Mortgage brokers and realtors are united: the end of the Federal tax credit was the end of the world.

Irvine Home Address … 14541 GUAMA Ave Irvine, CA 92606

Resale Home Price …… $749,000

{book1}

Bones, sinking like stones,

All that we fought for,

And homes, places we've grown,

All of us are done for.

Coldplay — Don't Panic

One of the hallmarks of an economic recession is the ongoing stress and periodic panic of the citizenry, particularly when there is no light at the end of the tunnel. The mainstream media becomes littered with feel-good stories about this statistic or that trend that is supposed to signal the end of the recession and the return to properity. Of course, each one turns out to be false, but the accuracy of the story was never the point; the story was written to provide emotional comfort.

It's rare to find a real sense of panic in news stories, and it is even more rare when the permanently bullish realtors lose their veneer of positivity and show their frightened inner selves. Today, I have a story of panic from the Mortgage News Daily and a freak out from a local realtor. Enjoy.

Purchase Demand In Freefall. Housing Industry Unraveling

The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending May 28, 2010.

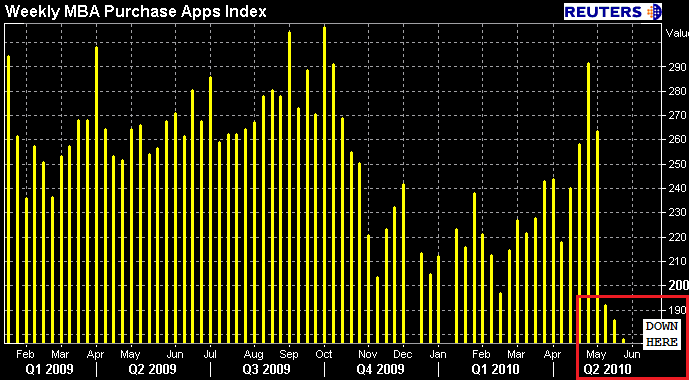

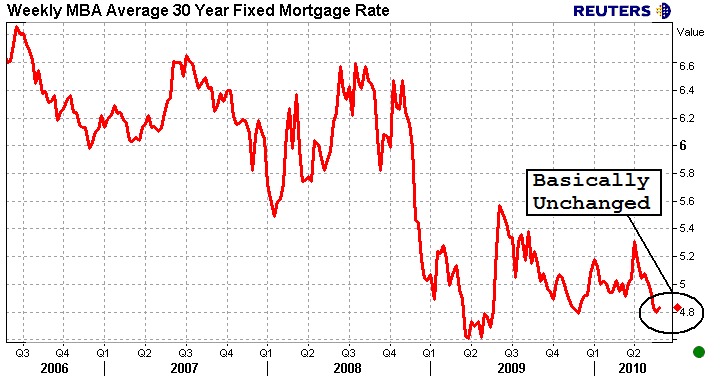

"With another week of historically low mortgage rates, the trend from the prior three weeks continued, as refinance applications increased while purchase applications dropped. Purchase applications are now almost 40 percent below their level four weeks ago, while the refinance share, at 74 percent, is at its highest level since December," said Michael Fratantoni, MBA's Vice President of Research and Economics. "In addition, the ARM share dropped last week to its lowest level since March of this year, as borrowers took the opportunity to lock in at historically low fixed mortgage rates."

The Mortgage Bankers Association application survey covers over 50% of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. The data gives economists a look into consumer demand for mortgage loans. In a low mortgage rate environment, a trend of increasing refinance applications implies consumers are seeking out a lower monthly payment which can increase disposable income and consumer spending (or give consumers a chance to pay down other debts like credit cards). A falling trend of purchase applications indicates a decline in home buying interest, a negative for the housing industry and the economy as a whole.

Everyone knew purchases would drop off when the Federal tax credit expired, but few expected the drop to be as severe as it has been. I had the following data forwarded to me. It was written by Mark Raymond Godleski, a realtor with Altera Real Estate:

There has been a huge drop in Demand for Orange County residential Real Estate — 12% in just two weeks, and 17% in four weeks, to only 3303 new escrows within the past 30 days! Looks like the expiration of the first time Home Buyer tax credit has had a bigger effect than we thought. We are now 10% Below 2009 Demand for May! Where we go from here is anybody's guess.

Inventory has slowly increased, unabated since the beginning of the year to 9839 residences for sale in OC — an increase of 2674 homes, 37%! And an increase of 3% in just the last 2 weeks! CAUTION TO SELLERS: current Buyers just are not ready to pay more than the most recent comparable sale. They are very price conscious.

Market Time has increased from 2.53 months to 2.98 months, a 18% increase in just 2 weeks! When Demand drops and Inventory rises, this is what happens. It is Great News for Buyers as this will reduce the fierce competition for Homes. This is still a Sellers' Market, just less so.

When the positive spinmeisters start freaking out, you know something bad is brewing.

Back to Purchase Demand In Freefall. Housing Industry Unraveling

Excerpts Taken From The Release…

The Market Composite Index, a measure of mortgage loan application volume, increased 0.9 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 0.3 percent compared with the previous week. The four week moving average for the seasonally adjusted Market Index is up 3.5 percent.

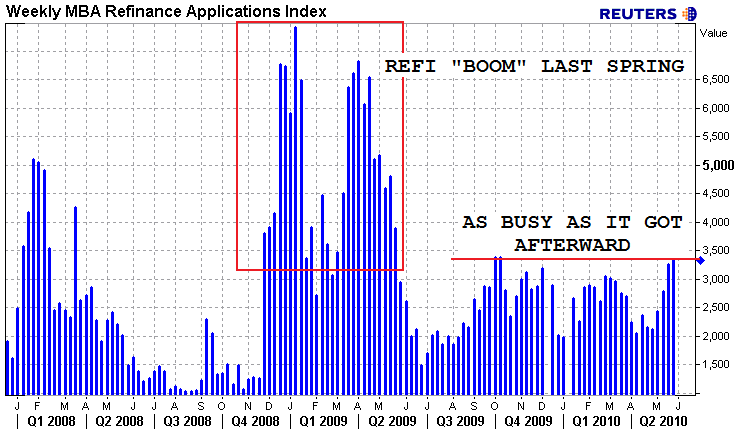

The Refinance Index increased 2.4 percent from the previous week. This was a smaller increase than in previous weeks, but was still the fourth consecutive weekly increase for the Refinance Index and it remains at its highest level since October 2009. The four week moving average is up 11.5 percent for the Refinance Index. The refinance share of mortgage activity increased to 73.8 percent of total applications from 72.2 percent the previous week.

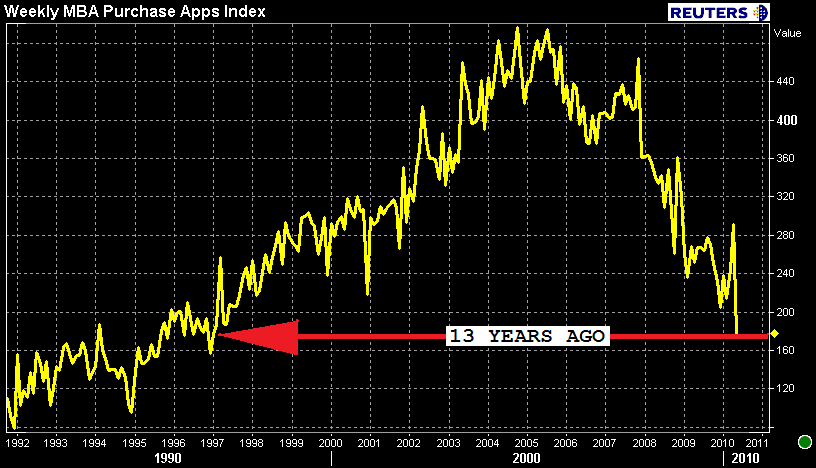

The seasonally adjusted Purchase Index decreased 4.1 percent from one week earlier. The Purchase Index decreased for the fourth consecutive week and is currently at the lowest level since April 1997. The unadjusted Purchase Index decreased 5.2 percent compared with the previous week and was 16.8 percent lower than the same week one year ago. The four week moving average is down 12.1 percent for the seasonally adjusted Purchase Index.

That chart doesn't really put things in the proper perspective, but this one does…

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.83 percent from 4.80 percent, with points decreasing to 1.05 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The effective rate also increased slightly from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 4.24 percent from 4.25 percent, with points increasing to 1.11 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week due to the increase in points.

The average contract interest rate for one-year ARMs increased to 6.96 percent from 6.83 percent, with points decreasing to 0.27 (including the origination fee) for 80 percent LTV loans. The adjustable-rate mortgage (ARM) share of activity decreased to 5.2 percent from 6.0 percent of total applications from the previous week.

Ugh. This morning I talked about how all the optimistic data we've been hearing on housing is just "fine and dandy"…but was nothing unexpected. Homebuyer demand spiked at the end of the original tax credit in early November and it did the same thing at the expiration of the extended version of the homebuyer tax credit this April. No surprises!

The true barometer of the health of housing rests in May housing data..not April. If the recent downtrend in purchase apps holds any clue as to what sort of results we'll see in May, it won't be pretty. Anecdotal evidence is highly supportive of this theory. Heck, besides the drastic decline in purchase demand we've seen, pull-through on refi apps is poor thanks to the vast variety of hoops that must be jumped through before a loan can be cleared to close.

Working in this industry is no fun right now. Borrowers don't trust loan officers. Originators are losing deals for a measly $250 processing fee. Underwriters and appraisers are annoying each other to protect their own behinds. Meanwhile, secondary is fronting the bill and processors (a generally "testy" group to begin with) are stuck in the middle of it all. To make matters worse…Realtors are pointing the finger at mortgage professionals for the slowdown. I feel like my world is unraveling in front of me. Can't we all just get along?

When interest rates are at historic lows, it would be logical to assume mortgage activity would be at an all-time high, particularly refinances. The fact that this activity is near historic lows is very revealing. Basically, everyone who could refinance already has, and the buyer pool is seriously depleted because so many are unemployed, underwater, or recently foreclosed.

This isn't just a disaster for mortgage and real estate professionals, this is part of the ongoing disaster for banks. Who are they going to sell all their distressed property to? The reason we have such a backlog of delinquencies and foreclosures is because lenders know they don't have any buyers to sell to. Lenders are not allowing long-term squatting because they want to; they allow squatting because they have to.

Another typical Irvine home owner HELOC abusing squatter

- The previous owners of today's featured property paid $475,000 on 5/29/2003. The owners used a $322,700 first mortgage, a $100,000 second mortgage and a $52,300 down payment.

- On 3/31/2004 they refinanced with a $450,000 first mortgage.

- On 2/3/2005 they refinanced with a $623,000 first mortgage.

- On 3/16/2006 they obtained a HELOC for $100,000.

- Total property debt is $723,000.

- Total mortgage equity withdrawal is $300,300

-

The squatted off an on for about 2 years.

Foreclosure Record

Recording Date: 03/03/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 11/30/2009

Document Type: Notice of Default

Foreclosure Record

Recording Date: 02/19/2009

Document Type: Notice of Rescission

Foreclosure Record

Recording Date: 11/14/2008

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 08/06/2008

Document Type: Notice of Default

Lemons into lemonade

Someone is making a profit from this property. It was picked up at trustee sale in March. The new owners is looking to flip it for a quick $93K. They will probably get $70K out of the deal.

Irvine Home Address … 14541 GUAMA Ave Irvine, CA 92606 ![]()

Resale Home Price … $749,000

Home Purchase Price … $610,500

Home Purchase Date …. 3/23/2010

Net Gain (Loss) ………. $93,560

Percent Change ………. 22.7%

Annual Appreciation … 84.6%

Cost of Ownership

————————————————-

$749,000 ………. Asking Price

$149,800 ………. 20% Down Conventional

4.87% …………… Mortgage Interest Rate

$599,200 ………. 30-Year Mortgage

$152,801 ………. Income Requirement

$3,169 ………. Monthly Mortgage Payment

$649 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$62 ………. Homeowners Insurance

$43 ………. Homeowners Association Fees

============================================

$3,924 ………. Monthly Cash Outlays

$3,924 ………. Monthly Cash Outlays

-$770 ………. Tax Savings (% of Interest and Property Tax)

-$737 ………. Equity Hidden in Payment

$280 ………. Lost Income to Down Payment (net of taxes)

$94 ………. Maintenance and Replacement Reserves

============================================

$2,790 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$7,490 ………. Furnishing and Move In @1%

$7,490 ………. Closing Costs @1%

$5,992 ………… Interest Points @1% of Loan

$149,800 ………. Down Payment

============================================

$170,772 ………. Total Cash Costs

$42,700 ………… Emergency Cash Reserves

============================================

$213,472 ………. Total Savings Needed

Property Details for 14541 GUAMA Ave Irvine, CA 92606

——————————————————————————

Beds: 4

Baths: 1 full 2 part baths

Home size: 2,327 sq ft

($322 / sq ft)

Lot Size: 5,000 sq ft

Year Built: 1971

Days on Market: 21

Listing Updated: 40305

MLS Number: S616253

Property Type: Single Family, Residential

Community: Walnut

Tract: Cp

——————————————————————————

Gorgeous remodeled home in College Park. Four bedrooms & one spacious bonus room. Recessed lights throughout. Crown moldings & ceiling fans. Granite countertop & stainless steel appliance. Pre-wired surround sound speakers in family room. Newly-built fireplace with BBQ in the backyard. Within walking distance of school & park.

I hope you have enjoyed this week, and thank you for reading the Irvine Housing Blog: astutely observing the Irvine home market and combating California Kool-Aid since 2006.

Have a great weekend,

Irvine Renter

IR,

Get a grip. The 40% decline is a 1 week to 1 week comparison. That April spike was mostly concentrated in the final week. We all knew demand would be pulled forward from at least May into April. So, you need to correct for that, both in the April numbers and in May.

So, let’s take the last week of April and the last week of May and say that they should have been on par with one another under no-incentive. Then all you need to do is steal 1/4 of the end of May’s applications and apply it to the end of April. This makes April’s count at 5/4ths, and May’s at 3/4’s for a 40% drop between the two of them.

40% sounds big and scary. But you added to one side and subtracted from the other. The fact that even an effect that big only lastest for 1 week, means it’s really no big deal. For the whole month of May compared to the whole month of April it’s more like a 25% drop.

Basically, May’s numbers tell you how April should have been renormalized. Which means the end of March and all of April was really more similar to the beginning of March. (although, one would really like the exact numbers so that one can do the correct calculation, and I’m too lazy to do more than guesstimate this part).

June’s number’s for purchase applications and contracts will be the key to understanding what the true underlying trend really is.

Cara,

I didn’t write the analysis. I claim no responsibility for the math. There are obviously circumstances that make the numbers more dramatic. If you go to the original article, Mark Hanson has made some clarifying remarks that deal with some of the reporting issues.

The post was not intended to dramatize the declines. I thought it was amusing how the mortgage brokers and realtors are reacting to the news.

These same groups have been scaring the crap out of buyers for the last year telling them the bottom is in and they better buy now or be priced out forever. Everyone is being jolted back to reality and starting to realize how weak the market really is. Without the variety of government props, pricing will simply not hold up at any reasonable volume.

The problem is really pricing. Sales volumes would almost certainly increase if prices were lower. Current pricing is still at the high end of affordability, so volumes are low as the few most motivated buyers bid as high as they can. Lenders are facing the fact that they will have to lower price to increase volume and get rid of their REO and distressed short sales.

Well I would say the numbers bear out that they’re over-reacting to the news due to poor math skills. Which, we already knew they were weak on math skills so no surprise there.

Pricing is the problem in Irvine, but places like Irvine are a small percentage of the overall purchase application volume. And I’m not sure pricing is the problem everywhere… I think sales volume is just down because the “only” people in the market are those unencumbered by a house. And that’s normally what, 1/4 of the market? So 400 down to 200 doesn’t seem that wierd. Volumes won’t pick up until people have enough equity to sell. That could be years, even in the less bubbly places, never in places like Vegas. But the national sales volume is going to be dictated by the bulk of the housing market not Vegas.

From what I can see, in desirable places with jobs, pricing is the problem. In places with high unemployment, income is the problem. Issue is, the banks and government deal with things on a national level, leading to polices that are a poor fit in most places.

For instance is you pick 220 as the nominal number for purchase applications, the excess in April + March + week 1 of May is 226, and the decrement in the next three weeks of May is only 105.

So, either the “real” level would have been a bit higher than 220 (still way under last summer/fall) or, we have a bit more slack in June that can still be accounted for with a nominal level of 220.

As I said, June is the key. Do the June numbers come back up to 220 soon? or was demand stolen from that far ahead?

Once again IR is far ahead of the group think.

The demand for mortgages in Irvine is rock solid, for those who need mortgages.

In the bottom 80% the demand for mortgages couldn’t get much worse.

Hey IR you may want to get that lake forest listing on par with comps. I mean come on less square footage and a 20% price higher than pending sales? What do you think Lake Forest is Irvine? Please post yet another pick of the exterior of the unique exclusive condo you have for sale 😛

I was going to pick apart the listing IR-style — with all the exclamation points and no interior pictures — but figured that was a bit too ironic.

I agree, way too many exclamation points, and I’m not so sure I like ‘fantastic views’ that overlook a ‘fantastic park, the ‘whole new kitchen’ (as opposed to a ‘partially new kitchen’ or ‘fractionally new kitchen’), and the ‘fantastic opportunity’ to own a home in a ‘unique’ location.

The description is certainly more fantastic than most of the trash on the MLS.

$325 HOA dues? Remember kids, when it comes to homeownership, even if you pay your mortgage off you still have to pay taxes and/or HOA dues. If you don’t pay, you don’t stay.

IR has apparetly decided that when it comes to making money fairness goes out the window. Good luck with that. It’s beyond hypocritical and speaks volumes.

Making fun of bad listings is all in good fun. And I also noticed the repetition of the word fantastic and the second exclamation point.

The $325 HOA is for the up keep of the B-U-Tiful exterior which you can see in all 8 pictures. Every picture has a subtle difference showing the crapilicious condo.

They don’t make them more unique and exclusive than this one. The Irvine Company should be scared of this competition. Quick SUBMIT your offers to IR today for this unique opportunity to own a slice of heaven only 20% above comps. If AZDavid is looking for failed flips….

Where did you get this $325 a month HOA figure? The listing says $43 a month.

Geotpf, and for those who missed it, you may still have a chance to purchase this unique exclusive opportunity:

https://www.irvinehousingblog.com/blog/comments/ideal-home-brokers-exclusive-access-properties/

On Shevy’s site in Feature Homes, View Recently Sold Properties

We have a North Koren Tower

3131 Michelson Drive 1606

Irvine, CA 92612

Sold for $1,099,000.

On redfin.com is shows as sold in 2006.

So Shevy sold this? If he did, that is impressive. Maybe he can get Irvine pricing on Lake Forest properties.

LOL if true I wonder how that client feels now.

Maybe we can get that client to report on the IHB beacon of honesty and integrity?

PR is the true beacon of honesty and integrity. Go PR!

Shevy did not sell any units in the North Korea towers.

PR, the asking price is at $231 per sqft. Granted, I have not taken an in-depth look at recent comparable sales, but that is basically at western Inland Empire prices. The asking price is the starting point of a negotiation. It does not read “$275k Firm.” I don’t see the reason to bust IR’s chops on the asking price. Who knows what the seller’s threshold is.

Sure, it would be nice to have interior pics. It’s not like IR went and took these shots with his cell phone himself then uploaded them. Maybe they plan to take more. Maybe they couldn’t gain access immediately. Maybe paint is drying. Who knows. It is not uncommon to add more pics at a later date. We don’t know have all the info. He doesn’t need to please us. If somebody is a serious buyer, they’ll go see it in person or contact the listing agent.

@SOS:

Hold.

In today’s webcentric society… pictures are everything. If you are going to push a new service as “Exclusive” you need to show me more than 8 pictures of the exterior if you want me to call you about it or even be the least bit interested in your service.

IR pokes fun at listing descriptions and photos all the time… therefore IHB’s own listing should be held up to the same standards… ESPECIALLY the exclusive ones.

At least show me the pig behind that lipstick.

I agree that good interior photography may motivate the buyer and catch attention. We do not disagree there at all. All I am saying is that the criticism is both premature and unfairly harsh (especially since IR did not directly create this listing himself.) Where we disagree will be in what would prevent us from wanting to see IHB’s exclusive property/ies. For me personally, the specs and price are enough if it means I’m not contending with MLS traffic. For you, it’s the photos or lack thereof. Everybody is different. For some, this will be enough for now.

SOS:

There are easy solutions to all of that.

1. Don’t show me 8 photos that are variations of the same exterior. Try 4 and then put into the listing description that interior photos will be up shortly. The listing itself says the kitchen and bathroom are newly renovated so to not show pictures raises questions. IR just explained why… but the fact that he had to illustrates the problem I am talking about.

2. How is the criticism premature or harsh? This is an IHB service and when I last checked, IR is partly responsible for anything he posts here. He should have talked to Shevy about his listing description as this is a known issue from previous Shevy listings that more than one of us had pointed out when IHB first turned into a division of Evergreen.

3. Price and specs would be enough if it were truly below comps. A quick Redfin search of LF for 2/2s doesn’t really make $270k stand out as below market but I would have to do more research as I see many of those are shorts.

I do like that the IHB is doing a pocket listing type service… if only they can find me a 3CWG in Irvine.

Fair enough. It could be beneficial to have mentioned that the interior pics don’t exist due to current renovations. It’s just simply not a deal breaker, though. I would argue that Shevy’s current or previous listing descriptions are only an issue for those who either have an axe to grind or are in need of some silly entertainment. Yes, we’re aware IR has engaged in critiquing other listings but he, in turn, is allowing comments on the L.F. property now, isn’t he? After all, we are discussing it here right now. He is not deleting anything.

For me, it’s all about the bottom line. If the seller is negotiable, the property is what I’m looking for, and the conditions are right, Shevy or any other agent can use the same adjective as many times as he desires and as many exclamation points as he wants to in the description. It is completely irrelevant to me. I do not care if the agent is a “fantastic” writer, though it can never hurt to be. I really only care for the aforementioned qualities. My initial comment was only directed at PR. It is difficult, if not impossible, to detect tone on the internet. When I read these comments sometimes I think people are looking for any reason they can to criticize IR. He probably doesn’t mind being the party pinata especially if it’s all in good nature, but it just gets tiresome when the loudest voice in the room is presumed to be the most correct one. IMHO, nothing that IR has presented here has reflected negatively on his intellect, capability, etc. People here tend to make a mountain out of a molehill.

These properties are trustee sale purchases. Each of them requires renovation. During the renovation period, there are no good interior pictures. The contractor is supposed to be finished today (Friday). There is an open house on Sunday for those who wish to personally view an off-MLS property with a newly renovated interior.

Please post yet another pick of the exterior of the unique exclusive condo you have for sale

While I disagree with PlanetRealty’s Irvine-is-immune implications, I do agree with his criticism of that listing and IHBrokers. Several others have already chimed in with similar observations.

Ideal Home Brokers has consistently displayed poor quality on pics and descriptions, bad math on comps and other calcs, and poor attention-to-detail in general. That was why I campaigned so hard for the Redfin links to stay on the articles in some form. I’m a huge fan of IHBlog, and I consistently recommend it to my friends, but I would never get involved with IHBrokers after so many repeated displays of incompetence.

-Darth

I saw this on Patrick.net:

Giving Back the House

Video explains how to strip and destroy a foreclosure and devalue it for the repossessing lender. Walking away is one thing, willful destruction is another. This video encourages illegal activity. It’s funny though…

Sound funny, but just a destruction (money out) of the house and not how to get money into your pocket. More of the Stalinist mindset of leaving nothing for your enemies or others. Very neo-corporate.

Cara,

Even with your recalculation to a 25% drop, that’s a big drop. The media has been making a big deal about 0.2% increases in other areas. More telling is overall trend inspite of the banksters stimulus packages (ultra low interest, transfer of liability) and squatters’ benefit stimulus package.

Been pumping since Cyrus came into office, blame Bush and try to get markets to a low, get 3 Trillion dollars, pump and now it time for dumping (for WS) for Cyrus hope it after the elections.

newbie2008,

But you’re missing the point. A 25% drop is not a 25% drop it’s a recalibration of what the April numbers meant in terms of the underlying trend.

Of course that’s kind of like saying the fall in house prices from peak to trough isn’t a drop, it’s a recalibration of what they should have been all along.

The important differences being that this is 1 week event, 1 month tops, readily identifiable in cause, emminently predictable in timing, unlike a self-perpetuating bubble.

I saw that “spike” as well. My home is for sale, and April was busy with showings, with the last week more so. Then the first week of May there were crickets. It picked up again quite vigorously in mid-May.

Have you had any offers yet? Just curious how much time you’ve been on the market and what your price strategy is…

/not being snarky

I’ve tried to price near comps. We’ve had a ton of interest, particularly in the middle part of May. I’ll post more when we close escrow.

Get ready… the second wave of dramatically falling prices is around the corner.

My .02

Either that or squatters get another extension of their free housing term.

Prices must grind lower…way too much inventory and way too much macro pressure in the economy. The best we can do is loose a decade like Japan. I see no reason to feel ‘desperate’ to get into a house b/c prices are going higher.

The ‘high end’ is begining to collapse now and rents are declining. We can’t undo the unbelievable excesses of the last 5-7 years in a short time. The worst is that the prudent savers and responsible home owners will pay – and are paying – the biggest price.

just my .02

I think College Park is near the railroad tracks.

I do like how they updated this 1971 house.

BTW..Shevy is a nice looking guy 🙄

The Godleski excerpt is fascinating—I didn’t know that the realtor convention of unnecessary capitalization and exclamation mark usage applied even outside of listings. (I’m talking about sentences like: “We are now 10% Below 2009 Demand for May!”) Someone should study this linguistic subculture…

I don’t think the end of the Fed credit would have that much of an impact on Orange County… or any other county in California thanks to Ahnuld.

And if you haven’t seen the commercials, even Coldwell Banker is offering an 8k credit on their listings… it’s the new hula hoop.

I wonder if houses will end up like cars where rebates become expected and sales plummet without them.

I have three Hondas out front and a bunch of neat Japanese stuff inside, so my house is technically an import (Honda) and so it doesn’t need a rebate or incentive. 😉

Let me guess… your house is lower than everyone else’s, you have 20″ baseboards, surround sound and neon lighting throughout.

(Please don’t tell me you have a wing-shaped back patio)

My house if Powered by Honda…. it’s not a Scion or Toyota…. jeez… get your autos right. If things work out I’ll get an Asimo butler and Soltec solar panel cells with an in house CNG refueler.

I do have the four rear surround speakers in my den built in, but they are Canadian (PSB).

Wouldn’t the banks have a decent claim for restitution for the time these squatters have been freeloading? It sure seems as though they are being unjustly enriched in that they are receiving the benefit of free housing without payment. Keep in mind that restitution is a non-contractual remedy. Such an action would have to proceed with a judicial foreclosure lest it be barred by the one action rule. Any thoughts?

For the bank to claim restitution, they would have to establish the owners were enriched at the bank’s expense and against the bank’s wishes. Since the banks had option to foreclose at any time, I don’t see how they could claim damages. Their damage was entirely self-inflicted.