Government efforts to prop up house prices are in effect mandating unaffordable housing and forcing the next generation to transfer wealth to the current one.

Irvine Home Address … 103 ORANGE BLOSSOM #97 Irvine, CA 92618

Resale Home Price …… $199,900

Just another lesson learned

Wear a scar, a bore repeating

Take a simple fateful turn

Opened up to stop the bleeding

Feeling like you never could

Been the disconnected frying

Hit the vein and struck a nerve

Seeing through a self that's blinding

Nowhere to buy in

Most of us hiding

Alice in Chains — Lessons Learned

The agents of denial seem bent on failing to learn the lessons of the housing bubble, or worse yet, they want to learn the wrong lessons. We are setting up a system where actions have no consequences, money is for the taking, and the bills get passed on to the prudent and law-abiding. All under the watchful eye of our bought-off politicians who will tell us the plundering of our nation's wealth was for our own good.

In my opinion, government has no place in setting market prices. We need regulations to ensure markets are transparent, contracts are enforceable, and our notions of justice are maintained. Even that level of regulation seemed burdensome to many prior to the meltdown of 2008.

Now the same people who wanted free markets and deregulation are looking for government policy to set prices in the housing market through any and all policies necessary. They can't have it both ways.

Affordability is at the heart of the problem. Lower house prices benefit new buyers who will be putting less of their income toward housing or obtaining better housing for their money. Affordable housing benefits the local economy because people have more disposable income they can spend on goods and services. Expensive housing is a drag on the economy that can only be temporarily masked by mortgage equity withdrawal. Contrary to popular belief, appreciation is not income.

Why Does The New York Times Want Government to Make Housing Unaffordable?

May 26, 2011 — Dean Baker

The lead New York Times (NYT) editorial tells readers that it is surprised and upset by the deflating of the housing bubble. It tells us:

“At times, it has looked as if things were improving, like last year’s jump in sales because of a temporary homebuyer’s tax credit or the recent rise in new-home sales from near-record lows. But, over all, sales and construction have been flat for two years, while prices, driven down by foreclosures, are plumbing new depths.”

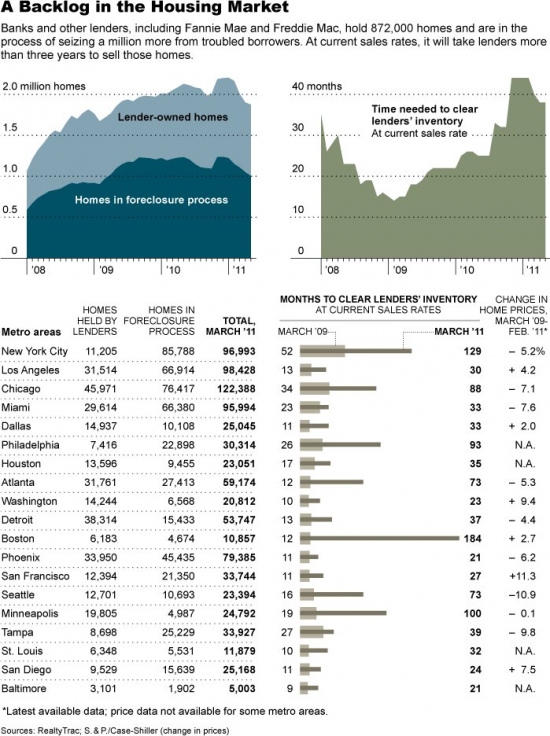

Actually no; it never looked like “things were improving” to people who follow the housing market. It looked like the tax credits were temporarily delaying the deflation of the housing bubble. This delay allowed banks and investors to have hundreds of billions of dollars in mortgages, which would be underwater today, taken off their books and replaced by Fannie and Freddie guaranteed loans, through sales or refinancing.

That is exactly what happened. With the previous profits properly privatized and the losses put on the backs of taxpayers and ordinary citizens, banks may have averted the need for nationalization. This policy undoubtedly preserved the bonuses of the idiots who lead us into this disaster. Are you still convinced this was necessary to save the economy? I'm not.

Prices are still close to 10 percent above their trend level, based on either the 100-year long-term trend in house prices or the current price to rent ratio. Neither the NYT, nor anyone else, has provided an explanation as to why we should expect prices to settle above trend.

Dean Baker will have to be forgiven for not reading the astute observations on the IHB. He would find plenty of reasons offered for prices to remain elevated above any measurable historic norm. Some of those reasons are more plausible than others, but as the ongoing decline in prices will attest to, they are all wrong.

It is not clear why the NYT would view any delay in the bubble's deflation as a positive development. People who buy houses at prices that are still inflated by the bubble can anticipate losing money on their house. Does the NYT have some reason for thinking it is good policy to get new homeowners into homes where they can anticipate capital losses.

realtors maneuver buyers into homes where capital losses are likely in order to generate commissions for themselves. They endorse the same failed policies designed to keep prices inflated, partly out of their perceived function as the voice of buyer manipulation, and partly out of a desire to feel less guilty about their previous deceit when they told people to buy during the bubble. To realtors, every problem is solved by more buying at ever-higher prices, affordability be damned.

More generally, high house prices amount to a transfer of societal wealth from people who don't own homes to those who do. Since the latter group is much wealthier on average than the former group, why should it be public policy to promote this sort of upward redistribution of wealth?

Each house that sells for a bubble price represents a current buyer paying off the debts of a previous one. When a new buyer is compelled to overpay by artificially restricted supply, the excess is a direct transfer from the new buyer to the former owner. Since banks are now owners of large amounts of REO, they are happy to join forces with other owners and lobby for policies that promote higher prices and greater indebtedness being passed on to the next generation.

The NYT's failure to seriously think about the housing market demonstrates an extraordinary laziness that prevents it from clearly understanding the policy implications. The economy will have adjust to a situation where prices return to trend levels. This will mean lower consumption. (Isn't this what everyone wants — higher savings?) The lost consumption must be replaced in the short-term by government spending, in the longer term by more net exports. The latter will require a lower dollar. This is all Econ 101.

Lower consumption! The horror of it. What would happen to Orange County if people had to consume less and live within their means? i guess they would have to cancel the Real Housewives of Orange County and bring back Kung Fu.

As far as the housing market, a little clearer thought would get policy to distinguish between markets where the bubble is still deflating (e.g. Seattle, Los Angeles, Boston)

and markets where prices are likely overshooting on the low side (e.g. Los Vegas and Phoenix).

It might make sense to have policies to boost prices in the latter set of cities. It makes no sense to have policies to boost prices in the former.

Sacrilege! Everything possible must be done to preserve Irvine's home prices! If something isn't done to keep coastal California real estate prices inflated, the bank losses are going to be astronomical. Who cares about Las Vegas? They're a lost cause, right?

The common sense nature of Mr. Baker's commentary will not be popular in the inflated housing markets that remain.

Finally, the simplest and cheapest way to help homeowners facing the loss of their home is to give them the right to stay in their house as renters paying the market rent. This requires no taxpayer dollars and no new bureaucracy and would immediately help all the homeowners affected. For these reasons, it is a non-starter in Washington.

The real reason his right-to-rent idea is a non-starter is because it would flatten coastal California, and it would strongly encourage strategic default which would wipe out the banks.

The real answer is to let the process go forward unimpeded. Borrowers who cannot afford their homes will vacate them either through short sale or foreclosure. Many of those people will need to declare bankruptcy and start over. Once all the excess debt has been purged from the system, house prices will be lower, less income will be diverted to debt service, and the economy would improve as people saved money and had more disposable income.

The only problem with the best solution is the pain. Ponzis and loan owners aren't big on austerity, and they seek out bogus government solutions that amount to handouts and support politicians who endorse these bad policies. Ultimately, cooler heads will prevail, and despite the unnecessary diversion of resources to hold back the floodwaters, the market will flow and find it's own course. That's why prices are falling again now.

Left or Right?

I am a left-leaning libertarian who finds myself being pulled in both directions by what I observed in the housing bubble. I have become far more conservative about issues of personal responsibility, yet I have become far more liberal about getting out from under debt through strategic default. Some decry my hypocrisy. So be it. I believe personal responsibility to one's family outweighs one's responsibility to a lender.

I have become far more liberal about economics and regulatory issues. I have lost faith in the workings of unfettered capital markets to avoid Ponzi schemes and cycles of booms and busts, yet I have become far more conservative in what I perceive as sensible solutions for market regulation that take a minimalist approach.

The New York Times article mentioned above is one of the finest examples of empty-headed liberalism I have read in a while. After the author makes his bogus contentions that falling house prices are bad, he follows with this jaw dropper:

Since the problems in housing are not self-curing, a government fix is in order.

What? No. a government fix is not in order. Enforcement of government regulations and an improvement in those regulations is in order, but some makeshift bailout program designed to prop up house prices at the expense of the next generation is a rip off. it's government facilitated theft.

It's the ideal issue for a politician to pander to the middle class. Of course, such a position is giving the bird to renters and future buyers who would benefit from lower prices, but perhaps bailing out the middle class and baby boomers at the expense of their children will help someone get elected.

I hope not. People need to learn their lessons eventually.

Another long term owner that went Ponzi

My records don't go back far enough to say exactly when these owners bought, what they paid, and what they borrowed. However, it looks as if they purchased at the peak of the previous bubble in 1990. If that is accurate, they lost their home to foreclosure from excessive borrowing after 20 years of ownership. Very sad.

My records pick up with a $163,500 first mortgage on 4/1/2003. The bounced back and forth between Washington Mutual and World Savings Bank with various HELOCs until on 5/9/2005 they obtained a new first mortgage for $250,000.

The pinnacle of stupidity was Bank of America that gave them a $20,000 HELOC three months after the final refinance.

Apparently Wells Fargo got the servicing on this loan from World Savings Bank, and since they weren't on the second mortgage, they proceeded with foreclosure.

Foreclosure Record

Recording Date: 08/12/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 05/13/2010

Document Type: Notice of Default

Irvine House Address … 103 ORANGE BLOSSOM #97 Irvine, CA 92618 ![]()

Resale House Price …… $199,900

House Purchase Price … $186,454

House Purchase Date …. 10/12/2010

Net Gain (Loss) ………. $1,452

Percent Change ………. 0.8%

Annual Appreciation … 10.5%

Cost of House Ownership

————————————————-

$199,900 ………. Asking Price

$6,997 ………. 3.5% Down FHA Financing

4.56% …………… Mortgage Interest Rate

$192,904 ………. 30-Year Mortgage

$42,184 ………. Income Requirement

$0,984 ………. Monthly Mortgage Payment

$173 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$42 ………. Homeowners Insurance (@ 0.25%)

$222 ………. Private Mortgage Insurance

$275 ………. Homeowners Association Fees

============================================

$1,696 ………. Monthly Cash Outlays

$0 ………. Tax Savings (% of Interest and Property Tax)

-$251 ………. Equity Hidden in Payment (Amortization)

$12 ………. Lost Income to Down Payment (net of taxes)

$45 ………. Maintenance and Replacement Reserves

============================================

$1,502 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$1,999 ………. Furnishing and Move In @1%

$1,999 ………. Closing Costs @1%

$1,929 ………… Interest Points @1% of Loan

$6,997 ………. Down Payment

============================================

$12,924 ………. Total Cash Costs

$23,000 ………… Emergency Cash Reserves

============================================

$35,924 ………. Total Savings Needed

Property Details for 103 ORANGE BLOSSOM #97 Irvine, CA 92618

——————————————————————————

Beds: 1

Baths: 1

Sq. Ft.: 819

$244/SF

Property Type: Residential, Condominium

Style: Two Level, Contemporary

View: Creek/Stream

Year Built: 1976

Community: Orangetree

County: Orange

MLS#: P781272

Source: SoCalMLS

Status: Active

——————————————————————————

Amazing price for this Orangetree condo with creek/stream views. Upper level end unit with 1 bedroom + Loft, 1 bath, approx. 819 sq. ft. that has: NEW interior two tone paint. NEW exterior paint. NEW carpet. NEW kitchen counters/sink/faucet. Eating area/living room/kitchen all overlook each other. Neutral colors throughout. Central heat and a/c. Laundry area in kitchen. Vaulted ceilings. No one above you. THIS IS NOT A SHORT SALE. Seller will assist owner occupied buyer with closing cost assistance-Call for details. Come on by and take a look today!

Have a great weekend,

Irvine Renter

.jpg)