Detailed stats on the Irvine housing market are something we are always

interested in. The Inventory number in the sidebar comes from

ZipRealty. A chart of those numbers shows some interesting trends. We also have some great resources provided by ipoplaya and IrvineRealtor.

A new resource we just learned about are the Neighborhood Analytics that Redfin launched. Irvine charts available after the jump…

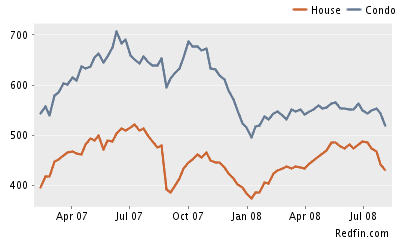

Irvine: Number of Homes for Sale

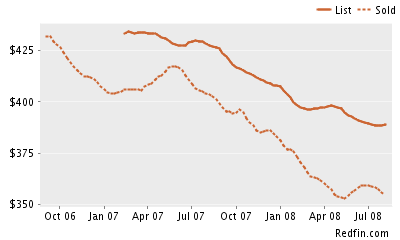

Irvine Homes: $/Sq. Ft.

{adsense}

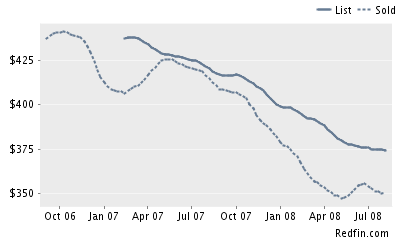

Irvine Condos: $/Sq. Ft.

All of these charts can be found on the Irvine page at Redfin. Another cool thing about these charts is that they are also available by neighborhood (ie Northwood, Oak Creek, etc) and by zip. Take a look and let us know if you see anything interesting.

My guess is that Redfin gets it’s numbers from the MLS.

It turns out the MLS is significantly understating resale inventory since the introduction of large numbers of REO on the market.

http://sacrealstats.blogspot.com/2008/08/insight-into-shadow-inventory.html?ref=patrick.net

Looking for (honest) detailed stats from NAR or anyone else in real estate is like asking a Las Vegas casino for win loss stats. NEVER GOING TO HAPPEN.

However as long as people in Irvine will continue to believe their area is so special (you are not Newport so quit trying) there will always be speculator and kool aid drinking buyers.

God knows what guide of problems we will see if real estate buyers begin to exercise prudence.

Love the blog and the Kool aid references…

cheers mate.

“NEVER GOING TO HAPPEN” = in non-capsloc speak, “nagahappen”… Did I just make the world better?

That link is a must read on shadow inventory. What a sham the real estate industry is STILL inflicting on its customers.

Don’t most of the REOs end up in the MLS before too long, though? Or are most of them sold at auction?

Does anyone know who publishes the MLS?

Redfin pulls from multiple sources, prominently including the local MLS systems and Homes and Land Magazine.

MLS systems are maintained by local associations of realtors, with some guidance from the NAR. The NAR initially tried to keep sites like Redfin from getting to all of their listings, in an attempt to make the sites less useful to consumers and keep realtor commissions higher. The US Department of Justice came after the NAR and the local MLS services. The DOJ won, and the MLS systems can no longer withhold any listing from them.

The decision is from May 2008, available at http://www.usdoj.gov/atr/cases/f234000/234013.htm

Because the local MLS systems are run by local associations, there can be major differences in the information they collect and how they operate. Frankly, some of them suck, even for realtors using passwords. Redfin, Trulia, and other web vendors often have added valuable related content, such as better maps, street views, and different historical data analysis. The big internet providers have definitely made the interface more consistent and user friendly.

although trustworthy stats, suggested by redfin or for that matter ziprealty, is in question, YTY inventory comparison and pricing trend is more reliable source of information.

Check out this QH beauty to see for yourself how it looks like to chase the market to the downside:

515 Luminous

Irvine, CA 92603

Price: $1,675,000

Last Sale: 12/28/05

Sales Price: $1,894,500

Listing Price History

Date Price

Nov 15, 2007 $2,399,900

Mar 12, 2008 $1,899,900

Apr 04, 2008 $1,899,000

Apr 10, 2008 $1,849,000

Apr 13, 2008 $1,799,900

May 17, 2008 $1,749,900

Jun 13, 2008 $1,739,900

Aug 14, 2008 $1,675,000

http://www.redfin.com/CA/Irvine/515-Luminous-92603/home/5929442

Hey folks of the Irvine Housing Blog,

I’m a broker in Austin Texas and have been following your blog for a few months and love the commentary. I’ve been trying to follow some of the financial analysis and I must admit that I’m not as skilled in a lot of the economic analysis as you are, but I wondered if you had a place where I could go to pick up some of the financial analysis basics. I have a degree in comp sci and comp engineering so I’m no strange to formulas and equations, but I’m more in need of what is generally accepted to use and what those formulas and stats tell you about a given property or market. If you have any advice on blogs, sites, or posts to read, I would be very appreciative.

Joe

In all seriousness: the posts under “analysis” contain a lot of thought-provoking stuff.

In the end, however, all the analysis in the world can’t get it PERFECT, because we’re dealing with individual human beings buying and selling individual houses. Collectively, there are emergent properties, but your experience may vary.

That said, I was a total neophyte before I started coming to IHB. Now, I’m slightly better informed (though far from an expert).

You want Calculated Risk

http://calculatedrisk.blogspot.com/

and especially the ubernerd posts.

Don’t skip the comments if you can take the time – some very smart people post there.

Sh*t, degrees comp sci and comp engineering yet you’re working as a real estate broker? In Austin, Tx, home of Dell Computer, AMD, AMAT, Origin Systems, PayPal? D*mn, no wonder I got the ‘final’ layoff from my 35 yr tech career… Not sure what my next career will look like but it sure *s h*ll won’t be as a real estate broker, sorry, folks, I need to make an honest living… (long time lurker, Austin resident)

I have nothing to add except for the fact that they posted a link to “Home” By Simple Minds – and it’s a great tune. Who knew!

Rock it

https://www.youtube.com/watch?v=Pazb6mRrxUI

Who knew? Why only Simple Minds, of course.

“I Didn’t (Forget About You)”

Do condo listings normally behave seasonally?

I can see how they might: people trading in condos for houses, and the height of market activity is in the summer, but what seems odd to me is the condo inventory dropping while house inventory stayed relatively constant.

Anyone know why?

TCE Plume matter from IRWD………..

http://www.irwd.com/AboutIRWD/ElToroCleanup.php

Background:

In 1985 portions of the groundwater basin beneath the former El Toro Marine Corps Air Station and the central area of Irvine were found to contain trichloroethylene (TCE) which is an aircraft cleaning solvents known as volatile organic compounds (VOCs). These chemicals resulted from past disposal and waste management practices on the former base that was common before the development of stricter environmental regulations in the mid-1970’s. A one-by-three mile plume of contamination now extends off the base (see map below). The contamination is about 150 feet deep beneath the base and 300- 1,000 feet deep in the community area.

It really matters……..TCE concerns

http://www.irwd.com/WaterQuality/IDP/idp-sitemap-May2006.pdf

Irvine’s Drinking Water is Safe

First and foremost, drinking water in Irvine has been and remains absolutely safe. IRWD drinking water continues to be well within all state and federal water quality regulations. IRWD maintains a state-certified water quality laboratory that annually performs more than a quarter of a million tests on our water supply to ensure that this quality is monitored and maintained. The plume does not affect IRWD’s drinking water since IRWD’s main well field is still several miles from the affected area.

TCE concerns fyi…

http://www.google.com/search?hl=en&q=TCE+plume,+irvine,+ca&start=10&sa=N

Financial advice for Sheeple…http://www.rocklintoday.com/news/templates/realestate_california.asp?articleid=6457&zoneid=48

trap more sheeple to make their defict up, who? those are living on tax payer’s money = blood + sweat + kids’ laptop + envorpating savings, what a game, what a sheeple owner……

TCE? Irvine is an industrial area. Many people don’t even know that there are houses in Irvine. It has a bigger reputation as a workplace and for housing high tech companies. The Irvine Bubble covers a lot more than real estate prices: it appears to extend over health and well being as well. For instance, did you know that Irvine covers some of the most polluted watersheds in Orange County, like Aliso Creek?

Norco and Corona have cows in feed lots, Irvine has people. Sorry to burst your bubble.

Another contributor to the house of card that toppled.

http://news.yahoo.com/story//ap/20080818/ap_on_bi_ge/mortgage_mess_appraisers

“After the nation’s last major banking disaster, Congress set up a system to catch rogue appraisers. Their game: inflating the value of homes at the direction of equally unscrupulous real estate agents and mortgage brokers, whose commissions are determined by the size of the deals.”