Mitt Romney is the first presidential candidate to demonstrate the courage to endorse the right policy for housing.

Irvine Home Address … 67 HAVENWOOD Irvine, CA 92614

Resale Home Price …… $444,900

antichrist vanguard advance

spilling the blood of matyrs abd slaves

credo decimatus

machinery of the cleansing

decay and degradation dwell amongst us

machinery of the cleansing

sepsism swells the flock obscene

machinery of the cleansing…

Angelcorpse — Machinery of the Cleansing

Foreclosure is the machinery of the cleansing. Unfortunately, both lenders and loan owners are loath to take a bath, and politicians are too busy pandering for votes to do the right thing. Perhaps that is about to change.

I am neither left nor right in my political leanings. I am one of the moderate swing voters who votes for either party. I was annoyed by McCain's pandering to loan owners in the 2008 election, so he blew his slim chance at getting my vote (I was probably still too pissed at Bush to vote Republican.) So far, I have seen nothing by clueless pandering or outright avoidance of housing issues by any of the presidential hopefuls. Nothing Obama has done has impressed me so far either.

When I read today's featured article on Mitt Romney's comments, I was pleasantly surprised. He actually seems to display a grasp of the issue and is endorsing a politically unpopular policy. He wants to let markets work which means letting home prices fall.

Foreclosures: Don't slow them, Romney says

Foreclosures need to go forward so the housing market can begin to recovery, GOP presidential hopeful Romney says in Nevada. Nevada leads the nation with the highest rate of foreclosures.

By Kasie Hunt, Associated Press / October 20, 2011

Las Vegas: Mitt Romney came to the state with the highest foreclosure rate in the nation and said he wants to allow home foreclosures to “hit the bottom” to help the housing industry recover.

He picked the right place to make those statements. There are no successful market props working in Las Vegas. Prices have crashed, transaction volumes are high, and the market is bottoming as cashflow investors are moving in to clean up the debris. That's how markets are supposed to work.

In an interview published Tuesday ahead of presidential debate, Romney told Las Vegas Review Journal's editorial board that solving the foreclosure crisis would require letting banks proceed against homeowners who have defaulted on their mortgages. New investors could then rent out the homes until markets adjusted.

“As to what to do for the housing industry specifically and are there things that you can do to encourage housing: One is, don't try to stop the foreclosure process. Let it run its course and hit the bottom,” Romney said.

Wow! Romney is right — completely and totally right. I imagine the “give away free houses” movement on the left will freak out over these comments. Apparently, Mitt Romney either isn't listening to his advisors who want him to pander to loan owners, or he actually has the courage to say what needs to be done. I thought Ron Paul was the only politician with the bravery to do that.

Romney elaborated during the presidential debate Tuesday night. “The idea of the federal government running around and saying, 'We're going to give you some money for trading in your old car…or we're going to keep banks from foreclosing if you can't make your payments,” Romney said, “The right course is to let markets work.“

This is the first utterance from this campaign that got my attention. He is right on with his comments.

Nevada, where seven of the presidential candidates are debating, has the country's highest foreclosure rate and the nation's highest unemployment rate.

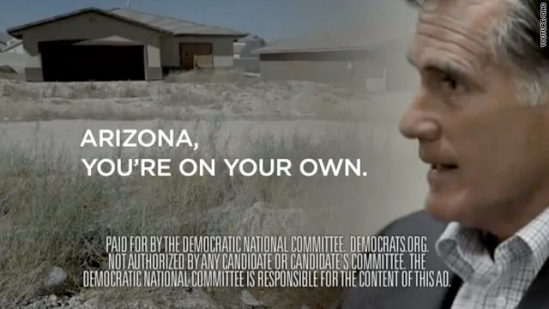

Democrats immediately criticized Romney as out of touch with middle class Americans, many of whom are struggling to hold on to their homes amid high unemployment.

I suppose Romney is out of touch with loan owners who are trying to hold on to the bank's home.

“Mitt Romney's message to Nevada homeowners struggling to pay their mortgage bills is simple: You're on your own, so step aside,” President Barack Obama's reelection campaign spokesman, Ben LaBolt, said in a statement.

Yes, that's exactly what he's saying, and it's about time someone did.

“This is just one more indication that while he will bend over backwards to preserve tax breaks for large corporations and tax cuts for millionaires and billionaires, Mitt Romney won't lift a finger to restore economic security for the middle class.”

No, it's an indication Romney doesn't want to give free houses to people who aren't making their payments.

Senate Majority Leader Harry Reid of Nevada also went after Romney. “Nevada has the highest foreclosure rate in America, and it has for almost three years. And here's what Mitt Romney said: He would just let them hit rock bottom,” Reid said during a press conference in the U.S. Capitol. “I don't know what's more graphic than that, in how we have different views of what the world should be like than our Republican friends.”

These bozos may cause me to vote Republican in the next election. I haven't done that for a federal office since 2002. The bottom line is that Democrats are wrong, and they are endorsing the wrong populist pandering policies.

But the home foreclosure issue has been almost entirely absent from the GOP presidential race. While it was mentioned during the presidential debate Tuesday, and Romney addressed it as part of a larger answer, the candidates quickly started talking about bank bailouts instead.

Romney has just scored points with me. My personal view is that he will likely win the nomination but lose the election. Too bad, if he keeps making economic sense, I may vote for him.

Apparently, I am not the only one impressed with what Mitt Romney said:

Romney's Finest Hour

He speaks the truth about housing and foreclosures.

A friend of ours quipped recently that Mitt Romney could do his Presidential candidacy a lot of good if he took even a single position that is unpopular in the polls. Well, we can report that he has done that on housing policy, that he's being pummeled for it, and that it may be his finest campaign hour.

They just couldn't afford it

Today's featured property was sold on 7/30/2004 for the ridiculous price of $619,000. The loaners used a 433,300 first mortgage, a $123,800 second mortgage, and a $61,900 down payment. On 8/22/2006 they obtained a $125,000 HELOC and got access to their down payment plus a little spending money. There is no way to tell if they took out the money.

With no further mortgage equity withdrawals, they still couldn't make the payments on the first mortgage, and the property was foreclosed on in early September. Perhaps it was unemployment, or perhaps they just couldn't afford it to begin with.

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 67 HAVENWOOD Irvine, CA 92614

Resale House Price …… $444,900

Beds: 3

Baths: 2

Sq. Ft.: 1578

$282/SF

Property Type: Residential, Condominium

Style: Two Level

Year Built: 1980

Community: Woodbridge

County: Orange

MLS#: U11004456

Source: SoCalMLS

Status: Active

On Redfin: 2 days

——————————————————————————

This home offers three bedrooms, two and a half bathrooms, two car garage and rear patio area with brick accents. Living room boasts wood-type flooring, conversation-area with a cozy fireplace. Kitchen has plenty of storage, ceramic tile flooring, granite countertop and stainless steel appliances. The property requires some cosmetic touches such as new carpet and fresh paint, perfect opportunity to put your personal touch on your new home.

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis ![]()

Resale Home Price …… $444,900

House Purchase Price … $619,000

House Purchase Date …. 7/30/2004

Net Gain (Loss) ………. ($200,794)

Percent Change ………. -32.4%

Annual Appreciation … -4.5%

Cost of Home Ownership

————————————————-

$444,900 ………. Asking Price

$15,572 ………. 3.5% Down FHA Financing

4.18% …………… Mortgage Interest Rate

$429,328 ………. 30-Year Mortgage

$132,425 ………. Income Requirement

$2,094 ………. Monthly Mortgage Payment

$386 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$93 ………. Homeowners Insurance (@ 0.25%)

$494 ………. Private Mortgage Insurance

$354 ………. Homeowners Association Fees

============================================

$3,421 ………. Monthly Cash Outlays

-$329 ………. Tax Savings (% of Interest and Property Tax)

-$599 ………. Equity Hidden in Payment (Amortization)

$23 ………. Lost Income to Down Payment (net of taxes)

$76 ………. Maintenance and Replacement Reserves

============================================

$2,592 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,449 ………. Furnishing and Move In @1%

$4,449 ………. Closing Costs @1%

$4,293 ………… Interest Points @1% of Loan

$15,572 ………. Down Payment

============================================

$28,763 ………. Total Cash Costs

$39,700 ………… Emergency Cash Reserves

============================================

$68,463 ………. Total Savings Needed

——————————————————————————————————————————————————-

Needs new carpet, fresh paint? Still looks like WTF pricing to me @ $444,000!!!

Hallelujah, it’s about time. I don’t know much else about Mitt Romney but good for him, finally a Republican running with housing policy that reflects a position a Republican should take.

He’s Mitt Romney though – meaning, he always has the right opinion and policy first, then he back-tracks later when it’s either not popular or against the extreme Right.

e.g. As MA Gov, he supported gay marriage and a form of universal healthcare and has since back-tracked.

I wouldn’t count on it. Romney is tacking Right to get enough Republicans to nominate him by default for lack of any credible alternative. Within days of getting the nomination, he’ll be saying how the economy has changed, as he backpedals as close to the center as he possibly can. He probably can’t win the Presidency with only partial, lukewarm Republican support from the hard Right, Evangelicals and social conservatives, so he’s got to try to pick up as many Democrats as he can. Bye-bye let the Market do its work talk.

As much as I would like to demonize the ethically deficient borrowers, the vast scale of our housing disaster requires a little more perspective. Were these folks bad? Of course. Did they single-handedly create the massive over-pricing that they were able to take advantage of through piggy mortgage equity withdrawals? No. So therefore, we can’t put the blame (and the pain) solely on borrowers.

Here is a good place to understand why there are other ways to look at what is going on here (the Madoff analogy is an excellent one – who on this blog shares any sympathy for a Madoff investor? none – but that doesn’t mean that Madoff investors should be completely hung out to dry – the Madoff recovery lawsuits have been funded with a budget that almost exceeds the entire annual SEC budget – imagine if that kind of money had been spent going after the housing finance fraudsters among the i-banks, warehouse lenders, mortgage brokers and chiselers at the private mortgage shops and home builders (all of whom spent vast money recruiting more fools for their ponzi schemes).

http://blogs.reuters.com/great-debate/2011/10/25/how-ed-demarco-finally-cried-fraud/

The problem with all these moral hazard arguments is that any “fix” just creates more moral hazards.

(i.e. Crazy “fix it” proposals from Obama)

Moral hazard “fixes” are just like an ameboa cut up. They just grow bigger in more places.

That’s why foreclosure is the superior solution.

Its clean, unambiguous and doesn’t spawn even more truckloads of toxic waste.

I agree, but we can’t kid ourselves into thinking that clearing the market through foreclosures has no negative impact on non-parties (people other than the borrowers losing their homes and banks losing principal).

That’s why I think the question should be, “How can we soften the blow to the economy and non-parties while using foreclosure as the primary tool to de-lever?” This is why I support the revised HARP and support an expansion to non-GSE loans.

Isn’t the real resistance coming from those that invested in MBS, i.e. pension funds, and brokerages who sold them to big and small investors not only in the U.S. but worldwide? Loanowners probably have the least to loose if haircuts start happening.

Yeah, it’s funny how when there are too many parties with varied interests, the most reasonable solution isn’t the one chosen.

It’s sounds a lot like the Greek crisis. There are a lot of people with a lot to lose, but that doesn’t mean they’ll all agree to a solution that will limit their losses.

I was told by a knowledgeable person in the mortgage business that most of those loans bundled into MBS had clauses in them preventing the servicing companies (read: lenders) from alterting the terms of the contract in any way without express permission from them. Therefore, NO rate changes, NO principal reductions, NO adding on to the time period, etc. That’s why there are still so many out there. They can’t be “un-bundled” and the bad ones separated from the OK ones, and the terms and conditions cannot be changed. I happen to own some…all executed in 2005, so you know they are all under water now. But they keep paying every month. So…who is paying?

Exactly! There are no easy solutions. Let’s all keep in mind the “be careful what you wish for” mantra. Many of those careful renters sitting on the sidelines waiting for the housing collapse would have lost their jobs and their savings if the whole system would have bee allowed to just crash completely. That doesn’t mean things couldn’t have been done differently, but the idea that everyone else would lose their jobs and livelihoods and be in a great position to scoop up super cheap houses is fantasy. Unless you had many times your annual income socked away and with nothing else to do with it besides buy housing, no one could easily predict want a full-on Great Depression would do to you and your loved ones. People forget how much has been done to avert a worse collapse and it is still really bad out there for many many many people.

Should you honestly look at the policies Obama has advocated (campaign promises not withstanding nor honored) Obama has governed as a Repub moderate, a species that no longer exists in the the current Repub party. Which is why I don’t plan to vote in the pres. election 2012. Subject to change, of course, but I do wish Warren had done a primary challenge. Romney supports any agenda that gives him an edge, wait a few days & he’ll support yours, at least for 15 minutes until his polls change…

No he isn’t. Ron Paul has been beating this drum much longer. Ron Paul has been warning about this manipulated

Economy for 15 years.

You’re way off. Ron Paul has been saying this since before the housing bubble burst. Mitt Romney is nothing but a carpet bagging phony RINO.

So, logically, a phony RINO is actually a true Republican, right?

Obviously I was saying that Romney is a phony Republican, meaning RINO.

Romney’s contrarian remarks are going to attract a lot of fire from critics, but they may bait Obama and other candidates into defending the efficacy and fairness of government handouts to insolvent banks and unqualified home debtors, the waste of valuable time and resources, etc.

My question is did Romney come to this conclusion on his own or did he have “pray on it”?

I find both parties remarkably unpleasant to deal with as voter, but it’s striking to me that Republicans actually believe they will win more elections with C-grade holy roller candidates like Bachmann, Perry, Romney, etc. I look at the list of candidates and think to myself these guys are to the Presidency what the St. Louis Rams are to professional football.

HoA appears to be $354.50. “Home” appears to be a 1980 2-level townhouse.

I personally think it’s worth half of the $444,900 ask, but if I had a nagging wife that insisted on being a loaner in Irvine, you could do worse.

It appears that foreclosure auction collusion is a federal crime:

San Mateo Daily Journal: Investors guilty of rigging real estate auctions

I guess when you mess with the banks, they show who has the power.

Sorry, the time for this has long passed: just because Irvine and pockets of Southern California have resisted the full brunt of the housing market decline, doesn’t mean the rest of the country has.

For all the talk of letting the markets “naturally” hit bottom, residents of the heartland have seen enough decimation of both local economies and housing markets. They’re not going to tolerate government allowing another wave of housing market declines so that a handful of sidelined Irvinites can stop renting and afford a 3/2 in Turtle Rock. Perspective, folks.

Where’s the recommend/like button when you needed one?

Okay, since you have characterized this discussion as completely selfish, let’s have some perspective.

The housing bubble was fueled by people selfishly bidding up prices to obtain appreciation. It was a transfer of wealth from new buyers to existing homeowners enabled by greedy and stupid lenders. Now that the bubble has popped, existing homeowners and stupid lenders are trying to keep the illusory wealth they were enriched with, only this time they are hoping to transfer wealth from all taxpayers.

It isn’t selfishness to want to see the government get out of the housing market and stop transferring its wealth to those who don’t deserve it. That’s justice.

And, if this debt and house price adjustment to reasonable house prices isn’t too painful, we will all benefit greatly when less household income is going to service less mortgage debt.

Imagine a world in which an average house can be financed by the average household in any given area at a DTI < 30% (in a fixed-rate loan)!

Sorry, IrvineRenter, you lost me–a long-time fan of this blog–a while back. And it also appears you’ve lost touch with your Wisconsin roots. Here in the Midwest (and most of the rest of the country) we’re well beyond anyone keeping “illusory wealth”–i.e., no one’s winning in a Ponzi game, because the Ponzi game ended here long, long ago (and, in fact, never existed in many regions, where housing prices never ballooned). Wealth isn’t getting transferred “upward” in the Midwest–or, if it is, it certainly isn’t the function of local housing markets.

Ironically, you sound like you’re in your own bubble, where housing prices are stubbornly clinging to mid-’00’s levels, and HELOC-ers are still swimming in their bubble-gained excess. I think if you’re honest with yourself, you’ll realize that Irvine is purely the exception: in the rest of the country, everyone has lost, and there’s nothing to be squeezed from homeowners and “stupid lenders”. No one is being enriched by illusory wealth, because the bottom has already fallen out–long ago, in fact.

In other words, you want a national solution to Irvine’s problem. I think we all realize that is not going to happen. And, equally important, we realize it should not happen.

Nick:

The bubble is still alive and inflated throughout California and other coastal areas.

Irvine has nothing on Cupertino or Mountain View, let alone Palo Alto or San Francisco.

While I don’t disagree with you on the Irvine part, the part about the BA being *more* than So Cal (let me clarify that…OC) is stupid (and probably a bit arrogant if I may add). I should know since I’ve lived in San Jose and pocket areas throughout BA for over 2 decades.

I’d rather live in a more diversified area (Irvine) than to be stuck in an area surrounded by Apple (Cupertino), Google (MV), Facebook (PA originally) and Salesforce.com (SF) where few innovators are, don’t get me wrong, innovating….but then are surrounded by H1Bers toiling away forever.

Chris:

You’re out of touch with BA real estate prices. Cupertino and Palo Alto have not decreased, while OC has.

As far as the rest of your comment about successful BA companies, I think success is better than the alternative.

Geez, you’ve only mentioned PA and Cupertino but have you forgotten other cities such as Santa Clara, Fremont, and…..San Jose (where I assume you’re currently living in)?

Rivermark is not exactly doing well and please don’t get me started on Fremont (even MSJ area has experienced a drop). San Jose is a basket case as far as I’m concerned even though Cisco is there.

I’m outta touch with BA prices? Puh-leese.

Would be profitable for IRs property flip business if the bottom did fall out though …

… gotta wonder about the political tin ear – going to a state where more than 60% of homeowners are underwater and telling them the govt doesn’t care and they should lose even more doesn’t make one popular or electable …

http://www.vegasinc.com/news/2011/sep/13/underwater-mortgages-declines-nevada-still-leads-n/

While I agree entirely with the sentiment that the quickest way to clean up this foreclosure mess would be to let the markets clear…I am not at all certain that the markets themselves can handle it. Meaning if we clear homes through foreclosure are the banks solvent? Haven’t the banks passed a goodly portion of their mortgages on to the GSE’s? If so doesn’t foreclosure en mass result in simple debt transference to the government and people? Maybe still a wise idea in the sense that by clearing the bad debt we can spur the economy as we nationally become more globally competitive.

Regardless, this mess is going be be with us for quite a while and be messy.

According to today’s OC Register feature story on Donald Bren, Bren “thinks Mitt Romney should be the next president.” “He’s the most qualified.” So given that, and Romney’s stated preference for the market to correct through the foreclosure process, what will that mean to the artifically high prices in Irvine? With Bren’s apartments renting at $1800+ (and there are already 39,000 units of them) and his plans to add some 6,000 more in the near future, can he artifically sustain the prices in the for-sale sector by manipulating rental prices to sustain the cost of his dirt? Lansner this week quoted a source as forecasting rents to raise 12% next year and that renters are currently spending 38% of income on rent. Is this the ‘competitive’ market we can look forward to? Isn’t it just as onerous as the one we have?

Yes, you are correct. The finaincial beatings will continue until debt servitude is the norm.

IMO, Donald Bren is an evil man.