Here’s the link to the article: Orange County Business Journal

The link currently works but when I tried to access it from my email, it was asking me to pay. If you search for it in Google News, it should come up. But here’s the whole text anyways:

Posted date: 11/13/2006

Standard Pacific, Shea Out of Condo Projects

REAL ESTATE: Slowing market, lawsuits are factors

By Mark Mueller

Orange County Business Journal Staff

|

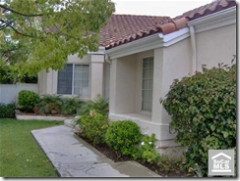

| 2851 Alton: Shea pulled out of 171-condo project |

Standard Pacific Corp. and Shea Homes, two of Orange County’s largest homebuilders, have backed out of separate plans to build a combined 615 condominiums in Irvine.

It’s the first big example of homebuilders walking away from condo projects in the Irvine Business Complex, the 2,800-acre office and industrial area near John Wayne Airport, since the housing market began slowing earlier this year.

Irvine-based Standard Pacific had planned to build five condo buildings with 444 homes at 2323 Main St. The 10-acre site is at the corner of Main Street and Von Karman Avenue and is home to shoemaker American Sporting Goods Corp., which is moving to Aliso Viejo.

Shea Homes, part of Walnut-based J.F. Shea Co., was looking to build 171 condos at its 2851 Alton Parkway project at the corner of Alton Parkway and Murphy Avenue.

Both builders stepped back from the projects in recent weeks, according to real estate sources.

The condo projects still could move ahead under different owners.

Standard Pacific no longer is under contract to buy the Main Street land. The property’s owners are said to be in talks to sell the land to someone else.

Shea’s Alton Parkway project has shifted hands to Costa Mesa-based homebuilder Warmington Group, according to sources.

The moves by Standard Pacific and Shea come amid a sluggish housing market that has some builders looking to shed land they once planned to build on.

Local home sales in the past six months have been off roughly 30% from a year earlier.

Given the housing slowdown, building in the Irvine Business Complex isn’t as attractive as it used to be.

Homebuilders there face opposition from area businesses worried about homes near their operations and neighboring cities concerned about traffic.

About 40 housing projects totaling about 14,000 homes are on the books for the Irvine Business Complex. Roughly half of those projects have been approved or are under construction.

The 2323 Main St. project, which received City Council approval in August, has seen the brunt of the opposition as of late.

Drug maker Allergan Inc., one of the biggest businesses in the area, and Deft Inc., a maker of finishes and coatings, have sued Standard Pacific and the city to try and halt development.

Newport Beach and Tustin joined the litigation over 2323 Main St., out of concern for increased traffic and environmental issues stemming from the condo development.

The two cities also have filed a separate lawsuit against a 290-unit apartment project planned at the intersection of Jamboree Road and Alton Parkway by Avalon Bay Communities Inc. of Newport Beach.

Officials from Standard Pacific and Shea declined to comment on their decisions to back away from the two projects.

The uncertainty surrounding the lawsuits were a likely factor, along with questions about the demand for homes, sources said.

Another factor that could be weighing on developers: increased development fees in the Irvine Business Complex.

They now stand at about $42,000 per home to pay for road and other improvements in the area.

For the homes that were planned at 2323 Main St., that would mean a city bill of $19 million, about 20% higher than a year or so ago.

Standard Pacific and Shea have been among the county’s most active homebuilders. The two sold a combined 824 homes here last year, most at traditional housing developments.

Each has had mixed results with redevelopment projects.

In August, Shea Homes pulled out of early plans to build a 573-home development in Santa Ana that included a 24-story condominium tower. The company reportedly withdrew its proposal due to rising construction costs and a desire to focus on low-rise homes.

And in Los Angeles, Standard Pacific recently backed out of a $34 million condo conversion project near Union Station after slow sales. The homes are being turned back into apartments.