In an effort to ease the saturation on the MLS, lenders have slowed the rate at which they are filing default notices and moving on foreclosures. The result is more shadow inventory, more delinquent mortgage squatting, and another delay for the hoped-for housing market recovery.

Irvine Home Address … 14951 GROVEVIEW Ln Irvine, CA 92604

Resale Home Price …… $419,900

I fought it for a long time now

While drowning in a river of denial

I washed up, fixed up, picked up all my broken things

'Cause you left me, police tape, chalk line

Tequila shots in the dark scene of the crime

Suburban living with a feeling that I'm giving up

everything for you

Oh, oh, oh, how was I supposed to know

That you were oh, oh, over me

I think that I should go (GO!)

Something's telling me to leave but I won't

'Cause I'm damned if I do ya, damned if I don't

All Time Low — Damned If I Do Ya (Damned If I Don't)

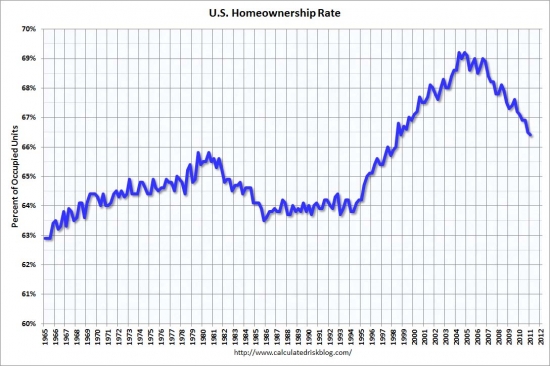

Since mid 2008, foreclosure statistics have been largely meaningless. Prior to 2008, defaults were tethered to delinquencies, and foreclosures promptly followed defaults. Since the amend-extend-pretend dance got started, delinquencies rose for another two years while default notices and foreclosure auctions happened at whatever rate the banks felt was appropriate at any given time. Right now, with prices falling in nearly every market, lenders are turning off the flow of properties in an effort to manage MLS inventories and stop prices from falling any further..jpg)

In the short term, it is probably the right policy for the lending cartel to operate under. If the price drops continue unabated, more borrowers will strategically default. Of course, as banks stop issuing notices of default and stop foreclosing on delinquent borrowers, they add to their shadow inventory and encourage strategic default because borrowers know they can get years of free housing. Lenders really are between a rock and a hard place.

Since this is a cartel, and since the GSEs are not playing along, each lender that delays foreclosure will ultimately recover less from the property than if they foreclose now. Lenders still seem to be suffering from the delusion that prices will come back and they will get more if they wait. It isn't going to happen that way. The overhang of inventory will be with us for years, and each disposition will prevent any meaningful appreciation. For each cartel member the choice is to sell now or sell later and get less. Under those circumstances, the incentive to cheat is strong, and the reward for withholding inventory is only more denial.

The number of Californians entering foreclosure is at lowest level since 2007

Notices of default against California homes dropped 17% in the second quarter from the first quarter and 19.2% from the second quarter of 2010. Banks repossessed 10.9% fewer homes than a year ago and 1.4% fewer than in the first quarter.

July 20, 2011 — By Alejandro Lazo, Los Angeles Times

The number of Californians entering foreclosure dropped steeply in the second quarter to the lowest level since 2007, a sign the foreclosure crisis in the Golden State could be easing as the housing market stabilizes and regulators increase scrutiny of lenders.

No, it is not a sign the foreclosure crisis is easing. First, there is no foreclosure crisis. There is the foreclosure cure which ailing lenders are avoiding. Second, a decline in foreclosures is not a sign lenders are running out of people to foreclose on. It isn't until the shadow inventory is gone that we can talk reasonably about the foreclosure cure having taken its effect.

Notices of default filed against California homes dropped 17% from the previous quarter and 19.2% from the same period last year, according to San Diego research firm DataQuick. A total of 56,633 homes received a notice of default, which is the first formal step in the foreclosure process.

DataQuick President John Walsh attributed the second-quarter declines to a steadier housing market.

The more I read John Walsh's statements, the less credibility he has. He is a data provider not a data analyst. In short, he is a clueless shill who really shouldn't be quoted for stories like this.

“Homeowner distress spreads fastest when home price declines are steepest,” Walsh said in a statement. “And it now appears likely that, barring some new economic shock, the worst of the price declines are behind us.”

Walsh is calling the bottom? Again? One of these times he will be right, depending on how many times he makes this prediction in the next two or three years before we finally reach a durable bottom.

The number of homes taken back by banks also fell in the second quarter. A total of 42,465 homes were repossessed during those three months, a 10.9% decline from a year earlier and a 1.4% drop from the first quarter. On average, California homes took 10 months to wind their way through foreclosure, up from 9.1 months in the previous quarter and the year-earlier period.

Foreclosures have slowed nationally partly because homeowners are challenging them in court and the nation's biggest banks are negotiating a settlement with regulators over faulty repossession practices.

Some experts believe that if a settlement is reached, foreclosures could surge again once banks overhaul their practices and compensate borrowers. But unlike states where the foreclosure system is overseen by the court system, California has seen a steady decline in default notice filings for more than two years with the housing market recovering faster than other hard-hit regions.

Since we do have non-judicial foreclosures, our system has the potential to process foreclosures quicker; however, that has nothing whatsoever to do with the decline in default filings. Banks are managing inventory, pure and simple.

Still, a steady flow of distressed properties could continue for years, said Robert Hooker, executive director of the Inland Empire Economic Recovery Corp., a San Bernardino nonprofit that buys, rehabilitates and sells foreclosed homes.

“This current decline is probably short-lived because the banks are readjusting themselves,” Hooker said. “They still have a tremendous amount of shadow inventory, and they don't want to saturate the market.“

Finally, half way through the article we hear from someone who knows what they are talking about.

And Bruce Mirken, a spokesman for the Greenlining Institute in Berkeley, said many troubled homeowners still remain in serious need of government assistance.

“It's way too early to pop the champagne corks,” he said. “Dropping back to 2007 levels is a positive trend, but foreclosures in 2007 were quite high by historical standards — more than double the rate in preceding years. There are many reasons to doubt whether the housing market has really turned the corner, and the need for serious foreclosure relief and principal reduction has absolutely not gone away.“

No, there is no need for “serious foreclosure relief and principal reduction.”

I have an idea. For everyone who thinks loan owners need principal reduction, why don't they go knock on doors on their own street until they find an underwater loan owner not making their payments. It shouldn't take more than ten attempts to find one. Once a delinquent mortgage squatter in need of principal reduction is found, they should write them a personal check and tell them to send it to the bank. It's grass-roots political activism at its best. I can support that initiative because I don't have to see any of my tax money going to support someone else's entitlements.

The second quarter marked the lowest level of default notices received by California homeowners since the second quarter of 2007. That was when the subprime mortgage crisis was pushing the nation into the throes of a credit crunch that would end in financial crisis and the most severe recession since the Great Depression.

Last quarter's numbers were also well below the record 133,431 default notices filed in the first quarter of 2009, when home prices were still dropping sharply.

Homeowners in more affluent, coastal counties were less likely to enter foreclosure than those in other parts of the state. Mortgages on properties in San Francisco, Marin and San Mateo counties were the least likely to go into default, while those in Kings, Sutter and Yuba counties were the most likely, DataQuick reported.

Loan owners in coastal California are much more likely to be admitted to shadow inventory than borrowers in other parts of the state. Lenders don't want to take the losses that are still forthcoming. From the article, one could surmise that coastal California is more prosperous and less subject to mortgage delinquency. Nothing could be further from the truth..png)

In one sign that the most beaten-down areas of the state might be getting some relief, the default-notice decline was greatest in the state's least expensive communities, where foreclosures had been the most prevalent, DataQuick said.

Most loans receiving default notices last quarter were made in 2005 through 2007, the tail end of the bubble, indicating that the most distressed homeowners in the state bought their properties during the run-up in home prices and during the height of the shoddy lending practices that pervaded the mortgage industry.

The most active lending institutions foreclosing on Californians were JPMorgan Chase & Co., Wells Fargo & Co. and Bank of America Corp. Although 56,633 default notices were filed in the second quarter, they involved 55,153 homes because some borrowers were in default on multiple loans.

alejandro.lazo@latimes.com

Lender filings are down everywhere. Someday, not today, lender filings will be down because borrowers are not delinquent on their loans. Then, and only then, will the housing market's supply problems be solved. Unfortunately, we won't reach the point of zero shadow inventory and low delinquency rates for several more years.

$419,900 for 800 square feet

Being a flipper of auction properties, I was intrigued by today's featured property. A forty year old 800SF property in Las Vegas would probably sell for $31,000 at auction. Here in Irvine, it fetches $311,000.

The flippers did a very tasteful job on the renovation, and they likely spent a large sum of money on their 800SF gem. It isn't 40 years old inside anymore.

What do you think? Was this flip a good idea? Will they get $419,900 for this?

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 14951 GROVEVIEW Ln Irvine, CA 92604

Resale House Price …… $419,900

Beds: 2

Baths: 1

Sq. Ft.: 800

$525/SF

Property Type: Residential, Single Family

Style: One Level, Traditional

Year Built: 1971

Community: El Camino Real

County: Orange

MLS#: S666630

Source: SoCalMLS

Status: Active

On Redfin: 7 days

——————————————————————————

IF SPECIAL IS IMPORTANT, YOU SHOULD TAKE THE TIME TO VIEW THIS TOTALLY REFRESHED LOVELY SINGLE STORY FAMILY HOME. No Mello Roos, No Association Dues, just a short walk to a distinguished elementary school, a blue ribbon middle school, a high school and a community park with basketball court. This fantastic remodeled home is complete with new kitchen cabinets including a large island and buffet counter with beautiful granite counter tops, all new stainless steel appliances, nice distressed look flooring thruout with new carpet in the bedrooms. Also included is a serene outdoor living area that flows right into the house thru french doors. Last but not least a beautiful relaxing bathroom that you wont want to every come out of. All of the beautiful decorator touches will be well beyond your expectations. Dont forget to take a alook at the clubhouse for the kids in the backyard.

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis![]()

thruout? alook? IF SPECIAL IS IMPORTANT? WTF? No, I want a house that isn't special. Special is not important to me.

a beautiful relaxing bathroom that you wont want to every come out of… Sorry, but I will always want to get out of the bathroom.

Did they count the clubhouse in order to ge to 800SF? This house puts a new meaning to cozy.

Resale Home Price …… $419,900

House Purchase Price … $311,000

House Purchase Date …. 5/20/2011

Net Gain (Loss) ………. $83,706

Percent Change ………. 26.9%

Annual Appreciation … 126.3%

Cost of Home Ownership

————————————————-

$419,900 ………. Asking Price

$14,697 ………. 3.5% Down FHA Financing

4.48% …………… Mortgage Interest Rate

$405,204 ………. 30-Year Mortgage

$87,784 ………. Income Requirement

$2,048 ………. Monthly Mortgage Payment

$364 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$87 ………. Homeowners Insurance (@ 0.25%)

$466 ………. Private Mortgage Insurance

$0 ………. Homeowners Association Fees

============================================

$2,966 ………. Monthly Cash Outlays

-$328 ………. Tax Savings (% of Interest and Property Tax)

-$536 ………. Equity Hidden in Payment (Amortization)

$24 ………. Lost Income to Down Payment (net of taxes)

$125 ………. Maintenance and Replacement Reserves

============================================

$2,251 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,199 ………. Furnishing and Move In @1%

$4,199 ………. Closing Costs @1%

$4,052 ………… Interest Points @1% of Loan

$14,697 ………. Down Payment

============================================

$27,147 ………. Total Cash Costs

$34,500 ………… Emergency Cash Reserves

============================================

$61,647 ………. Total Savings Needed

——————————————————————————————————————————————————-

.png)

.png)