A recent study has concluded there are not enough first-time homebuyers to absorb shadow inventory.

Irvine Home Address … 49 CLOUDS Pt Irvine, CA 92603

Resale Home Price …… $2,450,000

I have waited a lifetime

Spent my time so foolishly

t feels like the first time

Feels like the very first time

It feels like the first time

It feels like the very first time

Foreigner — Feels Like the First Time

Someone has to buy all the homes from the banks. The amend-extend-pretend fantasy of lenders is that rising prices from natural demand was going to bail them out. It was never going to happen. As I noted in The Great Housing Bubble:

… late buyers who were “pulled forward” from the future buyer pool overpaid, and many lost their homes. This eliminated them from the buyer pool for several years due to poor credit and newly tightened credit underwriting standards.

We are seeing the impact of a depleted buyer pool now.

In a healthy market, move-up buyers can sell their homes and buy a different one. These buyers represent a significant portion of sales, and they are almost completely absent from the market right now because few of the buyers over the last 5 years have any equity, and many who bought in the 5 years prior are trapped underwater in their debtor's prisons.

The problem with the depleted buyer pool is going to be with us for quite a while.

First, everyone who short-sells, or defaults and goes into foreclosure is going to be forced to wait some period of time before they can obtain a down payment and qualify for a loan. I have documented the government's desperation to qualify warm bodies, but as they lower their standards, they simply encourage more strategic default.

Second, those who lost their jobs will need to wait until lenders consider their work history stable enough to qualify for a loan. Potential borrowers cannot get a job and buy a house a month later. Most often lenders will force a wouldbe buyer to wait for two years of stable employment. in addition, many of the unemployed exhausted their financial reserves to survive the recession, and they don't have the necessary down payment to close the deal.

Third, Americans took on so much debt during the borrowing binge of the 00s that many can't qualify due to the back-end lending ratios which are still quite liberal. Even those who qualify with a 50% back-end DTI really can't afford the property even if they get it.

Fourth, the ongoing slide in prices is going to trap more and more borrowers in an underwater condition preventing them from selling and moving on to another property. Further, the slide in prices erodes the equity future buyers need to provide a down payment for a move up.

Fourth, the ongoing slide in prices is going to trap more and more borrowers in an underwater condition preventing them from selling and moving on to another property. Further, the slide in prices erodes the equity future buyers need to provide a down payment for a move up.

Due to the variety of conditions either limiting or eliminating existing owners from entering the buyer pool, it will fall to first-time homebuyers to absorb the inventory controlled by the banks. Unfortunately, there simply aren't enough first-time buyers to do the job.

First-time homebuyers are too few in number to absorb inventory overhang

by CHRISTINE RICCIARDI — Thursday, May 19th, 2011, 1:03 pm

The number of first-time homebuyers coming to market this spring is not enough to absorb the amount of housing inventory on the market.

The percentage of first-time homebuyers searching for a property fell to 35.7% in April, according to the latest Campbell/Inside Mortgage Finance HousingPulse Tracking Survey. First-time homebuyers comprised 43.4% of the demand market in April 2010, when the homebuyer tax credit was in place.

The decline in first-time buyers is largely responsible for the decline in sales. It's a trend likely to continue until well after unemployment bottoms.

In the latest NAr press release (the topic for Monday's post), I found this tidbit:

First-time buyers purchased 36 percent of homes in April, up from 33 percent in March; they were 49 percent in April 2010 when the tax credit was in place. Investors slipped to 20 percent in April from 22 percent of purchase activity in March; they were 15 percent in April 2010. The balance of sales was to repeat buyers, which were 44 percent in April.

First-time homebuyers were nearly half the market, and now they are only a third. Demand was pulled forward as many 2011 buyers opted to overpay in 2010 to obtain the tax credit. As I noted last week, the $8,00 tax credit didn't do homebuyers any favors. Back to the HousingWire article:

Research Director for Campbell Surveys Thomas Popik said while there are still a “normal” number of first-time homebuyers searching for a place to live, the number of available homes is causing a demand gap.

“The normal proportion of first-time homebuyers is about one-third of the market and that’s where we are now,” said Thomas Popik, research director for Campbell Surveys. “Unfortunately, that’s not enough demand to absorb the excess supply from homeowners defaulting on their mortgages.“

First-time homebuyers absorb housing inventory, as opposed to current homeowners who trade in their property for a another one, thereby sustaining the supply level. According to the survey, the gap between first-time homebuyers and distressed property supply climbed to 12% in April, compared to just 3.5% in the year prior.

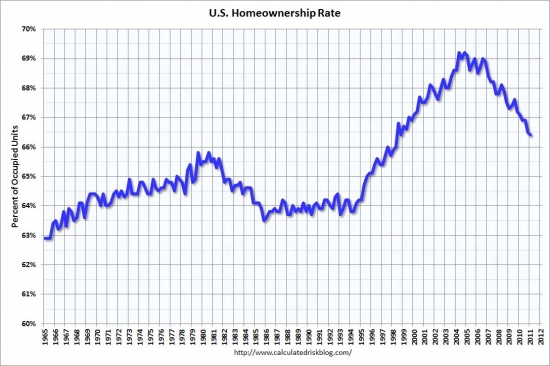

In a normal market, current homeowners do trade in their property for another one, but that isn't what's going on. Current loanowners are trading in their properties for rentals because they are either short selling or going through foreclosure. They are a net loss of buyers in the buyer pool as evidenced by the plummeting home ownership rate.

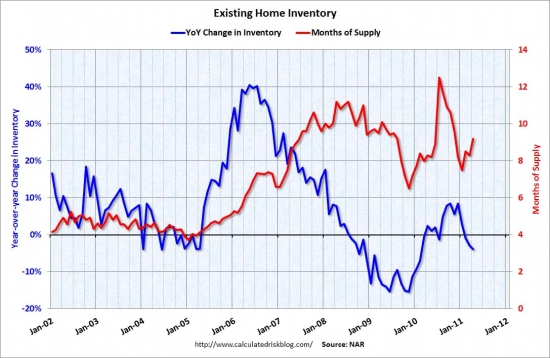

And, the housing inventory is at a five-month high, according to a report from the Federal Reserve Bank of Cleveland. The report also laid out data that found sales are down 12.6% compared to 2010 (see chart below).

I substituted Calculated Risk's chart in favor of the one provided in the article.

“As a result, we expect existing home sales for the spring/summer buying season to be significantly below last year and that will put continued downward pressure on home prices,” Popik said.

Yes, any bullishness for 2011 was crushed by the latest news on sales and prices.

This circumstantial “deficit” of first-time homebuyers is putting a dependence on investors to buy up distressed properties. Investors accounted for 23% of sale transaction activity in April, the Campbell/IMF survey found. This figure is up from 18% one year earlier.

Investors are also buying the properties first-time homebuyers are not, as 45% of foreclosed properties were dubbed damaged or inhabitable in April's survey. The Campbell/IMF Distressed Property Index, which measures the health of the U.S. housing market, fell slightly to 47.7% during the month from 48.6% in March.

When I buy a foreclosure in Las Vegas, about one-third only need minor work, but another third to a half would not pass an FHA inspection. That's why fund's like mine are needed to clean up this mess.

The depleted buyer pool does impact Irvine

Irvine is generally not a first-time homebuyer market. To the degree our market relies on move-up buyers, it faces the challenges listed at the beginning of this post. Expect sales of both new and resale homes to remain tepid for the foreseeable future.

From an IHB reader who commented on the new Irvine Company offerings:

I went to Stonegate Maricopa and Laguna Altura Toscana over the past few days. Findings are below, sales will be slow…..

Though they will both say they are more than pleased with sales, etc., the fact of the matter is they are not starting off like gangbusters compared to the well marketed launch of homes in Woodbury in early 2010. (Though I would love to poll new owners in Woodbury today to see if they feel they got a good deal….)

STONEGATE

– Since early April, Stonegate has sold about 12 houses in Maricopa and they were borderline pushy to sell a Plan 3 home with June delivery once they heard I did not have to sell a home….

– For a house that is nearly a million dollars, I want more than 10 feet from the back of my home to the back of my property….

– Layout of homes on inside were Decent

LAGUNA ALTURA – TOSCANA

– I felt trapped once I was inside the gate – at least 7 minutes from house to any commercial location

– I was surprised that I did not hear the highway traffic more but TOSCANA is farthest from the highway

– NOT a single lot was designated as “sold” though they were happy with sales (read foot traffic) the first 3 days….

– For 1.25 Million, I want more that 12 feet from the back of my house to the back of the lot

– $400 a square foot before landscaping and window treatments, etc. is steep though the layout is functional

– With HOA, RE taxes and Mello Roos, your monthly obligation is nearly $2000 before you even get to the mortgage……

I received this email from a reader:

Laguna Altura appears very much like Stonegate, no, wait, it is EXACTLY the same as Stonegate, except that there are NO schools, no community amenities, killer HOA fees, and a higher tax rate on the smaller homes than on the larger homes….located with only one way in and one way out on one of the most dangerous roads in the county, at prices that are $400/sq/ft…..makes you wonder what were they thinking?

The next $200,000 haircut

Today's featured property is a microcosm of the slow decline in high end prices experienced across much of coastal Southern California.

The property was purchased by a knife catcher in early 2008 for $2,685,000. It was listed for nearly $3M, so the buyer probably felt they got a bargain. They sold it on 4/14/2010 for a $235,000 loss. Given the astronomical cost of ownership on these Turtle Ridge properties, if you add the nearly $10,000 per month they lost in equity, this was a very, very expensive home.

The 2010 knife catcher is trying to get out with a minimal loss. Do you think they will escape unscathed, or will they be the next in line to take a $200,000 haircut?

Irvine House Address … 49 CLOUDS Pt Irvine, CA 92603 ![]()

Resale House Price …… $2,450,000

House Purchase Price … $2,450,000

House Purchase Date …. 4/14/2010

Net Gain (Loss) ………. ($147,000)

Percent Change ………. -6.0%

Annual Appreciation … 0.0%

Cost of House Ownership

————————————————-

$2,450,000 ………. Asking Price

$490,000 ………. 20% Down Conventional

4.56% …………… Mortgage Interest Rate

$1,960,000 ………. 30-Year Mortgage

$428,616 ………. Income Requirement

$10,001 ………. Monthly Mortgage Payment

$2123 ………. Property Tax (@1.04%)

$450 ………. Special Taxes and Levies (Mello Roos)

$510 ………. Homeowners Insurance (@ 0.25%)

$0 ………. Private Mortgage Insurance

$395 ………. Homeowners Association Fees

============================================

$13,480 ………. Monthly Cash Outlays

-$1659 ………. Tax Savings (% of Interest and Property Tax)

-$2553 ………. Equity Hidden in Payment (Amortization)

$833 ………. Lost Income to Down Payment (net of taxes)

$326 ………. Maintenance and Replacement Reserves

============================================

$10,427 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$24,500 ………. Furnishing and Move In @1%

$24,500 ………. Closing Costs @1%

$19,600 ………… Interest Points @1% of Loan

$490,000 ………. Down Payment

============================================

$558,600 ………. Total Cash Costs

$159,800 ………… Emergency Cash Reserves

============================================

$718,400 ………. Total Savings Needed

Property Details for 49 CLOUDS Pt Irvine, CA 92603

——————————————————————————

Beds: 5

Baths: 4

Sq. Ft.: 4333

$565/SF

Property Type: Residential, Single Family

Style: Two Level, Tuscan

View: Tree Top

Year Built: 2004

Community: Turtle Ridge

County: Orange

MLS#: P781598

Source: SoCalMLS

Status: Active

——————————————————————————

Great floor plan for young kids!!! Exclusive community of Turtle Ridge. This Amberhill residence is located on a private cul-de-sac with a lot over 14,500 sqft. Ideal for entertaining, this home features a dramatic living room with vaulted ceilings and a separate dining open to the backyard. A catering gourmet kitchen totally remodeled, upgraded with custom cabinetry, stainless steel appliances and travertine floors. With approx. 4333 sqft of living space, there is plenty of room for everyone. Casita with custom built-ins, wood paneled ceilings & custom fireplace. Master suite with balcony overlooking the pool offering privacy & room for relaxation. Dramatic master bath totally upgraded with stone floors and counters, appointed with custom cherry cabinets and custom details. Entertain and unwind in your own private resort like backyard, professionally landscaped, appointed with a pool, spa, fireplace, built-in bbq & cozy loggia. Minutes from schools, shopping and the beach.

Have a great weekend,

Irvine Renter

I apologize for the late posting. I accidentally set the posting time for 3:30 PM rather than 3:30 AM.

http://www.crackthecode.us/images/professional_landscaping.jpg

I missed that one.

What do you suppose a “catering” gourmet kitchen looks like?

I’ve been renting since 2005 and thinking of buying a SFR in Irvine now (need it for our growing family)and a bit tired of renting. But afraid that I’ll have waited for 6 years and screwed up by not waiting another year. What are your thoughts and how much per sq. ft should it go, generally speaking in Northwood?

I live in your area too.. renting… waiting. home prices are not flattening out (bottoming) soon. keep waiting, or if you can’t wait to move up then simply rent-a-home til the numbers make more sense.

there are plenty of people that would love to cover their monthly nut and gain a little equity (assuming they aren’t so far underwater as to be hopeless), albeit with taxes, insurance, and maintenance what they are, they probably won’t cover all.

I don’t really feel the stress over waiting another year, except for not having enough room. was planning to buy in late-2011 or early-2012 myself but now that’s not even realistic in a declining market with too much supply and more and more inventory set to hit the market in the next couple of years. especially since we don’t have kids yet.

anyway if you think prices are low now, just wait until this Oct-Dec when the real price “adjustments” start to kick in.

At first I looked at the pictures of this house and thought, wow nice house, $2.5 million not bad. But then I heard it was a great floor plan for young kids and it sealed the deal.

Much cheaper houses than this in Irvine have mello Roos HOAs, and property taxes which alone exceed the monthly expense of 2 or 3 Las Vegas houses. Apparently buyers have high down payments and high salaries in Irvine.

Funny, I looked at the price first and thought, “This must have some nice views of Catlina, but why didn’t they include any pics of that in the listing?”

Surely, for $2.5 million, you at least have a view of the Pacific, right?

That’s wishful thinking.

Try tacking on an additional $2M for the view and subtracting from the 14,500sqft lot size.

Not for that price in Irvine. In Newport Coast, yes, but Irvine, that would be $3M+. You know, the school rating thing…

If you are shelling out $2.5 million for a home, are you really sending your children to public school?

Probably, at that stage in life, the children are the ones worrying about where to put their kids in school.

FCBs = Yes

The housing price is the premium you are paying for the Irvine public schools- supposedly IUSD has better scores than the private schools in the area.

We toured this house in 2008, when it was listed around $3M. We never seriously considered it at that price, but were wondering whether we were interested in the low to mid-2s if it got to that price point. We weren’t, and it didn’t. It’s a nice house — great by Turtle Ridge standards (excluding La Cima). But Turtle Ridge was a little too cramped and artificial for our tastes. That being said, the backyard is fantastic. No views, but very private, enormous and well done. The floor plan is OK. It has a detached casita, which I hate. Casitas are NOT family friendly, unless you turn the casita into a jail for your delinquent teenage son.

We thought the buyer in 2008 overpaid by a couple hundred grand. It is amusing to me that this house is now back on the market for the third time since we started our home-buying process. We still haven’t bought anything, but we’ve saved around a million dollars by waiting.

I suspect the next buyer might actually pay something close to a “bottom” price. I think fair value for this home is probably in the 1.9-2.2 range. Still not for us, though.

I wouldn’t really expect that many first time buyers to stomach the “joys” of buying a short/REO anyway. They would probably start with standard or new sales…

I disagree, because I know someone who is enjoying having bought an REO. The joy comes from the lower cost. The husband works construction, and with the dramatic downturn has time to fix up their home. I imagine that they are not the only people in that situation.

I would say that the combination of higher down payments needed, low prices on REO’s and low rates makes now as good a time as ever for those homes to be bought by first-time buyers.

You mentioned the husband works construction and has a bit of free time, not everybody has that luxury. It’s like Irvine Renter preaches, might as well just lease for a year in a nice apt with granite countertops while waiting for prices to plummet.

My husband is actually my wife, and she has no free time.

It’s a woman I work with, whose husband got laid off from a construction job. Her salary is enough to pay for the REO and he is fixing it up while business is slow. I imagine there are quite a few couples in situations like this.

I bet that house is going to look great!

short and REO are similar on the surface, but not one in the same. I’d certainly consider buying an REO but don’t really know how involved I’d get with a short sale just to have it all fall apart 6 months (or more) down the road, unless it were absolutely my dream home and was in absolutely no hurry to close. between the two REO is definitely the way to go for many many more buyers.

barely…. both REO and short sales are “as is”, so if you have cement in your toilet…

I meant the deal fall apart… generally the bank has to approve a short which can take 6 months or more. in a REO the bank IS the seller, so although the home is likely distressed in some form, it more closely resembles a standard sale as far as the buying process.

in both cases, the house is what it is. that’s what an inspection and concessions are for.

This statement is just not true, “none of the buyers over the last 5 years have any equity”

Buyers have no equity from home price appreciation, but that does not mean that they have no equity. They have a fraction of the equity they brought in, and what principal they have paid down on their loan (for a 15 yr, that can be significant).

Excellent point.

That’s a fact.

The average down payment in Irvine = ~30% and the average Irvine home buyer has paid down $40,000 of the loan in that time.

“None” must mean a very large number.

Another good point. Plenty of cushion for a downturn. If only we all could put 30% down, this would be a much better market….

There are no such things as Irvine Knife Catchers on Planet Realtor. Can’t go wrong buying in Irvine, right PR?

But if those people are putting down 30%, keeping it for 10+ years, not pulling out equity, and not looking to make a profit (or loss), what’s the issue?

No issue at all.

Right, but we’re chasing our home’s value downward right now, at about a $700 monthly principal reduction pace.

Exactly. Down payments can be seriously eroded (and lately, annihilated) and principal reductions totally counteracted by even relatively slow price declines. Irvine’s declines maybe of the intermittent, slow, grinding, obnoxious kind, but still.

A person who probably felt they were buying as much house as they reasonably could on their evidently Irvine-norm 30% downpayment, isn’t going to be keen to move up when they’ve seen their “equity” shrink to more like 18% vis-a-vis their current house (and a more pathetic percentage of what their move up home would cost). Yes, I still have some equity, but the utility/economics of moving up would make no sense (not that irrational behavior is unheard of in real estate…). I took what I could get on what I had–and now I have less. Probably I’ll sit tight.

We think about moving-up every once in awhile too. If we chose to move-up today, we would have very little cash remaining (after the sale of our house and covering the negative position) that we would have to get a 90%+ LTV loan on the new place. If we used an FHA loan, that comes with stiff up-front MIP and on-going MIP of 115 bps, and that is not deductible. The move-up loses its attractiveness quickly.

So we’ll sit tight, like you, and continue to chase our value down while building our savings. At some point our home’s value will meet our mortgage’s principal!

“This statement is just not true, “none of the buyers over the last 5 years have any equity””

You didn’t copy the qualifying word “almost.” I changed the post to say “few.”

I am not usually so careless with my limiting qualifiers. I should not have used the word “none” even if preceded by the qualifier “almost.”

To you point, you are correct. There are people who bought during the bubble who have equity because they either put a large amount down or they paid down their mortgages.

To his point, he left out the part about those who bought with large down payments may have LOST large amounts of the equity they had.

I need an /asshole tag for the end of that original comment.

My point was that price appreciation fueled equity varied dramatically across the country. It was present here, to a small degree, but for the most part people’s down payments here come out of savings/investments. That is a healthy market. If you need constant price appreciation to keep your market moving, it is not healthy.

I love the “great floor plan for young kids” in the advertisement! That is just rich! How many couples with young kids could afford a place like this? This is hilarious!

What exactly makes a floorplan “great for young kids?”

My wife and I are currently in the market and drag our little one to open houses pretty frequently. I can’t tell you the number of times we get the stink eye and third degree from realtors (and we are in the market for a home well below the $2.5 million here). It’s like the realtors take a look at a fairly young couple/family and don’t think that we can afford the home that is in a “family” neighborhood. Who do they think is their target buyer if it isn’t us.

Of course you don’t match the profile of their buyer. They need boomers with lots of bubble wealth ready to be rolled over into a new house. Not many young couples are going to save up 200K down payments the hard way. I call it the “boomer way” – buy when interest rates are high and prices are low and ride the interest rate cycle to the bottom and sell for big profit to naive young people as the prices get all bubbly.

There are people with $100k-200k down to buy new homes in my neighborhood. They are ‘young’: mid-30’s to mid-40’s. The DP is not from rapid home appreciation because there hasn’t been much of that here, ever. There are companies that are still very profitable, and people who don’t max out their DTI (people buying $2M homes have $500k-$1M/yr incomes). And there are places that never experienced this bubble. Not saying that’s Irvine, but places like that exist.

It’s always about the children isn’t it? Sounds a lot better than “Great floorplan to show up the Joneses with”.

I would love to see more listings like that! Gotta put in some humor in this crappy market right?

What all of these analyses of how first-time buyers will be needed to eat into the overhang of supply forget is that a huge fraction of sales during the bubble were non-owner-occupant sales. Some portion of homes will be bought as second homes, especially as prices in places like FL continue to fall. Couple foreign countries (I’m thinking Canada & South America) strong economies and improved exchange rates, and that will somewhat replace the US HELOC buyers.

My bigger gripe is that people do not understand how distorting the non-owner-occupant (specuvestor & vacation) buyers were.

It’s not even going to only be first timers. Think about it this way. The boomers enjoyed years of falling interest rates that caused prices to sky rocket. The current generation will not be so fortunate.

Even if interest rates remain flat, anyone with a 30YFRM is going to have little equity by year 7 when many will want to “trade up”. They will be in the exact same boat as first timers entering the market for the first time.

How about emerging trend of growing foreign investors as dollar keeps depreciating and foreigners want to park or diversify their cash into the “American Dream”?

Can some one run a research on this?

If there are a lot of foreign money pouring into Irvine, then all your predictions about price correction will not happen.

I keep reading in many places about the foreign buyer due to favourable exchange rate.

This will work only in cases where these buyers are buying it for themselves for their family to live in.

Because as an investment, if this does not pencil out in dollars , again mortage (or 100%0 is in dollars and rental income is in dollars, it does not mean much to foreign buyers as an investment. Atleast not smart innvestment.

Like some one said, if they money laundering , they dont care about return on investment, they may be ok at any price 🙂

I’m not thinking investment, I’m thinking vacation. Think Canadians vacationing in South Florida. If you are used to spending 5-20k/yr on rentals, and then you can buy comparable properties which reduce your per-year payments for those vacations why not do it?

Remember that people were buying RE at inflated prices, 100% financing, using exotic option-arm mortgages…as an investment.

I really have no idea how to price luxury properties in your area, so I’m asking, because this house still looks like a burn compared to other prime SoCal properties I see. It really looks like about $1.6M or so, but i don’t know your area.

How does Irvine compare to Rancho Mirage, for example? I ask because author Ann Rice has her really magnificent modern house for sale there.

Here’s the listing:

http://www.redfin.com/CA/Rancho-Mirage/70305-Thunderbird-Rd-92270/home/6111456

Rice’s house looks like about $5m worth at least to my untutored eyes, yet she is getting no bites at the current price of approximately $2.7M.

What do you all think?

Laura – I don’t know if you can really compare Irvine to Rancho Mirage. They are very different and have a very different demographic.

These areas are not comparable at all. Usually old people go to Rancho Mirage after they retire. No families with children would go there. Irvine’s appeal is the school district and proximity to high paying jobs and the ocean. It’s all about quality of life and location.

That’s why I asked… I wanted to know if you could compare them, because the Rice house is an absolutely gem-like modern house with wonderful architecture, space, and amenity; and about 5 acres of beautifully landscaped grounds.

It looks like it is close to Palm Springs and is probably more of a resort community, with no industry or commerce to speak of, and far from any other commercial centers. Nevertheless, the Rice house looks like a gift at $2.7M. Some extremely well-off person who doesn’t need to show up at the office every day will get a very, very good deal.

To get a comparable to Irvine you need to find a town with the top school district far superior to surrounding towns. Also you need proximity to high paying jobs. These areas tend to cost double or triple surrounding suburbs. In Irvines case it’s 20% more than nice towns within 30 minutes and 2-3 X towns that are an hour or more away.

As to schools, all you really need is for that “top school district” to be not that much better than the surrounding districts, but just have developed this Alan Greenspan-ish incorrect consensus about it’s greatness.

And you need it to be like Utah/Omaha Beach for rich invaders.

And you need blowhard realtors who are ready to celebrate every little downward fart of the almost bottomed out interest rates, or every government (temporarily) rigged uptick in prices, whilst we live underneath the crush of a 30% slide in prices that keeps grinding along interminably which by the way was totally impossible (I must be making this up). For without these realtors, we are not Irvine. And if we are not Irvine, we are Tustin. And if we are Tustin, then what are we really?

RM is to Irvine what Ft. Pierce is to Miami. You would never use a comp from 2 hrs away to a premium area. How about Poughkepsie to NYC – only 80 miles?

I wonder how Irvine prices compare to somewhere like Aliso Viejo. I looked at some of their prices and there is not a giant premium.

I think the premium of one area over another may actually increase with the current housing downturn. Where I see that is the price of rural homes. Jobs are moving into cities here, and have been for a while. There is becoming less and less of a reason to live out there, especially if you have to commute. Higher gas prices will only exacerbate that point.

Even though everything seems to be overpriced things in these areas move so fast. Property in this post went pending in like 7 days.

Investors selling to investors. Sound familiar?

Sorry not this post. I meant the post with 27 reserve in it.

Sorry, reposting at the bottom, rather than the top…

I’ve been renting since 2005 and thinking of buying a SFR in Irvine now (need it for our growing family)and a bit tired of renting. But afraid that I’ll have waited for 6 years and screwed up by not waiting another year. What are your thoughts and how much per sq. ft should it go, generally speaking in Northwood? Am I making a big error?

Price per square foot is a nominal arbitrary number.

If you can buy for the same monthly cost as renting (including all expenses and benefits) you should feel comfortable buying.

If you have a lot of cash and your are buying in a cash heavy neighborhood (down payments of 50-100%) then it may also make sense to buy.

> If you can buy for the same monthly cost as renting (including all expenses and benefits) you should feel comfortable buying.

I see this B.S. all the time from realtors and rationalizing homeloaners in markets where houses are priced at 6x-9x professional salaries.

Conventionally what was meant was that a $150,000 house was rent-equivalent when the rent is $1,500/month or so.

If you’re paying the same monthly rent as a house mortgage payment+expenses in Irvine (ie. $4000-$5000/mo), then you made a mistake and should downsize to a small condo rental, which will be a fraction of the monthly cost of a SFR.

homeloaner

LOL!

If you like like using ppsf in the list of factors you use to buy, then by all means use it.

You SHOULD feel comfortable whenever you feel comfortable. How much arrogance must it take to tell someone else when they should feel anything?

It makes sense to buy when you decide it makes sense for you. How would anybody else know when it makes sense for you to buy? Maybe a trusted advisor who knows the intimate details of your circumstances, but some know-it-all on a blog whom you have never ever met? Yeah, right.

Nothing wrong with waiting, especially if you’re spending the time to learn the neighborhoods, what type of lots you like, which floorplans you like and don’t like, etc etc.

> need it for our growing family …

Doubtful, unless you’re filming the Brady Brunch.

> waiting … Am I making a big error?

Prices are still going down, and lending standards are still increasing. So waiting for the past few years was smart.

Throw in some really bad news, like an Armageddon event, and prices will tumble further … higher interest rates, higher oil prices, etc.

Since most banks aren’t giving away houses anymore, what you can do is to get 100% prepared to qualify for a mortgage when you’re ready:

– use the excellent IHB mortgage calculator

– save up a 30% downpayment plus rainy day fund

– figure out what houses you want to bid on.

“Prices are still going down, and lending standards are still increasing”

For the price part it depends on city, neighborhood, street, floor plan, lot etc etc

You are flat wrong on the lending part. Lending was tightest in late 2008 / spring 2009. Lending is loosening up and will continue to loosen, slowly.

Lending to businesses may have been worst in 2008.

But mortgage lending requirements are a complete nightmare on residential properties now, which is what this blog is about.

I don’t know how you can say otherwise.

Waiting in Irvine, I’m currently renting in Irvine as well because homes in the neighborhood that I’m living in are still listed in the $900’s while by rent is circa 3k.

1) Generally, price per square foot is only one factor and not always the best indicator of value. However, awgee is right, if that’s a basis that you are comfortable with, you should take it into consideration. That said, in Irvine much of the value is in the land, therefore, in most areas of Irvine PPSF goes down as square footage goes up for homes in the same tract that have similar lots to smaller homes.

2) Awgee is also right, it is a personal choice, and the most important thing is that you do your homework and consider your situation and make the best choice for you without influence of people motivated by their own selfish goals or needs. That includes friends or family that have purchased and are encouraging you to do the same. That was one of the largest peer pressures that I saw during the bubble and one that many of our clients bring up that they’ve experienced, the, “oh your a renter” or “oh your just renting” peer pressure. Or course, now that the market is correcting there is much less of it. By reading blogs like this you are already way ahead of most buyers and sellers.

3) I agree that cash heavy neighborhoods have less down side risk.

4)I do not agree that cash heavy buyers should buy just based upon being cash heavy. If one is cash heavy they will benefit more when rates go up than higher leverage borrowers and it may be a reason to wait, particularly if they can earn a good return on their cash in the mean time.

5) Rental parity is an important factor and the basis for the property report that we provide our clients.

6) There are numerous other factors that one should consider. Including, how long to you plan to live in the home, your tax situation, how much are you earning on the money that will go to your down payment, etc.. We recommend that if someone is going to buy and finds the right home for below rental parity they plan to hold it, ideally for the term of the loan. We recommend that a buyer is open to the idea of leasing the property out when they eventually move on or up.

While I agree with most of what your saying, your braintrust for cash heavy buys comes off as freaking hilarious.

HOA fees is another factor that has a massive impact on $/sf. The condos lining Yale Loop that are masquerading as palatial SFR’s have some of the lowest $/sf in Woodbridge, because their HOA fee is ~$360/mo.

-Darth

Darth exactly price per sq ft is virtually meaningless compared to a rental parity comparison. It’s a nominal arbitrary number worth close to nothing against a rent comparison including all expenses and benefits.

If you want to get the lowest price per sq foot it’s very easy… All you need to do is buy the house in the worst area, on the worst street, with the highest HOA, the highest mello roos, the worst floor plan, the least upgrades, the highest maintenance, the worst neighbors, the smallest lot, next to the 5 fwy… The list can go on, if you want lowest ppsf – mission accomplished.

PR,

Please do not make the mistake again of thinking that you and I agree on anything. At all. Ever. Period. Your usefulness to this blog is comic relief and a living warning to those who would repeat the foolish mistakes of the past few years. People can look to you and see how the entire system has been engineered to lie to us and separate foolish buyers from their money.

$/sf is NOT a meaningless metric. It is VERY useful. It is not, however, the only useful measurement, and it should be taken in context as one of many variables.

For me personally, $/sf is one of the top 2 or 3 most important metrics that I use to analyze the local RE market. I don’t do as much macro analysis (I focus more on individual properties or types of properties), so it’s not THE most important measurement that I use.

The divergence between list $/sf and sale $/sf is probably my current MOST favorite method for predicting the broad-based direction of the RE market. The current nearly $100/sf spread between list prices and sale prices in Woodbridge tells me that prices here are headed down, down, DOWN in a hurry!

http://www.redfin.com/neighborhood/3111/CA/Irvine/Woodbridge

The spread for condos in Woodbridge is only $10/sf, but it’s been widening since late April. I expect that it will get worse from here, as most of the condos are still not priced at or below rental parity. The ones that have been selling recently have been priced below rental parity.

Irvine as a whole is doing better than Woodbridge in SFR’s but worse in condos with both having a divergence of about $20-30/sf, but that still shows us that the overall market is headed down for the foreseeable future.

http://www.redfin.com/city/9361/CA/Irvine

Unfortunately, neither of these charts go any further back than May 2009. I’d like to see some more historical data.

Caveat emptor!

-Darth

Darth – I find PR to also be one of the better contrary indicators, and a reminder of how I do not want to treat others.

$239/sf for a condo with a ‘private beach’: http://www.redfin.com/CA/Irvine/103-Lakeshore-92604/unit-47/home/5532997. Yep, it sure sucks that these Irvine prices are staying so high.

-Darth

P.S. I’m not saying to buy this particular property. It’s still overpriced by at least $75K.

The devastation since 2008 for premium areas never ends:

http://www.mbconfidential.com/2011/05/flashbacks-from-08.html

The recession has been brutal for the upper half and even worse for the upper quarter.

5 years into the recession, Las Vegas appocolypse should be coming to premium areas any day, year, decade now.

Asking prices aren’t sales, so we’ll see where they end up.

As for asking prices, the price history of my in-laws neighboring home is

7/02 485k sold-new

9/06 846k peak-pricing

12/08 478k panic-pricing

current 590k

It is priced $250k over comparable recent sales in the neighborhood, and there are lower priced homes available.

Thanks everyone for your replies. Of course, it’s a personal choice but I value the opinions on this blog as I’ve been reading it for years now and the advice has been correct, for the most part.

Shevy–Can you cancel the contract within 17 days of signing for any reason?

waiting-in-Irvine, I prefer to discuss contract details in person whenever possible, it normally takes at least 30 minutes.

The standard CAR (California Association of Realtors) RPA (Residential Purchase Agreement), includes a 17-day contingency period, however, most REO’s will have long addendums and may change this, trustee sale sellers may counter this or have an addendum, etc.. The contingency period normally includes specific contingencies, ie. appraisal, loan, and the inspection contingency which is relatively broad.

Ultimately it comes down to the the agreed upon contract between the buyer and the seller. There are many other terms in most contracts that are important to understand, please feel free to contact me at; shevy@idealhomebrokers.com and we can review a standard RPA in person.

For all that FCB money PR talks about…CA as a whole is the #2 state in foreign $’s coming in. #1?

We jokingly use the term “banksters” here, but it is gangster behavior when top executives conspire to not maintain properties.

LA gets tough with banks for foreclosure blight