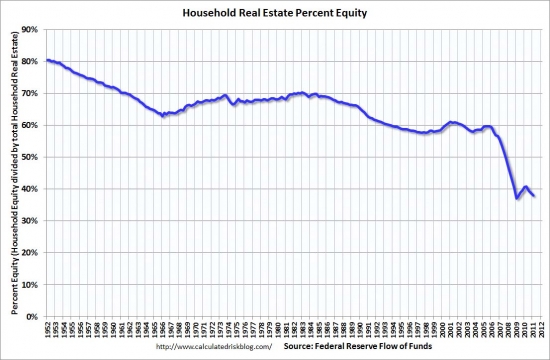

With the deflation of the housing bubble, home equity hit its lowest level in seventy years. It will fall further.

Irvine Home Address … 165 ROCKWOOD Irvine, CA 92614

Resale Home Price …… $315,000

My heart is aching, I'm a fool

To let it go on breaking

Maybe I'll awake and find that I'm mistaken

I wonder

Louis Armstrong — I Wonder

The process of market capitulation requires the individual participants to realize their folly. Their pocketbooks are aching, and they ask themselves how long they should let it go on breaking, and finally they realize they were the fool.

As prices fall in the wake of the housing bubble, whatever equity wasn't spent through rampant HELOC abuse is being washed away by falling prices.

One data series that shocked me when I first saw it was the graph of home equity during the housing bubble. Everyone assumed home equity went orbital when house prices rose so far so fast. It would have except for one inconvenient truth: people were extracting that equity and spending it the moment it appeared. As a result, the expected huge increase in aggregate home equity from 2003 to 2006 never happened. Loan owners spent it all.

Home equity sinks to nearly lowest point since World War II

June 9, 2011 — The Associated Press, Bloomberg News

Falling home prices have shrunk the equity Americans have in their homes to nearly the lowest percentage since World War II.

Average home equity plunged from more than 61% at the start of 2001 to 38% in the January-March quarter this year, the Federal Reserve said in a report Thursday. That drop comes as home prices in big metro areas have reached their lowest level since 2002.

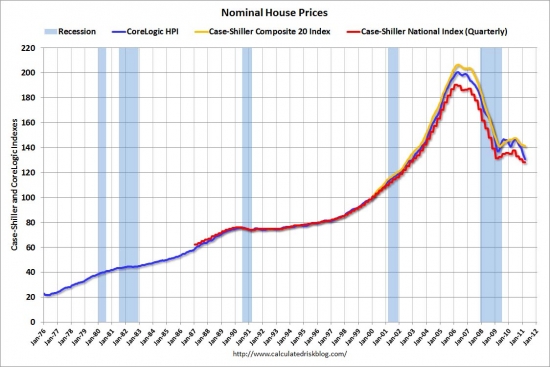

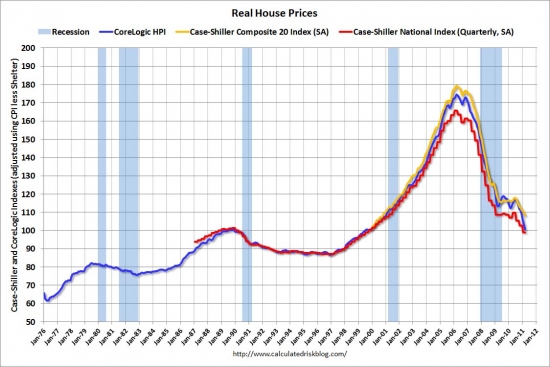

Prices fell 33% in 20 cities through March from their 2006 peak, reaching their lowest level since 2003, according to the Standard & Poor's/Case-Shiller index of U.S. home prices on May 31. The decline signaled a “double dip” as the index fell below its previous post-housing-bubble low set in April 2009. Prices more than doubled from 2000 to July 2006.

Further declines in home prices are likely.

Robert Shiller, the economist who co-founded the S&P/Case-Shiller index, said a further decline in property values of 10% to 25% in the next five years “wouldn't surprise me at all.”

“There's no precedent for this statistically, so no way to predict,” Shiller said Thursday at a Standard & Poor's conference in New York.

It's called overshooting to the downside, and it is very difficult to predict because the reasons it occurs is part mechanical and part psychological.

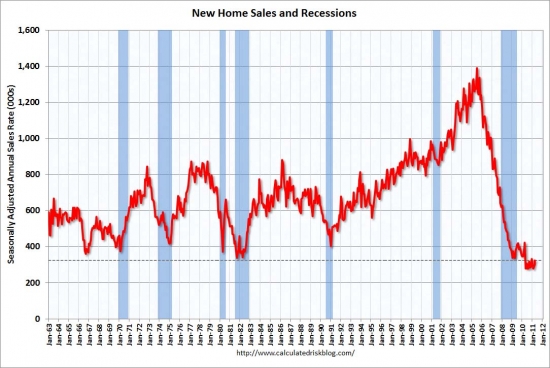

Mechanically, downside overshoot is caused by excess supply. With the millions of foreclosures lenders have already absorbed, and the millions more waiting in shadow inventory, housing markets everywhere have a huge supply problem. It has been masked over the last 3 years by withholding this inventory, but the problem didn't disappear, it's merely being held in abeyance to prevent a catastrophic price decline.

Psychologically, downside overshoot is caused by a change in buyer psychology. Since capturing appreciation was the primary reason people were buying during the bubble, and since prices are now depreciating, buyers who once were enthusiastic about real estate are shunning it like the plague. And they should.

Buyers need a new reason to buy, and and realtors calling the bottom is not sufficient. Only when prices are less expensive than competing rentals will buyers find a new motivation to buy real estate. And since rental parity is well below current pricing in markets like Irvine, buyers sit and wait, and sales volumes are anemic.

A backlog of foreclosures poised to hit the market means prices may stay depressed, dissuading builders from starting new construction.

The main reason for our ongoing economic doldrums is the lack of new residential construction. Housing is the economy. Nearly every recession since WWII has ended when residential investment picked up. Residential investment will not increase until the housing market has found a natural, sustainable bottom. The reason is simple: unemployed construction workers don't buy goods and services and stimulate the economy.

When the government tried to stimulate the housing market with tax credits and the federal reserve bought mortgage debt, their goal was to stimulate housing and jump start the economy. It failed.

The stimulants all failed because prices had not fallen to the point of affordability where real demand could sustain the momentum. It's like drinking coffee to stay up studying for an exam. You might get a temporary boost, but if the body is tired, it needs sleep, not stimulants. Similarly, if prices are inflated, temporary stimulants may cause prices to rise temporarily, but if what the market needs is a deeper price adjustment, that is what is eventually going to occur. And in fact, that is what's happening now.

How could someone tell if the market needed a deeper correction? On a macro level, measures of price-to-rent or price-to-income provide a clue. Plus, simply looking at long-term trendlines reveals prices are still too high.

On a micro level, rental parity is the best indicator. If prices are not affordable as measured by the cost of ownership compared to comparable rents, then prices need to come down. By both macro and micro measures prices are still too high in many markets.

Unemployment, which rose to 9.1% in May, and stricter lending conditions are signs that any recovery in housing may take years.

Shiller's comments paint a more pessimistic possibility for home prices than other forecasts. Additional declines will be “incremental,” Bank of America CEO Brian Moynihan said last week..

The CEO of Bank of America is telling people prices will go down. He is a good person to listen to because he will be one of the primary agents of the decline. Other than the GSEs, B of A has more REO than any other lender, and they are planning to liquidate. They won't dump the properties all at once, but they will liquidate, and their activity will push prices lower.

While it would be a surprise to see prices fall steeply, it's possible for homes to lose more value if inflation picks up, Karl Case, co-founder of the index, said Thursday.

“You could have flat nominal prices but still have it go down 20%,” Case said during an interview at the conference.

“If house prices stabilize, they could still go down in real terms. If we had inflation, it'd be great, because it'd mask a 25% decline.“

Did Karl Case just say inflation would be great because it would mask a 25% decline? A professional economist really said that? WTF? Does he really think it's a good thing for prices of everything else in our economy to rise significantly relative to housing is good because it keeps housing prices up? I'm starting to wonder who the real brains behind the Case-Shiller Indices is.

The Fed report showed that household debt fell in the January-March period at an annual rate of 2% from the previous quarter.

That drop was due entirely to a decline in mortgages.

Auto loans, student loans and other consumer credit rose 2.4% — the second-straight gain after nine consecutive declines.

We still have a long way to go to write down all the bad mortgages lenders are holding. Appreciation is not going to bail them out. The moment prices begin to rise, lenders will sell into the rising prices in order to liquidate their inventory. If both prices and volumes rise, lenders will quicken the pace of liquidations to stop the bleeding from their carrying costs. Any increases in lender selling will snuff out appreciation before it gains any momentum.

As long as lenders have copious amounts of houses and droves of delinquent mortgage squatters, house prices will not go up. Excess supply and carrying-cost pressures for liquidation will prevent price appreciation. Affordability will be excellent.

100% financing makes everything affordable

By far the dumbest idea that was fully executed during the housing bubble was embracing 100% financing. When lenders ran out of people with down payments and high credit scores, they took anyone off the street and gave them all the money to buy a house. With absolutely no barriers to entry to the housing market, everyone could afford to buy, and prices went straight up.

Of course, giving out the money is easy for lenders, but getting it back is more problematic, particularly when they loaned money to people under terms that nobody could meet.

What we are left with are properties like today's featured property. The owners paid $245,000 on 7/25/2002, and they obtained a $245,000 first mortgage. They put nothing down.

After a refinance for $225,600 and a stand-alone second for $24,000 on 6/5/2003, the owners went back to the housing ATM on 5/18/2006 and refinanced the second for $165,000.

Basically, they put nothing down and extracted about $130,000 in HELOC booty during their first four years of ownership. Now that prices have dropped more than 30% for small condos like this one, these owners are underwater and bailing out. Why wouldn't they?

They already extracted whatever the lenders was going to give them, and now with the large debt, it costs them far more than a comparable rental. Since they don't have any of their money in the deal, only their emotional attachment to the property or a sense of moral obligation would keep them paying. Since people don't often fall in love with tiny condos, and the moral obligation to repay debt is largely washed away, short sales like this one should not be surprising.

This is the type of inventory that will prevent appreciation until it is cleared from the market.

Irvine House Address … 165 ROCKWOOD Irvine, CA 92614 ![]()

Resale House Price …… $315,000

House Purchase Price … $245,000

House Purchase Date …. 7/25/2002

Net Gain (Loss) ………. $51,100

Percent Change ………. 20.9%

Annual Appreciation … 2.8%

Cost of House Ownership

————————————————-

$315,000 ………. Asking Price

$11,025 ………. 3.5% Down FHA Financing

4.49% …………… Mortgage Interest Rate

$303,975 ………. 30-Year Mortgage

$65,931 ………. Income Requirement

$1,538 ………. Monthly Mortgage Payment

$273 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$66 ………. Homeowners Insurance (@ 0.25%)

$350 ………. Private Mortgage Insurance

$337 ………. Homeowners Association Fees

============================================

$2,564 ………. Monthly Cash Outlays

-$141 ………. Tax Savings (% of Interest and Property Tax)

-$401 ………. Equity Hidden in Payment (Amortization)

$18 ………. Lost Income to Down Payment (net of taxes)

$59 ………. Maintenance and Replacement Reserves

============================================

$2,099 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,150 ………. Furnishing and Move In @1%

$3,150 ………. Closing Costs @1%

$3,040 ………… Interest Points @1% of Loan

$11,025 ………. Down Payment

============================================

$20,365 ………. Total Cash Costs

$32,100 ………… Emergency Cash Reserves

============================================

$52,465 ………. Total Savings Needed

Property Details for 165 ROCKWOOD Irvine, CA 92614

——————————————————————————.png)

Beds: 2

Baths: 2

Sq. Ft.: 1125

$280/SF

Property Type: Residential, Condominium

Style: Two Level, Contemporary

Year Built: 1983

Community: 0

County: Orange

MLS#: P782595

Source: SoCalMLS

Status: Active

——————————————————————————

Wonderful Woodbridge living at its best. This is a completely remodeled townhome. Nice laminate hardwood floors, beautiful upgraded kitchen w/ granite countertops, new cabinets & appliances. Bathrooms have been remodeled and upgraded. Features scraped ceilings with recessed lighting. Keep cool with energy efficient attic fan and ceiling fans in both bedrooms. Both carports are directly behind patio. Enjoy the Woodbridge Village Association amenities, including the lakes, parks, sport courts, and much more!

RELAY FOR LIFE is THIS WEEKEND

June 11-12 (9:00 am to 9:00 am) CENTRAL PARK in RSM (Behind the Bell Towers, across from the movie theatres) The Relay event is a 24 hour team relay supporting our survivors and in memory of those we have lost and a fundraising effort on behalf of the American Cancer Society. As of this morning we have raised approximately $13,500 with only $1,500 left to raise to meet our goal of $15,000 for St. John's. We have about 30 official team members toward our goal of 50. There is still time to JOIN the official St. John's team on line (avoid filling out waivers on the day of the event) and/or DONATE to the team or a team member — www.relayforlife.com/ranchosantamargaritaca

You are welcome to make cash donations on the date of the event as well. Please note that the despite a possible misunderstanding, there are NO DOGS allowed on the track during the event, sorry. Please note that if you did not get your St. John's black shirts they will be available at the event, and those that pre-registered on line as a team member and raised $100 or more will also be provided with an official RSM Relay for Life T-Shirt as well. As in years past, St. John's will have a booth and will be providing free food and drinks all day to St. John's members as well as providing to the general population on a donation basis (all proceeds will go to the RSM Relay event).

On Sunday morning our own Bob Hayden will be making his “world” famous waffles as a fundraiser to the event as well. Please feel free to stop by and walk a few laps as part of our team and in support of those you have loved and cared about that have survived or fallen to this disease. Help wipe it out…..run, walk, eat, play…. ALSO, there is a silent auction taking place from 11:00 a.m. ending at 6:00 p.m. with over 35 baskets available for bidding (along with our own donated basket from Kathy O'Connor of fabulous Silpada jewelry).

SATURDAY IS THE DAY – RELAY FOR LIFE

When my grandparents retired, it was probably that they had two properties w/no mortgage – primary residence and a vacation/retirement property. My parents & in-laws may have one property paid off, but that would be because they have 15 yr mortgages and they will end around when they hit 65.

I don’t know if people bought vacation homes as an investment counting on appreciation…At first I thought they were just counting on higher prices to be able to sell when they wanted to, but the more I think about it, the only thing that makes sense for a lot of 2nd homes is the appreciation. There is some bottom-buying of vacation homes, but I think it was the heloc fueled buying of the bubble that really sustained that market. Without people pulling equity out of their primary residences to put towards second homes, that market will be very slow to return.

Not sure that I agree with that. Speaking strictly from my personal perspective, I am considering a second home (actually a third, I have a second that is for my mom) that I would like to use as a part-time residence. Since I have a home in Atlanta where winters are bearable but summers are pretty miserable, something in the northwest sounds good to spend the summers in. Or, maybe I would want a 2nd home near a ski resort so that I can spend my winters skiing. Or, me being Korean, we thought about buying a condo there to spend spring & fall in.

I’m sure there are many who think similarly, no? Certainly I don’t want my 2nd home to depreciate in price, but whether I’d make money on it never really entered my mind.

I grew up in FL, so I don’t think that ATL summers are that bad 🙂

In NC, most people get either beach or mountain homes. One segment has plenty of $ and isn’t that cost sensitive. Another segment had to think that the beach & mtn appreciation would continue. My thinking is that if you told the people that they’d need to bring 10-20% of the home’s cost to the closing table to make a normal sale they would not have bought in the first place. Renting is still less expensive than comparable owning costs. The benefit of owning is if you have a stay-at-home parent who takes the kids there for long stretches, or if you get enough vacation to make 2-3 week periods workable.

Are you going to heloc your primary residence for the DP on this 3rd home?

While there are probably a lot of people in your situation, I don’t think you’re the typical 2nd/3rd home buyer in the US.

No heloc’s, probably making typical 20-30% down unless buying in Korea, which would likely need to be 50%+ or even cash-only.

That’s what I’d be curious to see, how many are actually buying as true 2nd home used for part-time residence vs. buying for investment. Like to see the stat on that.

Personally, I think it is far too early to buy a vacation home.

I go back to rural central Wisconsin every year, so I look in on these markets occasionally. Right now, there is no market. There are thousands of second homes sitting empty that nobody is paying for. Very few can afford the asking prices, and in many places, some of these properties may deteriorate to the point of being uninhabitable before they are ever sold. Banks have no idea what to do with all the Northwoods cabins they own. Prices will fall much, much more in many of these markets.

I would agree. It has been over a season since I’ve been to the NC beach, so I’m not sure what’s happening there. I would imagine that even if they aren’t paying the mortgage, the ‘owners’ would still be using the properties or renting them out. When I’ve gone, the only homes that seem vacant are the originals 40-50 yrs old, a couple blocks away from the beach. Those are probably owned outright by people in my grandparents generation.

FWIW I am seeing a generational change coming in views of the property market given what has happened in the last decade. When I was a late 20’s DINK in the 90’s it was very natural to consider homeownership before you started to raise a family. (buying of course with 28% DTI and at least 10% down with PMI).

Alot of the 20’s DINK I work with today look at their older peers with homes as losers with giant albatrosses around their necks and they don’t want that. Almost all are still renting and those that are looking keep coming back with “I still get more bang for buck renting than owning and why take on leverage to buy a depreciating asset’ (This is in NYC area where prices are still high relative to rents).

It gives me some hope this younger generation seems to ‘get it’. They will be s—–d by the Boomers in so many ways they don’t need to add ‘buying boomer homes at inflated prices’ to the list.

it’s not just 20-somethings. many (now) 30-somethings who worked for say, ten years to save up a downpayment or pay down student loans found themselves priced out of the market or facing insane housing costs just when they’d traditionally be ready to buy.

The Irvine down payments range from 20-30% from 1988 to 2011.

When is that big change happening again, you know the time when all the cash for down payments runs out in Irvine? Is it this summer or next summer? 33+ years and counting, it must end soon right?

Realtors are Liars – who knew? Truly ground breaking stuff… It’s gone viral LOL, the comments will never end at the big picture blog. Very intriguing, really makes you think, stimulating story.

If what you say is true, why do waste your time reading this blog and commenting?

What do you know another value added post by awgee, if only you had more insgihtful comments like that on your blog. What i say isn’t true LOL well my math was wrong that data only goes back 23 years and counting in the chart.

If it is such a good time to buy, when and where was the last home you bought?

My sense is that much of the high down payments in Irvine have come from people rolling previous appreciation into ‘trade-up’ purchases. With the market now stagnant to down I don’t know how this can continue outside of FCB’s. A lot of folks have given up the trade up curve and instead have cash out refinanced over the last 12 months whatever gain they still had since their last trade up. Just anectdotal conversations while watching our kids play sports…

You’re never going to get an answer about PR’s personal RE collection, he’s too busy making money with other investments.

I think PR must be a realtard, seems like he took us calling them liars personal.

@WoodburyRenter:

FYI: High downs and all-cash downs were prevalent before, during and after this latest bubble. It can’t all be trade-up purchases, especially when many of those making those high-downs are first time buyers.

Wasn’t it IrvineRenter who said that the 2010 Collection had no move-up buyers? So where did those down payments come from?

I think PR’s a realtard too, but he writes in complete sentences and is a decent advocate for his positions, which makes me think there’s no way he’d (she’d?) stoop to pimping real estate for a living.

“is a decent advocate for his positions”

Must disagree. He resorts almost exclusively to putting others down rather than rationalizing his position, and seems more interested in telling people how wrong and stupid they are rather than asserting how intelligent and right he is. That makes for a horrible advocate, just a troll.

IHO is a much better representative for the dissenting side. He states his positions and presents data that favors it, and never resorts to debasing others.

“IHO is a much better representative for the dissenting side. He states his positions and presents data that favors it, and never resorts to debasing others.”

Yes, he has consistently earned my respect.

You make me think of someone who spends $70 per day to go to Disneyland every day, and while there, spends the whole day telling anybody who will listen, not listen, or is trapped in line with them what is wrong with Disneyland and how awful it is.

I think Disneyland admission was $70 about 10-12 years ago. try $95.

PR,

Everywhere you turn, you’re flat wrong. But somehow you just keep talking. Someone mentioned the Dunning-Krueger effect recently, and it seems you personify it. Here, just to save you the trouble of googling:

“The Dunning–Kruger effect is a cognitive bias in which unskilled people make poor decisions and reach erroneous conclusions, but their incompetence denies them the metacognitive ability to appreciate their mistakes”

So what exactly did I say wrong, what is:

A. Realtors Lie – earth shattering news has gone viral

B. The down payment data for Irvine shows 20-30% down payments in Irvine from 1988 throguh 2011

C. Long time rate prediction – rates have gone lower and lower staying low as fed rate stay at 0%

D. None of the above

You have 30 seconds, I’ll give you an extra minute since everything I write is wrong inside your head

Okay, so you are right. And the IHB is wrong. Again, why do your waste your time?

I was debating whether the correct answer was A or D. There are often shades of gray.

Anywho good luck to all of the OCAR members of the IHB (Ideal Home Brokers). Maybe you get to wear a special double secret probation hat at the kangaroo court. Theres nothing like critical special interest stories that go viral

I’ll ask again.

Because now is such a good time to buy. Where and when was your last home purchase PR?

Well first off I only state the facts, this would include rental parity information, down payment facts, and interest rate facts. If there is a specific propert that sold in Jan 2009 for less than current maket, I will also be sure to state that fact.

As for me, it was 1996, rates were oh 9% or so. Housing seemed so unafordable, and it was to many. Now I recently refi-d into 15 year fixed at 3.7%. I could easily rent it and cash flow $2000 per month. However I smell a sweet refi coming soon, many here say rates were only going up. Looks like I may get another nice refi as rates head lower. Times are truly devastating.

So why haven’t you bought any second properties?

How convenient that PR bought at the absolute bottom of the market. Would we expect anything else from such a smart individual. Life is all about timing PR…you were lucky you bought when you did. Had it been mid 2000s, you wouldn’t be singing your arrogant tune here.

Aye, I’ve heard of 3.25% @ 10 years, who knows, maybe three and a quarter for 15, the very best rates are for those whom do not need it. Why give low rates to people underwater, holy sh1t that would be SOCIALISM! Only those whom have “earned” the right to low rates by having large amounts of wealth deserve money at extremely low rates. Only the banksters who need no money at all, get it from the FED for what… 0.25%?

B is false. Today’s featured property had a 0% down payment + HELOC extraction. Just because the average Irvine DP is 20-30% doesn’t mean there aren’t problem purchases like today’s.

@Chris M

“Just because the average Irvine DP is 20-30% doesn’t mean there aren’t problem purchases like today’s.”

By the same token, just because IR can profile HELOC abuse and 0% down on this blog regularly does not mean that type of transaction is the majority of Irvine purchases.

0% down was not prevalent in my region, nor was heloc abuse, so the default rate is lower than many other regions. There is a neighborhood similar (by the same developer) but a little older than mine that had a few foreclosure sales the past few years. I checked one from 2009 to see how good a deal the buyer got (the home was ugly & needed work, so not a super discount like foreclosures can sometimes be). What shocked me was that this was the 2nd time the home had been foreclosed in 4 years. The first was a 100% financing, where, just 5 months after, the buyer pulled 10% out of the deal. I’ll give you $60k to have you live in this home…

100% financing and helocs happened everywhere. I am still curious as to why they were so prevalent in some areas, and less in others.

You mean not all Christians are Catholic?

My mind is blown!

RE: C

and good luck qualifying for average buyers, now that Obama changed the rules.

“The Irvine down payments range from 20-30% from 1988 to 2011.”

So if down payments have been pretty stable in Irvine during this period, and Irvine experienced significant price declines during subsets of this period (1991-1996, 2007-2009), then that means today’s down payment levels are wholly compatible with declining prices. Not the point that PR was trying to make I’m sure, but true nonetheless. If down payment levels have no correlation with price movements, their presence is neither evidence for or against further price declines.

keep ignoring facts, I guess. the average loanholder has 37% equity nationwide… lowest in over 60 years. this isn’t happening because housing is stable and a great investment in this decade. after all, there are many more baby boomers in homes than any other category of loanholder.

bottom line is the giant housing ponzi scheme is finally becoming de-leveraged. anyone interested in owning their own residence in 2011 has very few choices, pay cash and hope prices don’t freefall, or keep renting and wait for prices to hit historical norms or overcorrect before getting into a mortgage. the latter will happen eventually, but it’s still going to take a while.

“It’s called overshooting to the downside, and it is very difficult to predict because the reasons it occurs is part mechanical and part psychological.”

thanks for mentioning psychology.

psychology is always a huge, probably -the- primary reason bubbles inflate.

most people have this misplaced notion investors are rational and for the amateur/average/typical “investor” rationality is one of their weakest characteristics. emotion is what drives their purchases and sales.

having said that sentiment is turning. people thought in 2010 we escaped the RE bottom and in 2011 we’ve just past the previous bottom.

i see another leg down.

when things are bad and they get worse, that’s when you see the sh*t fly. when it does i’m going to enjoy it.

I challenge “B” What is the source for this data. I have personal experience that disputes that notion.

“And since rental parity is well below current pricing in markets like Irvine, buyers sit and wait, and sales volumes are anemic.”

Yep, waiting for 6 years and counting.

Your thanksgiving heloc pic doesn’t really fit. A $20 turkey cooked at home isn’t much of a splurge.

Need the caterers and prime tenderloin beef if you want the picture to fit the message.

really dumb question here….

rental parity is defined as what exactly? For example, if I pay $2000/mo in rent does that mean when I buy a house all of the monthly expenses associated with the purchase (PITI + HOA + Mello-Roos, etc) should be somewhere between $2000-2500/mo?

apparantly it is suppose to be 160 X rent. So 2,000 rent is a $320,000 house.

Rental parity is the price point where the total cost of ownership is equal to rents on a comparable property. Hence a $2000 per month rental should cost $2,000 per month to own (PITI + HOA + Mello-Roos, etc). If it costs $2,500 to own a $2,000 per month rental, then the price was too high.

“rental parity is defined as what exactly?”

Ask 10 different people, you’ll get 10 different answers. That being said, IR’s calculator is the best I’ve seen.

Actually, savvy cash-flow investors hunt for 100x or maybe 120x, not 160x.

Slightly off topic.

I was wondering if you could do a rent-vs-buy analysis on one of your Las Vegas properties from a owner as well as an investor perspective?

I am curious as to how the numbers tally up for those looking for cash flow positive properties.

The property that was the subject of the post Not leaving North Las Vegas shows the cost of ownership. The costs are roughly the same for an investor, although the interest rate is a little higher, and you have property management fees. That house which would cost and investor about $750 a month to own with 20% down, would rent for about $1,100 leaving about $300 per month positive cashflow after reserving for vacancy loss. There is also amortization in the loan which benefits the investor.

With 20% down, the mortgage comes out to be $443. Fairly close to the monthly payment depicted in the web post ($471). With 20% down, there won’t be a PMI so the investor saves the $ 106 there. Adding up tax, HOA and insraunce we get 197. Which gives us a monthly outlay of 640. You have quoted a figure of 750. Is the extra $110 a month enough for (property management + maintenance). To my untrained eyes, it appears a bit less

I am just trying to see if it makes sense for someone in CA to just buy something like this with 20% down and have a property management firm run the place. I just see 2 issues with this. 1) Is the $110/month enough for repair + property management form and 2) If the $1100 a month too aggressive an estimate for the rent as I have *NO* clue on what these rent for.

Thanks for the good work.

The posting includes $32 for maintenance and replacements. For investors wouldn’t that price be higher because they have to basically clean and paint the whole place every time a tenant leaves? Or is this

Also, what about the cost for

Maintenance is regular maintenance, it has nothing to do with the house being occupied or not. You still need to do things like upkeep landscaping, cleaning air ducts, etc.

Things like interior cleaning and painting, those aren’t supposed to come out of pocket – that’s what a renter’s deposit is for.

HELOC Manhattan big-time style

I always see reference to median purchase price and down payments. Boo! I’d rather see the mode and a nice pie chart what do you say Larry. Can you guys put that together?

“As a result, the expected huge increase in aggregate home equity from 2003 to 2006 never happened. Loan owners spent it all.”

This is not correct. The increases did happen, and only part of it was spent. Aggregate home equity, in dollars, increased massively during the 2003-2006 period (even before). Problem was that aggregate mortgage debt increased at about the same rate. Hence, the stable % home equity figure to about 2006. After that, of course, equity dollars and mortgage dollars both fell, just equity dollars fell much faster, hence the declining % home equity seen in your graph from 2007 on.

yes, percent is what matters. comparing total dollars is silly. that’s because as home prices increased at historical rates, loanholders took money out nearly as fast. while first time buyers brought little or no money to the table to start with. just as suspected.

Very low Cash-Out Refinance Activity

Two things are readily apparent:

(1) There is little money going to consumers through GSE refinancing (since GSEs are the bulk of the market, this is significant.

(2) There was a massive level of cash going to consumers through re-fi’s during the bubble. >80% of loans adding to principal.

If home prices ever go up again, this is something that needs to be dealt with through increased regulation.

Bank of America, and most other banks I presume, is still pushing their HELOCs. No application fees. No closing costs. Fixed or variable rates. You can search your home’s estimated value on the Bank of America website, meanwhile an agent will popup to online-chat you through your options.

Pretty nifty stuff.

Not sure about the approval process for all of this. Maybe it’s a lot tighter now. Maybe not though. Anyway, the Kevorkian debt instruments are all there, if you really want them:

https://www8.bankofamerica.com/home-loans/home-equity/line-of-credit.go?state=CA