Having been found culpable in a government report, an embarrassed Ben Bernanke admits he failed to see the housing bubble (but it's okay because everyone else failed too, right?)

Irvine Home Address … 14 VIENTO Dr Irvine, CA 92620

Resale Home Price …… $360,000

You've been caught in a lie!!

You can't deny it!

So let the war begin

You're far from innocent

Hell I just don't know where it will end

You are the one to blame

Another fallacy

Is laid in front of me

Now I just don't know

What to believe

This idiot won't let me go

Slowly penetrating the mind

Disturbed — Deceiver

We want our government officials to lie. We must, or we wouldn't continually put liars in positions of power. Ben Bernanke made a number of public statements around the peak of the housing bubble and during the financial meltdown that suggested his grasp of the obvious was challenged.

Personally, I prefer to assume men like Bernanke are knowingly deceiving the general public to avoid feeding into a financial panic. If Bernanke is as clueless as his public statements make him out to be, he is more like Greenspan than I am comfortable with, and our financial system is being run by a fool.

Last week I noted that the government commission to study the housing bubble and the financial meltdown found Greenspan and Bernanke responsible for the debacle due to their negligent handling of monetary policy.

Bernanke Says Fed Failed to See Broader Risks From Housing

By – Jan 27, 2011 9:14 AM PT

Federal Reserve policy makers failed to foresee a threat to the financial system from the housing market in 2005 in part because central bank economists didn’t find major risks, Chairman Ben S. Bernanke said.

At one Federal Open Market Committee meeting in mid-2005, Fed governors and regional presidents heard staff briefings suggesting that the U.S. mortgage system “might bend but would likely not break” from a large home-price drop, and that the market may rest on “solid fundamentals,” Bernanke said in a Dec. 21, 2010, letter to the Financial Crisis Inquiry Commission, providing his views and revealing new details on FOMC meetings from 2005 to 2008.

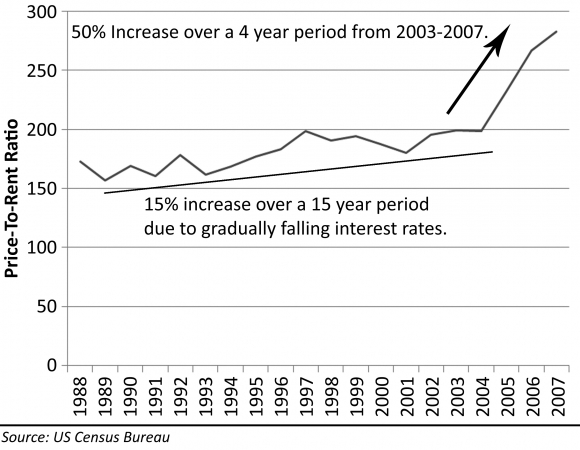

The evidence that prices were not resting on fundamentals was quite compelling. The price to rent ratio went up abruptly.

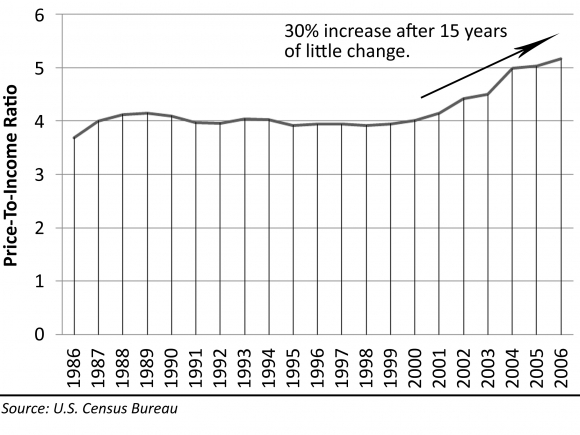

The price-to-income ratio showed the same inexplicable rise after years of flatlining.

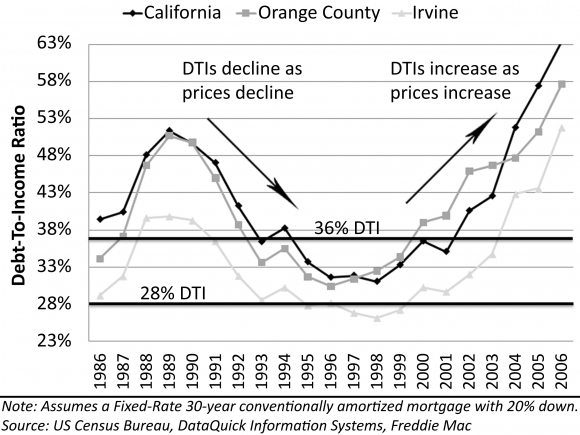

And more importantly, as this is really an market fundamental, the debt-to-income ratio showed borrowers were taking on huge debt loads only sustainable with toxic financing.

Of course, Bernanke argues that none of these were important because money was flowing and the economy was making jobs. In his mind, those were the fundamentals, and anything happening with price would be resolved by continued economic growth. Obviously, Bernanke was totally wrong.

“Given these and other analyses, it was hard for many FOMC participants, in the summer of 2005, to ascribe substantial conviction to the proposition that overvaluation in the housing market posed the major systemic risks that we now know it did,” Bernanke said in the letter, posted on the FCIC’s website.

Really? Given the data above, it is hard not to believe the markets are poised to crash. I said so at the time, and I was not alone.

The FCIC, the congressionally appointed panel assigned to probe the origins of the 2008 credit crisis, heaps blame on “reckless” Wall Street firms and “weak” federal regulators and concludes that the meltdown could have been averted. Some points from Bernanke’s letter are included in the commission’s a 545-page report, released today.

The 2005 presentations were made public this month as part of transcripts of that year’s FOMC meetings. The Fed, which has a policy of giving out FOMC transcripts with a five-year lag, hasn’t published any records from 2006 or later.

It will be interesting to read the meeting notes from later meetings when the housing market was obviously crashing.

Change for ‘Worse’

While most participants at a June 2005 Federal Open Market Committee meeting agreed that “the probability of spillovers to financial institutions from lower housing prices seemed moderate, they recognized that circumstances could change for the worse,” and several officials raised concerns about subprime lending and mortgage-backed securities, Bernanke said in the letter.

Atlanta Fed President Jack Guynn called the housing bubble in 2005.

In 2006, Fed officials “expressed nervousness” about some practices in the mortgage industry, said Bernanke, who became chairman in February of that year. He said he “had in mind increased regulatory oversight” and “increased vigilance” for the implications of housing on interest-rate policy.

He was ready to start looking in to the industry after it already took every housing market in the country to the abyss.

FOMC members were briefed in June 2007 about the liquidation of subprime securities at two hedge funds sponsored by Bear Stearns Asset Management, Bernanke said. Some Fed officials were concerned that the Fed didn’t understand “the scope of the problem” because the central bank couldn’t “systematically collect information from hedge funds,” which were outside the Fed’s jurisdiction, he said.

Extent of Threat

In August 2007, as turbulence in the subprime-mortgage market rose to a “considerable” degree, policy makers at an FOMC meeting disagreed over the extent of the threat to the economy, Bernanke said.

“One participant, in a paraphrase of a quote he attributed to Churchill, said that no amount of rewriting of history would exonerate us if we did not prepare for the more dire scenarios discussed in the staff presentations,” the Fed chairman said.

The federal reserve knows they can commission studies after the fact to justify anything they do. Last year they exonerated themselves for responsibility for the housing bubble. Their argument was that interest rate policy did not cause the housing bubble; therefore, the federal reserve did not cause the housing bubble. The first part is true, but the second part is only true to the degree that interest rates were responsible for the housing bubble. The real failure at the federal reserve was in their oversight of the entire financial system as well as the toxic loans being churned out by the shadow banking system.

At that meeting, Bernanke and his colleagues judged that inflation was their “predominant” concern and left their benchmark interest rate at 5.25 percent. Within two months, they had scrapped that view and begun cutting rates. That December, the worst recession since the 1930s began, and a year later, the federal funds rate was cut almost to zero.

In September 2008, FOMC members briefed on the failure of Lehman Brothers Holdings Inc. were divided on what the government should do in such a situation. Some wanted the government to have no role in a rescue, while others sought capital injections instead of central bank liquidity or monetary policy interventions, Bernanke said.

“My own view at the time was that only a fiscal and perhaps regulatory response could address the potential for wide-scale failure of financial institutions during that period,” Bernanke said. “Such an approach would involve tools such as a robust resolution authority and a capital injection program, neither of which was authorized at that time.”

To contact the reporter on this story: Scott Lanman in Washington at slanman@bloomberg.net.

To contact the editor responsible for this story: Christopher Wellisz at cwellisz@bloomberg.net

The real reason Bernanke had to step in and take over AIG was because the debt resolution of such a large entity with international creditors has not been worked out. In short, if we had not paid off a number of foreign banks (and Goldman Sachs) the entire financial system may have ground to a halt as countries begin seizing assets of distressed companies in an chaotic collapse. A wave of international protectionism and the resulting shutdown of international financial transactions would have been an economic catastrophe. It wasn't the housing market that needed to be saved.

The temporary liquidity operations launched by the federal reserve to get us through the crisis were quite successful. Before the fed enjoys too many kudos, it is worth noting that they were cleaning up their own mess.

Milking the cash cow

Many people who bought their first homes in the early 90s kept the property when they moved up and bought a larger home. It used to be that if you wait long enough, rents would rise to cover even the most bloated mortgage. Not thts time.

With payments on many houses significantly more than rental parity, people are faced with the prospect of negative cashflow, perhaps for decades. Of course, that can be made to work in the short term if appreciation is rampant, but most of the time, running negative cashflow is a financial cancer. All who nurture a negative cashflow investment will be consumed by it.

The owners of today's featured property paid $189,500 in 1991 at the peak of that housing bubble. The must have sustained ownership through a nine-year negative equity mortgage period, also known as a home prison sentence. After enduring such a protracted financial hardship, frugality should have been the lesson of the dark times. Instead, they went Ponzi.

- Their original mortgage data is not available, but they likely put 20% down ($37,900) leaving a first mortgage of $151,600. They may have borrowed more. In any case, on 1/4/1999, they had a $163,000 first mortgage.

- On 2/26/2002 they opened a HELOC for $40,000.

- On 7/24/2003 they refinanced the first mortgage for $200,000.

- On 5/27/2004 they obtained a $100,000 HELOC.

- On 1/28/2005 they enlarged to a $194,000 HELOC.

- On 11/3/2006 they got one last HELOC for $285,000.

- Total debt is $485,000.

- Total mortgage equity withdrawal is around $335,000, but I can't be sure how much was borrowed and spent. What would you guess?

Irvine Home Address … 14 VIENTO Dr Irvine, CA 92620 ![]()

Resale Home Price … $360,000

Home Purchase Price … $189,500

Home Purchase Date …. 5/31/1991

Net Gain (Loss) ………. $148,900

Percent Change ………. 78.6%

Annual Appreciation … 3.3%

Cost of Ownership

————————————————-

$360,000 ………. Asking Price

$12,600 ………. 3.5% Down FHA Financing

4.84% …………… Mortgage Interest Rate

$347,400 ………. 30-Year Mortgage

$73,190 ………. Income Requirement

$1,831 ………. Monthly Mortgage Payment

$312 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$60 ………. Homeowners Insurance

$348 ………. Homeowners Association Fees

============================================

$2,551 ………. Monthly Cash Outlays

-$300 ………. Tax Savings (% of Interest and Property Tax)

-$430 ………. Equity Hidden in Payment

$23 ………. Lost Income to Down Payment (net of taxes)

$45 ………. Maintenance and Replacement Reserves

============================================

$1,890 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,600 ………. Furnishing and Move In @1%

$3,600 ………. Closing Costs @1%

$3,474 ………… Interest Points @1% of Loan

$12,600 ………. Down Payment

============================================

$23,274 ………. Total Cash Costs

$28,900 ………… Emergency Cash Reserves

============================================

$52,174 ………. Total Savings Needed

Property Details for 14 VIENTO Dr Irvine, CA 92620

——————————————————————————.jpg)

Beds:: 2

Baths:: 3

Sq. Ft.:: 1460

Lot Size:: 2,269 Sq. Ft.

Property Type:: Residential, Condominium

Style:: Two Level, Traditional

Year Built:: 1978

Community:: Northwood

County:: Orange

MLS#:: S645459

Source:: SoCalMLS

—————————————————————————-

Charming and spacious Sundance home located at Northwood Irvine. Clean and in good conditon. Newer wood laminated flooring throughout. Newer dual-paned vinyl windows. Open and airy. Large living areas. Kitchen sink and great room opens to back patio for outdoor entertaining. Gas fireplace. Laundry area located in attached two car garage. Closet and half bath first level. Master bedroom suite and bath area with tub redone and updated. 2nd bedroom with large window and natural light. This home is close to and walking distance to public schools and shopping areas with restaurants. Northwood Irvine was once part of the old Irvine Ranch with romantic orange groves history and nearby eucalyptus trees and lining streets and roadways. This is a short sale listing.

I’d be curious to know the segment of Irvinites who buy these condos.

Are they currently living in a 900 sq. ft 2 BR TIC apartment for $1800-$2200 a month?

They see this and say: I can have a 2 car attached, hard wood floors, 1450 sq. ft., more outdoor space, etc for the same or less than what I’m currently paying. ($1890 monthly cost of ownership, even less with a normal Irvine 20% down payment)

Or do those folks want to move and pay more per month for a house with a yard. I’m sure there is a mix of both but curious to know the segment who buys these.

Typically, a housing crash ends when it is cheaper to own than to rent, so your first scenario becomes the norm until distressed inventory is absorbed and prices are pushed back up to a natural equilibrium. Some will hold out for nicer and larger properties, but most will buy when the opportunity is made available.

Most of the nicer areas surrounding Irvine are currently at a price to income ratio of 4.2 – 4.5.

This aligns well with the historical norm for Orange County. This should be expected. What is interesting is that rates are close to half of what they were in the 1990s. Housing is currently more affordable in OC than the 1990s.

Irvine continues to out perform.

Why would someone spend $1800-$2200 for 900 sf when there are numerous 1000+/- sf Northwood apartments and condos listed for $1500-$1700?

Since I don’t believe the “hidden equity in payment” will be recovered if this property is sold in the next ten years, unless considerable extra cash is put into updating (love that 80s dishwasher!), you are really paying $2300/month for this 900sf.

Last time I looked at IR2’s leasing numbers, most irvinites are paying $1.5-$1.7/sf, not $2.5 this gem represents.

This “gem” is $1.3/sf. Face the facts this is more than affordable.

I was referring to the $1800-$2200 that Planet Realtor stated one would pay to rent a 900 sf apartment.

I agree that hidden equity is a joke. Especially for a place like this. Hidden future assessments, appliance replacement and remodeling costs are more likely.

I’m surprised nobody who is currently renting in one of the over 100 irvine co. Apt complexes responded.

I’ll bite. I currently live in Corona del Mar in a place that is much nicer than this (new kitchen/bathroom/flooring), although a little smaller on a sq ft basis, and I’m literally a 3 minute walk to the beach. I pay in the $1500-$1700 range in rent a month.

Why in the world would I want to buy one of these places when I have something much nicer in a far better location for less cost? For that matter, why would I pay something equivalent to live in a TIC property?

This is at rental parity if you have the down payment. I agree with you on this one. Prices in the lower segment of Irvine will only go down by a large % if rates go up, excluding the still overpriced towers.

I mean a couple making 50k each can easily buy this if they aren’t riddled with unsecured debt and expensive car leases.

Lol you hit the lotto then. I tried for 5 years to find what you describe in CDM and couldn’t. Don’t move because you got extremely lucky.

That said comparing the norm to an outlier isn’t exactly fair. I would say that normal CDM prices for the equivalent property is 2200-2400 a month.

CDM Renter, you are paying 30% below market rent for CDM. Some advice: if you are happy don’t bother looking to buy. It will never ever be cheaper for you to buy, never ever.

I’m a bit late to the party, I see.

I am currently renting in one of the over 100 Irvine co. apt. complexes.

That equity-hidden-in-payment thing is a big issue… at this point, I see a greater likelihood of losing money than recouping any of the “equity” unless I keep the place forever.

I’d buy for a place to live, not for an “investment”, and I don’t know that I want to stay in a 2&2 in Irvine forever.

The place would need some work, which will cost some money, plus there’s always the chance of those special assessments that I keep hearing about.

Though I pay lots of attention to the market, having never owned property, I’m not a very sophisticated real-estate buyer yet, so I can’t necessarily assess the risks accurately.

I’m not a buyer of this property at this price. If I could believe that $1890 number, then I might be more inclined to be interested.

Plus it is a short sale (isn’t everything) and so I never know if the price (and listing, for that matter) is real or make-believe.

I’ve never believed it either. Especially since it takes about 7 years to pay down the equity enough to cover the realtor fees, and the average time in a home is 7 years. I don’t understand why so many use it.

I am one of those people PR, not in this complex however. I bought because it was a higher quality of living for the same as I pay in rent. I get a tax break that further pushes me below rental parity minus the large opportunity cost of a 30% down payment. But it was worth it for me. I can easily save as much now as I did before. I can remodel if I want too and rent it out around break even down the road. I definitely am not a big winner but I don’t feel like a loser either.

My neighbors are more respectful then in the echo filled TIC apartment buildings. I do not have to deal with constant moving, parties and such.

I would of waited longer before buying but getting woken up nightly at Villa Siena by a guy on his patio calling Pakistan at 2 am on speakerphone was making me crazy.

LOL, thanks for sharing. There are thousands upon thousands more like you renting in Irvine from TIC, paying between $1800-$2200 per month, who don’t have the 1460 sq ft, hard wood floors, “exposed” brick, fire place, 15 by 15 foot patio, 2 car attached garage,, that this “gem” provides.

Congratulations.

IR:

me too … I have to believe that our officials are just crooked, and not as incompetent as they say they are.

And that fee whoring and lobbyist money inflated the bubble, not profound stupidity.

I love the elephant and Fed meeting images. lol.

IMHO, the free market decides what rental parity “should” be. Outside of the occasional housing bubbles we’ve experienced, the normal situation that the market has settled upon is that rent > own for equivalent properties. Which only makes sense, if you think through the economics of it (rental units have higher upkeep, more vacancies, management overhead, less tax breaks, etc, etc). Yes, this holds true even in premium areas like Irvine.

The vast majority of Irvine homes are currently trading at own > rent. A few, like this one, are arguably own ~~ rent. If you find one of these and like it, by all means buy now. Or if you somehow think we’ve had a paradigm shift and Irvine will never return to the historically normal state of rent > own, then by all means buy now. I don’t think we’ve had any paradigm shift like that, and I’ve never heard anyone make a real argument as to why we have, but if anyone wants to I’d listen.

Bernanke obviously never talked to people at Fitch, S&P or Moody’s:

You can just say that the housing market will bend and not break, but if you do zero research into it, by actually talking to people in the trenches, you’re just giving your opinion. Just asking an i-bank or ratings house, “what will happen if home prices fall 5% (a small drop)?” would have given enough information to not say that the mortgage market could survive a large drop in prices.

Words are important too. Do you want your builder to say that your home ‘may’ sit on a solid foundation. I’d replay, ‘may’…WTF are you talking about ‘may’. That is issue #1 for you to thoroughly check!!!

Bernanke is for the most part a manager. Managers aren’t the ones pushing the paper or making things happen on a loan-by-loan basis, so they are often the last to know how bad things are. Plus he’s rich & insulated. When you see neighbors buying 2-3X more house than they can afford, you know there’s a problem.

There should be a bipartisan call for the release of all fed minutes up to at least 1/1/2008. I understand the issues of the crisis minutes of 2008, but really, those should be released today also. The odds of abolishing the fed are ZERO, but we can bring them a little more into the mainstream by hearing their dissenting voices and smelling their obvious BS.

It is unfortunate that we have to wait to read the transcripts from these meetings. What they did know and what they didn’t know when they made key decisions will be very revealing.

Absolutely, but I doubt they will give up some really shocking things. It will all be like: Yeah, we’ve maybe got a problem here with the housing market, but we’re not sure…Just don’t let the nasty journalists make us do some premature steps!

The minutes go something like this.

Wall Street calling the FED on line 1

Ben answers the phone then asks “Who do I make the check out to?”

I disagree. The degree to which they were presenting fundamentals and coming up with similar conclusions to IR was in 05/06/07, AND that BB could, with a straight face, say ‘subprime’s contained’ is a shock. What we can learn is that keeping this information hidden helps no one. I have to believe that people would have paid attention to it – they paid attention to the nearly unbelievable ‘subprime’s contained’ line.

Bernanke also said:

The ramification of house bubble is our next generation inherits a huge debt for this generation.

And, now, in order to stimulus economics, our generation is borrowing feature job from next generation.

I wouldn’t blame Bernanke.

The real reason of the current mess is that American workers earn too much money but spend their earnings on cheap foreign goods, not American. More money is left to pay for American houses, medicine, education; that’s why their prices skyrocketed.

Can you point to anything cheap manufactured in Irvine?

I think only about Maruchan noodles.

Fisker – produces $100,000 cars. Recently relocated from Irvine to a bigger place for a cheaper price. Its production is overseas.

Breast implants and Botox from Allergan – quite expensive.

St. John’s dresses – expensive.

Broadcom, Toshiba – use factories in China.

Ben:

Good point.

Everything made here just too expensive, we all know, the manufacture job won’t come back and 20% unemployment rate is normal. And the more we stimulus economics, the more debt our next generation will inherit.

But how can I tell public the true without losing my Fed chairman position?

It is you encourage me to lie. And I am the biggest lair in the human history.

“The temporary liquidity operations launched by the federal reserve to get us through the crisis were quite successful.”

IrvineRenter,

Were the liquidity operations temporary?

Are we through the crisis?

Define quite successful.

Calculated Risk did a nice write up on these programs after the majority of them were wound down. I can’t find the link.

I wouldn’t call this one a “gem” but If you can get it at 310-325k it beats TIC route any day as its at or below rental parity then. Its well below rental parity if you come with a large down.

IR said the low end is dancing near rental parity and other then the silly delusional owner priced properties (450k for a 2b2b) I am finding that to be true. The mid level to high end properties have a further 15-20% to drop before they hit parity(based on the current Int rate). By then current condo owners will have amassed another large down payment and off they go irregardless of their current places worth. Because housing is a cost first an investment 2nd.

Hello All –

…ask yourself a simple question if you are considering a purchase in Irvine or any place in CA or other for that matter.

Will rents or rates rise faster over the next decade or more?? Will incomes rise faster than inflation over the next decade or more??

If you subscribe to my thesis – that rates will rise faster than rents and that incomes will rise very slowly over the next decade as we work off the unemployment and underemployment – then prices in CA and the US in general will grind lower for the next decade as wages slowly increase.

Remember, that for every 1 point rise in rates people loose 10% in purchasing power based on current incomes. My bet is that we will have 8-12% 30 year fixed rates in the decade as the US responds to the growth coming from emerging markets (China, Russia, Brazil, India, Asia in general and Australia).

With unemployment so high it is really unlikely that we see wage inflation.

The result is that you buy a place now for rental parity only to find out that in a decade rates have rised from 4.5% to 9%. This means that people buying your property have to have roughly double the income to buy your property and it’s current price.

UNLIKELY. There is NO appreciation on the horizon for CA or Irvine….

And worse still prices haven’t come down nearly enough for most of CA to even get close to ‘rental parity’. Case in point. I just leased a beautiful new place in SeaCliff on the Greens – condo in HB near the golf course and 3minutes ride to the beach! The unfortunate owner subsidizes my living to the toon of $1200/month. Thanks much!!!! I rent 30% less than it cost to own with the very best rates!!!

My new place had a high asking price of $875K and now with $675K…it will grind lower to less than $500K as rates rise or magically I will make 2000 dollars more a month in the next decade!!

I win either way!!! Be dumb if you like…pay more than rent to own with all of the commitment and pray you don’t get fired or relocated. Maybe you are just simply rich and can afford to loose lots of money. Either way, I warn the practical and encourage the idiots (there are really remarkable number of well to do idiots) …your loss is my / our gain.

Remember its not the price you buy at – it is the price you sell at that matter. This is clearly too pedantic but, also realize that if you buy with a 30 year fixed mortgage and money and do nothing but pay your mortgage down you only reduce principle by 19% in 10 years!!! So if rates rise 2% over the next decade you loose your investment!!! Idiots all who don’t do the simple math…

BD

We used to live in IAC’s Orchard Hills for three years. We paid $2,500 for the largest unit. We liked it but had to put up with neighbors who talked continuously from 5pm to past midnight, and neighbors who threw cigarette butts into the common areas, and neighbors above who would walk back and forth all night, for what reasons nobody can figure out. We recently bought an Irvine townhome (nobody above) with a large down payment from money in a CD that was paying about 1.5% yield, so our monthly costs including the lost opportunity costs of CD income is slightly lower than IAC rent, and since we plan to stay in Irvine for a very long time, we are happy with our purchase compared to renting, both psychologically and financially. Plus every year IAC tried to raise the rent and although so far we successfully negotiated rent decreases or same rent, it was stressful to anticipate proposed rent increases everytime the lease came up for renewal. In comparison, over the next ten years, my cost of housing shold stay roughly the same (granted the HOA and prop taxes can increase slightly) but the IAC rent will probably go up, so in the longterm, the IAC option is probably more expensive on a monthly basis than buying at today’s prices (just in my humble opinion).

I have lived in IAC before and had similar problems except for people walking above as we were on top floor.

instead of buying though, we are renting private party and getting killer deal. 1200+ sq ft in avenue 1 2B+loft with vaulted ceilings for 1775 on month to month. How much would rent be in your townhome area?

Rent is about $2,500/mo for our unit in the development that we bought in, but we went from 1200 sf at the IAC apartment to 1600 sf townhome. The larger townhomes that are over 2000 sf are renting in the low $3,000s/mo.

Best of luck all. I’m sure PR has a reason why rates wont simply go back up. There is no inflation in the market. Or maybe my analysis and math are very poor… I would like to hear why you think in general buying a house now in Irvine or CA in general is now a ‘good buy’.

Let’s hear all about affordability etc…. let’s hear how this is wrong????

Please……….. where will rates be in a decade when you sell?? Or do you really plan to be in the house for 30 years??

BD

One other thing about renting from IAC or any apartment complex that we found out the hard way(granted this may not hold true for renting from individual landlords who figure a lower rent from a good tenant outweighs the costs of tenant turnover) is that the initial attractive monthly rent is designed to suck in new tenants who are then subjected to rent hikes upon renewal. After being shocked to find a proposed rent increase in 2009 upon our first lease renewal in a bad economy, we googled “rent increase” stories and found that it’s a common tactic to lure new tenants with low prices and hike them after renters settle in. We found that it’s a common situation in many apartment complexes for long-time renters to actually pay several hundred dollars more a month than new renters, because apartment managers know that moving is such a hassle that most renters pay increases rather than move.

>We paid $2,500 for the largest unit… We recently bought an Irvine townhome

Why would you rent from the Irvine Company and complain about neighbors, when you can rent a nice townhouse from a person?

Like this: http://orangecounty.craigslist.org/apa/2190875105.html

3 bedroom + 3 bathroom + 2 car garage

We rented in Orchard Hills because it had quite a few benefits, it was newly built and had a nice clubhouse area with pool, pretty “luxurious” resort feel, and we originally liked the idea of renting in an apartment complex so we could rent as long as we wanted instead of renting from a private party and having to move if the landlord wanted to sell the property or lost the property if they didn’t pay their mortgage, or deal with the delays in repairs from a private party landlord. IAC was great with any repairs/maintenance issues and the complex was beautiful and we had planned to stay for many years. We just didn’t expect such noisy neighbors but the result was we now have a bigger and better place to live at about the same cost as renting.

When we rented back in the day, I would casually say “Gosh, it sounds good, but I’d hate to think that the price would go up in just a year, etc..” and the really nice guy showing us around would say, “Oh, we don’t do that” or something of that nature.

When we’d sit down to sign the lease, I’d say, “Oh yeah, can you note that my rent won’t go up next year?” It would be deer-in-headlights for a few seconds, then he’d relent 🙂 This was Costa Mesa, though.

“Embarrassed Bernanke admits failure to see housing bubble”

You know what’s even MORE embarrassing? The U.S. population’s failure to see Bernanke’s failures BEFORE he admits to them.

Just an FYI as I live in this neighborhood. HOA’s were $290 just a few months ago. Although the letter claimed other reasons, I am guessing the hike from $290 to $348 is more due to people not paying their HOA’s.