Government officials and the federal reserve are working feverishly to reinflate the housing bubble. It's a fools errand doomed to fail.

Irvine Home Address … 52 GRAY DOVE Irvine, CA 92618

Resale Home Price …… $1,075,000

The world's a nicer place in my beautiful balloon

It wears a nicer face in my beautiful balloon

We can sing a song and sail along the silver sky

For we can fly we can fly

Up, up and away

My beautiful, my beautiful balloon

The Fifth Dimension — Up, Up and Away

The housing bubble was a wonderful time. Inflated housing prices created illusory wealth for everyone, and lenders allowed people to quickly convert this newfound wealth to anything a homeowner desired. If it would have been sustainable, it would have been wonderful. The ultimate Ponzi fantasy of endless free money for doing absolutely nothing.

I can see why ordinary citizens and loan owners wouldn't want the situation to change. Free money is certainly more convenient than money you have to earn, particularly when the free money isn't a one-time lump sum. When the golden goose is laying a steady stream of eggs, life is grand.

The ideas and fallacies of the housing bubble seem laughable now, but many people embraced the too-good-to-be-true concepts of the housing bubble, and many became very upset when anyone suggested it was all a financial fantasy created in their own minds. Of course, we all know now the housing bubble was a massive Ponzi scheme, but that doesn't stop the powers-that-be from trying to reflate it.

Friday, November 4, 2011

Nov. 4 (Bloomberg) — It's almost six years since the air started to leak, then gush, out of the U.S. housing market, and the best one can say is that residential real estate is bouncing along the bottom.

Almost every housing indicator, from starts to sales to prices, has been flat-lining for three years. Various government initiatives, including a first-time-homebuyer tax credit, gave home sales a temporary boost in 2009 and 2010. But just as water seeks its own level, home prices are still seeking theirs.

We are now into the liquidation phase of the housing bust. Lenders will spend the next three to five years cleaning up their mess. During this period, high priced areas will slowly deflate while low prices areas will bounce along right were they are. Areas will less distress will begin to recover first, but even these markets will be held back by the substitution effect in nearby lower cost markets. Prime areas will not see rapid or sustained appreciation while nearby subprime areas are still clearing out the REO and shadow inventory.

They've had lots of impediments along the way, well- intentioned though they may have been. (The counterargument, that things would have been worse without intervention, can't be proven.) From the Federal Reserve's purchase of $1.25 trillion of agency mortgage-backed securities in 2009-2010 as part of its first round of quantitative easing to renewed talk of additional MBS purchases to temporary tax credits to mortgage modification and forgiveness programs, housing has been the center of government attention and ministration — at least until President Barack Obama pivoted to jobs last summer.

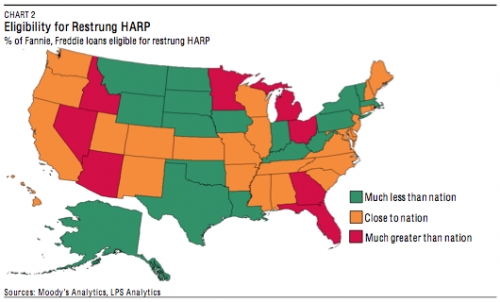

Even now it's very much in the administration's cross hairs. Earlier attempts to facilitate mortgage modifications via programs with abbreviations like HAMP and HARP all fell short of expectations. Fewer than 900,000 homeowners have refinanced their mortgages through the Home Affordable Refinance Program compared with the 4 million to 5 million touted by Obama when he introduced the program in 2009.

HARP 2.0

So last month, the president said he was revamping HARP, waiving fees and the 125 percent loan-to-value ceiling so that borrowers with no equity in their homes will now qualify for a refinancing. (For every borrower who sees his mortgage payment reduced there's an offsetting saver who receives less interest income from his MBS. In some circles this would be considered a wash.)

Actually it isn't a saver who pays the price of the MBS refinancing, it's an investor and the US taxpayer. Some of these loans are bundled into MBS pools owned by private investors, and these investors are absorbing the cost of the government's actions (I smell lawsuits in the future). The remainder will be losses covered by the GSEs themselves as these MBS pools are held on their books. The US taxpayer will absorb that cost in a larger bailout.

Why is so much energy being directed, or misdirected, at housing? Wouldn't those efforts be better spent charting a sound course for the overall economy rather than targeting a specific sector?

For starters, housing's footprint is larger than its current 2.4 percent share of gross domestic product. Even at its recent peak in 2005, residential investment, as it's known in the GDP accounts, made up only 6 percent of GDP, the highest since the 1970s when inflation was driving demand for real assets.

For most Americans, their home is their major store of wealth. The value of household real estate peaked in the fourth quarter of 2006 at $25 trillion, falling to $16.2 trillion in the second three months of this year, according to the Fed's latest Flow of Funds report. A reverse wealth effect is depressing consumer sentiment and spending.

The real drain on the US economy is in the lack of mortgage equity withdrawal. The housing ATM is shut off, and with our HELOC economy, that spells bad news.

It's also limiting mobility. Unemployed homeowners who owe more on their mortgages than their homes are worth can't pick up and move to areas of the country where labor is in demand.

Finally, home purchases beget spending on big-ticket items, such as refrigerators, washing machines and furniture.

Between 1997 — when home-price appreciation started to outpace the consumer-price index — and the peak in 2006, the average price of an existing home rose about 125 percent, according to the S&P/Case-Shiller U.S. Home Price Index. It was arguably the biggest real-estate bubble in history. I know of no law of nature, or finance, that allows for the reflating of a burst bubble. (Another asset class, yes; the same one, no.)

This is a key point. Attempts to reflate a housing bubble will invariably go to another asset class. The problem with bubbles is that prices get detached from their underlying values. The inevitable crash refocuses investors on value, so even when cheap money is made available, that money will not flow into the previously inflated asset class. Instead, the cheap money will flow into some other asset class and form a bubble there. Anyone noticed how well commodities have done since housing and stocks crashed?

This is a key point. Attempts to reflate a housing bubble will invariably go to another asset class. The problem with bubbles is that prices get detached from their underlying values. The inevitable crash refocuses investors on value, so even when cheap money is made available, that money will not flow into the previously inflated asset class. Instead, the cheap money will flow into some other asset class and form a bubble there. Anyone noticed how well commodities have done since housing and stocks crashed?

Not that politicians aren't trying. Complaints about lending standards being too tight — from the same folks who pressured lenders to lower their standards — would be funny if they weren't so sad.

“Underwriting standards are too tight?” asks Michael Carliner, an economic consultant specializing in housing. “Relative to six years ago, they are. And they should be.”

Everyone who wants higher prices and lower lending standards harkens back to the prices and standards of the bubble which by definition were not stable. Lending standards are not too tight today. In fact, they are still loose by pre-bubble standards. Many in the real estate industry viewed looser lending standards as a sign of innovation in finance. In reality, it was merely folly, and we are all paying the price for this epic failure.

Everyone who wants higher prices and lower lending standards harkens back to the prices and standards of the bubble which by definition were not stable. Lending standards are not too tight today. In fact, they are still loose by pre-bubble standards. Many in the real estate industry viewed looser lending standards as a sign of innovation in finance. In reality, it was merely folly, and we are all paying the price for this epic failure.

Fourth Rail

Housing is still the most tax-advantaged asset, which contributes to its appeal. Mortgage interest and real-estate taxes are tax-deductible. In 1997, the tax laws on capital gains were relaxed. Instead of a one-time exclusion of $125,000, the first $250,000 of capital gains ($500,000 for a married couple) is exempt from taxation provided the owner lived there for two years. What a coincidence that home prices took off just about that time.

All the discussion about closing tax loopholes to raise revenue tiptoes around the mortgage deduction. Why? Because it's a bad time to remove an incentive for home purchases.

It's always a bad time, but good times won't return to the real-estate market until prices are allowed to fall so they can perform their traditional role of allocating supply.

She is right. realtors will always argue against removing any housing subsidy no matter the circumstances. The arguments they will make will differ, but their clamoring for subsidies will always be the same.

She is right. realtors will always argue against removing any housing subsidy no matter the circumstances. The arguments they will make will differ, but their clamoring for subsidies will always be the same.

There are still plenty of reasons to own a home, but the deductibility of mortgage interest isn't one of them. For the last two decades, the nation's housing policy was designed to convert as many Americans as possible into homeowners. It was aided and abetted by Fannie Mae and Freddie Mac, which lowered the standards on mortgages they guaranteed; lax lenders; fraudulent loans, with borrowers and lenders often in cahoots; bankers that securitized and sold the mortgages; credit-rating companies that thought enough collateralized junk was worthy of a AAA; and, yes, a public eager for a free lunch.

What a wonderful synopsis of the housing bubble.

The 11 million homeowners currently upside down on their mortgages probably wonder about the wisdom of such a policy, which succeeded beyond anyone's wildest imagination. The homeownership rate rose to 69.2 percent in 2004 from 63.8 percent a decade earlier before slipping back to 66.3 percent now.

The rest of us can only imagine what other calamities (think ethanol) lie in store, courtesy of a tax code that encourages what the government deems to be “good” behavior at the time. Good can turn bad without warning.

Short sale and REO workshop

Last month was our first short sale and REO workshop. I was very impressed with the outcome. I knew Shevy was very good at what he does, or he wouldn't be the #1 agent in sales volume at his 900+ agent brokerage, but listening to him go through the details of his strategies gave me a deeper understanding of how he adds value to a typical transaction. But don't take my word for it, come out and listen for yourself. You too will come to recognize the value he adds to the process.

Shevy Akason and Larry Roberts will host a short sale and REO workshop at 6:30 PM Wednesday, November 16, 2011, at the offices of Intercap Lending (9401 Jeronimo, Suite 200, Irvine, CA 92618).

Register by clicking here or email us a sales@idealhomebrokers.com.

Down payment and HELOC money lost

For the first several years of the bust, many were of the opinion that Irvine's high end was going to be spared the bust. Of course, this belief only requires one to change their definition of high end to suit market reality.

At first, it was Columbus Grove that collapsed because the builder was still actively selling there as prices were falling. This lead many to decry the lack of quality or some other supposed features of this community.

As the high-end communities fall one-by-one, the definition of what is immune keeps getting narrower. Some small enclaves in Irvine may survive, and if any do, the bulls will point to that block or neighborhood as evidence of Irvine's supreme market immunity. People see what they want to see.

Today's featured property was a high end property in Portola Springs. Now it's asking price represents a 25%+ decline from the peak. I profiled this property when it was a short sale back in January:

The owner of today's featured property paid $1,410,500. He used a $1,000,000 first mortgage, a $269,404 HELOC and a $141,096 down payment. For this he obtained his unique tract home that surely was going to hold its value in the bad times and appreciate like crazy when times are good. We all know how that is turning out. This is another 25%+ loss on a high-end property.

Foreclosure Record

Recording Date: 11/30/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 08/19/2010

Document Type: Notice of Default

Apparently, he did not complete the short sale as this is now an REO. The bank paid $1,148,909 at auction which was the full amount due on the note. It isn't clear how long the former owner was not making payments, but the bank racked up nearly $150,000 in fees on the first mortgage during that time.

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 52 GRAY DOVE Irvine, CA 92618

Resale House Price …… $1,075,000

Beds: 4

Baths: 4

Sq. Ft.: 3383

$318/SF

Property Type: Residential, Single Family

Style: Two Level, Tuscan

Year Built: 2006

Community: Portola Springs

County: Orange

MLS#: S678715

Source: CRMLS

Status: Active

On Redfin: 2 days

——————————————————————————

Beautiful Executive home in Portola Springs. This home boasts lavish upgrades. Refinished hardwood floors throughout. 3 Bedrooms suites each with its own private bath. Separate casita located off courtyard and has its own separate entrance. Sizeable bonus room upstairs. Gracious Master suite. Formal living room and dining room combo. Gpourmet kitchen w/ granite counter tops, vegetable sink in center island, glass front cabinets, breakfast bar and nook. Adjacent to the kitchen is a spacious family room w/ fireplace. Good size rear yard w/ upgraded hardscape. Eentertainers home. Additional features include 3 car garage, mud room, upstairs laundry room, plantation shutters, recessed lighting, and crown molding throughout. Must See!

Beautiful Executive home in Portola Springs. This home boasts lavish upgrades. Refinished hardwood floors throughout. 3 Bedrooms suites each with its own private bath. Separate casita located off courtyard and has its own separate entrance. Sizeable bonus room upstairs. Gracious Master suite. Formal living room and dining room combo. Gpourmet kitchen w/ granite counter tops, vegetable sink in center island, glass front cabinets, breakfast bar and nook. Adjacent to the kitchen is a spacious family room w/ fireplace. Good size rear yard w/ upgraded hardscape. Eentertainers home. Additional features include 3 car garage, mud room, upstairs laundry room, plantation shutters, recessed lighting, and crown molding throughout. Must See!

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis ![]()

Resale Home Price …… $1,075,000

House Purchase Price … $1,410,500

House Purchase Date …. 12/26/2006

Net Gain (Loss) ………. ($400,000)

Percent Change ………. -28.4%

Annual Appreciation … -5.5%

Cost of Home Ownership

————————————————-

$1,075,000 ………. Asking Price

$215,000 ………. 20% Down Conventional

4.08% …………… Mortgage Interest Rate

$860,000 ………. 30-Year Mortgage

$228,535 ………. Income Requirement

$4,146 ………. Monthly Mortgage Payment

$932 ………. Property Tax (@1.04%)

$467 ………. Special Taxes and Levies (Mello Roos)

$224 ………. Homeowners Insurance (@ 0.25%)

$0 ………. Private Mortgage Insurance

$136 ………. Homeowners Association Fees

============================================

$5,904 ………. Monthly Cash Outlays

-$1080 ………. Tax Savings (% of Interest and Property Tax)

-$1222 ………. Equity Hidden in Payment (Amortization)

$308 ………. Lost Income to Down Payment (net of taxes)

$154 ………. Maintenance and Replacement Reserves

============================================

$4,065 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$10,750 ………. Furnishing and Move In @1%

$10,750 ………. Closing Costs @1%

$8,600 ………… Interest Points @1% of Loan

$215,000 ………. Down Payment

============================================

$245,100 ………. Total Cash Costs

$62,300 ………… Emergency Cash Reserves

============================================

$307,400 ………. Total Savings Needed

——————————————————————————————————————————————————-

I have no data to back this, but I speculate that jumbo borrowers are more likely to strategically default than subprime borrowers. Many subprime borrowers recognize that the subprime loan they never should have been given is their only reasonable opportunity to attain and sustain home ownership. This will motivate them to hang on tighter and sacrifice more. On the other hand, jumbo loan owners know they will be given another change to borrow and own again, so if things don't work out in their favor, they can simple walk away and start over. It is much more of a business and financial decision for a jumbo borrower.

I have no data to back this, but I speculate that jumbo borrowers are more likely to strategically default than subprime borrowers. Many subprime borrowers recognize that the subprime loan they never should have been given is their only reasonable opportunity to attain and sustain home ownership. This will motivate them to hang on tighter and sacrifice more. On the other hand, jumbo loan owners know they will be given another change to borrow and own again, so if things don't work out in their favor, they can simple walk away and start over. It is much more of a business and financial decision for a jumbo borrower.

The loans they reduce principal on are likely to be the lost causes they were going to lose anyway in a foreclosure. Most likely they will forgive part of the principal on some deeply underwater loan owners to induce them to make a few more payments. By giving false hope to the hopeless, they will actually gain a few additional payments they would otherwise miss to strategic default.

The loans they reduce principal on are likely to be the lost causes they were going to lose anyway in a foreclosure. Most likely they will forgive part of the principal on some deeply underwater loan owners to induce them to make a few more payments. By giving false hope to the hopeless, they will actually gain a few additional payments they would otherwise miss to strategic default.

All principal reduction is a bad idea, but as I noted above, banks will use this as a loss mitigation measure to try to induce some deeply underwater loan owners to make a few more payments.

All principal reduction is a bad idea, but as I noted above, banks will use this as a loss mitigation measure to try to induce some deeply underwater loan owners to make a few more payments.

Why is that important? Banks are going to do what's in their best interest financially. They want to keep borrowers paying. The deal doesn't have to be punitive to be effective.

Why is that important? Banks are going to do what's in their best interest financially. They want to keep borrowers paying. The deal doesn't have to be punitive to be effective.

.jpg)

.png)

Bren and the Irvine Company embraced the false rally of 2009. I think they were genuinely surprised when it fizzled out. Their plans were clearly to build on momentum from the false bottom in 2009 with a large production run in 2010 extending into 2011 and beyond. When the props were removed from the market and the underlying problems frequently discussed here surfaced, I don't think they anticipated it. Empty developments like Orchard Hills and half-dead developments like Portola Springs speak to this reality.

Bren and the Irvine Company embraced the false rally of 2009. I think they were genuinely surprised when it fizzled out. Their plans were clearly to build on momentum from the false bottom in 2009 with a large production run in 2010 extending into 2011 and beyond. When the props were removed from the market and the underlying problems frequently discussed here surfaced, I don't think they anticipated it. Empty developments like Orchard Hills and half-dead developments like Portola Springs speak to this reality.

He is probably right. The era of the large master-planned community is probably over. For starters it's too difficult to assemble a large enough parcel of land unless you go way out in the hinterlands, and with the perpetual tightening of regulations, it's far too difficult to develop over multi-decade timeframes.

He is probably right. The era of the large master-planned community is probably over. For starters it's too difficult to assemble a large enough parcel of land unless you go way out in the hinterlands, and with the perpetual tightening of regulations, it's far too difficult to develop over multi-decade timeframes.

.png)

.png)

Obama showed the courage to do the right thing despite pressures from the extreme left. He lacks the courage to say no to this bill, and he is hoping the Republicans in the House will kill it and take the heat for him.

Obama showed the courage to do the right thing despite pressures from the extreme left. He lacks the courage to say no to this bill, and he is hoping the Republicans in the House will kill it and take the heat for him. .

. Any increase in the conforming limit will increase the losses at the GSEs and will serve as a bailout to the banks. When the conforming limit was high, banks could offload their toxic crap through purchase or refinance to the GSEs. Once the conforming limit dropped, banks were stuck with their remaining bad loans.

Any increase in the conforming limit will increase the losses at the GSEs and will serve as a bailout to the banks. When the conforming limit was high, banks could offload their toxic crap through purchase or refinance to the GSEs. Once the conforming limit dropped, banks were stuck with their remaining bad loans..png)

proeprty is just above its 2002 purchase price. When commissions and negotiating room is factored in, this will be a 2002 rollback.

proeprty is just above its 2002 purchase price. When commissions and negotiating room is factored in, this will be a 2002 rollback.

.png)