Fiserv Case-Shiller is now calling a bottom in most housing markets over the next 18 months followed by years of grinding along the bottom.

Irvine Home Address … 1 LANCEWOOD Way Irvine, CA 92612

Resale Home Price …… $395,000

I'm trying to scream but I can't exhale

The world seems to spin as I'm left on this square

With no will to hold on

Am I the only one crushed by the weight of the world?

Antimatter — The Weight of the World

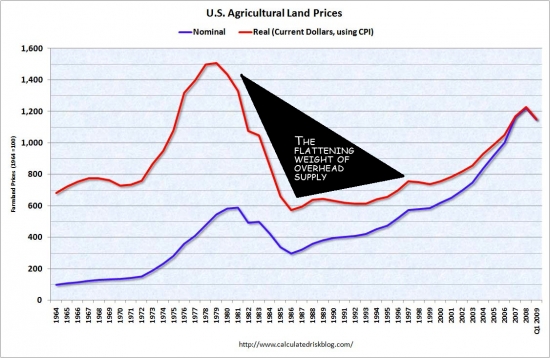

When a bubble bursts, sellers compete to bail out before prices fall further. Strategic defaults and the inevitable foreclosures plus those who purchased at higher price points form an overhead supply that must be liquidated before prices can go back up. The weight of this inventory if left unchecked will push prices well below the previous equilibrium as is now happening in Las Vegas. Over time this inventory is sold, and the weight of this inventory lessens, and prices can slowly begin to rise. It is only after all this inventory is purged can prices resume a level of appreciation equal to wage incomes.

Fiserv Case-Shiller Home Price Insights: After Five Years of Record Declines, U.S. Home Prices Begin To Stabilize

Source: Business Wire

Publication date: February 1, 2011

Fiserv, Inc. (NASDAQ: FISV) today released an analysis of home price trends in more than 375 U.S. markets based on the Fiserv® Case-Shiller Indexes®. The indexes are owned and generated by Fiserv, the leading global provider of financial services technology solutions, and data from the Federal Housing Finance Agency (FHFA).

In the third quarter of 2010, U.S. single-family home prices saw an average decrease of just 1.5 percent over the year-ago quarter, as a growing number of metro area housing markets begin to stabilize after five years of record home price declines. Fiserv and Moody's Analytics report that home prices have already leveled out in one out of four metro areas. They estimate that price stability will characterize 75 percent of U.S. metro markets by the end of this year and 100 percent of markets by the end of 2012.

Even as metro markets stabilize, the Fiserv Case-Shiller data analysis indicates a slow recovery in home prices with many false starts, especially in markets with large amounts of foreclosed properties.

“Large supplies of foreclosed properties will continue to be the biggest downside risk for home prices and metro area housing markets,” said David Stiff, chief economist, Fiserv. “Foreclosure activity declined at the end of 2010, but sales activity of bank-owned homes increased. In bubble and crash markets, the uncertain timing and volume of bank liquidated properties will cause home prices to bounce around their lows for many years.”

I described this same phenomenon in Shadow Inventory Signals Three Years of Falling Prices.

The weight of overhead supply stops prices from moving upward in any meaningful way because as soon as prices start to rise, sellers come out to liquidate inventory and blunt any price increases.

Expected stabilization in specific markets include:

Markets where prices have already stabilized include San Diego, Washington, D.C., and San Francisco.

I think coastal California is far more at risk than lenders are willing to admit.

Markets where prices will stabilize by the end of 2011 include Minneapolis, New York City and Portland, Ore.

Markets where prices will not stabilize until 2012 include Miami, Phoenix and Las Vegas.

Data from the Fiserv Case-Shiller showed that improved housing affordability is luring many buyers into the market, as the huge decline in home prices and low mortgage interest rates have reduced the cost of owning a home to pre-bubble levels. Other factors, however, are dampening demand.

“Since a significant number of households no longer have access to mortgage credit, improving affordability does not necessarily translate into sustained housing demand in every metro market,” added Stiff.

The depleted buyer pool is one of the biggest obstacles the market faces. There simply aren't enough qualifying people to absorb all the inventory at all price points. Far too much of our real estate is considered high end based on its price-to-income ratio.

Every house on the MLS is affordable to someone, but the low end in Orange County is generally depleted of supply so 10 buyers compete for one property, but the high end is depleted of demand, so 10 sellers compete for one buyer. Most of the high end inventory sits there waiting to see if they are that lucky homeowner who gets out while prices are still inflated.

The Fiserv Case-Shiller Indexes forecast that average single-family home prices will fall another 5.5 percent over the next 12 months, with steep home price declines expected to continue in markets that have been hurt most by the housing crisis. These markets, including many in Florida, California, Nevada and Arizona, will begin seeing prices stabilizing throughout this year and through the end of 2012. Factors weighing on the housing market continue to include chronic high unemployment and the large number of distressed properties that remain in many of the bubble markets.

The Fiserv Case-Shiller Indexes, which include data covering thousands of zip codes, counties, metro areas and state markets, are owned and generated by Fiserv. The historical and forecast home price trend information in this report is calculated with the Fiserv proprietary Case-Shiller indexes, supplemented with data from the FHFA. The historical home price trends highlighted in this release are for the 12-month period that ended September 30, 2010. One-year forecasts are for the 12 months ending on September 30, 2011. The Fiserv Case-Shiller home price forecasts are produced by Fiserv and Moody's Analytics.

More information on the Indexes can be found at the Fiserv Case-Shiller website at www.caseshiller.fiserv.com.

Mortgage equity withdrawal that exceeds the current purchase price

They spent the whole house… and then some. The owners of today's featured property purchased back in 1995, and by the time of their last refinance ten years later in 2005, they had already pulled out nearly half a million dollars — a number that exceeds the resale price of that house today.

- Back on 5/13/1995, the owners of today's featured property paid $180,000. They used a $171,000 first mortgage and a $9,000 down payment. Nine thousand got them five hundred thousand. Not bad.

- On 5/15/1998 they refinanced for $193,000. Almost three years to the day later, and they have withdrawn their down payment, and they picked up another $13,000 for Ponzi money.

- On 10/29/1998 they refinanced for $192,500.

-

On 7/2/1999 they needed another $15,000, so the got a HELOC.

- On 6/26/2000 the obtained a stand-alone second for $65,000.

- On 7/12/2002 they obtained a $134,475 stand-alone second.

- On 9/24/2003 they refinanced with a $356,000 first mortgage.

- On 8/11/2004 the got a $140,000 HELOC.

- On 8/18/2005 they refinanced the first mortgage for $540,000

- Finally, on 6/20/2006 in a last gasp of desperation, these owners refinanced with a $548,000 Option ARM and took out a $68,500 HELOC.

- Total property debt is $616,500 plus negative amortization.

- Total mortgage equity withdrawal is $445,500.

- They quit paying last year.

Foreclosure Record

Recording Date: 11/30/2010

Document Type: Notice of Default

It shouldn't be surprising that so many think California real estate is a pot of gold. It certainly was for this couple. They put down less than $10,000 and nearly pulled out half a million. That is living the California dream.

Irvine Home Address … 1 LANCEWOOD Way Irvine, CA 92612 ![]()

Resale Home Price … $395,000

Home Purchase Price … $180,000

Home Purchase Date …. 5/12/95

Net Gain (Loss) ………. $191,300

Percent Change ………. 106.3%

Annual Appreciation … 5.0%

Cost of Ownership

————————————————-

$395,000 ………. Asking Price

$13,825 ………. 3.5% Down FHA Financing

4.99% …………… Mortgage Interest Rate

$381,175 ………. 30-Year Mortgage

$81,696 ………. Income Requirement

$2,044 ………. Monthly Mortgage Payment

$342 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$66 ………. Homeowners Insurance

$110 ………. Homeowners Association Fees

============================================

$2,562 ………. Monthly Cash Outlays

-$337 ………. Tax Savings (% of Interest and Property Tax)

-$459 ………. Equity Hidden in Payment

$27 ………. Lost Income to Down Payment (net of taxes)

$49 ………. Maintenance and Replacement Reserves

============================================

$1,842 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,950 ………. Furnishing and Move In @1%

$3,950 ………. Closing Costs @1%

$3,812 ………… Interest Points @1% of Loan

$13,825 ………. Down Payment

============================================

$25,537 ………. Total Cash Costs

$28,200 ………… Emergency Cash Reserves

============================================

$53,737 ………. Total Savings Needed

Property Details for 1 LANCEWOOD Way Irvine, CA 92612

——————————————————————————

Beds: 3

Baths: 2

Sq. Ft.: 1493

$265/SF

Lot Size: 3,441 Sq. Ft.

Property Type: Residential, Single Family

Style: One Level, A-Frame

Year Built: 1966

Community: University Park

County: Orange

MLS#: S646211

Source: SoCalMLS

Status: Backup Offers AcceptedThis listing is under contract, but the sellers are looking for additional offers in case the current offer falls through.

On Redfin: 8 days

——————————————————————————

Lowest price 3 bed in University Park. Beautiful end unit in a desirable location. Huge living room with cozy fireplace. Enclosed front patio with private backyard. Easy access to freeways, outstanding schools and association amenities. Low association fee, NO MELLO ROOS.

The most important things about real-estate: location^3.

We bought about 6 months ago, but I still monitor the comparable for-sale properties. There is one, new construction, in new neighborhood, built in 2008, still unsold. The assessed lot value is $100k, and the home is worth maybe $450k. The builder was also the developer, so his lot cost is much less than $100k. The neighborhood has 30 lots, 3 completed homes, and 1 sale. That neighborhood is not just in for a grind, but a long hard slog. Prices have not cratered in my town (down maybe 10% from peak), but this neighborhood is in a small city (17k) between my town and another similar sized town. Plus the neighborhood is pretty much cluster homes for retirees.

It is sad because my wife and I did business with the builder’s wife and she was very nice. But I wonder what made them think that these were a good idea to build in this area, this type of home? If you’re talking retirees, cluster homes are OK, but they have to be close to amenities, or have lots of in-neighborhood things to do. I think banks just didn’t pay much attention to the idea that new home construction would not keep increasing indefinitely. The guy also got hit with terrible timing – first homes in a neighborhood being finished mid-late 2008, but there have been 30 homes built in our new neighborhood over the past year. Some homes are being built, somewhere – I know not many, but some. My prediction is that it will be 20 years before all those lots are developed, probably with much less expensive homes.

From 2400 miles away, Irvine has two things going for it: a critical mass of jobs and amenities (schools included) that keeps demand strong, and a managed supply. The value that really modulates during bubbles is the value of land. If you don’t let builders keep building new construction on ever decreasing lot prices, you keep a main negative influence on existing home prices out (if a new home sells for less than an older identical home, the older home’s price will come down).

I’m confused by your comment. If the development where you purchased your house has been hit hard by the housing collapse – you think it might be 20 years before the all the lots are developed – why did you purchase there 6 months ago? Surely, the situation wasn’t that different then.

The neighborhood that will take 20 years to finish is 15 minutes from ours. Ours will probably take twice as long to build out as projected in 2006, but there is still building going on there. There can be vast differences between market conditions between what would seem to be comparable areas.

is florida a buy (yet?)

It’s no different than the other bubble markets. The low end has crashed and is more or less at bottom. The middle still has another 20% to go and the high end still has another 40% to go.

Middle end will probably bottom out by the end of 2012. High end is looking like 2014 at this rate as the banks are circling the wagons not wanting to deal with those losses.

I’m aiming for middle so I’ll be ready to by the 250K Scottsdale Dreamhouse next year if prices continue to improve at the present rate of decline.

Of course it could all be stalled again if the government jumps in with a new round of new and improved gimmicks to incentive lemmings to overpay today. However, it’s looking promising that this isn’t going to happen and the failure of QE2 leads me to believe that the Fed is out of ammo. Let’s hope this is the case so we can all buy for a fair price and move on with our lives.

where does one invest the down payment in the meantime?

Oil futures and pipeline stocks are looking good.

Cash looks good, too.

But best of all are things like a 6 month food supply, a few 55 gal barrels of water, emergency power generators, and lots of durable, warm clothing. Oh, yeah, medications and medical supplies you might need, too.

This stuff might get VERY expensive in the next couple of years, so stock up.

I subscribe to the NIA initially just out of curiousity. Recent emails state similar grim predictions. THese are the scariest emails I get. I hope they are full of BS.

I completely agree. This snowball is still getting bigger.

I bet 90% of people who think they are middle class are actually lower. Credit and debt have kept many Americans disillusioned for many many years.

AZ’s analysis seems about right… low end basically done with some volatility. Middle another easy 20% (but, before you all hyperventilate – I consider middle 850-1.2M), and then everything north of 1.2 as little as 20% to over 60%. I love it when I see one of the housetards of OC go REO (and they all have..just lucky idiots ridding a wave with other people’s money – not smart enough to get out). Always interesting when you see originally listed in Newport Coast for 15.9M now reduced by 7M for quick sale… 🙂 Ha! To whom???

Everyone here needs to know that none of my houseing price drops have even BEGUN to consider what happens when we get consistent rates rises and a return to 20 whole percent down!

There is NO URGENCY… prices are going lower and then sideways for the next decade.

Just my .02!!

No pictures of the cozy fireplace?

I’m totally digging the giant mirror wall next to the kitchen table so we can all get our jollies off by watching one another eat breakfast.

The decorations are spot on as well. The lone racquet attached to the living room wall really brings out the warmth and coziness. Does the association’s outstanding amenties include a Badminton court? Perhaps IrvineRenter could form the IHB Badminton Team but no whacking of each other’s shuttlecocks please.

It says so much when the realtor doesn’t even bother asking the tenants to please tidy up a bit for the picture of the kitchen. It just screams hopelessness and desperation.

California plans $2-billion program to help distressed borrowers

http://mobile.latimes.com/wap/news/text.jsp?sid=294&nid=38149672&cid=16689&scid=-1&ith=0&title=Business

an efficient use of capital indeed

Ugh… not great news. More government fiddling which (if passed) will prevent more homes from going up for sale. This will keep the supply of homes from growing, and further delay the correction in home prices.

http://www.bubbleinfo.com/2011/02/10/get-free-cheese-program/#comments

Government out of ammo? Not so fast. More bailout is on the way for Californians.

i used to think the bottom was in for the san francisco low end.

we’re not anywhere near there yet.

i just checked prices in the projects/ghetto where my girlfriend grew up (robbery 4.5 times national average; motor vehicle theft 3 times national average; lareceny 1.6).

her parent’s place is next to a drug dealer on one side, and another drug dealer in front. the neighbor in front fixes other people’s car on the street(so you see all these s.h.i.t boxes parked out front). my gf’s uncle was shot and murdered a few years ago in this neighborhood. everyone in my gf’s family has been robbed at least once while living there.

there are virtually no white collared workers. no one is making six figures. there are often multiple families (typically 2 generations, sometimes more) per household. people are working retail, low wage blue collar jobs.

median sold house price: $450k.

at a 4 times multiple, household income should be around $110k/year to support a $450k price.

this “low” priced zip code is certainly still in bubble territory.

across the SF bay in places like Hayward, Union City, Newark, 30 miles away, you can find comparable houses in the $300k range with much more space, much better schools, and much lower crime.

i’m using this ‘low-end’ neighborhood as my gauge to indicate when things are close to normal.

if prices get down to $200k-$250k or the demographics of the neighborhood change (ie gentrifies – good luck with that) then i’ll become more bullish. seems like it’s going to be another 5 or 10 years before we get back to sane prices if we get there at all.

the good news is peak prices (circa 2006) were about $700k and have dropped $250k in the last 5 years.

another $200k drop over the next 5 years and we should be back to normal prices.

This is the best preface material ever. The casual mention of your gf’s uncle being murdered made my day.

Union city million plus dollar houses have dropped at least 30%. It location, location, location or timing, timing, timing. There projects near these once million dollar house (not necessary homes). SF will have potential due to location. Remember, so hack’s relative took by entire neighborhoods “at just compensation” court order rates (steal) and bulldozed and rebuilt over them. At least with a high market price the steal would not happen. Lots of govt property also transfer for private redevelopment in the 1990’s for a few thousand dollars per acre in SF area to groups that just happens to have a relative in office. Private land in those area were taken with “just compensation, i.e., peanuts if you’re not a business.

My rent finances my landlord’s retirement at $2500 a month. I am just hoping I will save a huge downpayment for a future purchase. Any price drop will work in my favor but this long drawn out process is tiresome. I want to see a precipitious drop, not some dripping torture.

Its either $2500 a month in his retirement or $2500 a month in some banker and his wife’s Mercedes payments.

Either way you gotta nice place to call home.

Don’t you wish you were a baby boomer?

No, wouldn’t you rather be poor and much younger? Personally I prefer young and wealthy. Also there are plenty of poor Boomers. To each their own I guess.

Why in the world are you paying $2500 a month for a rental home? How much McMansion do you need? I live in a beautiful 1,800 sq. ft. home with a two-car garage, on 1 acre in the forest. Not far from Microsoft HQ. Rent for me is $1670. Wifey and I save $6,000 a month.

“Why in the world are you paying $2500 a month for a rental home? How much McMansion do you need?”

One-acre lots are nearly non-existent in Irvine, except for the multi-million dollar estates in Shady Canyon. You could rent the home you described on a quarter acre for about $3,200/mo in Irvine.

$2,500/mo will get you about a 1,500 sq. ft. 1980’s-or-earlier SFR with a very small yard or maybe only a patio instead of a yard. In some neighborhoods, such as the one I live in, that price point will have a shared driveway with the house next door. The tradeoff is that we don’t need to do all of our living inside of our homes for any period throughout the year. The weather permits us to do more of our living outdoors. We’re also paying for infrastructure (bike trails, parks, swim areas, etc.) both indirectly through house sale prices and directly through HOA fees. I grew up in a rural area (south of Redding, CA), and having seen the tradeoffs, I choose this lifestyle.

-Darth

Here’s another beautifully staged dwelling, what with the kitchen a mess and junk furniture all over the place. Could the real estate agent have given the seller a call and told him to clean the place a little before it was photographed/

Put yourself in the debtor’s shoes.

Realtor: “Hey…can you clean the place before it’s photographed”

Debtor: “Come over and clean it yourself. You’re the only one who will be walking away from this deal with any money”.

:^)

Just a little Math reminder – If you buy a new home today with a 30 yr fixed rate, in one DECADE you will have paid down an additional 18.1% of priniciple. In other words, in the first third of your mortgage term you pay down less than 20% of what was borrowed. This makes sense and is just amortization.

Now, consider that for every 1 point rise in 30yr fixed rates you loose 10% or so of your purchasing power. So if you can possibly imagine a scenario where rates rise 2points in the next 10 years…. you will have LOST ALL of the paid for equity!

Now, what are the odds that rates would only go to 7% in the next decade??

It’s not the price you buy at that matters..it is the price you sell at!!! We use 4.5% rates with the FFunds at zero and trillions of dollars in QE…but, oh my….rates will be here in a decade…

Right…get real.

BD

We are saving $6,000 a month and renting a “conservative” rental home. Comfortable and meets our needs. Our goal is to buy our next home in cash. We’ll be sitting in precious metals in the meantime. Screw the banks, we don’t need them anymore. We welcome all of you to do the same.

oops… strike “additional” principle. Only 18.1 percent of priniciple period.

This problem of coming rate rises and well overextended housing prices in SoCal, coupled with the state’s need to raise taxes and real structural problem with unemployment – leads us in SoCal to the same problem that Japan had the larger US had in the 70s. Stagflation is coming. Or as many have suggested for CA “screwflation”.

IMHO, unless you can make a case for much higher salaries and wages and a flat interest rate environment for the next DECADE or MORE. RE will decline for the next year or so and then gring lower or at best sideways for many, many years.

The likely scenario?? Rising commodity costs, i.e. what it costs to eat and put gas in your car while salaries stay flat, and interest rates to borrow money for anything go slowly up at best… or rapidly up to fight inflation.

Just go to http://www.bankrate.com and find a mortgage calculator. Now plug in 7 or 8 or 10% rates on the money you borrow for your home. This is what people will have to pay in a decade or more to buy your house. It’s not funny…it’s math.

It’s actually, very sad. We have structural and fundamental headwinds that will blow hard against housing in SoCal for probably as long as any of us plan to work – 20 yrs +. There will be volatility – we will see some up moves and more likely large down moves on the housing we all really find desireable but, a slow grind lower is in the “screwflation” future.

If you want to buy – either be a wealthy person who doesn’t care if they loose a few hundred grand. Or, be a person that plans to live in your new home for 10-20-30 years. That is housing here unfortunately. You can always hope for large increases in your wages and others that will have to buy from you in the future – or, hope that the US struggles for the next 20yrs and the fed buys down rates forever by printing money. Neither are likely….

For all of the “wonderful schools” in Irvine we still have a huge number of economically and math challenged folks.

This is just the inevitable result of pulling forward 20 years of appreciation into 2006.

Sad…rent if you want money to live and have the flexibility to move to a new job or be prepared to ‘stay and pay’ for a long time. The parallels exist in every bubble ever dreamed of…

If you bought Cisco in 2000 (the best tech company on the planent) you would now have lost 60+ percent of your investment and no hope of recovery for decades. Apple and Google will be the same – always happens with investments that run out of growth. Unfortunately, with housing it takes years to sell – and with APPLE or MSFT or GOOG you can see the top and be out in 9 milliseconds.

Somebody tell me how prices will be higher in 10 years????

I always worry about my posts here. I only get crickets following.

I wonder if I have been too much of a ‘downer’ or ‘ass’. I’m sure I have been both.

But, I never here or see people look forward in their analysis. I only here about how this is the best time to buy because affordability has never been higher in the last 20 years in OC.

Of course, all of the analysis I read from the OC register or from bloggers here only look at a static representation of factors that go into buying property. People say with rates at 4.5/5.0% and wages where they are, and with 2% down we have obviously hit bottom.

Honestly, I would have thought with all of these great “Irvine Schools” I would have heard somebody say, but what if rates don’t stay low and wages don’t rise, and what if, new rules require 20% down – what would that do to pricing of SoCal homes in the next decade or two??

It makes me realize this is the basic difference between people that live in the now and those that prepare for the future. We apparently have lots of ‘gifted’ Irvintes that can do math and understand that based on our current economic variables of income, and rates, and down payment – that they can now “afford” good Irvine / SoCal RE.

What you all need to think about is the “FUTURE”. Ask any investment bank if they would be buying SoCal RE now – following a 20-30-40% decline? They all say no. Why??? Because they have models of what is likely to happen going forward!!!! I know this for a fact.

My wealthy collegues say I will buy out of Irvine and SoCal and take the rest and invest. You can litterally afford to live in a big house in Vegas, send your kids to private schools and take a plane to your apartment on the water in Laguna on a monthyl or twice weekly basis and still break even.

Please all of you…look forward in your analysis. Don’t give me facts about today unless you can also make a case for why these facts will be materially different in decades going forward. Most of these facts that are most important to buying power like rates and downpayments and salaries – WILL ALL go against us in SoCal for many, many, many years.

BD

If you want to know the future, then study the Bank of International Settlements, the World Bank, the International Monetary Fund, and their collective well-dccumented plan for the entire planet: UN Agenda 21.

Then be preparted to keep your mouth shut as you will be a target for a lot of belligerence and mockery once you realize what’s going on.

More crickets??? IR do you think this is deserving of some discussion of future values for Irvine and SoCal? Or, other high-priced markets?

The minute people have to pay cash for RE and not use other people’s money and put real money down things seem to change.

I would like to see some basic “what if” scenarios in your cost of ownership analysis.

For instance, do I believe that I or others in general, will make a lot more in a decade? Well, how much more?? What do I think 30 yr. fixed rates will be in that decade?? Well, how much more or less?? And, finally what do we think downpayments will be required as a percentage of purchase price??

For instance, what if I make DOUBLE what I make now in 10 years and rates only rise back to their median over the last 75 years?? And, I only half to put down 2% or 20% money?? Then what happens to values if people buy our ‘move up’ property have to pay that??

…just tired of hearing crickets I guess.

BD

Hello All –

As I await IR’s comments on the future cost of RE and high-priced markets. I will only ask the rest of you to do some basic math. If you are now located in Irvine – you should probably ask your children for help.

I really don’t have a horse in this race. I bought in Huntington Harbor before things got nuts. My rental rates will give me a positive cash flow from here to forever (unless the world collapses and that is my least concern). I bought in the 1990s…

So also know that I came from a public school in the MidWest. We clearly don’t do math as well as you from Irvine and it’s great public schools but, we think.

I’m on IR’s path. Buying in markets where prices are clearly less than replacement costs.

I have a healthcare job but, trade stocks / bonds / derivatives for the “fun money”.

My only comment to the group is please do the math and anticipate changes in your analysis. The beauiy of the equity and bond markets is you have nearly instant buy and sell. The minute we have unrest in Egypt I can either get long or liquidate my shorts on oil.

Housing is a very illliquidade investment. It takes years to sell.

My analysis of now and the future 20 years suggest that you should own if you paln to stay and pay. If you are a young couple or a retiree please don’t need the money – or count on – any appreciation. It’s just a house. It doesn’t make things. And ultimately, it is only worth what it costs to rent.

We all want to be rich. But, the first step is differentiating the difference in an investment or a trade and a place to live.

It’s either sad or nothing new to you but, most of the people who drive MBs, Bentley, and Ferrari do so witout the money to actually pay for those things. There are clearly exceptions who I know can pay for anything. But, the vast majority of wealthy clients I know from all over drive honda and lexus and belive it Hundai!

They are hard working people who have saved and built businesses. they aren’t ‘silver spoon’.

They all say the same thing. I know what is likely to happen in the next 30 years with US policy on rates and other. CA RE is a place to enjoy. I will buy and live someplace else. And, some of these people have 50M dollar jets!!!!

You would be suprised. The very wealthy are very much like Warren Buffet…built wealth carefully overtime.

They won’t risk it… Why would you??

BD

BD, I liked reading your posts…very thought provoking. I agree with you that most people are not thinking about the future (higher rates, crushing debt, a state that is in a financial death spiral, etc). Real estate (especially in overpriced places like Irvine) is dead money for years to come. You are gambling quite a bit by pulling the trigger to buy now. And we are seeing first hand that the Fed can’t keep rates ultra low for infinity, even though many people on this board thought they could.

Face it folks. We are in a brave, new world. This is not the economy our parents enjoyed. The landscape can and will change real quick. Do the math, keep your ear to the ground and be one step ahead of the herd.