Predatory lending happens across the financial spectrum. Subprime lending has long been associated, but today we have a case at the very top of the market.

Irvine Home Address … 8153 SCHOLARSHIP Irvine, CA 92612

Resale Home Price …… $998,000

Such a feelin's comin' over me

There is wonder in most everything I see

Not a cloud in the sky

Got the sun in my eyes

And I won't be surprised if it's a dream

The Carpenters — Top of the World

The top of the world must be a lonely place. But with so many looking up in envy, people strive for a lifetime to reach the pinnacle. Today we have tales of high end property distress in Newport Beach and in Irvine.

Predatory Lending

According to Wikipedia predatory lending is described as follows: “Predatory lending typically occurs on loans backed by some kind of collateral, such as a car or house, so that if the borrower defaults on the loan, the lender can repossess or foreclose and profit by selling the repossessed or foreclosed property.” It certainly looks as if the highest of high-end homes may be a target of predatory lending. After reviewing the following article, I will let you decide.

I want to start by saying I don't know John McMonigle. I have no ax to grind with him, nor do I have reason to take his side. I know nothing specific about this case other than what is in the OC Register article.

High-profile agent's headquarters in default

Lenders have filed a default notice against the Newport Beach headquarters of luxury-home agent John McMonigle.

McMonigle confirmed that the default notice was filed and said his firm also has been sued as part of an ongoing dispute with a bank that cut off construction funding to McMonigle's signature Villa del Lago development in Newport Coast.

“We're intent on restructuring the debt here, and letting it work its way through the courts,” McMonigle said late Tuesday. “We're on it, and I don't think (our building) is at risk.”

McMonigle maintains that the dispute, not financial difficulties, are the reason for lenders moving against his 20,000-square-foot building at 1000 Newport Center Dr., near the Fashion Island mall.

The problem with stories like these where the property owners are specifically named (something I never do here at the IHB) is that their reputations are smeared by implication rather than fact. If McMonigle is delinqent on his loan and his properties are going into foreclosure, the implication is that he is experiencing major financial distress. The facts may or may not bear that out. Mr. McMonigle maintains he is merely reacting to the bank's bad behavior, and his statements may be accurate, and his actions may be justified.

Circle Family Trust, which provided McMonigle Group with a $1 million second loan on the building, filed a notice of default against McMonigle Residential Group Inc., CountyRecordsResearch.com shows.

McMonigle maintains that the Circle Family Trust default notice was triggered by his firm's decision to halt mortgage payments to the building's first lien holder, OneWest Bank of Pasadena.

OneWest had issued a first loan on the building for $9.4 million, according to County Records Research.com.

McMonigle said his firm since paid that debt down to $6.8 million, but stopped making payments in retaliation for OneWest's decisions to withhold just under $2 million from a construction loan and to deny the firm access to $4.25 million in cash collateral that it has on deposit with OneWest.

If this accusation is true, and if the building in question is worth more than the current loan balance, the lender is engaging in predatory lending with regards to his Villa del Lago project, and this property is being drawn into the broader dispute.

It is likely the debt on the office building was paid down from $9.4M to $6.8M due to the loss of value on the property. The lender will want to maintain a safe loan-to-value ratio, and if the property value falls, the loan balance must fall with it. The lender may have the contractual right to compel the borrower (McMonigle) to maintain a certain LTV which required him to pay it down.

The predatory lending is the bank's decision to stop funding the construction loan on Villa del Lago. Whatever that property is worth, it is worth significantly more if it is completed and can be marketed appropriately to high-end clients. If it goes to auction, it will fetch the lowest possible sales price.

Look at this from the bank's perspective. They already have $20,000,000 into the property, and if they add $$2,000,000 more, it makes the house worth $30,000,000. As it sits unfinished, it is probably worth $12,000,000 at auction, maybe less. The bank can buy the property for the amount of their note, finish it themselves, and they can make $8,000,000.

By forcing a stop to construction, the lender can foreclose and step into Mr. McMonigles shoes and take his equity. No competing bidders will step forward at that price point, and even if they did, the bank would probably be relieved to get their principal back on a property that is not complete after the housing bust.

In short, if what Mr. McMonigle alleges is true, this looks like predatory lending.

OneWest filed suit in recent weeks seeking, among other things, missed loan payments on the headquarters building, McMonigle said. His firm is in the process of preparing a counter suit.

“They're playing hardball, and we're at a stalemate with them,” McMonigle said. “They're trying to bring closure to (Villa del Lago). We are, too, and it'll find its way through the courts.”

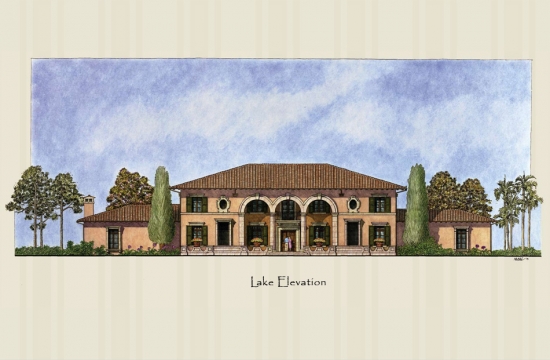

At the heart of the dispute is a $20.6 million construction loan issued by the failed La Jolla Bank for the construction of the $37 million Villa del Lago project, a sprawling Newport Coast estate with a 17,500-square-foot mansion, private lake, tennis court and stables. The property is the priciest house now for sale in Orange County.

OneWest Bank decided to cut off the loan after taking over La Jolla Bank, McMonigle has said. The project is at least 90 percent complete, but the cutoff in financing means that McMonigle and his partners are unable to complete construction.

McMonigle said that he and his partners also have $4.25 million on deposit with OneWest as cash collateral for the construction loan.

“They will not let us tap (it),” he said. “We did not breach (on the headquarters loan) until long after they did.”

A OneWest spokesman could not be reached for comment late Tuesday.

So he has millions on deposit with this bank, but they won't release his money or the loan money for him to complete the project. It doesn't look good for the bank.

The other side

Perhaps the lender is merely protecting itself because the various loans Mr. McMonigle has are underwater? The lender has a right to protect itself by keeping the loan-to-value to a reasonable level, and despite the delusions of high-end owners, prices have fallen.

Further, the lender has a broader look at Mr. McMonigle's financial status. Perhaps he really is distressed. The real estate commissions aren't what they were five years ago. I have no idea, but there may be very legitimate reasons the bank is acting to protect itself and not give this borrower more money.

If the facts bear out the bank's case, everything Mr. McMonigle contends is public relations spin, and I have completely fallen for it.

Is predatory lending real?

If you think predatory lending sounds fartetched, I have seen another lender act in a predatory manner on a project I am familiar with. After nearly a decade in the entitlement process, the developer had four or five million into the project, and the lender had nearly ten million in debt applied. If the project gains entitlement, it's worth $80,000,000. If it sits as raw land, its value is a few million at most.

On that project, I watched the lender start putting the screws to the developer, and with the final vote within sight, the lender triggers some contractual provisions which put a chain of events in motion which lead to the developer defaulting to compel the lender to continue funding and the lender chosing to foreclose instead.

In that instance, the representative for the lender clearly saw the value in the property and figured they could take it back and get the value. In the end, the bank failed to recognize that the developer had “cultivated” the political relationships to get the final vote. The new guy in town had none of this political cloout, so the vote went against the bank and the project was denied.

The developer lost his entire investment, and the bank lost more than 80% of theirs due to greed, stupidity and predatory lending.

That's a BIG loss

I don't have the property records, but the details of who lost what aren't really that important. What matters is that this property lost $884,880! OMG! That is so much money! He buys this place in the summer of 2007 when rumors of a collapsing housing bubble abounded. But he knew better, right?

He tried to sell it for $1,950,000 back in early 2009. Clearly, this owner was a delusionall fool.

At least he isn't the biggest loser in Irvine….

Irvine Home Address … 8153 SCHOLARSHIP Irvine, CA 92612 ![]()

Resale Home Price … $998,000

Home Purchase Price … $1,823,000

Home Purchase Date …. 8/3/07

Net Gain (Loss) ………. $(884,880)

Percent Change ………. -48.5%

Annual Appreciation … -16.3%

Cost of Ownership

————————————————-

$998,000 ………. Asking Price

$199,600 ………. 20% Down Conventional

4.85% …………… Mortgage Interest Rate

$798,400 ………. 30-Year Mortgage

$203,131 ………. Income Requirement

$4,213 ………. Monthly Mortgage Payment

$865 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$166 ………. Homeowners Insurance

$1124 ………. Homeowners Association Fees

============================================

$6,368 ………. Monthly Cash Outlays

-$1023 ………. Tax Savings (% of Interest and Property Tax)

-$986 ………. Equity Hidden in Payment

$371 ………. Lost Income to Down Payment (net of taxes)

$125 ………. Maintenance and Replacement Reserves

============================================

$4,855 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$9,980 ………. Furnishing and Move In @1%

$9,980 ………. Closing Costs @1%

$7,984 ………… Interest Points @1% of Loan

$199,600 ………. Down Payment

============================================

$227,544 ………. Total Cash Costs

$74,400 ………… Emergency Cash Reserves

============================================

$301,944 ………. Total Savings Needed

Property Details for 8153 SCHOLARSHIP Irvine, CA 92612

——————————————————————————

Beds: 2

Baths: 3

Sq. Ft.: 2000

$499/SF

Lot Size: –

Property Type: Residential, Condominium

Style: Two Level, Modern

View: yes

Year Built: 2007

Community: Airport Area

County: Orange

MLS#: S649539

Source: SoCalMLS

Status: Active

——————————————————————————

Expansive views of the nature preserve, mountains and twinkling city lights from this highly upgraded Penthouse (1). Two bedrooms plus den/office, 2.5 baths poised on the 15th and 16th floors of the magnificent Plaza Irvine. Live and entertain in grand style from the gourmet kitchen with Viking appliances, custom countertop with backsplash. Enjoy the custom hardwood flooring, handsome fireplaces both in the master suite and living room, surround sound and PLasma TV in HD. First class service and top of the line amenities. Experience an urban lifestyle that is second to none!

Don’t forget the $1,124 monthly HOA fee.

Properties like this should never have been built in Irvine or anywhere in Orange County. High end urban living in Irvine was a losing proposition from day 1.

They may have been successful had they targeted the high end rental market and toned down the luxuries, size, etc

IR good balanced reporting today, so rare these days

From the listing:

Association Fees Include:

Building and Grounds, Cable TV, Clubhouse, Concierge, Earthquake Insurance, Gas, Insurance Paid, Maintenance Paid, Trash Paid, Water and Sewer Paid

Can anybody price what those are worth compared to the HoA of $1,124/month? Anybody seen the clubhouse?

Might be a good post for IR: status of HoAs, and where the money goes.

Can McGonigle go to a different bank to refinance? If there is a whole lot of equity left in the deal, then there should be a little to give the new bank. Plus, it could be structured as a short-term loan.

Doesn’t this type of action with a developer mean you won’t get a lot of new business from them? Not that banks are really looking for new property development to put money into, but I wouldn’t want to bank with them if I were a business…if the story is true as McGonigle is telling it.

It’s not predatory lending.

The bank is doing the right thing to protect its balance sheet by imposing stricter loan to value requirements.

McMonigle’s cash and assets have deteriorated otherwise he’d have no problem getting bridge debt.

I worked in McMonigle’s orbit for a while… and am familiar with many of his deals.

I doubt he is having money issues. He has been one of the top 5 producing brokers in the country for over 10 years (often being the top), and has an above average turnover rate on homes… all of this while his cheapest house starts at $1mm.

He is an interesting guy because he has become a go to deal maker in OC for buyers that tend to be recession proof… not a bad deal if you can get it.

What I find most surprising is that his office is worth $9mm… It isn’t that big. I guess Fashion Island real estate commands a premium.

If he has so much money and so many options why wouldn’t he just get his bridge financing somewhere else?? Why risk all of this clearly negative publicity??

My guess is that his troubles are real… he probably leveraged himself and his companies up so dramatically that he is facing the very same problems other commercial and residential RE owners have… can’t roll the debt on my stuff b/c it has lost 30-50% value, and he doesn’t have the money to pay the current bills…

Maybe… call me naive but I guess I still get surprised (even though I know better) when someone pulling down coin (like he still does to this day) is stupid enough to go “all in” on a deal or is really careless with their millions. Though it happens all the time (Donald Trump).

Maybe he just refuses to get rolled by the bank.

My guess is he will be just fine.

Another OC poseur who has lived on borrowed money and now owes to everybody.

He even printed his own Magazine M

He probably speaks neither Arabic nor Russian. How will he sell his cheap looking villa?

Here is a private villa of a small Russian oligarch. It looks more Italian and more expensive:

http://englishrussia.com/index.php/2009/10/07/russian-barocco/

Sounds like strategic default on the part of McMonigle.

Everyone else is doing it (just like the councilman in Huntington) so why not jump on that wagon and renegotiate a better rate?

I bet if McMonigle had unloaded before the RE market collapsed, he would have happily posed for various magazine covers, standing in front of a luxury vehicle with a smug smile, lauded as the “Trump of OC”, “OC’s Top Gun” or some nonsense. Sorry, cuts both ways.

Viking Appliances:

http://www.crackthecode.us/images/Viking_Appliances.jpg

Kills em and cooks em.