In an appauling display of collective victimhood, a recent rally of loan owners and formerly owning renters came together to bond over their victim status.

Irvine Home Address … 4391 BERMUDA Cir Irvine, CA 92604

Resale Home Price …… $415,000

And some say this can't be real

And I've lost my power to feel tonight

We're all just victims of a crime

When alls gone and can't be regained

We can't seem to shelter the pain inside

We're all just victims of a crime

Avenged Sevenfold — Victim

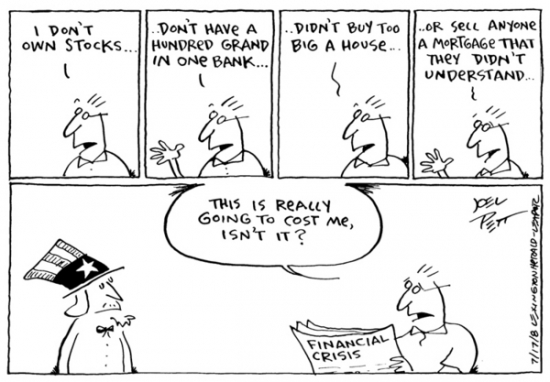

Whenever someone does not want to take responsibility for their own actions, they claim victim status. Our society is rife with this nonsense. Each time we bail out one group or another, we enable and encourage victim thinking. People portray themselves as a victims, and if a critical mass accepts these people are victims, then political pressure mounts to give them money. Perhaps I should start a taxpaying renter victim group to see if we can garner some government gold?

Rally: Most homeowners who experience foreclosure are 'victims'

Published: Wednesday, April 20, 2011 10:23 p.m. MDT — By Amanda Verzello, Deseret News

SALT LAKE CITY — Utah is fourth in the nation in home foreclosures, and it's mostly the mortgage industry's fault.

Well, I do agree that lenders are more culpable than borrowers. But just because lenders are more responsible doesn't relieve borrowers of all responsibility for their actions.

That was the message voiced by politicians and activists Wednesday at a rally on Capitol Hill organized by the Utah Foreclosure Crisis Coalition.

Foreclosure prevention workbook? This is asinine. Do we really need a workbook to tell people to pay their mortgage? Wouldn't making their mortgage payment be the best form of foreclosure prevention? Are people so thick that they need this explained to them?

I could write a much shorter workbook. It would only be one page. The text would read, “Don't buy a house you cannot afford.”

“They are not perpetrators,” said Sen. Ben McAdams, D-Salt Lake, of the thousands of Utah homeowners who have recently gone through foreclosure. “They are victims.”

What about the HELOC abusers who irresponsibly borrowed and spent their homes? What about the borrowers who strategically default? Are they victims, or are the banks their victims?

A report recently released by Irvine, Calif.-based RealtyTrac indicated that foreclosures were filed for one in every 98 Utah households during the first three months of this year.

Some people borrowed more than they should have, McAdams said, but they're in the minority.

Oh, really? Responsible borrowers are not losing their homes. The people who are losing their homes are those who over borrowed. Those who borrowed prudently and lost their homes due to a job loss are the minority.

“By and large I don't think that's the average person being foreclosed upon,” he said. “The person who's losing their home today is somebody who lost their job because of the financial crisis.”

McAdams said he thinks the mortgage industry—with its “predatory” lenders—should be more heavily regulated, but that lawmakers can't do it all.

“This is not an easy problem to deal with,” he said. “What's needed, though, is leadership.”

When victims have no rational policy they can get behind, they fall back on the nebulous, “we need leadership” bullshit to rally support.

One way distressed homeowners can find help is by meeting with a counselor whose services are provided free of charge through at least 11 organizations approved by the Department of Housing and Urban Development.

AAA Fair Credit Foundation counselor Ryan Carver said 94 percent of the homeowners who seek counseling from his organization are able to avoid foreclosure and that other centers should boast similar success rates.

Afton January, foreclosure prevention coordinator for Utah Housing Coalition, said counselors can help homeowners make “the wisest decision for them” when facing the possibility of foreclosure.

In the real world, strategic default is the wisest decision for most loan owners. Somehow, I doubt that reality is part of the foreclosure prevention counseling.

But due to federal budget cuts, the counselors may not be around for long.

“Our funding runs out in June,” she said. “Some of our agencies have already seen these effects.”

So that's why this rally is being put on. A group of bureaucrats implementing a bad idea are rallying support from the victims they are enabling so they can keep fostering the victim mentality. I hope their budget gets cut to zero.

The housing counselors have saved the state a lot of money—approximately $147 million between 2009 and 2010—which is why the lack of funding so unfortunate, said Linda Walker, housing supervisor for Salt Lake Community Action Program.

WTF is this woman talking about? How have they saved anyone any money? Perhaps the banks are thrilled they got a few more payments out of a select group of loan owners, but I don't see how spending money on foreclosure prevention saves the state anything.

Nearly all the speakers at the rally said foreclosures don't just affect the people who lose their home, they affect whole communities because of consequences such as a decrease in property maintenance and an increase in crime.

“We are all victims of the housing crisis,” McAdams said.

e-mail: averzello@desnews.com

Yes, we are all victims of the housing crisis. A true victim is someone who through no fault of their own has to endure hardship resulting from the actions of others. People hit by drunk drivers are victims. A false victim is someone who suffers due to their own bad decisions. Alcoholics and drug addicts fall in the false victim category. Loan owners are responsible for the outcomes of their choices. They signed loan papers, and they failed to meet their obligations.

Unfortunately, there is one group of true victims in the housing mess: renting taxpayers. Those of us that didn't participate are being victimized by dumbass programs like these that take taxpayer dollars and squander it. We did nothing to warrant our money being stolen by the government and given to loan owners. We are the victims here.

The ATM got cut off

Ponzi schemes go on as long as lenders provide more borrowed money. And as we all witnessed during the bubble, lenders will often take this to an extreme. Instead of pulling back in 2004 when prices were already far too high, lenders came up with the Option ARM as an “innovation” in finance that allowed them to push prices even higher.

Borrowers became adept at obtaining and spending this money, and many became dependent upon that income to support their entitlements. The owner of today's featured property is one such Ponzi borrower.

- The property was purchased on 7/2/2002 for $300,000. The owner used a $285,000 first mortgage and a $15,000 down payment.

-

On 5/2/2003 the house was refinanced for $289,000.

- On 8/9/2005 a new $400,000 first mortgage was underwritten.

- On 21/11/2006 this property was encumbered with a $417,000 first mortgage and a $70,500 HELOC.

- Total property debt is $487,500.

- Total mortgage equity withdrawal is $202,500.

- Total squatting has been for at least 17 months.

Foreclosure Record

Recording Date: 09/08/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 05/06/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 02/05/2010

Document Type: Notice of Default

Do you ever wonder if I will run out of these? I suppose once they all lose their houses to foreclosure, I will see a few less Ponzis. Or maybe not.

Irvine House Address … 4391 BERMUDA Cir Irvine, CA 92604 ![]()

Resale House Price …… $415,000

House Purchase Price … $300,000

House Purchase Date …. 7/2/2002

Net Gain (Loss) ………. $90,100

Percent Change ………. 30.0%

Annual Appreciation … 3.6%

Cost of House Ownership

————————————————-

$415,000 ………. Asking Price

$14,525 ………. 3.5% Down FHA Financing

4.78% …………… Mortgage Interest Rate

$400,475 ………. 30-Year Mortgage

$89,842 ………. Income Requirement

$2,096 ………. Monthly Mortgage Payment

$360 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$86 ………. Homeowners Insurance (@ 0.25%)

$461 ………. Private Mortgage Insurance

$65 ………. Homeowners Association Fees

============================================

$3,068 ………. Monthly Cash Outlays

-$342 ………. Tax Savings (% of Interest and Property Tax)

-$501 ………. Equity Hidden in Payment (Amortization)

$26 ………. Lost Income to Down Payment (net of taxes)

$72 ………. Maintenance and Replacement Reserves

============================================

$2,323 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,150 ………. Furnishing and Move In @1%

$4,150 ………. Closing Costs @1%

$4,005 ………… Interest Points @1% of Loan

$14,525 ………. Down Payment

============================================

$26,830 ………. Total Cash Costs

$35,600 ………… Emergency Cash Reserves

============================================

$62,430 ………. Total Savings Needed

Property Details for 4391 BERMUDA Cir Irvine, CA 92604

——————————————————————————

Beds: 2

Baths: 2

Sq. Ft.: 1432

$290/SF

Property Type: Residential, Single Family

Style: One Level

Year Built: 1972

Community: 0

County: Orange

MLS#: W11050229

Source: CRMLS

Status: Active

On Redfin: 5 days

——————————————————————————

great location! walking distance to Irvine High and shopping area. at a quiet cul-de-sac. the owner has upgraded it with new paint and laminate flooring in living room and hall way a couple of years ago. kitchen is bright and is adjacent to the backyard. the den can be altered into a bedroom since there is closet in it.

Why does Utah have such a high foreclosure rate? They are in the bottom third of states in unemployment rate peaking this recession at 8%. They are tied for 5th with 1 notice per 97 households with Idaho. The only states that are worse are NV/CA/AZ/FL – the bubble’s epicenter.

Utah has lots of skiing, and second homes. Non owner occupied homes hae been crushed the hardest with the housing bubble. It’s where speculation was most rampant and where the cost of default is smallest.

I only have to think about one of the worst counties in terms of mortgage deliquencies – Miami-Dade. Condo delinquency performance is an ugly number, but the uglier number to me is that at the peak of the bubble, 80% of condo sales were going to ‘investors’. Think they were putting a lot down?

That people don’t talk about the percentage of sales going to ‘investors’ means they are not genuinely being honest about the issue. My thinking on principal reductions has gone 180 to against them. Why? Because I could not think of a real ‘victim’. 5 years ago if someone lost their job, they would just sell their home. They still have to move, and the kids can see it the same was as a foreclosure (as long as the parents are responsible). Moving to an overall housing market where more people, owners and renters alike, can afford and are making their payments is something that will require a lot of foreclosures over the next 3-5 years.

Thank you for your 180 degree turn on principle reductions.

I have never been able to think of people who overborrowed as “victims”, even those who are poor and uneducated, possibly because I have met people who never made it past the 8th grade and yet manage to build considerable net worth just by being frugal and prudent, and creative with their time and efforts. They read their contracts carefully and if they don’t understand them, they hire someone who does. They know how to calculate compounding and they know that you can’t get something for nothing.

I have sympathy for those who lost their houses because of extended periods of unemployment, business reversals, or steep drops in income due re-employment at a much lesser job. But does it make sense, and is it FAIR, to award even these deserving people a massive benefit that will come out of the pockets of unemployed renters, as well as the rest of the population.

There is no way we can be fair and just about the way we distribute favors and entitlements above the basic social safety nets that help people survive when the floor has dropped under them. Anything above that is necessarily an injustice done on someone else-the person who pays but is not eligible to benefit.

http://www.wealthwire.com/news/headlines/1063

Foreclosure Prevention Workbooks, LOL.

One thing I’ve learned from this blog is how craptacular the typical Irvine home really is. I thought Irvine was supposed to be a great place to live. I don’t see that here. Must have been those stainless steel, built-in ATMs.

Most of irvine is really ugly and boring. The older neighborhoods have no charm either as the city was built around HOAs. Some of the neighborhoods look nicer but generally, its not that nice to look at. Neighboring areas are visually better like south OC but don’t have the jobs, schools, or convenience allure.

I disagree. Turtle Rock, the original Irvine Company neighborhood, is just lovely. Great walks, lots of greenery, pretty, mostly unique-ish houses. I like it.

[Posting 1 of 2]

You seem to be repeatedly become angry when you observe a group of people banding together to further their own interests. That does not seem newsworthy to me. What might be newsworthy, is a suggestion for how we (“good and pure Americans” as opposed to the “evilhearted scofflaws”… heavy dose of sarcasm) might band together.

We may choose to disparage people by referring to them as squatters or banksters, but scale and context matter greatly. Just like Freddie Smith of FedEx apparently observed something like, “When you owe someone a little money you have a creditor; when you owe someone a lot of money you have a partner.” And similarly, we tend to fondly remember our “founding fathers” as brave men but to the British crown they were traitors who should have been hung.

You may see folks as debtors and traitors but others may see them as victims and heroes. No one is right or wrong. We merely have our own opinions. When we start to believe our opinions are objective truths we are doomed for, “Pride precedes a disaster, and an arrogant attitude precedes a fall.” I really am sorry to type that I think you tend to suffer from too much pride in many of the astute observations you post on this blog. Come on. People are people. I’ve read some stuff you’ve posted (about saving Las Vegas and not being interested yourself in profiting from the carnage) that has been simultaneously blatantly biased yet also poignantly human.

We are all human, man. Don’t you see that? It’s life. Remember? Noone gets out alive. We are all struggling in one way or another making all sorts of “obvious” mistakes (obvious to others, but often not to ourselves).

I wish you’d lighten up a bit. Then maybe you’d see the humanity- sitting their quietly amongst all the chicanery, deceitfulness, outright lies and other darkness- without succumbing to your tendency towards absolute self-righteousness.

You, in spite of the many clever and insightful blog posts you have written, do not have a monopoly on the truth. Nor do I. How about a little less self-righteousness and a little more humility?

It seems to me that you obsessively excoriate the banksters and the squatters. At first I thought it was clever and cute. But frankly, I’ve grown weary of reading it over and over and over again. IR I think you’re a very sharp guy with a great deal to offer, but your righteous indignation and obsessive focus are gradually driving me away from this blog. Unless you soften and humanize your approach, I predict this blog will become increasingly marginalized until it’s hardly considered more than an obsessive screed.

I’m sorry to say that currently it seems to me that CalculatedRisk.com presents a far more level-headed and helpful approach understanding the subject matter he covers than this blog. To me the guy who writes CalculatedRisk.com seems like a accountant or scientist who for the most part dispassionately writes his blog; whereas to me you seem like a feverish zealot.

If this blog helps you to safely vent your anger and frustration, then perhaps it’s best for you to continue in the same vein. But frankly, I think you and Planet Reality are much more similar to one another in terms of your personalities than either of you would likely care to acknowledge.

You both seem angry to me. You both seem certain that you know the source of your anger. I think this certainty gives you both tremendous strength but it also blinds you to the possibility that perhaps you each have a tendency towards anger and obsession. In other words, cause and effect, at least to some extent, may be reversed.

I do not think it’s a coincidence that we tend to use mad and angry as synonyms today. If I’m not mistaken, initially a person who was “mad” was considered to be crazy. But crazy people are so often angry that we seem to now consider anger and madness to be very similar. In other words, I think you and Planet Reality are looking for something to vent your anger on and simply finding convenient targets (dare I say scapegoats, which comes from the Jewish Torah).

As for me, I’m tired of reading the ranting and raving on this blog. They make me sad. We’ve got some really serious problems in this country that you certainly have the passion and ability to address. But instead it seems to me you too often descend into angry and obsessive vitriol.

It seems to me that this approach is both unbalanced and unhealthy. But hey, I certainly could be wrong. As for me, I don’t intend to keep reading and watching as you guys seem to unwittingly descend into Dante’s Inferno. It’s an ugly place to go. The wisdom of the ages, such as that contained in many sacred texts of many ancient religions, teaches us that.

[Posting 2 of 2]

This blog has great potential to enlighten folks and bring them together towards a common purpose, but I’m sorry to say essentially I don’t think you are moving the discussions on this blog in that direction. I’m starting to think of it more and more as “The Diary of a Madman.”

I hope you’ll carefully consider the final sentence in the quotation below:

*****

http://en.wikipedia.org/wiki/Diary_of_a_Madman_(short_story)

The story satirizes the rampant petty officialdom of the bureaucracy in the 1830s in St Petersburg, and some have interpreted it as going beyond this to become an allegory about the political state of Russia at the time, revealing Gogol’s view of the government from the standpoint of a lowly citizen. The story also portrays the average man’s quest for individuality in a seemingly indifferent, urban city.

*****

Literally or figuratively I abhor our collective tendency (as Americans) these days to move towards war and away from peace. Why is it in times of war people seem to crave peace and in times of peace people seem to crave war? Sure, war is unavoidable in the long run. Another Russian, Tolstoy, taught us that with his famous book, “War and Peace.” But in the short run we should work hard to create and maintain peace.

Therfore, if you haven’t already, I hope you’ll put up a link to an Elivs Costello video in which he sings, “What’s so funny about peace, love, and understanding?”

I hope you and your readers will consider this posting some “tough love.” Furthermore, I sincerely hope you, Planet Reality, all the other contributors, and the readers of this blog farewell. Really. I do.

Calculated Risk has done a superb job staying ahead of the curve, staying level headed, and changing view point to reflect

reality.

What you get here is far different. I haven’t figure out if it’s hypocrisy by design or hypocrisy by ignorance.

Maybe calculated risk overseas the entire country in his posts while IR focuses on select areas where the numbers of heloc abuses are much larger and wider than anywhere in this country.

This is what you seem to be missing here.

Since I have been renting and looking for a house in this area and have lived in many other states no where else do you see simple homes with one million is excess heloc abuse.

IR’s take on our market is right on target.

This was the epi-center of mortgage abuse and continues to be so.

“true believers are not intent on bolstering and advancing a cherished self, but are those craving to be rid of unwanted self. They are followers, not because of a desire for self-advancement, but because it can satisfy their passion for self-renunciation.”

“true believers are eternally incomplete and eternally insecure”

-Eric Hoffer

A fool is one who does not do his own homework–

http://www.fbi.gov/aboutus/investigate/white_collar/mortgage-fraud/mortgage_fraud

FBI has shown us the fraud and has been my source besides living with it here.

IR has been the only one to show it in home after home–

Show me another site where you see all the abuse.

@tlc8386:

“This was the epi-center of mortgage abuse and continues to be so.”

I think you’ve said this before but you haven’t proven it. Are you talking about Irvine? I’m sure there is more HELOC/mortgage abuse in other cities than Irvine.

Your FBI link, as far as I can tell, does not single out Irvine.

Take a ook in the mirror.

Um, “look”?

Beware — When I said something similar on this blog a few months ago (using fewer words) Larry told me “don’t come back”. Dissenting opinions are not really wanted around here, particularly if suggesting a little less vitrol. But if you are good at mindless photoshop images you are a golden god at IHB.

It looks like Patrick Star is still a loyal daily reader too. Why keep reading, Patrick?

I love these posts that demand change under threat of “lost readership”. What kind of leverage is your threat supposed to create exactly? Are you paying money to read the blog or something? Does the blog author stand to lose something if you stop showing up? Explain how it works.

lol Dave, hardly. I drop in here from time to time — much less frequently now that I have moved out of Irvine — and (gasp!) joined the evil loanowner ranks. But since I: 1) used to be a loyal reader and contributor to IHB back before that *change* in mission, and 2) I actually did live in Irvine for 5 years so this stuff really means something to me. Given how infrequently I comment, that should also give you an idea how infrequently old CK reads IHB.

What’s your reason for spending so much of your life here?

I drop in here from time to time

Yes! It was just a big coincidence that you leisurely happened upon the blog today moments after Tech Support’s blog meltdown. Very good.

and (gasp!) joined the evil loanowner ranks

Congratulations on obtaining a mortgage and living the dream.

used to be a loyal reader and contributor to IHB back before that *change* in mission

Oh, the big change in mission. As you can see, the blog has not been the same since that fateful day.

What’s your reason for spending so much of your life here?

It’s a good housing blog with very little interference by moderators. The blog author runs a pretty open dialog and even lets little pricks like you insult him on a regular basis without resorting to banning or deleting posts. Have to give some credit for that.

Right on, Dave — keep on keeping on my man. No matter how infrequently one reads IHB, you can always count Dave saying exactly the same thing each and every day, with special treatment reserved for anyone questioning his hero. For the record, I would hardly characterize one post every six months or so as “regularly insulting him” — but hey, no point in arguing with you. And if your implication above is that I am also “tech suppport”, think again. But your mentor can verify that for you.

But as you wish, I’ll just slink back to my little prick world now, because this was just a slow day at work, giving me an opportunity to do a little trolling. Makes me happy to see I got your blood boiling, though.

Actually, I’ll slink back out to my backyard for a beer. I’ll tip one in your honor, my man. I’d love to give you a visual of how I “live the dream” as you call it after a day at work. You might be surprised at what can be accomplished in life if you shake the bitterness and start approaching life with a glass is half full attitude. Or get laid. Whichever may apply to you.

I’ll expect next time I decide to troll IHB I’ll find I’ve been banned. So I’ll bid you a fond farewell, AZDavidPhx. Best of luck with that karate thing.

LOL, let’s start a get AZDavid laid fund. As a charity we may be even be able to claim a tax deduction.

with special treatment reserved for anyone questioning his hero

I’m not that concerned with climbing the water tower with my bucket of paint to defend Irvine Renter’s honor. You are the one who cast the first stone with your statement: “But if you are good at mindless photoshop images you are a golden god at IHB” which I could only assume was directed at me as I am the one who usually puts up the “photoshopped” images. That is why I assumed you crawled out of the little prick world.

And if your implication above is that I am also “tech suppport”, think again

Not at all. The implication was that you read the blog more often than you claim. I find it hard to believe that someone who comes around once every few months just happened to stumble on the blog today when Tech Support melted down. Doesn’t wash.

But as you wish

Who said I wished for anything? I do not care what you do.

You might be surprised at what can be accomplished in life if you shake the bitterness and start approaching life with a glass is half full attitude.

Yes, I am very jealous of you and all of your accomplishments in life. If only a bank would give me a mortgage I could be the envy of all renters too.

I’d love to give you a visual of how I “live the dream”

Oh, you little tease, you.

LOL, let’s start a get AZDavid laid fund

Well Well, PR. Word on the street is that you are offering services. Want to make a Dollar the hard way? Moo Moo Buckaroo.

Sheesh, I was just trying to help you relax and progress in life.

Easy on the IT karate chop kiddo. Go back to wishing you were a boomer and forget about getting laid.

Oh, stop being a butthurt little child. You obviously haven’t been “banned”, or your post wouldn’t be showing up.

Glad you invested in an Irvine home! Oh wait, you didn’t…

ROFLMAO! Have an addiction problem?

“Beware—- When I said something similar on this blog a few months ago (using fewer words) Larry told me “don’t come back”.”

Yes, I did. Why did you come back?

See further comments below.

“I wish you’d lighten up a bit. Then maybe you’d see the humanity- sitting their quietly amongst all the chicanery, deceitfulness, outright lies and other darkness- without succumbing to your tendency towards absolute self-righteousness.

You, in spite of the many clever and insightful blog posts you have written, do not have a monopoly on the truth. Nor do I. How about a little less self-righteousness and a little more humility?”

I have an opinion. People come here to read it, and they can discuss their own if they disagree. But people who come here to tell me not to express my opinion can piss off. That includes you.

I have to ask. What makes you think I care about your opinion? Is it because I responded to some of your more thoughtful comments? Do you think you built some rapport with me where I might actually pay attention to your bullshit?

“It seems to me that you obsessively excoriate the banksters and the squatters. At first I thought it was clever and cute. But frankly, I’ve grown weary of reading it over and over and over again.”

By all means, feel free to stop reading.

Everyone got F$%#@# by this housing fraud. It started from the top, rolled down to the little people getting “free” money, the ones who bought multiple homes, flipped, invested, etc etc made by far the most out of this FRAUD, but we should really stop looking at them, and cast all our hatred on the little guys who bought, and are now struggling to live in this artificially induced slave mentality to own a house.

I bought I got F$%$^&% in the a#$, and yes, I WILL default, and I *will* legally strip anything worthwhile from my home when I leave. I have learned, that our system sucks, our police force sucks, our military is used as mercenaries for the oil companies, and generally, every politician is full of complete sh!t.

I understand Davids hate towards people like me, after all, I live so large barely keeping the bills paid, but hey, I bought, I DESERVE that sh1t right? F you.

Did the idea that loan owners claim victim status hit too close to home?

Interesting thoughts. One reason I don’t have the anger I sometimes see on this blog is that I have some historical perspective. Namely, the elites have always run the system to benefit their own interests. Always. Sometimes the elites change (for example in Russia in 1917) but soon the inexorable pattern reemerges. Realizing our own powerlessness does make life a little sweeter.

I’m not sure you’re being entirely fair to IrvineRenter, though. I don’t see a lot of anger coming out of his writing (besides his use of loaded terminology). I was so impressed with his evidence and data-heavy approach back in 2006 and it has persisted. I just think the “victimhood” thing really sticks in his craw (he’s talked about this before). When he *does* get angry, though, it strikes me a bit like he is full of sound and fury, but, sadly, it signifies nothing.

That was a very astute observation of the psyche of this blogger, I think. But maybe you should consider couple of things before preaching “tough love”:

1) I read this blog with the understanding that it provides one-sided opinions and observations, and believe that to be the intent. PR then provides the other side. I suppose we could write a long letter to a pro-Republican radio show and ask them to love thy Democrat, but what would be the point of that? Whereas Calculated Risk might provide a more objective observations and that’s definitely worthwhile, I would not expect nor want all blogs about this subject to be such.

2) What provides great entertainment on this particular blog IS the opinions posted by IR, establishing a platform for additional arguments to occur. And I certainly appreciate the likes of PR and IHO that gives differing views, further allowing for banter back-and-forth. That’s not a bad thing.

I think you should ease up a bit yourself…

I try to provide a service. I’m never as one sided as the blogger or the lower quality blog commenters here. The truth always falls far away from the blogger here or Las Vegas, wherever he is. The truth always falls between extreme

view points. Calculated risk has been the best at updating view point in real time to reflect reality.

Oh noble PR, what service is that?

PR is providing services now?

Isn’t that what Pimps say?

You are so full of yourself, it’s hard to take what you say seriously.

Keep on, though.

wow–if you love CR so much than stay there gees no one is asking for your opinion. The service you are providing is what? your opinion–just like everyone else–sounds like what you realy want is your own blog—go for it then–

Bwa-ha-ha-ha-ha! Oh man, that was the best laugh I have had in a couple of days.

Provide a service? Never as one-sided? Higher Quality? You know the truth?

PR – Do you have any idea what a joke you are?

Calculated Risk is smart. You, however, are the master of boring, predictable comments. I think you have a deluded sense of the effect of your input here. Unless your sneaky intent is to convey the POV of banality and obvious trolling. In which case: success!

(Due to the limited embedding on this site, it might not have been obvious that my comment was directed at Planet Reality.)

LOL Yes the blog is full of angry rants and raves. You’ve got to love the astute observers who cannot tell the difference between a maniacal rant vs clever tongue in cheek.

Unbelievable – a 1 Million word diatribe about how “angry” other people are and hypocritically acusing others of acting out with righteous indignation as he threatens to stop reading the blog in “protest”?

OH NO, Irvine Renter better tone it down or Tech Support is going to get medieval and stop reading! GASP! Oh MAN that’s some messed up stuff right there! What’s next? A peace march? Tie some ribbons to some trees? Maybe hold a virtual die-in?

What arrogance.

Doesn’t IR always qualify his opinions? e.g. When he mocks borrowers while they’re claiming victimhood, doesn’t he always add that lenders hold a greater responsibility?

I’ve mentioned in the comments a couple times when IR (in the distant past) had suggested that all borrowers of the last decade made a mistake or are in trouble. He rarely uses absolute terms like this.

Are you personally offended Tech Support? Tell us your victim story. Make me a believer that there is ONE borrower who is truly a victim in this housing crisis. Please. I want to hear it.

You guys have misread me. Until about 6 months ago I’d hardly ever paid much attention to real estate. I still consider myself an utter novice. Frankly I’ve always had a very difficult time getting interested in things like cars and houses. They just don’t do much for me.

I’ve lived most of my adult life in Santa Monica and West Los Angeles. Prices here were all way to high for me to consider buying. It was always much, much cheaper to rent. Therefore, I rented.

I’m a little guy who was looking for a new business to get into. That’s what attracted me to this blog. I very seriously considered the fix and flip business but have recently decided against it. My reasoning is outlined here:

http://tomtarrant.com/new-project-the-painted-lady/

Frankly, I’m tired of the obsessiveness and bickering on this blog. This blog could be something great, but frankly after a couple of months of reading it, I strongly suspect it will not. That’s ok. If it works for you guys then more power to you. Really. To each his own.

As for me, I’m planning on moving on. I wish you guys well.

Jesus, please–we don’t need any more fix & flippers in this world. Can’t you do something productive for society?

I decided *not* to get into the fix and flip business. However, in and of itself, to me at least, rehabbing old houses does actually seem productive for society.

The real estate game we currently have in our society generally seems rife with abuse. Futhermore, having both a husband and wife work full-time at dreary meaningless jobs to pay a mortgage while they let strangers and technology raise their children and prepare their “food” (much of what McDonalds sells doesn’t seem like food to me) seems pretty awful to me.

But that doesn’t mean old houses shouldn’t be fixed up.

Technical Support,

I saw your exchange on the San Diego fix&flip; blog (Tom something or other). I am impressed with the level of thought you put into things. Do you have your own blog? I’d like to read it if you do.

[Part 1 of 1]

I appreciate your compliment. Really. I do. I’m trying to avoid commenting on blogs, let alone creating my own. I enjoy writing so much that I’m afraid I’ll become a “blogaholic.” Seriously.

Look at Irvine Renter. He’s written some very clever things; I’ve learned very much reading this blog. However, Irvine Renter seems like he’s a blogaholic to me. Blogaholic may sound cute, but I think like all addictions it’s unhealthy.

In spite of some of our apparently clever arguments, neither Irvine Renter nor I are really very wise. Honestly, I think we both often cleverly proffer foolish ideas.

For example, Irvine Renter has repeatedly claimed that investors should buy cash flow positive rental properties not cash flow negative ones. Although at first blush, this seems sensible, clearly it is sheer nonsense for it is based on unsupportable implicit assumptions that have often turned out to be wrong.

Warren Buffet has deftly debunked the somewhat popular myth of the so-called “efficient market hypothesis” which claims somewhat unbelievably that stocks are always priced properly (as Buffet has written, “In the short run the stock market is a voting machine; in the long run it’s a weighing machine). However, sometimes, even if a property is cash flow positive, it turns out to be a loser property because rental prices and property values turn out to head downwards.

Similarly, merely because a property has negative cash flow, doesn’t mean the property will be a bad investment. It may be that both property values and rents will go up in the future. Therefore, the negative cash flow may merely be a temporary phenomena. Actually, in some cases negative cash flow may scare away other investors and therefore help to artificially depress the current market price of a property.

Of course, Irvine Renter implicit assumption is that the efficient market hypothesis is correct. It’s not a reasonable hypothesis at all; it’s sheer, unadulterated, nonsense much like the notion that, “We hold these truths to be self-evident, that all men are created equal…” All men equal? Really? 2 + 2 = 4. Equality isn’t a term that should even be applied to human beings.

Instead of uber-rational nonsense underpinning the notion of efficient markets, investors should focus on a deceptively subtle and complex notion: value. Similarly, when it comes to how to treat human beings we should not focus on the rationalistic term of equality but on another *extremely* subtle and complex notion: justice.

It seems to me that folks like Irvine Renter and me, enjoy “hearing ourselves think.” Personally, I’ve been inadvertently mislead by some very clever folks who mistakenly doled out foolish advice which I gobbled up like a hungry mouse greedily devouring cheese laced with strychnine. Now, if you want to read something really wise and enlightening, I recommend joining a traditional religious community and reading their ancient holy books in the manner they proscribe.

Personally, I’m Jewish (as if my obsessive intellectualism wasn’t a dead giveaway). Therefore, I went to synagogue this morning. Reading this week’s Torah portion and the accompanying commentary made me realize how much *genuine* wisdom is contained in that ancient document. As I read this week’s Torah portion and the accompanying commentary, I felt like a mere novice setting out to learn a little wisdom. It was a *very* humbling experience. You know the old saw, “The more I learn, the more I learn how much I have to learn.”

I plan to get out of this “blogging game” and start going to pray each morning in synagogue. As far as I see it, in terms of human nature, essentially there’s nothing new under the sun. Therefore, why try to recreate the wheel when numerous ancient religions already contain much of the accumulated wisdom of the ages? And unlike my “clever” advice in these “astute observations”, the wisdom of the ages has actually stood the test of time. In a week or two who’s going to read this cute little blog post? A thousand years hence, the wisdom of many of our world’s current religions will likely still be avidly read by millions of people.

As Paul Simon sagely observed, “It’s every generation throws a hero up the pop charts.” Will Rogers, Babe Ruth, and the Beatles “all owned the world” in their day. They were “It” man! Now they are but distant memories on their way to being confined to the dustbins of history.

On the other hand, Jesus, Mohammad, the Buddha, and Moses have been studied continuously as wise and holy teachers for thousands of and thousands of years to this very day (literally).

[Woops, the previous post should have started with, “Part 1 of *2*”, this is Part 2 of 2]

If you are intent on reading a blog I’d recommend one I came across recently. It’s by Rabbi Daniel Perlo at Adat Shalom here in West Los Angeles.

http://www.adatshalomtorah.blogspot.com/

Rabbi Perlo is still young and therefore has much to learn but although he hasn’t even been rabbi at Adat Shalom for a year yet, I think he’ll have a very long and very successful career there. I think he’s on the road to becoming a “super duper” rabbi.

I particularly liked this post:

http://adatshalomtorah.blogspot.com/2011/04/power-of-ritual.html

Hopefully this is one of last “astute observations” I’ll post on this blog. Personally, much like television, although the internet has potential to be used for good, sadly mostly we (I) become addicted to it.

Why do we sit mesmerized in front of brightly lit screens instead of congregating with real people who are part of our own authentic communities?

We seem to be like the proverbial moth drawn to an artificial light. Perhaps moths flew up towards to moon so as to be caught up in winds that would distribute them around the world and thereby increase their chances of surviving. Perhaps we are instinctively drawn to the safety of a campfire (which was the first artificial light). But perhaps now this instinct leads us to indulge in unhealthy behavior, such as spending countless hours- looking to outside observers like zombies in a trance- as we sit in front of televisions and computers. Perhaps, perhaps, perhaps. We’ll never know most of the *whys* in life. Frankly, I think we will all doing very well if we learn but a few of the *whats* in life.

Hey, feel free to take my advice, after all, as this blog post clearly demonstrates, I’m not using most of it myself!

Interesting… I’ve don’t think I would ever use the word “angry” to describe IrvineRenter.

We’ve disagreed on a few things, but for the most part, he is usually level-headed. His blog entries may sometimes lean to support his opinion (still waiting for him to admit that the sales pace of new homes in Irvine for 2010 was surprising) but I don’t know if I would classify what he writes as vitriol.

Seeking Alpha is bullish on housing & commercial real estate

http://seekingalpha.com/article/265690-real-estate-update-looking-more-and-more-attractive

[since 2006] disposable personal income has risen by about 15%

I’ll have what he is having.

When you see the stock market making these huge gains of late of course you are going to see some new buying in RE. The ice is melting it’s safer to get back into housing for investors who have not been hurt too badly the last few years. These folks are out there I run into them on every bid of the last 6 homes I tried to buy and yes they are all cash. They are investors. They will buy the prime properties to rent them out. They will buy and flip them. They will buy the properties that are worth the price. This is why buying is up.

Is the value there? A $3.4 house on Bolsana, in Laguna went into foreclosure the owner lost a million and it went into REO sold for 2.1 and now for rent for 10k a month–and for sale for 2.4. Who is winning this?

Did some nice family get their dream house? Or did some investors get more money for their next buy.

IR has stripped away and showed the fraud seeing some buying has not diminshed this fraud only pushed it onto some new buyer.

I can sympathize that almost everyone who got sold an OPTION ARM was victimized by the bank cabal.

Frankly most people are idiots.

Think of the Average person. Think how stupid they are. Then realize half of all people are below average.

Okay, so realize this. Then, Look at the misery.

If some (Moron) is offered an OPTION ARM with some real low teaser rate, they will take it and

not think much further.

What they did was get suckered into a lease with a huge escape penalty. They can walk but it’s hard.

Very few renters got into that because rent is simple. XX/Month, forever, some inflation every other year.

Had the Banks been prohibited from selling OPTION arms and IO’s this would have been a trivial problem.

Banks invented complex finance not consumers.

The reason why folks bought the option/arm is because they thought housing goes up forever. I had many an RE agents tell me now is the time to buy, prices are going up ,take whatever you can get And I told them we are going down and that was 6 years ago.

Housing became a financal market when they changed the taxes for buying and flipping them, changed the profits that are taxed and turned it into a money making business.

Heloc’s were not taxed, owning for two years you could walk away with 500k tax free for a family–so incentive to turn housing into a commodity–on top of the banks making MBS out of them as well.

Packaged and sold world wide. This is what ruined housing.

http://www.doctorhousingbubble.com/rental-roulette-west-coast-california-foreclosures-up-22-percent-santa-monica-rental-5500-or-buy-2-million/#more-4535

now this is a very good assessment of what is really happening

exactly what I am running into–

“The reason I think we are still years away from any normal market is the fact that there is still a large appetite for housing. The current market is now dominated by investors and first time buyers. These buyers are picking lower priced properties but again, a bulk of these people are speculating even for cash flow purposes. Psychologically assessing the market I believe sentiment is still too strong in some areas. The bottom will come when people look at homes more as a place to live instead of an investment. The California market is facing challenges ahead”

I can sympathize that almost everyone who got sold an OPTION ARM was victimized by the bank cabal.

I disagree. Yes, we agree that the banks took advantage of people, but many of these people were happy to jump into bed with these banker Don Juans only to cry rape after they came down with Financial Herpes.

Being ignorant does not make one a victim by default.

Wait for it…

I agree with AZDave on this.

GASP!

Pat B, average intelligence is not equal to median intelligence. A person of average intelligence, by definition, possesses roughly the same intelligence as a large percentage of the population. Only a small group of people would be of higher or lower intelligence.

Half of all people are, therefore, of at least average intelligence, not lower intelligence. You are postulating that most people are of lower intelligence. I think you are incorrect. I think most people stuck in this mortgage mess either let their emotions get away with them and borrowed more than they could ever pay back, lost their high paying job, or both.

Larry keeps the blog focused on how the behavior of many individuals caused enormous pain for all of us. So what? That has a lot of value.

He has shown that there are endless ways that people rationalize their greed and try to dissociate themselves from any responsibility for their actions.

Today’s entry is a perfect example. Cry long enough and loud enough that you are a victim, and you will eventually come to be regarded as such.

The daily stories are fascinating in the variety of, and nuances in, rationalizations, distortions and lies that are being told by different psrties to advance their own cause. This blog is a daily study of human nature and greed. IR has refused to let people forget what got us into this mess and how collective bad behavior was responsible.

THAT is important – when we forget, or let people get away with bad behavior – it starts all over again.

I don’t give a crap about CR’s projections and prognostications. There are more valuable life lessons to be learned over here.

Thank you. I see that you really get it.

Bye.

Larry, as usual, great stuff.

It really cracks me up that some people think you need to change what you do because they disagree with you or don’t like what you write.

I don’t get that either. I write and express my opinions and enjoy the creative outlet. People can take it or leave it. If they don’t like what they find, why do they read it? Nobody forces them to come to this website.

> appauling

try appalling …