Home sales are off again in 2011 and remain well below historic norms. Are lenders creating this problem with overly tight lending standards?

Irvine Home Address … 507 TERRA BELLA Irvine, CA 92602

Resale Home Price …… $285,000

I'd put out a burning building with a shovel and dirt

And not even worry about getting hurt

I'd lay in a pile of burning money that I've earned

and not even worry about getting burned

The Fabulous Thunderbirds — Tuff Enough

Everyone who put a down payment on an underwater home is laying in a pile of burning money they earned. In the end, they all get burned. Some will succumb to the financial pressures, some will accelerate their defaults, and some will hang on paying far too much for the properties they inhabit.

Now that house prices are again in free fall, lenders need to be concerned about loan quality and borrower qualifications more than ever. If they make bad loans now, they won't have a rising market to sell into that will recover their capital.

Slow spring: Home demand off 5%

May 2nd, 2011, 6:34 am — posted by Jon Lansner

The latest Orange County home inventory report from local broker Steve Thomas — data as of April 28 — says …

Demand, the number of new pending sales over the past month, decreased by 5% over the past month, shedding 169 pending sales and now totals 3,189. This year, the height in demand was reached on March 31st with 3,358 pending sales.

My criticism of Steve Thomas's methodology is that pending sales fall out of escrow — frequently. Using pending sales simply distorts the numbers. During the beginning of the selling season escrow numbers should be increasing instead of going down.

Two weeks prior, on March 17th, demand had increased to 2,982. So, current demand may be off over the past month, but it is definitely up from earlier in the year. The Orange County market had been following a normal cyclical pattern, but has changed course over the past month. Typically, demand remains elevated or increases during the spring, not dropping.

This is a sign of just how weak the market really is.

Is it the negative press on pricing, buyer fear, tight financing, unemployment, consumer confidence, gas prices, the Middle Eastern upheaval, the U.S. economy, or the world economy? Maybe the answer is a bit simpler; we suffer from the “too much information age.”

I will admit, the IHB contributes to the “too much information age.” Now people know what is really going on with the market. it must have been much easier for realtors when people accepted their bullshit as experts.

Market psychology is not what is holding back the market right now. The problem is that there are not enough people with jobs and good credit scores to buy the available inventory, not to mention the shadow inventory lingering out there.

In The Great Housing Bubble, I wrote about the problem this way:

In the denial stage of a residential real estate market, many speculators are unable to obtain the sale price they desire. The accumulation of unrealistically priced houses starts to build a large inventory of homes “hanging” over the market. Overhead supply is a condition in a financial market when many units are held for sale at prices above current market prices. Generally there will be a minor rally after the first price decline as those who missed the big rally but still believe prices will only go up enter the market and cause a short-term increase in prices. This is a bear rally. It is aptly named as those bullish on the market buy right before the bear market reverses and quickly declines. For prices to resume a sustained rally, the overhead supply must be absorbed by the market. Once prices stopped going up and actually began to fall, demand is lessened by diminished buyer enthusiasm and the contraction of credit caused by mounting lender losses. With increasing supply and diminished demand prices cannot rally to absorb the overhead supply. The overall bullish bias to market psychology has not changed much at this point, because owners are in denial about the new reality of the bear market; however, the insufficient quantity of buyers and the beginnings of a credit crunch signal the rally is over and the bubble has popped.

The problem is not buyer psychology. Kool aid is still alive and well in Orange County.

Back to the OC Register article.

Everybody seems to react to just about anything and everything that is happening locally, nationally and abroad. There just is too much information at our fingertips with cable news, Internet news, print news, blogs, and RSS feeds. So, where do we go from here? Demand is not going to plummet like it did a year ago with the end of the first time home buyer tax credit. It will be interesting to gauge demand in June and see if it finally surpasses 2010 year over year comparisons, a real measure of market strength.

Yes, this summer will tell us if the market is going to hold its own over the winter or take another major leg down. Based on the weak sales number so far this year, I am becoming more bearish about this fall and winter. It could get ugly.

Thomas calculates a “market time” benchmark tracking how many months it theoretically takes to sell all the inventory in the local MLS for-sale listings at the current pace of pending deals being made. By this Thomas logic, as of last Thursday, it would take:

- 3.49 months for buyers to gobble up all homes for sale at the current pace vs. 3.36 months two weeks ago vs. 2.45 months a year ago vs. 2.35 months two years ago.

- Of the 8 pricing slices Thomas tracks, 1 had faster market time vs. 2 weeks ago; and 2 improved over a year ago.

- Homes listed for under a million bucks have a market time of 3.10 months vs. 9.43 months for homes listed for more than $1 million.

- So, basically, it is 3.0 times harder to sell a million-dollar-plus residence!

- And just so you know, the million-dollar market represents 17% of all homes listed and 6% of all homes that entered into escrow in the past 30 days.

Is there any good news in there for bulls? I don't see it. By any measure, the market for high end homes in Orange County is very weak. The reduced asking prices will likely continue to be reduced. There is far too much inventory and very few buyers.

Here’s the recent data, as of last Thursday, for listings; deals pending; market time in months; last Thursday vs. 2 weeks ago, a year ago and 2 years ago (Note: k=thousand; m=million) …

Slice Listings Deals Time (month) 2 week ago 1 yr. ago 2 yr. ago

$0-$250k 1,833 648 2.83 2.72 1.64 1.61

$250k-$500k 4,068 1,441 2.82 2.72 1.62 1.62

$500k-$750k 2,329 669 3.48 3.30 2.62 2.40

$750k-$1m 1,081 247 4.38 4.27 3.39 3.16

$1m-$1.5m 718 117 6.14 6.56 6.50 5.78

$1.5m-$2m 384 39 9.85 8.56 7.89 6.83

$2m-4m 526 37 14.22 13.42 13.49 11.71

$4m+ 295 11 26.82 26.45 38.44 29.50

All O.C. 11,144 3,189 3.49 3.36 2.45 2.35

The glut of high-end homes is apparent. And since many delinquent mortgage squatters are inhabiting these high end properties, the shadow inventory makes the time on the market much, much longer.

The main reason there are so few sales at the high end is because people in Orange County don't make enough money to support those prices. The jumbo loan market is the only game in town. Jumbo loan lenders are lending their own money, so they are concerned about loan quality, whereas the rest of the market is origination-based lending where it only has to pass GSE or FHA standards.

Jumbo loan lenders won't loan money to people who won't pay them back, so FICO score requirements are high, interest rates are between 0.5% and 1.0% higher than conforming mortgages, and lenders are carefully scrutinizing what people really make. Jumbo loan lenders are not willing to count the appreciation and HELOC booty as income. Without mortgage equity withdrawal, far fewer people can afford the payments on jumbo loans, hence we have very low sales volumes at the high end.

That isn't going to change because the government is not insuring the market.

To make matters worse, the conforming limit is going down which will force more buyers to go jumbo — a loan they may not qualify for.

Are lenders being too tough?

May 3rd, 2011, 8:11 am — posted by Jon Lansner

In his latest biweekly commentary, veteran Orange County home broker Steve Thomas ranted about lenders going overboard with their underwriting, claiming it’s a reason the home market looks sluggish these days.

Lenders have reversed course and now look at every potential borrower as not lendable unless they can prove their worthiness with a mountain of written documentation and many requests that are borderline ridiculous.

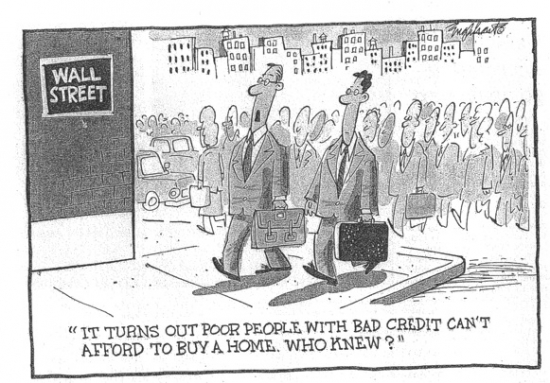

Apparently, documenting income with more than a signature is too cumbersome for him. It certainly would be easier if everyone could just apply for a loan and get whatever they want, but when lenders tried that, they found that borrowers often didn't pay them back. Whocouldanode?

Their reaction reminds me of my kids reactions to painful experiences. Mia, my four year old daughter and splitting image of her gorgeous mother, was stung a few weeks ago after accidentally placing her hand on top of a crawling bee. After wiping her tears and a quick dose of Benadryl to stop the swelling, she didn’t want to go outside in fear of being stung again. Fortunately, she swiftly recovered after I took her by the hand and explained to her in front of a flowering bush swarming with bees that they were not out to get her as long as she left them alone. She resumed her normal neighborhood activities and hasn’t talked about it since.

That is cute analogy. However, what if those bees were African honey bees who will aggressively attack anyone nearby? Leaving those bees alone wouldn't be enough to protect yourself.

Lenders were stung, and they should be afraid to lend. Their lack of caution was directly responsible for the disaster they created. In a declining market with few qualified buyers, the aggressive lenders simply lose more money and go out of business — provided they are not too big to fail. The danger has not yet passed. The likelihood of more defaults and price declines is high. Lenders who fail to recognize that risk won't last very long.

I would like to take lenders and the U.S. government by the hand and show them that hard working buyers with a respectable job history, good credit and a reasonable down payment will NOT sting them. Instead, the lenders won’t go outside to play right now.

That is simply not true. Sales volumes are 30% below normal right now, but that still means 70% of the normal transaction volume is still occurring. Who are those people? They are the hard working buyers with a respectable job history, good credit, and a reasonable down payment. There aren't enough of those people. That is the problem.

They are playing it WAY too safe by lending only to those that qualify by the strictest of standards. It is time for lenders to go outside and play nicely.

Readers, do any of you think it's a good time to loan money to jumbo borrowers in Orange County? Would you put your own money behind such a loan? I wouldn't, except for those few good borrowers that remain.

They won’t get stung again as long as they don’t lend based upon one’s ability to fog a mirror.

If I understand his argument, he is saying we can do many other varieties of lending — which were proven losers during the housing crash — to inflate prices and increase sales as long as we don't go back to the worst of the housing bubble's lending practices. That sounds like nonsense to me.

Dr. Lawrence Yun, the chief economist for the National Association of Realtors estimates that if lenders would just relax their standards, sales activity would receive a 15% bump. If you don’t believe me, ask buyers and Realtors in the trenches. Lenders are commonly requesting letters of explanation for the absurd: a job 10 years prior, an old phone number that is no longer used, and much, much more.

Lenders learned from their mistakes of the housing bubble, and they don't want to repeat them. Steve Thomas does want them to repeat these mistakes because it would increase sales volumes and make him a few more pennies on commissions.

Lenders learned from their mistakes of the housing bubble, and they don't want to repeat them. Steve Thomas does want them to repeat these mistakes because it would increase sales volumes and make him a few more pennies on commissions.

MEMO TO LENDERS AND THE U.S. GOVERNMENT: go outside and play again, lend to those that qualify, the entire economy and housing market is counting on it. An increase in sales activity would translate to more homes sold and a quicker improvement in the housing market. An improvement in the housing market helps in reestablishing consumer confidence. Confident consumers translate into more dollars spent and a return to a robust U.S. economy. Until then, expect more of the same, a housing market and an economy that lacks much direction other than sideways.

Does Thomas have a point?

No. Not really.

He paid over $400,000 for a 1 bedroom apartment

One of the surest signs of the housing bubble was the amounts people were willing to pay for glorified apartments. Properties like this only make sense as rentals. It's an obvious bubble when the cost of ownership is more than double the cost of rental — as it is with a $405,000 price tag.

This purchase was foolish for a couple more reasons. One, this was purchased in May of 2007 which is after the subprime meltdown and after outlets like the IHB were telling people the market was going to crash. The future buyer for this place was going to have difficulties without ignorant subprime lending. Two, there was no backup plan if the price didn't continue to rise 10% a year. Renting makes no sense when you are losing $1,000 or more a month with no opportunity for HELOC supplementation.

This purchase captures the essence of kool aid intoxication. It's a property purchase that only makes sense if you believe prices are going to rise significantly every year and lenders are going to give out unlimited HELOC money at ever-decreasing interest rates. Obviously, that didn't happen. It never could.

This property was purchased on 5/24/2007 for $410,000. The owner used a $328,000 first mortgage, a $82,000 HELOC, and a $0 down payment. I am amazed that any of the no money down deals still survive. We don't see them very often any more.

Despite this borrower's perseverance, the market has collapsed, and this owner is hoping for a 35% loss. I think it needs to go lower. The rent still only covers about two-thirds of the cost of ownership. Not exactly a cash cow.

Irvine House Address … 507 TERRA BELLA Irvine, CA 92602 ![]()

Resale House Price …… $285,000

House Purchase Price … $410,000

House Purchase Date …. 5/24/2007

Net Gain (Loss) ………. ($142,100)

Percent Change ………. -34.7%

Annual Appreciation … -9.1%

Cost of House Ownership

————————————————-

$285,000 ………. Asking Price

$9,975 ………. 3.5% Down FHA Financing

4.72% …………… Mortgage Interest Rate

$275,025 ………. 30-Year Mortgage

$61,272 ………. Income Requirement

$1,430 ………. Monthly Mortgage Payment

$247 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$59 ………. Homeowners Insurance (@ 0.25%)

$316 ………. Private Mortgage Insurance

$395 ………. Homeowners Association Fees

============================================

$2,447 ………. Monthly Cash Outlays

-$133 ………. Tax Savings (% of Interest and Property Tax)

-$348 ………. Equity Hidden in Payment (Amortization)

$18 ………. Lost Income to Down Payment (net of taxes)

$56 ………. Maintenance and Replacement Reserves

============================================

$2,040 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,850 ………. Furnishing and Move In @1%

$2,850 ………. Closing Costs @1%

$2,750 ………… Interest Points @1% of Loan

$9,975 ………. Down Payment

============================================

$18,425 ………. Total Cash Costs

$31,200 ………… Emergency Cash Reserves

============================================

$49,625 ………. Total Savings Needed

Property Details for 507 TERRA BELLA Irvine, CA 92602

——————————————————————————

Beds: 1

Baths: 2

Sq. Ft.: 944

$302/SF

Property Type: Residential, Condominium

Style: 3+ Levels, Other

Year Built: 2000

Community: 0

County: Orange

MLS#: S656825

Source: SoCalMLS

Status: Active

On Redfin: 4 days

——————————————————————————

Exclusive Northpark community with 24 hour guard gated security, 6 swimming pools, tennis courts, sports courts, clubhouse, parks and trails. Spacious floor plan with an indoor laundry and a 2 car tandem garage space. Highly desirable and sought after unit. Please note, sale excludes wash/dryer and refrigerator.

The idea of lenders being too strict causes both laughter and crying at the same time.

Diminished sales are not the result of lenders tightening. There are probably 5 or 6 neighborhoods in my town very similar to mine, some with larger lots, smaller lots, gated vs. ungated, less amenities. However, sales and new construction in those other neighborhoods has pretty much ground to a halt for the past 3 years, while there my neighborhood has > 10 new homes going up (200 total homes in ‘hood). Why are sales and construction down in other neighborhoods down while mine seems OK? Are lenders looser in my ‘hood? My view is that builders and developers paid little attention to what they were doing (there are some back story factors that made the development process different for my neighborhood vs others).

That people are being more careful about where they buy and how much they pay is very important to the market. When people don’t care about details, because prices always go up, prices migrate away from fundamentals and sustainable levels.

Hopefully the development that goes on now is also influenced by $4 gas. In 10 years, we’ll be closer to $5/gal than to $2/gal. Not putting more homes where people have long, and now expensive commutes, will help the housing market, and potential buyers.

The thing I absolutely do NOT understand is this: Why do banks give out 30 year mortgages at such low interest rates? I understand that conforming loans can be transferred by banks to Uncle Stupid (Gub’mint). But, if I understand this correctly, the bank generally keeps the jumbo loans. Why would ANYONE in their right mind lend out $1 million over 30 years to an individual/family at about 5%???

Home as collateral? 30 years from now, anything can happen to that home. McMansions are built to be sold, not built to last. And what about the near certainty that the US will experience high levels of inflation at some point in the next few decades? The banks are finance people, for goodness sake. They should know better than anyone else that with the current high levels of debt in the system, some type of default is very likely, and the easiest way to default is to “soft default” through inflation.

If I was lending my own money, no way would I accept 5%, or even 6%. Maybe 7% or 8% would do it. Which basically means going back to historical pre-2001 mortgage rates, i.e. rational mortgage rates. Which would align them with other consumer interest rates (credit cards, personal loans, etc, which do not currently have unusually low interest rates).

Still, I go back to this point: OK, we have low mortgage rates on conforming loans because of GSE/FHA support. But why are jumbo rates also low? Am I missing something?

H

There are multiple parts this answer.

First is that the duration on a portfolio of 30 year mortgages I believe 7 years.

Next is that strong credit quality jumbo loans can still be cut up and parceled out to those that are matching their obligations’ durations to the duration of their portfolio. (IE life insurance, pensions who have very long lived durations obligations, car insurance companies want 4 to 5 year durations).

So if a bank takes a jumbo and understands/appreciates the credit risk, they can pass off the interest rate risk to others that need it and still make a nice bundle originating, servicing and keeping the subordinated pieces which probably yield some crazy % much higher than the supposed 5%. (or they will sell those to a hedge fund so that they don’t have to take any loss reserves on those)

That is why you probably see jumbo’s requiring 30% down because they want the first 30% down side risk to go to home owner and then they are comfortable holding/selling a credit enhanced subordinated tranche of their private label MBS. They will make a killing given today’s rate environment.

That was what was supposedly happening before but the key phrase that was missing was “credit quality.” If they have it now, they will make nice change.

Thanks for that explanation. Very informative.

H

Very good answer. Precisely so.

Lenders having the requirement that the borrowers have the ability to pay back the loan! That’s an financial inovation that needs to stop if we’re to have the housing market back on track.

It’s only human nature and greed that the loan originator approve a loan, be paid the commission up, get paid for selling it off in a CDO, get paid for servicing the loan and not care if the borrower can pay. The lost money is no skin off his back with the govt bailouts and claiming that was standard practice and risk. In fact is more pay with the late fees and FC fees.

Now that the originators (banks) have skin in the game for Jumbo Loans, they are actually checking credit, assess and employment history and pay. For GSE/FHA that’s another story for there’s no skin in the game. All they need is to show the facts checked out with proper documentation and it’s investor/GSE beware. Your tax dollars at work.

“The glut of high-end homes is apparent. And since many delinquent mortgage squatters are inhabiting these high end properties, the shadow inventory makes the time on the market much, much longer.”

I disagree with IR on this. High-end homes by nature have a much longer market time than lower-priced homes, since there is a much smaller pool of buyers and demand. I don’t think the numbers in the chart can be properly gauged until we can see a longer period data, but purely based on what’s shown we can make several observations:

Market time on high-end homes have been increasing at a much slower pace than those of lower-priced homes in the past 2 years, approximately 17.5% to 55.5% respectively. I used $1.5M as cut-off based on the movement of these homes and what might constitute “high end” in OC during the time period measured. Again we probably want to look at 5-yr & 10-yr numbers and compare these market time numbers to historical data, but numbers here do not indicate shadow inventory any more significantly than lower-end homes. It does hint to a more willingness to buy higher-end homes than lower-end, possibly due to greater leverage for people with capital to move into a larger home at “cheaper” prices.

Saying lenders underwriting guidelines are too tight is nothing less than industrial grade bullshiat. We’re back to circa year 1 AD through 1998 AD underwriting guidelines. Yes, there are a few notable exceptions including:

1) If you don’t have a history of being a property manager for 2 years, lender’s won’t count rental income from your investment property. That’s prudent, not tight.

2) If you say your renting your departure residence after you buy your new home, we can’t use the rent income unless you’ve got equity, cash in the bank, and a history of property management – also prudent, not “deal killing”.

I’d like at least 5 crystal clear examples from Agents of “crazy” or “tight” guidelines that killed their deal. Upon further investigation we’ll likely find an over leveraged buyer, an over priced home, or some still ocurring shady deals by market participants that really capsized their deal. It’s not that banks are too tight with their underwriting, it’s that we’ve gotten better at catching the BS before the loan is booked.

There are two main participants in a sale – the buyer and the owner trying to sell. There are hundreds of lenders out there from Brokers, Bankers, Credit Unions, Commercial Banks, TBTF Banks, Hedge Funds, and Private Money lenders. Is someone actually suggesting (without evidence…) that every one of these funding resources all are grinding deals into the ground. Really….?

My .02c

Soylent Green Is People.

I like the not using rental income from your unsold previous residence. We qualified for our current mortgage under the assumption that our prior home would not sell and we’d have to handle both payments. Other house sold, so it was easier, and we could have qualified for a bigger mortgage.

But clearly it wasn’t a deal killer was it? All this Sturm und Drang from the agents about loan underwriting is getting stupid. Price. Price. Price. That’s the only issue.

My .02c

Soylent Green Is People.

It may be worth considering that the demand for loans has decreased, is continuing to decrease, and will continue to decrease until prices are affordable.

We were fine because we weren’t pushing to the extreme on DTI. The cash at closing was nice to have for furniture and other upgrades on the new home.

This is what I’ve seen regarding standards for “renting your departure residence after you buy your new home.” You’ll have to squeeze the new and existing housing costs into a back-end DTI of 45% too, plus have 3-6 months’ reserves on each house (I’ve seen as little as 3, but as much as 6).

Jeeze … I thought I was bearish on housing. I was watching a video on Yahoo’s finance page. Barry Ritholtz of the Big Picture blog predicts that it’ll take another 5-10 years of housing being in a slump before it finally rebounds. I’ve always respected Ritholtz, but (even) I think he’s too bearish on this call.

JMHO … this country cannot have a real economic recovery without the real estate market first capitulating. The more the govt gets involved, the more debt we pile up, and the more pain the average joe experiences.

> I would like to take lenders and the U.S. government by the hand and show them that hard working buyers with a respectable job history, good credit and a reasonable down payment will NOT sting them …

I’m a hard-working guy, but there’s a difference between that and being a hard-working buyer and working for the bank.

When I see 5x and 6x house prices, I rent.

So Steve, when you have an impressive Silicon Valley listing for 2x or 3x, give me a holler.

Actually, I have observed this in practice. A close relative of mine has been attempting to buy a condo in FL. Their income easily covers the mortgage, which will be much less than they pay now in rent even after HOA, property taxes, etc., they have perfect, 800+ credit, they are putting down 25% or so, and they have several times the purchase price in cash in the bank – yes, a whole digit multiple of the purchase price in cash. And the bank has given them an absolutely unbelievable runaround getting financed – asking for all kinds of contingencies, checking everything under the sun with the HOA and its insurers and the IRS, etc. They have actually missed their contract date and are just hoping the seller will hold out, and simultaneously so frustrated that they’re on the verge of walking away. So I’d say yes, the banks at this point have gone way too far in the other direction – from NINJA loans to refusing to lend money to people who don’t need it.

Three words: Investment Florida Condo – the riskiest of all transactions today. Expect significant scrutiny when buying a property like that, even if uou are highly qualified

My. 02c

SGIP

I don’t disagree but what they’ve experienced goes well past significant scrutiny and well into the runaround, not dissimilar from what you’re hearing about folks trying to get mods or short sales approved – it would be enough to deter many and may yet kill their deal.

What part of FL? Many condos are having problems with non payment of HOA, so to keep things going, the payers have to pay multiples of their stated HOA. Plus there is the huge risk to collateral that banks have seen. I’ve seen condos in FL sell for 80% off peak, which all things considered makes that collateral worthless.

If they’ve got multiples of the price in the bank, why get a mortgage?

Yeah, the bank already checked all of that in their condo association (they’ve got a couple of foreclosures but less than 5%), plus double checked the numbers with the HOA’s insurers, the IRS, and everyone else and their mother. They’re getting a mortgage because rates are so low, once the recession ends, they’re likely to be paying an effective zero after inflation.

In any event, just wanted to provide a counterpoint here – there are strong buyers out there in the market who are having serious trouble getting financed. I can’t even imagine what it must be like for someone with less than an 800 credit score who couldn’t buy in cash if they wanted to.

The average condo in South Florida, outside FTL is not very strong. I picked a random condo in Boynton and 11 of the last 15 sales were either foreclosures or REO sales. That is what I would have expected around Ft Lauderdale. There may be condos that are stronger, but with so many of them crushed, I would be cautious too.

I think your example is more home specific than borrower specific. Some homes are still very hard to get loans on.

Perhaps, but in any case that’s my point – this is a situation where the borrower is beyond reproach, spotless, the HOA is doing fine, and they’re still getting no end of crap. Apparently it may finally come through now, but it took them sooo much trouble and haggling, for average people I have to imagine this would be nigh on impossible. And this was the bone of contention with the story – the banks really *are* making it very, very difficult to get financing in many cases, to the point where I could very easily see it affecting the market; one of my close friends also had a lender jerk him around good before finally allowing him to close last year, here in CA rather than in FL. Even if you’re absolutely golden as a buyer, financing is really difficult for some these days (and if we say CA and FL don’t count, or some communities don’t count, then this is ignoring the effect of this on the market as a whole, which is nontrivial IMHO).

Perhaps the pendulum has swung to too much loan underwriting in FL, but you have to acknowledge the truly sorry state that underwriting was in before the crash.

That said, condo prices in FL are not low because lenders aren’t lending. Lending might take more hoops, but lots of condos are going all-cash because prices have fallen so far. Prices are low because there are too many condos and not enough buyers – regardless of whether lending is reasonably or unreasonably tight. If lending standards were abandoned again, and I could get 100% financing for speculative FL condos, even my 4th, 5th, 6th, then prices might go up, but that is not happening again anytime soon.

Oh, and it’s near Fort Lauderdale somewhere, I think maybe near Boynton Beach…? The market there has been absolutely savaged.

After what seemed like a lifetime of thirty-Year adjustable-rate mortgages, with monthly mortgage payments going up all the time, The “Mortgage Refinance 123” helped me to lock in a great low fixed rate of 3.16%, helping me to guarantee myself the ability to always make my mortgage payment on time with money to spare.

this one is in my ZIP right down the street so I figured it would be a good read. didn’t dissapoint.

to put this into a visual, I picture Bart Simpson standing in front of the local megabank saying, “eat my shorts, man.”