The Orange County unemployment rate is under 10%, but unemployment in the construction industry is an astounding 38%. Projections are for a slow recovery.

Irvine Home Address … 4 PINEWOOD #67 Irvine, CA 92604

Resale Home Price …… $498,000

When they've tortured and scared you for twenty hard years

Then they expect you to pick a career

When you can't really function you're so full of fear

A working class hero is something to be

A working class hero is something to be

John Lennon — Working Class Hero

I know many people whose livelihood depends on construction and real estate. Most of them are hurting right now. With 38% unemployment, and 62% underemployment (that's a guess), nearly everyone in a real estate related field is suffering. Thirty-eight percent unemployment is remarkably high. Unemployment rates higher than 10% represent widespread suffering. Back when the government kept accurate and reliable records of unemployment during the Great Depression, the rate exceeded 25%. Thirty-eight percent unemployment is beyond description.

It's not only people in construction and real estate that suffer. With so many out of work, the demand for goods and services of all kinds is diminished. In short, the troubles in construction and real estate are not confined to that sector of the economy. On the bright side, it is getting a little better.

1st gain in O.C. construction jobs in 4 years

By JON LANSNER — July 5, 2011

The number of Orange County construction workers in May was 200 jobs higher than a year ago. That's no hiring spree but it's the first year-over-year gain since December 2006.

State Employment Development Dept. stats show Orange County construction bosses reported 67,000 workers in May – up 1,800 from April. That's the largest month-to-month gain since June 2007.

What's driving what is at a minimum a stabilization of Orange County construction work?

- Well, EDD figures show big Orange County projects – so-called heavy and civil engineering jobs — up 600 in a year to 6,900 positions in May. That's the 7th consecutive gain for this Orange County construction niche, driving by big infrastructure programs such as highway work in northern Orange County and grading efforts for new housing in Irvine. Heavy and civil engineering jobs had previously been falling, year-to-year, for 16 months before the recent surge that leave employment in this category 2,200 positions – 24% – below the September 2006.

- Specialty trade contractors add 300 workers in the year ended in May to total reported Orange County payrolls of 46,200 positions. That's the second straight year=to-year gain; and third in four months. This Orange County group is benefiting from slowly improved homebuilding efforts around the county and renewed boost in remodeling work for both homeowner and corporate clients. Specialty construction trade jobs in Orange County had previously been falling, year-to-year, for 51 months before the recent surge that leave employment in this category 30,000 positions – 39% – below the September 2006.

- Still hurting are jobs in Orange County building construction, down 700 in a year – the 41st consecutive drop in a losing streak that dates to August 2007. Modest homebuilding efforts have not stemmed job losses in this niche, as construction of Orange County commercial real estate – from offices to shopping centers – remains all-but dead. Employment in this Orange County construction niche is down 10,300 jobs – 41% – from its September 2006.

Nobody wants to dampen good news, but it's been a painful Orange County real estate downturn: 42,500 construction jobs – 38% of the work force – gone since the September 2006 peak. In that same period, Orange County lost 157,000 jobs – so, construction alone was 27% of the drop.

The end of this suffering is nowhere in site. The Irvine Company has been employing construction workers for the last couple of years, but they aren't selling many of the homes they built recently, and some wonder if they won't stop due to lack of sales. If the Irvine Company stops construction, it isn't very likely that Rancho Mission Viejo or other competitors will pick up the slack. With residential, commercial and industrial all out of commission, only apartment construction will keep the industry afloat.

The end of this suffering is nowhere in site. The Irvine Company has been employing construction workers for the last couple of years, but they aren't selling many of the homes they built recently, and some wonder if they won't stop due to lack of sales. If the Irvine Company stops construction, it isn't very likely that Rancho Mission Viejo or other competitors will pick up the slack. With residential, commercial and industrial all out of commission, only apartment construction will keep the industry afloat.

UCLA: Calif. housing ‘completely imploded’

June 15th, 2011, 12:00 am — posted by Jon Lansner

UCLA economists offer little near-term hope for California real estate in their latest forecast:

- “Even the glimmer of hope we saw with slightly elevated prices in the coastal cities of California during the home purchase incentive months has now faded. The basic story of today's housing markets is that of a market that completely imploded, that has many Californians underwater and a market with demand diminished by both a lack of easy financing and a lack of jobs.”

- “Another year before we see significant increases in the demand for housing.”

- Homebuilding runs at historically low levels. “There are no signs of that changing soon.”

- “When the potential demand finally turns into actual demand it is going to look a bit different than just a recovery in the housing market. It will be on the coast, and focused on multi-family housing. That is important because it has implications for the number and location of construction and real estate jobs generated by the resurgence in residential markets towards the end of next year.”

- Multifamily construction is expect to eclipse its peak of the previous cycle — permits pulled for 62,000 units — by 2013. But home construction will peak this cycle at 119,000 units — 23% below the 2005 peak.

- Construction employment will grow 25% in the next decade to 709,000. Still, that’s 225,000 jobs short of the previous cycle’s 2006 peak.

If UCLA is correct, we are witnessing a structural change in the California construction industry. The golden age of homebuilding and construction has past. By the chart above, they do not project reaching year 2000 employment levels by 2020. The only thing reducing unemployment will be workers giving up and seeking work in other fields.

Why the Housing Crash Remains a Wreck

By Marcie Geffner — Published June 27, 2011 — Bankrate.com

Foreclosures. Short Sales. Unemployment. Tight credit. Overbuilding. Those are but some of the reasons housing markets in many parts of the country remain stubbornly depressed, even while activity in other economic sectors has begun to rebound.

New-home building and sales of existing homes historically have been leading economic indicators, pointing the way to robust recovery after a downturn. In the current cycle, however, that hasn't happened, says Lawrence Yun, chief economist at the National Association of Realtors.

“Housing has always been the leader in terms of getting the economy back on track,” Yun says, “but that is not the case this time around.”

On rare occasions, Lawrence Yun says something that is not complete bullshit. In this instance, he is right. Residential investment has historically been the best indicator of the bottom of a recession. With homebuilding at historic lows, construction employment and spending is not boosting the economy and helping us pull out of recession.

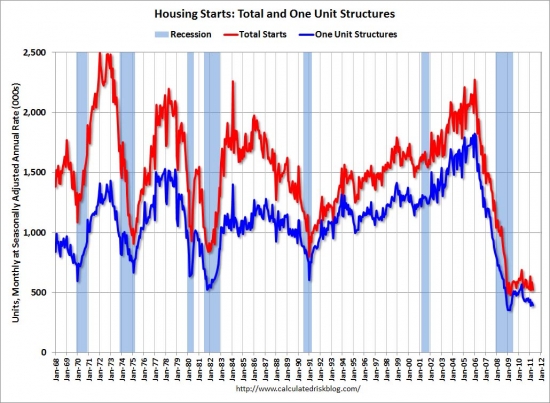

Housing Starts Shrivel

The biggest stumbling block has been the sharp downturn in new-home construction, which is usually a major contributor to economic growth not only through new-home sales, but also jobs in home construction and purchases of new appliances, fixtures and furnishings.

But construction starts for residential units fell to an annualized pace of 560,000 units in May, a drop of 3.4% compared with the 582,000-unit pace for construction starts set a year earlier, according to the U.S. Census. Sales of new-built homes have lifted from last year's rock-bottom levels, but are still far lower than normal.

Building has been constrained, Yun says, due to a plentiful supply of existing for-sale homes relative to demand, rising prices of building materials such as lumber and steel, and builders' difficulty in getting construction loans.

The ample inventory of for-sale homes includes an “enormous overhang” of bank-owned properties that depress home prices and present tough competition for builders, says Rick Sharga, senior vice president of RealtyTrac, a foreclosure data firm in Irvine, Calif. Homes that are in some stage of the foreclosure process are so commonplace that they accounted for 28% of all homes sold nationwide in the first quarter of this year, RealtyTrac's latest survey showed.

Anyone who believed residential investment would bottom in 2009 was ignoring the overhang of REO. The UCLA forecast is probably a realistic assessment of what the future holds.

Tight Credit Squeezes Demand

Meanwhile, homebuying has been held back largely due to lenders' tighter grip on mortgage financing. Higher credit scores, fatter down payments and pickier underwriting have combined to outweigh fallen home prices and low interest rates, which have made owning cheaper than renting in some U.S. cities. One indicator of just how tight lending has become: 31% of U.S. home sales in April were to all-cash buyers, down only slightly compared with a record-high 35% share of cash transactions in March, according to the National Association of Realtors. Most cash buyers are investors who don't intend to occupy the homes they purchase.

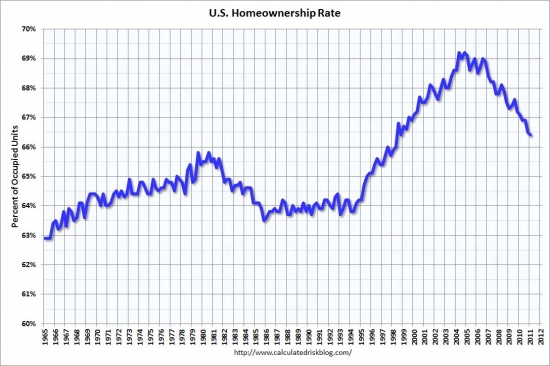

The influx of all-cash buyers has corresponded to the declining home ownership rate. This was fully expected by anyone who anticipated a looming foreclosure crisis from insolvent borrowers.

Another demand-depressing factor has been the trend toward young adults living with their parents or an additional roommate, rather than forming their own new households. Household formation traditionally creates demand for smaller or less costly starter homes, the sales of which, in turn, allow current homeowners to buy larger or more expensive residences.

“What we have today is a weak recovery in the labor market, which is holding back some of the household formation,” Yun says. “The only way to unleash this household formation is to have strong consistent job growth.”

The national unemployment rate stood at 9.1%, or nearly 14 million people, in May. Another 8.5 million people were employed part time, but wanted full-time positions.

Homeownership Loses Appeal

Sharga points to a shift in consumers' attitudes toward homeownership as a factor in the housing sector's weakness: People aren't as interested in buying homes as they used to be. One recent RealtyTrac survey found that a huge percentage of today's renters don't want to buy a home — ever.

“No one wants to catch that proverbial falling knife (of lower home prices) and no one wants to become the next foreclosure statistic, so it really is an issue,” Sharga says.

Like the slower household formation, that lack of homebuying enthusiasm translates to less demand for entry-level houses and less opportunity for current homeowners, who might not have much equity, to trade up to another home.

So what will it take to get housing back in action? In short, a chain reaction of a robust economy, strong job growth and more household formation, easier credit, fewer foreclosures and an absorption of the existing excess supply of for-sale homes.

I have argued it will take an outside stimulus from an industry other than homebuilding to restart the economy. Once one sector the economy begins to flourish, the demand for housing will pick up, and then we will see the chain reaction everyone is waiting for.

Perhaps that Option ARM wasn't such a good idea

Today's featured property is an Option ARM gone bad. The owners are Ponzis savvy mortgage managers who extracted about $350,000 after investing $13,750 of their own money. Now they are selling short.

- The owners paid $275,000 on 9/18/2001 using a $220,000 first mortgage, a $41,250 second mortgage, and a $13,750 down payment.

- On 8/29/2002 they refinanced with a $268,000 first mortgage.

- On 3/3/2003 they obtained a $60,000 stand-alone second.

- On 3/17/2003 they obtained a $66,000 HELOC.

- On 10/28/2003 they refinanced with a $346,500 first mortgage and a $99,000 stand-alone second.

- On 4/12/2005 they got another cash infusion with a $190,000 HELOC.

- On 11/10/2005 they refinanced with a $600,000 Option ARM.

-

In a stunningly stupid move, Bank of America gave them a $37,900 HELOC on 1/18/2008. They quit paying shortly thereafter.

Foreclosure Record

Recording Date: 03/02/2009

Document Type: Notice of Default

I looks like they followed with a loan modification which allowed the Option ARM holder to delay the short sale or foreclosure until today.

Foreclosure Record

Recording Date: 06/09/2009

Document Type: Notice of Rescission

Apparently their income did not more than double while their mortgage did.

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 4 PINEWOOD #67 Irvine, CA 92604

Resale Home Price …… $498,000

Beds: 3

Baths: 3

Sq. Ft.: 2300

$228/SF

Property Type: Residential, Condominium

Style: Two Level, French

Year Built: 1977

Community: 0

County: Orange

MLS#: S661690

Source: SoCalMLS

Status: Active

——————————————————————————

BACKS TO SHOREBIRD PARK!!! BEAUTY & HARMONY SURROUNDS YOU IN THIS LOVELY 3 BEDROOM (MASTER & OTHER DOWNSTAIRS), PLUS ARTIST/SEWING ROOM & 3 FULL BATHROOMS. SUNSHINE FILLS THIS HOME WHICH HAS BEEN EXPANDED/REMODELED FOR ELEGANT ENTERTAINING, & MAKING MEMORIES WITH FAMILY & FRIENDS. SNUGGLE AND READ A BOOK IN THE CHARMING, QUAINT LIBRARY/OFFICE UPSTAIRS. KITCHEN FEATURES CORIAN COUNTERS, UNDER COUNTER LIGHTS, CANNED LIGHTS, TILE FLOOR, PANTRY CLOSET, GAS COOKTOP. BREAKFAST NOOK LEADS TO PATIO & VIEW OF PARK. LIVING ROOM & FORMAL DINING ROOM INCLUDE SOARING VAULTED CEILING. WOOD/GAS BURNING FIREPLACE IN ELEGANT LIVING ROOM WITH SLIDING DOOR LEADS TO BACK PATIO/PARK. TRAVERTINE FLR IN MSTR SHOWER RM. NEWER HVAC SYSTEM & SOME NEWER DUCTS. EXTERNAL GAS HOOKUP IN BACKYARD PATIO FOR PICNICS. RAISED PANEL DOORS THROUGH-OUT, DECORATOR INTERIOR PAINT, NEWER SKYLIGHT IN MASTER BATH, SPECIAL TREATED WOOD SHAKE ROOF. WOODBRIDGE OFFERS TENNIS COURTS, CLUBHOUSE, BEACH, BOATING, POOLS.

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis![]()

The word “snuggle” has no place in a real estate listing.

This property is at the cusp of what I consider an FHA financing candidate. With the cost of mortgage insurance, this property is still quite expensive. With 20% down, perhaps the cost of ownership is close to rental parity.

Resale Home Price …… $498,000

House Purchase Price … $275,000

House Purchase Date …. 9/18/2001

Net Gain (Loss) ………. $193,120

Percent Change ………. 70.2%

Annual Appreciation … 6.0%

Cost of Home Ownership

————————————————-

$498,000 ………. Asking Price

$17,430 ………. 3.5% Down FHA Financing

4.49% …………… Mortgage Interest Rate

$480,570 ………. 30-Year Mortgage

$104,234 ………. Income Requirement

$2,432 ………. Monthly Mortgage Payment

$432 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$104 ………. Homeowners Insurance (@ 0.25%).jpg)

$553 ………. Private Mortgage Insurance

$456 ………. Homeowners Association Fees

============================================

$3,976 ………. Monthly Cash Outlays

-$390 ………. Tax Savings (% of Interest and Property Tax)

-$634 ………. Equity Hidden in Payment (Amortization)

$29 ………. Lost Income to Down Payment (net of taxes)

$82 ………. Maintenance and Replacement Reserves

============================================

$3,063 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,980 ………. Furnishing and Move In @1%

$4,980 ………. Closing Costs @1%

$4,806 ………… Interest Points @1% of Loan

$17,430 ………. Down Payment

============================================

$32,196 ………. Total Cash Costs

$46,900 ………… Emergency Cash Reserves

============================================

$79,096 ………. Total Savings Needed

——————————————————————————————————————————————————-

Have a great weekend,

IrvineRenter