Falling house prices are pushing more loan owners underwater and into strategic default.

Irvine Home Address … 14 ROCKY Knl Irvine, CA 92612

Resale Home Price …… $799,900

i'm underwater

i feel the flood begin

we're flesh and bone

together and alone

and we're looking for a home

Delerium — Underwater

More than 28% of US homeowners underwater on their mortgage

Home values in the first quarter fell 3% from the prior quarter and are now nearly 30% lower than the June 2006 peak.

Real estate data analytics firm Zillow said its home value index for the first three months of 2011 declined 8.2% from a year earlier to $169,600. The first-quarter decline was the steepest since 2008.

Zillow now doesn't expect home values to reach bottom before 2012, “at the earliest.”

“Home value declines are currently equal to those we experienced during the darkest days of the housing recession,” Zillow Chief Economist Stan Humphries said. “With accelerating declines during the first quarter, it is unreasonable to expect home values to return to stability by the end of 2011. We did expect substantial payback from the homebuyer tax credits, which buoyed the housing market last year, but underlying demand post-tax credit, as well as rising foreclosures and high negative equity rates, make it almost certain that we won't see a bottom in home values until 2012 or later.”

The level of single-family homeowners who owe more on their mortgage than the property is worth rose to a new high of 28.4% at March 31, up from 27% at the end of 2010, according to Zillow.

The percentage underwater is very important because strategic defaults go up significantly when home owners become loan owners as evidenced by the dismal cure rates on underwater loans.

As the author of our next article points out, the 28% figure above is misleading. The truth is more dire. These studies of underwater loan owners only considers the first mortgage. When you factor in the total debt on the property and include the second mortgages and HELOCs, the percentage who are underwater is much higher than 28%.

Strategic defaults could get very ugly

May 4, 2011, 2:01 p.m. EDT– By Keith Jurow

BRIDGEPORT, Conn. (MarketWatch) — In an article posted last September I discussed the growing threat that so-called “strategic defaults” posed to major metros which had experienced a housing bubble.

With home prices showing renewed weakness again, now is a good time to revisit this important issue. See Strategic defaults threaten all major U.S. housing markets

I define a strategic defaulter to be any borrower who goes from never having missed a payment directly into a 90-day default. A good graph, which I will discuss shortly, illustrates my definition.

For purposes of statistical analysis, his definition is useful because it is an easily identifiable trait which can only be explained by a sudden and conscious decision. However, it doesn't pick up the millions of strategic defaulters who struggle for a time juggling payments until they either give up or run out of resources. Many borrowers finally give up after missing some payments, getting behind, and realizing they can never dig out.

Who walks away from their mortgage?

When home prices were rising rapidly during the bubble years of 2003-2006, it was almost inconceivable that a homeowner would voluntarily stop making payments on the mortgage and lapse into default while having the financial means to remain current on the loan.

Then something happened which changed everything. Prices in most bubble metros leveled off in early 2006 before starting to decline. With certain exceptions, home prices have been falling quite steadily since then around the country. In recent memory, this was something totally new and it has radically altered how most homeowners view their house. In those major metros where prices soared the most during the housing bubble, homeowners who have strategically defaulted share three essential assumptions:

• The value of their home would not recover to their original purchase price for quite a few years.

• They could rent a house similar to theirs for considerably less than what they were paying on the mortgage.

• They could sock away tens of thousands of dollars by stopping mortgage payments before the lender finally got around to foreclosing.

Put yourself into the mind and shoes of an underwater homeowner who held these three assumptions. Can you see how the temptation to default might be difficult to resist?

Those are the standard reasons for strategic default we have discussed at length on this blog. They are good reasons. Anyone facing those circumstances will benefit financially from walking away. That's why strategic default is so common and will become the norm before this crisis has past.

Those are the standard reasons for strategic default we have discussed at length on this blog. They are good reasons. Anyone facing those circumstances will benefit financially from walking away. That's why strategic default is so common and will become the norm before this crisis has past.

In fact, one of the primary reasons lenders should never loan money when the rental cashflow doesn't cover the loan payment is because it exposes them to strategic default risk. There is no amount of signatory assurance that will prevent strategic default. The only way lenders can limit their risk effectively is to make sure that the property can cover the payments even if the borrower cannot.

Who doesn’t walk away?

… Last year, two important studies were published which have tried to get a handle on strategic defaults. First came an April report by three Morgan Stanley analysts entitled “Understanding Strategic Defaults.”

The study analyzed 6.5 million anonymous credit reports from TransUnion’s enormous database while focusing on first lien mortgages taken out between 2004 and 2007.

The authors found that loans originated in 2007 had a significantly higher percentage of strategic defaults than those originated in 2004. The following chart clearly shows this difference.

Why are the 2007 borrowers strategically defaulting much more often than the 2004 borrowers? Prices were rising rapidly in 2004 whereas they were falling in nearly all markets by 2007. So the 2007 loans were considerably more underwater than the 2004 loans.

Note also that the strategic default rate rises very sharply at higher Vantage credit scores. (Vantage scoring was developed jointly by the three credit reporting agencies and now competes with FICO scoring.)

Another chart shows us that even for loans originated in 2007, the strategic default percentage climbs with higher credit scores.

Notice in this chart that although the percentage of all loans which defaulted declines as the Vantage score rises, the percentage of defaults which are strategic actually rises.

A safe conclusion to draw from these two charts is that homeowners with high credit scores have less to lose by walking away from their mortgage. The provider of these credit scores, VantageScore Solutions, has reported that the credit score of a homeowner who defaults and ends up in foreclosure falls by an average of 21%. This is probably acceptable for a borrower who can pocket perhaps $40,000 to $60,000 or more by stopping the mortgage payment.

Most people overestimate how damaging strategic default, short sale, or foreclosure are going to be on their credit score. This is a perception lenders foster because if everyone facing strategic default realized how light the punishments really are, nearly everyone would do it.

Further, some people facing strategic default see the light and realize their credit score doesn't matter at all if they simply abstain from using credit. If you have no desire to use credit, your FICO score could fall to zero, and it wouldn't impact your life.

Why do homeowners strategically default?

Is there a decisive factor that causes a strategic default? To answer this, we need to turn to the other recent study.

Last May, a very significant analysis of strategic defaults was published by the Federal Reserve Board. Entitled “The Depth of Negative Equity and Mortgage Default Decisions,” it was extremely focused in scope. The authors examined 133,000 non-prime first lien purchase mortgages originated in 2006 for single-family properties in the four bubble states where prices collapsed the most — California, Florida, Nevada, and Arizona. All of the mortgages provided 100% financing with no down payment.

By September 2009, an astounding 80% of all these homeowners had defaulted. Half of these defaults occurred less than 18 months from the origination date. During that time, prices had dropped by roughly 20%. By September 2009 when the study’s observation period ended, median prices had fallen by roughly another 20%.

People who stretched to buy at the peak were counting on mortgage equity withdrawal to afford their payments and their lifestyles. When it became obvious that money was not going to materialize, the borrowers bailed.

This study really zeroes in on the impact which negative equity has on the decision to walk away from the mortgage. Take a look at this first chart which shows strategic default percentages at different stages of being underwater.

Notice that the percentage of defaults which are strategic rises steadily as negative equity increases. For example, with FICO scores between 660 and 720, roughly 45% of defaults are strategic when the mortgage amount is 50% more than the value of the home. When the loan is 70% more than the house’s value, 60% of the defaults were strategic.

This last chart focuses on the impact which negative equity has on strategic defaults based upon whether or not the homeowner missed any mortgage payments prior to defaulting.

This chart shows what I consider to be the best measure of strategic defaulters. It separates defaulting homeowners by whether or not they missed any mortgage payments prior to defaulting. As I see it, a homeowner who suddenly goes from never missing a mortgage payment to defaulting has made a conscious decision to default.

The chart reveals that when the mortgage exceeds the home value by 60%, roughly 55% of the defaults are considered to be strategic. For those strategic defaulters who are this far underwater, the benefits of stopping the mortgage payment outweigh the drawbacks (or “costs” as the authors portray it) enough to overcome whatever reservations they might have about walking away.

Each borrower has a different tolerance for financial pain. Some bail as soon as they go underwater, and some wait until they are deeply submerged. In markets like Las Vegas where over 80% of loan owners are deeply underwater, even the most upstanding morally guided borrowers with firm beliefs about paying their mortgage will walk away.

Where do we go from here?

The implications of this FRB report are really grim. Keep in mind that 80% of the 133,000 no-down-payment loans examined had gone into default within three years. Clearly, homeowners with no skin in the game have little incentive to continue paying the loan when the property goes further and further underwater.

While the bulk of the zero-down-payment first liens originated in 2006 have already gone into default, there are millions of 80/20 piggy-back loans originated in 2004-2006 which have not.

We know from reports issued by LoanPerformance that roughly 33% of all the Alt A loans securitized in 2004-2006 were 80/20 no-down-payment deals. Also, more than 20% of all the subprime loans in these mortgage-backed security pools had no down payments.

Here is the most ominous statistic of them all. In my article on the looming home equity line of credit (HELOC) disaster posted here in early September Home Equity Lines of Credit: The Next Looming Disaster?, I pointed out that there were roughly 13 million HELOCs outstanding. This HELOC madness was concentrated in California where more than 2.3 million were originated in 2005-2006 alone.

Last April I reported that Banks refuse to recognize HELOC and second mortgage losses. Negotiations with these second lien holders is primarily what holds up short sales.

How many of these homes with HELOCs are underwater today? Roughly 98% of them, and maybe more. Equifax reported that in July 2009, the average HELOC balance nationwide for homeowners with prime first mortgages was nearly $125,000. Yet the studies which discuss how many homeowners are underwater have examined only first liens. It’s very difficult to get good data about second liens on a property.

So if you’ve read that roughly 25% of all homes with a mortgage are now underwater, forget that number. If you include all second liens, It could easily be 50%. This means that in many of those major metros that have experienced the worst price collapse, more than 50% of all mortgaged properties may be seriously underwater.

Realistically, the only thing that kept most of these people paying since early 2009 was the false bottom engineered by the federal reserve. Many more borrowers will strategically default now that prices are falling and hopes of a price recovery are flagging.

The Florida collapse

Nowhere is the impact of the collapse in home prices more evident than in Florida. The three counties with the highest percentage of first liens either seriously delinquent or in pre-foreclosure (default) are all located in Florida. According to CoreLogic, the worst county is Miami-Dade with an incredible 25% of all mortgages in serious distress and headed for either foreclosure or short sale.

An article posted on the Huffington Post in mid-January 2011 describes the Florida “mortgage meltdown” in grim detail. Written by Floridian Mark Sunshine, it begins by pointing out that 50% of all the residential mortgages currently sitting in private, non-GSE mortgage-backed securities (MBS) were more than 60 days delinquent — either seriously delinquent, in default, bankruptcy, or already foreclosed by the bank. I checked his source — the American Securitization Forum — and the percentage was correct.

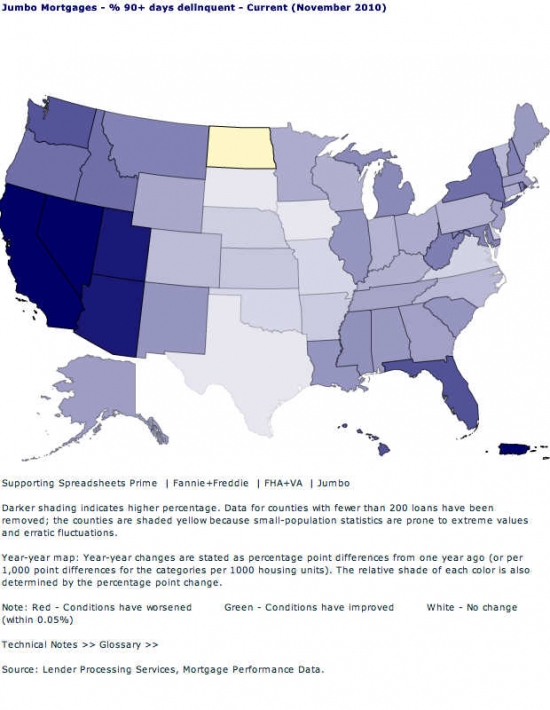

for more details on mortgage delinquencies by product type, see the interactive graph at the Federal Reserve Bank of New York. Below is the graph for delinquent jumbo loans. Orange County, California has 8.3% delinquent. Apparently local wages don't support the jumbo loans underwritten here.

The author then goes on to discuss a strategic default situation among his friends in Florida. One of them had purchased a condo in early 2007 for $300,000. By mid-2010, it had plunged in value to less than $100,000 and he decided to stop paying the mortgage. When he expressed his concerns about the possible consequences to his buddies — including an attorney, an accountant, and a doctor — all expressed the same advice to him. They told him to walk away from the mortgage, save his money, and prepare to move to a rental unit. To them, it seemed like a no-brainer.

The author was a little surprised that no one thought there was anything wrong with strategically defaulting. The attorney actually suggested that the defaulter file for bankruptcy to prevent the bank from going after a deficiency judgment for the remaining loan balance after the repossessed property was sold.

The attorney was providing sound advice. After a strategic default or a foreclosure on a recourse loan, borrowers should declare bankruptcy. Lenders are merely laying in the weeds waiting for borrowers to become solvent again before pursuing collections. No lender has forgotten they are owed money.

The conclusion expressed by the author has far-reaching implications. As he saw it, “More and more Floridians who pay their mortgage feel like chumps compared to defaulters; they turn over their disposable income to the bank and know it will take most of their lifetimes to recover.”

As prices slide to new lows in metro after metro, will this attitude toward defaulting spread from Florida to more and more of the nation? A May 2010 Money Magazine survey asked readers if they would ever consider walking away from their mortgage. The results were sobering indeed:

• Never: 42%

• Only if I had to: 38%

• Yes: 16%

• Already have: 4%

In late January of this year, a report on strategic defaults issued by the Nevada Association of Realtors seemed to confirm the findings of the two studies I’ve discussed. The telephone survey interviewed 1,000 Nevada homeowners. One question asked was this: “Some homeowners in Nevada have chosen to undergo a ‘strategic default’ and stop making mortgage payments despite having the ability to make the payments. Some refer to this as ‘walking away from a mortgage.’ Would you describe your current or recent situation as a ‘strategic default?’”

Of those surveyed, 23% said they would classify their own situation as a strategic default. Many of those surveyed said that trusted confidants had advised them that strategic default was their best option. One typical response was that the loan “was so upside down it would never have been okay.”

What seems fairly clear from this Nevada survey and the two reports I’ve reviewed is that as home values continue to decline and loan-to-value (LTV) ratios rise, the number of homeowners choosing to walk away from their mortgage obligation will relentlessly grow. That means growing trouble for nearly all major housing markets around the country.

Strategic default is the snowball increasing in size as it rolls down hill. Even Fannie Mae has noted that nearly twice as many borrowers think its okay to walk away from their mortgages than just on year ago (more on that later)

The momentum of this second leg down in pricing will likely pick up speed as more and more borrowers strategically default. The only option lenders have is to increase shadow inventory and allow more squatting, but that will in turn encourage more strategic default because borrowers know they get an extended period of free housing.

The herd is spooked, and the stampeded that follows will lead to Las Vegas style market capitulation in many other markets around the country.

He changed his mind

One change in the market I have noted this spring is the number of heavy-cash or all-cash buyers from the bear rally who are bailing out. After two years of negative cashflow and no appreciation to show for it, many FCBs are becoming impatient.

The owner of today's featured property paid $755,000 on 12/26/2008. He used a $417,000 first mortgage and a $338,000 down payment. Like many before him, he is pricing the property at breakeven in hopes a greater fool will come along.

I don't think that greater fool exists in this market. We will see.

Irvine House Address … 14 ROCKY Knl Irvine, CA 92612 ![]()

Resale House Price …… $799,900

House Purchase Price … $755,000

House Purchase Date …. 12/26/2008

Net Gain (Loss) ………. ($3,094)

Percent Change ………. -0.4%

Annual Appreciation … 2.4%

Cost of House Ownership

————————————————-

$799,900 ………. Asking Price

$159,980 ………. 20% Down Conventional

4.62% …………… Mortgage Interest Rate

$639,920 ………. 30-Year Mortgage

$140,921 ………. Income Requirement

$3,288 ………. Monthly Mortgage Payment

$693 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$167 ………. Homeowners Insurance (@ 0.25%)

$0 ………. Private Mortgage Insurance

$380 ………. Homeowners Association Fees

============================================

$4,528 ………. Monthly Cash Outlays

-$789 ………. Tax Savings (% of Interest and Property Tax)

-$824 ………. Equity Hidden in Payment (Amortization)

$277 ………. Lost Income to Down Payment (net of taxes)

$120 ………. Maintenance and Replacement Reserves

============================================

$3,312 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$7,999 ………. Furnishing and Move In @1%

$7,999 ………. Closing Costs @1%

$6,399 ………… Interest Points @1% of Loan

$159,980 ………. Down Payment

============================================

$182,377 ………. Total Cash Costs

$50,700 ………… Emergency Cash Reserves

============================================

$233,077 ………. Total Savings Needed

Property Details for 14 ROCKY Knl Irvine, CA 92612

——————————————————————————

Beds: 5

Baths: 3

Sq. Ft.: 3100

$258/SF

Property Type: Residential, Condominium

Style: 3+ Levels, Other

View: City Lights, City

Year Built: 1975

Community: Turtle Rock

County: Orange

MLS#: P779956

Source: SoCalMLS

Status: Active

——————————————————————————

The model E has been modified and the downstairs storage areas have been converted to a large bedroom and bathroom on the ground floor. Huge living spaces, two fireplaces and gorgeous hand scraped hard wood floors.  Large master bedroom with huge views over the city of Irvine and a spacious bathroom with separate shower and tub, double sinks and walk in closet. There is a separate laundry room, off the huge kitchen with gorgeous granite counter tops and new dishwasher and a private outside patio just right for BBQ's and a quiet morning coffee and paper reading! New upgraded carpet and padding throughout and Italian porcelain tile on the bathroom and kitchen floors. New fittings and fixtures in wetbar and bathrooms and kitchen, just move in!! What a FIND!

Large master bedroom with huge views over the city of Irvine and a spacious bathroom with separate shower and tub, double sinks and walk in closet. There is a separate laundry room, off the huge kitchen with gorgeous granite counter tops and new dishwasher and a private outside patio just right for BBQ's and a quiet morning coffee and paper reading! New upgraded carpet and padding throughout and Italian porcelain tile on the bathroom and kitchen floors. New fittings and fixtures in wetbar and bathrooms and kitchen, just move in!! What a FIND!

From my brief look, it appeared Miami-Dade county had the worst overall 90+ day default rate, at 23%. There is another, probably less important, but still significant factor – the cultural hurdle to default. I think that is similar to the cultural hurdle to suing your doctor. So it should be no surprise that Miami-Dade county is one of the worst places for medical malpractice

With the 6% commissions on sales and significant other transaction costs (closing costs, moving, cleaning) the housing market needs some positive price appreciation to stay lubricated. Higher rates of appreciation fuel even higher rates of appreciation because of the ability to extract equity to put towards down payments. Say the 20% down payment is the limiter on prices. 10% appreciation per year gives you enough equity to double your home ‘value’ in 4 years. Do it for more years and higher or lower rates and you’ll see a lot of down payment equity for most of the bubble areas.

I suppose that many of the high Vantage scoring crowd in the Morgan Stanley study had purchased properties for investment value, versus to occupy themselves? Assuming that is true, there would certainly be less of an impediment to strategic default, either on psychological/moral grounds, or from an investment strategy standpoint…. Not that the potential effects on the RE market are any less onerous regardless of the reason…

Fascinating article. Two questions:

1) I’ve seen the Zillow estimate of 28% underwater, and other estimates. And I’ve read that HELOCs are notoriously difficult to fully count. But even if they’re difficult to count, why would Zillow publish something misleading? If Zillow did not count the HELOCs, then their 28% underwater figure is totally inaccurate. Especially here in SoCal, where HELOC abuse was endemic. So my question is this: Is the Zillow statistic (and others I’ve seen that are also in the 25% underwater range) TOTALLY BOGUS???

2) IR, you said that “Lenders are merely laying in the weeds waiting for borrowers to become solvent again before pursuing collections. No lender has forgotten they are owed money.”

–What about situations where the loan was settled? I know several people who settled their 2nd mortgages (with the 2nds actually being recourse) for less than full amount with a particular lender. They signed the settlement contracts, paid the settlement amount,took a hit to their credit scores, and declared it in their taxes. In the settlement contract, the lender explicitly stated that after the loan is settled, the lender won’t go after them for any deficiency. Can the lender still go after them? Wouldn’t that be violating the contract?

–What I asked one of them was this: What if the bank sells the loan to a collector, and the collector goes after you? Would that be legit, where the bank says “See, we’re following the terms of the contract. It said WE can’t come after you for the deficiency, but it never said HE can’t come after you, Ha Ha Ha!!!”

H

I just discovered IR’s repost of my article. Great question that you ask. Not bogus, just very misleading and inaccurate. I have yet to see a negative equity study that included the second liens, especially HELOCs. Seems it very hard to track both a first lien and a second lien on the same property for the data providers. So Zillow doesn’t try.

As I said in my September article about the HELOC disaster on minyanville.com, there were 13.2 million outstanding HELOCs in late 2009 according to Equifax. That article also included very reliable stats on HELOC originations in California from CoreLogic. It’s mind-boggling. I venture to say that 99% of properties with these HELOCs in California are underwater.

So the sad but obvious conclusion to me is that there is no housing bottom in sight for California.

Keith,

Thanks for stopping by. I love your work.

not too fret ; we’re all saved ; post just now on my facebook from the NAR meetings going on in DC as we speak :”Economic and Residential RE Outlook at NAR – Lawrence Yun sees stronger second half. Good news!”

But I thought we were in the middle of the yearly spring selling season where house debtors line up to buy new houses so their children have a warm place to do their homework when school begins. We should be seeing massive euphoria and surging demand.

Oh well, maybe all that pentup demand will show up in December when the Christmas shopping season hits full swing.

Why is the author of the article “sobered” to learn that many people think it is OK to walk away from their mortgages? Of course it is OK. It is a contract, and the contract states in essence “pay this money each month or we take back the house”. So, they are satisfying their obligation by giving back the house. (Squatting for months is a bit of a gray area…) A mortgage isn’t a sacred covenant signed in blood, for God’s sake. The lenders would like you to think that way, because then maybe you will make a few more payments on your dead weight asset.

The lenders and corporate America in general exhibit this kind of behavior ALL THE TIME. If you have a bad year in sales, you lay off a bunch of workers. Very, very few companies will dip into reserves to pay workers, and I’m sure companies that will take onerous loans to maintain their workforce are quite few and far between. An office building downtown in the city where I work was recently foreclosed on. It was a 100 Million dollar foreclosure or something so it made the news. The CEO or CFO or something of the Commercial Real Estate firm that owned it said something like “We didn’t feel it was a viable investment going forward”. Now THAT is a strategic default. Damn. “Just Business.” I’m sure he sleeps quite well at night after pulling his Lexus into his Newport Beach garage.

“I’m sure companies that will take onerous loans to maintain their workforce are quite few and far between.”

Except if you’re the Dodgers owner.

McCourt saddled the Dodgers team with loans so that he could continue to run the organization and skim off lucrative management fees. He was also taking up front cash on TV deals that were negotiated at less than market rates to get his hands on the money right away. So would corporate denizens saddle their companies with debt to pad their personal net worths? Haven’t they for a while.

FCBs money in Irvine is geared toward new and contemporary.

Turtle Rock does not fall into that category.

Yep, this is the Ds not the FCBs.

What does this sell for? Above the 2008 sales price and by how much?

That Irvine housing “crash” sure is a bi@tch!

Right again PR

Where are all those detractors with their updates on the 10-Year?

Not a peep when it falls

Ten, yep, but I love my haters they keep me motivated. Besides I make money being right and that’s the real pleasure I get.

Anywho, weren’t we supposed to be at 9% mortgage rates by now?

Check out that 5/1 ARM: 3.1% – devastating. Do I hear 2.9% coming soon?

I’m with you PR, keep up the great work and don’t give up the fight.

Yeah, it was supposed to be 9% rates

and BLACK HAWK DOWN for the Irvine housing market.

April 2010 vs April 2011 YOY

Irvine 92603 Median Price down 52.8%. Only 27 sales.

Irvine 92602 Sales down 12.5%, prices about flat. Only 21 sales.

Irvine 92604 Median Price down 10%, sales down 17%. 29 sales.

Irvine 92620 Median Price down 14%, sales about flat. 49 sales.

Irvine 92618 Median Price down 20.5%, sales up 31%. 38 sales.

Irvine 92606 Median Price down 7.7%, sales up 42%. 17 sales.

Irvine 92614 Median price down 24%, sales down 16%. 21 sales.

Irvine 92612 Median Price down 3.7%, sales down 6%. 31 sales.

It’s a good thing that the “crash” is not affecting Irvine. I assume that anyone listening to PR and tenmagnet last year will be really excited to hear about this bull market that they are experiencing.

Keep up the good fight, ladies. The bull market is upon Irvine.

You can thank the big banks for helping to keep prices up in Irvine, together with the pent up demand for new homes. Banks are keeping distressed properties off the market to help keep inventories low. Treasuries haven’t gone up yet cause we’re still in this big game of extend and pretend. Once we can’t play that game anymore, watch equities and real estate slide like a water ride. There will be plenty of sad faces in Irvine the next few years, those who bought into the hype recently..

Nice David, now give us the comparison of the LOW versus where the prices are TODAY.

I’m just hoping the sales of Laguba Alturaa drop like a rock, but I see a lot of new faces from other countries here. In fact, as I drive down the street, in some areas it’s all asian. Kinda like when I drive in Santa ana how it’s all latino. See? You *can* compare Nirvine to San Tana.

$258/sf seems pretty cheap… And it was sold in 2008 for $244/sf? Was this a foreclosure back then? That crash sure was a b$@ch for this house, it happened way earlier than rest of Irvine…

PR did this the other week in a similarly spurious claim where he claimed that a house was selling for the 2007 asking price; the implication being that Irvine house prices in general are fetching ’07 prices. Then when you look at the data you see that what it sold for in 2007 was actually WAY lower than what the comps were selling for at the time.

Hey PR – no comment on the price reduction at 2 Sunpeak? Is it too much of a WTF price even for a bull like you?

In general housing prices in Irvine haven’t changed much since the end of 2007-2008. Some premium neighborhoods have gone up in price.

The real “devastating crash” happened from 05/06 to late 07. The median changed with mix since then, you need to look at single data points like this to see reality. Premium neighborhood SFRs are up, even Columbus Grove seems to fetch a million dollars, yep CG, the facts are crazy aren’t they?

Damn that 5/1 ARM heading into the 2s%

Oh, so you are going with the 5 year ARM now to re-arrange the goal posts for the 2% interest rates that you did not predict but agreed 110% with?

I am sticking with 30 year FRM. Still a ways to go.

No one in Orange County would ever use a 3.1% five year Arm, interest only, no sir.

Why would we be talking about ARM rates and housing? Are you trying to be a house trader and flipper? 99.9% of people on this board are most interested in the macro trend and trade. And that trend is still much intact: Lower prices nearly across the board. Recent activity is nothing but, a correction – just like the artifical rise in housing after the tax credits in 2009.

Feel free to talk about 3.0 or 2.0 percent ARMS. We’ve seen how well they work out for the real home buyer.

Why is it so difficult to admit that prices will be flat at best over the forseeable future? And here is why:

1. Rising rates = lower prices to maintain carrying costs. The smartest people in bonds Bill Gross and Jim Rogers are short treasuries. This because they are macro traders and look out 5-10-20 years. Inflation will go up and down in the short term but, can only go higher as time goes on… do you really think we have a normal market when the FED is buying bonds to keep rates low??

2. Stagnant Wages

3. Underwater Homeowners and more foreclosures to come

4. Increasing downpayment requirements coming thanks to FinReg and ‘qualified mortgages’

5. Tax increases likely to come for all of the people that can afford anything nice in Irvine or OC. You have to make a good living to afford $1M home with 20% down

Reallly?? You don’t think these things are significant?? Good luck with that…

As IR as demonstrated many times – housing prices are just simply STILL too high and out of whack compared to incomes and historical trends.

Housing head winds are enormous when it comes to pricing here in OC. Sideways at best.

My .02

BD

There’s another launch of 597 homes coming this weekend.

Why does TIC bother even building all these new homes, introducing even more supply into the market knowing they won’t sell?

It’s a misconception that people are not looking to buy in Irvine or willing to pay the premium.

Apparently the premium they are willing to pay in the current market is not as high as the folks who bought last year.

Why would the Irvine Company care? They could cut the price of the houses they build by 50% and still make a profit. Ask them how much it really costs to build one of those tract houses.

It’s still a premium and in some cases much higher than what others paid last year.

500 new underwater buyers in the next 3-4 years in one development alone. sweet, that should fix the Irvine market!

I guess the TIC greed never ends. why wait 5-10 years til the market stabilizes toward real recovery. build and sell ’em while you can, apparently.

“…The attorney was providing sound advice. After a strategic default or a foreclosure on a non-recourse loan, borrowers should declare bankruptcy…”

I think you meant to write “on a recourse loan.”

There’s no concern here in California on purchase money mortgages, as they’re non-recourse.

Thanks. I changed the post.

From Mark Hanson Advisors:

“With respect to negative equity as it relates to the housing market and repeat buyers — the much needed but missing ingredient to a magic housing fix — effective negative equity is far greater. This is because to rebuy a homeowner has to sell, which means paying off the first (and second) mortgages, paying a Realtor 6% and putting 10% to 20% down on the new purchase. When you lower the negative equity thresholds to real life, effective negative equity is epidemic and will keep the organic buyer — especially at the mid-to-high end — at bay for a generation.“

Building Wealth through Renting

Link to Fed Paper

Irvine Renter –

Your hardwood graphic should say

“I love scraping hardwood”.

Scraping the hardwood by hand in these houses. I tell you, those Irvine contractors are quite the motley crew aren’t they.

The divergence between List Prices and Sale Prices in Irvine is now $25/sf: Irvine Market Trends graph as of May 9, 2011

Sellers are listing at an average of $342/sf, but properties are only selling for an average of $317/sf. The divergence on SFR’s is even worse! SFR sellers are listing at an avg of $366/sf, but they are selling at $338/sf.

That’s some powerful kool-aid!

-Darth

Hmm, I still seem to be having trouble with inserting links into my posts. Trying again…

Irvine Market Trends graph as of May 9, 2011

…hopefully, one of those will work.

-Darth

add a space between ‘a’ & ‘href=’

Irvine Market Trends graph as of May 9, 2011

Nope. Hmm, following this advice from iho:

“Darth,

Replace the ‘[’ ‘]’ with ‘<’ ‘>’ in my example below:

[a href=“http://whatever.com”]Description[/a] ”

OK, trying again…

Irvine Market Trends graph as of May 9, 2011

Here’s the web address if it still doesn’t work: http://www.redfin.com/city/9361/CA/Irvine

-Darth

Like this:

[a href=”http://www.redfin.com/city/9361/CA/Irvine”]Irvine Market Trends graph as of May 9, 2011[/a]

Swap each “[” with “<" and each "]" with ">”

and you get :

Irvine Market Trends graph as of May 9, 2011

OK, ignore the “B” tags. Was trying to bold the “[” and “]” characters. It didn’t like it.

[

]

Yep, that’s what I did, but it didn’t work. Look at my 2nd post above. It includes this line:

The line directly above that is identical, but with a space between the ‘a’ and the ‘href’. That should work, right? Dunno why it isn’t. Here, I’ll enter it again:

[a href=“http://www.redfin.com/city/9361/CA/Irvine”]Irvine Market Trends graph as of May 9, 2011[/a]

…substituting ‘<' and '>‘ for ‘[‘ and ‘]’ should convert to:

Irvine Market Trends graph as of May 9, 2011

We’ll see if it does.

-Darth

Nope, still broken. Err, sorta. Now it’s automatically converting the hyperlinks!

Methinks some site upgrades may be underway.

-Darth

You have to put a space between “a” and “href=”

You entered “ahref=”. Should be “a href=”

Everything else was correct.

Yes, I know about the space. The line without the space was put in to show you how the previous line looked. That’s what I was referring to when I said “The line directly above that is identical, but with a space between the ‘a’ and the ‘href’.”

If I enter it without the space, then it shows up like this, and people aren’t able to troubleshoot as well: Irvine Market Trends graph as of May 9, 2011

I entered it again with [ and ] instead of < and >, just in case it was unclear what I had said above. At this point, I’m pretty certain that I’ve entered it correctly. If you spot something else that’s entered incorrectly, feel free to point it out.

-Darth

Copy-pasting what you posted but added a space between href.

Irvine Market Trends graph as of May 9, 2011

Yeah, that’s what happens whenever I enter it. Dunno what’s going on. Something wonky with the forums, maybe.

-Darth

I’ll take a shot here.

This is your original post w/the less than and greater than signs and a space between a and href.

Irvine Market Trends graph as of May 9, 2011

This is the same line with

in front and

after on the same line.

Irvine Market Trends graph as of May 9, 2011

The following two links are the same as above except I’ve replaced the ‘<' with (shift-8)lt; and '>‘ with (shift-8)gt; . Note, ignore the (), they are just for readability.

<a href=“http://www.redfin.com/city/9361/CA/Irvine”>Irvine Market Trends graph as of May 9, 2011</a>

<a href=“http://www.redfin.com/city/9361/CA/Irvine”>Irvine Market Trends graph as of May 9, 2011</a>

Let’s see what happens.

I have no idea what is going on…

Heheh, welcome to the club! 🙂

-Darth

Testing…

Test

Finding a remodeled home that actually used their heloc money could be a decent buy because they have been forced down in price but real value is inside these homes because they have been upgraded or remodeled.

Those without mello roos and in lower tax areas are competing with the older homes that owners still want their perceived value out of them but can’t compete with the fixed up home.

Those folks who bought before 03′ possibly 00′ and made these repairs have equity in their homes are now seeing prices come under their gains are now putting them up for sale.

It appears ten years has been lost in some homes for equity gain. Especially those without any improvements.

What happens to these older homes they eventually go for sale much lower and are on the market the longest amount of days. No investor will pick them up because the cost to fix them up is too high unless they become foreclosure victims.

And even in some cases the loans on them are still so high that cost to repair is prohibitive to any kind of gain. This pressure is more intense further south of Irvine I have noticed in my home shopping experience—jmo

The problem is that the sellers of most of the upgraded homes VASTLY overestimate the real value of their improvements. Take 24 Wayfarer, for example: http://www.redfin.com/CA/Irvine/24-Wayfarer-92614/home/4692458

They made a bunch of very nice upgrades, and now they think their house is worth $430/sf!!! WTF?!?! At $675,000, they are almost $200K over the recent sale comp at 9 Spring Buck, which is a non-upgraded model match. And that’s after a $20K price reduction a few weeks ago.

IR profiled this mismatch here: https://www.irvinehousingblog.com/blog/comments/irelands-housing-bubble-like-ours-only-worse/

As he pointed out, with 2 recent sales on the same block below $490K, 24 Wayfarer will be lucky if they appraise for $525,000.

-Darth

People want what they think their house is worth and many of the folks I meet are very emotional about their remods. If you use a bank they will say it won’t appraise but these folks still don’t care it’s for you to come up with the rest in cash—The silly part is it’s still not based in reality but their price for the sweat and tears and the years they lived there. Owners it’s still used–And may not be your taste!!!!!

Y’know something I haven’t heard in several weeks, at least? The NA[r], or any of its state-level parrots, attempting to spin this as a good housing market. It’s probably been at least since March that I heard the last bit of ridiculous BS from Lawrence Yun or one of the other NA[r] tools. It seems that this current market is so bad (and they are so low on credibility), that even the spinsters are ashamed of their own BS.

Even the shills at the OC Register have caught on a bit. They aren’t even shameless enough to slap cheery headlines on the dismal news anymore. Here are 3 current OC-Reg articles:

O.C. home sales dip, 9th fall in 10 months

http://lansner.ocregister.com/2011/05/12/o-c-home-sales-dip-9th-fall-in-10-months/109533/

Analyst: Spring homebuying looks lame

http://www.ocregister.com/articles/analyst-300200-call-spring.html

Housing market ‘in a rut’

http://www.ocregister.com/articles/-300334–.html

-Darth