A new report from Amherst Securities projects that 20% of all mortgages will default and 11 million people will lose their homes.

Irvine Home Address … 5151 DOANOKE Ave Irvine, CA 92604

Resale Home Price …… $549,000

I was thinking of a series of dreams

Where nothing comes up to the top.

Everything stays down where it's wounded

And comes to a permanent stop.

Wasn't thinking of anything specific,

Like in a dream, when someone wakes up and screams.

Bob Dylan — Series of Dreams

Is it possible for the housing market to stay wounded permanently? Will prices in Las Vegas fall forever? Will prices reach zero? Will Orange County prices stay high forever? Perhaps if lenders give away homes to the squatters the inventory will never hit the market and prices will not crash.

What does a delinquent squatter do if they want to sell? Oh, wait… since they don't have any equity, there really isn't anything to sell. They really don't own anything other than a big loan and dreams of future equity during the next housing bubble.

A Mammoth One in Five Borrowers Will Default

October 3, 2010 by Michael David White

A leading mortgage analyst predicts over 11 million homeowners will default and lose their home if the government fails to take more radical intervention.

Amherst Securities Group LP, one of the most respected names in mortgage research, has trumpeted an ambitious call-to-government arms in its October mortgage report.

“The death spiral of lower home prices, more borrowers underwater, higher transition rates (to default), more distressed sales and lower home prices must be arrested.”

Must the decline be arrested? I suppose it depends on the market. If the decline is stopped to early, you end up with inflated markets like Orange County. If the decline is not stopped and the market is cleared through capitulation, prices get pounded back to the early 90s like they are in Las Vegas. I proposed a method to stop the decline in Should Government Mortgage Subsidies Be Offered to Cashflow Investors?, and anyone who reads the comments can see how well that idea went over.

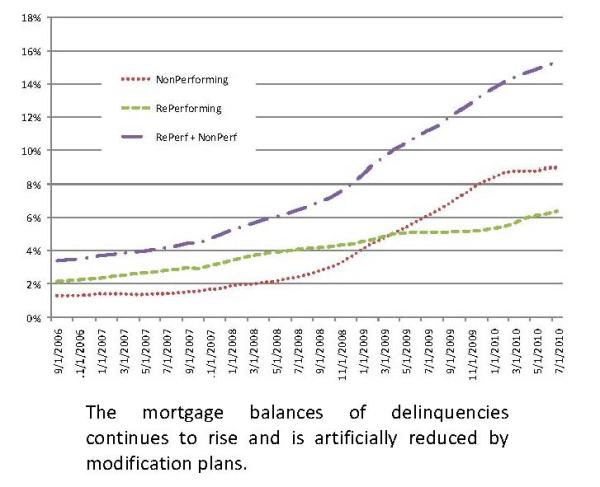

The authors dismiss recent talk of mortgage performance improvement as statistical sleight-of-hand magically conjured by modifications.

“This ‘improvement’ (in mortgage performance) simply reflects large scale modification activity having served to artificially lower the delinquency rate” (Please see the chart above of mortgage balances delinquent and re-performing. All charts in this post are from “Amherst Mortgage Insight” dated October 1, 2010.).

It's refreshing to see an analysis that goes beyond the headlines and takes a hard look at the effectiveness of these programs and the redefault rate. It's obvious that the loan modification programs have been a complete failure, and the statistical blips these programs create merely foster false hope that the problems in housing will somehow cure themselves.

The report offers an astounding forecast of the fate of severe negative-equity properties. Nineteen percent of properties with a loan-to-value (LTV) of 120% or greater are defaulting every year. A death-defying 75% of mortgages on 120% LTV properties will eventually go bad (19% + 19% + 19%, …).

The current crop of mortgages is already “impaired” at the one-of-five level. Nine of 100 are seriously delinquent. Six of 100 are “dirty current” (made current by modification). Five of 100 are seriously underwater (LTV greater than 120%) (Please see the chart above categorizing the forecast of 11 million defaults.).

The authors, who describe current conditions as leading to “an impossible number” of defaults and one that is “politically unfeasible”, unveil a major arms race of measures to counteract the default tide.

Brace yourself: if you didn't like my idea to stabilize prices, wait until you read through this list….

The solutions include

- mandatory principal reductions,

- looser underwriting of new mortgage loans,

- leveraged capital pools for investors, and

- penalties for defaulting homeowners.

Amherst reports that a family who defaults can live rent-free for 20 months on average. They propose that missed mortgage payments, including property taxes and insurance, be counted as W2 income.

I love that idea! Tax the squatters!

They make note of recent new signs of distress including two record-low readings of existing home sales in the last two reports. Another block is that underwriting standards have grown much stricter at Fannie and Freddie. Only 2% of Freddie purchases are now bad-credit borrowers where they represented about 20% of borrowers in 2006. FHA purchase mortgages, however, which have by definition much more lenient lending guidelines, have exploded upwards from roughly 10% of their lending in 2006 to more than 50% today.

The buyer pool is also compromised by the fact that 17% of borrowers now have a seriously compromised credit history. After mortgage default a typical wait-time to qualify again is anywhere from 3 to 7 years. One of the more desperate measures suggested by the authors seeks a new mortgage for those who are now behind or in danger of failing. “This (default) can be fixed by re-qualifying borrowers who are in a home they can’t afford into one they can afford.”

The dilemma of a deflating bubble is that supply grows while demand shrinks largely due to tigher credit standards and increasing borrower delinquency. There is no easy solution. The process must move forward to completion. There is no magic wand the government can wave and make everything better.

Risk is so high in today’s real estate market that private money has largely left the mortgage category. The retreat is most easily seen in the jumbo mortgage market. Total jumbo mortgage origination has fallen from a high of $650 billion in 2003 to $92 billion in 2009 (see the chart above). Government loans account for 90% of current originations.

“If government policy does not change, over 11.5 million borrowers are in danger of losing their homes (1 borrower out of every 5),”‘ the report said, which estimates the total of homes with a first mortgage at 55 million. “Politically, this cannot happen.”

I have heard this bogeyman thrown out before. What does it mean to say this politically cannot happen? What if it does? I doubt we will see rioting in the streets or the collapse of government. What you would see is a lot of renters who used to be owners saving a lot of money on their housing costs.

Don't loan HELOC abusers money

Every once in a while, I see a private party loan get recorded in the property records. These usually come at the end of a long series of refinances and represent a personal loan from a friend or family member. These are almost always a bad idea. Whatever relationship these two people had is now ruined because the loan will likely never be repaid.

- This property was purchased for $265,000 on 6/23/1999. The owner used a $212,000 first mortgage and a $53,000 down payment.

- On 5/22/2002 he obtained a stand-alone second for $50,000.

- On 5/27/2003 he refinanced with a $304,500 first mortgage.

- On 11/13/2003 he obtained a stand-alone second for $120,000.

- On 2/7/2005 he refinanced with a $455,000 first mortgage.

- On 5/3/2006 he got a stand-alone second for $150,000.

- On 4/22/2008 he borrowed $20,000 from a private individual.

- Total property debt is $625,000.

- Total mortgage equity withdrawal is $413,000.

He hasn't been served a default notice yet, but I image this owner is part of the non-paying shadow inventory. People who put their houses up for short-sale rarely make payments during the process. Why would they?

Irvine Home Address … 5151 DOANOKE Ave Irvine, CA 92604 ![]()

Resale Home Price … $549,000

Home Purchase Price … $265,000

Home Purchase Date …. 6/23/1999

Net Gain (Loss) ………. $251,060

Percent Change ………. 94.7%

Annual Appreciation … 6.3%

Cost of Ownership

————————————————-

$549,000 ………. Asking Price

$109,800 ………. 20% Down Conventional

4.74% …………… Mortgage Interest Rate

$439,200 ………. 30-Year Mortgage

$110,335 ………. Income Requirement

$2,288 ………. Monthly Mortgage Payment

$476 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$46 ………. Homeowners Insurance

$0 ………. Homeowners Association Fees

============================================

$2,810 ………. Monthly Cash Outlays

-$387 ………. Tax Savings (% of Interest and Property Tax)

-$554 ………. Equity Hidden in Payment

$198 ………. Lost Income to Down Payment (net of taxes)

$69 ………. Maintenance and Replacement Reserves

============================================

$2,136 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$5,490 ………. Furnishing and Move In @1%

$5,490 ………. Closing Costs @1%

$4,392 ………… Interest Points @1% of Loan

$109,800 ………. Down Payment

============================================

$125,172 ………. Total Cash Costs

$32,700 ………… Emergency Cash Reserves

============================================

$157,872 ………. Total Savings Needed

Property Details for 5151 DOANOKE Ave Irvine, CA 92604

——————————————————————————

Beds: 4

Baths: 2 full 1 part baths

Home size: 1,976 sq ft

($278 / sq ft)

Lot Size: 5,543 sq ft

Year Built: 1970

Days on Market: 18

Listing Updated: 40437

MLS Number: P752184

Property Type: Single Family, Residential

Community: El Camino Real

Tract: Ch

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

TWO STORIES, 4 BEDROOM, 3 BATHS, EL CAMINO TRACT. NEW KITCHEN CABINET, NEW GRANITE COUNTER TOP. PROPERTY SOLD 'AS IS' CONDITION. SELLERS ARE VERY MOTIVATED, CO-LISTING AGENT PHU NGUYEN 714-210-0204.

I can tell you why the co-listing agent is involved with this transaction, but that might give away too much….

Extrapolating what’s happening in Irvine to the rest of the country is as misguided as when people ignored what was happening in bubble areas because it wasn’t happening everywhere.

You’ll see different waves of foreclosures. From what I’ve seen in FL, the specuvestors of 05/06/07 are nearly extinct. Unemployment related foreclosures are very different. If we think that 10% unemployment will persist, then those homes will definitely be foreclosed. If employment gets better, then some of those dq’s will cure, prob thru refi.

The analysis is on the right track, and there may be that many additional foreclosures. If that is the case, then the number of additional foreclosures will be close to twice what we’ve already seen, which I don’t see happening.

If you’re counting on prices to go down (speaking nationwide here) based on higher interest rates, Bernanke will not let that happen. Buying MBS’s and GSE paper is a very focused intervention directed at home prices. BB has done it and will do it again to keep prices from falling much further – again speaking nationwide.

What will happen is some areas will keep falling due to more supply and falling demand – see Detroit. Other places like South Florida will see excess picked up by vacationers. Other areas in FL that dont’ have vacation markets will be crushed.

“If you’re counting on prices to go down (speaking nationwide here) based on higher interest rates, Bernanke will not let that happen.” Bernanke does not control interest rates. Bernanke has had success manipulating interest rates at a prolonged decreased number, but he does not control rates, especially at the long end of the curve. Interest rates can start jacking up at any moment and there will not be a thing he or anybody else will be able to do about it.

“Control” might be too strong a word, but the Fed “strongly influences” interest rates.

You are right about general interest rates, but the federal government can do whatever it wants with mortgage rates. Taken to the extreme 0% mortgages provided by the government are possible. Stupid yes, but definitely within the span of control.

As a side note it appears the entire world is trying to devalue their currencies and keep rates low.

“They propose that missed mortgage payments, including property taxes and insurance, be counted as W2 income.”

I love it.

I’ll be one of the many that walk from their home…with nothing. I suppose you could try and make me pay even more for the fraud than I did, but a BK will take care of all that nonsense.

I plan on squatting as long as I can to recoup my 20% down payment. Not everyone getting kicked in the ass tried to scam the system, but I *will* make the best financial decision possible.

Why don’t you just pay your mortgage?

Don’t forget to replace all the fixtures before you’re finally booted out; abiding by the law of course.

Any high end appliances should be replaced with the cheapest Wal-Mart garbage possible. Go look for some old mismatched 80s vintage fridge and stove that someone is getting rid of.

Also don’t forget to replace all copper plumbing with plastic (should be able to get a hundred bucks or so for that from scrap value).

Just don’t do what this bonehead in Temecula did.

This attitude is exactly why squatters should be taxed. If you’re only looking out for yourself, why shouldn’t the taxpayers and banks?

It is unfortunate that you are underwater, but I do wonder, as people like yourself were buying, hoping RE would continue to appreciate forever, did you 1) ever think it might not? or 2) consider how you were part of the dynamic of pricing first-time home buyers out of the market? If RE had gone up another 5 years in a row, and only brain surgeons could afford to live in your neighborhood, would you feel any guilt about profiting at others’ expense?

I didn’t think so. So don’t expect us who sat on the sidelines during all of this to feel sorry for you. Because had you timed the market right, you wouldn’t have felt sorry for those left holding the bag.

I don’t expect anyone to feel bad or sorry for myself, and I surely don’t think the government should cover losses of my BANKSTER.

The simpleton sweeping generalizations I read here helped confirm in my mind to walk away. The only thing *you* worry about is yourself, hence the reason your panties are all in a bunch. Just go vote more conservative republicans in office to make things better, it’s worked so well since Reagan.

No, I’m taking my “ownership” and I will cash it in NOW to put some money aside for my financial well being (aka enough to afford a rental and a reserve cash account).

Take the fraudulant/artificially high prices of homes and shove it, I’m not sacrificing my families well being to make you feel better about “morals” and “ethics”. F that. When I default I’ll post and let you know how many months I get too live while recovering the $100,000 CASH I invested.

Did you not know how much you were paying for your house when you bought it? I assume you did, so at some point you were A-OK with “the fraudulant/artificially high prices of homes”.

That being said, provided you don’t trash the place, you are basically abiding to the terms of your loan agreement. Either you pay what you owe, or the bank has the right to kick you out. They also have the right to not kick you out, or wait a damned long time to do so.

“Did you not know how much you were paying for your house when you bought it? I assume you did, so at some point you were A-OK with “the fraudulant/artificially high prices of homes”.”

Exactly, did they have the price of the house blacked out? And had it appreciated, I’m sure he’d have been happy to pass along his house to some other poor guy to be hopelessly indebted.

“I don’t expect anyone to feel bad or sorry for myself, and I surely don’t think the government should cover losses of my BANKSTER.”

But of course you know the government will do that if everyone walks away and banks crater. Odds are your lender already has TARP funds keeping it afloat. And banks are owned by individual shareholders, not some rich fat cats.

“The simpleton sweeping generalizations I read here helped confirm in my mind to walk away. The only thing *you* worry about is yourself, hence the reason your panties are all in a bunch. Just go vote more conservative republicans in office to make things better, it’s worked so well since Reagan.”

Ha, where do I even start? Generalizations? I didn’t see a job loss or a cancer diagnosis in your original post, so it looks like this is, in fact, all about you, Strategic Defaulter, walking away when he doesn’t have to. Where did we go wrong with our generalizations? Typical lib, no personal responsibility, nothing is your fault, you were tricked into a big, expensive house by big mean bankers!

Yeah, blame Republicans. Bush isn’t innocent with his ownership society bullshit, but at least he tried to reform Fannie and Fred in 2001 but libs like Barney Frank killed it. Yeah, all that government intervention with low rates and easy F&F credit and low FHA standards had nothing to do with it. Blame it on free market Republicans, LOL!

“No, I’m taking my “ownership” and I will cash it in NOW to put some money aside for my financial well being (aka enough to afford a rental and a reserve cash account).”

Not sure what that means exactly. Good luck with the short sale? You expecting a net profit in your sale?

“Take the fraudulant/artificially high prices of homes and shove it”

Ha, “fraudulant/artificially high prices,” what does that even mean? Did the seller write in an extra zero on the contract when you weren’t looking? And your buying too much house in the middle of a bubble didn’t contribute to this pathology at all. Those Big Bad Bankers are at fault! You really have convinced yourself that you are the good guy in this.

“I’m not sacrificing my families well being”

So your family’s well-being was OK living in that nice house paying the mortgage every month until you went underwater? Same house isn’t it? Does the roof now leak? What has changed other than your ability to flip-for-$$?

“to make you feel better about “morals” and “ethics”. F that.”

Ha, morals and ethics are silly, meaningless words with scare quotes, huh? “Ask not for what you can do for your country, ask how you can fleece taxpayers for your bad decisions.” Isn’t that how it goes?

“When I default I’ll post and let you know how many months I get too live while recovering the $100,000 CASH I invested. ”

Great, because it’s all about you when your foreclosure helps tank property values even more, makes banks (owned by individual shareholders) more insolvent, making taxpayers even more on the hook. A candid look at a liberal, all about public service and looking out for the other guy, LOL! Thanks for your service!

JD, even if one takes the most cynical possible view of people like Swiller, their arguments simply don’t make sense, as you correctly point out, and as I tried to point out above. They agreed to buy a house, and agreed to pay a mortgage. The fact that the house has supposedly lost market value is meaningless – he’s just upset that the house he bought hasn’t made him paper rich.

I laugh at the use of the term ‘bankster’ – since it is the bank that Swiller ripped off in his “heads I win/tails you lose” view or ethics. I don’t feel sorry for the bank, since they shouldn’t have loaned him the money in the first place, but if anyone here is a crook, it isn’t the ‘bankster’!.

No worries.Aint gonna replace my 70k lost income from layoff.Screw the house payments.Sue me.Just get in line.

Swiller wasn’t the only person who got burned like this. Lots of people bought into the hype and didn’t think about the true consequences. He/she has an obligation with the bank, and the terms of the deal are clear. Stop paying and the bank takes your house back. This is the key problem with non-recourse mortgages; it makes it too easy to gamble and simply walk away.

I don’t feel sorry for Swiller and I certainly don’t feel like helping out in any way. I’m saying this without considering all the possible consequences, but what’s the worst that could happen if all the hopelessly underwater people just walked away? Screw the banks, the GSEs, and the pension/retirement funds heavily invested in these junk investments. In the world of investing there are gains and there are losses; people need to get over the entitlement mentality. We need to stop bailing these losers out. The GSEs should have never been taken over and should have been declared insolvent.

Whew, maybe I need some afternoon coffee!

The problem is, we now own the banks (through TARP and further assumptions of TBTF) and the GSE’s. If everyone walks away, it socializes their bad behavior at taxpayer expense. A ton of walk-aways means prices crater even further, banks and GSE’s are even more insolvent, even more tax dollars wasted.

I definitely think strategic defaulters should be treated much harsher than those forced into it by job loss, etc. There should be a “you’re banned for life from any FHA loan, dummy” registry.

Your’re forgetting the FDIC insurance on bank accounts.

It’s not just some corporate guys pay he k that takes the loss, it’s everyone who has a bank account.

I suspect the govt has done the math and having the taxpayers do the ridiculous bailour so far\ ongoing is still cheaper than having house prices plummet, borrowers walk away en masse, the banks losing tons of money, and then the FDIC (ie. Taxpayer again) refill the difference to everyone’s bank account. Plus the costs of economic downturn that would follow such actions (like everyone panicking and spending nothing, and pulling their money our of banks and money market funds like we had before).

Swiller, you are good. I tip my hat to you.

I second this. The carrot and the stick, there have been plenty of carrots, it’s time for the stick.

While a great sounding idea… I not sure you can classify unpaid mortgage as “income”. Your income has already been taxed, to declare it again and tax it again sounds like double taxation to me.

But I’m not an awgee.

This should be covered in the taxation of Debt Cancellation. But the feds already let that go. Reinstate the old Debt Cancellation policy first.

http://www.irs.gov/individuals/article/0,,id=179414,00.html

Who “paid” this “income”?

You can not claissify unpaid mortgage as income any more than you can classify unpaid rent as loss. Normally the realized loss to the bank is declared as income through a 1099-C, forgiven debt to the borrower, but your elected smart guys have temporarily suspended tax liability of the majority of frogiven mortgage debt.

Unpaid mortgage interest is a liability that if cleared/forgiven/written off certainly becomes income. Economically there is no doubt about that. Whether or not such income is covered under the primary mortgage exclusion is another question.

It isn’t the income they would be taxing but the free benefit. If I win a free car in a contest I have to pay taxes on that too.

I guarantee that if they taxes squatters, they’d get the F out in a hurry. Income tax is not dischargeable in BK. Might as well make them pay rent somewhere and contribute to the economy somehow.

So if I own a loan on a home in TR and I cease paying my mortgage payments, someone would like to tax me for the missed payments as if they were income. Does that mean I can then claim the missed payments as “good” since I am being credited with income (and an income tax liability) from them?

I’m curious and maybe this is a dumb question, but I’d like to put those default estimates into context and I haven’t been able to find historical default rates presented succintly anywhere. The 11 million number seems large; as you note, 20% or so of outstanding mortgages. I am wondering how this compares to the historic averages? I’m guessing something like a 2% annual default rate is the historical norm. Guessing even further, adjusting for new loan originations I’ll just assume that the time horizon for a loan to go bad in would be five years; so possibly a 10% ultimate default rate might be normal. In other words, perhaps one in ten mortgages historically eventually defaulted? That estimate could be wildly wrong for any number of reasons – as noted, I haven’t yet found the historical data. If the number is anywhere near current, it is compared to the 20% of currently existing mortagages that are estimated to default. So, if those numbers were correct we would expect twice the normal historical rate of defaults in the existing mortgage pool. That sounds bad, but not catastrophically so. Does anyone have the ‘real’ historical numbers?

Those numbers are available for Fannie/Freddie, which admittedly had (have??) lower average default rates than the industry as a whole (due to loan type).

Until recently, the Fannie/Freddie default rate after 10 years was around 1% (that’s TOTAL defaults, not defaults per year).

I refer you to the charts at

http://seekingalpha.com/article/204265-the-disconcerting-truth-about-fannie-and-freddie-default-rates

These show a DRAMATIC disconnect from the historical norm starting with loans originated around 2004. We’re not talking twice here . . .

That is one ugly house, inside and out. I wonder if the iron gate has some kind of message or meaning.

I was going to say the same thing. IR has featured many homes that are very nice; this is NOT one of them.

What’s up with that living room, if you can even call it that? Three pieces of furniture (one that doesn’t even come close to matching) which face… a giant aquarium?

I feel like emailing the realtor, “DOES ‘AS-IS’ CONDITION INCLUDE GIANT AQUARIUM? IF SO, I AM INTEREST IN PROPERTY. IS JUST ONE SINGLE ‘CABINET’ NEW, OR ARE ALL CABINET NEW?”

Ok, I apologize, I thought the amusement of poking fun of listings would get old very quickly, but it hasn’t!

Agree,

The front gate looks nasty and makes the entire neighborhood seem unappealing.

There’s a benefit to having an HOA.

They help keep these eyesores out.

Uh, no, the default rate is 2% pretty much until 2005, when it started to rise from 50,000 foreclosures a year to 7X that by 2009.

In May of 2009, 1.3% of all mortgages went into default.

Think about that statistic for a second. 1.3% in one month.

Thought you folks would get a kick out of this graphic:

http://www.yoism.org/images/AlanGreenspanFreeMarketMagic.JPG

If you’re interested in arresting the decline in housing, then I think the solution is this:

Fannie/Freddie should begin offering rate & term refis (no cash out) to all “qualified borrowers” up to 120% LTV. By “qualified borrowers” I mean using current underwriting standards, but increasing the LTV ratio to 120%. The mortgage should be 30-year fixed rate at below 5%, maybe even ladder the rate to start at 3% and increase slowly over the next five years to 5%. Limit the amount of the refi to the current conforming loan limits that are very high in high-cost areas.

This would reset underwater home-debtors biggest monthly expense freeing-up a ton of cash and strongly discourage walk-aways.

Taxpayers would be taking the risk onto the government’s balance sheet and off the banks’/ investors’, but many of these mortgages are already guaranteed by Fannie/Freddie. The Fed is already interested in Quantitative Easing II.

Of course, many here aren’t interested in arresting the decline in housing, and that’s completely understandable. I guess it depends on how damaging you believe another serious decline downward would be to the economy?

Good thought. That said, if it takes me a decade to get even why do I stay?

BD

You only stay, if: your mortgage after refi is below rental parity, you’re interested in preserving your credit score, you like the home you’re in, and would generally feel terrible if you walked-away from an obligation.

In theory, the additional cash-flow you’d receive from the refi could be used to improve your balance sheet and prepare for additional principal payments.

e.g. The current balance on our mortgage is around 10% higher than comparable homes are selling for in our neighborhood. We bought a house < 2.5x our income 3+ years ago, so we'd qualify under today's underwriting standards. If we could refinance the balance at 5% (fixed for 30) our mortgage payment would decrease $1,000+ (a 24% decline in our monthly obligation)! Sure, we'd still be underwater, but our payment would be well below rental parity (we're slightly above parity currently after adjusting for tax consequences). The government has rightly allowed the homeowners who stretched the most lose their homes and reset their finances. This has contributed to the weak economy. I think we could avoid a lot of further pain if we tried this refinance plan.

“PROPERTY SOLD ‘AS IS’ CONDITION.”

WTF? Did some new RE waiver law pass that I didn’t hear about? I guess no need for an inspection, LOL.

“SELLERS ARE VERY MOTIVATED”

LOL, how on earth is this supposed to help? Why not just say, “we’re desperate, low-ball us!”

What you need is motivated buyers, so lower your price. Then again, if the bank isn’t motivated, you’re dead in the water.

BTW, what does “mandatory principle reductions” mean? Was the Fifth Amendment repealed?

And yes, tax the squatters.

Ooooo…another listing where the property details in the listing and what the government says are different. The listing says it’s a 4 bed/2.75 bath house with 1,976 sq ft; the tax records say it’s a 3 bed/2 bath house with 1,480 sq ft. I wonder which is right, and if there’s an unpermitted addition (or a screw up at the tax collectors’ office)?

I think the unpermitted addition is the ugly front of the house. I bet at one time it was a one story.

Hello All –

…does anyone agree that quantitative easing which boosts commodities and the everyday expenses for Americans make housing prices look even more distorted? Suppose we do get inflation – modest or even they type that rips – what does that do to heavily levered assets like housing? By the way this is what the FED is trying to do i.e., increase inflation.

It seems to me that leveraged assests like housing will suffer in value. The short term may allow people to buy higher priced homes with less monthly income but, when rates reverse prices will get killed. We could easily see a 2 or 3 point rise in 30 year fixed rates over the next 10 years. This will likely mean that prices will fall another 20-30% on the same home purchased today.

You better hope to pay down that mortgage because appreciation from financing is gone in my humble opinion.

my .02

BD

All of the pressures on prices you’re describing are forcing economists and journalists to increasingly call for more assistance to home-debtors (like it or not).

Or, all those people and sovereign wealth funds parked in 2 year Treasuries making less than half a percent might wise up and start buying anything (ex. Houses or REIT fund) that the govt cannot print like money.

Hard to forecast which way it is going to go.

I dunno, so we bought the house like a car – something practical and affordable to be used. More like a good to be used than an investment. Had to live somewhere, sonwentnfor rental parity.

Again, what makes you think you can affort $650K at 4/38 for a 30 year now but, can afford $650K at 7 3/8 in 10 years?? Yikes, housing in SoCal is limited for the forseeable future. You better hope that median income rises dramatically over the next 10 years or pay that sucker down…

BTW, $650K only gets you dodo..

My .02

BD

Very few people will be able to afford $650 at 7 3/8. Anyone who thinks higher rates won’t have any effect on prices is huffing ether.

I know… 3 comments in a row are no good but, we are entering a scenario exactly like Japan did 30 yrs ago… their housing prices have still not hit 1987 levels.

BD

Here’s ANOTHER seller who should move his belongings out and get the place professionally staged… but I guess he figures it’s not worth it because he’s going to take a big hit no matter what he does.

WHERE did he get that furniture? I was seeing stuff like this advertised in the cheap “$999 for an 11-piece suite” furniture stores a few years back.

Can someone please explain this to me?

HUH?

“You May Buy The Land For An Additional $103,000.. Or Pay What Amounts Currently To $1,300 Per Year To Continue The Lease!”

So now we don’t get the land when we buy a house in Irvine? How unique.

Home buying Irvine has always been a land-lease proposition. When a buyer purchases the house in Irvine, that is ALL they are purchasing unless the purchase agreement provides otherwise.

The IC owns the land under each home in Irvine and this land is tax-assessed as agricultural land to the IC. The CA Legislature passed a special tax provision back in 1969/70 or thereabouts allowing this for the IC.

This is also why schools in Irvine receive less state education funds (entire city is state-taxed as agriculture land).

~Misstrial

Then why do most homes for sale in Irvine say “Fee” instead of “Lease”?

There is some misinformation being spread here.

Thanks Irvine home owner, I believe that misstrial had an innocent misunderstanding regarding property in Irvine. There are very few land lease properties left in Irvine. My understanding is that when Irvine was first built the homes in University Park area were meant to be affordable for professors and were on leased land. However, since then most if not all of them have been converted to fee simple properties. Moreover, all new construction that I know of, Portola Springs, Quail Hill, Woodbury, etc. are fee simple and 99.9% of sfr properties are now fee simple as well.

When one sees a land lease they will know it because the price will seem ridiculously low. There are a handful of these in Newport Beach that I get emails and calls on a few times a month by people that do not realize they are on leased land and are really excited by the low price. I have never got a call like this nor seen a leased land sale in Irvine with the exception of the one in this discussion and I look at a lot of properties

Major home builders that build in Irvine buy that land from the Irvine Company, build, and sell the property as fee simple.

This comes up a lot in regards to Irvine and like Shevy says, while that may have been the case in older parts of Irvine… that is no longer true in newer ones.

For anyone using Redfin, if you look under ‘Property Information’ at the line ‘Land Lease Type:’, you will see either “Lease” or “Fee”.

For 26 Oak Tree that Chris asked about above, it does indeed indicate “Lease” but that is less common for most of the Irvine listings (especially the newer ones).

Now if only the new homes salespeople (and TIC) can be more forthright about the difference between Single Family Residence, Single Family Detached, Single Family Home and Detached Condo. One wouldn’t even admit that they were a condo… I asked her what the lot size was and she couldn’t answer… hmmm.

I see now…thanks Shevy and everyone who participated in this discussion.