Is the TARP program a failure or a success? It depends on whether you ask Wall Street or Main Street.

Irvine Home Address … 117 ROCKWOOD 55 Irvine, CA 92614

Resale Home Price …… $289,000

Winners and losers, turn the pages of my life

We’re beggars and choosers, with all the struggles and the strife

I got no reason to turn my head and look the other way

We’re good and we’re evil, which one will I be today?

There’s saints and sinners

Life’s a gamble and you might lose

There’s cowards and heroes

Both have been known now to break the rules

Social Distortion — Winners and Losers

The story of the TARP program has been about winners and losers. Contrary to the much touted goal of preventing foreclosures, the TARP program is primarily designed to prop up our ailing banks. In this regard, it has succeeded. As for helping loan owners stay in their homes, not so much. Of course, the loan owners have benefited from amend-extend-pretend because they have been allowed to squat, but people don't want to squat, they want to own their homes with a reasonable payment. Unfortunately, they paid so much that owning with reasonable payments is not going to happen.

SIGTARP Quarterly Report (PDF)

Office of the Special Inspector General for the Troubled Asset Relief Program

General Telephone: 202.622.1419 Hotline: 877.SIG.2009

SIGTARP@do.treas.gov

www.SIGTARP.gov

October 2010

More than two years have passed since the Emergency Economic Stabilization Act of 2008 (“EESA”) authorized the creation of the Troubled Asset Relief Program (“TARP”). On October 3, 2010, Treasury’s authority to initiate new TARP invest- ments expired, marking a significant milestone in TARP’s history but also leading to the widespread, but mistaken, belief that TARP is at or near its end. As of October 3, $178.4 billion in TARP funds were still outstanding, and although no new TARP obligations can be made, money already obligated to existing programs may still be expended. Indeed, with more than $80 billion still obligated and available for spending, it is likely that far more TARP funds will be expended after October 3, 2010, than in the year since last October when U.S. Treasury Secretary Timothy Geithner (“Treasury Secretary”) extended TARP’s authority by one year. In short, it is still far too early to write TARP’s obituary.

At the same time, TARP’s two-year anniversary is a fitting time for an interim assessment. To what extent has TARP met the goals set for it by the U.S. Department of the Treasury (“Treasury”) in announcing TARP programs and by Congress in providing Treasury authorization to expend TARP funds — avoiding financial collapse, “increas[ing] lending,” “maximiz[ing] overall returns to the taxpayers,” “provid[ing] public accountability,” “preserv[ing] homeownership,” and “promot[ing] jobs and economic growth” — and at what cost? In answering these questions, it is instructive to compare TARP’s impact on Wall Street with its impact on Main Street. By fulfilling the goal of avoiding a financial collapse, there is no question that the dramatic steps taken by Treasury and other Federal agencies through TARP and related programs were a success for Wall Street. Those actions have helped garner a swift and striking turnaround, accompanied by a return to profitability and seemingly ever-increasing executive bonuses. For large Wall Street banks, credit is cheap and plentiful and the stock market has made a tremendous rebound. Main Street, too, has reaped a significant benefit from the prevention of a complete collapse of the financial industry and domestic automobile manufacturers, the ripple effects such collapses would have caused, and increased stock market prices. Main Street has largely suffered alone, however, in those areas in which TARP has fallen short of its other goals.

As these quarterly reports to Congress have well chronicled and as Treasury itself recently conceded in its acknowledgment that “banks continue to report falling loan balances,” TARP has failed to “increase lending,” with small businesses in particular unable to secure badly needed credit.

As an aside, I note that I was contacted by my bank and asked if I wanted a credit line for my new business. When I said, no, I run a cash business trading in hard assets, the loan officer told me they are getting pressure to extend these credit lines, and if I change my mind, they want to loan money.

Indeed, even now, overall lending continues to contract, despite the hundreds of billions of TARP dollars provided to banks with the express purpose to increase lending. As to the goal of “promot[ing] jobs and economic growth,” while job losses may have been far worse without TARP support, unemployment continues to hold at roughly 9.6%, 3% higher than at the start of the program. While large bonuses are returning to Wall Street, the nation’s poverty rate increased from 13.2% in 2008 to 14.3% in 2009, and for far too many, the recession has ended in name only. Finally, the most specific of TARP’s Main Street goals, “preserving homeownership,” has so far fallen woefully short, with TARP’s portion of the Administration’s mortgage modification program yielding only approximately 207,000 (out of a total of 467,000) ongoing permanent modifications since TARP’s inception, a number that stands in stark contrast to the 5.5 million homes receiving foreclosure filings and more than 1.7 million homes that have been lost to foreclosure since January 2009.

I find the blunt truthfulness of this report refreshing. I am amazed this came from our own government.

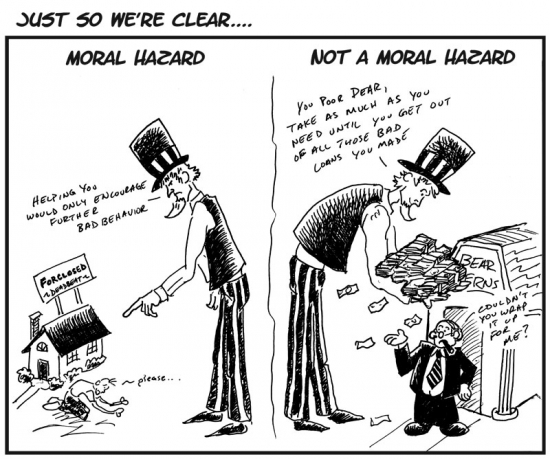

On the cost side of the ledger, the results have been mixed as well. It is undoubtedly good news that recent loss estimates continue to suggest that the financial costs of TARP may be far lower than earlier anticipated, with the most recent estimates placing the dollar loss at between $51 billion and $66 billion. But costs can involve far more than just dollars and cents. Any fair assessment of TARP must account for other costs that, while more difficult to measure, may be even more significant. For example, as SIGTARP has noted in past quarterly reports, increased moral hazard and concentration in the financial industry continue to be a TARP legacy. The biggest banks are bigger than ever, fueled by Government support and taxpayer-assisted mergers and acquisitions. And the repeated statements that the Government would stand by these banks during the financial crisis has given a significant advantage to the larger “too big to fail” banks, as reflected in their enhanced credit ratings borne from a market perception that the Government will still not let these institutions fail, although the impact of this cost may be blunted by recently enacted regulatory reform.

Indeed our big banks are in a race to see who can get too big to fail. Once there, they no longer have to worry about maintaining good financial ratios, making good loans that will get repaid, or sacrificing short-term gains for long-term growth.

Another even more fundamental non-financial cost, as SIGTARP warned in October 2009, is the potential harm to the Government’s credibility that has attended this program. Despite the recent surge in reporting on TARP’s successes, many Americans to continue to view TARP with anger, cynicism, and mistrust. While some of that hostility may be misplaced, much of it is based on entirely legitimate concerns about the lack of transparency, program mismanagement, and flawed decision-making processes that continue to plague the program. When Treasury refuses for more than a year to require TARP recipients to account for the use of TARP funds, or claims that Capital Purchase Program participants were “healthy, viable” institutions knowing full well that some are not, or when it provides hundreds of billions of dollars in TARP assistance to institutions, and then relies on those same institutions to self-report any violations of their obligations to TARP, it damages the public’s trust to a degree that is difficult to repair. Similarly, when the Government promotes programs without meaningful goals or metrics for success, such as its mortgage modification programs, or when it makes critical and far-reaching decisions without taking an even modestly broad view of their impact, such as pushing for dramatically accelerated car dealership closings without considering the potential for devastating job losses, or when it fails to negotiate robustly on behalf of the taxpayer, as it did when agreeing to compensate American International Group, Inc.’s (“AIG”) counterparties 100 cents on the dollar for securities worth less than half that amount, the Government invites public anger, hostility, and mistrust. And by doing so, it dangerously undermines its ability to respond effectively to the next crisis.

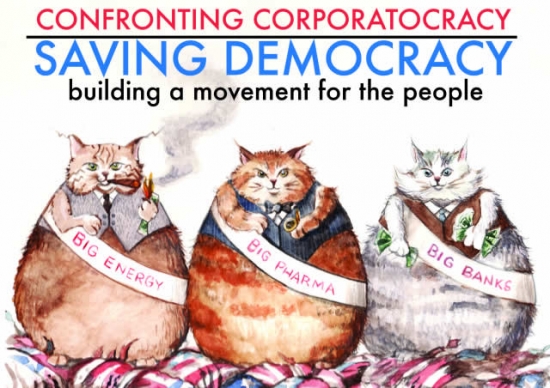

Interesting that this report documents exactly how the government corporatocracy is screwing us.

While TARP is arguably moving to a new phase, recent actions this past quarter unfortunately suggest that the risks it poses to the public’s trust in Government will continue. Indeed, two areas of the greatest anticipated spending going forward — the Home Affordable Modification Program (“HAMP”) and the AIG recapitalization plan — highlight those risks.

This rather scathing report has generated some uncomfortable questions at the Congressional Oversight Panel.

Schwartz to Congressional Oversight Panel: HAMP gets a bad rap

The government's much-criticized Home Affordable Modification Program helped set the stage for a successful private loan modification effort that likely wouldn't have gotten off the ground without it, said Faith Schwartz, former executive director of Hope Now.

If that is true, I wish this program had never started. Loan modifications do nothing but provide false hope to loan owners and extend this crisis.

Schwartz testified Wednesday before the Congressional Oversight Panel on the Troubled Asset Relief Program, in a hearing about TARP foreclosure mitigation programs.

"The HAMP roadmap set the stage for servicers to better apply solutions for distressed borrowers who failed to meet the HAMP requirements," Schwartz said in written testimony submitted to the panel.

"The Home Affordable Modification Program (HAMP) has received criticism, in part, because it did not immediately produce certain projected numbers of permanent loan modifications," she wrote.

The program has also been criticized by people like me who think it should not exist at all.

"This criticism is not entirely accurate," according to Schwartz. "HAMP has played an important role by helping to organize the participants and process in the loan modification effort and instituted a loan modification protocol that would have been difficult to mandate in any other way. Hope Now and government agencies attempted this in 2008 through the streamlined modification program, but it did not reflect all investors and primarily focused on GSE-owned loans. That was a start, but the HAMP program expanded and formalized those initial standards for loan modifications."

The Hope Now Alliance was formed in 2007 to expand and better coordinate the private sector and nonprofit counseling community to reach borrowers at risk.

"Early on, the goal of the Alliance was simple: reach at-risk borrowers that had no contact with their servicer," Schwartz said. "Research showed that over 50% of all foreclosures involved homeowners who were not in contact with their servicer."

Have you noticed rumors of principal forgiveness crop up whenever lenders want to get people to contact them? I think they use that as a bait-and-switch enticement to get people to contact their lender.

The alliance established a hotline, organized community outreach events, sent letters to delinquent borrowers and launched a website.

It also established HOPE LoanPort, a Web-based system that enables for uniform intake of an application for a modification, allows stakeholders to see the same information in a secure manner, and delivers a completed loan package to the servicer that is actionable. The pilot program includes 14 large mortgage servicers, representing a majority share of the market.

Everyone knows how slow and inneficient government programs are. As soon as the government got involved, it should have been apparent to everyone that by the time they got their programs working, the majority of loan owners would already be foreclosed on.

"HAMP modifications offer a well-defined safety net for borrowers as a first line of defense," Schwartz said. "As evidenced by Hope Now data, servicers are implementing significant modifications after reviewing for HAMP eligibility by offering alternative modifications in lieu of foreclosure. Servicers report proprietary non-HAMP solutions run almost three times greater than HAMP modifications due to eligibility challenges."

"These are modifications that do not require taxpayer dollars and they are meant to benefit the homeowner and investor in lieu of foreclosure," she said.

HAMP should not exist. It has largely been a failure; and in that, I think it was a success.

Get as much as possible as quickly as possible

One of the lessons the Ponzis learned from the housing bubble is that they need to refinance as soon as a new comp gives them some equity, and they need to keep borrowing to the full extend of their borrowing power. Besides the immediacy of the spending money, it gives them downside protection. When the market inevitably crashes, they have already sold the property to the bank for peak pricing. Then they get to walk away, and while the air comes out of the bubble, they can repair their credit to get ready for the next cycle.

- The owner of today's featured property paid $170,000 on 10/3/2000. He used a $163,150 first mortgage and a $6,850 down payment.

- On 8/20/2002 he refinanced with a $189,000 first mortgage.

- On 7/30/2003 he refinanced with a $189,200 first mortgage.

- On 8/29/2003 he refinanced with a $201,000 first mortgage.

- On 10/23/2003 he obtained a 21,500 stand-alone second.

- On 3/25/2005 he refinanced with a $251,000 Option ARM with a 1% teaser rate.

- On 1/10/2006 he refinanced with a $328,000 Option ARM with a 2% teaser rate. and obtained a $90,000 HELOC.

-

Total property debt is $418,000 plus negative amortization and almost two years of missed payments.

- Total squatting time is about 20 months so far.

Foreclosure Record

Recording Date: 08/16/2010

Document Type: Notice of Default

Foreclosure Record

Recording Date: 11/19/2009

Document Type: Notice of Rescission

Foreclosure Record

Recording Date: 06/18/2009

Document Type: Notice of Default

Do you ever wonder when I will run out of these? Irvine is supposed to be an upscale neighborhood where everyone makes hundreds of thousands of dollars a year. Why do we have so much HELOC abuse? Why are so many losing their homes due to their excessive borrowing? Could it be that Irvine is a facade? How much of Irvine is populated by posers trying to impress other posers?

Irvine Home Address … 117 ROCKWOOD 55 Irvine, CA 92614 ![]()

Resale Home Price … $289,000

Home Purchase Price … $170,000

Home Purchase Date …. 10/3/2000

Net Gain (Loss) ………. $101,660

Percent Change ………. 59.8%

Annual Appreciation … 5.2%

Cost of Ownership

————————————————-

$289,000 ………. Asking Price

$10,115 ………. 3.5% Down FHA Financing

4.29% …………… Mortgage Interest Rate

$278,885 ………. 30-Year Mortgage

$55,099 ………. Income Requirement

$1,378 ………. Monthly Mortgage Payment

$250 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$48 ………. Homeowners Insurance

$490 ………. Homeowners Association Fees

============================================.jpg)

$2,167 ………. Monthly Cash Outlays

-$125 ………. Tax Savings (% of Interest and Property Tax)

-$381 ………. Equity Hidden in Payment

$16 ………. Lost Income to Down Payment (net of taxes)

$36 ………. Maintenance and Replacement Reserves

============================================

$1,713 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,890 ………. Furnishing and Move In @1%

$2,890 ………. Closing Costs @1%

$2,789 ………… Interest Points @1% of Loan

$10,115 ………. Down Payment

============================================

$18,684 ………. Total Cash Costs

$26,200 ………… Emergency Cash Reserves

============================================

$44,884 ………. Total Savings Needed

Property Details for 117 ROCKWOOD 55 Irvine, CA 92614

——————————————————————————.jpg)

Beds: 2

Baths: 1 full 1 part baths

Home size: 917 sq ft

($315 / sq ft)

Lot Size: n/a

Year Built: 1980

Days on Market: 65

Listing Updated: 40474

MLS Number: S630604

Property Type: Condominium, Residential

Community: Woodbridge

Tract: Othr

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Price Reduction!!! CLEAN UPSTAIRS 2 BEDROOM, 2 BATH CONDO. BEAUTIFUL VIEW OF PARK/GREEN BELT. GREAT FOR FIRST TIME BUYERS/INVESTORS AND WONDERFUL FAMILY COMMUNITY. WOODEN BLINDS THROUGHOUT. NEWER CARPET AND PAINT. SEPARATE DINING ROOM.

Good for investors? Sure, I want to pay $289,000 to obtain $1,700 a month in rent, and give $490 a month to the HOA. Only a kool aid intoxicated fool would consider this a good investment.

HAMP is problematic because it only reaches a narrow spectrum of borrowers – those that aren’t very far from an affordable mortgage payment.

That’s why I think the solution, if you’re looking for one other than market forces, is for FHA to increase the LTV on refis to 120%. Keep all the new conservative lending standards and charge 150+ bps MI for the additional risk.

It’s my understanding that those utilizing HAMP are actually far from “an affordable mortgage payment”.

This is from Calculated Risk:

http://www.calculatedriskblog.com/2010/09/hamp-data-for-august.html

“If we look at the HAMP program stats (see page 3), the median front end DTI (debt to income) before modification was 44.9% – the same as last month. And the back end DTI1 was an astounding 79.9%.

This means that for the median borrower, about 80% of the borrower’s income went to servicing debt. And the median is 63.5% after the modification.

These borrowers still have too much debt, even after the modification – and that suggests an eventual high redefault rate. There have been 18,773 redefaults already. It would be nice to see percent defaults by months from when the “permanent modification” started.”

Honcho

“California has a comprehensive statute that must be followed to perfect a foreclosure. Producing the note is not required.

The holder can designate a party to initiate and conduct the foreclosure. These parties are authorized in the mortgage and are duly recorded in the real property records.”

And what about when the mortgages are sold or securitized? Are you saying that the new owner or holder and/or trustee is recorded?

Probably my fault for not being as clear as I needed to be in a public board where people are not 100% familiar with the legal/technical aspects of this. I’ll try to be a little more clear and straighten this out without getting too bogged down in the details.

Don’t confuse a trustee on the deed of trust with the trust that owns/holds the note once it has been securitized.

There is a designated trustee on the deed of trust that is recorded in the real property records when a loan is made. The Trustee, in this case, is tasked with only 2 responsibilities(I’ll try to make it simple): 1) to convey the property to the borrower upon full and final payment, or 2) to foreclose if the borrower doesn’t make payments.

The Trustee acts at the direction of the holder of the note or the agent of the holder. THe agent/nominee of the holder is also designated in the mortgage and does not change even when the loan is subsequently designed (see MERS).

Often, you will see a “substitution of trustee” that is filed in the public records before a foreclosure is commenced. Again, don’t confuse this Trustee with the securitized trust. Rather, this is the Trustee on the deed of trust that will initiate the foreclosure. This is often done by the designated beneficiary/nominee in your mortgage who is authorized to act on behalf of the holder of the note.

All of this is agreed to in your mortgage. Your mortgage reads right along with the California statute as far as who is entitled to foreclose.

Thank you for clearing this up. I, and probably many, have wondered about these “trustee” and foreclosure issues.

Let us see if I under this. The original trustee was designated as such when the mortgage originally recorded. If the mortgage is sold, resold, or securtized, the designated and recorded trustee does not change, unless the ownership of the property is transferred.

Query: If the owner of the note tells the trustee to foreclose, how does the trustee know that the owner of the note is the present and true owner of the note?

Honcho – Would you consider writing a post for my blog, Coto Housing Blog, on this issue? If IR does not object?

Yes, please do. I enjoy your posts very much.

“Honcho – Would you consider writing a post for my blog, Coto Housing Blog, on this issue? If IR does not object?”

I don’t mind. I would link to you if you get Honcho to write something.

Query: If the owner of the note tells the trustee to foreclose, how does the trustee know that the owner of the note is the present and true owner of the note?

A: The reality is that it is the servicer that drives this process. As part of their duties owed to the holder of the note and in accordance with their duties under the PSA, the servicer is the party that is charged with initiating the foreclosure on behalf of the note holders when there has been a default (the Trustee is acting at the direction of the servicer who is authorized to do this under the PSA).

Certainly the servicer knows where the payments are being sent and who they are acting on behalf of when collecting payments. I think AZDavid said something to this effect yesterday: when payments are made by the borrower, they are properly credited against the amount owed. Those payments are going to the proper pool(s) (at least I have never been made aware of a situation where this was not the case).

—

I appreciate the fact that you would like for me to post something, but I’m not sure I’m 100% comfortable doing so. Namely, because I have not been practicing in this area of the law for about a year now (my current practice is not mortgage or consumer credit related). Is there someway for me to contact you to discuss durther and figure out what aspect of this you would like for me to discuss?

My email address is cdcrez@cox.net and you could write it as a layperson opinion. I did not know you were an attorney, although the possibility was obvious. My idea is that I would ask you a series of questions, similar to the last few posts here; an interview. It would be unnecessary to identify yourself as an attorney and your blog nom de plume would be desirable.

” Irvine is supposed to be an upscale neighborhood where everyone makes hundreds of thousands of dollars a year. Why do we have so much HELOC abuse? Why are so many losing their homes due to their excessive borrowing? Could it be that Irvine is a facade? How much of Irvine is populated by posers trying to impress other posers?”

That’s not what Irvine in general is supposed to be. This entire zip code where this condo is located only has a median income of $97,000.

This is a 2BR condo, there are plenty of crappy condos and apartments in Irvine. At least half of Irvine is a 1200 sq ft condo or smaller.

When you start looking at particular neighborhoods in Irvine with a large density of sigle family houses the median income starts to go up into the $150-200K range.

What year was that? 2006?

TONS of people are out of work here. Business are moving out and real estate in OC is still way overpriced.

There is going to be a real correction in OC soon as many more people are going to do strategic default. It just makes good business sense.

There is nothing stating that you have any moral obligation to stay in a bad deal. Banks just want you to think that.

It looks like much of the median “income” in particular neighborhoods in Irvine in the $150-200K range was equity pulled out of the housing ATM.

The income data doesn’t include any helocs, but you already knew that. Coto’s best neighborhoods have even higher median incomes.

I saw the kind of people that live in Coto….they were on the “Housewives of Orange County” other than one of them who is hard working and fits your profile, one lives off a divorce settlement from a ex-BB player and the others turned out to be posers who had to move out.

We at the Coto Housing Blog have researched on a neighborhood by neighborhood basis, the amounts and percentages of equity removed by refis and HELOCs and the amounts are mind boggling. I do not have access to income levels or income data in Coto, but I suspect than many more than one would think were living beyond their means, using refis and HELOCs to extract money to make their mortgage payments until 2007 when the refi and HELOC train derailed.

The median income of Coto de Caza is $219,739.

Sure there are posers every where, Coto is no different but there is plenty of money.

Over generalizing based on inventory is a mistake.

“but I suspect than many more than one would think were living beyond their means, using refis and HELOCs to extract money to make their mortgage payments until 2007 when the refi and HELOC train derailed.

”

Yeah, like that poser Slade Smiley for one…

I’m in agreement with PR here.

The HELOC abusers IR profiles often here is not indicative of the majority of owners in Irvine.

If that were true, wouldn’t prices be lower instead of higher than the rest of OC?

And wouldn’t renters be “posers” too? Paying less for more? Easy with the generalizations IR… you’re creating drama where none exists.

This looks like the upstairs unit of the place IR profiled yesterday.

Turns out it’s not. But I can’t imagine paying 300k for a cookie cutter box. Where is the quality of life?

Deja vu. Another F , that’s 2 days in a row. These little condos look like apartments. The upstairs units only have the stair landing as their outdoor space. $289,000 for that? I wonder what these sold for during the peak. $400,000? 🙄

The good news is that someone making a very low income in Irvine of $55K can afford it now. (close to half the zip code median of $97K)

A run of the mill working couple in Irvine makes $120K-$140K combined. I wouldnt even call said couple successful they are basic working stiffs, and when they have kids the wife may be forced to work. Welcome to the rat race of Irvine. A more successful couple makes $200-$300K if both are working.

Run of the mill makes $120-$140K? Let’s my wife and I are both graduate degreed professionals with 15 years experience working for one of the largest employers in the OC and we don’t make that kind of coin.

What’s the percentage of family incomes in Irvine that are in your so-called “successful” range?

I’m not sure what your degrees are and where they are from. If they are valuable degrees and you don’t make that combined you shouldn’t have worked there as long as you have.

Ouch

sorry but have to agree with PR. if you have a 4 year degree and arent making 75k after 10 years of working, then you arent managing your career very well. one of the easiest traps is not changing employers so you never get that big salary bump. frankly, after 10 years, i find it hard to believe the you are making less than 75k even if you never changed careers

my wife works in recruiting and sees all the jobs and salaries associated with these jobs. entry level jobs that need 4 year degrees start at 45k in OC! 10 years is 5% annual raise and obviously thats not easy but have to assume 1 decent promotion in 10 years and then basic raises

He’s right – 2 people with graduate, professional degrees and 15 years experience each, should be making at least in the range of $60k to $70k per year in California. I guess that assume they are both working, and in some field somewhat related to their degrees. If working means Walmart greeters or burger flippers, then family income might suffer.

forget overall california…i am talking just about OC. of all my close friends that graduated in 2002, only 1 makes less than 75k now and thats because she absolutely loves her job and has no desire to change. this is out of 14 people and obviously not an indicator but nonetheless, the friends have a wide variety of jobs. sales, accounting, engineering, consulting

go to glassdoor and see what your job should be making in OC

I’m not sure who would purchase this 2 bedroom apartment. Before Planet Realty chimes in, at $1700 per month it’s probably at rental parity. Regardless, who would want to live here long term and risk losing anymore equity? Renting a similar apartment makes much more sense.

I’m not sure who would want to live here. I would consider buying and renting an Irvine crap shack like this if I could get it at rental parity on a 15 year loan term.

I like you was amazed that the SIGTARP report actually saw the light of day. It’s a refreshing read with great clarity in it’s purpose. Go through the AIG data if you really want to see Gubmint enabled fraud.

My .02c

Soylent Green Is People.

We all are makers or takers to some extent. Unfortunately more seem to be takers and believe something is owed to them.

For all … go out and produce!

If housing is a obvious example. So many people looking for mortgage modification or a principale “adjustment”.

Get real… why should the prudent pay for the imprudent? If you want to live off someone else go elsewhere.

My .02

BD

just some facts: half of Americans pay no income tax due to redistribution and ‘transfer payments’. Are you kidding me?!

Housing must fall in price. By keeping idiots in their houses that don’t pay we keep willing and prudent buyers out of a chance to own in a reasonable housing market.

We are still 30% too high in SoCal. Get real…

Your money is your money. My money is mine. It doesn’t belong to the governement. I work 6 months of the year just to pay them!!!!

BD

Enjoyed your article until I got to the Newer image at the end. I almost lost my stomach. Please no more pictures like that one.