Sometimes people thinking outside the box come up with great solutions to difficult problems; however, sometimes people believe they are innovative when they are merely clueless and inept.

Irvine Home Address … 7 PEARLEAF Irvine, CA 92618

Resale Home Price …… $599,900

As I sift and drift through bullshit,

That plagues from day to day,

Would you ever really notice I've gone away?

I'm over the wall,

Over the hill,

Over at your place,

I'm over the safeties,

Over the phone calls,

Over the rage,

What a mistake.

Nickelback — Mistake

Not long ago, I wrote about Government Bureaucrat Recommends Against 30-Year Fixed-Rate Mortgages and Another Ignorant and Misguided Attack on the 30-Year Fixed-Rate Mortgage. Both of those pieces were emtional appeals with poorly reasoned positions. It was apparent from reading them that the authors had an agenda supported by banking interests that would rather see everyone borrow with adjustable rate mortgages at the bottom of the interest rate cycle.

Today's featured article comes from the New York Time's “expert” on mortgages and related issues. Unfortunately, just as the previous two writers did, she wrote an emotional appeal with little substance supporting a dubious agenda. Shame on the New York Times for calling this news.

Housing Doesn’t Need a Crash. It Needs Bold Ideas.

By GRETCHEN MORGENSON

Published: September 11, 2010

WE all know that most of us don’t tackle problems until they’ve morphed into full-blown crises. Think of all those intersections that get stop signs only after a bunch of accidents have occurred.

Better yet, think about the housing market.

Only now, after it has become all too clear that the government’s feeble efforts to “help” troubled homeowners have failed, are people considering more substantive approaches to tackling the mortgage and real estate mess. Unfortunately, it’s taken the ugly specter of a free fall or deep freeze in many real estate markets to get people talking about bolder alternatives.

Wait a moment. She has dressed up her non-problem with plenty of emotional language, but why is this a problem that needs government intervention? Who says this is a “crisis?” Whatever “mess” we have is largely caused by all the government intervention. The “ugly specter of a free fall or deep freeze” is the natural cleansing process of a financial market. Too bad if that is politically unpopular.

One reason the Treasury’s housing programs have caused so much frustration among borrowers — and yielded so few results — is that they seemed intended to safeguard the financial viability of big banks and big lenders at homeowners’ expense.

It isn't that these programs “seemed” intended to benefit banks as the expense of homeowners, the frustration among borrowers is because these programs are intended to benefit banks at the expense of borrowers. The perception of borrowers is accurate, and they should be more than just frustrated, borrowers should be pissed off.

For example, the government — in order, it believed, to protect the financial system from crumbling — has never forced banks to put a realistic valuation on some of the sketchy mortgage loans they still have on their books (like the $400 billion in second mortgages they hold).

All those loans have been accounted for at artificially lofty levels, and have thereby provided bogus padding on balance sheets of banks that own them. Banks’ refusal to write down these loans has made it harder for average borrowers to reduce their mortgage obligations, leaving them in financial distress or limbo and dinging their ability to be the reliable consumers everyone wants them to be.

There is much nonsense in that last sentence. First, she is making a nonexistent connection between the banks refusal to accept write downs and the problems borrowers have with excessive debt. In some fantasy world of borrowers where banks forgive debt, this connection may exist, but in the real world, banks don't reduce borrower's mortgage obligations, borrowers do that by paying off their loans.

Banks refusal to accept write downs has resulted in widespread banking paralysis and lots of squatting, but that is a banking problem not a borrower problem. Borrowers don't really care because they have reduced their indebtedness by simply refusing to pay back the debt. Nothing the banks are doing has any connection to this borrower behavior except perhaps that the banks refusal to foreclose prompted more borrowers to default and eliminate their debt.

While it is true that over-indebted borrowers don't spend and stimulate the economy, widespread debt forgiveness outside of foreclosure is not the solution. What incentive would borrowers have to borrow prudently in the future? She has set up her argument to promote a solution that involves decreasing borrower distress without acknowledging the moral hazard any such effort creates. Borrowers who cannot afford their debt need to go through foreclosure and probably bankruptcy otherwise they will repeat the mistake.

Various proposals are being batted around to address the mortgage morass; one is to do nothing and let real estate markets crash. That way, the argument goes, buyers would snap up bargains and housing prices would stabilize.

Yes, that is the only viable solution to the problem, yet it is the solution everyone works against. Her argument below isn't that letting market prices fall would bring stabilization, her argument is that it will take a while because so many are frozen out of the market.

Yet little about this trillion-dollar problem is so simple. While letting things crash may seem a good idea, there are serious potential complications. Here’s just one: Many lenders and some government agencies bar borrowers who sold their homes for less than the outstanding loan balance — known as a “short sale” — from receiving a new mortgage within a certain period, sometimes a few years.

For example, delinquent borrowers who conducted a short sale are ineligible for a new mortgage insured by the Federal Housing Administration for three years; Fannie Mae blocks such borrowers for at least two years. Private lenders have similar guidelines.

Such rules made sense in normal times, but their current effect is to keep many people out of the market for years. And as home prices have plunged, leaving legions of borrowers underwater on loans, short sales have exploded. CoreLogic, an analytic research firm, estimates that 400,000 short sales are taking place each year.

More can be expected: 68 percent of properties in Nevada are worth less than the outstanding mortgage, CoreLogic said, while half in Arizona and 46 percent in Florida are underwater.

“There is this perception that maybe we should let the market crash and then prices will level off and people will come out and buy,” said Pam Marron, a senior mortgage adviser at the Waterstone Mortgage Corporation near Tampa, Fla. “But where are the buyers going to come from? So many borrowers are underwater and they’re stuck; they can’t buy another home.”

She has devoted a significant block of text to setting up the mortgage waiting period as a bogeyman. The logical conclusion from her problem definition is that we should shorten or eliminate the waiting period to get a new loan after a foreclosure. I addressed this bad idea in Fannie Mae Encourages Strategic Default by Reducing Punishment Time for New Loan. To solve the problem she describes would create an avalanche of accelerated default as every underwater loan owner in America would default and buy a different home at a much lower price.

Despite devoting so much space to making this point, it does nothing to support the argument she makes later. It reads more like a feeble attempt to justify some form of market intervention when none is required.

There is no doubt that real estate and mortgage markets remain deeply dysfunctional in many places. Given that the mess was caused by years of poisonous lending, regulatory inaction and outright fraud — and yes, irresponsible borrowing — this is no surprise. Throw in the complexity of working out loans in mortgage pools whose ownership may be unclear, and the problem seems intractable.

The moral hazard associated with helping troubled borrowers while penalizing responsible ones who didn’t take on outsize risks adds to the difficulties.

All the difficulties she outlines above are very real, but the problems are not intractable. All these problems are resolved by the foreclosure process. The debts are wiped clean, the imprudent borrowers are punished, and moral hazards are avoided — that is why we have foreclosure as part of the system. Just because people may not like the way the system works doesn't mean there is a better system. If the government would stop messing around and either allow or force these foreclosures and write downs to occur, we could get back on solid economic footing and move on.

STILL, there are real, broad economic gains to be had by helping people who are paying their mortgages to remain in their homes.

What the hell is she talking about? People who are paying their mortgages are remaining in their homes. I haven't heard of any borrowers who are current on their payments going into foreclosure, have you?

Figuring out how to reduce their payments can reward responsible borrowers while slowing the vicious spiral of foreclosures, falling home prices and more foreclosures. And it just might help restore people’s confidence in the economy and get them buying again.

OMG! That is the most ridiculous thing I have read in quite a while. How does rewarding responsible borrowers slow the “vicious spiral of foreclosures?” (Notice the emotional language she chose.) Responsible borrowers are not causing foreclosures. Second, what does any of this have to do with consumer confidence?

What she is proposing is that we give these people money in the form of lower payments so they will go spend it. Do we really want to stimulate the economy by giving money to underwater loan owners? I don't. Not even a penny.

With that in mind, let’s recall an idea described in this space on Nov. 16, 2008. As conceived by two Wall Street veterans, Thomas H. Patrick, a co-founder of New Vernon Capital, and Macauley Taylor, principal at Verum Capital, the plan calls for refinancing all the nonprime, performing loans held in privately issued mortgage pools (except for Fannie’s and Freddie’s) at a lower rate.

The mass refinancing could have helped borrowers, while retiring mortgage securities at par and thus helping pension funds, banks and other investors in those pools recover paper losses created when prices plummeted. Fannie Mae and Freddie Mac could have financed the deal with debt.

Now we come to the crux of her idea: take taxpayer money to buy underwater privately-held mortgages at full par value and make investors whole. I can't think of a worse way to waste taxpayer money.

For example, lets say a MBS pool has a $500,000 mortgage on a house that is now worth $400,000. That loan owner cannot refinance, and only the feeble hope of a recovery that is not forthcoming keeps him from accelerating his default. She is proposing that the US Taxpayer pay $500,000 for this loan, write down the interest rate, and pray that the poor schmuck we are “helping” doesn't realize we extended his debt servitude. When borrowers realize they are still hopelessly underwater, they will accelerate their default anyway, and the taxpayer ends up covering the loss — a loss that would otherwise be absorbed by a private investor. Does she really think this will solve the problem borrowers have with benefiting banks at borrower expense?

This is a blatant attempt to shift losses from the private sector to the US taxpayer. This is her “bold idea?”.jpg)

In the fall of 2008, when Mr. Patrick and Mr. Taylor tried to get traction with their proposal, roughly $1.5 trillion in mortgages sat in these pools. Of that, $1.1 trillion was still performing.

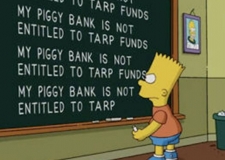

Instead of refinancing those mortgages, however, the Washington powers-that-be hurled $750 billion of taxpayer money into the Troubled Asset Relief Program, which bailed out banks instead.

Do you think investors in MBS pools put her up to this article? After all, they didn't get any of the TARP money because it all went to banks. Since we are bailing out banks from their bad investments, why shouldn't we bail out ordinary stupid investors?

Though one goal was to get banks lending again, it hasn’t happened.

Now, almost two years later, $1.065 trillion of nonprime loans is sloshing around in private mortgage pools, according to CoreLogic’s securities database. While CoreLogic doesn’t report the dollar amount of loans that are performing, it said that as of last June, two-thirds of the 1.6 million loans in those pools were 60 days or more delinquent.

Wow! Two-thirds of a trillion dollars in nonprime loans are delinquent. No wonder MBS pool investors are using Gretchen to pitch their bailout.

That means one-third of the borrowers in these pools are paying their mortgages. But it is likely that many of these people owe more on their loans than their homes are worth and would benefit greatly from an interest-rate cut.

Despite cloaking it as a benefit to borrowers, she is proposing that we save the full market value of the last third of the MBS pools through a government bailout. Who do you think this really benefits?

If Fannie and Freddie bought these loans out of the pools at par and reduced their interest rates, additional foreclosures might be avoided. The only downside to the government would be if some loans it purchased went bad.

The only downside? How many billions in taxpayer dollars will it take to cover this “only downside?” If it isn't that much, perhaps the MBS holders should take the loss. if it is a lot, then the MBS holders should certainly take the loss. What possible justification is there for this kind of MBS bailout?

The benefits of the plan could easily outweigh the risks. Institutions holding these loans would be fully repaid, a lot of borrowers would be helped and additional foreclosures that are so damaging to neighborhoods might be averted.

Let's take these “benefits” one at a time:

- “Institutions holding these loans would be fully repaid.” As a taxpayer, why the hell do I care about institutional losses? Why should I be paying money to cover the losses of professional investors? The idea that even one penny of my tax dollars would go toward this infuriates me.

- “a lot of borrowers would be helped.” How exactly does this happen? The borrower is still underwater. Making his payment affordable doesn't help him, it just makes his debt servitude manageable. What would really help is for him to go through foreclosure and eliminate the debt.

- “additional foreclosures that are so damaging to neighborhoods might be averted.“ This bullshit gets used every time someone wants to promote their latest bailout. Foreclosures have not caused riots, nor have they caused neighborhoods to deteriorate. Foreclosures have lowered property values and made many existing owners unhappy, but their neighborhoods are not “damaged” despite repeated claims that they are.

Every point she makes in summation to support her argument is nonsense.

“Every program that the government has announced was focused on bad credits, but they were trying to fix a hole that is too big,” Mr. Patrick said. “The idea is to try to preserve the decent risks and not let them go bad.”

At the very least, this is a sophisticated and realistic idea that’s still worth considering.

Give me a break. I give her credit; she does know how to polish a turd. This idea is neither sophisticated nor realistic; it is simplistic and stupid. The only beneficiaries are holders of MBS pools of toxic mortgages who will get to offload their crap on the US taxpayer. People considering this idea are not sophisticated; in fact, they are sheeple.

Seriously, do you think Ms. Morgenson is getting paid off, or is she just thick?

HELOCs are bad for your financial health

What lesson do you think Californians have learned about HELOCs?

- HELOCs are bad and using them often leads to foreclosure.

- HELOCs are great because they provide free money you don't have to pay back.

From what I have observed about human nature, some will learn lesson 1 (the right answer), but with the plethora of bailouts offered up to loan owners, most will learn lesson number 2, and our housing market is now doomed to be ruled by Ponzis.

- Today's featured property was purchased on 11/9/2004 for $615,000. The owners used a $491.920 first mortgage and a 123,080 down payment.

- On 8/17/2005 they refinanced the first mortgage for the same amount.

- On 3/13/2007 they obtained a $168,800 HELOC from Washington Mutual.

- On 3/19/2007 they obtained a $250,000 HELOC from Bank of America.

-

Does anyone smell mortgage fraud here? This couple processed HELOC applications at two banks simultaneously, and the applications were approved within days of one another. You have to assume they took out all the money. Why else would you get two HELOCs from two different banks at the same time?

- Total property debt was $909,920.

- Total mortgage equity withdrawal was $418,000 assuming they withdrew all the money from both HELOCs.

- They didn't get to squat long. I suspect the banks expedited the foreclosure process because of the mortgage fraud.

Foreclosure Record

Recording Date: 06/24/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 03/23/2010

Document Type: Notice of Default

The property was purchased at auction on 8/11/2010.

Irvine Home Address … 7 PEARLEAF Irvine, CA 92618 ![]()

Resale Home Price … $599,900

Home Purchase Price … $615,000

Home Purchase Date …. 11/9/2004

Net Gain (Loss) ………. $(51,094)

Percent Change ………. -8.3%

Annual Appreciation … -0.4%

Cost of Ownership

————————————————-

$599,900 ………. Asking Price

$119,980 ………. 20% Down Conventional

4.36% …………… Mortgage Interest Rate

$479,920 ………. 30-Year Mortgage

$115,325 ………. Income Requirement

$2,392 ………. Monthly Mortgage Payment

$520 ………. Property Tax

$150 ………. Special Taxes and Levies (Mello Roos)

$50 ………. Homeowners Insurance

$75 ………. Homeowners Association Fees

============================================.jpg)

$3,187 ………. Monthly Cash Outlays

-$396 ………. Tax Savings (% of Interest and Property Tax)

-$648 ………. Equity Hidden in Payment

$191 ………. Lost Income to Down Payment (net of taxes)

$75 ………. Maintenance and Replacement Reserves

============================================

$2,408 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$5,999 ………. Furnishing and Move In @1%

$5,999 ………. Closing Costs @1%

$4,799 ………… Interest Points @1% of Loan

$119,980 ………. Down Payment

============================================

$136,777 ………. Total Cash Costs

$36,900 ………… Emergency Cash Reserves

============================================

$173,677 ………. Total Savings Needed

Property Details for 7 PEARLEAF Irvine, CA 92618

——————————————————————————

Beds: 3

Baths: 2 full 1 part baths

Home size: 1,750 sq ft

($357 / sq ft)

Lot Size: n/a

Year Built: 2000

Days on Market: 30

Listing Updated: 40415

MLS Number: S628875

Property Type: Condominium, Residential

Community: Oak Creek

Tract: Acac

——————————————————————————

NEWER DETACHED SINGLE FAMILY HOME IN BEAUTIFUL NEIGHBORHOOD WITH POOL AND SPA. GREAT FLOORPLAN: GARAGE AND GUEST SUITE AT GROUND LEVEL. LIVING ROOM WITH FIREPLACE, OPEN TO DINING ROOM AND KITCHEN – WITH WHITE CABINETS AND BREAKFAST BAR – ON SECOND LEVEL, ALONG WITH INSIDE LAUNDRY ROOM WITH CABINETS AND SECOND BEDROOM AND BATHROOM; THE TOP LEVEL IS A MASTER SUITE WITH ADJACENT SITTING ROOM OR OFFICE AND A LARGE MASTER BATHROOM WITH SEPARATE TUB AND SHOWER AND WALK-IN CLOSET. NEW CARPET; TILE FLOORING IN DINING ROOM, KITCHEN, LAUNDRY ROOM AND BATHROOMS; SMOOTH CEILINGS; RECESSED LIGHTING. LARGE PATIO; READY TO MOVE IN.

As someone who is not philosophically opposed to principal write-downs, Morgenstern’s article is very weak. I think she also severely misses the point about 2nds being ‘written down’ by banks. They aren’t going to write down any performing seconds, and most of the non-performing seconds are going to get written down to zero at foreclosure. Neither acknowledgement is ‘good’ for a homeowner.

There are some details to the 500k mortgage on 400k home. A performing 500k loan at 6% is a lot more valuable than a 500k loan at 4.5%, assuming both continue to perform. Banks are stuck on these. They don’t want to refi because of the better interest margin, but they also don’t want to end up in a default situation.

I have no problem with principal reductions – on the courthouse steps, when the homeloaner and banksters get the world’s most expensive haircuts.

Let me guess, there will be zero consequences for these people regarding the mortgage fraud. Stuff like this really makes my blood boil.

The CRUX of the problem is:

Banksters get principal reduction in the form of CASH PAYMENTS for foreclosures, but the PEOPLE get kicked out of their homes, lose credit, and then are blamed and victimized again by Joe Q. Public idiot.

Principal forgiveness is a HAZARD for the working man, but is REQUIRED (by loss payments) to the banksters. Does anyone but ME see the disconnect here?

I thought the Supreme Court just voted to view Corporations as people?

Welcome to the NWO….it is a plutocracy. “We the sheeple, in order to fund a more plutocrat union….”

Swiller,

You need to realize that some people are more equal than others.

Forgiving a $500 credit card debt is a grave moral hazzard. Forgiving $200 million for a corporate debt is “required to avert a financial melt down.” Melting down metal is used to purify metal. On a national level:

The direction is the same only the rate is changed:

3x Republican=/~Democrates toward the goal.

So, let me get this straight… you are saying that someone who put $0 down on their house and borrowed $1 million dollars that they didn’t have is somehow a victim if the government doesn’t knock $500,000 off their mortgage and let them stay in the house? That is what you are saying right?

These poor poor mortgage holders that didn’t get something for nothing. What a horrible horrible world we live in.

That is most assuredly *not* what I am saying. The responsible (20% down) got hoodwinked in this and their equity is gone, THOSE people get nothing but a free whack in the a$$ from the banksters.

The 0% down, HELOC scammers, should be held accountable, but they walk. I’m the idiot who put 20% down, but seeing the loss is just my own, I don’t get jack sh1t, but if I walk, the banksters get paid any loss, I get tossed out. If I stay, I stay tied to an underwater home (not as bad as many because I ate $100,000 down payment loss) and my money is tied up in a lose-lose situation. The market will not correct anytime soon, and the people who scammed it (banksters, 0% down, HELOC spenders) walk free.

Maybe I should cash in now and default while I can ride 12+ months of free rent.

Were you a first time buyer?

Swiller,

What are you talking about? You haven’t lost anything. If you overpaid for your house, no big deal. You can default, or keep paying. If you keep paying, then you are just going along with the deal you originally agreed to – and you have a place to live – so what’s the problem?

Swiller,

Sorry for your financial loss. Many HELOC abuser/refinancers are not lossing anything, they are squatting and hold on to lots of refin money or at least spent the money on vacation, cars, boats, jewlery or other toys. If you have no equility and a defective loan (bogus appraisal, no income statement, classified as prime while it was subprime) you might be able to be a long-term squatter, especially in Newport Beach.

Be glad your didn’t take that loss in the stock market. No squatting allowed, no bailout for the 401k’s, IRA, etc. The FoolishRenter gets it twice.

Foolishly paying rent, but should of being squatting.

Oh, I got hit on stocks too. I listened to what I thought was good advice and have been putting money in the market since 1991.

“The responsible (20% down) got hoodwinked in this and their equity is gone, THOSE people get nothing but a free whack in the a$$ from the banksters.”

The responsible can not get a whack from the bankers because the responsible are paying their mortgage like they agreed to. How did you get scammed if you agreed to the price and the mortgage and … ?

Sorry about your loss, Swiller. By being a responsible homeowner with mortgage, you (as well as renters during the housing bubble and burst years) are now suffering the consequence of this govt’s actions.

Before you take that default and free rent route, I would advise that you tread water carefully and make absolutely sure that this is the best way to go in order to recoup your down payment with minimal hits to your financial well-being (i.e. credit hit).

Good luck.

IR- what did the flipper pick this up for at the auction?

According to Foreclosure Radar, the flipper paid $522,000 at auction. If they have comped the property correctly, this will be a good deal for them.

The public is groping in the dark and smoke. The principal reduction is for the banks. It’s not going to happen unless your a bankster. The delays are smoke until the loans can be written so the taxpayers will be liable for the loans. Sure the banks might need to pay a fee for the write down, but the ROI will be huge.

The delays allow this process to improve the banks’ books and reserves. TG has his tirate against the Republican and PRC. Blame game to distract while the transfer of wealth occurs. When enough of the bad loans are rewritten, the banks will move upon the squatters, FC will sky rocket, the house will go to a new equilbrum with lowering of price on the the coastal regions. The banksters and investors will be paid by the US taxpayers. The US will go into further debt. To pay off the debt, the US will first sell arms to some country, then when it gets hot, and your children and grandchilden will fight some wars to protect the banksters’ interest in some foreign region.

As for helping “those hopeless under water” why whouldn’t the banks try to help their co-conspirators and enablers? The behavior is similiar to the movie “Good Fellows” or “Godfather” Just trying to look legit after their estiblished but been pulled back-in.

You mean like this:

Report: U.S., Saudis close to largest arms deal ever

http://news.blogs.cnn.com/2010/09/13/report-u-s-saudis-close-to-largest-arms-deal-ever/?hpt=T2

And people think that we don’t make anything in the US anymore…. See we’re getting our oil money back one aircraft at a time.

That is actually not a facetious comment. US petrodollars ultimately have to be translated into payment for US goods, services, or property.

We need to keep that Shi’ite/Sunni conflict going, baby! YEAH!!!!!

IR- What do you make of this one?

http://www.redfin.com/CA/Irvine/8-Corriente-92614/home/4657448

I can’t verify that sale actually took place. My property records do not show the 9-7-2010 sale. I can’t imagine a legitimate reason why someone would pay 20%+ over comps for this property. It will be interesting to see what the financing terms are when my property record source is updated. Something doesn’t smell good.

Irvine Renter,

I wanted to ask you about how deluded some of the pricing is in OC. I know sellers want as much moolah as they can get, but to what degree do you think the delusion is caused by the seller-agent dynamic?

My theory is that any agent that were to give straight talk (e.g., “you need to cut your price.”) to a seller would be cast aside for one that tells the seller what they want to hear (e.g., “No you don’t have to lower your price!”), much as is the problem with our politicians who say we can have candy, and spinach later (or like Paul Krugman, never). I’ve met these agents, wasting their weekends, sitting in properties that will never sell. I don’t want to be rude to them, but they do need an intervention.

It is certainly easier to get a listing telling a seller what they want to hear than telling them an unpleasant truth. Most realtors tackle this problem by taking the listing, then they go back later and try to get a price reduction. It doesn’t always work.

I think the problem goes back to when the seller was a buyer. All the BS realtors fed these people when they were buyers creates these false beliefs when buyers become sellers.

IR, while I’m not 100% in agreement with you, I am just as outraged by the BS from the media. Well, what do you expect from an industry that cheer leaded us into Iraq?

But, you say:

Whatever “mess” we have is largely caused by all the government intervention.

If by “intervention” you mean the Bush administration blocking state regulators from taking action against mortgage fraud then I agree with you.

But, the bailouts (if that is what you mean by “intervention”) didn’t cause this mess. They are what we did after the mess was created – whether you agree with the bailouts or not. They do, however, have the potential to encourage future messes, but what can you do?

I agree with you on not bailing out these rat bastard investors that were the enablers of this whole debacle. A certain Newport Beach company has been getting under my skin with their transparent effort to have their crap mortgages bought by the government for a fantasy value.

My view is that irresponsible banks, investors, and mortgage holders should suffer as much pain as possible without bringing the whole economy to its knees. I personally would like to see the big banks forced to write down their losses and taken into receivership when they blow their capital ratios. Unfortunately, it doesn’t look like this is going to happen.

I really really hate this “too big to fail” garbage. We’re being held hostage by a bunch of reckless rich people. We should get our money back by taxing all income past $1,000,000 at a 90% tax rate. All income past $10,000,000 should be taxed at 200%.

I can’t help but think we made a huge mistake when we didn’t nationalize most of our banks in 2008. We could have wiped the slate clean and started over. I read the main reason we didn’t is because it would have brought down many foreign banks and possibly foreign governments who bought bonds from our worthless banks.

It’s funny that you mention those tax rates. In WWII, we did have 90% tax rates at the highest tax bracket to stop wartime profiteering. However, the war on terror was ushered in with tax cuts to help the rich get richer.

Nationalize banks? We actually have a Fifth Amendment here in America that prevents Chavezism.

Tax revenues went *up* when Bush cuts taxes, and the rich a larger share of taxes now than ever:

http://www.ntu.org/tax-basics/who-pays-income-taxes.html

Continue the Bush rates and watch the stock market pop. Otherwise, look for a sell-off to avoid the cap gains hit.

We have plenty of laws and practices that went up in smoke when the government decided it needed to prevent the collapse of the housing bubble. Why didn’t the Fifth Amendment stop them from nationalizing the GSEs? How do they continue to use mark-to-fantasy accounting? Where in the Constitution does it say they can use my tax dollars to bailout private corporations?

While I haven’t read Fannie’s and Freddie’s charters, I’ll assume they say somewhere that the God that creates them can take them over, unlike a real “private” company. I think a better question is where in the Constitution does it authorize GSE’s in the first place? We’re an awful long way from McCulloch v. Maryland.

We’re agreed on the bailouts. Hopefully SCOTUS will start reigning in federal government power grabs with Obamacare’s mandates, before it’s too late.

The worst part about not nationalizing the big banks is that their lobbying arms are still completely intact. It really angers me to know that my tax money is being spent to advocate policies that are against my interests.

It is funny, and sad, that the rich are able to play the victim card at the mere mention of raising the top rates. “These rates will put me in the poor house! Instead of having the $2 billion I deserve, I’ll only have $1.8 billion! The injustice!!!”

These people actually believe that they made their money all on their own. They didn’t need a society with workers and infrastructure to make their fortune. In fact, they could have gone from caveman to Learjetter in a year, since back then you didn’t have government or greedy workers getting in your way. Nowadays, it takes you twenty years to achieve that kind of success what with all the regulations and taxes. Man, oh man, how they long for those days of yore when they weren’t persecuted for being so awesome.

Banks are chartered in the United States.

The second that a charter’s terms were violated, or that self-dealing was detected, the bank should have been confiscated.

The reason that an average of 4 banks per week “fail” instead of 1,000 at one time is that the Feds can only shutdown a few at a time.

According to a Wall Street analyst I talked to, all of the financial firms were damaged by the meltdown. My guess is about 2,000 US banks need to be shutdown. Figure 10 years for that to happen at the current rate.

119 banks failed so far this year.

140 last year.

284 total since 2008.

Only 27 failed from 2000 to 2007.

I wonder if they’ll accelerate the process next year.

It drives me nuts that people think that the answer to problems brought about by government interference can be solved by more government interference.

If you think the bubble was caused by government “interference” then you were already nuts.

Wow, dumb post of the century award.

Low interest rates by the Fed providing cheap (and dangerous, when ARMs reset) money, government-created monstrosities like Fannie and Freddie dumping endless credit in the so-called “market,” and the FHA lowering standards and down payment requirements, and an official government *policy* of leaning on banks to make loans to people who ordinarily would be laughed out of a bank from 1776-1990.

Yep, no government tinkering here.

Wow, what a great list.

Too bad the cause of the bubble is just the lowered standards due to the private market funding the loans. It’s no different than the .com bubble.

Try quality rather than quantity next time.

No, you already get credit for your idiotic comments up thread. “Chavezism”!?!?! Good grief.

What is it about the righties and their lists of buzzwords?

I guess when you have no idea of how things work, you just kinda throw out words and hope you look smart.

What’s a “buzzword?” Something libs don’t understand?

Funny, I guess it’s just a coincidence that the housing market worked fine until the 1990’s when the government started tinkering. The Mother of all Coincidences, actually.

How can liberals consistently ignore reality?

All that cheap credit from the Fed and Fan and Fred was irrelevant. So freaking dumb.

You don’t understand what I mean? Or are you just a reflexive lefty who defends Chavez and communism at all costs? Either way, dumb.

I can see the appeal of right wing thinking. You don’t need personal responsibility when you can just blame everything on the government.

Mommy, the Federal Reserve just lowered the federal funds rate and I can get a mortgage for 6.5%. Why are they forcing me to borrow a million dollars that I’ll never be able to pay back?

Daddy, Fannie Mae and Freddie Mac… exist? Why are they forcing my bank to issue non-conforming negative amortization stated income loans?

Grammy, why’d the government make you into a communist by forcing you to take Social Security?

Nice try Kirk, but it’s the libs who want bailouts. I want everyone who bought off more than they could chew, especially HELOC abusers, to be foreclosed on (and yeah, banks dumb enough to make bad loans should fail too). How more clear can I be? I want the damn government out of the damn RE “market”, let the banks foreclose, and prices will correct, and those of us who didn’t play greedy, zero-down ARM flipper games will come in and say, “thanks for the granite counter tops.” And I’ll be paying cash, thanks.

And yeah, SSI is a Ponzi scheme that will bankrupt the US, along with Medicare. Fortunately my granny invested well and doesn’t have to rely on it. Anyone who does is an idiot that will be eating cat food in their 80’s.

You’re right. It’s because of ultra liberals like George W. Bush and Henry Paulson, who forced things like the Troubled Asset Relief Program, that we’re in this mess we’re in.

And Social Security is a huge Ponzi scheme that’s been running since 1935. It’s all part of Hugo Chavez’s plot to take over America. Have you seen FDR’s birth certificate? His REAL birth certificate? He was born in Venezuela!

Typical liberal argument, “Bush did it.” Yeah, and you all hated Bush, so how is that a defense? If anything, Bush doing something should be a liberal argument *against* a proposition. It’s unbelievable how libs do that, “But but Bush!” Ridiculous. I’m not Bush nor his PR guy, so make an argument, OK? And since when was Bush ever a real conservative?

Of course, all the banks knew Fannie and Freddie were implicitly backed by the gov, and the unholy relationship between the gov and the banks in mortgage policy got us all in so deep, it pretty much made it mandatory that we did TARP. The point is, had gov just stayed the hell out of things, TARP would never have been necessary.

And yeah, SSI, in 1935 the life expectancy was 63 and you couldn’t collect until 65, 47 payers for every payee. Now a very grayed American demographic has a near 80 life expectancy, 20% youth unemployment, and 3-1 payee ratio, soon to be 2-1. If that isn’t a doomed Ponzi scheme, I don’t know what is.

Oh… my… God… you actually think President Bush was a liberal. That pretty much says it all doesn’t it?

You’ve made no argument whatsoever regarding the government’s role in creating the bubble. You just keep listing government and government sponsored organizations. But, you never say how they actually inflated the bubble. Saying Fannie Mae or its apparently cool nickname “Fan” doesn’t prove anything.

Let’s try it… Duke.

There, I’ve proved that Duke is responsible for the housing bubble.

So, I say that Duke and the private sector that issued stated income, no money down loans that didn’t even meet Fannie Mae or Freddie Mac’s standards caused this bubble. After all, when you can just make up how much money you earn and get as big of a loan as you want, you can really start buying up houses.

Do you not believe that stated income, no money down loans existed? Do you not believe these loans were shoved into Collateralized Debt Obligations to make them appear safe to feckless investors?

If you don’t believe these existed then that explains a lot. If you do believe they existed… who made these products?

That whole life expectancy tripe regarding Social Security, or its awesome acronym SSI, it just that. Tripe. Social Security, if left untouched, will pay out 100% of its benefits until 2041. After that, it can still pay out 75% of its benefits. If we get rid of the cap on the wages subject to the Social Security tax ($106,800 this year), then it’s fairly likely that Social Security pays out 100% indefinitely given the progressive nature of the benefit schedule. Anyway, the point is there’s not a problem here that can’t be fixed rather easily. It’s hardly a Ponzi scheme. But, the real deal is that people like you just hate Social Security because you think it’s a communist plot as you’ve demonstrated quite clearly in your comments.

And another win for Kirk. Booyah!

Win? What did you win? You obviously aren’t interested in good faith debate. You just want to see how many keystrokes you can get the conservative to waste.

You obviously know exactly what I am referring to when I mention Fannie and Freddie, their buying mortgages that banks would have never made otherwise, that I never even remotely called Bush a liberal, and that the “Social Security Trust Fund” is a bigger fable than Gulliver’s Travels.

Bantering with bad faith liberals (excuse the redundancy) is a waste of keystrokes. Night.

Let’s see, I said that the loans that caused the bubble didn’t meet Fannie Mae’s and Freddie Mac’s standards. That means that Fannie Mae and Freddie Mac wouldn’t have purchased the loans. Yet, you still keep mentioning Fannie Mae and Freddie Mac.

Let’s see here… can I find a loan like this…

Oh wait. The very top post today.

* The property was purchased on 12/5/2001 for $475,500. The owner used a $468,750 first mortgage and a $6,750 down payment.

What was the conforming limit in 2001? Don’t know? $275,000.

Do you understand the significance of a non-conforming loan? No? It means that neither Fannie Mae nor Freddie Mac would buy it.

* On 4/16/2003 she refinanced with a $450,000 first mortgage.

Know the conforming limit in 2003? No? $322,700.

So, did Fannie Mae or Freddie Mac have anything to do with these loans? Don’t know? Let me answer. No.

Now, Fannie Mae and Freddie Mac are a whole different story after the bubble burst. They were forced to take on loans they wouldn’t normally touch. They were simply another bailout vehicle (a sacrificial lamb) AFTER the bubble was inflated. They had very little to do with inflating the bubble. That’s not to say they wouldn’t have had problems anyway. Everyone that did loans would have problems since the private sector inflated a huge bubble. Even if a loan provider required 20% down, that 20% and the principal paid would already be gone on loans made from 2004-2008 and that is when loans become at risk.

Your “free market” took everyone down. Good job.

Just as you are clueless on the cause of the bubble, you are clueless on Social Security and all the other rightie talking points you got echoing in your brain.

Booyah! Another win for people with a clue.

This was the most entertaining thread I’ve read in a long time. I was just enjoying the pure animosity of two people exchanging barbs, but I have to give props to Kirk for such a step by step take down on that last comment.

This blog has documented loan after loan like Kirk mentions, but it’s not just the loan amount that matters. The loans have to be structured a certain way. I don’t think any of the interest only or stated income loans are considered conforming loans. I could be wrong, but I think I remember reading about that a long time ago. I wonder about HELOCs.

If good faith debate means a bunch of dry comments, then I think I’d rather see more bad faith comments.

Absolute nonsense. No particular “type” of loan caused the bubble (Besides, I never said anything about Fan’s and Fred’s standards. I said the loans wouldn’t be made because private banks don’t have infinite capital, see below). Bad loans helped cause defaults in subprime, at first, but this disaster was well beyond subprime. Anyone with a “clue” would know this meltdown was way, way beyond just subprime. And by the way, FHA loans were in the mid to high *500’s* for crissakes. 500’s!

The bubble was caused by the flood of cheap, essentially “artificial” credit that wouldn’t be there in a free market, primarily ridiculously low Fed rates – for every point the Fed drops rates, millions of people suddenly “qualify” for loans – and magical “extra” credit that wouldn’t be there without Fannie and Freddie buying up loans. For every loan Fannie and Freddie buy, that’s one more a bank can make (they can only leverage so much based on capital on hand, under federal law). So if you took away the Fed’s intervention, and let rates float according to some market, and removes Fannie and Freddie pouring credit that otherwise wouldn’t be there, FHA’s ridiculous standards, and this thing never gets anywhere near this big.

But this is all moot, since you actually believe there was a free market in real estate.

Even worse, your insane belief in the actual existence of a Social Security Trust Fund – it’s a file cabinet full of IOU’s, ya tard! – A religious belief that the right hand of government promising to pay the left hand of government (SSI) tens of trillions plus interest – ha! – when it can’t even pay its current obligations without running a $1.5T deficit, is utterly preposterous. Plus, it will be supposedly paying itself with debased currency, since printing is the only way to keep the entitlement Ponzi schemes going (so seniors on SSI will need even more COLA’s, so those numbers are going to be even worse. We’ll all be doomed from the inflation, not just the seniors.)

SSI trust fund = government promising to pay itself back, plus interest, with debased currency, by running the printing presses. Good luck with that.

Look at all the nonsense in that one. In JD’s fantasy world every loan has the same risks and all credit comes from Fannie Mae and Freddie Mac.

The credit for the loans that caused this mess came from the private sector. Plain and simple. Banks packaged up the loans into Collateralized Debt Obligations and investors bought them. The Collateralized Debt Obligations took the loans off the banks’ balance sheets so they could make more loans to package into more Collateralized Debt Obligations and so on and so forth. Unfortunately for the banks, the securities from the Collateralized Debt Obligations matured earlier than the loans they held and investors stopped buying the securities when the bubble burst. That meant the loans went back on the banks’ balance sheets. Oops.

But, that’s okay right? Cause I’m sure the bank “insured” those loans with Credit Default Swaps. Too bad they were worthless because they were traded without a clearinghouse and were often chained dozen of entities deep with offsetting positions. Any entity that failed to fulfill its contract in a chain could bring down the whole chain. That’s why AIG was bailed out. To keep from setting off a massive chain reaction of failed Credit Default Swaps that would mean that banks would need to bring more bad loans on their balance sheets.

What a joke the right wing is. No matter how obvious the facts, they’ll stick to their beliefs like a religion. That’s all you guys have. Your beliefs. You’re just not good at anything else.

LOL! Loving it!

This time I give props to JDSoCal.

Sorry Kirk, but you just don’t seem to understand the mortgage industry at all. Let me explain what JDSoCal is saying using a car analogy so that you can understand.

1) Customer A buys a car that runs fine from JDSoCal Motors.

2) JDSoCal Motors uses the money from that sale to build a lemon.

3) Customer B buys the lemon from JDSoCal Motors.

It is Customer A’s fault that Customer B got stuck with a lemon.

I hope this clears things up.

Beautiful analogy!

Booyah! Three wins in a roll!

Looks like either Eric will get a $15 million settlement, or we’ll get to learn a lot about how Moody’s rated CDOs 🙂

Ex-Moody’s Manager Sues Over Firm’s Comments

http://online.wsj.com/article/SB10001424052748703466704575489981096091758.html

Hello All –

I know we are consumed by what will happen to housing in the next month or year but, what will happen to pricing if our 30 yr intrest rates revert to mean?

I’m afraid no matter how you slice it that housing in SoCal is stuck in a flat level at best. I would argue that the bubble popped when rates rose…

Say you buy your dream place at huge discount and get yourself a 4 and 3/8 mortgage. What will happen to your equity when you try to sell in 10 years when rates are 7 or 8 percent????

Unless we have huge increases in saleries housing will be at best stagnant. At worst, you could see a decade go by and still loose 30%!

Remember the Japs bought peeble beach for like 1B plus in the mid 80s only to sell it back for like a 40% discount a decade later. The same is true for anyone who ever invested in a NADAQ stock.. we are still 1/2 of what we were in 1999.

Just a thougt and my .02

BD