Government policymakers have gone through heroic efforts to save the housing market. The question is: should they?

Irvine Home Address … 20 AVANZARE Irvine, CA 92606

Resale Home Price …… $599,000

There's nothing left to say

But so much left that I don't know

We never had a choice

This world is too much noise

It takes me under

It takes me under once again

Rise Against — Savior

Should US Taxpayers responsible for every underwater homeowner? Many in government act as if they should, and many in the mainstream media report as if the status quo should be preserved.

It's common at housing blogs to find calls for the government to get out of the housing market. It's rare when you find this sentiment coming from a local newspaper editorial in conservative South Carolina.

Should we work to 'save' housing market?

Source: Herald; Rock Hill, S.C.

Publication date: January 5, 2011

By Thomas Sowell

“Housing Market Setback Forecast,” the newspaper headline said. A recently released report on housing says that home sales are down more than 25 percent and the inventory of unsold homes is about 50 percent higher than it was the same time last year.

This is just one of innumerable stories about the woes of the housing market. We all understand about human beings having woes. But how can a housing market have either setbacks or woes? Moreover, why should politicians be riding to the rescue of the housing market with the taxpayers' money?

Investors lost money. Many of them were homeowners who over-indebted themselves to capture appreciation. That's our daily tale of woe. Politicians are riding to the rescue, not to save the crying masses who lost money on their homes, but to save their large campaign backers in the banking industry. The are raping the US taxpayer because they can.

We hear all sorts of sad stories about people whose homes are “under water” or who are facing foreclosure. But why should our attention be arbitrarily focused on these particular people, rather than on the many other people who would benefit from being able to buy those same houses if the prices came down? The government is artificially keeping the prices up with subsidies and with pressures on lenders to accommodate the current occupants.

Can we not walk and chew gum at the same time? Is our attention span so limited that we can only think about one set of people that the media and the politicians have chosen to highlight?

Hasn't that been the story of the housing bubble from the mainstream media? Renters don't exist. Not like real people who own houses. The interests of renters as a group does not capture the attention of anyone in the mainstream media. The story is rarely told from their point of view.

Do other people count for less just because the media don't put their pictures in the paper or on the TV screen? Or because politicians are ignoring them?

Sometimes we are more concerned about some people because they are especially deserving. But this cannot be said about those who borrowed money to buy homes that they could not afford, or who borrowed against the equity in their homes, and now find that what they owe is more than the home is worth.

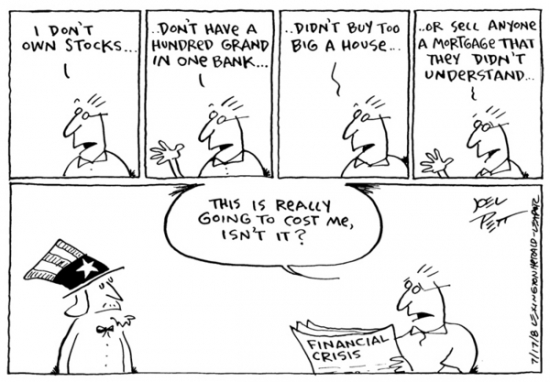

If anyone is especially deserving, it is those who had the common sense to avoid taking on bigger financial obligations than they could handle, but who are now expected to pay as taxpayers for other people's irresponsibility.

The circumstance that angers me most from the housing bubble is what has been done to the people who were responsible.

No doubt some people who are facing foreclosures might have been able to continue making their mortgage payments if they had not lost their jobs. But since when were we all guaranteed never to lose our jobs? People used to put money aside “for a rainy day.” But now people who have spent like there are no rainy days are supposed to have the taxpayers pay to give them an umbrella.

Why are so few making more noise about this? Think of the message we are sending everyone. Once Uncle Sam commits to bailing out everyone, what incentive is there to be prudent?

What about the people who saved and put their money in a bank? Those who blithely say that the banks ought to modify the mortgage terms to accommodate people who are behind in making their monthly payments forget that, however “rich” a bank may be, most of its money actually belongs to vast numbers of depositors, most of whom are not rich.

Those depositors deserve to get the best return on their money that supply and demand can offer. Why should people who save be sacrificed for the benefit of those who spent more than they could afford?

When the federal reserve lowers interest rates it diverts money to banks that would have gone to savers. Stealing from the prudent for the greater good, right?

Why are politicians so focused on one set of people, at the expense of other people? Because “saving” one set of people increases the chances of getting those people's votes. Letting supply and demand determine what happens in the housing market gets nobody's votes.

If current occupants are put out of their homes and the prices come down to a level where others can afford to buy those homes, nobody will give politicians credit – or, more to the point, their votes. Nor should they.

Rescuing particular people at the expense of other people produces votes. It also produces dependency on government, which is good for politicians, but bad for society.

That is why politicians give what Adam Smith called “a most unnecessary attention” to things that would sort themselves out better and faster without heavy-handed government intervention.

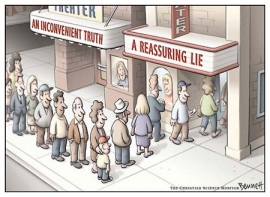

Why do the media fall in with this arbitrary focus on particular people who are having trouble holding on to homes they cannot afford? Partly because it makes a good story and partly because too many people in the media simply go with the politicians' talking points. That is a lot easier than thinking.

But the rest of us have no excuse for not thinking – or for letting ourselves be stampeded by rhetoric about “saving” the housing market.

Thomas Sowell is a senior fellow at the Hoover Institution. His Web site is www.tsowell.com.

Actually, every homeowner in America has a huge incentive to let politicians do whatever is necessary to save them. Willful ignorance will rule the day. It always does.

The fate of sheeple

I am trying to do more posts on different mortgage situations I find in the property records. The HELOC abuse cases are still the most interesting, but they do not tell the full story of the housing bubble.

A sheeple would be a middle of the road borrower: someone who didn't take out the most exotic terms and who put some money down but less than 20%.

Your typical Irvine sheeple borrower at the top of the bubble was more like today's owners. They bought at the wrong time with the wrong financing, and they are losing their home, their equity, and their credit rating. California real estate is not always a pot of gold.

These owners paid $753.000 on 6/5/2005. They used a $602,400 ARM, a $75,300 HELOC, and a $75,300 down payment. Five and a half years later, and the owners are selling short, and the bank is hoping prices haven't dropped more than 20%. The owner doesn't care anymore.

Foreclosure Record

Recording Date: 11/24/2010

Document Type: Notice of Default

Irvine Home Address … 20 AVANZARE Irvine, CA 92606 ![]()

Resale Home Price … $599,000

Home Purchase Price … $753,000

Home Purchase Date …. 6/3/05

Net Gain (Loss) ………. $(189,940)

Percent Change ………. -25.2%

Annual Appreciation … -4.0%

Cost of Ownership

————————————————-

$599,000 ………. Asking Price

$119,800 ………. 20% Down Conventional

4.79% …………… Mortgage Interest Rate

$479,200 ………. 30-Year Mortgage

$121,081 ………. Income Requirement

$2,511 ………. Monthly Mortgage Payment

$519 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$100 ………. Homeowners Insurance

$162 ………. Homeowners Association Fees

============================================

$3,292 ………. Monthly Cash Outlays

-$426 ………. Tax Savings (% of Interest and Property Tax)

-$598 ………. Equity Hidden in Payment

$219 ………. Lost Income to Down Payment (net of taxes)

$75 ………. Maintenance and Replacement Reserves

============================================

$2,562 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$5,990 ………. Furnishing and Move In @1%

$5,990 ………. Closing Costs @1%

$4,792 ………… Interest Points @1% of Loan

$119,800 ………. Down Payment

============================================

$136,572 ………. Total Cash Costs

$39,200 ………… Emergency Cash Reserves

============================================

$175,772 ………. Total Savings Needed

Property Details for 20 AVANZARE Irvine, CA 92606

——————————————————————————

Beds: 4

Baths: 2 full 1 part baths

Home size: 1,876 sq ft

($319 / sq ft)

Lot Size: 2,582 sq ft

Year Built: 1996

Days on Market: 210

Listing Updated: 40543

MLS Number: S622739

Property Type: Single Family, Residential

Community: Westpark

Tract: Trovata (Trov)

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Short Sale: Light & bright detached home In desirable Westpark area. This beautiful home has 4 bedrooms, living room, family room & Formal dining room. Kitchen with tile floor, granite counters & breakfast counter. Large master suite w/walk-in closet, shower & large bath tub. Separate laundry room upstairs. Side yard w/patio. Wood floors downstairs, Laminate on stairs/hallway & carpet in bedrooms. Plantation shutters. Washer, dryer & Refrigerator are included. Walking distance to association pool, spa, tennis court & park. Walk to Plaza Vista Elementary school. Very close to shopping center. EZ access to freeway.

I hope you have enjoyed this week, and thank you for reading the Irvine Housing Blog: astutely observing the Irvine home market and combating California Kool-Aid since 2006.

Have a great weekend,

Irvine Renter

That photo of the pigs reminded me of a great song by Nine Inch Nails. March of the Pigs! Keep up the good work!

You could also include days on market ‘210’ and price history. These owners are doing the chase the market down thing. They gave up in mid December. Wonder if this could be a divorce sale. Doubt they are still making the payments.

Prior to Jul 10, ’10 $750,000

Jul 10, ’10 – Oct 14, ’10 $729,000

Oct 14, ’10 – Nov 8, ’10 $665,000

Nov 8, ’10 – Dec 14, ’10 $650,000

Dec 14, ’10 – Today $599,000

I imagine July’s their last payment. If they were served a NOD in November, they didn’t pay for November, October, September, and August. Based on past lender behavior, these borrowers may have been delinquent even longer, but there is no way to know.

$18.9 million Irvine home hits the market

http://lansner.ocregister.com/2011/01/21/new-mansion-is-shady-hills-priciest-18-9-million/96316/

“a driveway specially sloped to accommodate exotic, low-to-the ground cars such as Ferraris or Lamborghinis”

Public housing policy has destroyed the housing market in the U.S.

Here’s what 75 years of policy meddling in housing has accomplished:

1. The blighting of our cities and destruction of our low-income population2 by the “slum clearance” of the Post WW2 era and warehousing of the very poor in blocky, badly built high rises that almost all are being torn down now.

2. The decanting of city populations into auto suburbs by “redlining” middle income urban neighborhoods in the 50s and 60s, making it impossible to get financing to either develop or buy in them, while offering little-or-no down payment VA and FHA loans for new production crackerboxes in distance suburbs.

3. Inflation of house prices from the late 70s forward by enabling securitization of mortgages, and consequent deterioration of underwriting standards, with the formation of the GSE’s (government chartered “private”agencies)that were formed specifically to form a market for higher-risk mortgages that would never have been written otherwise.

4. Section 8 rental subsidies for “market” rate housing, further blighting urban and suburban rental areas while driving up rents.

5. Multiplication of subsidies and incentives for home buyers, including tax deduction for mortgage interest, credits for first time buyers, and housing ‘affordability’ programs for buyers priced out by price escalation caused by forgoing. Result is to create more house debt at higher DTI ratios while causing house prices to inflate.

The end result is a population steeped in debt they almost certainly cannot repay, still-inflated house prices that are a massive barrier to first time buyers, low-wage workers priced out of major cities by Section 8 rental subsidies that enable a small minority of the poor to live well over their heads while landlords are enabled in overcharging for deeply substandard housing by the guaranteed income of the vouchers, miles of vacated, ruined apartment buildings destroyed by Section 8 renters, millions of foreclosed houses and condos languishing, often empty and subject to looting and vandalism, while there are more broke, homeless people and tent cities and more people burdened with crushing debt to pay for it all while they slip further down the economic ladder.

A character in an Ayn Rand novel remarked that “this is the age of the housing project, which is a prelude to the age of the cave”.

How true.

But you have to go back to why the goverment started medling in the first place. There were a lot of homeless people created by the great depression and at that time comunism (or marxism) was very appealing to the masses. Those in power in our goverment reasoned that homeowners were more likely to support the status quo and less likely to revolt. Hence, homeownership was to be encouraged to keep the masses docile.

the meddling, via control of credit and money supply, caused the great depression.

government and fed create unsustainable growth rates and resulting busts.

Interesting that the crash of ’29 and resulting rapid deflation of the Fed-created debt bubble of that era, was what caused such widespread destitution.

The creation of the Federal Reserve was the beginning of the end of a vibrant, free economy with sustainable growth rates. Prior to government meddling in financial markets, there were booms and busts and panics and short-lived recessions that were sometimes rather deep.

However, the creation of the Fed and increasing government intervention and monetary manipulation has led to greatly extended bubbles that result in deep, prolonged recessions while stifling the self-correcting adjustments that individuals make in response to contraction, that pave the way for recovery.

+100000

“busts and panics and short-lived recessions that were sometimes rather deep”

When we talk about a deep recession or a depression, its hard for words to grasp just how bad those events are. These problems must have been pretty bad because the Federal Reserve was created to prevent these things from hurting too much. I question whether or not the cure is better than the disease.

I encourage you to keep questioning.

this might clear things up

https://www.youtube.com/watch?v=lu_VqX6J93k

it would be a tough argument to call Mr Griffin lunatic fringe.

remember a business is fairly nimble and always assessing it’s market.

the only time you see widespread malinvestment simultaneously occurring in multiple sectors is when credit is artificially cheap and available. it sends misleading signals to all businessmen. this is the unintended consequence of the federal reserve. this is the cause of the great depression.

This literally has the potential to re-define the money system as we know it.

‘Bitcoin’

Based on some old technologies, and some very new technologies… Bitcoin is the result of combining… cryptographic encryption security + the idea of a limited quantity commodity, similar to gold and silver (where there’s only so much of it), and using it as money + the idea of massive numbers of computers connected by the internet… forming a strong, resilient, indestructible network.

It’s called a cryptocurrency. Since the invention of Bitcoin… Money will never be the same…

This is freggin’ unbelieveable.

It’s as free as email. Bitcoin transactions are free. Whereas credit cards and other online payment systems typically cost 1-5% per transaction, plus various other fees adding up to hundreds of dollars… Bitcoin usage and transactions are always free. It doesn’t matter if you send $0.01… or $1,000,000.00… the transaction cost is always the same: free

It’s as easy to send as email. Just one click. Bitcoin payments are sent with one click – just like email.

Payments are irreversible. No matter whether you accept Bitcoin payments for your business or otherwise, payments can not be reversed. There’s no such thing as a “chargeback” with Bitcoin. Payments can only be refunded by the recipient, voluntarily… as a separate new Send transaction.

It’s more secure than all other online banking existing in the world today. Traditional banks use encryption when you log on to your online banking. The encryption technology used in Bitcoin is even more secure. In other words, if it were to ever become possible to hack in to it… Then ALL the world’s banking would be compromised. At this point, it would take the government’s super computer more than 20 years to crack that level of encryption.

Bitcoin has no central issuing entity… therefore, no single point of failure. In many ways Bitcoin is more secure than your bank. If your bank were to fail, your money could be gone forever. The Bitcoin network is made up of millions of computers all over the world, connected via the internet. The entire internet would have to go down, in order for the Bitcoin network to fail.

In the Bitcoin economy, there is no central bank… no federal reserve. The value of Bitcoins does not go down when The Fed decides to “print more money”. In fact, it might even go up in value… as it triggers more people to seek out alternatives to storing their money in the world’s “fiat currencies” (paper money that different nations’ central banks just continue to “print more of”)… and buy more Bitcoin instead. In the news, they call it, “Quantitative Easing”…. or “QE2”. We think it would be more appropriate to call it, “The Titanic”.

It’s as anonymous as you want it to be. Just like with cash, transactions can be totally anonymous. Transactions are only identified by your Bitcoin address, and you can have as many Bitcoin addresses as you want. You create another new Bitcoin address with one click any time you want to. Most people create a new Bitcoin Address for every person sending them a payment. That way, they know for sure who the payment came from.

There’s no big brother. Third parties can’t prevent or control your transactions. Transfer money easily through the internet, without having to trust middlemen; no central bank, nor central authority.

It’s not paypal. What may be the best feature of all? “Bye bye, PayPal.”

listen to the interview at: bitcoinme.com

This house may have melo Roos, 1915 AD bond.