The UCLA Anderson Forecast predicts housing demand will be weak until at least 2013, and as a result, the economy will continue to languish.

Irvine Home Address … 39 SMOKESTONE #36 Irvine, CA 92614

Resale Home Price …… $280,000

Today you're laughing, pretty baby,

tomorrow you could be crying

They say every dog has its day

The good dogs win and the bad fade away

Peter Green — It Takes Time

When I first started writing about the housing bust back in 2006 and 2007, I believed that prices would bottom in 2011. When the government embarked on its campaign of market intervention, they managed to engineer a two-year bear rally which has finally run it's course. What they managed to accomplish — other than shifting much of the losses from lenders to the US taxpayer — is to delay the bottom by two years. I wish my crystal ball were accurate enough to say exactly when, but now others are starting to accept the idea that we won't see a sustained recovery until 2013.

California to suffer housing shift, UCLA forecasters say

Demand will grow for urban rental units by the coast and shrink for single-family homes inland, resulting in fewer construction jobs and no boom for some areas hit hard by the housing bust.

By Alana Semuels, Los Angeles Times — June 15, 2011

UCLA forecasters have seen the future of California's housing market, and it looks like this: more apartments near the coast, fewer McMansions in the desert.

Since housing is still grossly overpriced near the coast, and since people with jobs need a place to sleep, rental demand will pick up. Further, since people can no longer afford the extra square footage of a McMansion, builders are being forced to make houses smaller to achieve lower price points. Those are the real reasons why UCLA's predictions will be correct. The reasons that follow are somewhere between weak and bogus.

That prediction is based on several factors, including expectations that rising fuel prices will encourage people to live closer to jobs along the Southland coast and in the San Francisco Bay Area.

The state's population is also skewing younger, meaning there will be more demand for urban rental units and less demand for suburban cul-de-sacs, according to the quarterly economic forecast released Wednesday by UCLA's Anderson School of Business.

People don't base housing decisions on gas prices. They may choose to buy a car that guzzles less gas while prices are high, but the moment gas prices go back down, demand for SUVs goes right back up. Gas prices may influence how much of a discount is required to get someone to move inland, but even that is less of an issue than how much traffic they will have to deal with and how long the commute time will be.

The idea that a “skewing younger” population will shift demand doesn't seem likely either. Demographic shifts doesn't determine buyer behavior. People will want what they want, and they will substitute as necessary. Academics have written papers predicting housing crashes from the changing housing needs of baby boomers, and those predictions have consistently proven wrong.

“The incremental demand for housing is moving more into multifamily housing,” said Jerry Nickelsburg, senior economist with the forecast. “Many of the younger generation have been buffeted by the boom and bust in the housing market, and see value in living closer to work.”

Younger workers have been frightened by the housing bust, but home ownership hasn't lost its luster. People will demand what housing they can afford, and as long as housing is over priced, people will demand rentals as a substitute.

That's bad news for the state economy, however, for two reasons. One is that construction of multifamily homes requires less labor than construction of single-family homes. Second, areas such as the Inland Empire and Central Valley that were hit hardest by the housing bust won't get a construction boom to help pull them out of the economic doldrums.

This means “there is an even larger structural unemployment problem in California than we originally thought,” Nickelsburg wrote in the forecast. “Not only do we have excess construction, real estate and support skills, but some of those that will be demanded will be in the wrong geography.”

UCLA has been wrong in its previous estimates of the impact of the housing bubble. I'm glad they are finally correcting their mistakes. Many of the construction jobs of the bubble will not come back — it was an unsustainable bubble, and when demand finally reaches an equilibrium, it will be at a lower level of real estate related employment.

California won't start adding a significant number of building permits until 2013, forecasters say, which is one of the reasons the state's unemployment rate will stay above 10% until the middle of that year. Nonfarm employment in the state won't return to pre-recession levels until 2014, and construction employment won't reach those levels until at least 2021.

Construction starts and sales have been near their all-time lows for nearly three years now, and they will continue to drag along the bottom for another two years. As someone who works in the industry, that is not a comforting truth, but it is an accurate assessment of where we are and what we are facing.

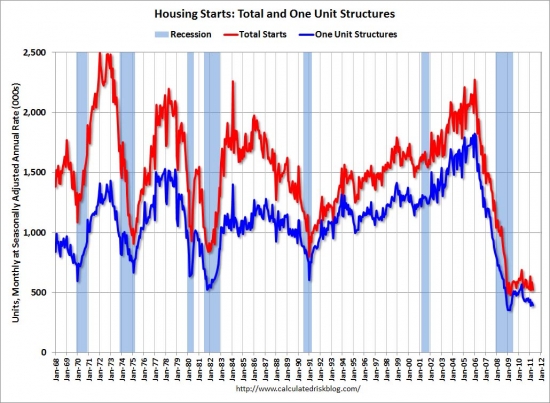

“In a typical recovery, you get a bounce-back in housing and hiring of a lot of construction workers,” (see chart above) Nickelsburg said in an interview. “We're not seeing that this time, which definitely slows the recovery, and slows economic growth.”

Changes in the state's demographics are driving some of these shifts, forecasters say. Household formation has slowed in California as the unemployed have moved in with their family members to save money, leading to less demand for new homes.

In addition, California is one of the youngest states in the nation, according to census data, with a median age of 35.2, compared with 38.0 in New York. Although there are many Gen Xers of home-buying age in the state, many “bore the brunt of sub-prime mortgage and housing bubble crash,” Nickelsburg said, and now do not think a home is a safe investment.

The surveys on this issue simply don't back up this contention. Despite the housing bust, people still want to own homes. That's not to say buyers are not wising up to the fact that housing is not a safe investment. People shouldn't perceive housing as a safe investment. Real estate prices do not always go up. The fact that people did believe it was a safe investment contributed to the financial mania that made prices crash.

The market is already responding to this trend, according to UCLA. Building permits for single-family homes have continued to decline while permits for multifamily complexes are starting to regain strength. Permits for multifamily homes are now at 40% of the peak number, comparatively stronger than permits for single-family homes, which are at 20% of their previous peak.

Those are dismal numbers. Real estate related unemployment is also correspondingly high.

These housing issues, coupled with the financial pain experienced by state and local governments, will keep California's unemployment rate at an average of 11.7% this year and 10.9% next year.

The picture is slightly rosier on the national level. Gross domestic product will grow at an annual rate of 3% through 2013, and the unemployment rate will decline slowly, reaching 7.8% by the end of that year. This year, the U.S. unemployment rate will average 8.9%.

There has never been a robust housing recovery in the face of persistent unemployment. It takes people with jobs to buy homes.

The recovery will remain tepid because many jobs are gone for good, said Ed Leamer, director of the UCLA Anderson Forecast. Outsourcing and robots have replaced about 2.5 million manufacturing workers. About 2 million construction jobs are gone permanently because they had been created by artificial demand. Retail technology and Internet shopping, coupled with consumers' spending fatigue, have led to the displacement of 1 million retail jobs.

Those 5.5 million workers are one reason the economy won't grow as robustly as it has in past recoveries, Leamer said.

“We have been vigilant for signs of a real recovery,” Leamer wrote. “These have been hard to find.“

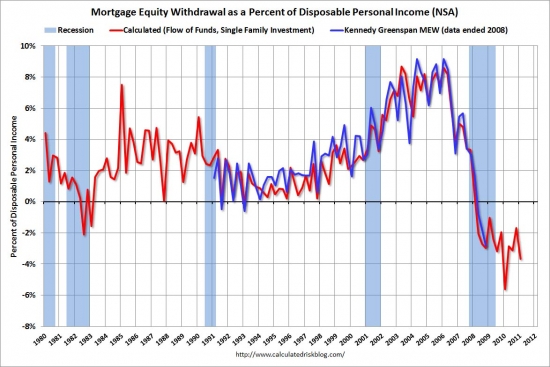

As reported here back in 2009, our HELOC-based economy will not recover quickly because so much of the demand was artificial. With the housing ATM shut off for the foreseeable future, and with consumer debt at very high levels, we will not be able to borrow our way to prosperity.

Minus 10% annual appreciation .jpg)

Today's featured property is not for sale. It recently closed for a whopping 41% loss which represents negative 10% appreciation for the four and one half years the owner had the place — and prices are still falling.

Remember when everyone bought in 2006 because they believed prices would rise 10% a year? Gary Watts said that was “in the bag,” not that a realtor would make overly optimistic projections of appreciation….

At the $280,000 sales price, this property is likely at or below rental parity. Of course, it is a condo which should trade at a discount to rental parity, but it is certainly a good sign for the housing market. When more properties reach price levels where the cost of ownership is less than rent, a bottom will form. Until then, local prices will continue to grind lower and affordability will improve.

Irvine House Address … 39 SMOKESTONE #36 Irvine, CA 92614 ![]()

Resale House Price …… $280,000

House Purchase Price … $451,500

House Purchase Date …. 12/29/2006

Net Gain (Loss) ………. ($188,300)

Percent Change ………. -41.7%

Annual Appreciation … -10.6%

Cost of House Ownership

————————————————-

$280,000 ………. Asking Price

$9,800 ………. 3.5% Down FHA Financing

4.49% …………… Mortgage Interest Rate

$270,200 ………. 30-Year Mortgage

$58,605 ………. Income Requirement

$1,367 ………. Monthly Mortgage Payment

$243 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$58 ………. Homeowners Insurance (@ 0.25%)

$311 ………. Private Mortgage Insurance

$315 ………. Homeowners Association Fees

============================================

$2,294 ………. Monthly Cash Outlays

-$125 ………. Tax Savings (% of Interest and Property Tax)

-$356 ………. Equity Hidden in Payment (Amortization)

$16 ………. Lost Income to Down Payment (net of taxes)

$55 ………. Maintenance and Replacement Reserves

============================================

$1,884 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,800 ………. Furnishing and Move In @1%

$2,800 ………. Closing Costs @1%

$2,702 ………… Interest Points @1% of Loan

$9,800 ………. Down Payment

============================================

$18,102 ………. Total Cash Costs

$28,800 ………… Emergency Cash Reserves

============================================

$46,902 ………. Total Savings Needed

Property Details for 39 SMOKESTONE #36 Irvine, CA 92614

——————————————————————————

Beds: 3

Baths: 2

Sq. Ft.: 1117

$251/SF

Property Type: Residential, Condominium

Style: One Level, Contemporary

View: Park/Green Belt, Yes

Year Built: 1980

Community: Woodbridge

County: Orange

MLS#: S602164

Source: SoCalMLS

Status: Closed

——————————————————————————

WOW!! THIS IS AN OUTSTANDING VALUE FOR WOODBRIDGE! SPACIOUS THREE BEDROOM TWO BATHROOM LIGHT AND BRIGHT CONDO IN PRESTIGIOUS WOODBRIDGE COMMUNITY CLOSE TO FREEWAYS, UNIVERSITY, AWARD-WINNING SCHOOLS, MAJOR SHOPPING AREAS, AND WITH LAKE AND ASSOCIATION PRIVILEGES! CLOSE TO PARKING AND WELCOMING VIEWS OF THE GREENBELT, THIS CONDO IS AN END UNIT WITH A PRIVATE ENTRY BALCONY PORCH, VISTA OF TREES, A LARGE LIVING ROOM WITH WINDOWS ON TWO WALLS, A SEPARATE DINING ROOM, A SUNNY KITCHEN WITH UPGRADED COUNTERS, A LARGE MASTER SUITE WITH SMALL BALCONY PLUS A DRESSING AREA WITH A WASHER/DRYER CLOSET, AND A SEPARATE BATHROOM WITH SHOWER/TUB.

That house seems good to me… I mean from pricing standpoint. It’s a bit dated, but at $251/sf it seems reasonable.

Anyway, housing market is officially lower than during the Great Depression. We’re down 33% from peak as of April report (I know it went up a bit in today’s May report), whereas it was 31% & change peak-to-trough during the Depression. Irvine is at 32% & change as of April. The peak-to-trough occurred over approximately a decade in the 30’s, it took about half that this time around… so far. -source: CNBC

I have often wondered if single family homes that

are now part of the shadow inventory will eventually be recycled into multifamily rental units.

If true, the implications are enormous, especially for cities like Irvine. I don’t believe Irvine’s master plan takes into account the added stress on infrastructure such as roads, schools, utilities added by 2 or more families living in a space designed and planned for one.

I have lived in Irvine for 32 years. I have

seen evidence of doubling/tripling up in recent years. How do I know? Some of these folks are friends and I helped them move in!

It’s the same in our neighborhood. It seems to be the way people afford Irvine homes. I see many homes with parents, friends, and others living together – not just “husband/wife/2 kids.”

One of the bigger changes I have noticed in Irvine over the past 32 years is the incredible increase in traffic congestion, particularly the last 10.

Now, I am not going to claim that all this new

congestion is due to families doubling up.

Certainly the general build out of WestPark Woodbury, etc add to the load, not to mention all those highrises off of Jamboree.

Personally, for me its a little sad. It wasn’t that long ago that Irvine had a country town feel

to it. Those days are long gone, I’m afraid.

Here in Denver, the recent scrape-offs seem to be re-built as duplexes, or, if combining adjacent lots, as triplexes. Developer profit is, obviously, the main (only?) driver, but the previous tradition was to bulldoze the old house and replace it with a single family residence with at least twice the square footage and no yard.

The McMansion farms well outside the city in Castle Pines and similar places feature many neighborhoods with 5,000-square-foot minimums. I see no future for these but conversion to multi-family dwellings. I don’t know what other use they can be put to: extended families, maybe, but that’s the same outcome.

Some good will come of this: duplexes make a lot of sense to me. A good use of space, but still plenty of yard, and energy efficient with fewer exterior walls per resident, but only two parties to the HOA, which reduces the likelihood of deadbeats and conflicts.

2.4% annual appreciation for this property from 1992-2011.

I disagree with your thought that gas prices will not impact behaviors. No one would say that gas prices at $1/gal vs. $3 would not change people’s behavior, and the move from $3 to $5 will continue that change. People are making decisions to leave jobs with long commutes for jobs closer to home, so the flip side impacting where people move will also take place. You have people going from two cars to one, even with both spouses working. That just doesn’t fly far from job centers. People want to be closer to amenities also.

I think you’ll see people reconsidering suburb-type homes with yards for more urban type settings. Mowing and landscaping is a pain in the add, especially for people who really don’t want to be doing it. It costs more to contract for that to be done to your home than it does for a HOA or condo to get things taken care of. Either way exurbs away from jobs, kid activities, and entertainment are going to lose out, but we’ll see what the market bears.

I agree with winston.

I also think high gas prices has made the substitution of the IE less desirable. It’s why demand is still high in cities that are more central to work, shop, eat and play.

For me, the price of gas is minor and not a big enough factor to base moving on.

I am moving closer to work because of commute time and quality of life.

Based on my experience, I think he is right:

“Gas prices may influence how much of a discount is required to get someone to move inland, but even that is less of an issue than how much traffic they will have to deal with and how long the commute time will be.”

Yeap, people can try to convince themselves that an hour commute each way is “do-able,” but that is a serious price to pay. I have a 3-mile commute home, and I appreciate it every day. It’s amazing how annoyed I get when I have to get on the 405 to meet friends for happy hour at the Spectrum – “How do people live like this?!?”

I’ve had commutes as short as 5 minutes and as long as one hour. I will never do the one hour commute again. It isn’t worth sacrificing two hours of time each day with my family.

It certainly is amazing how much free time becomes available once the commute goes from an hour 15 each direction down to a 3 mile commute.

I would love a 5 min commute, but it’s not in the short-term plans. My wife works in one town and I work in a town 20 minutes away. Her job trumps mine, so we live closer to hers, but nearby her office are older homes (75-100yrs) either small <1500 sqft, or large > 4000 sqft, mostly with very small yards (not the best for 2 big dogs and 2 little kids).

In our town, neighborhood amenities have been a better selling feature than closer to town. Some new construction, in older established neighborhoods, has been on the market for a while, with significant price drops.

I totally agree,I’m one of the lucky ones, I live and work in the same zip in Irvine.

30 minute commute and I hate it. My solution: work less.

I used to commute from north of Long Beach to Irvine. Whether by Metrolink (3 hour commute 1-way) or 405 (1+ hour commute 1-way) I hated my life. I remember a girl who would commute from around Coachella to Irvine every day. All for her dogs.

The impact of the price of gas is inversely proportional to one’s income. Right now is a hard time to sell, so I would agree that people will go to smaller cars, then look for jobs closer to home (not that finding a new job is easy today either). But, think about new household formation. Tends to be lower income (lower down the experience ladder). At that point, it’s not time with the family that is a huge change. Would someone making $8/hr take on more hours to help make ends meet? At the lower end of the income spectrum $s trump time.

I think gas prices may affect settlement patterns, but only if they stay high long enough for people to feel like they are permanent. I used to live in England, where gas is regularly something like $8/gallon. People there rarely choose to live a long way from work, unless it’s on a good bus or train line.

Gas (Petrol) in the UK is now $9.64 per gallon and all the roads are still gridlocked.

Yeah, the roads are still gridlocked, but that’s mostly because they don’t build nearly as many roads or make them as wide as here. Which is good policy, by the way. People will drive more if it’s convenient; if you want green space and quiet and fresh air, you need to let driving be inconvenient.

Of course, if you want economic opportunity, you need mobility. Nobody drives for the hell of it. Every trip not made represents a foregone economic or recreational activitiy.

Who needs to pay-down debt when you can just pay the interest? There were no lessons learned…

“Rise in Interest-Only Lending

American Banker (06/16/11) P. 16 Muolo, Paul

National Mortgage News and the Quarterly Data Report shows a 60 percent jump in interest-only mortgages to $11.3 billion funded in the first quarter of 2011 from the same period last year. Wells Fargo & Co.’s interest-only originations rose 55 percent to $3.1 billion. Rounding out the top three were PHH Mortgage of Mount Laurel, N.J., with $2.3 billion in interest-only originations, and Union Bank of San Francisco, with $1.8 billion.”

To play devil’s advocate, if we have a bout of inflation during a fixed rate IO period, that is a nice outcome. IO loans are just another finical product that can be used to an advantage, or cause harm if not used correctly.

lmao @

http://www.ocregister.com/news/woman-304715-police-gun.html

I’m not sure what her being a realtor had to do with the story, other than perhaps it makes a statement about her character, but it did make me laugh.

MISSION VIEJO – A 65-year-old Realtor has been arrested on suspicion of discharging a firearm in a negligent manner after police say she fired a gunshot to scare people talking loudly near her home.

A group of eight people in their early 20s were hanging out at Lake Mission Viejo near the 22000 block of Formentor around 11:45 p.m. on Tuesday, police said. A woman who lives near the lake went out onto her balcony and yelled at them to be quiet.

Police said the group saw the woman return to her balcony a short time later with an object. They then heard what sounded like a gunshot and saw a flash from the gun’s muzzle as it was discharged from the balcony. According to police, an individual in the group shouted up to the woman’s balcony to ask if she had a gun, to which the woman responded that she did.

The group left the lake and called police to report the incident. The woman also had called police to report people being loud near the lake.

Deputies were sent to the woman’s home to respond to the noise complaint and discovered she was intoxicated. The woman first told deputies she had only fired a flare gun, but later admitted to firing a gun up into the air. Deputies located a 38-caliber pistol with one spent round.

Deputies arrested Sandra K. Smith, 65, on suspicion of discharging a firearm in a negligent manner. Smith, whose occupation is listed as a Realtor on arrest records, is being held in lieu of $25,000 bail.

State Department of Real Estate records show a Sandra Kay Smith employed by Rainbow Realty Corp. Century 21 Rainbow Realty’s website lists a Sandra Smith as a Realtor with the company, which specializes in “working with seniors in listing and selling homes.”

65 yearold pistol packing realtors!

I’m wondering whether the other big financial bubble brewing right now in the US – education loans – will not become an increasingly important variable impacting a housing market recovery in 2013/2014 as well.

I mean, how can someone with very little to zero savings get a mortgage loan for a $350-$450K condo or SFH when they may already have $100K+ in education loans? Higher mortgage interest rates in the future are also an issue? The rental market will always be massive, but not without risk.

I’ve read that there’s a lot of people who are already on their knees in terms of student loan debt, and some will default. Except unlike a bad mortgage on an underwater house, the student can’t simply walk away from the student loans, which cannot be expunged in bankruptcy. The former student (ages 22 to 50?) would have that loan hanging over their neck well before they even filled out a mortgage loan app.

No, it’ll be the widespread collapse of the States based on Politician-State Worker Union-PAC complex.

There are presently numerous States tettering on financial insolvency because the structural deficiencies in their programs.

And in addition, since institutions (Fed Gov’t) won’t even give out much in the way of student loans directly to an undergrad, it is their parents who are expected to take on education loans (or come up with the cash). I suppose there were a fair number of moms/dads who came up with the funds by using HELOC $. Since HELOC $ is largely no longer an option, and a 18 year old can’t obtain a $20K+ loan per year, will higher education pricing eventually come down as a result? ‘Course, even so, I don’t suppose it’ll happen soon enough to benefit anyone currently in college… 🙁

Predicting a date when House prices bottom out is like predicting what happens to us when we die,let’s face it, nobody knows.

Why 2013? Are we going to see Wages triple in SoCal and an unemployment rate of zero before then? Are we suddenly going to solve the lack of skilled labor along with investment and enable Manufacturing to boom? Heaven forbid we actually create a real economy by producing Tangible Goods by 2013…

Irvine is a terribly difficult City to do or create a business in, why? Because it’s prohibitively expensive and there is way too much Red Tape when trying to get anything done here.

Why do People commute from the IE? Because they have to. They have no other choice, they work in Irvine but don’t earn enough to live here.

I’m not sure if you guys saw this, but uhh…whoa.

Gun fired for “talking”.

Are we on notice?

New rock band in town – Guns and Realtors?

http://www.ocregister.com/news/woman-304715-police-gun.html

http://www.homes.com/Agent/283669/SANDRA-SMITH/

Hahaha…did you notice she’s listing a Place with 2bd 0Ba ? Maybe someone will buy it at Gunpoint?

As I interpret this, you’re saying that gas-price fluctuations are not decisive in housing choices. I think this has merit: full-sized pickups would not still be selling if the roller-coaster price action of the last 3 years had any effect on consumers.

I think the long-term picture is far different. If gas prices ascend past $7.50 per gallon and stay there – the facts of declining petroleum extraction leave little doubt this will happen – then there is a point at which gas prices matter.

Some are saying we’re at that point – I have my doubts that this is the real cause – but the New York Times recently passed on some evidence that outer-ring Chicago suburbs are seeing such an effect:

Probably bull____, but if builders are saying it, then something is up: they’re not known for their smarts.

This does not sound permanent to me – yet. But there are pain receptors for gasoline prices within the human brain, and, incomes being finite, there is a point at which we all run out of cash. They’ll still want houses, but distance from work will become a determinant of buyer behavior at some gas price point.

Are you talking about tastes/desires here, or are you including demographic financial problems?

What if baby boomers, dependent on social security and busted 401k plans, and the current twenty somethings with student loan debt and poor earnings, are the primary actors in the housing market? This isn’t a matter of desires or tastes: they got no frickin’ money!

Move-up buyers: gone from the market. That means that first-time demand will be key to supporting the demand tower, which is top-heavy with over-leveraged 46-to-65-year-olds who will be watching their earnings drop as they age. They won’t be downsizing out of fashion. This isn’t about psychology: they won’t have enough money to service their debt and buy food.

Since there is such a healthy chunk of the population in this predicament, the government will bail them out: student-loan forgiveness is coming for the young ones, and high inflation for the elderly debtors. If you’re going to be stupid in America, join a large enough herd and your elected representatives will put it right.

Also, large public-transit systems will be built to service the poor outer-ring suburban dwellers, would could not have known that petroleum could would ever run scarce, and surely deserve our sympathy and prayers. Most of the beneficiaries will claim, if asked, to be strictly opposed to socialism.

forgiveness of student loan for other than govt service, disability is not likely in my book. If there are large student loans defaults and the students have no bread, a similar bailout will be done — bailout the banks and let the old students eat cake.

The last time there was large-scale unrest in the USA, was post-WWI to pre-WWII. The 1960’s were small scale compared to prior unrest and just go alot of news/TV coverage.

Unrest has nothing to do with it, and has rarely been a prerequisite for rewarding the stupid.

The government has pumped the value of housing hard since the end of the tech bubble, because so many stupid people were already over-committed to housing that there was no other way to keep consumer demand alive.

Poor decision makers who bought at the top of the bubble or HELOC’ed themselves into oblivion have been rewarded by the government by bank bailouts which allow the banks to leave the squatters be in order to pretend the defaulted properties are worth more than they are.

Those who walked away have been forgiven the taxes on the free money they received, through the Mortgage Forgiveness Debt Relief Act.

The government will continue to try to destroy the currency to protect debtors, lowering the real value of their debts. It may not work, but it’s the goal.

No riots brought this on. You just need a certain percentage of people do do something stupid, and policies will be enacted to soften the consequences to the stupid.

You can’t get blood from a stone. You can’t collect taxes from some one who’s broke, but can buy their votes and their families’ votes. The tax forgiveness is for a limited time, but with an election, it may be extended or a new taxforgiveness law passed.

The govt is borrowing and printing money to pay back with “cheap money” in later years. The current support/bailout is for the banksters and global companies based in the USA. The squatting is a by-product of the bailout not the goal. The banks and govt. need to keep the supply down to keep the prices high. Just think what would happen if millions FC empty houses hit the market in 2 to 3 months. The house market would really tank.

Gas prices will not matter in the long-term – not because public will tolerate ever-escalating gas prices, but at a certain threshold in price alternative energy sourced vehicles will become viable and eventually commonplace. Once this happens (and we recover from recession, of course), there is likelihood home purchasing behavior will go back to what it was. As they build 400-mile range electric cars, who cares how much gas will be? Now we have a potential 60-mile commute each way with very little consideration for fuel costs. That’s why it won’t matter.

Agreed. Peak-oil doomers always prophesy that when oil hits $X/barrel, we’ll all go back to living like we did in the mid-19th century. But for this to happen history, economics and technology would all have to be turned on their heads. I wouldn’t bet on any technology in particular, but if gas gets expensive enough, something will take its place as a personal transportation fuel. It may not be as good as gas and it won’t be as cheap, but personal mobility is so vital to the economy that people are going to give up a lot of other things before they give that up.

I learned in entrepreneurship that someone will always invent something that will remedy the consumers’ “pains”. If gas prices become a “pain”, there will be something to replace it. That innovation is what is going to change consumer behavior, not lack of it. I wouldn’t be surprised if we see even greater commutes in the long term.

This vehicle already exists. It’s made of space materials and super efficient. It’s a bicycle. You can even add an electric battery and the mileage will be astounding.

Fortunately, there is an Irvine company that produces this super vehicle – Felt.