The California Association of realtors acknowledges that a lower conforming loan limit will further damage our already weakened housing market.

Irvine Home Address … 51 CEDARLAKE #84 Irvine, CA 92614

Resale Home Price …… $695,000

We're not scared to lose it all

Security throw through the wall

Future dreams we have to realize

A thousand sceptic hands

Won't keep us from the things we plan

Unless we're clinging to the things we prize

Howard Jones — Things Can Only Get Better

Are falling house prices good or bad? I suppose it depends on who you ask. According to homeowners and realtors, falling house prices are the end of the world (see below). For those who want to buy a house, falling house prices means things can only get better.

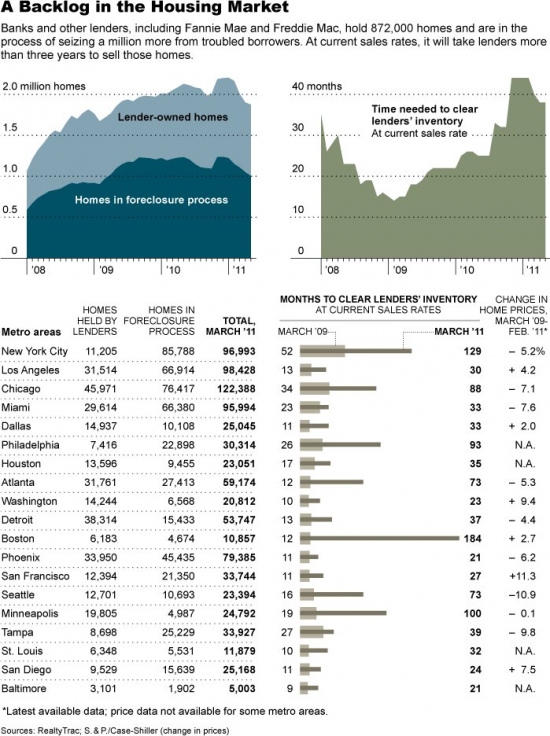

House prices are currently falling, and they are expected to do so for the foreseeable future. Despite the whining by realtors that lending standards are too tight, these standards will continue to tighten as the market is weaned off government supports.

In 2008, the conforming limit was raised from $417,000 to $729,750 in high priced markets like Irvine. Apparently, bureaucrats felt high wage earners needed government subsidies to afford the ridiculously priced housing in places like Irvine. The real motivation was to prop up prices and shift the losses from private lenders to the government-backed GSEs. To some degree, they were successful.

I have made the case on two separate occasions that lowering the conforming limit will lower house prices in Irvine, particularly on those properties that required conforming loans in the $625,000 to $729,750 range. This argument has been dismissed by some in the astute observations.

In February, I reported that Lowering GSE and FHA loan limits will lower house prices.

However, if they do lower the jumbo conforming limit from $729,750 to $417,000 or below, the meat of the Irvine market would suddenly have to pay jumbo rates. We would be among the first markets in the country to experience the transition from public to private financing. Jumbo rates are somewhere between half-a-point and one point higher than conforming rates. If future buyers are facing higher interest rates, their hopefully higher incomes will not be leveraged as much, and the loan balance will not be larger.

Markets where jumbo conforming loans ($417,000 to $729,750) are prevalent, the market impact will be the most noticeable. If you combine that with the possibility that loans that large will no longer be tax deductible, and borrowing huge sums to take a position in real estate doesn't seem quite so appealing. Future take-out buyers will not be so leveraged.

I followed up with the post Conforming mortgage limit falls to $625,500 October 1, prices to follow.

This change strikes at the heart of the Irvine single-family detached market. Many Irvine properties have loans between $729,750 and $625,500. Every buyer contemplating a loan in that range will face an interest rate half a percent higher. As a result, buyers will either need to come up with 10% more income to afford the same mortgage, or the loan they will qualify for will be 10% smaller. Since most Irvine borrowers are maxed out, loan balances in this price range will likely decline by 10%, and the houses they were intended to finance will similarly drop in price.

Market prices are set on the margins, and if the current balance of supply and demand is not sustaining prices, what happens when demand is curtailed even a little bit? Obviously, the market will find a new equilibrium, most likely at a lower price.

For those that dismiss this upcoming drop in the conforming limit as meaningless, why has the California Association of realtors raised the alarms and come out opposing this change? i think we all know the answer to that one.

Pending conforming loan limit decrease puts California on edge

With the conforming loan limits expected to drop in October, the California Association of Realtors warned of the impending harm to homeowners, while the only private-label securitizer left notified investors of more opportunities.

Have you ever noticed that realtors only defend the interests of homeowners? Aren't buyers half of their income and market? Why do realtors consistently want to screw buyers in favor of sellers?

The conforming loan limit determines the maximum mortgage amount the Federal Housing Administration, Fannie Mae and Freddie Mac can buy or guarantee. Without congressional action, the limit will drop to $625,500 from $729,950 for the majority of counties nationwide on Oct. 1.

These three agencies currently fund 95% of the mortgage market, and housing finance reformers point to lowering this limit as a first step to usher in private capital.

The lowering of the conforming limit back to $417,000 is the first step toward returning to a private market. Private loans without government backing will have risk, and providers of the capital for these loans will want to be compensated appropriately for the risk they are taking on. This will increase borrowing costs and thereby reduce loan balances which will in turn lower prices.

However, according to CAR, more than 30,000 Californian homeowners will face higher down payments, higher mortgage rates and stricter loan qualification requirements when the limits drop.

Notice the choice of words above. It isn't California homeowners who will face those problems, it is California home buyers. This will hurt current homeowners trying to get their inflated prices, so CAr has conflated homebuyers with homeowners and chosen sides to favor owners over buyers.

Further, CAr is acknowledging that the new lower conforming limit will dampen demand. Of course, they portray that as a bad thing because it doesn't benefit homeowners. However, it's great for homebuyers, and I think it's fantastic.

The $104,450 decrease in most counties will not be felt in some California counties. In fact, it will be steeper.

CAR analyzed the effect of dropping the limit across several specific counties in California. In Monterey County, for instance, the government-sponsored enterprise limit will drop a total of $246,750, followed by a $151,250 drop in San Diego, and $141,550 in Sonoma County.

The FHA conforming loan limit will fall $201,450 in Merced County and $164,650 in Riverside.

“By reducing the conforming loan limit, thousands of California homebuyers will be shut out of homeownership,” CAR President Beth Peerce said.

Bullshit. It really annoys me when I read that nonsense. Nobody will be shut out of ownership. Sellers will have to lower their prices in order to sell. Period. If sellers chose not to lower prices, they won't sell. Since so much of the market is must-sell distressed inventory, sellers will lower their prices, and properties will become more affordable.

“The higher mortgage loan limits are critical to providing liquidity in today’s housing market and are essential to our housing recovery.

More bullshit. A higher conforming limit is essential for prices to stabilize at higher levels, but no government guarantees are required to stabilize pricing or for housing to recover.

We urge Congress to maintain the current limits and make them permanent to provide homeowners and homebuyers with affordable financing and help stabilize local housing markets.”

She forgot to add the words “at inflated price levels” to the end of her statement.

Redwood Trust, a real estate investment trust based in California and the only firm to issue a residential mortgage-backed security since the financial collapse in 2008, said the conforming loan limit decrease could drop more loans into its grasp. Redwood already plans to issue two more RMBS by the end of the year.

If risk is properly priced, and if the buyer pool meets the qualification standards, the private market will pick up the slack. It will just do it at a lower price point. The return of the private market is what we want.

If annual residential mortgage originations return to $1.5 trillion and jumbo loans — which served as the collateral in its RMBS deals — account for 20% of that, originations of jumbo loans could reach $300 billion, Redwood said in its first quarter report to investors.

“With GSE reform, the portion of the mortgage market that could potentially be available to Redwood could be substantially larger if the conforming loan limits are reduced (as the Obama administration has indicated it intended to do) during the reform transition period, and perhaps still larger if, as part of GSE reform, the concept of conforming limits is eliminated,” Redwood said.

Write to Jon Prior.

Follow him on Twitter @JonAPrior.

There is no question in my mind that a lower conforming limit will lower prices on desirable single-family detached homes in Irvine. It's only a matter of how much and how soon the impact is felt. With the other market headwinds, during the fourth quarter of 2011 when the new standards will be in effect could be pretty ugly.

Did the former owners buy this at auction as a flip?

This property was emailed to me by a reader who thought the transaction appeared a bit fishy. The property was originally purchased by a realtor and another party on 4/27/2004 for $715,000. They used a $515,000 first mortgage and a $200,000 down payment. They refinanced up to a $600,000 mortgage, but that still left $115,000 of their own money in the property, which they lost.

Perhaps with the lowered income everyone in real estate has been dealing with, the payments became burdensome. The property was allowed to go into foreclosure.

Foreclosure Record

Recording Date: 02/02/2011

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 11/01/2010

Document Type: Notice of Default

The property was purchased at auction for $570,000 by SD Growth Fund LLC. In a strange coincidence, the initials of the last names of the former owners are S and D. Another reader (an attorney) looked into this coincidence, and there is no connection to the former owners.

The SD Growth Fund LLC is expecting a healthy profit from this property. With 20% down, the mortgage wouldn't be in the new jumbo range, but if it doesn't sell by October 1 when the new lower limits kick in, I suspect they will face some competition from nicer properties looking for those few buyers that remain.

Irvine House Address … 51 CEDARLAKE #84 Irvine, CA 92614 ![]()

Resale House Price …… $695,000

House Purchase Price … $570,000

House Purchase Date …. 4/25/2011

Net Gain (Loss) ………. $83,300

Percent Change ………. 14.6%

Annual Appreciation … 125.1%

Cost of House Ownership

————————————————-

$695,000 ………. Asking Price

$139,000 ………. 20% Down Conventional

4.49% …………… Mortgage Interest Rate

$556,000 ………. 30-Year Mortgage

$120,594 ………. Income Requirement

$2,814 ………. Monthly Mortgage Payment

$602 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$145 ………. Homeowners Insurance (@ 0.25%)

$0 ………. Private Mortgage Insurance

$280 ………. Homeowners Association Fees

============================================

$3,841 ………. Monthly Cash Outlays

-$469 ………. Tax Savings (% of Interest and Property Tax)

-$734 ………. Equity Hidden in Payment (Amortization)

$231 ………. Lost Income to Down Payment (net of taxes)

$107 ………. Maintenance and Replacement Reserves

============================================

$2,976 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,950 ………. Furnishing and Move In @1%

$6,950 ………. Closing Costs @1%

$5,560 ………… Interest Points @1% of Loan

$139,000 ………. Down Payment

============================================

$158,460 ………. Total Cash Costs

$45,600 ………… Emergency Cash Reserves

============================================

$204,060 ………. Total Savings Needed

Property Details for 51 CEDARLAKE #84 Irvine, CA 92614

——————————————————————————

Beds: 3

Baths: 2

Sq. Ft.: 2200

$316/SF

Property Type: Residential, Condominium

Style: Two Level, Other

Year Built: 1984

Community: 0

County: Orange

MLS#: S659826

Source: SoCalMLS

Status: Pending

——————————————————————————

Fantastic! The best ways to describe this wonderfully refreshed lake community home. With this ideal location you receive the best of all worlds. Quiet, tranquil neighborhood, tennis courts, pools, lake amenities, shopping, walking trails, and amazing schools makes it a joy to come home everyday. The home itself has a floor plan that not only speaks but yells out functionality, and elegance. Formal dining area, large vaulted living room cascading with natural light and cozy gas fireplace, functional kitchen and eating nook, and generous sized family room give the nuts and bolts to this interiors main floor that provide the perfect setting for all occasions. From day to day living, cozy family movie night, intimate dining and large family and friend gatherings you will not be disappointed. Three bedrooms upstairs give plenty of room for everyone to have their own space, including the master bedroom that boasts it's own reading enclave, gigantic walk-in closet, and spa like bath.

a floor plan that not only speaks but yells out functionality? Give me a break.

.jpg)

Have a great weekend,

Irvine Renter

In a select few neighborhoods this may be true. The rich have gotten much richer over the last decade or more. Unfortunately, this wealth is very concentrated in the hands of a few people. Certain neighborhoods may be spared the high-end crash, but properties that benefited from their proximity to wealth — properties typically purchased with extreme leverage by posers — these less desirable properties will be crushed just like the condos we see here in Irvine.

In a select few neighborhoods this may be true. The rich have gotten much richer over the last decade or more. Unfortunately, this wealth is very concentrated in the hands of a few people. Certain neighborhoods may be spared the high-end crash, but properties that benefited from their proximity to wealth — properties typically purchased with extreme leverage by posers — these less desirable properties will be crushed just like the condos we see here in Irvine.