Proving they are pawns of the extreme left, the Occupy LA movement disrupts foreclosure auctions and gets on the wrong side of the foreclosure issue.

Home Address … 110 DANBURY Ln Irvine, CA 92618

Asking Price ……. $499,000

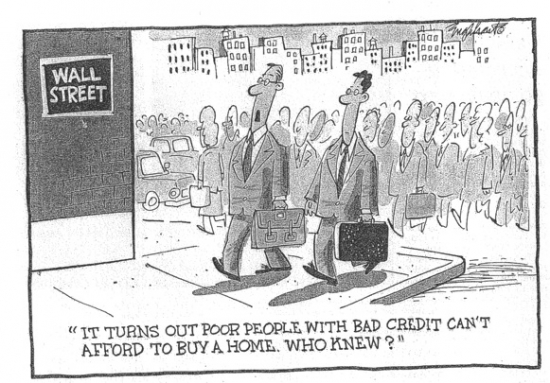

I don't have any political ax to grind with the left. In fact, on many issues, I lean more left than right, but on the issue of giving away free houses, I think the extreme left has it wrong. In their interest in pandering for votes, they are calling up the troops in the Occupy wherever movement and sending them to foreclosure auctions to disrupt the activities. Perhaps we should just stop all foreclosures and let everyone who occupies a house to keep it, right?

Occupy L.A. takes its fight to foreclosure auction

Protesters disrupt bidding outside Norwalk courthouse on homes owned by banks and title companies with chants of 'Shame on you' and 'Banks got bailed out / We got sold out.'

By Kate Linthicum, Los Angeles Times — December 3, 2011

Several times a week, a group of investors gathers in Norwalk to bid on homes that have been foreclosed.

The midmorning auction outside the Los Angeles County Superior Court building is a high-stakes, but usually low-key affair. On Friday, bidders sat in the sun in lawn chairs, and the auctioneer looked relaxed in a pair of baggy sweat pants.

But just as the auction was getting started, a commotion erupted from across the lawn. It was a group of protesters, marching with posters and howling an angry chant. “Banks got bailed out / We got sold out!”

The protesters are right, the banks did get bailed out, and the people doing the bailing got not much in return. However, it's quite a stretch to think that means we should be giving away free houses.

Some wore T-shirts identifying themselves as members of local labor unions. Others wore arm bands printed with “99%” — a now-famous reference that revealed a different allegiance.

Occupy L.A. may have lost its home outside City Hall this week, but protesters plan to continue the acts of civil disobedience that helped the movement capture national attention.

So that's what this is. They were looking for some other cause to gain attention. There are other causes they could go after.

Why don't they walk down to the unemployment office and demand higher unemployment benefits for a longer period of time?

Why not swarm an emergency room and demand free hospital stays for everyone?

Why not just go to the bank and demand free money from the the tellers? Why go through the hassles of signing loan papers and defaulting?

Demonstrations against the foreclosure process may be key among them, said one protester who spent nearly two months living on the City Hall lawn at Occupy L.A., and who hitched a ride to Norwalk to take part in Friday's action.

The protester, Abe, wouldn't give his last name, but said anger at the foreclosure crisis, and at banks that he believes haven't done enough to help homeowners get more favorable loans, helped draw him to Occupy in the first place.

Why would banks want to give homeowners more favorable loans? Loan modifications are not an entiltlement, and banks don't want to make them one.

Friday's protest was organized in conjunction with Good Jobs L.A., a coalition of labor unions and other community organizations. Although some within the Occupy movement have expressed fears that their protest may be co-opted by other groups — including unions — Abe said he isn't worried about that.

Abe should be very worried about that. The Occupy movement is a group of sheep waiting to be shepherded around at the whim of whatever interest group knows how to appeal to them.

“I don't think we should align with any power structure,” he said. “But anyone who wants to stand in solidarity with us, we're happy to have them.”

As the protesters circled the auction, the bidders drew closer so they could hear over chants of “Shame on you!”

On the auction block this day were properties from throughout the county — from Torrance to Van Nuys. Next up was a home on West 59th Place in South L.A.

The protesters booed. The bidding started. “Do I have $113,300?” the auctioneer asked. He is hired to sell the properties by the banks and title companies that own the homes.

“$115,000” said one man.

“$116,000,” said

another.

The price climbed and climbed. When it hit $130,000, protester Carlos Marroquin started shouting.

“Whose home is that? Whose home are you buying?” he yelled. “Do you know that families are breaking apart? People fought for those homes, and you guys are just taking them away.”

Whose home is that? Well, if the delinquent mortgage squatter who occupies the house doesn't have any equity, then the occupant certainly doesn't own it. See Money Rentership: Housing and the New American Dream.

Whose home are you buying? The bank's, that's who.

Do you know that families are breaking apart? Do you know that families are staying together and moving into comfortable rentals?

People fought for those homes, and you guys are just taking them away. Perhaps instead of fighting for those homes, the borrowers should have paid for them instead. It would have been far more effective at keeping the property.

Marroquin, who lost his own home to foreclosure, said he speaks from experience. “It destroyed my marriage and hurt my kids,” he said.

A member of Occupy L.A. since its Oct. 1 beginning, he set up a tent there and said he helped counsel 300 families facing foreclosure.

At first, bidders seemed amused by the hubbub — and the news reporters and photographers it had attracted.

“I kind of like it,” one said to another. “I like crazy, though.“

But as the morning wore on, and one protester held a microphone up to an amplification system, producing a deafening squeal, the bidder's patience wore down. “They're getting annoying,” he said.

I imagine it was annoying. People are bidding hundreds of thousands of dollars for houses, and they want to hear the auctioneer and other bidders. Foreclosures are a serious business.

Another bidder, Mike Lalani, told protesters that the buyers were the wrong target. “Your protest is good, it's great, but it's misguided,” he said. “You need to be saddened that these homes are being lost in the first place.”

The auctioneer agreed: “You guys need to go higher on the food chain.”

Exactly. Foreclosure is the end of the road. It is the cure to the problem of excessive debt. The borrowers should never have been given such large debt loads to begin with. The problem is at the front end of the process, not at the back end.

They have, of course. Last month, police arrested dozens of protesters in demonstrations in downtown's financial district, including one at Bank of America plaza.

At that protest and elsewhere, protesters have deployed tents — a symbol of the Occupy L.A. encampment — in their demonstrations.

A tent made an appearance Friday, when protesters offered to sell it to the bidders. A vigorous bidding war broke out. The final price: $20. kate.linthicum@latimes.com

A foreclosure tent. Now that's funny.

The Occupy movement means well, and there is certainly good reason to be angry at the bankers and the privileged class living under a different set of rules. The Occupy movement may become a real political force if it doesn't degrade into a ridiculous farce.

Rental parity hits Oak Creek's Cobblestone community

I used to live in Oak Creek near this community. I looked into renting properties in there a number of times. A few years ago, rents were between $2,500 and $2,700. Today, the cost of ownership for our featured property is $2,591.

With falling prices, some buyers will need bigger savings over renting to induce them to buy, but for others, owning a home at the cost of a comparable rental will be good enough. What's amazing to me is that someone paid $675,000 back when interest rates were about 6.5%. Their cost of ownership was closer to $4,500 a month instead of the $2,591 today's buyer will face. Timing does matter. That peak buyer experienced a 6.3% annual depreciation loss. Ouch!

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Home Address … 110 DANBURY Ln Irvine, CA 92618

Asking Price ……. $499,000

Beds: 3

Baths: 2

Sq. Ft.: 1500

$333/SF

Property Type: Residential, Condominium

Style: Two Level, Contemporary

Year Built: 1999

Community: Oak Creek

County: Orange

MLS#: P804859

Source: CRMLS

Status: Active

On Redfin: 1 day

——————————————————————————

Beautiful and Very Bright 3Bedroom Detached Home in Oak Creek. Largest Floor Plan in Cobblestone. Spacious Master Bedroom with Walk-in Closet, Over Sized Tub in Master Bathroom, Granite Counter and Sink Top in Kitchen and Bathrooms. Recessed Lighting Throughout. 2Car Attached Garage with Direct Access. Large Private Backyard for Relaxing and Entertaining. Low HOA Dues and Mello Roos ($622 per Year). Easy Access to 405 FWY & UCI. Walking Distance to Asso. Amenities, Restaurants and Shops. ''MOVE-IN CONDITION''

——————————————————————————————————————————————-

Proprietary commentary and analysis ![]()

Asking Price ……. $499,000

Purchase Price … $675,000

Purchase Date …. 3/8/2007

Net Gain (Loss) ………. ($205,940)

Percent Change ………. -30.5%

Annual Appreciation … -6.3%

Cost of Home Ownership

————————————————-

$499,000 ………. Asking Price

$17,465 ………. 3.5% Down FHA Financing

4.02% …………… Mortgage Interest Rate

$481,535 ………. 30-Year Mortgage

$136,787 ………. Income Requirement

$2,304 ………. Monthly Mortgage Payment

$432 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$104 ………. Homeowners Insurance (@ 0.25%)

$554 ………. Private Mortgage Insurance

$139 ………. Homeowners Association Fees

============================================

$3,534 ………. Monthly Cash Outlays

-$358 ………. Tax Savings (% of Interest and Property Tax)

-$691 ………. Equity Hidden in Payment (Amortization)

$24 ………. Lost Income to Down Payment (net of taxes)

$82 ………. Maintenance and Replacement Reserves

============================================

$2,591 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,990 ………. Furnishing and Move In @1%

$4,990 ………. Closing Costs @1%

$4,815 ………. Interest Points

$17,465 ………. Down Payment

============================================

$32,260 ………. Total Cash Costs

$39,700 ………… Emergency Cash Reserves

============================================

$71,960 ………. Total Savings Needed

——————————————————————————————————————————————————-

Tonight is the night

Larry Roberts is hosting a Las Vegas cashflow properties presentation at the offices of Intercap Lending (9401 Jeronimo, Suite 200, Irvine, CA 92618) on December 7, 2011, at 6:30. Please RSVP at sales@idealhomebrokers.com.

Blair Applegate of Peter Schiff's Euro Pacific Capital, Inc. will be presentating at the offices of Intercap Lending (9401 Jeronimo, Suite 200, Irvine, CA 92618) at 7:30 on December 7, 2011. Please RSVP at sales@idealhomebrokers.com.

I think you need to address the recent writings on the impact of ‘investors’ on local housing market price increases and busts.

Lawler on “Real Estate Investors, the Leverage Cycle, and the Housing Crisis” [today]

CR – Housing: Speculation is Key [2005, real time bubble analysis]

Recent Fed report [Sept 2011 publication]

Speculators had a huge effect on housing prices. These weren’t investors buying for cashflow but speculators buying for appreciation. When free money is given to speculate on any asset class, prices are bound to go up — a lot.

I understand the difference, and know that you’re a less-leveraged cash-flow positive investor.

What is important to find out regarding strategic default is the behavior difference between owner-occupant and ‘investment’ properties. Strategic default is far higher when you’re not living in the home. It probably doesn’t help to extrapolate data from non owner-occupied default scenarios to conditions where there is a higher percentage of owner-occupied homes.

Guess as a conservative I’m part of the “extreme left” as well.

I’m so tired of the crap I *will* default and jam my home up your collective rear ends. As a public that cannot or will not stand up to the corruption, you deserve for me to burden you with yet another home that the government WILL pay Chase bank off on.

You DESERVE it, enjoy, as there are millions of people just like me only waiting for the opportune time to default….and that time approaches rapidly.

I thought you already had defaulted. I know how unhappy you are with the situation. What has stopped you from defaulting already?

I’m paying less than rental parity at the moment. That will change when the interest rate goes up. Remember HAMP, well I’m in that program, and the astounding 5% loan that was awesome is now looking like BOHICA.

Interest rates will dive to 2%, all HAMP people will laugh and re-default now that the rich and those with equity borrow cash for LESS interest, yet let’s hold those whom own to a higher rate, while they are underwater, and HOPE those people don’t have a brain in their skulls to default.

Aye, thank you to those whom encourage me to default to *try* and recoup some of my 20% down, it appears there is no other option other than throw good money after bad. This whole shenanigan should never have happened, it was fraud from the top down, yet no one goes to jail. If I steal food because I’m hungry, I go to jail. If I sleep in a park because I’m homeless, I *can* go to jail. Honor, truth, and justice? Hardly.

Restore the Glass-Steagall Act.

What exactly is the “crap” that is tiring you?

I don’t understand the rage of underwater borrowers. If you’re in CA, and you want to default, do it. It’s a great option. Why so much anger? Yes, the banks would likely be better off modifying your mortgage than foreclosing on your home, but they have their reasons for not doing so (or they’re just inept). So what?

Dude, just stop paying. You’ll probably get 24 months of free living. When I’m writing my rent check every month, sometimes I wish I had that option myself.

Don’t be bitter, just make the smart move. I’m sure the banks will give you another loan in a few years when the dust has settled.

Swiller, I remember you said you put 20% down. That is why you are angry. Like the others said, add up two years of living free (other than utilities) and see how much of that 20% you get back.

I agree the whole ponzi scheme has fraud stamped all over it from the top down and it stinks to high hell. It’s obvious nobody will get charged and go to jail, you need to look out for yourself. If that means squatting for a few years…do it!

Aye beef, and ty. No worries, I’ll keep the blog informed when I do decide to default. I could even send in pictures of all the upgrades that will be removed and sold. You can see a before and after picture!

I should really start a blog called “Strip that House – Legally, with a wink and a nod.”

Wilsonart Flooring anyone? It’s not attached to anything, it’s a free-floating floor and as such, can be removed. Ceiling fans? Blinds? (I’ll pick a good neighbor for those to go to prolly).

Anyone want to exchange appliances? I have to leave something, who cares if it works or not. Y’all get my idea, some homeowners are a bit more aggressive than others, I’m quite creative when the need arises and i would rather bless YOU, people, rather than the banksters.

IR… I still don’t get it… the cost of ownership is only going to rise as interest rates rise and wages stagnate. Why not just go buy a 2500 square foot house with a pool in Scottsdale for 189K and retire??????? Or work on the golf course????

With the savings you can afford to come to CA every month and stay for a week in a nice hotel on the beach!

My .02

BD

A detached 3 bedroom listed for less than $500,000 in Irvine California … this is something the typical real estate bull, apologist, realtor said would never happen. Not only is is happening, we also have the lowest mortgage rates ever, delivering a false (faux & phony) affordability number.

So lets see here … we have the lowest mortgage rates ever, and home prices all over Orange County (especially the top end) are still in decline.

No bottom in sight.

mortgage rates going lower. see japan…about 2+% currently. But that is recourse.

Who said that would never happen?

It’s a detached 1500sft condo, many think $500k is still too high.

What I recall questioning is Irvine homes getting back to 1999 unadjusted prices.

This home sold for $271k in 1999… do you think it will get there? If I adjust for inflation, that’s about $368k… so you’re saying we have another 25% drop coming?

Who said that would never happen?

People have been calling a bottom in the real estate market for 4 years now. The National Association of Realtors called a bottom in 2007. Are you saying people didn’t suggest that prices would not come down in Irvine?

What I recall questioning is Irvine homes getting back to 1999 unadjusted prices.

I have little doubt if the the govt and Fed got out of the housing subsidy business, NOMINAL prices would be pre-Y2K. Imagine no Freddie, no Fannie, no FHA, no artificially low mortgage rates, no mortgage interest deduction, force banks to mark to market … all these subsidies and welfare programs have expanded since the financial crisis started. It’s very easy to see what would happen to pricing if all these welfare programs went back to pre-housing bubble status, or even worse, disappeared.

so you’re saying we have another 25% drop coming?

I wouldn’t be surprised, but who knows at this point. I never expected the govt/FED to do what they have done to protect this bubble.

lee in irvine – spot on. these subsidies must go, politically impossible however. homeowners equate strong house prices with strong economy, no matter how much debt people are buried under.

subsidized prices only serve to divert capital from more productive areas of the economy as well as hinder personal savings rates, which are one in the same.

Occupy should move to the North Pole, because santa is the best at giving out free presents to good little boys and girls.

O.C. population growth the fastest since 2001

http://lansner.ocregister.com/2011/12/07/o-c-population-in-biggest-jump-since-2001/155160/

The house was bought back in 2007 for 675k, now they’re asking for 499,000. How did you arrive at the (205,409) loss amount?

Unless you’re investing in some small business or backing an idea or invention/enterprise (be it a film project a record label or a lemonade stand), you are not really an investor; you’re a speculator — you’re not taking a risk to advance an idea or an enterprise. You’re parasiting off of a pre-existing utility and likely doing so with cheap, borrowed money. I’m not knocking you for doing it – hey, get all dollar’d up and be the biggest swingenest dick in your zipcode – but let’s not split the hair so fine. You’re not that much different from the much-reviled Joe or Jose Six Packs who were flipping houses back in ’04; different gambit, but same objective: money for nothing.

I got a fiver right here that says Cash Flow Investment is tomorrow’s Flip This House.

Max:

Everything you said is the opposite of correct.

Most people consider investments to have some basis in reasonable risk (CDs, RE, bonds), and speculation to be much greater risk (film projects, startups.)

The 2 main methods of valuing RE are market price and income (cash flow), and neither is a fad. Ask any accountant.

If you’re arguing that IR is rent-seeking, that’s true, but also has been legal for thousands of years.