The economists at the Federal Reserve take an honest look at the inefficacy of their policies.

Irvine Home Address … 12 PLEASONTON Irvine, CA 92620

Resale Home Price …… $660,000

The only way to win is cheat

And lay it down before I'm beat

and to another give my seat

for that's the only painless feat.

That suicide is painless

It brings on many changes

and I can take or leave it if I please.

Johnny Mandel — Suicide is Painless

Most people try to avoid pain, physical, emotional, financial. Anyone focused on playing in the California housing market Ponzi scheme, there is only one painless feat: pass the debt off to another person. Give them your seat and let them own the mortgage. Think about the windfall received by those few that sold in 2005-2007 and rented. Those left owning loans are feeling major pain.

The Federal Reserve exists to foster moral hazard by preventing banks, businesses, and consumers from feeling the ill effects of their poor financial decisions. The Federal Reserve has purchased $1,200,000,000,000 in mortgage-backed securities in an effort to lower interest rates and make the sky-high prices of the bubble affordable. They have printed money through two rounds of quantitative easing, and they help lenders dodge regulation that might expose their insolvency or hinder their business. Given the mission and behavior of the Fed, it is surprising when they publish a fact-filled paper with careful analysis, particularly when that paper is critical of government policy.

The Fallacy of a Pain-Free Path to a Healthy Housing Market

December 2010

Federal Reserve Bank of Dallas

by Danielle DiMartino Booth and David Luttrell

In the mid-1990s, the public policy goal of increasing the U.S. homeownership rate collided with a huge leap in financial innovation. Lenders shifted from originating and holding mortgages to originating and packaging them for sale to investors. These new financial products enabled millions of Americans who hadn’t previously qualified to buy a home to become owners. Housing construction boomed, reaching a postwar high—9.1 million homes were built between 2002 and 2006, a period when 5.6 million U.S. households were formed.

That is a huge supply imbalance. And like Ireland, much of this supply exists in areas where there is little or no demand. Second home communities are inundated with houses that nobody can finance at prices several times what local incomes can support.

The resulting oversupply of homes presents policymakers with a formidable challenge as they struggle to craft a sustainable economic recovery. Usually a driver of economic recoveries, the housing market is foundering as an engine of growth.

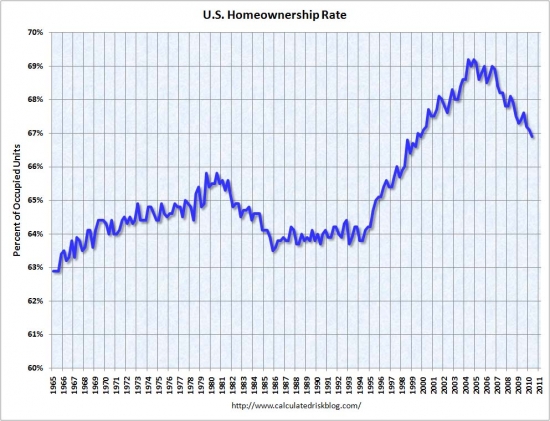

Generations of policymakers since the 1930s have sought to increase the homeownership rate. By the late 1960s, it had reached 64.3 percent of households, remaining there through the mid-1990s, in apparent equilibrium with household formation during a period of sustained U.S. economic growth. A fresh push to increase ownership drove the rate up 5 percentage points to its peak in the mid-2000s. Home price gains followed the rate upward.

Reverting to the Mean Price

As gauged by an aggregate of housing indexes dating to 1890, real home prices rose 85 percent to their highest level in August 2006. They have since declined 33 percent, falling short of most predictions for a cumulative correction of at least 40 percent.[1] In fact, home prices still must fall 23 percent if they are to revert to their long-term mean (Chart 1). The Federal Reserve’s purchases of Fannie Mae and Freddie Mac government-sponsored-entity bonds, which eased mortgage rates, supported home prices. Other measures included mortgage modification plans, which deferred foreclosures, and tax credits, which boosted entry-level home sales.

Adjusting for inflation, prices almost certainly will fall. The relationship between inflation and house price that have been stable for over a century doesn't suddenly break down and fail to limit home prices. If we manage to ignite inflation, we may get prices to hold up on a nominal basis, but adjusting for inflation, prices will fall significantly.

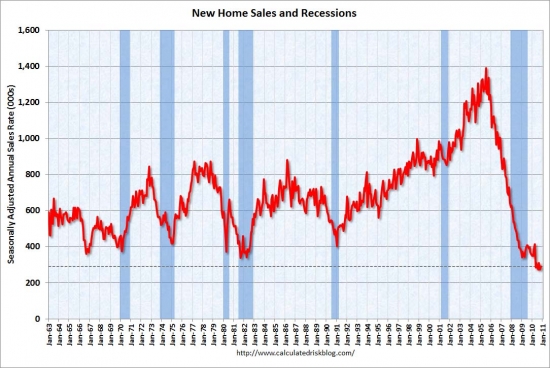

Measuring the success of these efforts is important to determining the trajectory of the economic recovery and providing policymakers with a blueprint for future action. New-home sales data, though extremely volatile, are considered a leading indicator for the overall housing market. Since expiration of the home-purchase tax credit in April, sales have fallen 40 percent to an average seasonally adjusted, annualized rate of 283,000 units. This contrasts with the three years through mid-2006 when monthly sales averaged 1.2 million on an annual basis. Before the housing boom and bust, single-family home sales ran at half that pace. Because current sales are at one-fifth of the 2005 peak, new-home inventories—now at a 42-year low—still represent an 8.6-month supply. An inventory of five to six months suggests a balanced market; home prices tend to decline until that level is achieved.

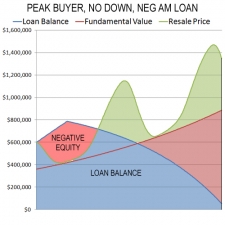

One factor inhibiting the new-home market is a growing supply of existing units. The 3.9 million homes listed in October represent a 10.5-month supply. One in five mortgage holders owes more than the home is worth, an impediment that could hinder refinancings in the next year, when a fresh wave of adjustable-rate mortgages is due to reset. The number of listed homes, in other words, is at risk of growing further. This so-called shadow inventory incorporates mortgages at high risk of default; adding these to the total implies at least a two-year supply.[2]

As predicted, the recasting of Option ARMs and interest-only ARMs is causing many borrowers to stop making payments. Many of those borrowers used that financing because they were in an inflated market. Many of those markets have crashed leaving the borrower deeply underwater and facing a much larger loan payment.

The surprise with the mortgage resets is the lack of foreclosures and foreclosure inventory to push prices lower. Mostly, this is due to amend-extend-pretend and the massive buildup of shadow inventory. These bad loans are out there, and this inventory will eventually make it to the market. How The Lending Cartel Disposes Their REO Will Determine the Market’s Fate.

The mortgage-servicing industry has struggled with understaffing and burgeoning case volumes. The average number of days past due for loans in the foreclosure process equates to almost 16 months, up 64 percent from the peak of the housing boom. One in six delinquent homeowners who haven’t made a payment in two years is still not in foreclosure.[3] Mounting bottlenecks suggest the shadow inventory will grow in the near term.

Notably, not all homeowners in arrears suffer financial hardship due to unaffordable house payments. Those with significant negative equity in their homes may choose to default even though they can afford to make the payments. Such “strategic default” is inherently difficult to measure; one study found 36 percent of mortgage defaults are strategic.[4] Though the effect is not readily quantifiable, the growing lag between delinquency and foreclosure provides an added inducement for this form of default.

Thinking About Accelerated Default? The Average Squatting Time Is Up to 449 Days.

Mortgage Modification Limits

One set of policies to aid home-owners in dire straits involves mortgage modifications, though these efforts have only minimally reduced housing supplies. The most far-reaching effort has been the Making Home Affordable Program (previously the Home Affordable Modification Program, or HAMP), in effect since March 2009. After only one year, cancellations—loans dropped from the program before a permanent change was completed—eclipsed new modifications (Chart 2). Since March, the number of cancelations has continued to exceed new trial modifications, which involve eligibility and documentation review, and successful permanent modifications.

In short, to the surprise of no one, the government run loan modifications programs have been a total failure by any performance metric.

The fact that many mortgage holders have negative equity in their homes stymies modification efforts. In the case of HAMP, the cost of carrying a house must be reduced to 31 percent of the owner’s pretax income. Even if permanent modification is achieved, adding other debt payments to arrive at a total debt-to-income ratio boosts the average participant’s debt burden to 63.4 percent of income. In many cases, the financial innovations of the credit boom era, enabling owners to monetize home equity, encouraged high aggregate debt.

You have to love academic writing. Note the euphemism “enabling owners to monetize home equity” when they meant that banks were giving out free money under the guise of “innovation.” The Fallacy of Financial Innovation.

A study found that in a best-case outcome, 20 to 25 percent of modifications will become permanent.[5] In 2008, one in three homeowners devoted at least a third of household income to housing; one in eight was burdened with housing costs of 50 percent or more.[6] Failed modifications suggest that, without strong income growth, the bounds of affordability can be stretched only so far.

Let's stop for a moment to ponder the math: if best-case scenario is for 20% to 25% of loan modifications to work, then at least 75% will fail. With around 10 million distressed loans, at least 7.5 million of them will not cure through loan modification. Far fewer will cure through paying back the loan balance, so that leaves short sale and foreclosure. Since most short sales fail, that leaves only foreclosure. We will see a lot more foreclosures than pundits are willing to admit.

Without intervention, modest home price declines could be allowed to resume until inventories clear. An analysis found that home prices increased by about 5 percentage points as a result of the combined efforts to arrest price deterioration.[7] Absent incentive programs and as modifications reach a saturation point, these price increases will likely be reversed in the coming years. Prices, in fact, have begun to slide again in recent weeks. In short, pulling demand forward has not produced a sustainable stabilization in home prices, which cannot escape the pressure exerted by oversupply (Chart 3).

The data clearly shows the fake prosperity of the tax credit, and the devastating impact of its expiration.

Lingering Housing Market Issues

About 3.6 million housing units, representing 2.7 percent of the total housing stock, are vacant and being held off the market. These are not occasional-use homes visited by people whose usual residence is elsewhere but units that are vacant year-round. Presumably, many are among the 6 million distressed properties that are listed as at least 60 days delinquent, in foreclosure or foreclosed in banks’ inventories.

Recent revelations of inadequately documented foreclosures and the resulting calls for a moratorium on foreclosures—what was quickly coined “Foreclosuregate”—threaten to further delay housing market clearing. While home price declines may be arrested as foreclosure paperwork issues are resolved, the buildup of distressed supply will only grow over time.

Lenders are hoping the inventory problems will simply resolve themselves as a resurgent economy sparks a great deal of household formation and sparks demand for a huge inventory of empty houses. It isn't going to happen.

Perhaps less obviously, some lenders with the means to underwrite new mortgages will remain skeptical about the underlying value of the collateral.

This is the real problem with delaying the bottom. Other than the FHA or the GSEs which are backed by the government, who else is confident enough about the stability of home values to take risk with new home loans? Nobody is. That's why the combined government programs now account for about 99% of the housing market. It is also why very few jumbo loans are being originated.

With nearly half of total bank assets backed by real estate, both homeowners on the cusp of negative equity and the banking system as a whole remain concerned amid the resumption of home price declines.[8] This unease highlights the housing market’s fragility and suggests there may be no pain-free path to the eventual righting of the market. No perfect solution to the housing crisis exists.

Fix the Housing Market: Let Home Prices Fall.

The latest price declines will undoubtedly cause more economic dislocation. As the crisis enters its fifth year, uncertainty is as prevalent as ever and continues to hinder a more robust economic recovery. Given that time has not proven beneficial in rendering pricing clarity, allowing the market to clear may be the path of least distress.

May be the path of least distress? The band aid analogy is best. We should have ripped the band aid off and been done with the pain. Instead, we have gone through heroic efforts to prop up prices and merely spread out the pain over a longer timeframe. The insolvent bankers undoubtedly like the path we chose. I, for one, think it was a mistake.

Peak buyer trying to save what she can

As people abandon hope of another market rally to save them and their finances, they take a hard look at their expenses and ask, “Why are we paying so much for this mortgage?” If there is no additional return on their investment, many will lose faith in rapid appreciation and sell out. It's all part of the capitulation process.

Today's featured property was purchased on 4/20/2007 for $673,000. The owner used a $538,400 first mortgage and a $134,600 down payment. If she gets her asking price and pays commission, she loses about $50,000. So for the last four years, she has been paying far more in cost of ownership than the cost of rental, and she is going to lose another $75,000 to the market. I imagine she thinks that sucks.

Irvine Home Address … 12 PLEASONTON Irvine, CA 92620 ![]()

Resale Home Price … $660,000

Home Purchase Price … $673,000

Home Purchase Date …. 4/20/2007

Net Gain (Loss) ………. $(52,600)

Percent Change ………. -7.8%

Annual Appreciation … -0.5%

Cost of Ownership

————————————————-

$660,000 ………. Asking Price

$132,000 ………. 20% Down Conventional

5.02% …………… Mortgage Interest Rate

$528,000 ………. 30-Year Mortgage

$136,971 ………. Income Requirement

$2,841 ………. Monthly Mortgage Payment

$572 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$110 ………. Homeowners Insurance

$70 ………. Homeowners Association Fees

============================================

$3,593 ………. Monthly Cash Outlays

-$487 ………. Tax Savings (% of Interest and Property Tax)

-$632 ………. Equity Hidden in Payment

$258 ………. Lost Income to Down Payment (net of taxes)

$83 ………. Maintenance and Replacement Reserves

============================================

$2,815 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,600 ………. Furnishing and Move In @1%

$6,600 ………. Closing Costs @1%

$5,280 ………… Interest Points @1% of Loan

$132,000 ………. Down Payment

============================================

$150,480 ………. Total Cash Costs

$43,100 ………… Emergency Cash Reserves

============================================

$193,580 ………. Total Savings Needed

Property Details for 12 PLEASONTON Irvine, CA 92620

——————————————————————————

Beds: 3

Baths: 2 full 1 part baths

Home size: 1,703 sq ft

($388 / sq ft)

Lot Size: 4,000 sq ft

Year Built: 1985

Days on Market: 209

Listing Updated: 40540

MLS Number: S620211

Property Type: Single Family, Residential

Community: Northwood

Tract: Othr

——————————————————————————

EQUITY SALE!! NOT REO!! NOT Short Sale!! Beautiful Northwood area. NO MELLO ROOS! LOW tax rate. HOA $70/mo. Single Family Detached Former Model Home. Bright open floor plan, lots of windows, plantation shutters, custom cabinets & crown molding. Beautiful hardwood floors. Living Rm & Dining Rm w/ vaulted ceiling. Family Rm w/ fireplace, custom computer center & sliding French door. Kitchen w/ custom cabinets & Italian tile floor. Master Bedrm w/ walk-in closet & vaulted ceiling. Jetted Tub. Brick patio w/ patio cover, 2 car garage w/ roll-up garage doors & cabinets. Laundry Rm w/ custom cabinets. Across Assoc bbq, tot lot, swimming pool/spa & Orchard Park w/ basketball courts, playground, bbq, picnic area, baseball/soccer field. Walk to tennis courts, parks, aquatic center, library, stores, schools. Great Irvine Unified School District Award Winning Schools. Minutes from OC beaches, museums, Irvine Spectrum, District, Tustin Marketplace, Fashion Island, South Coast Plaza & Great Park.

.

If I was a F*cked Borrower, I certainly wouldn’t take a loan mod.

Just take a look at what the debtors are jumping for joy over…

http://www.loansafe.org/forum/success-stories-homeowners-who-fought-back-won/22045-boa-successful-permanent-mods-2.html#post307153

Then again, they were probably pretty excited when they signed the docs for that $0 down NegAM toxic loan.

They are upside down on mortgages and instead of principal reductions, they are getting back interest lumped onto their principal. They have an illusion of savings because the loans terms are being stretched out and have a lower interest rate, so the payments are lower. But they are still probaly higher than rent would be.

How long will it be before they have any equity and can sell the place for enough to pay off the loan?

They’ll probably never have equity. Some even have deferred principal that will need to be refinanced after the 30-40 year loan period. It won’t be them refinancing it as they’ll probably be dead by then, so it will be their heirs.

People are giddy about “keeping” their homes but in fact are literally being locked into their homes forever. By the time they are paid off, they’ll most likely be ready for the bulldozer. They’re pretty much renting their homes from the bank but they’re responsible for all the maintenance.

Debt slavery at it’s finest.

I’m surprised that there aren’t any bubble blogs that have covered these “modifications” in detail.

Looks like post from yesterday did not get enough attention, posting again!

Treasury Drops Short Sale Requirements

http://www.cnbc.com/id/40930787/comid/1/cache/718#comments_top

Treasury, last week, decided to change the rules a bit:

HAFA no longer requires that servicers verify the borrowers finances

HAFA no longer requires servicers to determine if the borrowers monthly payment is higher than a 31 percent debt-to-income ratio.

HAFA no longer requires second-lien holders to agree to accept 6 percent of the unpaid principal balance owed them, up to $6,000. Servicers now decide who gets paid how much, with a cap still at $6000.

HAFA now requires borrowers seeking a short sale get an answer/agreement within 30 days.

What caused the bubble? NINJA loans! What will cause the collapse? NINKJA afadavits! with 30-day rule and no seller financial verification, flood of sellers will want to get out of the misery while the rule lasts. Short Sales are going to go thru the roof.

Watch housing market and prices crash hard here.

Why would this make the housing market crash. It seems to me that this makes loan mods easier and will result in keeping squatters in homes longer and extend the inevitable result.

Why? Because HAFA is a short sale program and not loan mod program. Loan mod program has not changed and still requires stringent (BS) standards. Its shocking that since HAFA was implemented, only 661 homes were sold under this program due to previous requirements. Its ironic that Govt. thought you could fight stringent standards of lending against the same NINJA loans, it was DOA. Now its NINJA with NINJA affidavits, it will do wonders and prices will fall hard.

Thanks. Makes perfect sense now.

Housing bust creates new kind of declining city

A study says cities where home prices have fallen the most — including Riverside, San Bernardino and Fresno — could suffer long-term deterioration similar to that of the Rust Belt.

http://www.latimes.com/news/local/la-fi-ghost-towns-20110106,0,3388283.story

I dunno. Riverside County had the highest population growth last year (percentage wise) of any county in the state. And much of it was migration (people moving there) as opposed to more births than deaths.

http://californiacitynews.typepad.com/california_county_news/2010/12/slow-to-grow-population-figures-show-modest-increase-riverside-county-w-highest-growth.html

I’ve seen no widespread abandoning of neighborhoods here in the city of Riverside (unlike places like Detroit), although I expected to. Many houses which seemed like they would never sell were eventually purchased by flippers, fixed up, and resold at a profit.

Here’s a good example:

http://www.redfin.com/CA/Riverside/3680-Franklin-Ave-92507/home/4934263

This is a house which, when I first started tracking it, I thought would remain vacant forever. Small, old house in a bad neighborhood. Instead, it eventually was flipped for 2.5 times what the (very small) amount the flipper paid for it.

Then again, I’m talking about the City of Riverside only. Elsewhere in the county, you have insanity like this…

http://www.redfin.com/CA/Palm-Springs/398-W-Palm-Vista-Dr-92262/home/6044258

This is a house which got flipped five times during the boom, going from $36,000 to $450,000. Since the crash, it has sold three times on the open market, at prices from $20,000 to $32,500 (so, as little as 95.6% off peak pricing). The house is trashed and unlivable, and Google Street View caught a drug deal in progress a block north of it. This part of Palm Springs has a chance to become quite Detroit-like.

This one put 20% down and didn’t withdraw equity. Glad to see that there were at least a few responsible borrowers out there.

I feel sorry that they bought at the wrong time and that they’re going to be soaked.

I was once an irvinite. One of the first. Utopia in a bottle, smothered by the 405 and 5 as they choked it. Glad to be removed.

Oh, and please, as it may not be important to you, but would be to Mr. Altman, Johnny Mandel wrote music for the film, but Robert Altman’s son wrote the lyric that you credit to Mr. Mandel.

“Johnny Mandel wrote music for the film, but Robert Altman’s son wrote the lyric that you credit to Mr. Mandel.”

Thanks for the clarification.

>The Federal Reserve exists to foster moral hazard by preventing banks, businesses, and consumers from feeling the ill effects of their poor financial decisions.

It seems that the Federal Reserve last efforts to ignite inflation and cover mortgage losses actually work.

http://fastfood.ocregister.com/2011/01/06/food-prices-especially-breakfast-items-soar-10-percent/84312/

“Year-over-year food prices rose 10 percent for the most popular store-bought grocery items, especially breakfast foods”

10% up for just one year. Jobs are difficult to find, salaries are going down,… but eggs and milk are getting more expensive.

To quote one successful loan mod receipient: “Giving God all the glory… will be so relieved to see the updated mortgage statement, but until then I am keeping the faith!!! ”

Man, and I thought the old testament god was vengeful. The new millenium testament god is even worse what with his loan terms!

They are upside down on mortgages and instead of principal reductions, they are getting back interest lumped onto their principal. They have an illusion of savings because the loans terms are being stretched out and have a lower interest rate, so the payments are lower. But they are still probaly higher than rent would be.

How long will it be before they have any equity and can sell the place for enough to pay off the loan?

So on one hand, when people default they suck and are bad people with no morals or ethics, on the other hand, if they take a mod to *try* and keep the house, they suck and are stupid asses.

I am a “success story” in regards to getting a mod, and that was with the HELP of Loansafe.org and the people that post there.

I got a 30 year fixed, years 1-5 are 2%, every year there after, it rises by 1% and caps at 5%.

Remember, I put 20% down as well and I STILL am tempted to walk because after 2012, the Mortgage Forgiveness Act goes away, and I don’t want to be held to the taxes.

Either way you look at it, I’ve been b&ttfuc;?. So for now, I watch and wait, and if things look like they will stagnate or fall further, looks like another house will go on the backs of the taxpayer. Sucks, but I will not be broke when I retire…and I *will* retire, I’ve got quite a bit of stash in my retirement account as it’s the only place the greedy bastards can’t garnish.

Wall St. made housing a casino, and for that I blame the lack of regulation which started with Saint Ronald Reagan stripping it down. Go Merril Lynch, er, I mean Donald Regan.

WTF?

You’ve been talking about walking for over a year now yet you get conned into a mod?

I take it you’re not in California as you have now “refinanced” and if you were in Cali, you would have gone from a non-recourse loan into a fully recoursable one.

I wouldn’t consider a single one of the mods that I’ve seen “success stories”. Not by a long shot.

This reminds me to bring up a point that one of my friends two homes went into foreclosure in 2009. two months ago, he received judgement letters from collection agencies looking for 100% of 2nd mortgages.

It never ends I guess, my friend is scared shit now. I told him to call them back and ask them if they would like a $1000 instead. LOL

I wasn’t “conned” into a loan, the entire mortgage industry was fueled by fraud, but none-the-less.

A household of 3, cannot make more than $70,000 and declare a Chapter 7 bankruptcy, you *have* to file Chapter 13, which is a payment plan of 36 or 60 months, and the amount to be payed back is determined by the court and your ability to pay.

1st Mortgages or non-recourse regardless whether you re-finance or not as this is California State Law.

HELOCS are fully the owners resposibility, and when the collection agency/ banksters find out how much you make (and they will), they will come seeking you for payment, thousands of people who tried to scam the system will get judgments against them, as it should be.

Those of us who tried to be “conservative” but bought at the worst time in American history, well, we shall suffer loss either keeping the home, or losing it.

Fair enough.

I said for the longest time that the people who bought as you did were the ones that got screwed the most in the whole deal. I remember seeing an article in the L.A. Times showcasing a high earning family that bought in Watts for $500k and touting the supposed “gentrification”. I immediately said “They’re ****ed.”

One question I have…WRT your loan mod, while it’s at the 2% level, are you able to make extra payments to drive down the principle or are there stipulations prohibiting that?

No stipulations against early payment. I was one of the very few who made the required DTI in order to satisfy the loan mod requirements.

It wasn’t easy because my lender refused to negotiate with me so I had to force the hand of Chase. by defaulting for 3 months.

The “trial modification” was a contract for 3 months to show ability/discipline to pay, but after 3 months and signed documents, the lender Chase would not finalize my modification…that is until I defaulted AGAIN. After 2 more months of no payment, I was finally given what I been told was the “cadillac” of loan mods. At the time maybe it was, until 30 year fixed mortgages for those who could buy/re-finance went to 4%.

As usual, the ones struggling, trying to do the “right” thing to keep the house, do not get help, while those who live large and have no need for lower rates, get re-financed to have even more discretionary spending.

I feel for you man. One of the personal I know happens to be a crook! He went to the bank and asked for loan mod, he was told that he needs to default first by BAC, he makes decent 6 figure income. He defaulted and went back to BAC and then they said that you have disposable income, you need to show your expenses are higher than your income, so he went on and bought $50,000 SUV on 3-yr payment plan, for sure he fell within the guidelines. He got the mod, his home value was not lowered but he says that his some $30,000 worth missed payments were forgiven which I dont believe. Anyway, this is the world of crooks and there is no place here to compete with them.

I put an offer on a home at $550,000, with FICO over 800 and downpayment of 10% at hand, bank sat on the short sale offers for 5 months saying that want cash, in the end they sold the home to cash buyer for $460K, and that home recently without any upgrades got flipped for $600K, so go figure. I definitely believe that bank officers are part of the fraud that is still happening here. Bank was Wells Fargo.

@OCHomeHunter…

Damn. Makes you wonder how much the collection agencies are paying for the debt in the first place.

Pay 10c on the Dollar and then go after 100%?

What a racket.

“In fact, home prices still must fall 23 percent if they are to revert to their long-term mean (Chart 1)”

Keep in mind that the “mean” is based on an average of many up and down market cycles. I would add that, since we are in a down market, the prices should actually fall below their “long term mean”… so, more than 23%.

I’m not claiming Irvine will fall 23+%, but those numbers have to come from somewhere.

I’m trying to make sense of this: In today’s post IR references an entry from September 17, 2010 entitled How the Lending Cartel Disposes Their REO will Determine the Market’s Fate. Fair enough. Always a good idea to go back and examine one’s theses.

However toward the end of the astute observations DarthFerret references a listing in Westpark that is priced at $172/sq. ft.

“$172/sf for a 5BR SFR in Westpark?!?!

http://www.redfin.com/CA/Irvine/32-Vienne-92606/home/4623407

Yep, you read that right. It’s a Westpark 5BR SFRIt will be interesting to see what this eventually sells for. This one will most certainly be flipped, but it is yet another data point on where home prices are headed in Irvine and all of The OC.”

I don’t mean to pick on Darth as I enjoy his input (I just think he got snookered on the short sale come on price as you’ll see in a moment) but he does say in a second post that this is evidence of how Irvine housing prices are being “CRUSHED.” And perhaps many of else interpreted this the same way.

Unfortunately we were dead wrong.

Being a curious sort I googled the address and surprise surprise, the house sold less than a month later for $965,000 ($333/sq ft). http://www.redfin.com/CA/Irvine/32-Vienne-92606/home/4623407

I understand that the $469,000 asking price was short sale horseshit from a sleezeball realtor, but the final price makes me wonder if anyone can truly predict housing prices. Or if it even makes sense to try. I mean it sold for more than TWICE a not altogether unreasonable price ($500,000ish), if one believes that prices are dropping, only two months ago?! So much for the great contraction of prices.

It all seems incomprehensible to me. Anyone know a good shrink?

Actually… I don’t think that a short sale, that was a price gimmick by a realtor who uses auction style bidding to get a house sold in one day.

The company is called Rex (I think) and they’ve done a few of these. They basically list a home for a week, dropping the price every day until the day of auction. You’re not allowed to view the home prior to that day and the auction day is the only opportunity to view it. The next day they delist the property, gather the bids, find the highest bid, call ever bidder and give them a chance to beat it.

They’ve done several in Irvine and it’s always a madhouse because of how low the final list price is (which they claim is the reserve but I highly doubt). It seems that they have kept their promise and sold the homes at the highest bid.

Another realtor recently did that with a home in Columbus Grove off of Camilia. Had the auction etc etc but would only call back the top 10 buyers. It looked like it went pending but is now relisted with a different(?) realtor at $1.1m:

http://www.redfin.com/CA/Tustin/16615-Camilia-Ave-92782/home/7202506

Long story short… don’t be fooled by abnormally low prices in Irvine… or anywhere.

Another shadow inventory house in Irvine.

It’s listed for half price and ends up selling like it’s 2 houses.

Fools like Darth were a magnet for these shadow inventory listings.

Sorry should read “And perhaps many of us (not else)

Befuddled, IMHO that low ball original listing was to keep real buyers away instead of spark a bidding war. A lot of realtors who are listing agents are trying to make two commissions representing both buyers and sellers. I have encountered this on two homes that I pursued and I concluded that in this market (Aug to Dec 2010) if you want to buy, you need to partner up with Listing Agent. I asked one of the listing agents over why they hit so low price, I was told that in short sales the bank sees what the agent shows them (which is wrong) but its done that way. By putting a low offer, it brings in pool of lower offers, much lower than the market value of home. This creates a spread between what his client offered vs what the lower offers are at, and it helps the agent close the deal with his client for below the market value, tricks the banks and lower offer folks. I would not discount the fact taht a lot of short sales have under the table money exchanges between investor buyer and agents+bank negotiators. Fraud may still be at full swing here, these folks dont ever learn and are crooks.

Well, the time has definitely changed now, with prices being lowered everywhere at pace faster than I have ever noticed. There is sense of panic out there by sellers and those who follow prices on Redfin can testify it. The fun has just begun! And yes, Irvine is not immune!

Where in Irvine are the prices being lowered at a faster pace?

There aren’t even enough listings in Irvine, but that doesnt mean that are no distressed homes. There are thousands of homes. As South OC corrects at faster speed, it would take out the buyers who would chase value. Remember, Irvine may fall the the last but it will. From Peak prices did fall, its just that inventory was held and is being held. With new short sale HAFA rule, we may see acceleration of fradulent sales from the past sold in short sales fradulenty again!

There are many different segments to the Irvine market.

Certain areas like Columbus Grove are well under $300/ft. while other areas have held up and appear healthy.