The US economy and housing market is suffering due to the excessive debts taken on during the housing bubble.

Irvine Home Address … 36 ALCOBA Irvine, CA 92614

Resale Home Price …… $449,000

The best things in life are free

But you can keep 'em for the birds and bees.

Your lovin' give me a thrill

But your lovin' don't pay my bills.

Money don't get everything it's true.

What it don't get I can't use.

Well now give me money (that's what I want)

A lot of money (that's what I want)

Whoa,yeah you know I need to be free (that's what I want)

Oh, now give me money money! (that's what I want)

The Beatles — Money

Money won't buy happiness, but it can provide the finest forms of misery. Everyone wants money. If given the chance to do nothing and obtain money, most people would take it. Such was the lure of the housing bubble.

People only had to do two things to obtain copious amounts of cash. First, they needed to buy a house. Then they needed to find a lender who would give them money for signing some paperwork. That's it. No work, no skills, no risk, no sacrifice, nothing. Buy a house, sign some papers, and anyone could obtain hundreds of thousands of dollars. It shouldn't be surprising that kool aid intoxication is so strong. Who wants to give up on that deal?

Unfortunately, as with most things in life that are too good to be true, the housing boom was not real or sustainable. Equity is an illusion, but debt is very real. The debt hangover is still plaguing the country. Our banks are imperiled by the toxic debts polluting their balance sheets, and borrowers are burdened by debt service payments to the ailing banks. This debt service is money that could be circulating in the economy as demand for goods and services. Instead, the money that should be creating aggregate demand is being sucked into the black hole of banking losses and dragging down the entire economy.

Housing's Job Engine Falters

Employment Lost in Property Crash Weighs on the Economy's Chance of Recovery

By S. MITRA KALITA — October 5, 2011

HAGERSTOWN, Md.—Joshua Bradley says it was the easiest job he ever had: power-washing windows of new suburban houses. Then, about three years ago, business dried up and he found himself out of work.

“People don't want to get anything done to their houses anymore,” says Mr. Bradley, 28 years old. “They do it themselves to save money.”

His experience wasn't unusual.

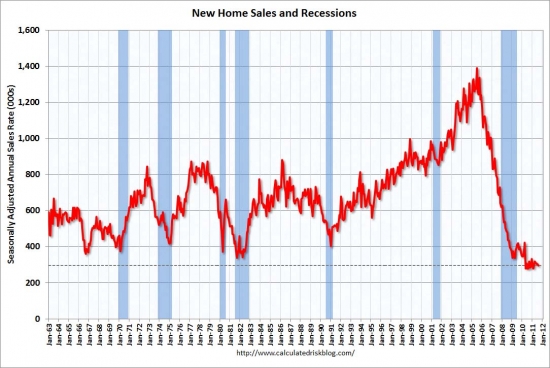

Over the past decade, the housing market has been a powerful engine: It helped the U.S. economy out of a recession and created jobs as construction firms took on workers and new homeowners hired contractors to decorate rooms and maintain the lawns, or purchased new furniture for indoors and outdoors.

But today, as the sector endures a prolonged slump, many of the jobs it created are gone, and housing has now become part of what many economists see as a vicious circle that has left the wider economy struggling to gain altitude.

Americans aren't spending because their home values are declining and employment prospects are dimming, and housing and employment is struggling because Americans won't spend.

“People are losing their jobs and never getting equivalent jobs,” says Yale University economist Robert Shiller. “That fear is spooking everyone, so people aren't in a mood to expand.”

It isn't that people won't spend, they can't spend. Borrowers everywhere have too much debt, and they aren't being given more Ponzi loans to make payments and buy more stuff. It's the natural result of a massive credit binge. Take a look at the size of the green area representing disposable income in the chart below.

In the past 10 years, housing and related sectors grew to represent an outsize portion of the economy, accounting for 16.8% of GDP in 2005, according to Capital Economics. That fell to 13% in the second quarter of this year, the lowest share since 1982.

“The whole U.S. economy in this last decade was built on housing and the services that come with it: mortgages, moving, furniture,” says Steve Blitz, director and senior economist at ITG Investment Research in New York.

Our HELOC economy has collapsed.

That is evident in such boom-to-bust markets as Hagerstown. Like Mr. Bradley, many now-unemployed workers in the city, which lies 75 miles from Washington, D.C., had a direct or indirect connection to housing. Some worked in the construction jobs supported by the surge in development; others worked in nearby distribution centers for retailers such as PetSmart and Staples, where new homeowners shopped. Some created small businesses catering to new residents, often tapping into home equity to do so.

Does anyone else think this is a bad idea? Is it wise to risk the family home on a business start up?

But then the housing bust arrived. The number of building permits for new construction in Hagerstown fell nearly 75% between 2006 and 2010, from 212 to 55, according to Sage Policy Group Inc., a Maryland economic-consulting firm. In July, the median price of a home in Washington County was $130,450, down nearly 45% from its $235,000 peak reached in June 2007.

Unemployment in the city has been particularly stubborn, climbing to 11.3% in June from 10.7% a year earlier. The national rate fell from 10.5% to 9.8% over the same period.

During the boom years, Hagerstown ranked among the highest for positive mortgage equity withdrawal—meaning people pulling cash out of their houses. Now, it ranks among the most negative, meaning families are defaulting or paying down debt, according to Moody's Analytics.

Hagerstown was taken over by Ponzis. The few who didn't participate get to pay the price in government bailouts and lowered property values.

On a recent afternoon, amid vacant storefronts and “for rent” signs, Karla Auch stood before her downtown gift shop, the Rainbow Connection, opened six years ago with a home-equity loan. “Going out of business,” announces a sign on the front.

“A lot of new businesses came in with all the people. We tried. It never really boomed,” Ms. Auch says.

People such as Charles Wible, a lifelong Hagerstown resident who left school in the 11th grade, see an uncertain future ahead. Mr. Wible, 39 years old, installs garage doors and says he had a nice life during the housing boom.

“Ten years ago, I was making $60,000 a year and working half as hard as I am now,” he says. “Now I'm making $25,000 a year and scrounging for work.“

Everyone who depended on real estate is facing this problem. How many realtors are complaining about the same issue?

The loss of jobs and businesses has led to high foreclosure rates across the U.S.; according to the National Association of Realtors, 31% of transactions in August were distressed sales. Credit, meanwhile, is tight, and banks are loath to lend in areas like Hagerstown, with home prices still falling.

Hagerstown resident Machiel van de Geer says he and his neighbors take turns mowing the lawn of foreclosed properties.

There is no obvious fix to the city's economic quandary—or the country's. “The only solution here is jobs,” says Anirban Basu, chairman and chief executive of Sage Policy Group and an expert on Maryland's economy. “In the absence of a resurgence of employment, a recovery in Hagerstown's housing market is impossible.”

But where the jobs will come from remains elusive. Mr. Bradley, for example, switched industries and found work as a shift supervisor at the Hard Times Café, a local restaurant. But every day brings a slew of people just like him to the restaurant looking for work, he says.

“We've got to invest in software, technology, manufacturing,” says Mr. Blitz, the ITG economist. “It's these industries that will create more jobs and income. We are transitioning from an economy built around the leverage on housing and finance to an economy built on real goods.”

The economy won't recover until some sector other than real estate creates new jobs. Once some other sector creates jobs, new households will form which will in turn create demand for real estate. With fresh demand for real estate, housing employment will start to recover, and the demand will snowball from there. The catalyst will not be housing. It must start in another sector of the economy.

The economy won't recover until some sector other than real estate creates new jobs. Once some other sector creates jobs, new households will form which will in turn create demand for real estate. With fresh demand for real estate, housing employment will start to recover, and the demand will snowball from there. The catalyst will not be housing. It must start in another sector of the economy.

Here, officials point to a business-technology park under construction. It would link Hagerstown Community College with the city's new hospital, in hopes of spurring jobs in biotechnology, health sciences and information technology.

For some it will come too late. Mr. Wible says he didn't expect a turnaround in his lifetime, so he's banking on his four sons.

“They are not building houses like they used to,” he says. “So I try to instill in my boys to stay in school. I don't want my boys out there fighting for work like I have to.”

—Nick Timiraos contributed to this article.

That is capitulation.

HELOC Abuse and Pascal's Wager

During the housing bubble, I can remember having conversations with kool aid intoxicated fools concerning house prices and mortgage debt. They would tell me house prices only go up, so it doesn't matter how much you borrow because the house will always pay for it. When the debt became expensive, you could serial refinance into one teaser rate Option ARM after another.

When I suggested that lenders may not always offer these teaser rates and that cheaper and cheaper credit might not always be made available, most scoffed at me as a fool who didn't understand California real estate finance. When i asked people to tell me what would happen if house prices did not go up, or if interest rates went up, or if credit became tight, they would look at me with a blank stare or tell me I worried about stuff that would never happen.

Whenever I had these conversations, I was always reminded of Pascal's Wager. Pascal's Wager is an idea from philosophy first postulated by Blaise Pascal. He believed a rational person should wager as though God exists, because living life accordingly has everything to gain, and nothing to lose. So it is with HELOC debt.

I was always under the belief system that one should not wager the family home on the necessity for prices to always increase and cheap debt to always be made available. Many California loan owners wagered their family homes for a little spending money… well, actually a lot of spending money. But no matter what benefit people thought they would obtain from borrowing irresponsibly, they should never have wagered their family homes on it. They did make this wager, and they all lost. Given the stupidity of that mistake, it's hard to feel too sorry for them.

Keeping up appearances

Many people fell victim to HELOC abuse due to their own frailties of ego. Far too many were trying to keep up with the Joneses while the Joneses were juicing on a HELOC high. I have no idea what motivated the owners of today's featured property to spend their home, but they bought before the bubble began to inflate, and they are now a short sale. They wouldn't have this problem if they wouldn't have tripled their mortgage debt.

- Today's featured property was purchased on 6/8/2000 for $260,000. The owners used a $208,000 first mortgage and a $52,000 down payment.

- On 3/17/2003 they obtained a $100,000 HELOC.

- On 7/25/2003 they enlarged the HELOC to $133,000.

- On 8/27/2004 they opened a $250,000 HELOC.

- On 12/12/2005 they refinanced with a $434,000 first mortgage.

- On 4/4/2006 they obtained a $200,000 HELOC.

- On 5/9/2008 they got a $300,000 HELOC.

- On 5/14/2009 they got another loan for $150,000.

- On 8/25/2011 they got one last loan for $108,000.

- Total property debt is $734,000 based on the $434,000 first and the $300,0000 HELOC.

- Total mortgage equity withdrawal is $526,000.

These borrowers withdrew more money in HELOCs and refinances than the house is currently worth!

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 36 ALCOBA Irvine, CA 92614

Resale House Price …… $449,000

Beds: 3

Baths: 2

Sq. Ft.: 1610

$279/SF

Property Type: Residential, Single Family

Style: Two Level, Modern

Year Built: 1989

Community: Westpark

County: Orange

MLS#: P798921

Source: SoCalMLS

Status: Active

On Redfin: 2 days

——————————————————————————

A great opportunity to own in the heart of Irvine. This nice home is located in a quiet community. Open floor plan with a bright and airy high-vaulted ceiling. This home features 3 spacious bedrooms and 2.5 baths. 2 car direct access garage w/ lots of space for storage. Wood floors all throughout the house. Nice sized backyard, good for relaxation. Homeowner's Association includes pool and spa. Convenient location. Award-winning schools: Culverdale, Westpark, SoLake Middle School and University High.

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis ![]()

Resale Home Price …… $449,000

House Purchase Price … $260,000

House Purchase Date …. 6/8/2000

Net Gain (Loss) ………. $162,060

Percent Change ………. 62.3%

Annual Appreciation … 4.8%

Cost of Home Ownership

————————————————-

$449,000 ………. Asking Price

$15,715 ………. 3.5% Down FHA Financing

4.03% …………… Mortgage Interest Rate

$433,285 ………. 30-Year Mortgage

$131,575 ………. Income Requirement

$2,076 ………. Monthly Mortgage Payment

$389 ………. Property Tax (@1.04%)

$50 ………. Special Taxes and Levies (Mello Roos)

$94 ………. Homeowners Insurance (@ 0.25%)

$498 ………. Private Mortgage Insurance

$292 ………. Homeowners Association Fees

============================================

$3,399 ………. Monthly Cash Outlays.jpg)

-$323 ………. Tax Savings (% of Interest and Property Tax)

-$621 ………. Equity Hidden in Payment (Amortization)

$22 ………. Lost Income to Down Payment (net of taxes)

$76 ………. Maintenance and Replacement Reserves

============================================

$2,554 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,490 ………. Furnishing and Move In @1%

$4,490 ………. Closing Costs @1%

$4,333 ………… Interest Points @1% of Loan

$15,715 ………. Down Payment

============================================

$29,028 ………. Total Cash Costs

$39,100 ………… Emergency Cash Reserves

============================================

$68,128 ………. Total Savings Needed

——————————————————————————————————————————————————-

Shevy Akason and Larry Roberts will host a short sale and REO workshop at 6:30 PM Wednesday, October 19, 2011, at the offices of Intercap Lending (9401 Jeronimo, Suite 200, Irvine, CA 92618). Register by clicking here or email us a sales@idealhomebrokers.com.

.png)

You relate Once some other sector creates jobs, new households will form which will in turn create demand for real estate. With fresh demand for real estate, housing employment will start to recover, and the demand will snowball from there. The catalyst will not be housing. It must start in another sector of the economy.

This is true.

Unfortunately, the economic, investment, and political tectonic plates have shifted the world into Kondratieff Winter. The world has moved out of the Milton Friedman Free To Choose Regime of Neoliberalism and into the Beast Regime of Neoauthoritarianism.

Freedom, Choice, Free Trade, Prosperity, belonged to the Age of Leverage. Now Diktat, Structural Reforms, Austerity Measures, Protectionism, and Debt Servitude are de rigueur in the Age of Deleveraging.

Mike Mish Shedlock writes Protectionism Cannot Bring Prosperity where makes the point that exported jobs will never return; and tariffs will destroy existing jobs.

I relate that the seigniorage of credit and basic materials such as coal, iron, and copper has failed. The seigniorage of diktat is commencing.

You have often reported on HELOC abusers, that is borrowers who withdrew more money in HELOCs and refinances than the house is currently worth.

I ask where did that money go, into trips to Las Vegas, investment property in Reno, cosmetic surgery like boob jobs? Did some of it make it into buying and holding gold coins?

I relate that In 1974, the 300 hundred of the world’s elite met as the Club of Rome, and presented regional economic government as the solution for the chaos that would come from deleveraging and disinvesting that comes with the failure of Mr Friedman’s Free to Choose dream. Their Clarion Call, has been heard by globalists such as Angela Merkel and Nicolas Sarkozy, who in their August 2011 Communique, called for a true European economic government.

Sovereign armageddon, that is a credit collapse and global financial breakdown, will come out of Gotterdammerung, the clash of the gods, that is the European leaders and the investors together with the rating agencies. This will result in the loss of national debt sovereignty, and extinguishment of state fiscal spending capability.

Sovereign crisis requires a sovereign solution. One Leader, the Sovereign, and his banker, the Seignior, will arise to speak for and to the Eurozone, which will be transformed into a Federal Europe, as leaders meet in summits and wiave national sovereignty, and implement a Fiscal Union, empower the ECB as a bank, and develop a common European Treasury. Seigniorage, that is moneyness, will no longer be based upon debt, but rather will be based upon the diktat of structural reforms, austerity measures and debt servitude; people will be amazed by this, and place their faith in it, and give it their full allegiance.

tl;dr

schizo drivel

How did they take out the last two loans in 2009 and 2011?

I don’t know. The property records source I use didn’t specify what kind of loans these were.

This post and comment above are so outstanding one can find much to think about almost sentence to sentence. May I suggest two California-centric bubbles that are “the big picture” above housing? If jobs are the issue, then the present dot com bubble phase…what, three?…repeating due to facebook/google/instant wealth, that’s still bubbling furiously. Without that, LA and San Francisco are going to fall on REALLY hard times. The second bubble is the US deficit spending and trade deficit almost beyond all human credibility: crank those down, the whole world but especially California will plummet in two waves, the first direct, the second as an echo of collapse of the overseas bubble empires built exactly on the continuation of US bubbles.

Now, the real estate bubble is clear; but somehow people have stopped as much pointing out the disaster several bubbles that are not being addressed or managed in the least, that threaten California. The third echo of that collapse, will be huge loss of tax income to the state, when the jobs get cut, and the dollar isn’t worth much,the newest dot com bubble collapses fake stock gains, and cheap foreign goods can’t be bought any more, how’s another ten or twenty billion lost to the state budget going to work out there?

Doesn’t anyone think it’s fishy that they were able to take out a HELOC while the financial crisis was about to implode, two loans after the crisis.

Furthermore, the last loan was in Aug. 2011, just two months before the short sale.

My guess is that these people know exactly what they’re doing, i.e. scamming the system. The short sale is probably just smoke and mirror that they’re in financial difficulty and trying to sell, but probably they will eventually strategically default and let the house foreclose.

This is a good case to follow up!

Yes, very very fishy. Brother-in-law probably works in a bank or something.

I’m getting sick and tired of these games in real estate. Like the homes that hit the MLS already “Contingent”, realtors underpricing their listings and then saying “Umm, no, you actually can’t get it at this price”, etc, etc, etc.

Any discussion of Redfin pulling its short-lived feature showing sales history for agents/brokers?

http://www.propertyportalwatch.com/2011/10/redfin-pulls-controversial-agent-scouting/

To me this was one of the best features for potential buyers. It is a shame that because it may not tell the whole story about an agent’s work that it had to be pulled completely. Just shows you how powerful the real estate brokerage lobby is still.

Always make sure you get at least 3 references from any broker you use from folks who have used them in the last year for a closed sale. Ask those references what disappointed them the most about the agent and you will likely get an earful.

That’s a shame. It was a nice feature. I did notice it made listing agents look better as their stats were higher for some reason. Unfortunately, the MLS doesn’t keep accurate enough records for this service to be useful.

IR:

1) The caption text in your HELOC.jpg image is not clear to me. There’s 4 bars but 3 descriptions.

2) Something you can add to the “this couple owns their home” image is this: a quote from some of the homeowners who went to their bank to make the final payment, and being told by the bank, “We don’t know how to close your mortgage file. Nobody’s every done finished paying their mortgage here.”

I think you need to look at the sideways text labels on the far right. The tall bar with no description on the top represents the skewing of one’s budget when you have a massive influx of the HELOC. I guess that’s the amount of disposable income many grew accustomed to…

> Is it wise to risk the family home on a business start up?

Normally, in 99% of business plans, no.

But if you are the heart of an existing profitable company and ownership falls in your lap, then it can pay off.

I’ve met some office equipment suppliers and electronic advertisers who had 20 years of industry experience, and were able to capitalize and step into ownership roles with virtually no business risk.

In other words, they had an extreme unfair advantage compared to most slobs.

(Of course, a heart attack or divorce can still derail even a sure thing.)

The last two “unknown” loans for $150,000.00 on 05/14/2009 and $108,000.00 on 08/25/2011 were HELOCs provided by the same bank that provided the $300,000.00 HELOC on 05/09/2008 (Wilshire State Bank)

All three of these loans have the same exact paperwork and Riders to Deed of Trust, the only difference being the amounts, dates and the notaries used.