Keeping the truth straight is difficult with good information, but once policitians and political operatives get involved with the flow of data, truth can be obscured and elusive.

Today's featured property belongs to a family that skimmed the appreciation and sold just in time to avoid a short sale.

Irvine Home Address … 34 CAPOBELLA Irvine, CA 92614

Resale Home Price …… $745,000

{book1}

Wouldn't it be nice if we were older

Then we wouldn't have to wait so long

And wouldn't it be nice to live together

In the kind of world where we belong

Maybe if we think and wish and hope and pray it might come true (run, run, run)

Baby then there wouldn't be a single thing we couldn't do

Beach Boys — Wouldn't It Be Nice

Wouldn't it be nice if houses really could provide lifelong income? California is truly a remarkable place. People here actually believe permanent, life-sustaining home-price appreciation happens. It does occasionally, and people build a life around it.

Wouldn't it be nice if politicians used real information to make substantive decisions? Instead we get and endless barrage of lies and manipulations. Politicians make realtors look honest.

Housing Bubble as Political Rugby

The housing bubble was a bipartisan failure. Both sides of the political spectrum have tried to blame the other for the housing bubble. It is all nonsense.

The political Right has touted the "Barney Frank inflated the housing bubble" about as far as it can go. The Right likes to forget that Barney Frank was in the impotent minority in the House from 1994-2006. He was a loudmouth who wasn't responsible for anything; although, he was effective as an annoying loudmouth. Personally, I think Barney Frank is a tool, and I wished he were not as powerful as he is today, but the characterizations from the Right about his involvement in the bubble are silly.

The latest evolving narrative on the Left is a populist appeal to blame the evil banks and get that bailout money back home to Main Street where we can bail out some victimized homeowners. That is nonsense too.

Resident Evil: Are Struggling Homeowners as Immoral as the Big Banks?

Do homeowners who are underwater on their mortgages deserve to lose their homes? That's what finance commentator Barry Ritholtz says, in a post called "More Foreclosures, Please." Ritholtz must have been channeling his inner Rick Santelli when he wrote that "the boom and bust saw irresponsible and reckless behavior by lenders and home buyers alike," adding that mortgage relief programs for homeowners reward those who were "reckless, speculative, and foolish" while punishing those who are not.

It's not reasonable to put Barry Ritholtz in the same category as Santelli, of course. Ritholtz is a highly informative, widely quoted writer on economic issues. Santelli's the frat-boy trader turned CNBC host whose rant about "rewarding the losers" got a cheer out of some morons on the Chicago Mercantile Exchange (and started the Tea Party movement). But Ritholtz puts financially beleaguered homeowners in the same "moral hazard" dumping ground as the banks who wrote their mortgages, suggesting that both of them "overused leverage, disregarded risk, (and) ignored history." Is that really fair?

Yes, It is.

After all, what kind of information was available to the average home buyer during the last decade? How would the average reasonable person have decided whether to buy a home or what kind of mortgage to use — in, say, 2004?

They probably read articles like the one published in February of 2004 in USA Today ("America's newspaper") with the headline "Greenspan says ARMs might be better deal." "Overall, the household sector seems to be in good shape," said Greenspan, who added that adjustable-rate mortgages might be the right choice for many homeowners. Greenspan enthusiastically promoted the new-style mortgages that later played a big role in the meltdown: "American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage," he said.

Greenspan wasn't just Chairman of the Federal Reserve at the time. He was the man the press kept touting as a genius, the one they called "Maestro." Were homeowners guilty of a "moral hazard" for listening to him? Should they face foreclosure because they weren't reading Nouriel Roubini or Paul Krugman or Joseph Stieglitz?

This just underscores the depth of Greenspan's failure. He was market cheerleader and irresponsible Federal Reserve chairperson largely responsible for unregulated derivatives that inflated the housing bubble. This guy's argument also ignores the more important role of the National Association of realtors. Nobody buying a house during the bubble paid any attention to Alan Greenspan; they were paying careful attention to their realtor telling them house prices were going up. They were also paying attention to their mortgage broker who was telling them they could borrow and spend that money as soon as it appeared from thin air.

Ignorance of the law is no defense, but ignorance of contrarian economic thought circa 2005 should be. If Greenspan and Geithner and Paulson and all the talking heads on CNBC and the other networks couldn't see the bubble, how could the average home buyer?

I can't believe he is making that argument. Ignorance is ignorance, and if it costs someone money, too bad. He is setting up ignorance as some reason people should be given a bailout. That is ignorant.

The truth is, most people buy homes because they need a place to live — and because for generations they've been told that buying a home is preferable to renting. Our tax code is structured to encourage home ownership, and the ownership message is reinforced in everything from news reporting to popular culture. (Think Miracle on 34th Street.)

BULLSHIT!!! (pardon the realtorspeak) People bought during the bubble because they wanted to get the appreciation and spend it. Very few people bought because they needed a place to live during the bubble. It was always a speculative investment they could also live in.

And generalizations about irresponsible, speculative borrowing overlook the fact that the nation's housing problems vary widely by geography. Some areas aren't having a housing bust:

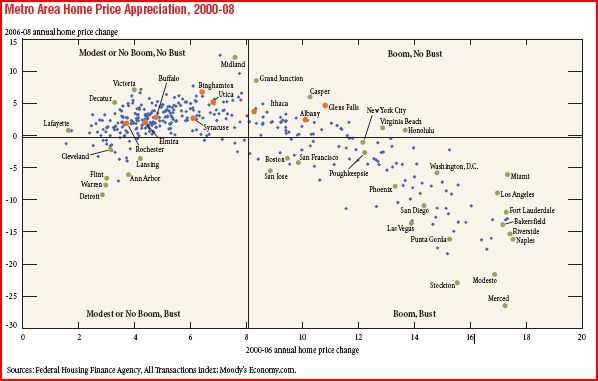

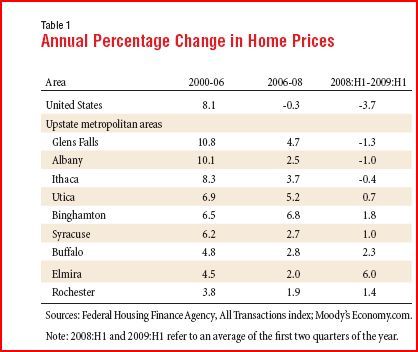

Is a homeowner in Glens Falls, NY any more "reckless, speculative, and foolish" than one a couple of hours down the road in Poughkeepsie? Poughkeepsie experienced a boom in prices followed by a bust, while high-performing Glens Falls experienced a boom with no bust. West of Glens Falls, my home town of Utica did pretty well too, as this chart illustrates:

It probably helps that Utica experienced its financial collapse a long time ago, so housing prices were already unusually low.

Above is a fine example of the intentional use of confusing and misleading data. If you can't dazzle them with brilliance, you can baffle them with bullshit. Obfuscation is helpful when there is no point to be made. The fact that the housing bubble varied by region was caused by many variables, and irresponsible borrowing and speculation are chief among them. This author is throwing up a mud screen of meaningless and confusing data to dupe you into thinking he must be some kind of special expert who understands these things. He is an idiot with an agenda.

Here's something interesting: The areas with stable housing prices had a much lower percentage of nonprime loans than the country as a whole. As the report's authors mention, the explanation for that probably "runs in both directions–an increase in nonprime lending led to more significant home price appreciation, and more rapid home price appreciation led to a rise in nonprime lending."

In other words, it was a cycle: Risky loans drove housing prices up, and climbing housing prices led to greater availability (and selling) of risky loans. That's not a borrower problem — it's a pattern of lender behavior. It's a sign of banks driving a speculative frenzy as a "get rich quick" scheme, then leaving the borrowers with the wreckage.

It takes two to tango. This is clearly a lender problem, and I have argued that Lenders Are More Culpable than Borrowers, but the endless stream of HELOC abusers and squatters I find right here in our affluent community of Irvine, California, show how widespread borrower malfeasance was. Hard-working honest borrowers are not the ones in trouble right now. Speculators and foolishly over-extended borrowers are the ones who are asking for bailouts.

Ritholtz makes some excellent points about the weakness of HAMP (the Home Affordable Modification Program), and its tendency to reward banks for their very real "moral hazard." The biggest problem with the revised HAMP program isn't that it's too generous to troubled homeowners. It's that it's a "pretty please" program that only requires lenders to consider lowering the principal on home loans (or, in the Orwellian language of the program's Fact Sheet, "servicers will be required to consider an alternative Modification approach" – "required to consider" being one of those self-contradicting phrases George Carlin used to rattle off, like "jumbo shrimp.")

But the idea of principal reduction — whether it comes from HAMP or individual lenders like Bank of America — is a reasonable one. Most reductions in principal will still leave homeowners owing more than their house is worth, which should give them their just portion of punishment for any "moral hazard."

The idea of principal reduction is not a reasonable one. It is a really, really stupid idea. They have received no punishment at all for their behavior, and that is exactly why moral hazard is a problem. The only people who think it is a good idea are the people whom might personally benefit from principal reduction. Of course, the author knows this. He is pandering to those people in hopes that they will support him. This is part of the evolving left-wing narrative and populist appeal.

"More foreclosures, please" is exactly what we don't want. Ritholtz is understandably concerned about the unfairness of "rewarding" homeowners who got in trouble in a way that keeps prices higher for those who behaved responsibly. But he paints an overly rosy scenario of bad actors being driven from their homes like poltergeists, so that new and vibrant families can move in — families that can afford the mortgage and have money left over to spend in the local economy. The real solution is going to look less like a ghost story and more like Tim Burton's Beetlejuice, where the ghosts and the living learn to live together happily.

More bullshit. Barry is exactly right, and this guy is exactly wrong.

The millions of homeowners who got in over their heads have already suffered a lot. Let's get them some help. And let's keep the focus on the people who caused this problem: The bankers who got rich off these schemes, and the politicians and regulators who let them do it.

I actually agree with his conclusion that we should focus our efforts on regulating banks and stopping the huge bankster ripoffs. However, the millions of fools who got themselves in trouble deserve not one penny of our tax money in bailouts. Not one penny.

I don't care about party affiliation, and I don't identify with labels of Progressive or Conservative. Any politician who supports bailing out anybody has lost my confidence. This shouldn't be a battle between the side the supports the lenders and the side the supports the common man. Both sides of that argument are wrong. Where is a good Libertarian when you need one….

Calculated HELOC use?

Occasionally someone will defend HELOC abuse as ordinary HELOC use, as if it is okay to spend home equity and use a house like a credit card. If there were no government bailouts, I might be more persuaded, but since we are all paying for the abuses, the line between "use" and "abuse" gets pushed much closer to zero use.

- This property was purchased ages ago on 6/22/1993 for $334,000. The original loan information is not present, but we can assume they used a $267,200 first mortgage (80%) and a $66,800 down payment.

- On 10/26/1999 they refinanced into a $307,500 first mortgage.

- On 1/7/2000 they opened a HELOC for $60,000.

- On 3/17/2003 they refinanced with a $424,000 first mortgage.

- On 9/14/2004 they refinanced into a $540,000 option ARM. It appears to have blown up 5 years later.

- On 12/22/2004 they opened a $116,000 HELOC.

- Total property debt is $656,000 plus negative amortization.

-

Total mortgage equity withdrawal is $388,800.

Foreclosure Record

Recording Date: 02/23/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 01/04/2010

Document Type: Notice of Default

Foreclosure Record

Recording Date: 11/20/2009

Document Type: Notice of Default

This property is scheduled for auction on 20 April 2010. Do you think the sale will close in time or will this go REO?

The borrowers who are about to sell today's featured property obviously grew their mortgage to obtain and spend their equity. They avoided a short sale; although, they spent most of their equity, and their credit is trashed. What lesson have they learned? Why won't they do this again on their next property?

The lesson this family learned is that they could spend their home equity the moment it appeared, and there is no real consequence. Of course, they could be leaving home with several hundred thousand dollars more in a closing check, but they wouldn't have had all the fun with their HELOCs. Do you think this behavior is wise? They do.

Renting with housing income

There is another way to look at this transaction. It may help explain why California homes are so desirable.

Lets say someone rented this home for 10 years with an average rent of about $2,500. It may rent for more now, but it probably rented for less in 2000. A renter would have spent $300,000 on housing during a ten-year period ($2,500 X 12 X 10 = $300,000).

These owners started their HELOC frenzy around the millennium, so they probably paid more in cost of ownership than they would have spent in a rental, so their total cost of ownership would have been closer to $360,000 during the same ten-year period ($3,000 X 12 X 10 = $360,000). At first glance, it would appear that owning was not a big advantage; however, If you factor in the mortgage equity withdrawal of $388,800, their net cost of ownership was less than zero. The house paid for itself.

That's why everyone in California wants a house.

When this family moves out, they are no better or worse off than a renter. They will leave with no equity. But the renter would have endured a housing cost whereas this owner endured none.

Irvine Home Address … 34 CAPOBELLA Irvine, CA 92614 ![]()

Resale Home Price … $745,000

Home Purchase Price … $334,000

Home Purchase Date …. 6/22/1993

Net Gain (Loss) ………. $366,300

Percent Change ………. 123.1%

Annual Appreciation … 4.8%

Cost of Ownership

————————————————-

$745,000 ………. Asking Price

$149,000 ………. 20% Down Conventional

5.23% …………… Mortgage Interest Rate

$596,000 ………. 30-Year Mortgage

$158,324 ………. Income Requirement

$3,284 ………. Monthly Mortgage Payment

$646 ………. Property Tax

$67 ………. Special Taxes and Levies (Mello Roos)

$62 ………. Homeowners Insurance

$41 ………. Homeowners Association Fees

============================================

$4,099 ………. Monthly Cash Outlays

-$811 ………. Tax Savings (% of Interest and Property Tax)

-$686 ………. Equity Hidden in Payment

$309 ………. Lost Income to Down Payment (net of taxes)

$93 ………. Maintenance and Replacement Reserves

============================================

$3,004 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$7,450 ………. Furnishing and Move In @1%

$7,450 ………. Closing Costs @1%

$5,960 ………… Interest Points @1% of Loan

$149,000 ………. Down Payment

============================================

$169,860 ………. Total Cash Costs

$46,000 ………… Emergency Cash Reserves

============================================

$215,860 ………. Total Savings Needed

Property Details for 34 CAPOBELLA Irvine, CA 92614

——————————————————————————

Beds:: 3

Baths:: 3

Sq. Ft.:: 2325

Lot Size:: 4,695 Sq. Ft.

Property Type:: Residential, Single Family

Style:: Two Level, Other

Community:: Westpark

County:: Orange

MLS#:: S606385

Source:: SoCalMLS

——————————————————————————

Spectacular Westpark location with 3 spacious bedrooms and a loft. Extremely private with property angled so neighbors cannot see in. Property is light and bright with cathedral ceilings and recessed lighting. The family room features a fireplace and the kitchen has GE Profile stainless steel appliances with dual convection ovens. The home has an in-ground spa and will be perfect for entertaining.

NO “The truth [LIE] is, most people buy homes because they need a place to live” The guy needs to go back to the stats. 85% of condos in Miami bought as non-resident investments!!! Just like with the bubble, it is useful to break statistics out in bubble vs. non-bubble areas. If 1/3 of all US home sales are to non-owner occupants, what is the percentage in the bubble regions? Easily over 1/2.

A lot of buyers bought as investments they never planned on living in! Some only had a mild trend toward renting. Look at the flipping new construction. You sign to buy at construction start, and then sell when construction completes. You take almost no risk…well, almost none.

I have to disagree, at least partially. I believe that peoples’ reasons for buying vary demographically and geographically. Giving my Bay Area perspective, *everyone* I know that bought during the bubble years (and is now underwater) did so because they were either soon getting married or soon starting a family, and were afraid of being “priced out forever.” I honestly don’t know a single person that took out HELOCs to sustain a lifestyle. It was all shrill, controlling wives that had nesting instincts kick in and demand to purchase a house before they had to *gasp* make babies in rental squalor. Am I sexist? Misogynist? Then why did someone spend the money and the time to make this commercial:

https://www.youtube.com/watch?v=Ubsd-tWYmZw

Just because a large enough portion of the population does match the stereotype to make the stereotype exist in the first place, doesn’t mean you have to surround yourself with stereotypical people.

Well-balanced, fiscally responsible, grounded women exist, I’m sorry your life has not intersected with them in sufficient numbers such that you still feel justified in painting with such a broad brush. Better luck in the future.

Well-balanced, fiscally responsible women who are grounded do exist, however “es” does make a valid point.

The majority of women have embraced the “pecking order” mentality whereby people are judged based upon their landed status.

I have experienced discrimination based upon my renter status and I can promise you the bad energy was coming my way through women. I mean not even talking to me. Unbelievable and I pull in about $215k per year. Much more than they do since the majority of these women got to where they were through leverage plain and simple.

This was particularly evident to me when watching the reality show, Tori and Dean Inn Love on the Oxygen Network.

Women in Temecula and surrounding neighborhoods near Tori and Dean’s rental (they were renters and completely renovated the inn property) were simply astonished that Tori and Dean were “just renting.”

It was amazing to watch the human interactions going on in that episode, which is probably available for purchase on iTunes or can be viewed on hulu.com

It was obvious to me that these women instantly compartmentalized Tori and her husband to a lower status simply because the property was a rental.

It is my view that this stupid bias that they experienced is one of the reasons why they moved back to Hollywood.

Any woman knows this and the “pecking order” mentality that many women possess can easily be witnessed by the popularity of TV shows where this sort of behavior forms the foundation of female relationships:

The Real Housewives series, pick one any one;

Little Miss perfect;

Toddlers and Tiaras;

Bridezillas;

Rich Bride Poor Bride;

among others.

This mentality certainly did play a bigger part than can be quantified at present, however, any regular viewer of the Dave Ramsey show on Fox Business or Suze Orman on MSNBC can hear how women set their families up for failure by demanding a home purchase when the spouses or partners was not in any position to do a transaction of this size.

~Misstrial

Have you not noticed that aside from things like contest based shows like Top Chef, reality TV shows are based on the worst of the worst of humanity and all it’s failings?

And while David Ramsey and Suze Orman are not reality shows per se, the callers are going to be skewed towards those who have made outrageously poor decisions. (except for the may I buy this segment which can have responsible folks).

Yeah, there are mean people out there. Dude, steer clear from them, it’ll make your life much better.

Perhaps such people are more concentrated in California? Or maybe southern California? I mean the worst of the HELOC abuse is concentrated there, and the absolute acceptance of 4x income being a reasonable house price is also prevalent there. Maybe it’s a self-reinforcing cycle?

But seriously, would you want to date anyone who looked down on you for renting? Aren’t they doing you a huge favor by showing their colors so early?

I do have to admit, I do have a very small number of female friends which does largely remove me from any pecking order. I have one friend who tries to create competition where there is none. You should have heard her daughter the first time they saw me after I got pregnant, the 6 year old says, “we’re so PROUD of you!”. Her mom’s a stay at home mom. I was like, hmmmm, interesting choice of parroted words…. But for the most part it’s just not that hard to recognize it in others and just let it brush off you, laugh at it, and move on. You know, you live your life, I’ll live mine, you’re happy with your choices, you don’t need me to validate them by making identical ones. Those are the right things for you, these are the right things for me.

If instead of a parade of women who have gone beyond stereotypes into the parody of stereotype realm, you wanted a parade of women who can’t stomach spending money on themselves you could choose to watch “What not to Wear.” Yes, occasionally it will be someone who does spend a lot of money just on really tasteless clothing, but 90% of the time it’s women who have a hard time spending a dime on clothes even when it’s $5000 of free money.

Yes, the show does promote self-respect through materialism, and hence is itself a product and promoter of the culture of money, but it does showcase tons of women each year who have refused to buy into that culture. (I wouldn’t necessarily call them normal or grounded though)

I have one very close friend who abused his HELOCs and cash-out refis. His parents started their Real Estate empire in South LA county back in the 1980s, accumulating a handful of investment homes over the years. When this friend got married in 2001, his parents essentially gave him one of these homes to live in, with him taking over the mortgage balance of around $100K. When home values skyrocketed, he and his wife decided to capitalize on all the equity hidden in their home, via a handful of HELOCs and one cash-out refinancing.

I remember him telling me how his house was appraised at $350K (in 2003) and he was going to tap his home equity to reward himself. He was telling me about how he got a big check and how with his new loan he only had to pay interest for the next five years, and it was less than the payment on the old mortgage! I questioned if he was making the smart choice rather than pay the low balance mortgage off, and his response was exactly what the TV commercials, realtors, and mortgage brokers were saying at the time.

In a period of two years, he went through FIVE new cars (two of them being $60-70K cars), two motorcycles, lavish spending on multiple weekend trips to Vegas, several vacations to Hawaii (staying in upscale resorts, not settling for the $150 a night hotel), a vacation to Tahiti, and even bought an ‘investment home’ in Las Vegas just before the peak.

So yes, I know a HELOC abuser very well. Fortunately for him, both he and his wife have stable high-paying jobs, Prop 13 keeps their taxes low, and there is no real issue of affordability with the new mortgage, however they’re now stuck with 30 years of house debt.

If I was in his shoes, I would have paid the house off to live mortgage free, of course I wouldn’t have enjoyed the high roller lifestyle for those years like he did. These days he’s much more careful with his money, and doesn’t buy new toys or take vacations since the HELOC ATM was shut down. That makes me wonder, how do HELOC abusers feel when their money supply is cut off and they have to live within their means again? Once you get used to that lifestyle, I imagine it is very painful to adjust back to reality.

damn, that just sounds like so much fun.

sometimes i think financial restraint/responsibility is so…boring, it’s like entering the priesthood sometimes.

Q: How do they feel when their money supply is cut off?

A: Well they probably go through withdrawal like any substance abuser.

This results in marital or partner arguments, the blame-game, bitterness over lost economic opportunities, how to ask the relatives for money, and family disagreements over how this is affecting the children.

In my experience this sort of financial mess nearly always ends up in dissolution.

Nearly every time.

Already I am seeing mostly males who have had enough. They blame their wives for demanding a home purchase simply due to impending childbirth or for some other personal reason, largely due to a desire for greater personal standing among “friends.”

Although it does go both way, mind you.

There are women who are cautious with money and who married a guy with outstanding debts. They ignored red flags and got married to the guy anyway, paid off his debts, and yet he continues(d) to buy toys and be a boy-child. You can watch this sort of thing on Til Debt Do Us Part. Very instructive on what goes on.

~Misstrial

Yeah, Michele Singletary at the Washington Post stresses continually that you HAVE to be able to talk about money before marriage. And you have to get your financial house in order or else you’re setting yourself up for divorce down the road.

My husband and I had to play to our strengths, I pay for everything, mortgage, food, utilities, car payment, health insurance, life insurance, you name it. Because I’m better at sticking to a budget and keeping track of paying bills on time, etc. He is the designated saver. His whole salary went towards the DP fund, emergency fund, maintanence fund, fund for buying the next car outright, maxing out the retirement savings (I just meet the match) savings for major purchases (which for us is like anything over $400). It works well because we make the same amount of money, and I now have him addicted to savings and getting that interest on it, rather than his previous habits of buying absolutely everything on a payment plan. The man bought a computer on a 5 year payment plan. Anyway, he’s cured. Got him a new addiction, having a cushion, paying for things outright and watching savings grow. He’s now worse than me about hating parting with money.

Point being, you’re never going to find someone who’s the same as you, but you need to be on the same page with the same goals, and play to your strengths.

One possible macro-economic “justification” for principal reduction is mobility. The housing bubble created a vast misplacement of workers. Whatever industries and localities actually expand and create a sustainable recovery it’s not going to be in housing and finance, and it’s unlikely to be in the bubble areas. Thus jobs created may not be where the underwater homeowners are.

Thus one could argue that for the good of the economic recovery, we need principal reductions and/or extremely expedited low-consequence short sales such that workers can freely move for better employment.

My sister and sister-in-law in the Bay area bought a 2 bedroom house in 2005 in an nice area of Oakland that’s so far held up relatively well. Down maybe 20%. But that still wipes out their downpayment such that they’d need to inject cash to cover transaction costs. They’ve finally after 15 years of dealing with overly high cost of living and scarce job opportunities and high costs to visit family back east, come to the conclusion that they should give up and move back east, where my sister would be easily employable at a better job than she has now and my sister in law might stand a chance of getting a more than 15 hr/week librarian job where governments and universities aren’t quite as strapped.

But they can’t move yet. Not until more amoritization brings them back above water, and that’s assuming no further falls in price.

Yes, they bought somewhat foolishly (in that it didn’t occur to them that prices would crash such that they could have waited for a lower price), it only made sense because house-rents were so high, and my sister was eligible for a subsidized loan at like 3.5% (30 year fixed). So while rents were high, it was only cheaper than renting under absurdly low interest rates. They do have that absurdly low rate, and amoritization is fast under that rate. But still, them moving sooner and both getting jobs better suited to full employment and use of their skills? Wouldn’t that be a net economic good?

Very few people got 3.5% ‘subsidized’ loans and many were probably the subsidizers. It sounds like they can already move, they would just need to bring money to closing. I’m sure there are people in the Bay area who lost equivalent amounts investing in dot-coms. Why should a housing investment be protected?

Someone is going to pay for the principal reduction. Imagine if you do give them a PR – how many Bay Area residents do you give it to? How many residents in FL – everyone? What about the people that ate their loss and had their ‘investment’ wiped out by bringing cash to closing?

I would like to see their skills put to maximum use, but am not sure a principal reduction is the way to do it.

After 10+ years renting with rent being over 50% of their income, and another 10 years of owning (owned a condo before, sold for purchase price, no appreciation even in the bubble, then rented for 1 year in between) at similarly high DTI, there is no money to bring to the table. It’s that high cost of living that’s never enabled them to save that’s finally convinced them that they have to move.

Sub-median non-profit and public sector jobs just don’t make enough in high cost of living areas, hence both the lack of savings and the subsidized loan.

These are not people who were living high on the hog, just people who wanted jobs that make a difference in the world, and that just doesn’t pay well.

They don’t need to get their DP back, they could rent out here easily and save up a new one. The difference between the dot coms and housing is leverage. You could lose everything in either, but most people couldn’t go negative with the dot coms (except for that whole getting hit with capital gains tax and then still having something worthless, for some I think that somehow did work out negative). Given that housing purchases are routinely leveraged, and generally not considered an “investment” but rather a long term savings and cost-fixing plan, there’s a number of differences.

My sisters’ aren’t the best example, because it’ll only be another 2-3 years before amoritization covers the transaction costs. But if what the country is lacking is labor mobility now… then that 2-3 years is a problem. And most people are further underwater than them, so need the short-sale route to be less, onerous.

I’m not saying it wouldn’t be outrageously expensive. I’m just saying that the benefits should be considered when weighing those costs. If the macro-economic benefits are found to be lacking, then it shouldn’t be done. But they need to be taken into account first before being disregarded.

(If you’re wondering where the first DP came from, inheritence).

They’re also a bad example because they do have a plan. This is the last year of paying off grad school debt, the last year of three days a week daycare, and the sister-in-law has been promised 30 hours next year, so soon, soon they will be able to start saving for the big move, and it should only take them a few years between amoritization and savings from fewer financial obligations.

So you’re right, they in particular, don’t need help. But I’m sure there are others.

What I do think they are a good example of is (a) people who put 20% down and yet are still unable to move, (b) people who bought because of life-timing not investment purposes, despite being in the middle of a bubble region.

Still, even in your example Cara, they have options available to them (other than taxpayer-provided help in the form of principal reduction). They can stay on course, or they can walk-away from their purchase money mortgage with no recourse for any deficiency. The only harm is to their credit score, and that can be quickly rebuilt.

I think those are two good and fair options. I don’t want to make the decision for them, and I don’t want the government pushing them in one direction or the other. I want them to decide what’s best for them with the options available today; and the option to walk remains open for the life of the mortgage!

Aren’t there any people back east that can do the job your sister wants to do? Mobility of labor isn’t a reason for principal reduction or debt forgiveness.

The logic is that one of the main driving forces behind our resilient economy has been labor mobility. Underwaterness has suddenly shut that off. If you allow people to leave California, Arizona and Florida unemployment in those places will improve.

Loan mods (of any sort) frequently make sense to the bank. If the bank nets more money by doing a loan mod than a short sale or foreclosure, then they will do so. The governmental incentives to do such are relatively minor and only change the calculation in borderline cases.

That is, let’s even take a rare principal reduction. If a house has a loan on it for $400k but is only worth $150k today, it would make fiscal sense to lower the principal to $300k if it would get the homeowner to stay put and make payments. Heck, the net for the bank if they sold it would be even less than $150k, due to repairs and real estate commissions and the like.

Now, many loan mods fail because the borrower can not or will not even make the reduced payments. But even without governmental incentives, it often makes sense for the banks to make an attempt at such.

I don’t see how being underwater has stifled labor mobility. Regardless of whether they walk away, do a short sale, or get a principal reduction, there is little stopping them from heading east to greener pastures.

Calculared Risk has done posts citing that we are currently at the least mobile our work force has been in a very long time.

You may not see it, the barriers may seem small, but it’s in the data.

Perhaps there are too many people being responsible with their debts and choosing to pay them down rather than move.

In case anyone thought Orange County was affordable… it’s not…

$129,850 income needed to buy O.C. home

The median income is quite a bit less than that. Only unsustainable financing terms make it appear affordable.

Orange County has never had that price to income ratio.

$130k income to buy a $435k home?

According to your post today that person can almost buy a $700k home.

There is more to this story. I’m all for affordability calculations but something is wrong.

IR, you could change that headline to read:

“$130k income required to afford a 2BR apartment in the OC”

Is that really the truth? It’s saying practically the same thing.

they could buy a home on that income but it wouldn’t be very smart. In particular, they’d be stuck in that home for a decade or more due to depreciation. That’s right, depreciation. Home values will continue to go down while interest rates go up, taxs increase, services (schools) diminish in quality, and wages stagnate. It’s called stagflation. Get used to it.

It’s apparent this family didn’t spend that $388K on furniture. Sheesh.

Hey David…we just had another earthquake!

9:45AM

Most people did buy house to live-in, but maybe 30% were “investors” and flipper who borrowed to get 2 or more houses. That drove the prices up for the rest. More mortgage, taxes, rent, etc.

The same old excuses. John got away with it, so I should also get away with it. John being the banksters and I being the borrowers. Time to claw back the money from John to replay the real victims, the taxpayers. Since the banksters control both the D and R parties and the borrowers with media support will yell the loudest for more bailouts, I don’t think the govt will do the right thing.

Tim when to Vegas as a high roller for 4 years and lost 2 million, so is lossing his house. Are the taxpayers going to cover this bets, so he doesn’t lose his house and have his kids on the street?

Now replace the word “bank” for “Vegas.”

BTW,

Your Metro house appreciation from 2000-2008(or is the date 2006?), indicates that for for most locations pre-2000 purchasers, they are still ahead of the game. Gain rate > Loss rate.

Best locations are in physically desirable areas — vacation destination type settings with jobs.

Almost all actually, because those are annual gain rates for 2000-2006 (6 years) versus annual loss rates for 2006-2008 (2 years).

To do it properly one would have to take into account compounding and that a 100% increase only requires a 50% fall. But I’m pretty sure the break even with 2000 line runs below almost all of those data points with the possible exception of Detroit Warren Flint and Ann Arbor (but I think even those are barely positive…)

That doesn’t mean people who bought in that era won’t be upside down, due to HELOC abuse and cash-out refis. In fact, it’s not uncommon for people who at one point paid off or nearly paid off their houses (people who have been in the same place for twenty or thirty years or even more) to then lose their houses due to refis or HELOCs. What’s really stupid about that type of thing is that they would have had a Prop 13 value of less than a high-end Lexus, so they would have been paying hardly anything in property taxes.

Is anyone else bothered that this house would cost about 150K in most other areas of the country?

Interesting article on CnnMoney today. Not only will HELOC abusers be taxed on the money they stole, but serial refinancers will be too. Only initial purchase money loans will be exempt from tax on forgiven debt…until 2012, and not in California.

Forgiven debt on vacation homes and investment property is taxable also, as is any amount of forgiven debt over $2M.

http://money.cnn.com/2010/04/08/pf/taxes/taxes_mortgage_debt/index.htm

A realtor I know just had to go up to Reno and find a specuvestor to sign off on a short sale. He blew his parent’s inheritance on rental duplexes in the mid 2000’s and is now a boozer living on the street.

If I bet on the stock market and lost would it be any different on someone who over leveraged himself and bought too many rentals with never thinking they may not always rent out–or who could never imagine rentals could drop down in price.

An investment of any kind IS A RISK–

would you pay for my losses in stock?? Pretty please—

We forget that Heloc’s were PURE CASH not taxed INCOME—not earned income just percieved future equity that popped.

While the rest of us who pay rent from earnings PAY the real tax burdened here because we pay from earned/taxed dollars.

I totally agree you take out any kind of loan you owe it back.

a Loan is a loan—

You can reduce the interest rate string it out into future years but paying back any kind of loan should STICK—

These remods only forgive the heloc’s while punshing us renters who did not recieve any tax free money into being the ones who actually work and pay for their greed.

The foreclosures also forgive the Greed. The best thing would be to change the loan but not the price. Pushing it onto the tax payers backs is why our debt is so high–

Everytime you read this board you wonder why would any one buy here? The system is so corrupt from all aspects. IR is right this is the biggest ponzi scheme EVER.

The property is listed at $745,000. Trulia reports that the median sales price for homes in ZIP code 92614 for Jan 10 to Mar 10 was $487,000.

The property could end up a REO; I wonder if FHA, that is one of the GSE’s will have title; they may try to force it back to the lender that facilitated the loan.

If it becomes a REO it will be added to the nation’s stock of vacant homes, which is about 13% of total; and the $487,000 value written off to greed, dissipation and debauchery; and property taxes accrued for quite some time.

Given total mortgage equity withdrawal was $388,800, it’s as Irvine Renter relates: the net cost of ownership was less than zero. This was very shrewd on the part of the borrowers. I have been very nieve about such investing.

Soon the stock market will be tumbling lower, and employers laying off, and US Treasuries will go unsold, so another Depression will be unleashed, and then property values will relly fall; all of this goes back to the repeal of the Glass Steagall Act in 1999 by a Senate vote of 92 to 8, which broke down the firewalls of financial protection that were established in 1932.

Redfin says comparable sales (past 90 days) of nearby houses averaged $365/sq ft, valuing this house at $849,369.

Sorry-past 6 months, not 3.

What kind of loans? Heloc’s?

LOS ANGELES – A Bel-Air mansion owned by Nicolas Cage has found no takers in a foreclosure auction.

The opening bid for the actor’s 12,000-square-foot home was $10.4 million, but there are $18 million worth of loans on the property.

The Tudor mansion boasts six bedrooms, a central tower, home theater and an Olympic-sized pool. The house reverted to the foreclosing lender at Wednesday’s auction in Pomona.

Even though he’s one of Hollywood’s highest-paid stars, Cage has money troubles. He owes millions in unpaid taxes and in January his foreclosed home in Las Vegas sold for nearly $5 million.

Cage sued his former business manager in October for $20 million, claiming the man’s advice led him toward financial ruin. The ex-manager says Cage is a spendthrift.

Whoops, wrong day. Here it is again, sorry for the dupe: Totally unrelated AND off topic but IR, I noticed you were interested in this on the weekend: Saturn’s Strange Hexagon Recreated in the Lab. IR Feel free to delete this note.

That is really cool. Thank you.

No thank YOU!