Delinquent mortgage squatters living in shadow inventory are obtaining the benefits of ownership while paying none of the costs.

Home Address … 1 STARLIGHT Isle Ladera Ranch, CA 92694

Resale Home Price …… $1,100,000

Racing faster.

Escape disaster.

Partners in crime will leave their mark.

We make our own way.

No thoughts of yesterday.

Black hearts of chrome and battle scars.

Black Veil Brides — The Legacy

Strategic default is often the wisest course of action for a family to take. Lenders are hoping to escape disaster while borrowers and attorneys partner to leave their mark on lender's balance sheets. In the future, the threat of strategic default should make lenders more reluctant to make stupid loans with payments greatly exceeding comparable rents (more on that soon).

However, after a strategic default, what is the borrower to do? I think they should get out and move on with their lives because once they quit paying, it is only a matter of time before they must leave. This lingering uncertainty takes an emotional toll on families that isn't necessarily offset by the savings.

Most borrowers in default don't move into a rental and move on with their lives. Those borrowers are intent on gaming the system for as long as possible to obtain the financial benefit of no housing costs. These delinquent mortgage squatters are the legacy of stupid lending in The Great Housing Bubble.

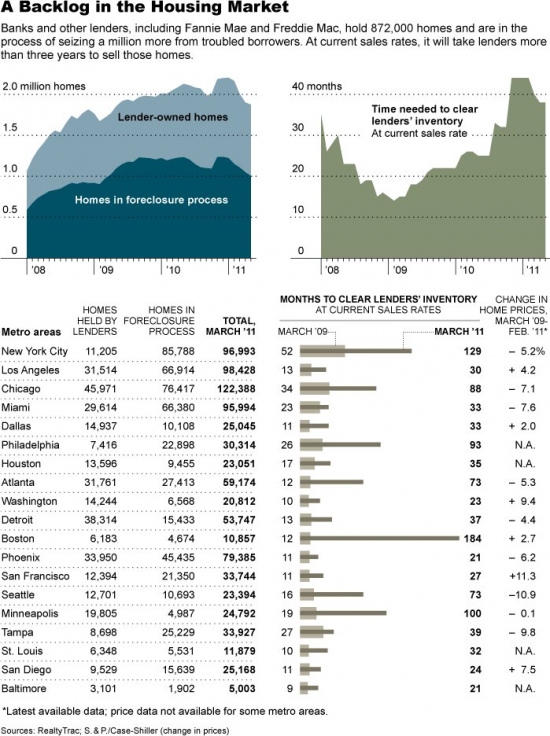

Backlog of Cases Gives a Reprieve on Foreclosures

By DAVID STREITFELD

Published: June 19, 2011

Millions of homeowners in distress are getting some unexpected breathing room — lots of it in some places.

In New York State, it would take lenders 62 years at their current pace, the longest time frame in the nation, to repossess the 213,000 houses now in severe default or foreclosure, according to calculations by LPS Applied Analytics, a prominent real estate data firm.

Clearing the pipeline in New Jersey, which like New York handles foreclosures through the courts, would take 49 years. In Florida, Massachusetts and Illinois, it would take a decade.

Ponder those statistics for a moment. At the current rate of resolution, states with judicial foreclosure will have lingering problems for decades.

In the 27 states where the courts play no role in foreclosures, the pace is much more brisk — three years in California, two years in Nevada and Colorado — but the dynamic is the same: the foreclosure system is bogged down by the volume of cases, borrowers are fighting to keep their houses and many lenders seem to be in no hurry to add repossessed houses to their books.

“If you were in foreclosure four years ago, you were biting your nails, asking yourself, ‘When is the sheriff going to show up and put me on the street?’ ” said Herb Blecher, an LPS senior vice president. “Now you’re probably not losing any sleep.”

Borrowers can obtain free housing if they merely stop making their payments. Strategic default is bound to expand under such circumstances. If given the option to obtain shelter for a huge payment or for no payment, many will chose no payment, particularly if they can stay in the property indefinitely.

When major banks acknowledged last fall that they had been illegally processing foreclosures by filing false court documents, they said that any pause in repossessions and evictions would be brief. All of the major servicers agreed to institute reforms in their foreclosure procedures. In April, the Office of the Comptroller of the Currency and other regulators gave the banks 60 days to draw up a plan to do so.

But nothing is happening quickly. When the comptroller’s deadline was reached last week, it was extended another month.

New foreclosure cases and repossessions are down nationally by about a third since last fall, LPS said. In New York, foreclosure filings are down 85 percent since September, according to the New York State Unified Court System.

Mark Stopa, a St. Petersburg, Fla., specialist in foreclosure defense, has 1,275 clients, up from 350 a year ago. About 75 clients have won modifications, dismissals or sold their properties for less than they owed. All the other cases are pending.

“Banks aren’t even trying to win,” said Mr. Stopa, who charges his clients an annual fee of $1,500.

An annual fee? WTF? This guy has stumbled upon a great business plan to take advantage of the amend-extend-pretend policy of lenders. The longer this process drags on, the more money he makes. Right now, he has 1,200 clients paying him $1,500 per year. That's $1,800,000 per year he is making from assisting squatters.

J. Thomas McGrady, the chief judge of Florida’s Sixth Circuit, which includes St. Petersburg, agreed. “We’re here to do what we’re asked to do. But you’ve got to ask. And the banks aren’t asking,” he said.

A spokesman for Bank of America said, “Any suggestion that we have a strategy to delay foreclosures is baseless.”

LOL! I watch the foreclosure market nearly every day. Each day 90% or more of the scheduled auctions are postponed or canceled to prevent too much product from entering the market. Further, the percentage of delinquent mortgage squatters that have not made payments in over two years continues to grow. Lenders are clearly executing a strategy of delaying foreclosures, and assertions to the contrary don't pass the giggle test.

A Wells Fargo spokeswoman blamed changes in state laws governing foreclosure for any slowdown. A GMAC spokeswoman said it was following “regulatory and investor expectations.” JPMorgan Chase declined to comment. Servicers said some of the decline in foreclosures could be traced to an improved economy.

Bullshit by any other name would smell as sweet.

There are many reasons that foreclosure, which has been slowing ever since the housing bubble burst, has been further delayed in many states.

The large number of cases nationally — about two million, plus another two million waiting in the wings — have overwhelmed many lenders and the courts.

Lenders, who service loans they own as well as those owned by investors, tried to circumvent the time-intensive process by using “robo-signers” who mass-produced documents, many of which made inaccurate claims. When the bad practices were discovered last fall, the lenders were forced to revisit hundreds of thousands of cases.

Over the last two years, most defaulting homeowners were people who had lost their jobs. Housing analysts say these homeowners are more likely to hire a lawyer and fight repossession than borrowers who had subprime loans that swelled beyond their ability to pay.

The link to unemployment is nonsense. Homeowners are hiring lawyers to game the system because it works. Paying a lawyer $1,500 a year is certainly cheaper than paying $1,500 a month in rent after a foreclosure. If the lawyer gains the squatter even one month of free housing, it was a good investment for the borrower. If it gets them a year of free rent, the payback is twelve fold. With such a good return on the money, it shouldn't be too surprising borrowers and attorneys are teaming up to screw the banks.

Judges these days are also more inclined to scrutinize requests for eviction rather than automatically approve them. The so-called foreclosure mills — law firms that handled many of the suits for the banks — are in retreat under law enforcement pressure. And some analysts suggest that banks are reluctant to take too many houses onto their books at any one moment for fear of flooding a shaky market.

Fear of flooding the market with REO is the primary reason lenders are not foreclosing and processing as fast as they can.

In New York, lenders seeking to repossess face additional hurdles. The legislature has mandated that borrower and bank meet to discuss terms under the auspices of the court, but these conferences have turned out to be anything but brief or simple. Instead of one conference, 10 are often needed, court officials say.

Borrowers are not going to be in a hurry to resolve anything since they are getting free housing. I imagine many borrowers and their attorneys have difficultly fitting these conferences into their busy schedules, and when they make no progress, they reschedule another one for six months from now. A requirement for conferences is guaranteed to add significant time to the process to the benefit of the squatter and the detriment of the bank.

And many foreclosure lawyers seem unable to meet a requirement, made last October by the New York Chief Judge Jonathan Lippman, to affirm the accuracy of their documentation.

“The affirmation has had a pretty chilling effect,” said Ann Pfau, New York’s chief administrative judge. “The attorneys for the banks tell us they can’t get through to the right people at their clients who can verify the information.”

Last September, before the documentation crisis, nearly 1,500 New Yorkers lost their houses as a result of foreclosure, according to LPS. The average over the last six months: 286. That is far lower than at any point since the recession began.

I discussed the problem of foreclosure delays in New York in the recent post: Free housing: the new bankster entitlement in New York City.

Similar foreclosure cases can have different fates. To increase their odds of staying put, the foreclosed who can afford it are hiring lawyers, a move that can drastically slow down a case.

Mr. Stopa, the Florida lawyer, said he divided his clients into three groups. Some are unemployed or disabled and just getting by. Others are able to save money and improve their financial situation as their case drags on. The third group are those who have strategically defaulted. They can afford to pay but are taking advantage of the banks’ plodding pace. Often the members of this group rent out the foreclosed home and keep the proceeds.

For as reprehensible as this behavior is, as long as this behavior is disclosed to the renter, I don't have a problem with it. Lenders created this situation, and they could stop it by foreclosing and taking the property back as REO. If the renter knows what they are getting into, then everyone is making choices based on full knowledge and disclosure. If the renter doesn't know, then I have a real problem with what the owners are doing.

Though delays in foreclosure might seem like a gift to those behind on their , the foreclosed themselves do not necessarily feel that way.

Margaret Bellevue waited nervously in a Miami courtroom early this month. She and her husband, Roland, an architect, are among 97,000 households facing foreclosure in Dade County, where the average time to foreclose is 738 days and climbing, according to LPS data.

Ms. Bellevue was on her third lawyer in a case that has stretched on as many years. “A friend of mine got her mortgage lowered through a modification,” Ms. Bellevue said. “I’d like to do that too.”

I imagine she would. The woman overpaid for her house, but she wants to keep it by having her debt reduced. When she and millions of others made a foolish and irresponsible purchases, they drove up prices and crowded out more prudent buyers. They should be forced to move out of their properties so there are some consequences for what they have done. Lenders are more culpable than borrowers, but it doesn't mean borrowers should have no consequences at all.

When her case came up, the judge told the lawyers they should try to work out a deal. They huddled outside the courtroom and agreed to meet again.

What is there to work out? The lender needs to foreclose, and the delinquent mortgage squatter needs to get out. It should be any more complicated than that.

Squatting is not just for the little guy

When you read stories about delinquent mortgage squatters, there is an implicit assumption that it involves lower income subprime borrowers. Nothing could be further from the truth. Many posers levered themselves into beautiful high-end mansions, and when the Ponzi borrowing ran out, they simply stopped making payments and squatted.

I can understand why they stay. Who would move out of a multi-million dollar property they can stay in for free and find another where it would cost $5,000 or more in rent? What is shocking is how long lenders have let this go on.

Lenders have made the argument that leaving occupants in a property prevents it from deteriorating. I call bullshit on that one. Properties deteriorate more quickly if they are being used and improperly maintained. What possible incentive does a delinquent mortgage squatter have to invest any money to upkeep a property? When they accidentally knock a hole in the drywall, will they spend money to patch it? At least a renter is going to call the landlord if there is a problem. A delinquent mortgage squatter will let small festering problems grow into large repairs rather than spend their own money fixing up the place.

Today's featured property is not in Irvine. The owner paid $2,265,462 on 8/24/2006 — the peak of the bubble. He used a $1,811,696 first mortgage from Countrywide, a $226,462 HELOC, and a $226,842 down payment. The owner had another property at the time in Aliso Viejo with several hundred thousand dollars of mortgage equity withdrawal.

A reader called this property to my attention. The haircut is enormous and newsworthy on its own, but what's more interesting is that the lender has allowed this owner to live there for over three years now without making any payments, and they don't appear to be in any hurry to foreclose.

Foreclosure Record

Recording Date: 06/23/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 12/03/2008

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 06/24/2008

Document Type: Notice of Default

The first NOD was filed in June of 2008 which means this owner stopped making payments sometime before March of 2008. He has been living there ever since and enjoying his entitlements.

While you were making your onerous house payments or paying your rent, this owner has been living for nothing in what was a $2M+ house. His neighbors must feel like chumps for continuing to pay their mortgages, particularly as his short sale pummels their property values.

Irvine House Address … 1 STARLIGHT Isle Ladera Ranch, CA 92694 ![]()

Resale House Price …… $1,100,000

House Purchase Price … $2,265,000

House Purchase Date …. 8/24/2006

Net Gain (Loss) ………. ($1,231,000)

Percent Change ………. -54.3%

Annual Appreciation … -14.9%

Cost of House Ownership

————————————————-

$1,100,000 ………. Asking Price

$220,000 ………. 20% Down Conventional

4.49% …………… Mortgage Interest Rate

$880,000 ………. 30-Year Mortgage

$190,869 ………. Income Requirement

$4,454 ………. Monthly Mortgage Payment

$953 ………. Property Tax (@1.04%)

$708 ………. Special Taxes and Levies (Mello Roos)

$229 ………. Homeowners Insurance (@ 0.25%)

$0 ………. Private Mortgage Insurance

$400 ………. Homeowners Association Fees

============================================

$6,744 ………. Monthly Cash Outlays

-$1062 ………. Tax Savings (% of Interest and Property Tax)

-$1161 ………. Equity Hidden in Payment (Amortization)

$365 ………. Lost Income to Down Payment (net of taxes)

$158 ………. Maintenance and Replacement Reserves

============================================

$5,045 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$11,000 ………. Furnishing and Move In @1%

$11,000 ………. Closing Costs @1%

$8,800 ………… Interest Points @1% of Loan

$220,000 ………. Down Payment

============================================

$250,800 ………. Total Cash Costs

$77,300 ………… Emergency Cash Reserves

============================================

$328,100 ………. Total Savings Needed

Property Details for 1 STARLIGHT Isle Ladera Ranch, CA 92694

——————————————————————————

Beds: 5

Baths: 6

Sq. Ft.: 5882

$187/SF

Property Type: Residential, Single Family

Style: 3+ Levels, Colonial

View: Canyon

Year Built: 2006

Community: Ladera Ranch

County: Orange

MLS#: S624677

Source: SoCalMLS

Status: Pending

——————————————————————————

Fantastic 3 stories including very large 13,000 Square foot lot. Gated courtyard has casita with separate entrance. Wolf appliances, Subzero fridge, Wood floors, gourmet kitchen w/ butlers pantry, granite countertops, built-ins, intercom and security system. Property includes high ceilings a large driveway, and plenty of bedrooms. Large basement with great area for a home entertainment.

I like to think that what borrowers and banks do is none of my business, but the truth is that it pisses me off.

When it was only between the borrower and the lender, it wasn’t anyone else’s business, but once we started having to pay for the bailouts, it impacted all of us.

I couldn’t agree more! When massive amounts of public treasure are being transferred into private hands … be it the squatter or the enabling bankster … I very much have a right to pass judgement.

This case makes me so angry, it’s difficult for me to stop myself from driving over to this guy’s place, ringing the door bell and punching him in the face.

This thief is stealing from honest people like myself who didn’t engage in this foolish and fraudulent behavior. Worse, he’s enjoying all the benefits while suffering not a whit … don’t kid yourself, he’s not losing any sleep or sweating the appearance of the sheriff. I guarantee you this guy has convinced himself and everyone around him he’s a victim. He probably even laughs (yet again) at us schmuck renters who keep paying our bills and foolishly keep trying to save for a home purchase while he sips $10 martini’s @ Hanna’s and leases a new Porsche every two years.

I have no sympathy for the banks … they built this house of cards and should suffer. In fact I propose that everyone strategically default on ALL their debt … credit cards, car loans etc. The tidal wave would overwhelm the financial system and maybe, just maybe us poor fools would get our government back from the banks and mega-corporations. But … I can’t stomach seeing greedy a$$holes … who know damn well what they’re doing … reap the benefits while I feel like a fool for doing what my parents taught me in honoring my debts and doing the right things for my family.

I can’t wait to start my default again and see how many free months of rent I get, I only received 5 months of no rent working a loan mod with zero principal reduction (moral hazard, so just default and walk).

Cracks me up when “conservatives” get angry at people but praise their moral crusaders they voted into office who are white-washed tombs.

I’m enjoying life immensely and look forward to saving a whole bunch of CASH while prices nose dive. Keep voting democrat or republican! Thank you.

July 1, 2010 stopped paying Citimortgage.January 1, 2011 CitiMortgage transfers loan to Nationstar out of Dallas,Tx. Enrolls us in unemployment plan for 6 months @ 55% discount on monthly payment, while they decide what program will work the best for us.Total of 15 minutes invested on my part. Didn’t want this property anymore so never contacted the lender, but hell, it’s cheaper than rent and I’m curious to see what happens next. Saved quite a roll of cash in the old safe.

I hope you’re a troll … but if you’re not … you should keep it to yourself. You should be ashamed of yourself.

You are NOT getting free rent, what you are doing is stealing from honest people! You’re living in a house someone like me, who’s saved and can make his payments, might buy if the market were operating properly and have tossed you out on your butt.

You are not entitled to anything. You made bad decisions and now, when you have to suffer the consequences of your actions, you want forgiveness and worse you think you’re entitled to it. Since when? Good people own up to their mistakes and take responsibility their actions. They don’t buy an overpriced house on shaky loan terms they knew could put their family in jeopardy if they lost a job.

Thieves think society owes them something.

Ladera Ranch is riddled with stories like this one. And, RMV is gearing up to launch the first phase of the rest of the Ranch? Sounds a whole lot like Irvine to me…..buyer beware.

According to this guy, not to worry…the bottom is here:

http://www.dailyfinance.com/2011/06/21/the-housing-bottom-is-here-economist-russell-price-explains/

Please feature more squatter properties like this. Maybe attention from your blog will force the banks to take action on these losers.

Exactly.

The media only seems to show poor families that are being wrongly foreclosed by the evil bank. Not the deadbeat squatters getting free rent form the stupid bank.

What really pisses me off is the FASB’s rule on relaxing the mark-to-market rule. This rule is allowing the banks to withhold the shadow inventories without repercussion.

Great post today IR, it’s completely criminal.

Countrywide basically hands him $2M in ’06

He defaults and gets hit with an NTS back on 12/08

How was he able to string it out and postpone it for this long?

He filed for bankruptcy and is bleeding every last option possible, instead of facing reality and taking responsibility for his irresponsible financial decisions. The irony is he’s a mortgage broker. lol. I know him.

What I find crazy about this, is way didn’t the banks push as many properties on the market as they could during the tax credit frenzy? They would have gotten a better price on the backs of the helpless tax payer.

I think the answer is the banks are only marginally more competent then when they were doling out the money to any one that would hold out their hand.

I’ve been thinking about this for some time. Strategic Default seems to becoming quite fashionable; I’ve heard of people hanging on for more than 2 years in my neighborhood (Carlsbad/Encinitas, CA) without paying their mortgage. It will snowball. Those who say it’s morally wrong are a shrinking lot.

But… maybe it’s the banks that have engineered the entire mess with the robo-signing, the question of legality of who owns the note, etc. Think about it – it gives an out to the banks. They not the ones slowing the process down anymore. It’s the damn courts following the law! It’s to the banks advantage not to flood the market with foreclosures.

While the squatters still irk me a bit, it pales in comparison to what the banks have/have not done:

1. bad titles (MERS/etc) making foreclosing problematic, in order to ‘save money’ in the 00s

2. no servicing expertise (why have risk management/asset maximization specialists, they cost more money. let’s outsource it and fire all of our expertise!)

3. no desire to foreclose (that’s money right off the bottom line! no bonus this quarter!)i.

Why should the squatter leave if the banks won’t FC? until the squatters are legally relieved of their title, they still own the place and are entitled to live there (and responsible for it), according to the law.

“Why should the squatter leave if the banks won’t FC?”

The plethora of empty houses is testament to the fact that people do leave and move on with their lives. The main reason people give up the free housing is to have closure.

If one dude acquired a string of properties via HELOC and they all go into foreclosure, he can only live in one of them …

Not only are they entitled to live there, but I believe they are liable for things that happen on the property until the house until it is foreclosed upon. That being said, IR is exactly right…at some point you just want some closure. Another motivator to leaving before being forced out is the ability to search for rentals and choose one you like instead of having to find a place in a short period of time and run the risk of having some pretty crappy options.

This, dear readers, is why the OCAR is gunning for Larry. You have no way to be certain that no funds were received by the bank during these years. There could have been partial, modified, full or any other type of arrangement you are not privy to. These assumptions are why you are in trouble.

I have made no assumptions. I have reported what is in the public record.

Bullshit

Brilliant reply.

Between this thread and the other one in which your every point was refuted, you are being a great spokesman for realtors.

What, you don’t swear here? Please post your source of the full payment history of this loan.

Have you actually spent the time to look at the public record regarding this property? If so, why don’t you post what you’ve found that proves your point rather than being lazy and making stupid assumptions?

For the logic-deprived: you can be paying and still be late enough to be foreclosed upon.

What I don’t understand Bill is the logic behind your argument that IR is doing something wrong. He takes information from the public record that I am too lazy to shift through and hypothesizes on causation. As a potential buyer in the area, I feel he is doing me a great service and he is far more credible than any Realtor I have ever met. Your position seems to be that everyone should be in the dark about things like mortgage squatting because then we’d be blissfully unaware of the problems and more likely to buy, which would increase your compensation. So maybe the person from the property featured today has been trickling money into the bank … so what. What does that change? Please, let me have access to the information IR provides so that I can draw my own conclusions.

That’s just it – it’s not public information.

I meant to say public record.

I’m not sure I follow. If the information on mortgages and NOD filings is not in the public property record at City Hall, then I have to assume IR subscribes to a service that provides him that information. That would mean the information is not on the public record but it’s also not confidential (otherwise a third party service couldn’t disseminate it … especially for a profit). Put all that aside for the moment, if this is not public information then it should be and if that means the legislature passing a law to make it that way and break-up someones little monopoly then so be it. I and the rest of the public have the right to know.

“That’s just it – it’s not public information.”

100% factually incorrect. It almost makes me think Bill is someone just putting us all on. No one in real estate can really be that ignorant of real property records, can they?

I assure you that I’ve had actual judges in actual courts take judicial notice of documents (both notices of default and notices of trustee sale) contained in the county recorder’s land records because they are PUBLIC DOCUMENTS. What IR has cited in the post is a matter of PUBLIC RECORD.

Non-default loan performance information is not public information and is strictly confidential. I might add that even default loan performance information is also confidential. Get it?

You don’t see because you don’t want to see. Loan performance is not public record – end of story.

Then why does a Notice of Default get filed and is public record? If I were a renter I’d want to know if my landlord is paying his/her mortgage.

Now you try to nuance your answer???? Nice try. Multiple posters read your response for what it was: ignorance of real estate.

NOD filed in June 2008 = loan in default for at least 3 months. You can call that an “assumption” if you would like but it is clear from the REAL PROPERTY RECORDS that the loan was in default (shame on IR for “commenting” on the fact that this deadbeat loanowner wasn’t paying his tab).

NTS filed 12/3/2008 = default not cured

NTS filed 6/23/2010 = default not cured

IR is 100% accurate (call it an safe “assumption” if you want): “His neighbors must feel like chumps for continuing to pay their mortgages, particularly as his short sale pummels their property values.”

Not sure why any of this concerns the OCAR, especially in light of the anti-trust litigation involving the NAR:

“[A]n MLS may not prohibit Participants from enhancing their [websites] by prohibiting information obtained from other sources other than the MLS . . .”

Great posts, Honcho. If I move back to CA, I’ll make sure to look you up to be my attorney 🙂

The individual bank’s total holding of defaulting loans may not be public record, but can be deduced by looking at the changes in receivable over time. The bank trade journals have estimate based on reported non-performing loans by regions. However, there’s plenty of bad loans that the banks are not declaring to the regional Fed. Reserve.

Regarding your original observation, your assumption that OCAR cares about what is said about home owners on this blog is ridiculous.

OCAR is gunning for Larry because he comments on whether someone paid on their mortgage or not? Right. THAT is logic-deprived.

Bill, this loan-owner, home-debtor is a fraud and is milking the system. Partial payments my ass. Even if he was / is, who cares? He’s in WAY over his irresponsible head on two homes…and the taxpayer is footing the bill for it. The irony of it all is that he’s a mortgage broker; what a joke. People like this should be renting responsibly, not buying $2.265M McMansions with housing bubble siphoned off equity as down payments.

It was never “just between the borrower and the lender” because EVERY SINGLE foreclosure effects YOUR property value.

OCRegister: Analyst: Rents to rise 4.5% for years

http://lansner.ocregister.com/2011/06/20/analyst-rents-to-rise-4-5-for-years/113665/

It’s a new scare tactics, “Buy now or your rent will go up very soon!”

Actually, I see many people stop renting from the Irvine Company and find much cheaper rents offered by distressed condo owners. And it’s more difficult for these condo owners to find renters than 5 years ago.

To Anonymous~

I’m a renter. I have found landlords looking for a very clean credit report and 3x income to cover rent. Between 1st mo rent and hefty security, you could come very close to qualifying for a “no down, no doc” loan. I doubt that rents will rise that much year over year. Does anyone believe Lansner?

If prices are dropping, the only way rents can be rising is if they’re below the cost of buying a similar property: that’s certainly true now.

The problem is that prices will continue to decline, which will relax that upward pressure on rents. This ignores the unemployment and income figures, which also place a ceiling on rents.

I think rents will rise for a couple of years and then stabilize until the economy improves. If house prices drop as far as 3x income, then rents will decline along with them.

The only thing which would sent rents far higher would be a return to old-school hard bastard loan underwriting. If the FHA disappears and the government forces the banks to retain their loans, then it could happen. Current owners would be stuck with their properties, but there would be plenty of homeless renters with no chance at a mortgage. This would clearly constitute a “problem” which politicians would feel compelled to “solve” by offering a “helping hand” to renters with “special” government-backed loans.

Bill~ Exactly what part is not public information? I have been a member of OCAR since 1975. I’ve had a license so long that I’m “grandfathered” and don’t have to take any Continuing Ed any more. I know full well what is required in a listing and what is not. But you must have different information. Please enlighten us.

The notice of defaults are public record.

What IR should say is “public records shows these notice of defaults.”

Bill is correct in that IR is making assumptions.

First of all IR is assuming more than what public record states. He is also assuming the public record is complete and accurate. The assumption occurs when IR states they haven’t made payments for 2 years. He states this definitively. It’s an assumption. It’s also information that goes beyond property details associated with the MLS listing.

I’m not saying IR is wrong. Maybe they haven’t made payments. I don’t know. What I’m saying is that assumptions are being made and the MLS listing has been used outside on what is allowed.

Public information is available for you to consume. That doesn’t mean you can’t get in trouble for sharing it publicly. Get it? Especially if you are making assumptions.

That is exactly what I meant. You would think it’s obvious.

Interpreting the data collected is subjective. There is always some degree of what Bill and PR called “assumptions”.

The PUBLIC RECORDS show a default first started 2 years ago. Since there are no other PUBLIC RECORDS showing that this default has been cured, it is the most LOGICAL way to interpret the data as being in default for 2 years. This is in accordance with SCIENTIFIC METHODOLOGY.

All it takes is one payment to be made in some modification attempt for the assumption to be false.

It’s an assumption plain and simple. Also the public records can be incomplete or inaccurate.

He is a licensed real estate broker selling leads to an OCAr realtor.

He can say whatever he wants outside of that. He has his freedom of speech.

there is nothing scientific about this website.

Maybe 2 realtors cancel eachother out and create a scientist.

Given the available PUBLIC RECORDS, the best position to interpret these data remains as what IR has said. Any other would be grossly lying.

There is no assumption made. There is no such thing as assumptions to the data. There is only interpretation to the data. Got it?

All is within the scientific method of interpreting the data given. See the logic?

Well, here is it what it all comes down to: some people (e.g., Bill, Planet Reality) want consumers to have less information, while others (e.g., IrvineRenter) want consumers to have access to more information.

Unless you’re a SoCal realtor, who preys on ignorance, then it’s clear that IrvineRenter’s approach should be supported to the max.

Wrong, all of the information is available to you and me regardless if one real estate broker sales leads to another realtor.

I see that everything must be spelled out for you. Imagine you have a rolling late status, but you are making payments (full or partial). You never catch up and cure, but you have quite possibly made many such payments and are still in foreclosure. Get it? There are people in this situation as we speak.

heh….

maybe they cancel each other out via matter anti-matter convergence.

uh oh, someone sound the nerd alert.

Bill, you need to quit wasting your time here. Don’t you have clients who are interested in buying houses to tend to.

Bwahahahaha. Buy now or be priced out forever.

“There are people in this situation as we speak. ”

Yes there are. But for the most part the ones with scruples trying to save their ass (or home if you will) ARE NOT TRYING TO SELL IT, they actually want to LIVE THERE.

The part about “assuming” or “filling in the blanks” is a circus side show at best. Pray tell, how do you justify the NAr’s, “Now is the best time to buy”, mantra? Is that an assumption or was Suzanne’s research all of a sudden proven to be gospel? It is a distortion of logic.

The truth is; No one knows EXACTLY what has transpired due to the fact that ALL the information is not available. IR just points out the facts and adds color for readabilty. He focuses on behavior that needs to change for this counrty to heal and for the economy to improve.

YOU ARE JUST AN AGITATOR pulling eyes from the real issue. The issue is when will banks be required to follow FASB regs, when will they not be able to use my tax payer $ against me by holding inventory off the market, when will they foreclose like they should, and when will that inventory make it to market?

The rest is theater.

Amen brother!

The sooner the foreclosures happen, the sooner the prices normalize and the sooner people like me, who’ve been sitting this out for 4 years and saving, can buy. THAT is what will stabilize the economy.

Squatters are just thieves with better clothes and nicer cars.

I don’t buy it that rent are going to skyrocket. They have been saying this for several years now and it hasn’t come true.

More people are renting out rooms to make ends meet. The “shadow supply” of unused bedrooms in condos and houses can have a huge impact on the rental market. You can find 2 bedroom apartments at high end irvine co properties for 1700-1900 a month right now, which is lower than 4 years ago.

How many new apartment properties have opened in the past couple years? At least 3-4 big ones in Woodbury, as well as several in the Jamboree corridor. That is a lot of new supply. Also, with the economy bad, the high-end rents are going to be depressed regardless. Sure there will be “young professionals” who just got a nice new job and want a taste of the “good life”, who don’t mind wasting some money to impress their peers, but most people, faced with rising rents in higher end complexes, will simply opt to live in one of the older communities. Losing the granite counter-tops is really not that big of a deal.

On the lower end, it is quite easy to find a room in Irvine for 500-700 per month, as long as you don’t mind living in an older property. The new properties run 800-1000/room.

I know of a family in LA who stopped paying in 2006, with a mortgage of about $15,000.00/mo and they lived in the home, for free, for over 50 months now. As far as I know they are still in the home, approaching 5 years.

The bank’s unwillingness to foreclose has cost its investors at least $750,000.00 and counting.

I think my example is the record-holder, IR think you can dig up a better one?

I know one investor who has made more than $750,000 off of bank stocks over the past few years.

Not paying your mortgage is much lower risk then trading stocks. The risk/reward on the no pay is a lot better.

Source? Is this public information which can be independently verified? Are you merely trusting the word of someone who might well be exaggerating? Are you inferring facts not in evidence?

Call it anecdotal evidence.

If you haven’t noticed, PR claims they are fact based, but I have yet to see any of the ‘facts’ be verifiable.

“I think my example is the record-holder, IR think you can dig up a better one?”

Five years would break the IHB record. If you know the address, let me know, and perhaps I will feature it.

IR – Don’t you feel secure knowing that you have all these geniuses telling you how you should run your blog?

Or, how about properties like 4 Pinewood #67 in Woodbridge, which is NOD while owner is trying to get a renter. Nice. Aren’t you just itchin’ to hand over your cash to someone who can’t be bothered to pay the mortgage?

As a buyer, I would much rather tour a property that is vacant and empty because then I can determine what changes/alterations/repairs I want done without someone else’s stuff distracting me.

I don’t know where banks got this idea that its great to have someone living in the place. Staging is OK, but someone living there and wear and tear on the property?

Wow, a $1.23 million loss. That’s some haircut for the bagholder.

I’d love to hear the conversation between this loanowner and his accountant each April.

“So … you have $2 million in mortgages. Let’s calculate your mortgage interest deduction now. Let’s see … that would be $9,000/month times 12 … what? you didn’t pay any of your mortage last year?”

Quote: When it was only between the borrower and the lender, it wasn’t anyone else’s business, but once we started having to pay for the bailouts, it impacted all of us.

Even without the bailouts, it impacts all of us. This fraud affects the market prices and makes housing unaffordable to the responsible.

It also causes houses to become derelict. Maintenance is not done. Mosquitoes infect pools. Terminates tear apart roofs. Pipes freeze. Hippies and other undesirables squat in the house. And once you get hippies, they are hard to get rid of.

The bottom line is that mass mortgage fraud hurts all of us.

Hi IR,

I looked up the info, the address is:

4332 Shepherds Lane, La Canada Flintridge, CA 91011

That’s LA county, though, of course. A firm in OC took care of the relief from stay some months back, that’s how I heard of it.

Unfortunately, that address is not in the coverage area I pay for. Sorry.

Herein lies the core of the problem.

“Not paying your mortgage is much lower risk then trading stocks. The risk/reward on the no pay is a lot better.”

The problem with price bubbles, mortgages guaranteed to go sour, mortgage failures….ALL began in the 1970’s, when folks began to expect that housing was more than just shelter, guaranteed to appreciate. It is simply NOT, never has been meant to BE that. It’s not liquid. You can’t call your broker and say “SELL” and expect to avoid a downturn in the market. We now have at least 2 generations of folks who believe this nonsense. Enabeled, like any addict, by greed. Gordon Gecko did us all great harm…everyone who saw that movie believed him. Residential housing is not meant to be a short term investment.

OK….I just got this e-mail from Lansner. Someone please tell me why this is substantially different from what is found on this post.

“http://lansner.ocregister.com/2011/06/22/32-million-in-price-cuts-on-4-o-c-villas/114497/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed:+Lansner+(Lansner+on+Real+Estate)”

Is he not using sacred MLS data? Is he not coupling it with public fact information? And his “transgretion” might be worse as he is publishing it in a newspaper, rather than a forum.