California cities dominate Forbes.com's new list of America's most miserable cities. The housing bubble is the direct cause of the suffering.

Irvine Home Address … 50 ARBOLES Irvine, CA 92612

Resale Home Price …… $420,000

Looking out for number 1

California here we come

Right back where we started from

Hustlers grab your guns

Your shadow weighs a ton

Phantom Planet — California

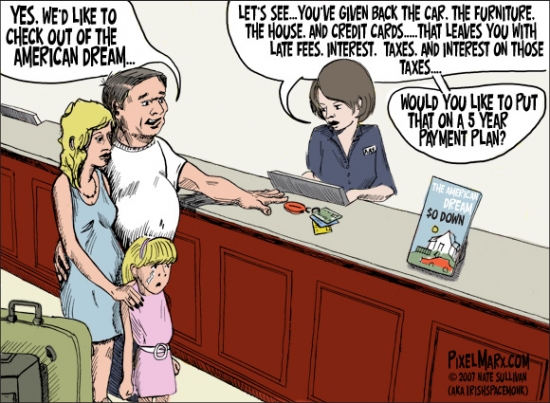

California was the land of milk and honey, but with the collapse of the housing Ponzi scheme, Californians are not being given free money. It's making them miserable.

America's Most Miserable Cities

Kurt Badenhausen, 02.02.11, 12:00 PM EST

California has never looked less golden, with eight of its cities making the top 20 on our annual list.

Arnold Schwarzenegger was sworn in as the governor of California at the end of 2003 amid a wave of optimism that his independent thinking and fresh ideas would revive a state stumbling after the recall of Gov. Gray Davis.

The good vibes are a distant memory: The Governator exited office last month with the state facing a crippling checklist of problems including massive budget deficits, high unemployment, plunging home prices, rampant crime and sky-high taxes. Schwarzenegger's approval ratings hit 22% last year, a record low for any sitting California governor.

California's troubles helped it land eight of the 20 spots on our annual list of America's Most Miserable Cities, with Stockton ranking first for the second time in three years.

Congratulations, Stockton! I remember being contacted by a recruiter in 2005 about a position in Stockton. I remember thinking to myself that Stockton is not where I wanted to be trapped when the housing bubble burst. Construction related unemployment will be high there for a very long time.

In Pictures: America's Most Miserable Cities

Located in the state's Central Valley, Stockton has been ravaged by the housing bust. Median home prices in the city tripled between 1998 and 2005, when they peaked at $431,000. Now they are back to where they started, as the median price is forecast to be $142,000 this year, according to research firm Economy.com, a decline of 67% from 2005. Foreclosure filings affected 6.9% of homes last year in the Stockton area, the seventh-highest rate in the nation, according to online foreclosure marketplace RealtyTrac.

A 67% decline down to 1998 prices. Wow!

Stockton's violent crime and unemployment rates also rank among the 10 worst in the country, although violent crime was down 10% in the latest figures from the FBI. Jobless rates are expected to decline or stay flat in most U.S. metro areas in 2011, but in Stockton, unemployment is projected to rise to 18.1% in 2011 after averaging 17.2% in 2010, according to Economy.com.

“Stockton has issues that it needs to address, but an article like this is the equivalent of bayoneting the wounded,” says Bob Deis, Stockton city manager. “I find it unfair, and it does everybody a disservice. The people of Stockton are warm. The sense of community is fantastic. You have to come here and talk to leaders. The data is the data, but there is a richer story here.”

He is probably right. The misery in a town experiencing economic hardship is not bore equally. Those that are unemployed suffer greatly while those who continue working as during the boom suffer very little, other than perhaps the loss of their home equity. Those that are unemployed and did not take on a toxic mortgage to buy a house suffer most.

There are many ways to gauge misery. The most famous is the Misery Index developed by economist Arthur Okun, which adds unemployment and inflation rates together. Okun's index shows the U.S. is still is in the dumps despite the recent gains in the economy: It averaged 11.3 in 2010 (blame a 9.6% unemployment rate and not inflation), the highest annual rate since 1984.

Our list of America's Most Miserable Cities goes a step further: We consider a total of 10 factors, things that people gripe about around the water cooler every day. Most are serious issues, including unemployment, crime and taxes. A few we factor in are not as critical, but still elevate people's blood pressure, like the weather, commute times and how the local sports team is doing.

The Green Bay Packers do more to uplift Wisconsin than economic data. Go Packers!

One of the biggest issues causing Americans angst the past four years is the value of their homes. To account for that we tweaked the methodology for this year's list and considered foreclosure rates and the change in home prices over the past three years. Click here for a more detailed rundown of our methodology.

Florida and California have ample sunshine in common, but also massive housing problems that have millions of residents stuck with underwater mortgages. The two states are home to 16 of the top 20 metros in terms of home foreclosure rates in 2010. The metro area with the most foreclosure filings (171,704) and fifth-highest rate (7.1%) last year is Miami, which ranks No. 2 on our list of Most Miserable Cities.

The good weather and lack of a state income tax are the only things that kept Miami out of the top spot. In addition to housing problems (prices are down 50% over three years), corruption is off the charts, with 404 government officials convicted of crimes this decade in South Florida. Factor in violent crime rates among the worst in the country and long commutes, and it's easy to understand why Miami has steadily moved up our list, from No. 9 in 2009 to No. 6 last year to the runner-up spot this year.

California has its own miseries it heaps upon its cities. Do you think California will get a federal bailout?

California cities take the next three spots: Merced (No. 3), Modesto (No. 4) and Sacramento (No. 5). Each has struggled with declining home prices, high unemployment and high crime rates, in addition to the problems all Californians face, like high sales and income taxes and service cuts to help close massive budget shortfalls.

The Golden State has never looked less golden. “If I even mention California, they throw me out of the office,” says Ron Pollina, president of site selection firm Pollina Corporate Real Estate. “Every company hates California.”

There are many highly trained and talented people living in California, and this will always be a draw to employers to locate here, but the high taxes and highly regulated nature of the state makes it very unattractive to business.

Last year's most miserable city, Cleveland, fell back to No. 10 this year despite the stomach punch delivered by LeBron James when he announced his exit from Cleveland on national television last summer. Cleveland's unemployment rate rose slightly in 2010 to an average of 9.3%, but the city's unemployment rank improved relative to other cities, thanks to soaring job losses across the U.S. Cleveland benefited from a housing market that never overheated and therefore hasn't crashed as much as many other metros. Yet Cleveland was the only city to rank in the bottom half of each of the 10 categories we considered.

Two of the 10 largest metro areas make the list. Chicago ranks seventh on the strength of its long commutes (30.7 minutes on average–eighth-worst in the U.S.) and high sales tax (9.75%—tied for the highest). The Windy City also ranks in the bottom quartile on weather, crime, foreclosures and home price trends.

President Obama's (relatively) new home also makes the cut at No. 16. Washington, D.C., has one of the healthiest economies, but problems abound. Traffic is a nightmare, with commute times averaging 33.4 minutes–only New York is worse. Income tax rates are among the highest in the country and home prices are down 27% over three years.

I note that Las Vegas did not make the list. An oversight, perhaps?

I also note that Irvine didn't make the list. Like Disneyland, Irvine is the happiest place on earth.

Leaving the family holding the bag

Everything you will read about this property today is speculation based on a few facts. First, according to Redfin, the 2006 sale at the peak was not an arms-length transaction. That usually means the property was transfered to a family member.

However, when that sale occurred, the peak buyer borrowed $545,000 to complete the transaction. Arms length or not, the lender was happy to extend 100% financing to the borrower. Basically, the bank bought this property at the peak in exchange for the buyer's credit score.

If this was a family member non-arms-length transaction, how do these two parties feel about it? The original owner sold at the peak and obtained a huge windfall. He must feel good. The family member who paid peak price has trashed credit, but isn't out-of-pocket any money. Does the buyer feel ripped off? Does she ask grandpa to make her whole?

Irvine Home Address … 50 ARBOLES Irvine, CA 92612

![]() Resale Home Price … $420,000

Resale Home Price … $420,000

Home Purchase Price … $177,500

Home Purchase Date …. 2/17/1988

Net Gain (Loss) ………. $217,300

Percent Change ………. 122.4%

Annual Appreciation … 3.8%

Cost of Ownership

————————————————-

$420,000 ………. Asking Price

$14,700 ………. 3.5% Down FHA Financing

4.84% …………… Mortgage Interest Rate

$405,300 ………. 30-Year Mortgage

$85,388 ………. Income Requirement

$2,136 ………. Monthly Mortgage Payment

$364 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$70 ………. Homeowners Insurance

$384 ………. Homeowners Association Fees

============================================

$2,954 ………. Monthly Cash Outlays

-$350 ………. Tax Savings (% of Interest and Property Tax)

-$502 ………. Equity Hidden in Payment

$27 ………. Lost Income to Down Payment (net of taxes)

$53 ………. Maintenance and Replacement Reserves

============================================

$2,183 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,200 ………. Furnishing and Move In @1%

$4,200 ………. Closing Costs @1%

$4,053 ………… Interest Points @1% of Loan

$14,700 ………. Down Payment

============================================

$27,153 ………. Total Cash Costs

$33,400 ………… Emergency Cash Reserves

============================================

$60,553 ………. Total Savings Needed

Property Details for 50 ARBOLES Irvine, CA 92612

——————————————————————————

Beds:: 2

Baths:: 2

Sq. Ft.:: 1440

Property Type:: Residential, Condominium

Style:: One Level

View:: Mountain, Park/Green Belt, Faces South

Year Built:: 1975

Community:: Rancho San Joaquin

County:: Orange

MLS#:: 22147357

Source:: i-Tech MLS

Status:: ActiveThis listing is for sale and the sellers are accepting offers.

On Redfin:: 15 days

This sophisticated Town Home is situated on park-like grounds on a quiet cul-de-sac. A corner unit, this home features a spectacular view of the Newport Coast Mountain RangE & Mason Wildlife Regional Park. This single-level unit with warm neutral tones and an abundance of natural light accentuate the exotic cherry wood flooring throughout the main living area. The spacious entry boasts a handsome built-in Alderwood desk, while the open living room and dining area is graced by an outstanding stacked stone fireplace. The bright and airy kitchen offers beautiful white Hartmark cabinetry, Delerium granite countertops, double porcelain Kohler sink & bay garden window. The well appointed master suite offers an impressive 16 feet of custom built-ins in a mirrored closet complete with cedar ceiling, a master bath that includes a bright picture window with a spectacular view, and 13.5' vaulted ceiling. The guest bedroom features French doors & custom closet with cedar ceiling.

One aspect of the merserible cities that was not covered is being a “commuter” city for long drives to the bay area for work. Sac and Stockton with neighboring towns skyrocketed because of the high housing prices in the bay area. Gas price went up and employment bubble popped in the bay area with the WJC’s internet virtual accounting of the 1990’s came home to roost in the 2000’s. GWB’s boost with low interest give it one last bucket of gasoline to the housing price fire. Who wants to spend 2 or more hours each way on the road? Only 20 to 25 hours on the highway a week. The joys of commuting by car.

French Doors! Magnifique!

It took a few weeks before someone slipped “French Doors” into a description, but the graphic made its debut. Thanks for creating it.

We definitely need more houses with French Doors.

I still miss your bass boards….

I forgot about the bass boards!

http://www.crackthecode.us/images/Irvine_BaseBoard_Room.jpg

384.00$ HOA

OUCH!

Welcome to Irvine.

Even with that high HOA this 1440 sq. ft. condo is at rental parity at a $2180 monthly cost of ownership.

Misery loves company, it’s too bad Irvine can’t join the misery party. It’s like Mardi Gras every night at Irvine Spectrum.

LOL, you sound like a recording:

Posted by Planet Reality on 01/28/11 at 09:40 AM

“It’s seems like the week before Christmas every night at the Irvine Spectrum.”

Posted by Planet Reality on 12/29/10 at 10:25 AM

“Spend a weekday night at the Irvine Spectrum and it’s like the recession never happened.”

Posted by Planet Reality on 12/29/10 at 11:15 AM

“in many parts of the country Malls have closed or are on the verge of closing, yet Irvine Spectrum and South Coast show a far different reality”

Posted by Planet Reality on 09/17/10 at 06:38 AM

“Take one trip to the Irvine Spectrum and marvel at the activity. The future of Irvine is bright. There is no comparison.”

Posted by Planet Reality on 02/04/11 at 07:41 AM

“It’s like Mardi Gras every night at Irvine Spectrum.

Which is it, dude? Is the Irvine Spectrum like Mardi Gras? Chistmas? Kwanzaa? Hey, I’ve got one: April Fools’ Day!

Irvine Spectrum….

A Schmorgesborg of Schadenfreude kryptonite.

Enough to make a hater go home and cower in the corner of a TIC apartment and avoid talkirvine for 6 months.

You definitely have your talking points down. Tell your supervisor to give a you bonus!

The malls ARE crowded – They are full of people that know nothing else to do. People in O.C. have become programmed over the last 10 years that if it’s the weekend, it must be mall time. I watch these people and they go, they hang out, they wander through the stores, and they leave…..empty handed. Go to South Coast plaza and notice the huge amount of people in the common areas – Then go into a high end boutique and you will have the place to yourself. We have been programmed to consume so even if we can’t put something in the offering plate, we still go to the house of worship.

“We have been programmed to consume so even if we can’t put something in the offering plate, we still go to the house of worship.”

Great analogy.

With such nice weather for the past month, it’s surprising that I don’t see more people doing outdoor activities. I spent the past few weekends at the beach with my kids, playing in the sand, throwing balls/frisbees around, flying kites, and even a little swimming in the 57 degree water. When I wasn’t at the beach, I had them out on hikes. FREE ACTIVITIES that don’t require much effort; it’s even better when we pack our own lunch and snacks and eat picnic style.

I despise malls or any other commercial shopping center. I only tolerate them when I *need* something.

I wonder if the vanity plate “MALL H8R” is taken?

LOL

PR – tell us how you really feel about “Irvine Spectrum”.

We have this huge mall down here called the “Tempe Marketplace” near ASU. It’s got all kinds of restaurants, shopping, etc, etc. It’s packed to the rafters every Saturday. Folks jammed in like Sardines, waiting in huge lines at overpriced restaurants. That must mean that the economy of Phoenix is booming and also explain why Phoenix dodged the house crash and recession.

That’s fantastic news, Phoenix must be similar to Irvine with current prices the same or greater than late 2008 prices. it’s nice to know AZ has some areas that are doing well 5 years into the “crash”

Indeed – the lines at the Fish Market and P.F Chang’s prove it. Clearly Phoenix was spared the “crash”.

PR –

I can totally see you hanging out at a place named “Irvine Spectrum”. The name suits you perfectly. I might even suggest that you consider using it as your IHB name at some point.

Despite his denial, I am 99% certain that PR is a loan owner in Irvine. This is just another way to justify to himself that buying that overpriced Irvine crapbox was a smart financial move.

The Fed and FCBs will save Irvine…just keep telling yourself that PR.

Have you seen the 10yr note today! This won’t bode well for housing prices.

Sure, keep telling yourself that.

Meanwhile, the demand for new product in Irvine continues to outpace supply despite the “economic downturn” and interest rate volatility.

Who’s buying all these new homes?

The Lucky Charms Elf and the Easter Bunny

the demand for new product in Irvine continues to outpace supply

What a catchy statement, tenmagnet. Did you generate it from one of those Corporate Bull$hit phrase generators?

Here is one that I just generated to add to yours:

“credibly customize high-quality niche markets”

Yeah, Dave

Kind of like the homemade B.S. generator you use when someone mentions they bought.

“Irvine is not Different”

“What new home sales?”

“You will lose your shirt”

“The 10-year Treasury at 3.64% will ruin everything”

No wonder, Spectrum is the only fun place in Irvine. Try to drive on Main after work hours, not a man around, empty buildings for lease…

Oh stop, you are going to rain on PR’s party. Just shush and let the man wank himself.

Careful there, the authorities forbid wanking at Irvine Spectrum.

Also, there are huge lines to buy $1 movie tickets at Starplex. Apparently, people don’t want to go to $12 movies at Spectrum, the main entertainment there.

@Vincenzo:

Really? Have you been at the Spectrum on weekends or Friday nights?

Interestingly enough, during the boom years, the Woodbridge Dollar theatre didn’t do so well (changed ownership two times I think).

But that doesn’t mean no one is watching movies at the Spectrum. Costco makes those movies less than 8 bucks… and there are tons of those in Irvine.

That’s funny, I was actually at the Spectrum last night and it was a ghost town.

Blame it on the snow.

Mortgage Bankers Miss Out on Profits

Wall Street Journal (02/04/11) P. A4 Troianovski, Anton

Demonstrating the rapid recovery for prime office space in certain cities, Munich-based GLL Real Estate Partners will buy the Mortgage Bankers Association’s former headquarters in Washington, D.C., for $101 million. The seller is CoStar Group Inc., which paid $41.3 million for the property a year ago. MBA purchased the edifice for $79 million when it was being built in 2007 but owed more on its $75 million mortgage than the property was worth when it was forced to sell last February.

http://images.mortgagebankers.org/newsletters/urlForward.asp?TargetPage=http://online.wsj.com/article/SB10001424052748704376104576122531523284382.html#printMode

10-year treasury 3.64% … ouch!

Your an odd one, you get way too much pleasure stabbing yourself with a butter knife.

Show us how it is done, PR. You must have a butter knife lying around there somewhere.

All I know is that the Bernank is losing control of the bond market in this zombie economy. And … the monthly outlay of an Irvine home will be increasing in the coming weeks, and that will apply more pressure on pricing. 🙂

…Bernanke is losing control of the bond market…

[mortage interest rates are closely tied to 10yr]

Not only for new money purchase loans, but

for re-fi’s of all colors and strips.

Case in point:

A majority of HELOC re-casts won’t even hit

a peak until well into 2012.

Given the spectre of higher interest rates, how

would it be arithmetically possible for asset

prices (ie Homes in Irvine) *NOT* to fall?

Interest rates are actually going down no matter what you say; PR and tenmagnet have assured the blog..

@AZDave:

Easy now… posters on this blog also “assured” that interest rates would rise considerably and the gov would not be able to interfere with the crash.

True, but PR has been gleefully gallivanting around the blog boasting of his past calls with tenmagnet right there cheering him on.

On 12/24/10, PR stated that “Nothing has changed, rates will continue to break record lows”

Then ochomehunter stated that he expected to see 2% interest rates at some point in the future to which PR replied “100% agree”.

It certainly seems like rates are heading in the opposite direction, but we still have a ways to go.

10-year yields finished the week at 3.65%. That’s up 32 bps (or a 1/3 of one percent) since last Friday’s close.

🙂

Cancel the Super Bowl

Between Shawn Green dropping the price of his house to a paltry $10M and the 10 year tbill at an apocalyptic 3.6%, we should cancel the Super Bowl. Lee needs to celebrate all of this earth shattering news devastating Irvine.

What’s next, are Lee and Dave planning to boycott the Irvine Spectrum?

Yes, i am boycotting. No more weekend getaways to irvine spectrum for me.

If rates increase 250-300 bps this year, it will hurt affordability significantly.

Think about that.

🙂

250 to 300 bps is actually quite tame considering the fact that the Fed presently has pegged the discount rate at “0” percent (WTF), and we’re now well into QE2 (WTF). I personally think we could be looking at perpetual QE … it just kinda becomes part of the American economy. Print as much as you need to keep assets from falling.

Just think everyone, we’re gonna see a reduction as a percentage of our HH budget going to shelter (mortgage & rent), but most, if not all of that reduction is gonna be absorbed by additional cost, not yet realized because morons are in charge of monetary and fiscal policy. Morons don’t want us to save, they want us to consume, and anything left over, they want to tax-tax-tax!

I hope everyone understands that The Feds and the US govt is setting this country up for another financial crisis.

Excuse me, but you’re shocked to discover that the US is a consumer culture? The economy, not to mention political system, is based on perpetual growth. With accelerating growth being the Holy Grail. Just try imagining a city planning to maintain its current size, much less to shrink. It just doesn’t compute.

Just two quibbles with their methodology for calculating the miserability index.

First, commuting on public transport is much less annoying than having to drive – I get to read for 30-40 minutes each way, I catch the train 1.5 blocks from my house and it drops me off at the back door of the office building where I work. Compare that with even a 15 minute commute, where I have to pay to park and at best get to listen to NPR or books on tape… They ought to have factored in percentage of people on public transportation, and at least discounted transit time on public transportation 50%.

Second, they measure corruption in terms of convictions. But when people are getting convicted of corruption, that says that there’s someone out there fighting it. The bigger problem is when (a) the prosecutors are coopted and are not bringing charges, (b) the corrupt officials are too good to get caught, or (c) the corruption is lawful (for instance, campaign donations) even when it’s immoral and destructive.

The problem with these misery indexes and google maps showing cities with the most foreclosures is that – let’s face it – why would anyone who wasn’t raised in these places ever want to move there?? I had family in Stockton and can tell you it was miserable 20 years ago. Ditto Bakersfield, Flint, Modesto, Toledo and the list goes on… I’m sure you can live a good life in any of those places but I doubt anyone who reads this blog would opt to live in them.

Now that hundreds of new residents are moving into Woodbury I have come to the conclusion that the real estate bubbles in China and Korea are much more important to housing in this community than anything happening domestically. I was at the Woodbury Town Center Ralph’s yesterday and there were too large Korean families who must have just landed…no English or familiarity with how to pay using the POS system (they probably are used to something much more sophisticated in Korea, like paying directly from their mobile phone). It was interesting seeing the cashier trying to communicate with them, it eventually took a committee including the front end manager to get it done. Oh and the entire purchase was a pile of 50 novelty candles…maybe the electricity was not yet turned on in their new home?

Excellent example,

Many here will try to discount and discredit the powerful role that FCBs play in certain Irvine markets.

As if an up tick in interest rates will drive these buyers away.

Wow, I guess it’s just an amazing coincidence that these rich foreigners managed to set off a bubble in Irvine whose timing has coincided almost exactly with the housing bubble in the rest of the US.

You should ignore the fact that the Irvine market turned at just about the exact same time as the rest of the US back in 2006. You should ignore the fact that prices increases during the bubble in Irvine were very similar to the rest of Southern California, and that the subsequent declines since 2006 have been very similar to those of other premium communities in Southern California. You should ignore the fact that demand for Irvine homes from banks, who wish to hold them for accounting purposes, is a couple orders of magnitude greater than demand from FCBs. Instead, you should base your conclusions on the fact that when you go out walking around your neighboorhood you see a lot of Asian people. Brilliant.

The dollar has declined sharply over the past several years against em currencies. FCBs have far greater purchasing power at thanks to currency appreciation and robust growth in many em countries.

FCBs are no myth.

Yes, FCBs exist and have money. So? How does that negate my argument that they play a relatively small role in pricing compared to non-local factors. You’ve said nothing.

You are ignoring how many homes TIC has sold in Woodbury in the last 12 months. A perfect example of how a community with a heavy concentration of FCB’s can buck the trend all around it.

Look, I’m not trying to pump Woodbury prices, far from it. In fact I’m actively looking to buy elsewhere.

No I’m not. What I’m trying to say is the mere existence of FCBs in an area doesn’t mean that they are driving the pricing trends in that area. In some cases there are other, better explainations.

Also just (finally) finished The Big Short by Michael Lewis – a great view into the mortgage market and the first understandable explanation of synthetic CDO’s and how unbelievably toxic they were. Good narrative and thankfully devoid of the class warfare that pollutes much of the writing on the subject. Especially good recounting of the role the ratings agency played in the absurd financial alchemy that made the whole market possible. Also an oblique reference to our very own IR when describing “California Housing Bloggers” who were pointing out the home price craziness on a daily basis.

“The housing bubble is the direct cause of the suffering.”

WRONG!

The direct cause of all the suffering in the housing market is radical Islam! There was no housing bubble!! We were very prosperous and then all of a sudden all Hell broke loose!!!

What changed?

The Muslim Brotherhood’s establishment of a shadow Caliphate within the financial services industry! After they infiltrated the banking sector they cut off loans to all the “infidels”!!

People assume that their banker doesn’t eat pork because they are Jewish, but did you know that Muslims can’t eat pork either!

Now you see… Now you know…

Impeach Obama.

Wow. How come I never thought of that? But wait a second. Muslims don’t believe in collecting interest on money because it’s considered a form of USURY.

Thank you for pointing out the real reason for the Federal Reserve’s Zero Interest Rate Policy.

I’m quite sure that many readers didn’t see the connection. I’m glad there is at least one person paying attention.

$431,000 back in the day in Stockton

now that’s rich