

Certainly liar loans and ARMs are the next thing to return based upon the evidence presented.

You are a real man of genius.

jonrent –

Your rhetorical question about being tired of the recession is ridiculous and indicates that your are of the opinion that if we would all sit around and engage in synchronized magical thinking, prayer, etc then all of our wildest dreams would come true and we could all retire to live in our fairy tale fantasies.

Grow up. WELCOME TO REAL LIFE.

::clap::

Well stated, AZDavid.

I’ve worked through 2 recessions, and if getting out of one only took “being tired” of it, I’d have improved the economy on my own after a month of being underemployed and underpaid.

Meanwhile, houses are being bulldozed to the pads in central Phoenix, but I see more and more traffic on the roads each day too. Could they possibly be . . . pickup trucks with paint rigs welded onto the beds? Mmmmmm . . . could be!

IR,

Awesome song, though I’d tweak the lyrics for those who got away without paying the piper:

“The bubble’s over

It’s time to move to L.A.

Though you’ve never been thrifty

You’re driving an E350 away.

You played it real well-

The masquerade.

The bank will short sell

and nobody must be paid.”

What’s your definition of low/mid/high end, in term of price?

“jonrent: Are you tired of this recession yet ???”

I am tired of Newton’s law of gravity.

Should we vote here to overturn the law?

Well, end of this bubble is just the beginning of another. History repeats itself but it’s slightly different every time.

late 1980’s: Expected peace dividends with fall of communism.

1990’s huge reduction in military spending and with base closure, especially in CA.

mid 1990’s ecomony “going well” and with internet phony accounting (trading advertising space on web as real income while losing 100’s million). Bailout of Mex. Hedge funds (FOB) and property insurances. Creation of Enron and laws to favor Enron.

2000 – 2001 internet bubble burst (blame it on the Bush administration instead of vapor income. Enron implodes. 401k and pensions loss big time.

9/11 Bailout of airlines, finances and insurances to hid the vapor income and stop the US financial system from collapsing. Made bubble for housing and expansion of federal powers (now this should be blame partially on Bush for the expansion of the bubbles).

IHB noted Subway sandwich artist received an approximately a half million condo loan but later defaults. So much for the inability of a hamburger rotation engineer to get a half million dollar loan. Note: $25,000 to get a 3.5% down FHA loan less $8,000 tax credit = $17,000 net cost. Taken in 2 roommates at $600 each per month. Stop paying mortgage. Collect 14 month rent. So truely no money down and 14 months of free rent on taxpayers’ dime. Anthing over 14 months is profit. Win-Win. Banks, realtor, appriaser, mortgage companies get fees/commissions off the top, banks remove liabilities from their books, “Home owners” gets free housing and possible profit. Taxpayers get ….

Most American confuse the Dow and S&P index as indicators of how the US ecomony is doing. Record unemployment but record increases in the stock market. With govt control of the money supply, bailouts, MS and Main Street are disconnected.

I agree with IrvineRenter that the high end will be dropping and the medium sale price may be increasing a bit. Just change in the mixture of house selling from lower end in 2009 to higher end in 2010. This trend will be reflecting the trend in the loans due. Subprime in 2006 to 2008. Delayings in FC for 2008/09. Higher end house loans due in 2009 to 2012.

But will commerical RE loans peak at the same time? will modified and FHAed loans be called at the same time? Better teach your children to work hard, so they can pay off the the federal debt.

My first post ever. IR, I love the blog and read it everyday. Thanks for all the hard work you put into it.

You made the statement that “more sales will occur at the high end.” This makes sense to me given that sales thus far have been concentrated on the low end, but where will these high end sales come from, given the dearth of move-up buyers?

Foreclosure and short sale. Few high end sales will be arms-length transactions.

You mean fewer high end sales will be standard sales, right? All short sales and REOs should be arms-length transactions (at least in theory). A non-arms length transaction would be if a father sold his house to his son.

Yes, I should have said “organic sales.”

Gemina13 –

It’s the old ‘think pothatively’ stroke. Oh those Negative Nancy’s are just so consumed with anger, low self esteem, depression, etc, etc.

If you maintain neutrality and do not join the lemmings on the march off the cliff then you must be some weird creepy social pariah who just can’t function in society.

Recall how Peter Schiff was nicknamed ‘Dr Doom’ by all those fools on television who are now eating crow.

The bulls always pull it out of their playbook. Accuse the sober individuals of being chicken little the sky is falling and telling the sheeple to ‘not worry’ about anything.

Just drink the Kool Aid – don’t worry about it.

This is why we cannot let others think for us.

Exactly. you know you don’t have an argument when you have to start name-calling.

AZDavePhz,

Negative Nancy’s are also conspiracy theorists, who are prolonging the recession because of their negative talk and economic theories. Bankers, lenders, business people, political leaders were all naive and didn’t know how to do math. They all learned how to do math now, so listen and follow their instructions. They have your best interest at heart.

Buy before you’re priced out of the market. The recession is over. :]

That’s right – all I had to do was pop a Zoloft and it all became clear!

I’m off to go contact my FHA loan officer and get pre-approved for a liar’s loan while there is still time.

Hate to change the subject, but “heads up” Check out your banks, since the FDIC went broke they are raising the banks’ premiums, and guess what folks, that’s right they are passing it on to us, the savers. No more free stuff for us! Oh, btw I heard Texas was a good place to relocate to, you can carry a gun there!!!!

I have been a good customer with my bank (one of the majors) for about 20 years. But now, every 2 or 3 months, they try to slap a monthly fee even though I way exceed the minimum balance required to waive the fees. Evry time they tell me a different execuse why the “mistake” happened, and I have to walk into the branch to talk to them about it. Their internet-based customer service is terrible.

Why, do you plan to make a living robbing banks?

Not saying the economy or housing will go up, just saying if the local economy (in SoCal) does improve.

I would expect the local housing market to improve as well.

And Yes I am very tired of this recession, and would not mind seeing companies start to hire again. (but yes I think that would mean higher home prices).

Anyway good luck.

jonrent –

Your belief is irrelevant. Many people believe non-sensical things.

If you show up here and make a statement that I disagree with then I am going to ask you to explain WHY you believe.

I say that prices cannot increases with mortgage hustlers or government goosing the monthly payments for debtors (aka Financial Innovation).

The other way is inflation and rising incomes.

You state that prices will go up when the economy improves. Why? Are you saying that inflation will make us all billionaires? Will liar loans make a fashionable comeback?

WHY johnrent Tell me WHY – This is not faithbased blogging here.

Because in Socal it is a numbers game.

for every 5 people employed some sales guy’s going to get a big bonus or commission, some manager is going to get a raise, some business owner is going to make his first million

Etc…

And yes there is not enough single family homes in socal for everyone who wants one and never will be (at least in coastal Socal).

Your kool aid detoxification will be a long one my friend.

Yesterday, I reposted the first chapter of The Great Housing Bubble. If you have a moment, go read that post, and you will get a list of tired real estate myths used to stoke fears during the housing bubble.

Some myths are based in reality that maybe hidden from sight at the moment.

I guess we will have to wait and see.

US workers are overpaid. It is necessary to reduce wages. Moderate inflation and dollar devaluation may be the best solution. Alternatives look worse.

What may happen in Orange County? Good question. Worst case scenario: International companies will thrive, and local businesses will struggle to survive. Inflation will eat away both wages and debts. No salary raises. No mortgages.

What would happen ??

My guess Foreign investors and just plain foreigners who want to have a place in L.A./O.C. would buy the heck out of all coastal SoCal,.

Although I don’t see many Foreign or Asian investors in the inland empire myself..

My guess is they are only interested in prime locations.

You relate: “How high will interest rates go in 2010? Morgan Stanley thinks they could hit 7.5% in 2010. That would be an unmitigated disaster for the housing market.”

Morgan Stanley consistently has good analysis; perhaps 7.5% is too high for 2010; nevertheless I see interest rates going easily and quickly to 8%, as you suggest in your charts and prices falling to the 1990 and 1993 levels; the price drop coming mostly from the shadow inventory hitting the market, and stupendous levels of unemployment and underemployment which we have now and will continue to have.

The shadown inventory is such a terrible thing; it comes largely because so many people stated their income falsely on their Alt-A and Option Arms loans; maybe they were thinking of lottery income, or their Aunt’s gift income, or their third job income.

A terrible social collapse is coming, with the State of California, Arizona, Florida, Nevada, and others declaring bankruptcy.

There will be social unrest and martial law will be declared. Those with gold coins, and gold at BullionVault.com will have some spending money.

Unfortunately, nine out of ten people will never have insight into the “financialized” mortgage backed securities industry, and the awesomely leveraged CDOs issued by the banks as well as the ponzi scheme that came out of subprime, Alt-A and Option Arms loans.

There will only be a handful of people who have insight into our national trajedy, these being those who read blogs like yours and DrHousingBubble.

Can’t fight the Fed.

As long as we blame “greedy bankers”, we’ve learned nothing.

Prices will continue to go nowhere as long as Uncle Sam is propping this pig up. Do you think that thinking is going to change anytime soon?

MBS expiring. Pah! So did the homebuyer credits. Guess what? Extended. They’ll keep extending or call it something different, squeezing the balloon on either end.

I’m fortunate to live in an area that’s at least priced in line with incomes (near the Viper coaster in zip 91354). But even as a loanowner, I know that values can only go down in the long run — but only once the fed stops meddling.

Call it “child worshipping” AZDavid (if/when you have kids of school age, would love to hear how your thinking may change on this), but we ended up pulling the trigger in Q2 2009. Kids in school, tired of getting bounced between rentals, wife wants a place to build a nest.

The policies aren’t going to change at least until the next election. That’s three years of more waiting (plus additional time for some sort of change) that would have put more strain on our household.

My advice to those on the fence: find an area that is corrected for incomes (hint: not Irvine) and aggressively hunt down a good deal. City-data.com has a ton of data, and there’s a great site for LA county called lalife.com that we used to narrow down our patch (haven’t seen something quite like it for OC yet). Waiting for Irvine values to finally be in-line with incomes is a fool’s errand in the short run.

There is no bankruptcy code for states. CA has technically been bankrupt a number of times (and if thoroughly audited, I’m sure it is now).