Eighty percent of North Las Vegas loan owners are underwater and unable to relocate to find a better job.

Home Address … 6388 BRIANNA PEAK Ct Las Vegas, NV 89142

Resale Home Price …… $95,900

Life springs eternal

On a gaudy neon street

Not that I care at all

I spent the best part of my losing streak

In an Army Jeep

For what I can't recall

Oh I'm banging on my TV set

And I check the odds

And I place my bet

I pour a drink

And I pull the blinds

And I wonder what I'll find

Sheryl Crow — Leaving Las Vegas

Many people leave Las Vegas broke. Most of them lost their money in games of chance, but the latest casualties of Las Vegas were ordinary home owners who bought homes.

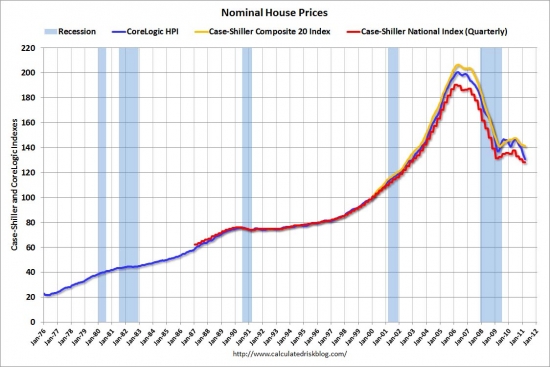

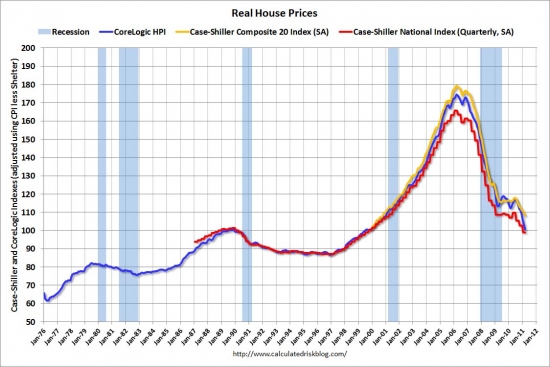

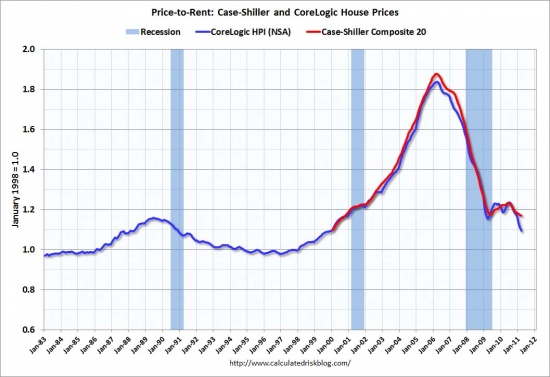

Unlike many markets where only the most indebted late buyers and HELOC abusers have been washed out by falling prices, in Las Vegas, prices have fallen so low that ordinary buyers from before the bubble who paid down their mortgage find themselves deeply underwater, unable to move, and hopeless. Those owners are the true victims of the housing bubble because they didn't do anything foolish. They happened to buy in the wrong place at the wrong time purely by chance.

Now these ordinary citizens are trapped in their underwater homes unable to move to seek employment elsewhere. Las Vegas is the only desert where people routinely drown.

Leaving North Las Vegas no option for many 'underwater' homeowners

In parts of North Las Vegas, more than 80% of homeowners owe more on their mortgages than their homes are worth. Staying is expensive, but many can't afford to move.

By Ashley Powers and Alejandro Lazo, Los Angeles Times — May 31, 2011

Reporting from North Las Vegas, Nev.— Charles Mills can barely afford to stay here. But he also can't afford to move.

That's why the 44-year-old heavy-equipment operator was preparing to leave his wife and young daughter here and go where he could find work — the Oklahoma oil fields. Mills has a mortgage to pay, even if its size pains him.

He purchased his house in 2006 for $308,500. Current value: $105,797.

“We talked about it: What can we do with the house?” Mills said. “Nobody's going to buy it. Nobody's going to rent it. If we walk away, my credit's shot. We're stuck.”

You can see why these people feel helpless. What's unfortunate is that this family isn't considering strategic default. Is his credit score really worth $200,000?

Think about this rationally. How long will it take for the value of a North Las Vegas house that currently sells for $105,000 to appreciate to $308,500? Realistically, it won't happen in the next 25 years.

It will take at least three years and probably closer to five before the housing stock turns over at the new lower values. Most people will default or short sale and move on with their lives. The constant pressure of all this distressed inventory is going to keep prices near $100,000 for quite a while.

Then after the inventory pressure abates, there will likely be a period of rebound appreciation, but at best that only will restore the market to its long-term trendline. Let's say that brings the price back up to $150,000 seven to ten years from now. At that point, prices still have to double which will take another 15 to 20 years with a 3% rate of appreciation.

For owners in that circumstance, they would be far better served by strategically defaulting, waiting the ever-shortening required waiting period to get a new loan, and repurchase. That is by far the shortest path to having home equity again.

In some parts of North Las Vegas, more than 80% of homeowners have plunged “underwater,” meaning they owe more on their mortgages than their properties are worth — a stunning concentration of aborted plans and upended lives.

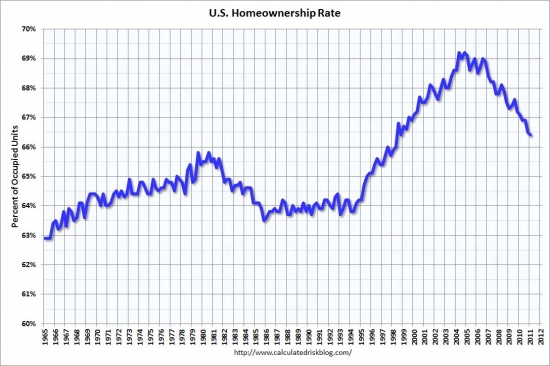

Mobility in search of new opportunity has long been a cornerstone of the American economy, much the way homeownership has long offered a path to firmer financial footing. But the housing bust has left tens of thousands of homeowners across Nevada essentially trapped.

They're considered the new normal here. They turn down higher-paying jobs elsewhere because they can't move. They tidy the yards of houses left vacant by foreclosure. They realize it's unlikely their children will receive tidy inheritances from the sale of their suburban homes.

Look at what the crash has done to homeowner expectations in Las Vegas. They don't believe they will have any equity in their lifetimes to pass on to their children. Compare that to the droves of kool aid intoxicated fools who believe they will be cashing HELOC checks soon from the double-digit appreciation sure to follow this brief correction.

Orange County will not become as desperate as Las Vegas, but we have a long way to go before the market psychology has changed enough to signal we are near the bottom.

When they look about their neighborhood, they question things they never questioned before. Are dead plants a sign that someone forgot to water? Or did the water get turned off? Does a garage sale mean more neighbors are about to bail?

“We don't even walk around our own neighborhood anymore,” Mills said. “Why? To say hi to strangers?”

Elsewhere on Midnight Breeze Street are Steve and Gay Shoaff, who once talked of selling their house and retiring somewhere pretty. Gay, 57, even toured a place in Wyoming.

But the Shoaffs have been living mostly off savings since the construction industry sputtered. Steve, 60, worked as a drywall taper and foreman.

“I'd say, 'Gay, we're going to become millionaires on this house,' ” Steve recalled one day as he and his wife unwound in the backyard they'd spent thousands of dollars sprucing up. Gay mustered a smile.

I give this man credit for the courage to admit his kool aid intoxication.

Their $187,980 home is now assessed at $99,220.

“This house won't be worth what we paid on it until after we die,” she said.

Some economists would agree, predicting that a full recovery in parts of the West's “foreclosure belt” — California, Nevada and Arizona — won't occur until at least 2030.

They are right. It will take longer than they have to live for prices to come back.

Nationwide, 23.1% of homeowners with mortgages are underwater. No state is more underwater than arid Nevada, with about two-thirds of borrowers holding such mortgages, according to CoreLogic, a Santa Ana research firm.

Some economists argue that, in a way, these homeowners are worse off financially than those who lost their houses through foreclosure and were forced to move on. Those borrowers often were able to live rent-free for years because of the snail's pace of foreclosure proceedings.

The people who bail and take their medicine are far better off than the people trapped in their homes. That's why strategic default is so common in Las Vegas. It's the wise thing to do.

Meanwhile, their underwater neighbors poured money into mortgages, not savings or investments. They couldn't chase higher-paying work. Homeowners with negative equity are at least a third less mobile than other homeowners, according to a recent study in the Journal of Urban Economics.

I feel sad for those who emptied their savings accounts and retirement accounts to pay mortgages. The poured their money down a rat hole, and now they are trapped in it.

But abandoning their homes was an option that appeared too dicey. “Walking away, it does wreck your credit history for a while and you can't get another mortgage for seven years,” said Richard Green, director of the USC Lusk Center for Real Estate. Defaulting also makes it harder to rent an apartment. “The other thing is, there is also some sense of obligation to repay your bills,” he said.

I'm sure the mortgage industry likes to see those comments from “experts” on these matters. Too bad it is totally inaccurate. The GSEs are letting people get new loans two years after a foreclosure. Further, the ramifications for people's credit scores, ability to get a lease or a job is hugely exaggerated. Plus, the whole notion of moral obligation to repay debts has been washed away. Mr. Green is wrong on every point.

Indeed, some North Las Vegas residents would rather forge a community here. Some feel blessed to have held on to their homes when so many people lost theirs.

… Mills, who was lured here from Los Banos, Calif., in 2006 by good-paying work and cheap housing, started seeing more neighbors padding around during the day, suggesting they had lost their jobs. Suddenly, they would vanish — sometimes after ripping out their toilets and sinks.

A family who lived near Mills, whose little boy played with his daughter, recently moved after his secretary mom and construction worker dad were laid off.

“I told my wife we don't have friends anymore. They all move away,” he said.

Actually, most of them moved into a rental in the same neighborhood. Unless they can't afford a rental, most who strategically default will rent a place in the same school district so their children can maintain friendships and they can keep their same social circle. In Las Vegas where unemployment is very high, particularly in construction, the neighborhoods are becoming much more fragmented.

Mills' wife, Maria, was let go by the entertainment department of a casino. He bounced from job to job, sometimes trucking cooking oil around Utah and Nevada, sometimes juggling security and janitorial work.

Determined to hang on to their four-bedroom house, he and his wife returned two new Nissans. “The cars, those are toys. Those are material things,” Mills said. “This is home.”

They waded through a mound of paperwork — and instructions to temporarily stop paying their mortgage — to cut their $1,600 monthly payment to about $900. The total amount they owe, however, remains the same.

The got a loan modification that essentially turns their mortgage into an Option ARM. They are staying in their underwater house, but have they really benefited from the arrangement?

James R. Follain, a senior fellow at the State University of New York's Rockefeller Institute of Government, argued in a recent study that former home-building hot spots, such as Las Vegas and California's Inland Empire, may crumble in the manner of Rust Belt manufacturing towns.

“There is a different mechanism leading to a similar outcome,” Follain said. “It was built on this upbeat set of assumptions about the future of house price growth, of population growth.”

That scenario is more likely to play out in Riverside County than in Las Vegas. Las Vegas has the gaming industry as a core economic driver. Riverside County has cheap houses and an economy based on providing cheap houses. What will bring back the economy there?

So last month, while Mills was gearing up for Oklahoma, the Shoaffs tried to keep their neighborhood from looking like so many in the Las Vegas Valley, the ones marred by one decaying home after another.

Drive down Midnight Breeze, and you'll spot few obvious signs of the real estate bust: no bank-owned signs, no broken windows, no doors jammed with unclaimed pizza fliers. That's partly because Gay busies herself yanking weeds from yards and ripping foreclosure notices from garage doors so the vacant homes won't tempt vandals.

This woman is tearing legal notices off neighboring properties. Sounds like a new foreclosure defense: the owners didn't receive notice because a neighbor tore it down.

On a recent evening, however, the Shoaffs took a walk through the neighborhood. In a backyard a few blocks away, someone had shoved over a foosball table, smashed a computer, tossed around stuffed animals and ruined the hot tub with what appeared to be white paint.

Gay's face fell. This house was likely another foreclosure casualty, its owner long gone.

The Shoaffs aren't going anywhere.

Picking up the pieces

The housing market in Las Vegas is a disaster. The enormous imbalance of supply and demand has pushed prices back to the mid 1990s.

I now make a living recycling the debris left over from the housing crash. Most of the homes I buy now are empty, and like this one I purchased in April, they are modest single-family homes selling near the median. These are the quickest and easiest to prepare and sell.

Between March 2 and April 23, I bought ten houses. Of those ten, this is the only one not in escrow or closed.

I will have about $80,000 into this property, and if it sells for its current asking price, my fund will make about $10,000. In all likelihood, I will have to negotiate a lower price or offer to pay the closing costs of an FHA buyer, but it will likely be a good flip like the other nine.

House Address … 6388 BRIANNA PEAK Ct Las Vegas, NV 89142 ![]()

Resale House Price …… $95,900

House Purchase Price … $69,000

House Purchase Date …. 4/12/2011

Cost of House Ownership

————————————————-

$95,900 ………. Asking Price

$3,357 ………. 3.5% Down FHA Financing

4.54% …………… Mortgage Interest Rate

$92,544 ………. 30-Year Mortgage

$20,190 ………. Income Requirement

$471 ………. Monthly Mortgage Payment

$83 ………. Property Tax (@1.04%)

$20 ………. Homeowners Insurance (@ 0.25%)

$106 ………. Private Mortgage Insurance

$94 ………. Homeowners Association Fees

============================================

$775 ………. Monthly Cash Outlays

$0 ………. Tax Savings (% of Interest and Property Tax)

-$121 ………. Equity Hidden in Payment (Amortization)

$6 ………. Lost Income to Down Payment (net of taxes)

$32 ………. Maintenance and Replacement Reserves

============================================

$691 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$959 ………. Furnishing and Move In @1%

$959 ………. Closing Costs @1%

$925 ………… Interest Points @1% of Loan

$3,357 ………. Down Payment

============================================

$6,200 ………. Total Cash Costs

$10,500 ………… Emergency Cash Reserves

============================================

$16,700 ………. Total Savings Needed

Property Details for 6388 BRIANNA PEAK Ct Las Vegas, NV 89142

——————————————————————————

Beds: 4

Baths: 2

Sq. Ft.: 1673

$057/SF

Property Type: Single Family Residential, Detached

View: Strip

Year Built: 2000

County: 0

MLS#: 1146598

Source: GLVAR

Status: Exclusive Right

On Redfin: 21 days

——————————————————————————

Not SS or REO. Great 4 bedroom house. Freshly painted. Carpets will be professionally cleaned. Very nice covered stucco patio with ceiling fans and electrically wired. Home boast a nice array of ceramic tile, hardwood floors and carpet. Appliances, including refrigerator to be installed by 05/20/11. Great strip view from front yard. Home is located on a great cul-de-sac street.

Have a great weekend,

Irvine Renter