Most owners contemplating selling resist the idea in a declining market. Today's post looks at the arguments in favor of selling now as opposed to waiting.

Irvine Home Address … 2 VERNAL Spg Irvine, CA 92603

Resale Home Price …… $3,395,000

Seems like I've been playing your game way too long

Seems the game I've played has made you strong

When the game is over I won't walk out the loser

I know I'll walk out of here again

I know someday I'll walk out of here again

Bruce Springsteen — Trapped

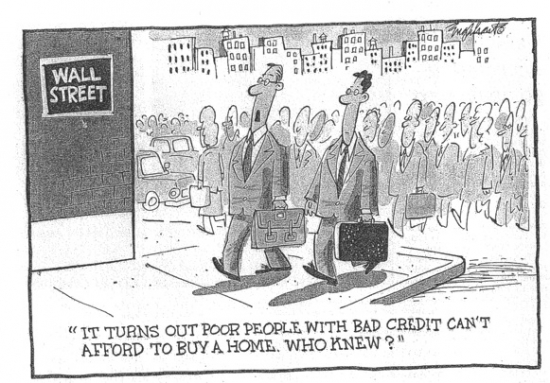

One of the more annoying lies realtors push on wouldbe buyers is “buy now or be priced out forever.” In the Great Housing Bubble, I described it this way:

When prices rise faster than their wages, people can obtain less real estate with their income. The natural fear under these circumstances is to buy whatever is available before there is nothing desirable available in a particular price range. This fear of being priced out causes even more buying which drives prices higher. It becomes a self-fulfilling prophecy. Of course, the National Association of Realtors, the agents of sellers, is keen to exploit this fear to increase transaction volume and increase their own incomes. If empirical evidence of the recent past is confirming the idea that real estate only goes up, the fear of being priced out forever provides added impetus and urgency to the motivation to buy.

Once prices begin to fall, the fear of being priced “out” forever changes to a fear of being priced “in” forever. A buyer who overpaid and over-borrowed will be in a circumstance where they owe more on their mortgage than the property is worth on the open market. They cannot sell because they cannot pay off the mortgage. They become trapped in their homes until prices increase enough to allow a breakeven sale. This puts the conditions in place to reverse the cycle and causes prices to drop precipitously.

Fear is not a good emotion for making clear decisions. Whether that fear is being priced-out or priced-in, it isn't an emotion a realtor should prey on if they truly want their clients to make the best financial decisions. Of course, we all know that realtors often are motivated more by commissions than they are by serving their clients.

The Case for Selling in a Falling Housing Market

Stan Humphries — Apr. 28 2011 – 10:20 am

The problem with the American housing market isn’t that too few of us want to move. We estimate that at least 4 million homeowners would love to sell their home and buy another one that’s bigger, smaller, better located or more affordable.

What’s holding back these “sidelined sellers?” Some can’t sell because they owe more than their homes are worth, of course. But many more are simply paralyzed by the fear of selling and buying again in a falling market. Often at root here is what psychologists and behavioral economists call “loss aversion.” We avoid accepting a grim loss on a current investment, and recent research suggests that we over-estimate the pain associated with a future loss (say, with buying a home that then loses value).

Loss aversion is paralyzing. The phenomenon is most apparent — and most dangerous — in securities trading. With a stock or other traded security, an investor can lose money by doing nothing. Selling for a small loss is often preferable to taking a risk on a very large loss. Most novice traders refuse to take small losses, and they end up allowing a few losers to grow out of control and wipe out their account.

So it’s understandable to want to wait for better days to sell, but—at least when it comes to your house—you’re probably making a mistake.

First, let’s dispense with the idea that better days are coming soon. The consensus among the 100 economists surveyed by Cambridge-based data firm MacroMarkets is that housing prices will slip 1.3% in 2011. That’s far, far too optimistic. At Zillow, we believe prices will tumble as much as 7% in 2011. After reaching the bottom, we expect real estate appreciation will remain in the doldrums for three to five years—something we’ve been forecasting for more than three years.

I think there is a bit of revisionist history going on here. I have been bearish for four and a half years, but I don't recall Stan Humphries and Zillow being so bearish. In any case, he is rightfully bearish now — in fact, he is even more bearish than I am.

.png)

So we’re all going to have to make a little peace with falling prices. But here’s the good news: If you run some numbers, you find that selling in a falling market is not always a bad idea. Especially if you’re thinking of trading in your current home for a smaller home or one in a less expensive neighborhood.

Check the math. Say you and your spouse own a nice two-bedroom condo like this on the north side of Chicago. You bought it in 2007 for $390,000, but it may only sell for $310,000 now.

Now say you’re feeling crowded in this condo because your two increasingly energetic kids have hit school age. You’ve got some savings and a good commuter car, and you think you can buy a 2,500-square-foot house like this one in a kid-friendly section of suburban Elgin for $370,000.

This is the oldest trade in the book—but here comes the loss aversion. First, you recognize that selling the condo means you’ll finally realize the painful $80,000 loss on your condo purchase. Then—and this is almost worse—there’s an anticipated loss on the new house. In February home prices in Chicago were down 10.3% from a year earlier, and you’re convinced they are likely to continue that decline and fall another 5%. Buy the new house and in a year you could be sitting on another $18,500 capital loss. It churns your guts, and maybe you decide it’s better to stay put and take the 5% hit in a smaller home.

That is a reasonable way to look at the problem. If prices are declining for all properties, it is better to wait out the decline in a less expensive one. Of course, it's even better to wait out the decline in a rental.

Trouble is, most of us wildly overestimate the benefits of waiting. We convince ourselves that avoiding a potential future loss is the same as saving money.

If you are a renter, avoiding a future loss is the same as saving money. Timing does matter. If you're a home owner, you're already exposed to whatever the real estate market has in store.

We underestimate the risks that we’ll face by waiting another year. And we totally ignore the real, measurable costs of staying in a home that’s too big or too small or poorly located.

Start with the $18,500 in savings that you thought you would garner by waiting another year to relocate to the suburb. Those savings will probably be offset by a similar decline in value on your downtown condo, which could sell for $15,500 less a year from now. Yes, by waiting you’ll also save $1,200 or so in reduced realty brokerage fees and closing costs to sell the depreciated condo. But add it all up and your total actual savings will be just $4,300.

That’s a couple of house payments, you may be thinking. That’s a solid down payment on second car—pretty handy when you move to a suburb. Wrong.

See, $3,500 of it that $4,300 would just be a net savings of home equity. It’s a paper loss you would avoid. The value would be on your family’s balance sheet, so perhaps it could serve as collateral for a loan. But it wouldn’t be real money in your pockets.

Actually, it would be real money in your pocket. If the timing is perfect, the savings would be real and tangible. It would be in a check at the closing. The fact that most people roll this equity into their new house doesn't make the money any less real.

The issue for home owners is whether or not trying to save a few thousand dollars is worth staying in a property the family wants to move out of. Financially, waiting is clearly the better decision, but for other reasons, it may not be the best decision for the family.

Now consider the risks you would have to take to get a shot at that $4,300 gain. Because while the potential savings are mostly on paper, the potential costs are quite real.

For one, you took an entire year’s worth of interest-rate risk. There are wars in the Middle East, escalating energy costs and lots of talk of inflation these days. If 30-year fixed mortgage rates move from 5% to 6.5%, the payment on a $200,000 loan goes from $1,070 to $1,260. That’s an extra $2,300 a year in mortgage costs.

That is a fallacy. If interest rates go up and mortgage costs rise, the overhang of distressed inventory will simply push prices lower. I exposed that nonsense last year in The National Association of realtors Latest Scare Tactic: Rising Interest Rates.

Then there’s market-timing risk. Different neighborhoods don’t always snap out of a market correction at the same moment. Maybe demand for bigger suburban homes will snap back faster than demand for condos in the city. That house in Elgin could get more expensive while the condo’s value continues to slide.

The risk of different market segments moving at different speeds is very real. The condo market will be the last to recover because people don't want to live in condos. The fact that the upper half of the market is crumbling shows the market is not at the bottom.

Then other, practical costs of holding the condo also creep in. Will you rent a storage space to hold the clutter that you would have shoved into the backyard shed in the suburbs? That’s at least $700 for the year. And what about the cost of sending two kids to private schools in the city for an additional year instead of sending them to Elgin’s public schools? That’s at least $10,000 per child. These costs won’t show up in the your house payment, but they’re real, measurable hits to the family cash flow.

Now he is bringing in bogus costs that could just as easily go the other way.

That’s just the math for a trade-up. Now suppose instead you want to downsize. The numbers become even more compelling.

Suppose you’re retiring. Say you dream of selling this home in Santa Monica for $900,000 and purchasing a significantly larger house like this 20 minutes away in Encino for $750,000.

Here, the costs of waiting to sell really pile up. If prices in Los Angeles fall 5% over the next year, the $150,000 difference in prices of the two homes will shrink by $8,000. And that $8,000 cost of waiting a year would not merely be a paper loss. You will actually have that much less money in your pocket after the sale of your home in Santa Monica.

I don't understand how this magic works in one circumstance and not in another. Whether prices are going up or down, there is a closing with a check to the owner. That check contains real money. Whether this money is spent on a down payment for another house, either more or less expensive, doesn't make any difference.

The $8,000 potential loss would be offset only somewhat by the lower commissions and closing costs you would face by waiting a year to sell your home in Santa Monica. But there would also be other costs involved in waiting for the trade-down. Like property taxes. Say you purchased your Santa Monica bungalow during the property bubble, when it was worth more than $1 million, and that your annual property-tax bill is roughly $13,000. That’s $3,000 to $5,000 more than you would have paid if you had moved to the Encino home.

Overall, it’s helpful to think of house prices as a river that flows forward and, on very rare occasions, backward. It’s natural for us to prefer to jump from one raft to the next when the river is moving forward—that is, when prices are rising, not falling. But even when the river is flowing backward, jumping rafts midstream can make sense. When the river is flowing backward, we tend to fixate on the speed of the next raft relative to the stationary riverbank (e.g., “My next home is going to fall 5% in value after I buy it”). We should focus instead on the speed of the two rafts relative to each other (e.g., “Both homes are going to fall 5% in value”).

He is right. Once a renter becomes a home owner, they are subject to the ebbs and flows of market prices, and when and where they move is not a big deal unless they are making a big change in the quality, price, or location of their home.

Here’s the bottom line. Of the three general classes of homeowner—first-time buyers, existing homeowners buying another home and existing homeowners exiting real estate altogether—only first-time buyers face a substantial risk when buying in a declining market. For homeowners seeking a trade, there are only real costs of selling now for people trading up, and even those are less than most of us perceive.

The broader housing market in the United States is heavily dependent upon first-time buyers, most of who should wait until prices stabilize. The failed government attempts at market manipulation simply delayed the real bottom by two years and made first-time homebuyers wait two years longer than they should have.

It turns out that in most scenarios, people who sell homes before the market bottoms do fine.

We devised this chart to show the potential loss (shown in amber or red) or gain (shown in green) you’d face in a year if you trade up or down in a falling market now. For example, trading up now to a house priced 20% greater than your current one in a market that you expect to decline by 5% over the coming year results in a 1.4% loss relative to waiting one year to buy that house. Most people likely anchor their loss expectations around the expected 5% decline in home values when, in reality, the actual loss is much less.

Percentages make the numbers seem small and insignificant, but if you talking about 4% on a $700,000 home, that is $28,000. That seems like a lot of money to me.

The third group—people leaving home ownership altogether in favor of renting—should, of course, always sell as early as possible in a falling market. That way they’re most likely to preserve as much equity as they can. In reality, I think many of these sellers are holding out in the current market hoping for some recovery in home values in the near-term. These people are waiting for Godot.

I agree that most discretionary sellers are holding their properties off the market waiting for better days that will not be coming any time soon.

My advice here doesn’t require you to be either a bear or a bull on home value appreciation. My chief point is that, when trading homes, future home value declines will matter a lot less than most people believe.

“I feel like this morning I’ve had nine different people tell me they don’t want to sell when the market is still falling,” Detroit-area real estate agent Jeff Glover says with a sigh. Glover wishes he could get more people into the leafy, prosperous suburbs west of the city, where prices have been falling now for nearly six years. He’s even got a catchy line he uses: “Do you want to wait this market out in your current house or do you want to wait it out in your next house?”

Most people ignore him. Maybe they shouldn’t.

It's unfortunate that what could have been an honest examination of the pros and cons of selling now instead turned into a smoke screen of nonsense. There are legitimate reasons to sell in a declining market. Selling to rent instead being first and foremost among them.

For home owners, the only real issue is the activity in the market for the existing home, and the activity in the market for the next home. If these markets are moving at different speeds, then either acting or waiting may be the correct decision.

For example, when the upper half the market finally does bottom, it will be better to get out of a condo and into a single-family detached. But right now with the upper half of the market falling and the lower half holding steady, it is far wiser to wait and stay in the condo until SFD prices come within reach.

Although there are good reasons to sell in a declining market, this article was not particularly convincing.

All Cash

The buyers of today's featured property bought it about a year ago in an all-cash transaction. Since they are selling it so quickly, it seems likely this was purchased as a speculative flip. Many people believed the housing market bottomed in 2009, despite proof to the contrary.

The high end already suffers from an excess of inventory and very few buyers, so where is the buyer for this property going to come? Do you think this owner will be able to sell this property and make money?

I don't.

Irvine House Address … 2 VERNAL Spg Irvine, CA 92603 ![]()

Resale House Price …… $3,395,000

House Purchase Price … $3,020,000

House Purchase Date …. 3/11/2010

Net Gain (Loss) ………. $171,300

Percent Change ………. 5.7%

Annual Appreciation … 10.1%

Cost of House Ownership

————————————————-

$3,395,000 ………. Asking Price

$679,000 ………. 20% Down Conventional

4.72% …………… Mortgage Interest Rate

$2,716,000 ………. 30-Year Mortgage

$605,094 ………. Income Requirement

$14,119 ………. Monthly Mortgage Payment

$2942 ………. Property Tax (@1.04%)

$625 ………. Special Taxes and Levies (Mello Roos)

$707 ………. Homeowners Insurance (@ 0.25%)

$0 ………. Private Mortgage Insurance

$610 ………. Homeowners Association Fees

============================================

$19,003 ………. Monthly Cash Outlays

-$1925 ………. Tax Savings (% of Interest and Property Tax)

-$3436 ………. Equity Hidden in Payment (Amortization)

$1215 ………. Lost Income to Down Payment (net of taxes)

$444 ………. Maintenance and Replacement Reserves

============================================

$15,301 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$33,950 ………. Furnishing and Move In @1%

$33,950 ………. Closing Costs @1%

$27,160 ………… Interest Points @1% of Loan

$679,000 ………. Down Payment

============================================

$774,060 ………. Total Cash Costs

$234,500 ………… Emergency Cash Reserves

============================================

$1,008,560 ………. Total Savings Needed

Property Details for 2 VERNAL Spg Irvine, CA 92603

——————————————————————————

Beds: 5

Baths: 8

Sq. Ft.: 5533

$614/SF

Property Type: Residential, Single Family

Style: Two Level, Spanish

View: Canyon, Golf Course, Hills

Year Built: 2004

Community: Turtle Rock

County: Orange

MLS#: U11001856

Source: SoCalMLS

Status: Active

——————————————————————————

Situated in the exclusive residential golf preserve of Shady Canyon, this beautiful residence has a private location and exceptional views. The home embodies Hacienda-style Spanish Revival architecture and sits on an oversized lot with a large salt water pool with water features, separate children's wading pool, spa and heated outdoor cabana with a built-in barbeque, bar and kitchen, a pool bath outdoor showers. This attractive and spacious home has warm hardwood flooring, a gourmet kitchen, great room, office, guest casita and media room and extensive upgrades throughout. The master suite offers a relaxing reprieve with a spa-like bath, fireplace, balcony and views of the golf course, rolling hillsides and canyon.

Lenders learned from their mistakes of the housing bubble, and they don't want to repeat them. Steve Thomas does want them to repeat these mistakes because it would increase sales volumes and make him a few more pennies on commissions.

Lenders learned from their mistakes of the housing bubble, and they don't want to repeat them. Steve Thomas does want them to repeat these mistakes because it would increase sales volumes and make him a few more pennies on commissions.

.png)

What does it mean to “fully evaluate?” And when did it become an entitlement for borrowers to get a loan modification? Aren't these private contracts? The attorneys will generate a lot of fees fighting over the definition of “fully.” No matter what banks do, lawsuits will be filed stating they haven't done enough.

What does it mean to “fully evaluate?” And when did it become an entitlement for borrowers to get a loan modification? Aren't these private contracts? The attorneys will generate a lot of fees fighting over the definition of “fully.” No matter what banks do, lawsuits will be filed stating they haven't done enough.

ONE BEDROOM DOWN AND THREE UP INCLUDING A GRAND MASTER SUITE WITH A SPA LIKE BATH + BONUS ROOM + COMPUTER CENTER. .. 3 CAR GARAGE. .. LIMITED SHOWINGS WITH 24 HOUR(OR MORE) NOTICE BUT WELL WORTH IT. .. DO NOT DISTURB OCCUPANTS

ONE BEDROOM DOWN AND THREE UP INCLUDING A GRAND MASTER SUITE WITH A SPA LIKE BATH + BONUS ROOM + COMPUTER CENTER. .. 3 CAR GARAGE. .. LIMITED SHOWINGS WITH 24 HOUR(OR MORE) NOTICE BUT WELL WORTH IT. .. DO NOT DISTURB OCCUPANTS

“The State Bar is very gratified that the court has agreed with us that Pines poses an imminent threat of harm to the public and therefore has removed him from active practice,” said Chief Trial Counsel Jim Towery. “Lawyers have an obligation to follow the law, not to break it. There are proper ways and improper ways for a lawyer to protest a court order. Taking the law into one’s own hands is an improper way and will subject the lawyer to discipline.”

“The State Bar is very gratified that the court has agreed with us that Pines poses an imminent threat of harm to the public and therefore has removed him from active practice,” said Chief Trial Counsel Jim Towery. “Lawyers have an obligation to follow the law, not to break it. There are proper ways and improper ways for a lawyer to protest a court order. Taking the law into one’s own hands is an improper way and will subject the lawyer to discipline.” Has this guy lost his mind? Before he set out on a zealous mission to keep delinquent mortgage squatters in homes they have no right to, did he bother to think through the ramifications of what he was doing?

Has this guy lost his mind? Before he set out on a zealous mission to keep delinquent mortgage squatters in homes they have no right to, did he bother to think through the ramifications of what he was doing?

.jpg)

Chef Kitchen, Top of the line Blue Star gas range and oven, industrial grade, Heated Marble Floors, Home Theater System w/ pull down screen from the ceiling, Sky lights, Modern recesses lights throughout, Whole house fan, triple pane windows, Water Softener and reverse osmosis water filter systems, Smart Home Electric System let you control the entire home from a remote or from your smart phone, Salt Water Pool and Spa, Private Yard, Open and Specious- Interior design was reconfigured to have the kitchen opened to both Living /Dining Room and to the family room. Unreal Master Bath with Jacuzzi Tub and Much Much more * * see full list in Media section * *

Chef Kitchen, Top of the line Blue Star gas range and oven, industrial grade, Heated Marble Floors, Home Theater System w/ pull down screen from the ceiling, Sky lights, Modern recesses lights throughout, Whole house fan, triple pane windows, Water Softener and reverse osmosis water filter systems, Smart Home Electric System let you control the entire home from a remote or from your smart phone, Salt Water Pool and Spa, Private Yard, Open and Specious- Interior design was reconfigured to have the kitchen opened to both Living /Dining Room and to the family room. Unreal Master Bath with Jacuzzi Tub and Much Much more * * see full list in Media section * *

I predicted that prices would fall between 2% and 5% this year.

I predicted that prices would fall between 2% and 5% this year.

The double dip is causing many real estate bulls to finally see their error in judgment. Bulls waited for three long years of serious declines to reach the illusory bottom of 2009. Now that prices are falling and gaining downside momentum, loan owners who less than a year ago thought they might be back above water soon are now faced with the reality of several more years waiting for a recovery that may never come.

The double dip is causing many real estate bulls to finally see their error in judgment. Bulls waited for three long years of serious declines to reach the illusory bottom of 2009. Now that prices are falling and gaining downside momentum, loan owners who less than a year ago thought they might be back above water soon are now faced with the reality of several more years waiting for a recovery that may never come.