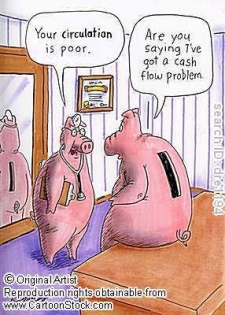

Many people speculated on appreciation in the housing bubble without considering the possibility that real estate does not always go up. Now they are stuck with a black hole on their family's balance sheet. What should they do?

Irvine Home Address … 43 BOWER TREE Irvine, CA 92603

Resale Home Price …… $369,000

Everybody's bitching

'cause they can't get enough

And it's hard to hold on

When there's no one to lean on

Bon Jovi — Keep the Faith

Real estate investors during the housing bubble put their money to work on faith. There is no logical reason to believe house prices only go up. In fact, there have been two prior periods in California's recent history where house prices did, in fact, go down. However, with kool aid intoxication, otherwise known as faith-based investing, reality is ignored.

If you truly believe house prices only go up, no price is too high, and you don't have to worry about a backup plan if house prices don't go up. There is only one viable backup plan when a speculative play on appreciation does not pan out: renting the property until you get out at breakeven.

For some people, this was as far as they took their analysis. A glib idea of renting it out gave them all the assurance they needed to pull the trigger on a foolish deal. If they had stopped to do the math, they would have quickly realized rents would only cover a portion of their monthly cost of ownership. A wise person would have recognized this risk and passed on the speculative bet. Investors during the housing bubble were not very wise.

I have read many accounts where everyone claims a collective ignorance. “Nobody could have seen the crash coming” or some other such nonsense. Any investor who bothered to consider their plan B would have quickly realized the risk of an extended period of negative cashflow was an unacceptable risk. Prices didn't have to crash to make this risk a pocketbook-burning reality. Even a flattening of prices for an extended period would have been a problem.

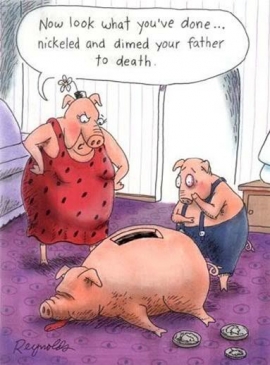

The people who ignored this risk and bought properties are now bagholders. They own property consuming their income and providing no benefit to them whatsoever. Many still cling to their denial and hope for rapid appreciation to bail them out, but many others capitulate to the market and sell. As they sell they keep prices from rising and discourage others. One by one, each market participant moves from denial to acceptance and capitulates by selling at a loss.

When to cry ‘uncle’ on an investment property

August 16th, 2011, 6:00 am — posted by Marilyn Kalfus, real estate reporter

Christine Donovan, a Realtor and attorney who does the weekly “Huntington Beach real estate minute” on listings, homes in escrow and sales, offers some advice in her blog about when to unload real estate bought as an investment that’s failed to pay off.

She writes:

“Have you been watching the value of your investment property go down and wondering what you should do about it?

“It likely depends on what your goals are. If you have lost value, are living in the home, can afford the payments, and it meets your needs, you’re one of the lucky ones, and you should probably just stay where you are. Perhaps when you’re ready for your next home, your home will have regained some of the lost value.

Or perhaps you are just a fool in denial.

“If on the other hand, your investment property is underperforming, perhaps you need to look at it carefully. For instance, let’s look at the following scenario.

“You have equity in your home …

- But, it’s $250,000 less than it was in 2006.

- You put money down on the home, and you’ve made payments for several years.

- You feel that selling it would result in a loss.

- It’s a rental, and you’re losing $600/month after your mortgage payment.

This is the folly of negative cashflow investment. Nobody should ever be in this circumstance. Nobody who follows my advice ever will be. I advise owner occupants not to pay more than rental parity for the same reason. Negative cashflow is a black hole on your balance sheet sucking the money out of your family never to be returned.

“At this point in time, you may want to do a few things:

Actually, you only need to do one thing: sell. Any rationalization you come up with is foolish denial.

- Review rental rates and see if you can increase rates to limit the loss or make the property cashflow

- Sit down with your accountant and see if you need the loss for income purposes.

- If you don’t need the loss and still can’t make it cashflow, it might be time to consider selling the property and reinvesting in a better performing one.

- Some people don’t want to “give up” and think that holding it might make more sense.

- But, if you’re losing $7,200 per year, you need to gain that amount in equity plus the amount that you lost when the market values fell, especially if you bought it for less than current market value.

I doubt many investors can review the rental comps and find they are under the market by $600 a month or more. Nice idea, but not very practical.

This woman claims to be a financial advisor, yet she perpetuates the myth that anyone should take a loss for tax reasons. Perhaps tax implications may favor taking the loss this year or next, but waiting several months or years will usually make for larger losses as the negative cashflow eats you up.

The people who doesn't want to “give up” are the ones still in denial. Holding a negatively cashflowing investment never makes sense. Her final point is a good one. For an negative-cashflow investment to make sense, the appreciation must compensate for the negative cashflow. If you examined such an investment's internal rate of return, it would be horrendous because the ongoing negative cashflow compounds against you. It isn't just the lost money, it is the lost opportunity cost on the lost money that really hurts.

“So, when is it time to cry “uncle” on your home? When the loss on your investment property just doesn’t make sense any more.

Anyone in a negative cashflow investment should dump it as soon as possible. It was a bad idea when it was purchased, and holding it makes it even worse.

Follow Huntington Homes and other real estate stories on Twitter @mkalfus

This is really about investor psychology. Many, many speculators in Orange County are sitting on negatively cashflowing investments waiting for the magic appreciation fairies to wave a wand and make them whole again. It isn't going to happen.

So how do you recognize capitulation when you see it? From the comments on the OC Register post:

InTheSameboat says:

Sounds like the situation my wife and I are in. Bought a condo in 2006 at the price peak (sigh). Lived in it for 2.5 years then started renting it out while renting out a bigger place for ourselves and new baby hey not so bad right? 2.5 years later and the loan modification (discount) expired when you add up the taxes, insurance, hoa. It looses 400 a month. $800 a year for the corporation to lease it under of course. Pay for those taxes filed separely of course. Like a lot of young couples on the move fast and making decisions fast we never really factored in all the costs to rent it out in a professional manner. Now with a second child on the way its more like good grief as long as we have a mortgage on this condo we don’t live in and loose so much money on we will never be able to buy a home for 25 years unless we drop it.

So we cried uncle, after 6 months of thinking about it and stubbornly thinking “just keep it” we just couldn’t shake the feeling that rents are going to go up, but only a little bit. The value will go up, but only a little bit. You can call it a recession, and recession part 2 but I think this is the new norm. The painfull and humbling decision was made to short sell it.

With noteable employers leaving the state its going to slow down the recovery and price increases we all prayed for the last few years. Jobs came back and values went up… just not around here. Accepting this reality strenghtened this decision and suppresed the remorse feeling.

I would like to know more about this (if you lived in it 2 years of the past 5 you won’t have to pay capital gain taxes) Our CPA told us otherwise, he said we would have to move back in for 6 months and then sell it to avoid the heavy taxes. Other than that we’ll just have to eat it.

That is capitulation.

The games listing agents play

Three days ago, this property was for sale for $769,000. Today it is being offered for $369,000. So what's up with that?

So what is the real asking price? Who knows.

The buyers paid $590,000 a few weeks ago. It looks like they are hoping to flip it. Since they were the most aggressive bidders in the market, it doesn't seem likely this marketing ploy to create a bidding war to get someone to pay more is going to materialize.

The listing agents are hoping that a hoard of clueless FCBs will bid the price up well beyond what was just paid so everyone can make a quick buck. If there is an auction, you can be sure most of the bidders are shills used to create a false sense of competition. If people are that stupid, more power to these guys. Personally, I find this kind of cheesy, shill-dominated, fake auction a form of real estate sales on par with used car salesmen. Their listings pollute the MLS.

The initial asking price was WTF crazy, and now the price reduction is equally stupid. It probably triggered many searches and ended up in the email inboxes of many market watchers. Perhaps some of them will show up to the auction to see if they can be duped.

If you attend, see if you can pick out the shills and the patsies. And remember, if you can't identify the patsy, it is probably you.

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 43 BOWER TREE Irvine, CA 92603

Resale House Price …… $769,000

Beds: 3

Baths: 2

Sq. Ft.: 1500

$513/SF

Property Type: Residential, Single Family

Style: Two Level, Other

Year Built: 2003

Community: Turtle Ridge

County: Orange

MLS#: P792545

Source: SoCalMLS

Status: Active

On Redfin: 1 day

——————————————————————————

THIS BEAUTIFUL HOME IS WELL LAID OUT AND VERY SPACIOUS IN THE PRESTIGOUS TURTLE RIDGE COMMUNITY. .. .THIS IS A MUST SEE HOME. .. OFFER FORMS WILL BE ON SITE AND WILL BE ACCEPTED ONE DAY ONLY. .. THIS SATURDAY, AUGUST 20TH!! FROM 11AM-4PM. .. RAIN OR SHINE. .. HOME WILL BE SOLD TO THE BEST BUYER/OFFER WHO PLACES A BID/OFFER ON THAT DAY ONLY. .. THE LIST PRICE IS THE RESERVE OR MINIMUM BID SUBJECT TO THE SELLERS ACCEPTANCE. PLEASE CALL YOUR AGENT IF YOU HAVE ANY QUESTIONS. AUCTION SALE . .. NOT A SHORT SALE, REO OR DISTRESSED PROPERTY.

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis![]()

PRESTIGOUS? NOT A SHORT SALE, REO OR DISTRESSED PROPERTY… just a delusional seller.

Resale Home Price …… $769,000

House Purchase Price … $590,000

House Purchase Date …. 8/8/2011

Net Gain (Loss) ………. $132,860

Percent Change ………. 22.5%

Annual Appreciation … 364.1%

Cost of Home Ownership

————————————————-

$769,000 ………. Asking Price

$153,800 ………. 20% Down Conventional

4.19% …………… Mortgage Interest Rate

$615,200 ………. 30-Year Mortgage

$164,923 ………. Income Requirement

$3,005 ………. Monthly Mortgage Payment

$666 ………. Property Tax (@1.04%)

$250 ………. Special Taxes and Levies (Mello Roos)

$160 ………. Homeowners Insurance (@ 0.25%)

$0 ………. Private Mortgage Insurance

$179 ………. Homeowners Association Fees

============================================

$4,261 ………. Monthly Cash Outlays

-$704 ………. Tax Savings (% of Interest and Property Tax)

-$857 ………. Equity Hidden in Payment (Amortization)

$230 ………. Lost Income to Down Payment (net of taxes)

$116 ………. Maintenance and Replacement Reserves

============================================

$3,046 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$7,690 ………. Furnishing and Move In @1%

$7,690 ………. Closing Costs @1%

$6,152 ………… Interest Points @1% of Loan

$153,800 ………. Down Payment

============================================

$175,332 ………. Total Cash Costs

$46,600 ………… Emergency Cash Reserves

============================================

$221,932 ………. Total Savings Needed

——————————————————————————————————————————————————-

When plan-A is so attractive, and you had seen the gains of the past 4-5 years (in 2004/5), why do you even think of plan-B? It was so easy, and there was so much money. When thinking about why people don’t think about plan-B, you have to really think about the attractiveness of plan-A. There has to be a heloc-fueled empire story somewhere to capture the psyche of the bubble.

How many bubble-era investors are still holding on to negative cashflow properties? They were the first to bail, or they rented it and pocketed the rent w/o paying the mortgage. The family with the condo were accidental landlords and didn’t completely view their home as an investment.

The perceived investment value of homes greatly skewed what people were willing to pay. There is no reason to pay appreciable more than rent apart that.

History of the listing agents on Bower Tree

Seller’s cancelled their listings on

1) 41 Bamboo, Original $690,000 dropped to $400,000, then raised to $580,000, The seller cancelled the listing after 9 days

2) 1 Fortuna originally listed for $850,000, lowered to $495,000, raised to $900,000 before the seller cancelled the listing after 5 days.

3) 53 Arborside, Original list $1,099,000, lowered to $900,000, raised to $1,200,000 before the seller cancelled the listing after 6 days.

4) 26 Iron Bark, Original list price $500,000, lowered to $250,000, raised to $500,000 before the seller cancelled the listing after 6 days.

Sold

1) 40 Meadograss oringal asking price $650,000, this is the price that the comps normally indicate and that the seller really wants for the property, they then dropped it to $345,000 before selling it for $560,000. Using this strategy is telegraphing that a seller is desperate to sell, what’s frustrating for buyers on these deals is that I would estimate that 50% of those that list with this group can’t sell their property for market value because they are underwater and less than 50% of their listing in Irvine sell. Moreover, many buyers that are new to the market looking at price points much less than what the seller would even consider get drawn to spending/wasting time on these. That said, if one is already looking in the neighborhoods these listings come up in this strategy plays in a buyers favor given the property is only shown for 1 day and they should know within a week if the seller is going to sell it to them or not.

2) 9 Laurelwood, Original $1,100,000 dropped to $495,000 sold for $935,000

3) 32 Vienne, Original $950,000, dropped to $495,000, sold for $965,000

Active

43 Bower Tree

26 Iron Bark

Hold

55 Valley Terrace

The listing agent is affiliated with Real Estate Xperts Inc. who, according to their website, specialize in the “One Day Home Selling System”. Is it shady? Their promises to have “hundreds of people show up” and “multiple offers” seem a stretch. Check out their website for more info

http://theonedayhomesale.com/thesystem.html

Yeah… I am familiar with REX, even bid on their Northwood Pointe “auction” to test the process (32 Vienne).

They usually drop the listing price prior to the single day viewing (they don’t even let realtors preview the property prior) and then the next day they delist it.

After talking to them, they say it’s usually done for clients who don’t want their home on the market for an extended period of time with buyers walking in and out.

The next day, they call back everyone who bid and tell them what the highest bid was and give them a chance to beat it. Not sure how legit it is, but considering that 32 Vienne did indeed sell for above the highest bid they had told me ($950k), I guess it works for some properties.

They had one just this last Sunday in Turtle Ridge (55 Valley Ridge), listed at $1.7m then dropped to $849k. I didn’t have a chance to go but I was curious to see what kind of buyers showed up.

The problem is the bids are not prequaled so the highest bidders may not even be able to close. I think it is also used by people who want to test the market on their home value. They only have to open their house one day, and if bids aren’t high enough, they just cancel.

Actually 32 Vienne was the Westpark II home, the Northwood Pointe one was 9 Laurelwood which closed for $935k, above the high bid of $900k.

IHO, excellent explanation of the process. The next step after they receive the one page bid sheet is for them to call the agents or if the buyer does not list an agent the buyer and ask them to submit a full offer package using a traditional contract.

At this step, they give the agent or buyer the number of their highest one page bid price (not sure if it’s always accurate) and tell them if they want to submit an offer at or above that price they can. Many times the highest bidders then back out (if they really offered in the first place) so I find it’s better to ignore the verbal price they give and stick to your guns.

At that point the buyer would submit a full offer package, pre-approval, proof of funds, full offer contract.

For seller’s that want to sell their home with the least amount of hassle and either don’t really care if they sell and will only sell if a certain number is reached and/or don’t mind risking potentially ten’s of thousands of dollars compared to market value, I can see where some version of this strategy might make sense. I don’t think it needs to be this extreme. There were a couple of recent sales in the Newport Heights area, one on Pirate and another one nearby that used a similar strategy without being so crazy far below market and many short sales feature a list price that is nowhere near what the property will sell for with limited or sometimes no showings, thus to some degree are similar.

This seems like a god awful way to buy a house. Like was said, read the fine print…the seller always has an out if they don’t get their price.

I personally wouldn’t waste my time or effort regarding bullshit like this.

I agree, that said in today’s market, if one wants a good deal, it normally takes a number of offers, willingness to walk away, one has to find a motivated seller and overall, it can be a long process. I have advised many buyers not to waste their time on these deals, that said, buyers that get the best deals often focus on on a few key areas and get to know a market really well, buyers should not ignore these purely on the basis of the gimmick, if they have narrowed their focus and know and like the tract and floor plan they will want to consider the property.

If a buyer is attracted purely by the gimmick price, they shoud not waste their time. I will include the CMA for the home on 40 Meadowood below. Given the market value at the time of the sale, I believe that the buyer probably felt like they got a nice deal and was glad that they pursued it, from the sellers perspective I would probably look at this with some regret.

“AUCTION SALE . .. NOT A SHORT SALE, REO OR DISTRESSED PROPERTY.”

I wonder if they have an auctioneer’s license…I wonder what OCNar would do if these clowns were cited for conducting an illegal auction?

My bad, apparently CA does not require an auctioneer’s license, even for real estate…

Hi Chrissy;

I’ve done some research on them because every time they list I get dozens of calls. For first time buyers or those new to the market buying a home is emotional enough, these listings waste a lot of people’s time.

Their listings get attention; however, I don’t think that the attention this strategy draws helps the seller to sell for more money. Imagine that your budget is $600,000 and you see a $1,000,000 Turtle Ridge home come up. Of course you will be interested, but desire is not demand. Crazy that OCAR can go after Larry (and me) regarding “ethics” yet these guys are allowed to waste hundreds of hours of people’s times and turn the MLS into a joke.

We’ve submitted offers on their listings, in one case they had it listed at circa 500k, the market value was circa $1,000,000 we offered somewhere in the low 900’s and they told us that unless we were going to submit at over $1,000,000, the seller would not consider the offer, they sold it for less than $1,000,000. However, it’s a huge turn off to buyers when these games are played and I’m confident in most instances their sellers get less as a result of well qualified buyers not wanting to participate in the charade or not being available to see the property during their one day open. It seems wrong to list a property at 500k and if you are not willing consider offers at $900k+ and only furthers agents poor reputations.

I had a recent experience that they told me that they had offers over 100k above ours only to call us back the next day when we said we were not budging and ask us if we were still interested at our original offer price.

They may be able to get hundreds of people to show up, particularly before people knew that their listing prices aren’t for real and more often than not the property won’t even sell. However, as Larry has said many times, desire is not demand. If I had a million dollar property I don’t think I would want hundreds of people walking through my house if their budget is $600,000, which is what this strategy does. Moreover, the chances of the best buyer for the property wanting to play this game or being available the one day that they show it is less than if they did not play this game.

It’s a gimmick to get listings and as long as people list with them they will continue.

I agree it’s gimmicky but I do think that for areas like Irvine with a lower amount of “quality” inventory (which we’ve talked about in the past), it could work if the home in question is a “sought after” property.

What I don’t like is the listing description makes it sound like the home will be sold to the highest bidder as long as it’s over the “reserve” price. But they have that out… “SUBJECT TO SELLER’S ACCEPTANCE”.

That being said, this process seems to favor sellers more than buyers because if they don’t get the price they want, they just either relist traditionally or just list later.

Have most of their closes been near comp prices?

CMA- Woodbridge, outside the loop

search ran

3 bedrooms, 2-3 baths,

square footage 1400- 1700

sales from 2/1/2010- 1/1/2011

A glitch in the MLS sometimes causes older comps to populate and I just caught it, please ignore 9 Pebblepath which sold 5/13/2009, I did not have a chance to remove it.

40 Madowgrass is the first sale on this list,

[IMG]http://i52.tinypic.com/1fxpo8.jpg[/IMG]

This should be easier to read

[IMG]http://i56.tinypic.com/m6grk.jpg[/IMG]

Thanks for the data Shevy.

It’s hard to tell how well these comp up just by the listing photos (17 Caraway only has one external picture). I only looked at the 1-story comps but it seems like 40 Meadowood was the most “classic” (AKA not that updated).

Of the two that I followed (32 Vienne and 9 Laurelwood), those seemed to be within comps so uh… 2 out of 3 isn’t bad right? 😉

Maybe this “auction” process doesn’t work too well on older less desireable homes.

IHO, I know you are familiar with Woodbridge so that’s why I picked this one. There is no perfect comp, however, in my opinion; the seller would have got more money if they would not have sold it in this manner, however, it’s by no means an investor that is looking to flip or trustee sale price either. Regardless, $30,000+ is a lot of money and I believe that most would wait in extra 60 days or so for the chance at an extra $30,000+.

I have not had time to analyze any other of their listings in detail recently, however, based upon the ones I’ve seen and the ones that I’ve had buyers offer on, the buyer psychology that this creates, the lack of showing availability, and the good buyers that choose to pass as a result of the way they run the process, I believe that it works against most sellers that do not have a minimum walk away and relist price set and if the real goal is to sell for market value (or close to) with less hassle I do not believe that it accomplishes this for most. Based upon their Irvine listings 3/8 sold and one of those was likely for below the market value at the time.

Regarding 32 Vienne and 9 Laurelwood, I agree that this works better when it’s a seller’s market and in high demand areas. I would want to do a more thorough analysis to determine what those sellers should have gotten based upon the market comps.

That said; there is value to getting as much exposure as possible, pricing a property properly, when leverage is created by multiple offer situations, and when there is true demand. I just don’t think that this accomplishes most of these well, to the detriment of the sellers.

When is the auction?

Would love to see this farce in person!

Tomorrow from 11:00 to 4:00. I don’t know if they have an actual auction of if they just have an open house to submit bids. I think its the latter.

It’s the latter.

They give you a form to fill out your information, bid, loan specifics (down payment, financing etc) and agent information.

Then as Shevy and I stated earlier, they’ll call everyone who “bid” back to give them the opportunity to beat the highest “bid”.

As with many Open Houses, this is also probably an opportunity to get more clients.

Yes, the latter, one page bid sheet and then a call back with the highest bid and a request to see who will submit a standard offer package.

“One by one, each market participant moves from denial to acceptance and capitulates by selling at a loss.”

I came across a prime example on a discussion board just this morning:

“I am going through this right now. My husband got laid off, and we moved to another state for a job for him. I found renters, and altho they paid the rent, they did some damage that had to be fixed before we could show the house.

We have the house priced at what we owe on it, plus the realtors fee. We have had 26 showings, and not one offer, not even a low ball offer.

In the meantime, we paid people to mow the lawn and clean the house. My daughter stopped by the house the other day and those people were in the house partying and smoking. I’m terrified someone will have a party there, and I will be liable for the damage.

I’m now in the process of doing a short sale. I cant help it that the market has changed the value of my house, and I don’t want the house to get destroyed sitting there vacant.

I could have stopped paying the house when my renters left, rented it to someone else, and made money on the deal. It would take 2 years to foreclose in my state.

I didnt do that- I tried to do the right thing. Now I want the bank to agree to lower the price so I can sell it to somebody who will appreciate it and love it the way that I did.

I will never buy a home again.”

Attitudes are changing, although I definitely think that’s dependant on location. I believe the above poster is in Florida.

Most people I’ve talked to in California, especially in OC, are still waiting for the magical market turn around to save them… and they know will be coming any day now.

Axiom,

Hi heard from people from TX that were quick to unload upon moving to CA. The risk of squatters and hotel guests on drug runs and illegal border crossings were too much for them. They were relo, so the company paid the closing. If the company will pay the appraised vakye, I would and did take it.

There are 3 forms of cash flow in real estate investing, each with its own risk profile:

1) Operating cash flow

2) Tax benefits

3) Capital gains on sale

Operating cash flow is great! What could be better than cash in hand to meet expenses and line your bank account as an investor? But there is risk! Unexpected maintenance, tenants destroying your property or not paying, and general vacancy.

Tax benefits only work if you have other income sources to reduce with the tax advantages that real estate affords. And with governments running the deficits they are, you can count on tax laws change…not in your favor as an investor!

And finally, the magical capital gain…this is the realm of the novice, the gambler, and the REALLY astute investor! Banking on value appreciation, alone, is a little different than rolling the dice in Vegas. It can certainly pay off, feels like you’re on drugs when you’re right, but the time will come for 99% of us out there where we will be burned!