One of the biggest drags on the economy at every scale is unemployment among real estate agents, mortgage brokers, appraisers, home builders, engineers, architects, and a number of related fields.

Irvine Home Address … 6 BUTTERFLY Irvine, CA 92604

Resale Home Price …… $470,000

I'm tellin' you it's got to be the end,

Don't bring me down,no no no no no,

I'll tell you once more before I get off the floor

Don't bring me down.

Electric Light Orchestra — Don't Bring Me Down

Our current economic woes were caused by the real estate sector. Lenders emboldened by sophisticated risk-shifting and securitization pumped trillions of dollars into real estate loans — loans that ultimately went bad because incomes were not sufficient to support them.

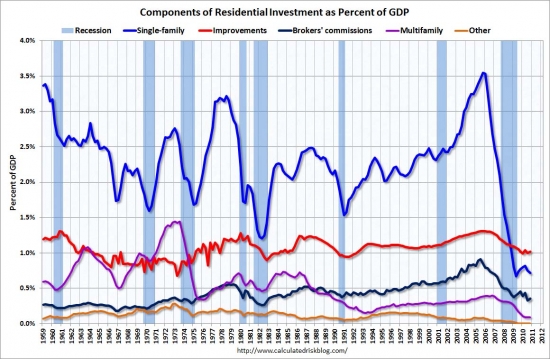

The resulting collapse in real estate prices has caused residential investment to fall to record lows.

That plunging blue line is just another statistical measure. The human toll in suffering among everyone involved in the real estate industrial complex can't be captured by a graph.

Mortgage industry workforce plunges by more than 50% in five years

April 11, 2011 — E. Scott Reckard, Los Angeles Times

Here are some hard numbers for the downturn in mortgage employment I wrote about last week — and they show a reduction of more than 50% in home-lending jobs since the peak of the housing and commercial real estate bubble.

The news peg for the story was mortgage goliath Wells Fargo & Co. saying it had eliminated 1,900 home-lending jobs, mostly workers hired temporarily to deal with last year's mini-boom in refinancings.

But that's nothing compared with the industry's overall decline from more than 500,000 employees in late 2005 and early 2006 to 248,000 in February, according to Bureau of Labor Statistics data compiled by the Mortgage Bankers Assn.

The latest numbers are the lowest for the industry since August 1997, according to the mortgage bankers group. The data, which arrived too late to be included in last week's story, showed that employment peaked at 505,000 in February 2006.

The numbers probably overstate mortgage employment slightly, because the trade group combined the BLS categories “real estate credit” and “mortgage and nonmortgage loan brokers.” But the lion's share of the jobs are related to mortgages and the downturn is dramatic.

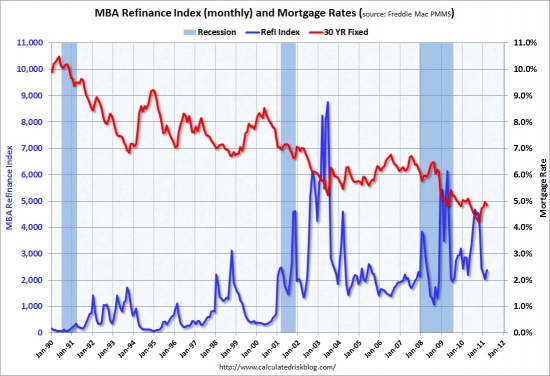

Following up on the story, Calculated Risk posted an interesting chart showing the correlation between 30-year fixed mortgage rates and refinancings. One notable detail is how round numbers catch the attention of homeowners. Check out the giant spike in refis when the rate dipped below 6% in 2003 and the also pronounced but smaller spike when it fell below 5% in 2009.

Mortgage employment also may have been affected by new licensing requirements for employees of nonbank lenders, adopted as part of regulations cleaning up the mess from the financial crisis. The licensing has made it more expensive for these independent brokers and mortgage bankers to maintain their payrolls, people in the industry say.

Chicago Bancorp, a large mortgage-banking firm, completed its purchase of Generations Bank, a Kansas City, Kan., savings and loan, last week to gain access to a nationwide lending market without the added licensing costs, Chicago Bancorp founder Stephen Calk told the Kansas City Star.

A spark from the outside

The economy will not fully recover until the real estate sector is put back to work. No, it doesn't have to attain the unsustainable heights of the housing bubble. A return to historic norms will feel like a boom compared to the last 4 years.

Real estate employment is an economic amplifier. Once people go back to work, new households begin to form, and demand for housing picks up, then and only then will residential investment pick up. Once residential investment improves, people working in real estate will add to demand for its own product, and the economy will gain a synergy from the real estate sector going back to work.

Unfortunately, it will require an outside economic stimulus to begin the chain reaction. In 2009, the federal reserve tried to prop up the housing market in hopes it would stimulate the economy and put the real estate sector back to work. Unfortunately, the policy was unsuccessful because the underlying problems with toxic mortgages was simply too big to be papered over by our central bank.

Until some other sector of the economy grows enough to put people back to work, the household formation necessary to stimulate real estate demand isn't going to happen. In the meantime, most of the real estate sector is unemployed, and the entire economy suffers along with it.

Severe HELOC abuse or mortgage fraud?

The owner of today's featured property weren't content to merely strip every penny from the walls the moment it appeared, she managed to process concurrent refinances at two different banks at the top of the real estate bubble. The timing certainly looks like mortgage fraud.

- Today's featured property was purchased on 3/30/1999 for $235,000. The owner used a $187,920 first mortgage and a $47,080 down payment. She waited four years before going Ponzi.

- On 3/18/2003 she refinanced with a $180,700 first mortgage and a $100,000 HELOC. At this point, she had been paying off his mortgage for four years, but the $100,000 HELOC was too tempting to resist.

- On 7/29/2003 she refinanced with a $273,000 first mortgage and a $78,000 stand-alone second.

- On 5/24/2004 she obtained a $154,000 HELOC.

-

On 8/18/2005 she obtained a $238,000 HELOC.

This is where the mortgage activity looks like mortgage fraud. Ordinarily, people only process one loan at a time because each lender will want to be in first position. Lenders check the property records before funding a loan, but if a borrower can time the funding at both banks to happen within a few days of one another, the recording of the first loan will not show up before the second one funds. The lender on the second loan believes they are in first position because the other loan, the one that funded a few days earlier, has not shown up in the property records. It's only after a week or two that the lender who funded the second loan realizes they were ripped off.

- On 2/23/2006 they refinanced their first mortgage with Bank of America for $540,000. They recorded first, so they are in first position.

- On 2/28/2006 they obtained two loans from Hanmi Bank. The first was a $270,000 mortgage, and the second was a $129,000 mortgage. Hanmi Bank recorded second, so they are totally screwed.

- Between the three loans recorded within days of one another, the total property debt is $939,000.

- Total mortgage equity withdrawal is $751,080.

There is no telling when she quit paying, but one of the lenders finally recorded a NOD in March.

Foreclosure Record

Recording Date: 03/23/2011

Document Type: Notice of Default

With over $900,000 in debt and a recovery closer to $450,000, someone is going to lose a lot of money. Hamni Bank will have to go after this deadbeat for theft via mortgage fraud. I doubt they have any assets for the bank to recover.

Irvine House Address … 6 BUTTERFLY Irvine, CA 92604 ![]()

Resale House Price …… $470,000

House Purchase Price … $235,000

House Purchase Date …. 3/30/1999

Net Gain (Loss) ………. $206,800

Percent Change ………. 88.0%

Annual Appreciation … 5.7%

Cost of House Ownership

————————————————-

$470,000 ………. Asking Price

$16,450 ………. 3.5% Down FHA Financing

4.87% …………… Mortgage Interest Rate

$453,550 ………. 30-Year Mortgage

$102,808 ………. Income Requirement

$2,399 ………. Monthly Mortgage Payment

$407 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$98 ………. Homeowners Insurance (@ 0.25%)

$522 ………. Private Mortgage Insurance

$215 ………. Homeowners Association Fees

============================================.jpg)

$3,641 ………. Monthly Cash Outlays

-$393 ………. Tax Savings (% of Interest and Property Tax)

-$558 ………. Equity Hidden in Payment (Amortization)

$31 ………. Lost Income to Down Payment (net of taxes)

$79 ………. Maintenance and Replacement Reserves

============================================

$2,799 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,700 ………. Furnishing and Move In @1%

$4,700 ………. Closing Costs @1%

$4,536 ………… Interest Points @1% of Loan

$16,450 ………. Down Payment

============================================

$30,386 ………. Total Cash Costs

$42,900 ………… Emergency Cash Reserves

============================================

$73,286 ………. Total Savings Needed

Property Details for 6 BUTTERFLY Irvine, CA 92604

——————————————————————————.png)

Beds: 3

Baths: 2

Sq. Ft.: 1950

$241/SF

Property Type: Residential, Single Family

Style: Two Level, Other

Year Built: 1977

Community: 0

County: Orange

MLS#: P776205

Source: SoCalMLS

Status: Active

On Redfin: 9 days

——————————————————————————

Beautiful hard wood floor with high ceiling, Granite counter top and Newer cabinet in Kitchen. Morrored Wardrobes, Custom added storage area in Master bedroom closet. Large lush backyard Backing to Greenbelt, Spacious and airy floorplan. Great location for shopping, park, and schools.

There is a debate as to whether unemployment today is structural or cyclical. Structural is when there is a big skills or geography mismatch. That is somewhat the problem in Detroit (auto jobs have moved out). That is the problem with RE & mortgage banking. A healthy level of employment in those businesses is NOT what we had in 2006. I predict mortgage volume to be very low the next 5-10 years as rate increase and no one refinances.

The other source of refinance activity won’t be around either – appreciation fueled equity to extract. Yesterday someone posted that 40 years from now, no one will care if you bought in 2005 or 2010. Looking at a realistic time frame of 10 years (isn’t the average stay at a home 7 years?). What has buying in a bubble area 2005-2007 done? Can you refinance into lower rates or move w/o bringing cash to the table? Consider if someone stretched to get into the home that really fit them (that they can now afford comfortably). A decision about when, where, and what to buy can have a huge impact on a family’s finances for a long time.

Most of our unemployment is not structural, but cyclical. However, in some industries – real estate, and finance included – a large portion of the unemployment is structural.

It’s important to understand what the problem is because it has a huge impact on the efforts taken to reduce unemployment.

It looks as though we are going through a really major economic shift and that the FIRE economy, which for the past 20 years has constituted a disproportionately large part of our GDP and which has become downright predatory, is due to shrink drastically. The unemployment, I believe, is at least have structural.

Additionally, the reduction in available liquid fuels will change the landscape drastically, and the end result will be an economy that supports far fewer people than our swollen population of 310 million or so humans.

The contraction will not be pretty. Those of us who are still in our reproductive years need to consider whether we want to have a 2nd or 3rd child, or any at all, because we are headed for times where the value of our houses will be the least of our worries.

If you open your mind to the big picture we live in a phenomenal economic time. One in which poor

Americans are extremely wealthy by historic standards. What are our problems really? Food is plentiful. Oh no we built

too many brand new larger homes, however will we survive as a country? People get the healthcare they need no matter how expensive on paper it is. Even if the standard of living declined it would still be dramatically better than historic America standards and current global standards. Face it, and accept it… Embrace it even.. We as Americans have a fantastic life.

The best that borrowed money can buy!

You mean we Americans HAVE HAD a fantastic life. There are many indications that these might be the last days of the incredible affluence we’ve enjoyed for the past 100 years.

The fact that most of our present “affluence” is debt-financed is a good indication that we are living beyond our means, and we’re probably not going to be able to do so for much longer, especially since we are very dependent upon fossil fuels from countries that hate us, and might decide to sequester more of their mineral wealth for their own use. When you consider that everything we have an do depends on fossil fuels, you can see that we might have to make a lot of lifestyle “adjustments”, to put it mildly, in coming years.

I’d like to hold on to what we have if at all possible, but I don’t see how we will if our population continues to increase while fuel supplies necessary to run our technology decrease.

Of course, the depletion will be offset by many great improvements in efficiency, mostly in new technologies that make much better use of existing resources and also those that make use of other fuels. But there is a limit to everything, including our water supply, as well as all the minerals we need to run our show, as well as fossil fuels, and we may be reaching it.

The same problems have existed and were even worse 300 years ago, 1000 years ago, 2000 years ago.

We live in a cornucopia of food, shelter, and freedom. The only problems you think the country has are minsucle in the grand scheme of things. If you have food, shelter, freedom, and good health you are extremely wealthy. Any problems you think you or the country have, have been invented by you and frankly that’s unfortunate. Understand that you are very lucky. People will be having kids 500 years from now and the risky genes will propagate to expand humanity.

I like your attitude PR. I remind myself of these very things often.

Perspective, you can be driven crazy by all the bullshit problems we are fed through the media and other outlets.

Bottom line is things are amazing in the country. We have everything we need and more.

Amen to that!!! Take advantage of our natural resources right here in OC. The gate was open up to the top of the mountain today, it was fantastic to be above the clouds. There are hiking trails that would blow your mind that are within a 1 hour drive and a few hours hike.

Life can’t continue for America the way it has with mass consumption, and really, wasn’t life MORE enjoyable when we grew up as kids without the electronic media blitz, trinkets and toyz?

Life is very good Laura, don’t let the reality of that be stolen by the stress of living 🙂

PR is correct on this. The American lifestyle will change, but it will are not in danger of becoming an impoverished anarchic lawless state like Somalia.

The biggest change I see is that future homes will be smaller than today. And the yards will be smaller too. More common spaces and walking to restaurants & entertainment.

One sign of the apocalypse is $4 gas. Get used to it, and it is only going up. With China’s ratio of men to women, do you think a little extra money will keep a single man from buying & driving a car to impress a woman? What will $10/gal gas do to America? OMG, we might have to drive less or buy more fuel efficient cars.

America is still a place where the best and brightest from other countries come.

I guess that is why the issuance and use of food stamps in the US is at an all time record.

This just in: a record number of people in America have food !!! Yes they have full bellies.

The horrific tragedies continue.

Yep, we Americans need food stamps. Especially since we’ve become conditioned to believe 4,000 calories per day are necessary for survival (not to mention that we burn so many calories washing our own cars, mowing our own lawns, cleaning our own homes, walking home from school, and cooking our own meals). We are universally thin and in danger of wasting away. If you go to the mall, the OC Fair, or the beach you will see many, many dangerously scrawny and gaunt people who are in desperate need of taxpayer-bestowed food-stuffs. It’s makes me terribly sad.

How ever will Americans survive with only 4000 calories of food per day and tons of brand new gigantic empty houses. I sure hope we can find a way to make it through these devastating times.

Yup, if you can’t address the issue with facts, resort to a strawman.

Let’s not all forget that this is also very much a government-assisted disaster. With Fannie/Freddie floating money all over town and every lender packaging their loans as fast as they could, this outcome was patently obvious. The only question was ‘when?’

The other thing that I think is more structural now is the desire for somewhat smaller units. Back in the boom years the view was buy the biggest house you could afford since a bigger house will appreciate more than a smaller home. Fast forward to today, few of the people that I know that have huge homes are thankful for having done that, while people that have more modestly priced homes are thankful for that. In the long run I think we will be better off if people realize homes are an expense and not an investment.

It is a combination investment and consumption expense. A company could ‘invest’ in a billion dollar factory, but if they could meet their existing and near-term future demand with a $100M factory, is the billion dollar one still an investment? Definitely not a good one.

I could look at the difference in cost between two cities or neighborhoods, one in which you’d send your kid to private school, and the other public school. You’ll tolerate a higher price in the neighborhood where you don’t send your kid to private schools. That cost difference could be seen as an investment.

Ripping out perfectly good counters/cabinets/fixtures and replacing with more expensive items is consumption.

bottom line:

Replacement value of land = investment %

Replacement value of structure = consumption %

I believe the replacement value of the structure is commonly way overvalued – especially by R/E agents.

Hence all the hype in a typical MLS listing about granite, security systems and eco friendly dishwashers. For valuation purposes, all this junk has a real value of zero.

What if lenders would treat the land and structure as distinct items secured by *seperate* mortgages?

Seems to me that [as a lender] the risk profiles for each entity would be completely different.

One advantage would be that the market would force down the price on the structure (in some

cases to nearly zero).

Land would most certainly carry a true market

value interest rate.

It would also make these endless arguments about “its different here” a little bit more plausable.

Anyone know of legal precedence for a scheme of this type either locally or elsewhere?

That’s an interesting point, and something I’ve been debating with myself. But it depends on what you mean by “bigger” and “smaller” – I mean where is the cutoff? 2,000 sq ft?

Henry

I guess it’s all relative – for example we have small 3br dutch colonial with about 1600 feet which is fine for a family of 4. But I’m surprised how many families of 4 in my have four bedroom homes in my town with dens and rumpus rooms full of stuff. In any event these people are paying about $75/month more than me on utilities, about $300/month more on taxes and more on their mortgage. Plus I’m only spending money to furnish 3 not 4 Br. Then I get the ‘how do you do it’ when we went to Europe last summer on vacation. I think my kids will have better memories of our trip than better memories of a walk in closet when they are older. Its a personal thing but I don’t think people realize that there are quickly diminishing returns on larger homes, and alot more expense.

A home can be an investment, not in monetary sense unless the kids will support your retirement.

A house can be an investment in the monetary sense, but the timing and location need to be right.

An RE house is not a home.

If you buy into the REA idea that a house is a home, then one will spend almost unlimited amount of money and effort on the house and neglect the home.

> One of the biggest drags on the economy at every scale is unemployment among real estate agents, mortgage brokers, appraisers, home builders, engineers, architects, and a number of related fields.

McDonald’s has 50,000 openings. Problem solved. 🙂

Based on what some people in the industry say and do, they may not be qualified to work at McDonalds.

As one of the appraisers that luckily saw this coming I:

-sold the house and vacation condo in 2005

-was ridiculed by various used house salesman through 2006 for doing so

-just ran into a “high profile” used house saleswoman who tried to have me offed an approval list for not hitting value working the makeup counter at Macy’s (schadenfreude in full effect!)

-transitioned into a new industry where I no longer have the advantage of working for myself but I’m earning a good living

-love reading this forum, learning viewpoints and laughing a lot

-trying not to be a “drag” on the economy but have definitely changed my consumer ways forever!

As far as land and structure, the not often talked about method to determine real estate value is the Cost Approach. In SoCal its a little harder to do as vacant lots that are able to be built on are rare, but it is doable. Think about it, LAND is the only thing that really can appreciate. The minute the toilet is flushed is it now worth more? Everything in the STRUCTURE is depreciating. Can the house be liquidated in parts? Can the nails be pulled out of the 2″ x 4″‘s and sold at an appreciated price?

This is the same reason much of the graniteel stuff was BS promoted by agents, contractors, building suppliers, etc. Travertine has the same function as linoleum. Any value (theoretically) that is assigned to a feature of the property, should be proven in the market. i.e. All other major things being somewhat equal, sq. footage, BR/Bth count, yr built, location, the $20,000 “adjustment” for the travertine should clearly be demonstrated by comparing 3 all else equal linoleum homes to 3 all else equal travertine and extrapolating the $20k difference.

Unfortunately, the banks and brokers able to shuffle stuff off to Wall Street were only interested in the fees, not in the long term returns of holding paper. That is where a competent valued professional turned into a hit the number by turning a blind eye for $350 a pop idiot! The only thing now is that they are $125 hit the number idiots, driving 100+ miles round trip into areas where they are not market competent, and if lucky are doing 5 a week. No thanks! I’m enjoying working for the man and not dealing with the numerous scumbags the industry has within it!

I remember meeting you at one of the IHB meetings. It’s good to hear you landed on your feet. It has been a struggle for all of us in real estate.

BTW, your timing and insight was perfect. Kudos.

socalappraiser – Would you please email me at cdcrez@cox.net

I have a question about the language and process of short sales.

I may or may not be the current buyer of a house in a short sale, and I’m a little confused by the process. After sending in a formal backup offer several weeks ago, the original buyer has dropped out, and the listing agent contacted my realtor this week and said that I should re-submit my offer at $5K below my original offer, and that I should add the terms, “seller to credit buyer by 3% towards closing.” This seems odd, but short sales, as far as I can tell, are really strange in general. Also, since they haven’t formally accepted an offer from me, I don’t know that I’m actually the only buyer.

So why, given that the agent had an offer from me for X, do they want me to pay X-$19K? My first thought is that the lienholder has taken (at least) six weeks to arrive at a set of terms that they could agree with for the previous buyer, and apparently the bureaucratic overhead for just getting the various sides of the bank to agree might cost more than $19K, so the bank and/or listing agent is just being pragmatic. Or perhaps it’s just because regardless of their internal overhead, they know it will take six more weeks to deal with my higher offer. Or perhaps they know that there’s something that’s already come up in inspection that they’d like to give me $19K to deal with after they’re out of the picture.

Or maybe the listing agent isn’t telling the bank that I made a higher offer several weeks ago.

Or maybe the bank has some internal rule that they can’t sell via the listing agent’s counter-offer and must only agree to an “original” offer from the specific buyer, or maybe some other weird thing. I’m assuming it’s some combination of everything: pragmatism, manipulation by the realtor, inefficiency and timeliness. Does anyone have any experience with this behavior?

Homebuyer suggestion to builders:

“Buy one, get one free,” Sally, suggested. They had a good laugh over that.” 🙂

NYT: Builders of new homes see no signs of recovery: With sales down 80 percent since 2005, analysts expect long-term changes in behavior